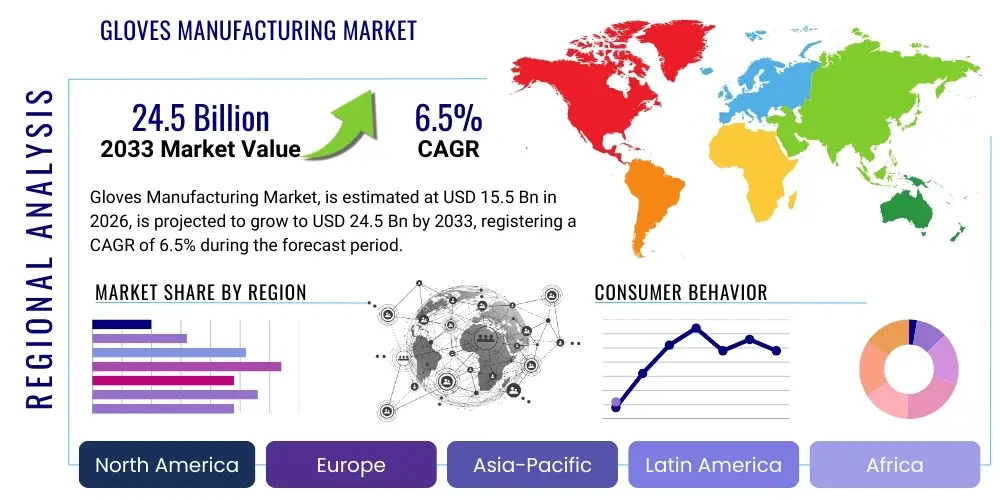

Gloves Manufacturing Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436115 | Date : Dec, 2025 | Pages : 255 | Region : Global | Publisher : MRU

Gloves Manufacturing Market Size

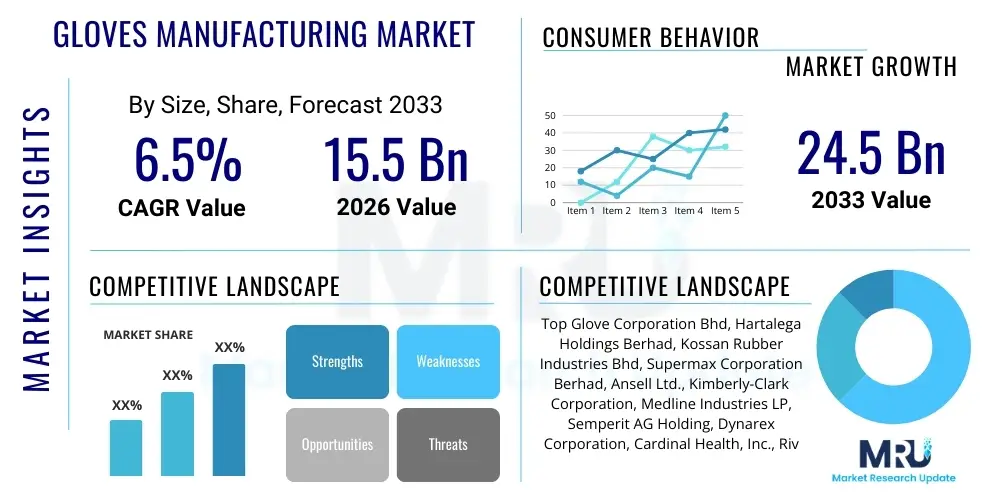

The Gloves Manufacturing Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at USD 15.5 Billion in 2026 and is projected to reach USD 24.5 Billion by the end of the forecast period in 2033.

Gloves Manufacturing Market introduction

The Gloves Manufacturing Market encompasses the global production and distribution of protective and functional hand coverings made from various materials, including natural rubber latex, nitrile butadiene rubber (NBR), polyvinyl chloride (PVC), and specialized fabrics. These essential products serve as critical barriers against chemicals, pathogens, heat, and physical abrasion across a diverse spectrum of industries. The market’s primary objective is to supply reliable protective equipment mandated by stringent occupational health and safety regulations, ensuring user dexterity while maximizing safety standards.

Product descriptions within this domain range significantly, from high-sensitivity surgical gloves and chemotherapy-rated examination gloves to robust industrial work gloves and insulated thermal gloves. Major applications span across healthcare (hospitals, clinics, surgical centers), industrial processing (chemical handling, manufacturing, automotive), food service, cleanrooms, and construction. The utility of these gloves is defined by their specific composition, thickness, and performance characteristics, such as puncture resistance, viral penetration resistance, and allergy profile.

The market expansion is fundamentally driven by the continuous expansion of the global healthcare sector, demographic shifts leading to increased surgical procedures, and heightened public health consciousness regarding infectious disease transmission. Key benefits include contamination prevention, enhanced hygiene compliance, and significant reduction in workplace injuries. Regulatory pressure requiring compliance with globally recognized safety standards (e.g., FDA, CE marking, ASTM) further solidifies demand, necessitating continuous innovation in polymer technology and sustainable manufacturing practices to meet escalating global demand efficiently.

Gloves Manufacturing Market Executive Summary

The Gloves Manufacturing Market is experiencing robust acceleration, largely driven by structural shifts in global supply chain management and sustained high demand from end-user sectors, particularly healthcare and specialized manufacturing. Current business trends indicate a strong move toward product diversification, with manufacturers heavily investing in advanced polymers like high-performance nitrile and non-latex alternatives to address rising allergy concerns and improve tactile sensitivity. Geopolitical stability and trade dynamics significantly influence raw material procurement, pushing key manufacturers to diversify their sourcing strategies and establish production hubs closer to major consumption centers, optimizing logistics and reducing lead times. Furthermore, the emphasis on environmentally sustainable manufacturing, including energy-efficient production processes and the development of biodegradable glove options, is shaping competitive strategies, appealing to corporate social responsibility (CSR) initiatives.

Regionally, the Asia Pacific (APAC) continues to dominate the production landscape, holding the largest share of manufacturing capacity due to favorable access to raw materials (especially natural rubber) and lower operational costs. However, North America and Europe remain the largest consumers, characterized by high regulatory standards and strong expenditure on healthcare and research activities. A significant trend involves the strategic expansion of production facilities into regions like Southeast Asia (e.g., Malaysia, Thailand, Vietnam) and increasingly, near-shoring efforts in the Americas and Europe to mitigate dependency on single source regions and strengthen supply resilience against future global disruptions. The push for localized sourcing in highly regulated sectors is a defining feature of regional market evolution.

Segment trends highlight the dominance of disposable gloves, particularly the nitrile segment, which has aggressively displaced latex due to its superior chemical resistance and hypoallergenic properties. The powder-free sub-segment is rapidly gaining traction across medical and cleanroom environments, driven by regulations limiting powder usage. In terms of application, the medical and healthcare segment remains the principal revenue generator, though the non-medical industrial sector, encompassing chemical processing, automotive maintenance, and food handling, is demonstrating significant volume growth. Consolidation among smaller regional players by large global entities is a consistent trend aimed at achieving scale, vertical integration, and securing long-term supply contracts with major governmental and private healthcare systems.

AI Impact Analysis on Gloves Manufacturing Market

User inquiries regarding the integration of Artificial Intelligence (AI) in the Gloves Manufacturing Market frequently center on concerns about process automation, quality control accuracy, and supply chain optimization. Common user questions often ask: "How can AI enhance the consistency and quality inspection of finished gloves?", "Will AI-driven maintenance reduce unplanned downtime in dipping lines?", and "Can machine learning algorithms accurately forecast demand for different glove types (e.g., nitrile vs. latex) globally?" Users seek clarity on how AI can move beyond simple robotics to truly revolutionize the inherently complex and material-sensitive dipping and curing processes characteristic of glove production, aiming for zero-defect manufacturing and enhanced operational efficiency in high-volume settings.

The analysis indicates that AI's primary immediate impact lies in enhancing quality assurance and optimizing operational flow. Traditional visual and physical testing methods for gloves are resource-intensive and prone to human error, especially at volumes reaching billions annually. AI-powered machine vision systems, utilizing deep learning algorithms, are being deployed on manufacturing lines to detect minute defects, such as pinholes, uneven coating, or thickness irregularities, far more rapidly and accurately than conventional systems. This automated, high-throughput inspection capability ensures higher product conformity to stringent medical standards, reducing scrap rates and improving overall batch reliability. Predictive maintenance, another critical application, uses sensor data analysis to forecast equipment failure, allowing for proactive servicing of complex machinery like formers, ovens, and chillers, thereby minimizing costly production interruptions.

Furthermore, Generative AI models and advanced machine learning are transforming strategic aspects of the business, particularly in demand forecasting and inventory management. By analyzing historical sales data, seasonal variations, regulatory changes, and real-time geopolitical health indicators, AI algorithms can produce highly accurate demand predictions. This allows manufacturers to optimize raw material procurement (e.g., NBR latex prices), adjust production schedules precisely, and ensure adequate buffer stock during peak demand periods, effectively stabilizing the volatile supply chain that has characterized the market in recent years. This strategic application enhances responsiveness and secures competitive advantage by lowering inventory holding costs while maximizing market fulfillment rates.

- AI-driven machine vision systems for real-time, high-accuracy defect detection (pinholes, tears, uniformity).

- Predictive maintenance schedules for dipping lines and curing ovens, minimizing unplanned production downtime.

- Optimization of chemical compound ratios and curing times using machine learning to maximize glove strength and elasticity.

- Advanced demand forecasting models analyzing global health trends, inventory levels, and regulatory shifts.

- Automated quality reporting and regulatory compliance documentation via natural language processing (NLP).

- Energy consumption optimization in large-scale manufacturing facilities through AI-managed HVAC and process heating control.

- Enhanced inventory tracking and warehouse logistics using computer vision and robotics integration.

DRO & Impact Forces Of Gloves Manufacturing Market

The Gloves Manufacturing Market is fundamentally influenced by powerful drivers, strict restraints, and promising opportunities, all combining to create significant impact forces. Key drivers include heightened global regulatory mandates concerning workplace safety and infection control, alongside the continuous growth in healthcare expenditure and increasing surgical procedure volumes worldwide. Restraints primarily involve the volatility in raw material prices, particularly for natural rubber and NBR latex, and the substantial environmental footprint associated with manufacturing and disposal of single-use products. Opportunities reside in developing biodegradable materials, expanding production capacity in cost-effective regions, and integrating advanced automation technologies like robotics and AI to improve yield and quality. The net impact force is highly positive, driven structurally by hygiene necessities and regulatory enforcement, compelling innovation primarily focused on sustainable, high-performance, and cost-efficient product development.

Primary drivers fueling market growth involve the escalating adoption of single-use medical gloves in non-traditional settings, such as home healthcare and elderly care facilities, reflecting demographic changes and decentralized care models. Furthermore, the enduring impact of recent pandemics has institutionalized higher standards of hygiene compliance across all non-medical sectors, including retail, hospitality, and public services, creating a new baseline demand plateau. Regulatory bodies globally are tightening standards for material performance, requiring certification for viral barrier properties and demanding low-protein or powder-free alternatives, thus necessitating continuous product innovation and upgrading of manufacturing technologies, which benefits established market leaders with substantial R&D capabilities.

Conversely, significant headwinds restrict market potential, most notably the intense competitive pressure leading to price erosion in commodity segments, especially vinyl gloves. The high capital expenditure required for establishing or expanding automated production facilities acts as a significant barrier to entry for new players. Moreover, dependency on a few raw material suppliers creates vulnerability to price shocks and supply shortages, challenging operational planning and profitability margins. Addressing the environmental cost of disposing billions of non-biodegradable gloves annually presents a crucial long-term restraint, pushing companies toward developing costly, yet necessary, sustainable polymers to maintain brand reputation and comply with future environmental legislation.

Opportunities for exponential growth are concentrated in specialty glove segments, such as chemical-resistant safety gloves and ultra-cleanroom gloves required for microelectronics manufacturing. These high-value segments command premium pricing due to sophisticated manufacturing processes and superior performance requirements. Strategic investment in vertical integration, securing proprietary raw material supply, and adopting Industry 4.0 technologies—including predictive maintenance and advanced process control—offer manufacturers substantial cost advantages and quality differentiation. Furthermore, market penetration in emerging economies with rapidly improving healthcare infrastructure presents a viable long-term opportunity for volume expansion, supported by increasing governmental focus on public health standards.

Segmentation Analysis

The Gloves Manufacturing Market is extensively segmented based on material, product type, form, application, and geography, reflecting the highly specialized nature of protective handwear. This segmentation allows manufacturers to target specific end-user requirements, ranging from the high dexterity and sterility demanded by surgical procedures to the robust chemical protection needed in industrial environments. Material composition remains the most critical differentiator, influencing properties such as tensile strength, barrier function, and hypoallergenic characteristics, dictating suitability for various regulatory environments and use cases.

The disposable versus reusable distinction defines operational utility and volume throughput, with disposable gloves (dominated by nitrile) accounting for the majority of the market due to hygiene mandates, particularly in medical and food service industries. Application segmentation—spanning medical, industrial, food & beverage, and cleanroom—determines the regulatory compliance and specific performance attributes required (e.g., sterilization levels for surgical gloves vs. abrasion resistance for industrial safety gloves). Geographical analysis identifies major manufacturing hubs (APAC) and primary consumption markets (North America and Europe), guiding resource allocation and supply chain optimization efforts.

- By Material:

- Natural Rubber Latex

- Nitrile Butadiene Rubber (NBR)

- Polyvinyl Chloride (PVC)/Vinyl

- Polyisoprene

- Neoprene

- Others (e.g., Butyl, Kevlar, Fabric)

- By Product Type:

- Disposable Gloves

- Examination Gloves (Medical Grade)

- Surgical Gloves (Sterile)

- Durable/Reusable Gloves

- General Purpose

- Chemical Resistant

- Cut Resistant

- Thermal Protection

- Disposable Gloves

- By Form:

- Powdered

- Powder-Free

- By Application/End-User:

- Healthcare & Medical (Hospitals, Clinics, Diagnostic Labs, Pharmaceutical)

- Industrial (Manufacturing, Chemical, Oil & Gas, Automotive)

- Food & Beverage

- Cleanroom & Semiconductor

- Construction & Utility

- Others (e.g., Retail, Tattoos, Beauty & Spa)

- By Region:

- North America (U.S., Canada)

- Europe (Germany, U.K., France, Italy)

- Asia Pacific (China, India, Japan, Malaysia, Thailand)

- Latin America (Brazil, Mexico)

- Middle East & Africa (MEA)

Value Chain Analysis For Gloves Manufacturing Market

The value chain for gloves manufacturing is complex and highly capital-intensive, starting with the extraction and processing of core raw materials and extending through highly specialized dipping and curing processes to global distribution. Upstream analysis focuses heavily on the procurement of base materials, primarily natural rubber latex (dominated by plantations in Southeast Asia) and synthetic inputs like acrylonitrile and butadiene used to synthesize NBR. Price volatility and supply chain concentration in these raw material markets significantly influence the profitability and stability of glove manufacturers. Strategic sourcing, including long-term contracts and establishing backward integration into NBR production, is crucial for mitigating risks and maintaining cost competitiveness in a high-volume, low-margin environment.

The core manufacturing stage involves converting these raw materials into finished gloves through highly automated dipping lines. This process requires substantial investment in machinery (formers, dipping tanks, vulcanization ovens) and relies heavily on proprietary chemical formulations and curing techniques to achieve desired physical properties (e.g., tensile strength, elasticity, low protein content). Quality control, sterilization, and packaging are integral parts of this stage, adhering strictly to global medical device standards (ISO 13485, FDA CFRs). Operational efficiency, minimizing energy consumption, and reducing the environmental impact of chemical wastewater are primary focus areas for maximizing manufacturing value.

The downstream phase encompasses distribution channels, which are bifurcated into direct and indirect routes. Direct sales involve large, institutional contracts, such as those with government health departments, large hospital networks, and major industrial conglomerates, offering greater control over pricing and volume. Indirect channels rely on a dense network of authorized distributors, wholesalers, and medical supply chain integrators (GPOs – Group Purchasing Organizations) who manage inventory, logistics, and supply smaller end-users. Effective inventory management and robust cold-chain logistics (where applicable) are vital in the downstream segment. The rise of e-commerce platforms is also creating a new avenue for selling non-medical and general-purpose gloves directly to small businesses and consumers, streamlining market access and enhancing transparency.

Gloves Manufacturing Market Potential Customers

The potential customers for gloves manufacturing are predominantly large institutional entities and governmental bodies where protective equipment is mandated for safety and hygiene protocols. The largest segment, healthcare, includes hospitals, surgical centers, clinics, dental practices, and diagnostic laboratories that require sterile surgical gloves and high volumes of examination gloves for routine patient care and procedural safety. These customers prioritize quality assurance, compliance with medical device regulations, consistent supply, and increasingly, specialized gloves offering enhanced tactile feel and low allergy risk (nitrile/polyisoprene).

Industrial sectors represent the second major customer base, particularly chemical processing, oil and gas, automotive manufacturing, and aerospace. These clients demand specialized durable and disposable gloves rated for specific chemical permeation, cut resistance, and abrasion protection, often requiring certifications like ANSI or EN standards. The food processing and handling sector constitutes a rapidly growing segment, driven by strict health department regulations requiring HACCP compliance and contamination control, leading to high-volume consumption of food-grade vinyl and nitrile gloves.

Additionally, the pharmaceutical and biotechnology industries, along with semiconductor and microelectronics manufacturing (cleanrooms), serve as premium customers. These entities require ultra-clean, low-particulate gloves manufactured in sterile environments, where quality control is paramount to prevent contamination of sensitive products or processes. The purchasing decisions across all these segments are highly influenced by regulatory compliance, bulk pricing capabilities, and the reliability of the manufacturer's supply chain integrity, favoring global suppliers capable of delivering consistent quality across diverse regional markets.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 15.5 Billion |

| Market Forecast in 2033 | USD 24.5 Billion |

| Growth Rate | 6.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Top Glove Corporation Bhd, Hartalega Holdings Berhad, Kossan Rubber Industries Bhd, Supermax Corporation Berhad, Ansell Ltd., Kimberly-Clark Corporation, Medline Industries LP, Semperit AG Holding, Dynarex Corporation, Cardinal Health, Inc., Riverstone Holdings Limited, Sri Trang Agro-Industry Public Co. Ltd., B. Braun Melsungen AG, Mölnlycke Health Care AB, Rubberex Corporation (M) Berhad, Showa Group, YTY Group, Adventa Berhad, Unigloves GmbH, Primus Gloves. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Gloves Manufacturing Market Key Technology Landscape

The key technology landscape in gloves manufacturing is defined by advancements in polymer science and sophisticated automation techniques aimed at improving product quality, reducing manufacturing costs, and addressing environmental concerns. The shift from natural latex to synthetic alternatives has driven significant research into NBR formulations, focusing on enhancing chemical resistance and elasticity while mimicking the tactile properties of natural rubber. Current R&D is heavily invested in accelerating the vulcanization process (curing time) and optimizing the dip formulation chemistry to create thinner yet stronger gloves, which reduces material usage and improves user comfort without compromising barrier protection integrity.

Manufacturing process technology is increasingly leveraging Industry 4.0 principles. High-speed, fully automated dipping lines are standard, integrating robotics for former handling and advanced sensors for continuous monitoring of dipping depth, curing temperatures, and chemical concentration in real-time. This level of automation ensures unparalleled consistency in batch production and minimizes the risk of human error. Furthermore, sophisticated online quality inspection systems, incorporating high-resolution cameras and AI-powered image processing, are crucial for achieving the stringent zero-defect goals required for medical-grade sterile gloves, enabling instantaneous identification and removal of faulty units before packaging.

Future technology focuses heavily on sustainability. This includes developing gloves made from bio-based or biodegradable polymers, such as certain types of polyurethane or specialized synthetic elastomers, to mitigate the enormous waste volume generated by disposable gloves. Additionally, advanced water treatment and recycling technologies are being implemented to minimize the massive water consumption and chemical effluent characteristic of traditional dipping processes. Energy efficiency is also paramount, with manufacturers adopting highly efficient heating and drying systems (e.g., thermal oil heating or infrared curing) to reduce the substantial energy required to run long, continuous production lines, ultimately lowering the operational carbon footprint and addressing increasing regulatory scrutiny.

Regional Highlights

Regional dynamics play a crucial role in defining the global gloves market, segmented by manufacturing capability and consumption demand, with clear distinctions between established high-consumption markets and primary production hubs.

- Asia Pacific (APAC): APAC is the dominant global manufacturing hub, primarily led by Malaysia, Thailand, and China. This dominance is attributed to cost advantages, established supply chains for natural rubber (in Southeast Asia), and immense production capacity expansion over the last decade. Malaysia alone accounts for a significant majority of global surgical and examination glove production. The regional market is characterized by intense price competition and continuous investment in automation and capacity expansion to serve international markets. India and China are also rapidly growing consumption markets due to improving healthcare access and increased safety standardization in industrial sectors.

- North America: North America represents the single largest consumption market globally, driven by stringent regulatory requirements (FDA standards), high healthcare spending, and advanced industrial applications. Demand here focuses on premium, powder-free nitrile gloves and specialized surgical options. The region has a structural dependency on imports, although recent geopolitical events have spurred significant interest and investment in near-shoring manufacturing capabilities to enhance supply chain resilience and security, particularly in the U.S.

- Europe: Europe is characterized by strict quality standards (CE marking) and a mature, highly specialized consumer base across medical and industrial segments (e.g., aerospace and chemical). The region shows strong preference for sustainable and hypoallergenic glove options, driving innovation in NBR and specialty polymer materials. Germany, the U.K., and France are key consumers, often sourcing through sophisticated pan-European distribution networks and Group Purchasing Organizations (GPOs).

- Latin America (LATAM): The LATAM region presents a high-growth potential market. While consumption is currently fragmented, driven mainly by major economies like Brazil and Mexico, increasing investment in public health infrastructure and rising awareness of occupational safety are boosting demand for both medical and industrial-grade protective gloves. Market penetration relies heavily on imports, making it sensitive to international pricing and logistical costs.

- Middle East and Africa (MEA): Growth in MEA is primarily concentrated in the Gulf Cooperation Council (GCC) countries, supported by large government healthcare projects and significant investments in oil and gas infrastructure, which require robust industrial safety gloves. Market growth is structurally linked to governmental spending on large-scale infrastructure and hospital expansion projects, requiring reliable, certified glove supply, largely fulfilled through imports from APAC.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Gloves Manufacturing Market.- Top Glove Corporation Bhd

- Hartalega Holdings Berhad

- Kossan Rubber Industries Bhd

- Supermax Corporation Berhad

- Ansell Ltd.

- Kimberly-Clark Corporation

- Medline Industries LP

- Semperit AG Holding

- Dynarex Corporation

- Cardinal Health, Inc.

- Riverstone Holdings Limited

- Sri Trang Agro-Industry Public Co. Ltd.

- B. Braun Melsungen AG

- Mölnlycke Health Care AB

- Rubberex Corporation (M) Berhad

- Showa Group

- YTY Group

- Adventa Berhad

- Unigloves GmbH

- Primus Gloves

- Atlantic Safety Products

- Health & Safety Products, Inc.

- Mercator Medical S.A.

- VWR International (Avantor, Inc.)

- Halyard Health (Owens & Minor)

- Integra LifeSciences Corporation

- Tronex International

- Ammex Corporation

- Polyco Healthline (Bunzl PLC)

- UG Healthcare Corporation

- WRP Asia Pacific Sdn Bhd

- Shield Scientific B.V.

- 3M Company (Safety Division)

- DuPont de Nemours, Inc.

- Honeywell International Inc. (Safety Products)

- Comfort Rubber Gloves Industries Sdn Bhd

- Kanam Latex Industries Pvt. Ltd.

- RFB Latex Limited

- Smart Glove Corporation Sdn Bhd

Frequently Asked Questions

Analyze common user questions about the Gloves Manufacturing market and generate a concise list of summarized FAQs reflecting key topics and concerns.What material dominates the gloves manufacturing market, and why is it preferred over latex?

Nitrile Butadiene Rubber (NBR) currently dominates the disposable gloves market. It is preferred over natural rubber latex primarily because NBR offers superior chemical resistance, puncture resistance, and most importantly, it eliminates the risk of Type I latex allergies, making it safer for healthcare professionals and patients alike.

What key factors are driving the long-term sustainable growth of the global gloves market?

The primary sustainable drivers are the global expansion and decentralization of healthcare systems, increasingly strict global infection control and occupational safety regulations (e.g., OSHA, FDA mandates), and heightened public awareness regarding hygiene standards following recent global health events, ensuring a sustained high baseline demand.

How is the industry addressing the environmental impact of billions of disposable gloves?

Manufacturers are heavily investing in research and development to produce biodegradable or bio-based polymer gloves, optimizing manufacturing processes for greater energy and water efficiency, and exploring advanced chemical recycling technologies to mitigate the substantial environmental waste generated by single-use protective equipment.

Where are the major global production hubs located, and what risks are associated with this concentration?

The major global production hubs are heavily concentrated in Southeast Asia, particularly Malaysia, Thailand, and China, due to access to raw materials and favorable production costs. The primary risk associated with this concentration is supply chain vulnerability to geopolitical instability, trade restrictions, and localized operational disruptions (e.g., labor shortages or regional disease outbreaks).

What role does automation and AI play in modern glove manufacturing?

Automation and AI are crucial for enhancing manufacturing efficiency and quality control. AI-driven machine vision systems perform real-time defect detection at high speeds, significantly reducing error rates, while predictive maintenance algorithms minimize downtime on complex dipping lines, ensuring consistent, high-volume production conforming to stringent medical standards.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager