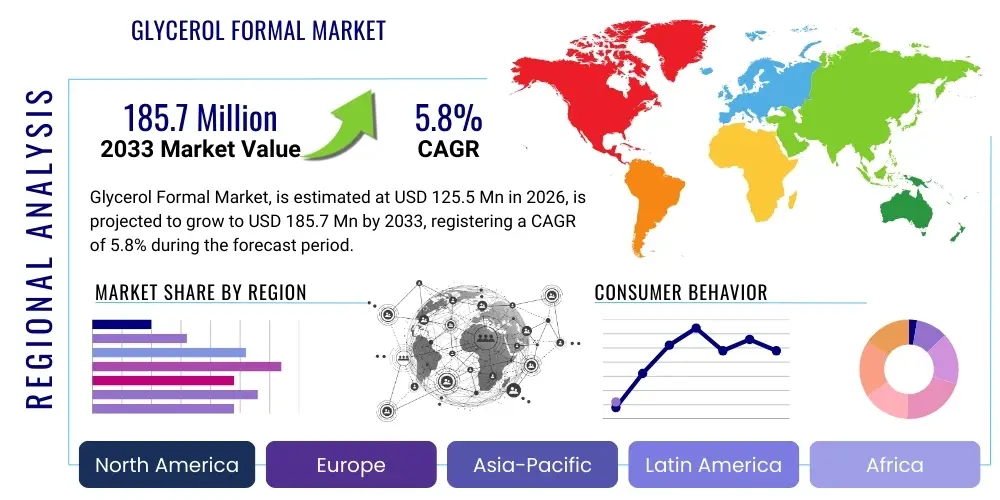

Glycerol Formal Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438596 | Date : Dec, 2025 | Pages : 245 | Region : Global | Publisher : MRU

Glycerol Formal Market Size

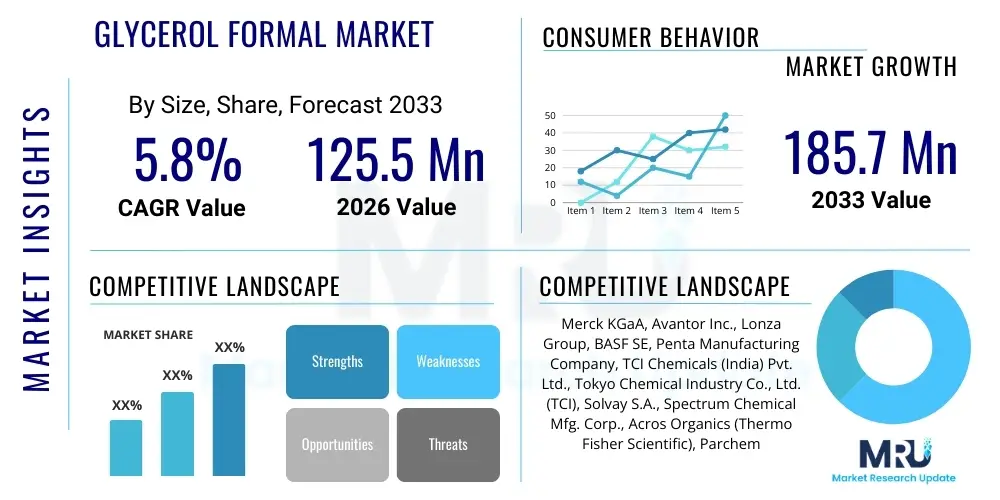

The Glycerol Formal Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at $125.5 Million in 2026 and is projected to reach $185.7 Million by the end of the forecast period in 2033.

Glycerol Formal Market introduction

Glycerol Formal, chemically known as 5-hydroxy-2-methyl-1,3-dioxane and 4-hydroxymethyl-2-methyl-1,3-dioxolane, is a versatile, clear, colorless, and low-viscosity liquid produced through the reaction of glycerol and formaldehyde. It is highly valued across several industries due to its exceptional properties as an aprotic polar solvent, offering high solvency for a wide range of organic and inorganic compounds. Its primary advantage lies in its biodegradability, low toxicity profile compared to traditional hydrocarbon solvents, and excellent stability, making it a preferred choice, especially in environmentally conscious and highly regulated sectors like pharmaceuticals and veterinary medicine. The pharmaceutical industry leverages Glycerol Formal as an excipient and solubilizer for active pharmaceutical ingredients (APIs), particularly those with poor aqueous solubility, thereby enhancing drug delivery effectiveness and bioavailability.

Major applications of Glycerol Formal extend significantly beyond pharmaceuticals, encompassing agrochemicals, flavorings, and specialized cleaning agents. In the agrochemical sector, it functions as an inert carrier and solvent in pesticide and herbicide formulations, ensuring active ingredients are effectively dispersed and delivered. This utility is increasingly critical as agricultural practices seek more targeted and efficient application methods. Furthermore, its use in veterinary products, especially as a delivery vehicle for injectable medications and feed additives, underscores its safety and compatibility with biological systems. The growing global demand for higher-quality, safer food sources and enhanced animal health provisions directly drives its consumption in this segment.

The market growth is substantially driven by the stringent regulatory shift favoring safer and greener solvents. As global chemical regulations, such as REACH in Europe and similar frameworks globally, restrict the use of highly volatile organic compounds (VOCs) and hazardous solvents, Glycerol Formal emerges as an eco-friendly and effective alternative. The increasing research and development activities focused on improving drug solubility and stability, coupled with the expansion of the generic drug manufacturing sector in emerging economies, are significant propelling factors. Its superior characteristics, including high boiling point and resistance to hydrolysis, contribute to the stability and extended shelf life of final formulations, securing its position as a critical ingredient in high-performance applications.

Glycerol Formal Market Executive Summary

The Glycerol Formal Market is characterized by steady expansion, propelled mainly by its irreplaceable function as a green solvent substitute across regulated industries. Key business trends indicate a strong focus on supply chain resilience, particularly securing high-purity glycerol feedstocks, and strategic capacity expansion by leading manufacturers in Asia Pacific (APAC) to meet rising pharmaceutical and agrochemical demands. The market exhibits consolidation in the high-grade segment, where regulatory compliance and product purity are paramount. Furthermore, significant investment in R&D is observed, aimed at exploring novel applications of Glycerol Formal, such as specialized polymer synthesis and advanced material formulations, moving beyond traditional solvent roles. This diversification minimizes reliance on single end-use sectors, ensuring sustained market stability and growth trajectory, despite fluctuations in feedstock pricing.

Regionally, Asia Pacific commands the largest market share and is forecast to demonstrate the highest Compound Annual Growth Rate (CAGR). This dominance is attributed to the rapid expansion of the generic pharmaceutical manufacturing base in countries like India and China, coupled with intensive agricultural practices driving agrochemical demand. North America and Europe, while mature, are characterized by high consumption of premium, high-purity grades, driven primarily by stringent regulatory requirements mandating non-toxic solvents in human and animal health products. The regulatory landscape, specifically concerning environmental impact and worker safety, reinforces the transition away from traditional solvents, cementing Glycerol Formal’s market position across all major geographies, with specific localized strategies focusing on logistical efficiency and localized regulatory navigation.

Segmentation analysis reveals that the Pharmaceutical Application segment dominates revenue, underpinned by the necessity for highly reliable excipients that enhance drug solubility and stability. However, the Veterinary Medicine segment is poised for the fastest growth, stimulated by rising global expenditure on livestock health and companion animal care, particularly in developing economies. From a product perspective, high-purity or Pure Grade Glycerol Formal, essential for injectable drugs and high-end cosmetics, maintains a significant premium over the Technical Grade, which is more commonly deployed in industrial cleaning and lower-end agrochemical formulations. The interplay between demand for sustainable agricultural solutions and the increasing global focus on non-toxic, biocompatible drug delivery systems dictates the overall segmented market dynamics and investment priorities.

AI Impact Analysis on Glycerol Formal Market

Common user questions regarding AI's impact on the Glycerol Formal market often revolve around optimizing synthesis processes, improving purity detection, and predicting feedstock price volatility. Users frequently ask: "Can AI optimize the reaction yield of Glycerol Formal synthesis?", "How can machine learning models improve quality control and impurity detection in high-purity grades?", and "Will predictive analytics stabilize the supply chain by forecasting glycerol feedstock costs?". Based on this analysis, the key thematic concerns center on operational efficiency, stringent quality assurance necessary for regulated applications, and leveraging data-driven forecasting to mitigate raw material risk. Users anticipate that AI integration will revolutionize process chemistry by creating digital twins for synthesis optimization and enhance market responsiveness by better managing complex, global supply logistics.

The direct impact of AI is less focused on substituting the product itself and more on refining its manufacturing and application phases. In manufacturing, AI and machine learning algorithms are being applied to multivariate analysis of reaction parameters—temperature, pressure, catalyst concentration, and residence time—to maximize the yield and selectivity of the desired isomers, minimizing the formation of undesirable byproducts. This precision in synthesis is crucial for high-purity pharmaceutical grades. Furthermore, AI-powered image analysis and spectroscopic data processing enhance quality control, allowing for real-time monitoring and faster release testing, significantly reducing batch failure rates and improving throughput efficiency, thereby decreasing the total cost of production.

In application development, AI facilitates high-throughput screening (HTS) of various solvent systems, including Glycerol Formal, against specific APIs to determine optimal solubility and stability profiles rapidly. This accelerates pre-formulation studies in drug discovery and agrochemical development. Supply chain optimization benefits profoundly from predictive AI models that analyze geopolitical factors, seasonal agricultural cycles affecting glycerol supply, and energy costs. These models provide enhanced forecasting accuracy, enabling procurement teams to secure raw materials at optimal prices and timing, reducing inventory risk, and ensuring consistent supply, which is critical for continuous manufacturing operations in end-user sectors.

- AI-driven optimization of reaction kinetics, leading to higher yield and reduced energy consumption in synthesis.

- Predictive maintenance analytics applied to production equipment, minimizing downtime and improving operational efficiency.

- Enhanced quality control through machine learning analysis of chromatographic and spectroscopic data for real-time impurity detection.

- AI-enabled forecasting models predicting fluctuations in glycerol feedstock pricing, improving procurement strategy and cost management.

- Accelerated R&D in formulation sciences by using AI to model drug solubility and excipient compatibility with Glycerol Formal.

DRO & Impact Forces Of Glycerol Formal Market

The Glycerol Formal Market dynamics are fundamentally shaped by the growing demand for safer, non-toxic, and biodegradable solvents, which acts as the principal driver. However, this growth trajectory is restrained by volatility in raw material prices and the high purity requirements mandated by regulatory bodies for specialized applications. Significant opportunities arise from the increasing adoption of sustainable chemistry principles and the potential for expansion into novel high-performance material applications. These intrinsic market forces—Drivers (D), Restraints (R), and Opportunities (O)—are aggregated and amplified by Impact Forces such as regulatory mandates, environmental sustainability pressures, and technological advancements in synthetic chemistry, collectively determining the market's direction and velocity over the forecast period, emphasizing the need for robust risk management and innovation.

Key drivers include stringent environmental regulations encouraging the phase-out of traditional hazardous solvents, such as certain volatile organic compounds (VOCs), especially in North America and Europe. Glycerol Formal’s favorable eco-toxicological profile makes it an immediate and compliant replacement. Additionally, the rapid expansion of the global pharmaceutical industry, particularly the production of complex, poorly soluble APIs that necessitate effective solubilizers and excipients, provides a continuous demand stream. Conversely, the market faces significant restraints. Glycerol, the primary feedstock, is a byproduct of the biodiesel industry, meaning its supply and price are highly sensitive to global biofuel policies and crude oil price fluctuations, creating cost instability for manufacturers. Furthermore, achieving the ultra-high purity required for injectable pharmaceutical grades demands costly purification processes, which increases the final product price and limits its adoption in price-sensitive industrial applications.

Opportunities for growth are concentrated in two primary areas: innovation and geographical expansion. The development of next-generation chemical syntheses and specialized applications, such as in advanced coatings, specialized lubricants, and as a component in advanced battery electrolytes, presents lucrative diversification avenues. Geographically, emerging economies in APAC and Latin America, characterized by expanding domestic pharmaceutical production and accelerating agricultural intensification, represent vast untapped potential where the shift towards safer solvents is still in its nascent stages. The overall impact forces are dominated by the global imperative for sustainability (pushing adoption) counterbalanced by raw material economic instability (restraining profitability), compelling market players to invest in backward integration and proprietary, cost-effective synthesis technologies to maintain competitive advantage and secure stable supply chains for end-users.

Segmentation Analysis

The Glycerol Formal market is segmented primarily based on Application, Grade, and Function. Application segmentation is critical as it dictates the required purity level and regulatory compliance, with pharmaceuticals and veterinary medicine demanding the highest specifications. Grade segmentation distinguishes between Pure Grade, necessary for human and animal health products, and Technical Grade, sufficient for industrial and bulk agrochemical uses. Functional segmentation provides insight into the primary utility of the product—whether it is used as a highly effective solvent, a low-toxicity diluent, or a specialized chemical intermediate—each commanding different market values and growth rates, thereby offering a multifaceted view of the market structure and commercial viability.

The dominance of the solvent function highlights its intrinsic value, but the fastest growth is often seen in its role as a specialized chemical intermediate in complex synthesis routes. The detailed segmentation structure enables market participants to strategically target high-value niches, particularly those requiring superior toxicology profiles, which currently includes advanced drug delivery systems and high-end cosmetics. Understanding these segment dynamics is essential for anticipating shifts in raw material requirements, optimizing manufacturing processes for specific purity levels, and aligning R&D efforts with high-growth end-user needs, ensuring maximum market penetration and competitive positioning.

- By Application:

- Pharmaceuticals (Injectables, Oral Solutions)

- Veterinary Medicine (Feed Additives, Injectable Drugs)

- Agrochemicals (Pesticide and Herbicide Formulations)

- Industrial Cleaning and Degreasing

- Specialty Chemicals and Intermediates

- By Grade:

- Pure Grade (USP/EP/JP Standards)

- Technical Grade

- By Function:

- Solvents and Cosolvents

- Excipients and Carriers

- Chemical Intermediates

- Plasticizers and Diluents

- By Region:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America

- Middle East and Africa (MEA)

Value Chain Analysis For Glycerol Formal Market

The Value Chain of the Glycerol Formal market begins with the upstream procurement of essential raw materials, primarily high-purity glycerol and formaldehyde. Glycerol supply is heavily linked to the biodiesel production cycle, making upstream pricing highly volatile and necessitating robust risk management strategies by chemical producers. The manufacturing phase involves proprietary synthetic processes (catalyzed acetalization reaction) followed by complex, energy-intensive purification steps, especially to meet the stringent purity standards (USP/EP) required for pharmaceutical applications. Efficient purification technology is a key differentiator in the midstream. Manufacturers then distribute the product either directly to large end-users (pharmaceutical majors) or through specialized chemical distributors who handle inventory management and localized regulatory compliance for smaller clients.

Downstream analysis reveals highly diversified applications. Direct distribution often targets major pharmaceutical companies and leading agrochemical formulators who require large, consistent batches of Pure Grade Glycerol Formal. These end-users integrate the solvent into complex formulations where quality and consistency are paramount. Indirect distribution channels, utilizing local and regional chemical trading houses, cater to technical grade requirements in industrial cleaning, specialized coatings, and as intermediates for chemical synthesis. The indirect channel relies heavily on the distributor’s logistical network and capacity to repackage and deliver smaller, specific volumes tailored to various manufacturing needs, optimizing localized supply chain efficiency and minimizing transportation costs associated with bulk liquid handling.

The profitability and stability within the value chain are significantly influenced by optimizing conversion efficiency during synthesis and minimizing energy consumption during purification, emphasizing technological advancement at the core manufacturing level. Key stakeholders across the chain, from glycerol producers to final pharmaceutical formulators, exhibit strong vertical collaboration. This is driven by regulatory pressures demanding full traceability and quality assurance from raw material to finished product, especially within the pharmaceutical segment. The successful deployment of Glycerol Formal relies on efficient logistics for bulk liquids and expert technical support provided by manufacturers and specialized distributors, ensuring the product is correctly integrated into complex downstream formulations, thereby creating high barriers to entry for new players lacking established technical expertise and supply contracts.

Glycerol Formal Market Potential Customers

The primary potential customers for the Glycerol Formal market are organizations requiring non-toxic, highly effective polar solvents and specialized excipients compliant with global health and environmental standards. The most significant buyers are large multinational pharmaceutical companies that utilize Glycerol Formal as a crucial solubilizer for poorly water-soluble Active Pharmaceutical Ingredients (APIs) in both oral and injectable formulations, focusing on drug stability and improved bioavailability. Their demand is characterized by extremely high-purity requirements (Pure Grade, validated to USP/EP standards) and reliance on stable, audited supply chains, often engaging in long-term supply agreements with established chemical manufacturers to ensure uninterrupted production of essential medicines.

Another major customer segment includes global agrochemical giants. These companies utilize Technical Grade Glycerol Formal as an inert solvent and carrier to enhance the efficacy, spreadability, and stability of their pesticide, insecticide, and herbicide concentrates. The selection of Glycerol Formal in this sector is driven by its low phytotoxicity and favorable environmental profile, which increasingly matters for market acceptance in regions with strict environmental oversight. Furthermore, the veterinary pharmaceutical industry represents a rapidly expanding customer base, needing high-quality solvents for large-volume injectable livestock treatments and companion animal medications, placing high value on its proven track record of biological compatibility and low systemic toxicity.

Beyond these core markets, specialized chemical processors, manufacturers of advanced coatings, and cosmetic formulators constitute a growing segment of potential customers. In cosmetics, Glycerol Formal serves as an effective solubilizer for fragrances and active cosmetic ingredients. In industrial applications, smaller manufacturers use Technical Grade for specialized precision cleaning and degreasing operations where environmental and worker safety standards restrict the use of harsher chlorinated or petroleum-based solvents. The purchasing decisions of these diversified customers are motivated by a blend of regulatory compliance, performance characteristics (solvency power, stability), and competitive pricing, making customer engagement highly tailored to the specific grade and application requirements.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $125.5 Million |

| Market Forecast in 2033 | $185.7 Million |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Merck KGaA, Avantor Inc., Lonza Group, BASF SE, Penta Manufacturing Company, TCI Chemicals (India) Pvt. Ltd., Tokyo Chemical Industry Co., Ltd. (TCI), Solvay S.A., Spectrum Chemical Mfg. Corp., Acros Organics (Thermo Fisher Scientific), Parchem fine & specialty chemicals, Central Drug House (CDH), Aarti Industries Ltd., Haihang Industry Co., Ltd., Wuxi Bikang Bioengineering Co., Ltd., Otto Chemie Pvt. Ltd., VWR International, Finar Chemicals, J&K Scientific, Loba Chemie Pvt. Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Glycerol Formal Market Key Technology Landscape

The manufacturing technology landscape for Glycerol Formal is primarily centered on enhancing the efficiency and purity of the acetalization reaction between glycerol and formaldehyde. Traditional synthesis involves acid-catalyzed processes, which require careful control of temperature and pressure to maximize the yield of the desired isomeric mixture (dioxolane and dioxane forms) while minimizing side reactions and the formation of impurities like unreacted formaldehyde or residual acids. Current technological innovations focus heavily on using heterogeneous catalysts, such as solid acid catalysts (e.g., zeolites or ion-exchange resins), which offer significant environmental benefits by simplifying downstream separation and eliminating the need for neutralizing the reaction mixture, thereby reducing waste generation and corrosive equipment wear. This catalytic shift is crucial for meeting the stringent specifications of the Pure Grade segment.

Furthermore, separation and purification technologies represent a critical technological bottleneck, particularly for achieving pharmaceutical-grade purity (less than 0.1% water and minimal residual formaldehyde). State-of-the-art purification techniques utilize advanced multi-stage distillation columns operating under optimized vacuum conditions, coupled with specialized adsorption or membrane filtration systems. These integrated purification trains are designed to remove trace impurities, unreacted raw materials, and water highly efficiently, dramatically reducing production cycles and associated energy costs. The continuous flow synthesis methods are also gaining traction, enabling precise process control, rapid reaction times, and scalability, providing manufacturers with greater flexibility in meeting fluctuating market demands and reducing batch-to-batch variability, which is essential for pharmaceutical compliance.

Digitalization and process analytical technology (PAT) are increasingly integral to the modern Glycerol Formal production facility. Implementation of real-time spectroscopic monitoring (e.g., Near-Infrared or Raman spectroscopy) allows for continuous measurement of critical quality attributes directly within the reaction and purification streams. This enables immediate adjustments, optimizing yield, and ensuring consistency. The integration of advanced process control systems (APCS), often leveraging AI algorithms as discussed previously, minimizes human error, optimizes energy usage, and provides comprehensive data logging necessary for regulatory audits. This technological evolution ensures that production can reliably deliver high volumes of ultra-pure product while maintaining cost competitiveness in a tightly regulated global market.

Regional Highlights

- Asia Pacific (APAC): APAC is the dominant and fastest-growing region, primarily driven by the colossal expansion of generic drug manufacturing bases in India (known as the pharmacy of the world) and China. Favorable government policies promoting domestic pharmaceutical and agrochemical industries, coupled with lower manufacturing costs and abundant raw material access (as both countries are major biodiesel producers), fuel demand. The increasing pressure on Asian countries to adopt greener chemical alternatives in their manufacturing processes further accelerates the transition to Glycerol Formal from traditional solvents.

- North America: This region is characterized by high demand for Pure Grade Glycerol Formal, driven by rigorous FDA regulations requiring non-toxic excipients for injectable drug formulations and veterinary products. Innovation in high-performance coatings and specialty chemicals also contributes significantly. While the market growth rate is stable compared to APAC, the volume consumed per application often carries a higher price premium due to the ultra-high purity specifications and reliable supply chain requirements demanded by major U.S.-based pharmaceutical corporations.

- Europe: Europe holds a strong market position, highly influenced by the REACH regulatory framework, which actively restricts hazardous chemical use and encourages the adoption of sustainable solvents like Glycerol Formal. The robust presence of global veterinary medicine companies and a mature specialty chemical sector, particularly in Germany and Switzerland, ensures sustained consumption. European market growth is intrinsically linked to the continent's commitment to Green Chemistry principles and circular economy initiatives, necessitating continuous substitution of legacy petrochemical solvents.

- Latin America: This region is experiencing moderate growth, mainly fueled by the expansion of its agricultural sector, requiring large volumes of Technical Grade Glycerol Formal for efficient agrochemical formulations, particularly in Brazil and Argentina. The domestic pharmaceutical industry is developing, driving demand for lower volumes of Pure Grade material, but the primary consumption remains linked to commodity-driven agricultural output, where cost efficiency is a major deciding factor in purchasing.

- Middle East and Africa (MEA): The MEA market is currently the smallest but exhibits emerging potential, especially in countries investing heavily in developing localized pharmaceutical and veterinary medicine manufacturing capabilities (e.g., Saudi Arabia and UAE). The consumption is largely dependent on imported finished products, but infrastructure investment is gradually shifting demand towards local sourcing of chemical intermediates and excipients, positioning the region for future gradual market penetration.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Glycerol Formal Market.- Merck KGaA

- Avantor Inc.

- Lonza Group

- BASF SE

- Penta Manufacturing Company

- TCI Chemicals (India) Pvt. Ltd.

- Tokyo Chemical Industry Co., Ltd. (TCI)

- Solvay S.A.

- Spectrum Chemical Mfg. Corp.

- Acros Organics (Thermo Fisher Scientific)

- Parchem fine & specialty chemicals

- Central Drug House (CDH)

- Aarti Industries Ltd.

- Haihang Industry Co., Ltd.

- Wuxi Bikang Bioengineering Co., Ltd.

- Otto Chemie Pvt. Ltd.

- VWR International

- Finar Chemicals

- J&K Scientific

- Loba Chemie Pvt. Ltd.

- Kao Corporation

- Yingkou Tanyun Chemical Research Institute Co., Ltd.

- Sigma-Aldrich (Merck KGaA)

- Fisher Scientific International Inc.

- Honeywell International Inc.

Frequently Asked Questions

Analyze common user questions about the Glycerol Formal market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary function of Glycerol Formal in the pharmaceutical industry?

Glycerol Formal primarily functions as a highly effective, low-toxicity aprotic polar solvent and excipient used to solubilize Active Pharmaceutical Ingredients (APIs) that have poor water solubility, enhancing drug bioavailability and stability, particularly in injectable and oral liquid formulations.

How is the pricing of Glycerol Formal influenced by external factors?

Pricing is significantly influenced by the cost and supply volatility of its main feedstock, glycerol, which is largely a byproduct of the biodiesel industry. Fluctuations in crude oil prices, biofuel mandates, and agricultural output directly impact the economic viability and production cost of Glycerol Formal.

Which geographical region exhibits the fastest growth potential for Glycerol Formal?

The Asia Pacific (APAC) region is projected to show the fastest growth, driven by massive expansion in generic pharmaceutical manufacturing, increased agrochemical usage, and the growing transition toward compliant, green solvents across industrial sectors in countries like China and India.

What are the key differences between Pure Grade and Technical Grade Glycerol Formal?

Pure Grade must meet rigorous regulatory standards (e.g., USP/EP), featuring extremely high purity and low moisture content, making it suitable for human and animal health applications. Technical Grade is less pure and used in industrial cleaning, specialized coatings, and bulk agrochemical formulations where regulatory stringency is lower.

What role does sustainability play in the adoption of Glycerol Formal?

Sustainability is a major driver; Glycerol Formal is classified as a green solvent alternative. Its low VOC content, biodegradability, and favorable environmental safety profile make it a preferred replacement for traditional hazardous petrochemical solvents, aligning with global regulatory trends like REACH.

Is Glycerol Formal used in non-solvent applications?

Yes, besides being an excellent solvent and excipient, Glycerol Formal is utilized as a specialized chemical intermediate in certain organic syntheses and occasionally acts as a plasticizer or diluent in complex polymer and coating formulations where its low toxicity is advantageous.

What are the primary safety concerns associated with Glycerol Formal?

Glycerol Formal is generally considered low toxicity. The primary safety concerns revolve around handling concentrated liquid, ensuring proper ventilation, and maintaining minimal residual formaldehyde levels in the final product, especially for pharmaceutical use, which is managed through rigorous purification.

How does technological advancement affect Glycerol Formal manufacturing?

Technological advancement, particularly the implementation of heterogeneous catalysts and continuous flow reactors, improves reaction selectivity, reduces the need for corrosive acid catalysts, and enhances purification efficiency, lowering production costs and improving consistency for high-purity grades.

Which end-user segment consumes the largest volume of Glycerol Formal?

The Pharmaceutical application segment, encompassing both human and veterinary medicines, currently accounts for the largest revenue share due to the high value and stringent purity requirements placed on the solvent when used as an injectable excipient and drug solubilizer.

How does AI contribute to optimizing the Glycerol Formal supply chain?

AI uses predictive analytics to forecast the price and availability of glycerol feedstock, helping manufacturers optimize procurement timing and inventory management, thereby stabilizing production costs and ensuring supply chain resilience against market volatility.

What impact do strict environmental regulations have on market entry?

Strict environmental regulations create higher barriers to entry for new competitors who lack the necessary technological sophistication for green synthesis and high-level waste management, thereby favoring established players with proven compliance records and advanced purification technologies.

Is Glycerol Formal prone to degradation or instability?

Glycerol Formal exhibits good chemical stability under normal storage conditions due to its high boiling point and resistance to oxidation. However, it is sensitive to hydrolysis under strong acidic or basic conditions, which necessitates careful formulation and storage protocols in end-user applications.

Where is Glycerol Formal commonly used in the agricultural sector?

In the agricultural sector, it is predominantly used in the formulation of concentrated pesticides and herbicides, acting as a carrier and solvent to enhance the stability, delivery, and efficacy of the active agrochemical ingredients on the target crops.

How do cosmetic manufacturers utilize Glycerol Formal?

Cosmetic manufacturers utilize it as a safe, effective solvent and solubilizer for incorporating difficult-to-dissolve active ingredients and fragrance oils into lotions, creams, and specialized skin care products, capitalizing on its low dermal irritation potential.

What differentiates Glycerol Formal from traditional solvents like DMSO or DMF?

Glycerol Formal offers superior environmental and toxicological profiles compared to traditional highly polar solvents such as Dimethyl Sulfoxide (DMSO) or Dimethylformamide (DMF), leading to its substitution in applications requiring higher worker safety and environmental compliance.

What is the significance of the two isomeric forms of Glycerol Formal?

Glycerol Formal exists as a mixture of two isomers: 5-hydroxy-2-methyl-1,3-dioxane and 4-hydroxymethyl-2-methyl-1,3-dioxolane. The specific ratio of these isomers can affect the solvency power and physical properties, often requiring tight control during synthesis for specific high-end applications.

Does the market rely on specific patents for production?

While the basic synthesis method is mature, manufacturers often hold proprietary patents concerning specific heterogeneous catalyst systems, advanced purification techniques, and processes optimized for achieving ultra-low impurity levels required for highly regulated Pure Grade products.

What is the primary constraint limiting the market's overall expansion?

The primary constraint is the price volatility of the glycerol feedstock, which is intrinsically tied to global energy markets and biodiesel production economics, leading to unpredictable operational costs for Glycerol Formal manufacturers.

How does the veterinary medicine segment contribute to market growth?

The veterinary medicine segment is a rapidly growing contributor, driven by increased global expenditure on livestock and companion animal health, where Glycerol Formal is valued for its proven safety and efficacy as an excipient in injectable animal medications and feed supplement carriers.

Are there substitutes that pose a threat to the Glycerol Formal market?

Yes, while specialized substitutes exist (e.g., certain glycol ethers or advanced bio-solvents), Glycerol Formal maintains a competitive edge due to its optimal balance of solvency power, non-toxicity, and cost effectiveness, although continuous innovation in green chemistry substitutes necessitates vigilance.

What is the typical regulatory approval process for using Glycerol Formal in pharmaceuticals?

Pharmaceutical use requires approval from regulatory bodies like the FDA or EMA, where the material must be manufactured according to GMP standards and documented thoroughly as an excipient in the drug master file (DMF) submission, confirming its purity, stability, and lack of adverse effects.

Which industrial applications utilize Technical Grade Glycerol Formal?

Technical Grade Glycerol Formal is utilized in specific industrial applications such as cleaning printed circuit boards, degreasing precision machinery components, and as a component in specialized brake fluid and heat transfer fluid formulations due to its high boiling point and solvency.

How do geopolitical events affect the market supply chain?

Geopolitical tensions or trade restrictions can disrupt the global flow of key feedstocks, specifically glycerol derived from biodiesel, impacting the supply consistency and increasing logistical costs for Glycerol Formal manufacturers globally.

What impact does the trend toward biopharmaceuticals have on demand?

While traditional small-molecule drugs are the primary consumers, the biopharmaceutical sector occasionally uses Glycerol Formal in auxiliary cleaning and preparation phases or in specific formulation steps where high-purity, inert solvents are required, though its role is less central than in small-molecule drug delivery.

How is environmental safety ensured during production?

Manufacturers employ strict containment protocols, advanced wastewater treatment, and utilize greener catalytic processes to minimize the environmental footprint. Solid acid catalysts, for instance, eliminate corrosive liquid waste streams, aligning production with modern environmental standards and reducing regulatory risk.

What is the significance of the low volatility of Glycerol Formal?

Low volatility is highly significant as it reduces losses during formulation, improves worker safety by minimizing inhalation exposure, and ensures compliance with increasingly strict regulations regarding Volatile Organic Compounds (VOCs) in commercial products and industrial processes.

Does the market show potential for customization?

Yes, there is potential for customization, primarily related to the isomeric ratio of the final product and specific concentration levels of stabilizers or co-solvents, allowing manufacturers to tailor the product to meet precise solubility requirements for unique downstream chemical syntheses.

What factors drive the growth of the specialty chemicals segment?

The specialty chemicals segment growth is driven by the use of Glycerol Formal as a superior, non-toxic intermediate for synthesizing complex fine chemicals, advanced polymers, and specialized additives that require high-purity starting materials.

How does the market manage the risk of feedstock price fluctuation?

Market players manage feedstock price risk through long-term contracts with glycerol suppliers, strategic hedging, and investing in advanced inventory management systems optimized by predictive AI models to secure raw material purchasing at advantageous prices.

What is the estimated market share held by the Pure Grade segment?

While Pure Grade accounts for a smaller volume share compared to Technical Grade, it commands a significantly higher price per unit, contributing disproportionately to total market revenue, estimated to hold over 40% of the market value due to pharmaceutical utilization.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager