Gluten-Free Foods & Beverages Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433974 | Date : Dec, 2025 | Pages : 255 | Region : Global | Publisher : MRU

Gluten-Free Foods & Beverages Market Size

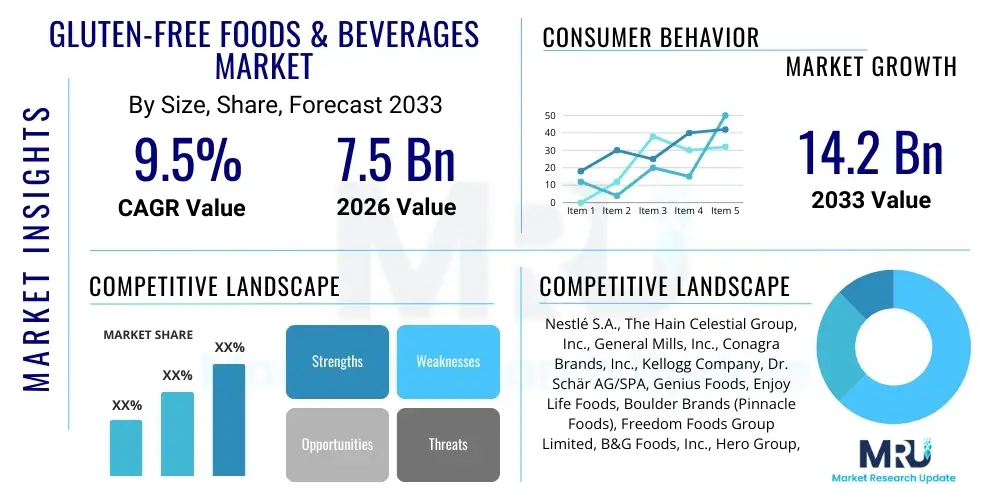

The Gluten-Free Foods & Beverages Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 9.5% between 2026 and 2033. The market is estimated at USD 7.5 Billion in 2026 and is projected to reach USD 14.2 Billion by the end of the forecast period in 2033.

Gluten-Free Foods & Beverages Market introduction

The Gluten-Free Foods & Beverages Market encompasses a wide array of products specifically manufactured and processed to contain less than 20 parts per million (ppm) of gluten, adhering to stringent international regulatory standards designed to ensure safety for individuals with celiac disease, non-celiac gluten sensitivity (NCGS), or those voluntarily avoiding gluten for perceived health benefits. This market segment includes staples such as bakery products (breads, pastries, biscuits), pastas, snacks, flours, mixes, breakfast cereals, and specialized beverages like gluten-free beers and oat milk alternatives. The primary product description revolves around utilizing non-wheat grains and alternative starches—such as rice, corn, quinoa, sorghum, tapioca, and various legumes—to replicate the texture and nutritional profile traditionally provided by wheat, barley, and rye. These substitutes require innovative food technology to mimic the viscoelastic properties of gluten, ensuring palatability and consumer acceptance.

Major applications of gluten-free products are predominantly in the consumer retail sector, addressing both therapeutic dietary needs and lifestyle choices. The therapeutic application is crucial for the approximately one percent of the global population affected by celiac disease, for whom a strict gluten-free diet is the only effective treatment, preventing severe gastrointestinal damage and associated long-term health complications. However, the market growth is significantly amplified by the lifestyle application, driven by consumers seeking "clean eating" labels, improved digestive health, or weight management solutions, often under the self-diagnosis of gluten sensitivity. Key benefits offered by this market include improved accessibility to diverse dietary options for restricted diets, enhanced nutritional quality through fortification (especially in products derived from nutrient-dense pseudo-cereals like quinoa), and a higher degree of transparency in ingredient labeling, which appeals to health-conscious consumers. The increasing incidence and diagnosis rates of celiac disease and NCGS globally constitute a foundational driving factor. Furthermore, aggressive marketing campaigns highlighting the wellness and digestive health aspects of gluten-free eating, coupled with rising disposable incomes in emerging economies, are accelerating market expansion, transforming what was once a niche offering into a mainstream retail category. The ease of availability in standard grocery stores and quick-service restaurants has democratized access, further driving mainstream adoption.

Gluten-Free Foods & Beverages Market Executive Summary

The Gluten-Free Foods & Beverages Market demonstrates robust business trends characterized by significant product diversification, strategic investments in ingredient innovation, and substantial merger and acquisition activity among leading food manufacturers aiming to capture market share in high-growth segments like artisanal baked goods and specialized ready-to-eat meals. A critical trend involves the shift from addressing basic dietary restrictions to fulfilling demands for superior sensory attributes, meaning modern gluten-free products must match the taste, texture, and shelf-stability of their gluten-containing counterparts. Business strategy is increasingly centered on Clean Label initiatives, where consumers prefer products with recognizable, minimal ingredients, challenging manufacturers to use natural binders and starches instead of synthetic additives. Furthermore, the integration of plant-based proteins and ancient grains (amaranth, teff) within gluten-free formulations is driving premiumization, allowing companies to command higher price points. The expansion of private label brands offering competitive, accessible gluten-free options is simultaneously pressuring margins while broadening market access, establishing a dynamic competitive landscape where innovation speed and supply chain efficiency are paramount for sustained profitability.

Regionally, North America maintains market dominance due to high celiac disease awareness, advanced diagnostic capabilities, and significant consumer spending power directed toward specialized diets. However, the Asia Pacific (APAC) region is projected to exhibit the fastest growth, propelled by the Westernization of diets, increasing health consciousness, and rapidly growing middle classes in countries like China and India, where traditional diets are transitioning to packaged and processed foods. European markets, particularly Western Europe, show maturity but continue growth driven by strong regulatory support and entrenched consumer confidence in certified gluten-free products. Segment trends indicate that the Bakery & Confectionery segment remains the largest revenue generator, consistently introducing innovative products like sourdough and multicereal loaves. Simultaneously, the Beverages segment, especially specialized gluten-free craft beers and fortified non-dairy milk alternatives (often inherently gluten-free but marketed under the banner), is gaining momentum, fueled by younger demographics seeking functional and experiential drinks. Distribution channel analysis highlights the continued importance of supermarkets and hypermarkets as primary sales points, though e-commerce platforms are rapidly gaining traction, offering convenience, wider selection, and direct access to niche brands, serving as a critical accelerator during periods of restricted mobility or specialized purchasing needs.

AI Impact Analysis on Gluten-Free Foods & Beverages Market

User queries regarding the impact of Artificial Intelligence (AI) on the Gluten-Free Foods & Beverages Market predominantly focus on how AI enhances production efficiency, improves ingredient sourcing and quality control, and personalizes consumer experiences. Key themes center on optimizing complex blending ratios required for non-gluten flours to achieve desired textures (a major technical challenge in this sector), predicting consumer flavor preferences in novel product development, and streamlining supply chains to ensure the integrity and prevent cross-contamination of gluten-free raw materials. Concerns often revolve around the initial investment costs for AI implementation in smaller manufacturing facilities and the ethical implications of using predictive analytics for highly personalized dietary recommendations. Expectations are high regarding AI’s potential to dramatically reduce new product development cycles and minimize batch inconsistencies, thereby lowering overall production costs and making specialized products more affordable for consumers requiring medically necessary diets.

The application of AI and machine learning models is revolutionizing research and development within the gluten-free space. AI algorithms are adept at analyzing vast datasets related to ingredient interaction, rheology, and consumer feedback, allowing manufacturers to quickly iterate on formulations using novel ingredients like hydrocolloids or modified starches to optimize texture, volume, and moisture retention without gluten. Furthermore, AI-powered computer vision systems are being deployed on production lines to detect even microscopic cross-contamination, ensuring compliance with strict "less than 20 ppm" standards, which is critical for brand trust and regulatory adherence. In the area of consumer engagement, AI-driven recommendation engines and personalized nutrition platforms utilize demographic and health data to suggest specific gluten-free products and meal plans, linking purchasing behavior directly to health outcomes, significantly boosting consumer loyalty and targeted marketing effectiveness. This technological integration is transforming manufacturing practices from reactive quality control to proactive predictive modeling, substantially reducing waste and enhancing overall food safety.

- AI optimizes complex blending ratios of alternative flours, improving product texture and palatability.

- Machine learning models predict consumer preferences, accelerating the new product development lifecycle.

- AI-powered vision systems enhance quality control, proactively identifying and preventing gluten cross-contamination on production lines.

- Predictive maintenance driven by AI minimizes downtime in specialized gluten-free processing equipment.

- Personalized nutrition platforms use AI to tailor product recommendations based on individual health metrics and dietary needs.

- AI assists in optimizing inventory and supply chain logistics for specialized, often high-cost, gluten-free ingredients, reducing spoilage and maintaining freshness.

DRO & Impact Forces Of Gluten-Free Foods & Beverages Market

The dynamics of the Gluten-Free Foods & Beverages Market are strongly influenced by a complex interplay of Drivers, Restraints, and Opportunities, which collectively constitute the impact forces shaping its trajectory. The primary driver is the verifiable increase in diagnosed cases of celiac disease and the self-reported prevalence of non-celiac gluten sensitivity (NCGS) globally, necessitating therapeutic dietary changes for a growing population segment. This core demand is powerfully supplemented by the lifestyle trend toward perceived healthier eating, where gluten avoidance is linked to general wellness, improved digestion, and reduced inflammation, attracting a much larger pool of elective consumers. Increased awareness, fostered by media, social networking, and robust medical diagnostics, further encourages market penetration. Concurrently, aggressive promotional activities by major food manufacturers and the continuous innovation in product quality and flavor profile ensure that gluten-free options are viable, attractive alternatives to traditional foods, solidifying consumer loyalty and driving repeat purchases.

However, the market faces significant restraints that temper its growth rate and challenge manufacturers’ profitability. The most pronounced restraint is the persistently high cost of production associated with gluten-free products. Specialized ingredients (such as certified oat flour, specialized starches, and proprietary binders) are generally more expensive than wheat flour, and the necessity for dedicated, segregated processing facilities to prevent cross-contamination adds substantial operational overhead. Consequently, gluten-free items typically carry a significant price premium (often 50% to 150% higher) compared to conventional counterparts, limiting accessibility for price-sensitive consumer groups. Additionally, historical challenges concerning the inferior palatability, texture, and nutritional value (specifically lower fiber content and vitamin B fortification) of earlier gluten-free generations have left a lingering perception that modern products must continually overcome through expensive research and development efforts, demanding substantial investments in food technology.

Opportunities for growth are concentrated in product diversification, geographic expansion, and technological improvements. There is an immense opportunity in developing 'free-from' products that simultaneously address multiple common allergies or dietary restrictions (e.g., gluten-free, dairy-free, and nut-free), catering to the increasingly complex dietary requirements of modern consumers. Emerging markets in APAC and Latin America represent vast, untapped potential as health consciousness rises and diagnostic capabilities improve in those regions. Technological advancement offers the most compelling opportunity; leveraging advanced processing techniques like high-pressure processing (HPP) or enzymatic treatments can further enhance the texture and shelf life of gluten-free baked goods, while biotechnological solutions can develop novel, functional starches that mimic gluten’s properties more effectively. Strategic partnerships between specialized ingredient suppliers and large-scale food manufacturers are vital to capitalizing on these opportunities, driving down ingredient costs through volume purchasing and shared innovation pipelines, ensuring the long-term sustainability and market penetration of premium gluten-free offerings.

Segmentation Analysis

The Gluten-Free Foods & Beverages Market is comprehensively segmented based on product type, form, distribution channel, and end-user, allowing for detailed strategic analysis of consumer behavior and market penetration across various categories. The segmentation provides crucial insights into where current demand is concentrated and identifies nascent growth areas, guiding manufacturers' resource allocation for R&D and targeted marketing campaigns. Product type segmentation, which includes bakery, snacks, pizzas/pasta, cereals, and beverages, reveals the high inelasticity of demand for staples like gluten-free bread and pasta among celiac patients, while the snacks and ready-to-eat segments are highly sensitive to lifestyle trends and innovation. Analyzing the form (dry, frozen, chilled) indicates shifts toward convenience, particularly in chilled and frozen ready meals, reflecting busy consumer lifestyles requiring quick, yet specialized, dietary solutions. These segmentations are fundamental for understanding the competitive intensity and pricing power within specific product categories.

Further analysis by distribution channel highlights the ongoing structural importance of traditional retail, such as mass merchandisers and specialty stores, which still account for the majority of sales volume due to established consumer purchasing habits. However, the rapidly expanding e-commerce channel is becoming pivotal, especially for specialty brands and consumers in geographically isolated areas, offering unparalleled convenience and direct access to niche products that local stores might not stock. The end-user segmentation differentiates between clinical (medically diagnosed celiac patients) and lifestyle consumers, showing that while clinical demand provides a stable baseline, the lifestyle consumer segment drives volatility and rapid growth, often correlating with broader wellness and diet trends. Recognizing these distinct consumer profiles is essential; marketing messages targeting clinical consumers must emphasize certification and safety, whereas campaigns aimed at lifestyle buyers focus on attributes like superior taste, natural ingredients, and functional health benefits, allowing companies to tailor their messaging for maximum resonance and market effectiveness.

- Product Type:

- Bakery & Confectionery (Breads, Rolls, Cakes, Cookies, Pastries)

- Snacks & Savories (Chips, Pretzels, Crackers, Energy Bars)

- Pizzas & Pastas

- Cereals & Breakfast Foods (Oatmeal, Granola)

- Flours, Mixes, and Batters

- Gluten-Free Beverages (Beer, Malt Alternatives, Dairy Substitutes)

- Form:

- Dry

- Frozen

- Chilled

- Distribution Channel:

- Supermarkets & Hypermarkets

- Convenience Stores

- Specialty Stores (Health Food Stores)

- Online Retail

- End-User:

- Clinical Diagnosed (Celiac Disease & NCGS)

- Lifestyle Consumers (Wellness Seekers)

Value Chain Analysis For Gluten-Free Foods & Beverages Market

The value chain for the Gluten-Free Foods & Beverages Market is characterized by highly specialized upstream sourcing and demanding downstream distribution requirements, necessitated by the imperative to maintain absolute segregation and avoid cross-contamination at every stage. Upstream analysis begins with the cultivation and sourcing of certified gluten-free raw materials, such as rice, corn, quinoa, and certified oats. This stage involves significant due diligence, as suppliers must guarantee that their fields and processing facilities are free from contact with wheat, barley, or rye. High-cost inputs, particularly specialized flours and functional ingredients like hydrocolloids (e.g., xanthan gum, guar gum) and enzyme preparations used to improve dough structure, form a critical part of the initial cost structure. Innovation at this stage is focused on agricultural technology to enhance yields of alternative grains and developing cost-effective, high-performance binders that can replace gluten structurally, thus setting the foundation for the product's ultimate quality and price point.

The midstream phase involves manufacturing and processing, which requires substantial capital investment in dedicated, contamination-free production lines and rigorous quality control protocols. Direct manufacturing operations focus on blending and baking processes, where precise temperature and moisture control are essential for compensating for the absence of gluten. Downstream activities involve managing the complex logistics of moving specialized finished goods through both direct and indirect distribution channels. Direct channels often include sales through proprietary e-commerce platforms or direct-to-consumer subscription services, which allow manufacturers higher margin control and direct feedback loops, particularly beneficial for smaller, niche brands. Indirect distribution relies heavily on partnerships with large-scale distributors and specialized food brokers who navigate the complexity of placing these specialized products in mainstream retail shelves, often requiring premium placement fees due to the specialty nature of the items.

Distribution channel choice significantly impacts market reach and final consumer price. Supermarkets and hypermarkets (indirect channel) serve as the primary volume driver, benefiting from high foot traffic, but demand extensive inventory management to prevent shelving adjacent to gluten-containing items—a critical operational hazard. Specialty stores and online retail, while lower in volume, offer better margin potential for premium brands and serve the highly informed consumer. The growing reliance on certified gluten-free logistics providers, who guarantee segregated warehousing and transport, adds another layer of cost but ensures product integrity throughout the supply chain. The overall value chain success hinges not just on efficiency, but on maintaining certification rigor (e.g., from organizations like the Gluten-Free Certification Organization), which acts as a non-negotiable trust component for the end-users, driving brand valuation and consumer confidence in a market where absolute safety is paramount.

Gluten-Free Foods & Beverages Market Potential Customers

The potential customer base for the Gluten-Free Foods & Beverages Market is segmented into two main demographics: clinical consumers and elective/lifestyle consumers, both of which represent distinct purchasing behaviors and motivational triggers. Clinical end-users are individuals who require a strict gluten-free diet as a medical necessity. This group includes patients diagnosed with Celiac Disease, Dermatitis Herpetiformis, or severe cases of Non-Celiac Gluten Sensitivity (NCGS). For these buyers, the non-negotiable attributes are product certification, guaranteed gluten levels below the legal threshold (20 ppm), and brand trust. They demonstrate high loyalty to brands that consistently deliver safe, high-quality staples like certified breads, flours, and pasta, viewing these purchases as essential healthcare expenditure rather than discretionary food choices, thus making their demand highly inelastic to moderate price increases, provided safety and efficacy are maintained.

The elective or lifestyle segment, which constitutes the larger and faster-growing customer base, includes health-conscious consumers, athletes, individuals seeking better digestive health, and those following specific fad diets who perceive gluten avoidance as beneficial for energy levels or weight management. This demographic is highly sensitive to product attributes such as superior taste, texture, clean label ingredients, and alignment with other wellness trends (e.g., high protein, low sugar, vegan). These buyers are more likely to purchase discretionary gluten-free items like specialty snacks, baked goods, and prepared meals. Their purchasing decisions are heavily influenced by digital marketing, social media trends, and celebrity endorsements. The market opportunity lies in converting these lifestyle buyers into repeat customers by consistently offering innovative, great-tasting, and premium products that dispel the historical notion that specialized diets inherently compromise sensory satisfaction, pushing the market beyond its clinical niche and into the mainstream wellness category.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 7.5 Billion |

| Market Forecast in 2033 | USD 14.2 Billion |

| Growth Rate | 9.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Nestlé S.A., The Hain Celestial Group, Inc., General Mills, Inc., Conagra Brands, Inc., Kellogg Company, Dr. Schär AG/SPA, Genius Foods, Enjoy Life Foods, Boulder Brands (Pinnacle Foods), Freedom Foods Group Limited, B&G Foods, Inc., Hero Group, Amy’s Kitchen, Inc., Barilla G. e R. Fratelli S.p.A., Blue Diamond Growers, Quinoa Corporation, Bob’s Red Mill Natural Foods, Inc., Pamela's Products, Udi's Healthy Foods, Snyder's-Lance. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Gluten-Free Foods & Beverages Market Key Technology Landscape

The technological landscape of the Gluten-Free Foods & Beverages Market is defined by intense innovation focused primarily on replicating the viscoelastic properties of gluten, extending shelf stability, and ensuring absolute safety against cross-contamination. A crucial area of research involves the use of novel hydrocolloids and protein structuring techniques. Traditional gluten-free formulations often yield products that are dense, crumbly, and prone to rapid staling. Modern technology leverages advanced combinations of gums (like xanthan, guar, and methylcellulose) in conjunction with protein isolates (pea, rice, potato) to create complex matrices that mimic gluten's network structure, resulting in lighter, loftier, and more resilient baked goods. Furthermore, specialized milling techniques, such as air-classification and cryogenic grinding, are utilized to create ultra-fine flours from alternative grains, significantly improving the mouthfeel and reducing the gritty texture often associated with earlier gluten-free products, thereby enhancing consumer acceptance and driving mainstream adoption.

Another significant technological advancement lies in the processing methodology, specifically enzyme technology and fermentation techniques. Enzymes, such as transglutaminase and amylases, are increasingly employed to modify the structure of non-gluten proteins and starches, improving water retention and dough handling characteristics without compromising the gluten-free status. Controlled fermentation, particularly using specialized sourdough cultures that do not process gluten, enhances the flavor complexity and nutritional profile (e.g., increasing digestibility and B vitamin content) of gluten-free bread, addressing historical consumer complaints about blandness. These biochemical processes not only improve the sensory attributes but also contribute to extended freshness, tackling the economic challenge presented by the notoriously short shelf life of many gluten-free baked products, thereby optimizing distribution logistics and minimizing retail waste.

In terms of operational and quality assurance technology, the market relies heavily on advanced analytical instruments and supply chain tracing systems. High-sensitivity ELISA (Enzyme-Linked Immunosorbent Assay) tests are the gold standard for verifying gluten levels in raw materials and finished products, ensuring compliance with the stringent 20 ppm limit mandated by regulatory bodies like the FDA and the European Commission. Beyond testing, manufacturers utilize advanced packaging technologies, including modified atmosphere packaging (MAP) and specialized barrier films, to protect products from moisture, oxygen, and potential environmental contamination during transit and retail display, further extending freshness and maintaining safety integrity. The integration of blockchain technology is also emerging as a pivotal tool for enhancing supply chain transparency, allowing certified tracing of ingredients from farm to shelf, which builds exceptional trust with the highly sensitive clinical consumer segment, differentiating reliable brands in a competitive environment where safety assurances are paramount.

Regional Highlights

North America currently holds the largest share of the Gluten-Free Foods & Beverages Market, primarily driven by exceptionally high awareness of celiac disease and related sensitivities, coupled with strong consumer purchasing power dedicated to specialized and premium food products. The United States market benefits from well-established diagnostic infrastructures, aggressive labeling regulations (mandating gluten-free claims meet FDA standards), and pervasive cultural adoption of various specialized diets, treating gluten avoidance as a major wellness trend. The mature retail sector, characterized by extensive product variety across major supermarket chains and large specialty retailers, ensures ease of access. Furthermore, proactive R&D investments by major domestic food conglomerates like General Mills and Conagra Brands consistently introduce high-quality, innovative gluten-free substitutes across all product categories, cementing regional dominance and setting global benchmarks for product development and marketing strategy.

Europe represents the second-largest market, exhibiting strong growth, particularly in Western European nations like the UK, Germany, and Italy, where high consumption rates are sustained by robust regulatory frameworks and historical demand linked to high celiac incidence rates. The European market is distinctively influenced by stringent national standards and established certification bodies, lending high credibility to certified products. Growth is accelerated by the rise of artisanal and specialized producers focusing on high-quality, traditional-style gluten-free products, such as authentic Italian pasta and German rye-style breads made from alternative ingredients. While Western Europe is mature, Eastern European countries offer significant potential, aligning with increasing disposable incomes and greater exposure to international dietary trends. The regional landscape is shifting toward products incorporating local, traditional gluten-free grains (e.g., buckwheat), appealing to the desire for both specialty and localized food origins.

The Asia Pacific (APAC) region is projected to register the fastest CAGR during the forecast period. This growth is attributable to rapid urbanization, increasing per capita expenditure on packaged foods, and a growing incidence of obesity and chronic diseases that spur consumer interest in preventative and specialized diets. While historically celiac diagnosis rates were lower, modern diagnostic capabilities are improving, revealing previously undetected cases, especially in urban centers of China, India, and Japan. Manufacturers are seizing the opportunity to adapt gluten-free formulations to suit local taste profiles, incorporating regional staples like rice flour and millet into products. Latin America and the Middle East & Africa (MEA) currently account for smaller shares but show upward trends, driven by increasing health consciousness among the affluent demographic and better availability of imported specialty foods, though high import costs and lower general awareness remain temporary barriers to widespread adoption.

- North America: Market leader due to high consumer awareness, advanced diagnostics, and extensive product availability in mainstream retail; significant driver is the elective wellness consumer segment.

- Europe: Second largest market, driven by stringent regulatory standards and high celiac incidence; strong focus on high-quality, artisanal gluten-free baked goods and established certification schemes.

- Asia Pacific (APAC): Fastest-growing region, fueled by urbanization, dietary shifts, and increasing health consciousness; potential concentrated in adapting products to regional taste preferences.

- Latin America & MEA: Emerging markets with growth potential tied to rising affluence and better distribution infrastructure, though constrained by high import premiums and lower general medical awareness.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Gluten-Free Foods & Beverages Market.- Nestlé S.A.

- The Hain Celestial Group, Inc.

- General Mills, Inc.

- Conagra Brands, Inc.

- Kellogg Company

- Dr. Schär AG/SPA

- Genius Foods

- Enjoy Life Foods

- Boulder Brands (Pinnacle Foods)

- Freedom Foods Group Limited

- B&G Foods, Inc.

- Hero Group

- Amy’s Kitchen, Inc.

- Barilla G. e R. Fratelli S.p.A.

- Blue Diamond Growers

- Quinoa Corporation

- Bob’s Red Mill Natural Foods, Inc.

- Pamela's Products

- Udi's Healthy Foods

- Snyder's-Lance

Frequently Asked Questions

Analyze common user questions about the Gluten-Free Foods & Beverages market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the current growth of the Gluten-Free Foods & Beverages Market?

The primary driver is the combined effect of rising diagnostic rates for celiac disease and, more significantly, the widespread adoption of gluten-free diets by elective consumers seeking perceived health benefits, such as improved digestion, better energy levels, and overall wellness, transforming the category from a medical necessity to a mainstream lifestyle choice.

Why are gluten-free products typically more expensive than conventional foods?

The higher cost is primarily due to several factors: the premium cost of certified gluten-free raw materials (like specialized flours and binders), the need for dedicated, segregated manufacturing facilities to prevent cross-contamination, and the extensive R&D required to ensure superior taste and texture without gluten.

Which product segment holds the largest share in the gluten-free market?

The Bakery & Confectionery segment consistently holds the largest market share. This includes staples such as breads, cookies, cakes, and mixes, which form essential, inelastic purchases for individuals managing medically required gluten-free diets and remain high-demand items for lifestyle consumers.

How does the strictness of contamination standards (20 ppm) affect manufacturing processes?

The 20 parts per million (ppm) standard necessitates rigorous, segregated processing from raw material sourcing through packaging. Manufacturers must implement stringent sanitation protocols, use dedicated equipment, and conduct frequent, high-sensitivity ELISA testing to verify compliance, which adds substantial operational complexity and cost to production.

Is the growth rate of the gluten-free market sustainable, or is it a passing trend?

The market growth is considered sustainable. While the rapid growth fueled by lifestyle trends may moderate, the foundational demand driven by increasing diagnoses of celiac disease and non-celiac gluten sensitivity represents a non-discretionary, permanent consumer base, ensuring consistent long-term demand and stable market expansion supported by ongoing product innovation.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager