Glycine Based Amino Acid Surfactant Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433313 | Date : Dec, 2025 | Pages : 245 | Region : Global | Publisher : MRU

Glycine Based Amino Acid Surfactant Market Size

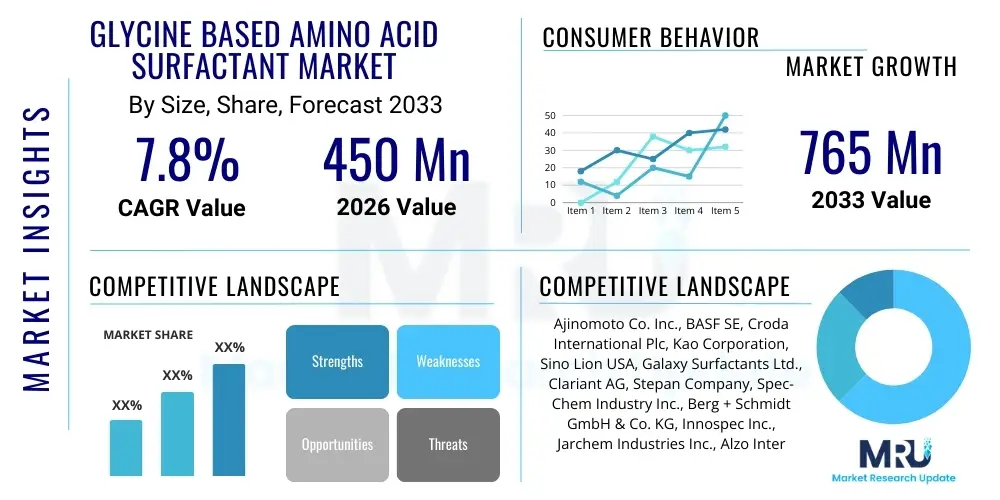

The Glycine Based Amino Acid Surfactant Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.8% between 2026 and 2033. The market is estimated at USD 450 Million in 2026 and is projected to reach USD 765 Million by the end of the forecast period in 2033. This substantial expansion is fundamentally driven by the escalating consumer demand for natural, mild, and highly biocompatible ingredients in personal care and cosmetic formulations, particularly in highly developed economies like North America and Western Europe, where regulatory scrutiny and consumer awareness regarding synthetic chemicals are exceptionally high.

Market expansion is further bolstered by technological advancements in green chemistry and fermentation processes, which are reducing the cost and improving the scalability of manufacturing high-purity glycine derivatives, making them increasingly competitive alternatives to traditional sulfate-based surfactants. The versatility of these amino acid-based compounds—offering excellent foaming, cleansing, and conditioning properties while maintaining skin barrier integrity—positions them as premium ingredients essential for specialized product lines targeting sensitive skin and eco-conscious consumers. The shift towards waterless beauty and concentrated formulations also favors these surfactants dueencing to their high performance in complex solvent systems.

Geographically, the Asia Pacific region, led by China, Japan, and South Korea, is anticipated to register the highest growth rate, fueled by a booming domestic cosmetic industry, rising disposable incomes, and the strong cultural affinity for high-quality, naturally derived beauty products. Investments in regional manufacturing capabilities and the establishment of local supply chains are critical factors supporting the exponential growth observed in this region, which is rapidly adopting global trends in sustainable and mild personal hygiene solutions. This sustained growth trajectory confirms the integral role of glycine-based surfactants in the future landscape of specialty chemical ingredients.

Glycine Based Amino Acid Surfactant Market introduction

Glycine based amino acid surfactants are a class of mild, biodegradable, and low-irritating surface-active agents derived from glycine, the simplest non-essential amino acid, combined with fatty acids (typically derived from coconut oil or palm oil). Key products include Sodium Cocoyl Glycinate (SCG) and Potassium Cocoyl Glycinate (PCG). These compounds are synthesized via the acylation of glycine with fatty acid chlorides, resulting in amphoteric molecules that exhibit exceptional foaming, detergency, and emulsifying capabilities while being gentle enough for sensitive skin and mucosal membranes. Their superior biocompatibility is a defining characteristic, making them highly sought after in formulations where mildness is paramount, such as baby products and ophthalmic solutions.

The major applications of these specialized surfactants span across the personal care industry, encompassing facial cleansers, body washes, shampoos, toothpastes, and specialized skin treatment products. Beyond personal care, they are increasingly utilized in high-performance household cleaning products and industrial cleaners requiring mild yet effective cleaning power combined with rapid biodegradability. The growing regulatory environment pushing for the replacement of harsh chemicals like sulfates (SLS/SLES) has significantly accelerated the adoption of glycine-based surfactants, establishing them as essential building blocks for clean beauty and green chemistry initiatives globally. Their inherent ability to maintain the skin’s natural pH and moisture balance is a key driver for consumer acceptance and formulation preference among leading brands.

The primary driving factors propelling this market forward include the robust consumer preference for natural and organic ingredients, stringent global regulatory measures curtailing the use of petrochemical derivatives, and continuous innovation aimed at improving surfactant stability and performance under various temperature and pH conditions. Benefits derived from utilizing these surfactants include reduced skin irritation, enhanced product stability, improved foam quality (dense and creamy), and strong environmental profiles due to their quick and complete biodegradability. This confluence of consumer demand, regulatory pressure, and superior performance metrics underpins the market's current positive momentum and future growth forecast.

Glycine Based Amino Acid Surfactant Market Executive Summary

The Glycine Based Amino Acid Surfactant Market is experiencing dynamic growth, characterized by strong business trends centered on sustainability, customization, and supply chain optimization. Key business trends include the increasing number of strategic partnerships between chemical manufacturers and major consumer goods companies to secure stable sourcing of specialized glycine derivatives, ensuring formulation consistency across global product lines. Furthermore, manufacturers are focusing heavily on investing in advanced fermentation and biotransformation technologies to produce these surfactants more efficiently, reducing reliance on traditional chemical synthesis routes and improving the overall 'green' credentials of their offerings. This shift toward bio-based feedstocks aligns with broader corporate social responsibility goals and directly addresses investor and consumer demands for environmentally sound practices.

Regional trends indicate a pronounced divergence in market maturity and growth dynamics. North America and Europe represent mature markets defined by stringent cosmetic regulations (e.g., EU Cosmetics Regulation) and high consumer willingness to pay a premium for certified natural ingredients. In contrast, the Asia Pacific region exhibits exponential growth, driven by rapid urbanization, increasing per capita spending on beauty products, and the rise of localized 'K-Beauty' and 'C-Beauty' trends, which heavily feature mild, high-performance ingredients. This region is not only a major consumer but is rapidly becoming the epicenter of manufacturing capacity expansion, particularly in China, leveraging economies of scale to cater to both local and international demand.

Segmentation trends highlight the dominance of the Cosmetics & Personal Care application segment, specifically within facial cleansing and specialized hair care, where the mildness and superior foam quality of glycine derivatives are critical differentiators. Within the product type segment, Sodium Cocoyl Glycinate (SCG) maintains the largest market share due to its excellent cost-to-performance ratio and established use history. However, there is an accelerating trend toward customized surfactant blends and novel glycine derivatives tailored for specific functions, such as enhanced moisturizing effects or improved compatibility with cationic polymers, suggesting future market fragmentation and specialization across product lines.

AI Impact Analysis on Glycine Based Amino Acid Surfactant Market

User inquiries regarding AI's influence on the Glycine Based Amino Acid Surfactant Market primarily revolve around three core themes: accelerated ingredient discovery, optimization of synthesis processes, and enhancing predictive safety and efficacy profiling. Users frequently ask how AI and machine learning (ML) models can shorten the time needed to identify novel, highly functional amino acid derivatives or optimize fermentation conditions for increased yield and purity, thereby lowering production costs. A major concern addressed by AI analysis is the ability to predict the interaction and compatibility of these mild surfactants with complex polymer systems and active pharmaceutical ingredients (APIs) much faster than traditional laboratory screening, thus speeding up product development cycles in the competitive personal care sector.

The application of AI in computational chemistry allows researchers to simulate the micellar structure and surface tension properties of thousands of glycine derivatives virtually, identifying candidates with optimal performance characteristics before expensive and time-consuming physical synthesis is initiated. This shift from physical experimentation to digital modeling drastically enhances R&D efficiency. Furthermore, predictive analytics, powered by vast datasets of historical synthesis runs, enable manufacturers to fine-tune reaction parameters (temperature, pH, solvent ratios) in real-time within production facilities, ensuring maximum batch consistency and minimizing waste, which is particularly crucial for maintaining the 'green' promise of these eco-friendly ingredients.

AI also plays a pivotal role in consumer trend analysis and personalized product development. By processing massive volumes of consumer feedback, social media data, and market sales figures, AI algorithms can accurately predict the demand for specific characteristics—such as 'sulfate-free, deep-cleaning foam' or 'ultra-mild baby formulation'—allowing manufacturers to rapidly formulate and launch glycine-based products precisely tailored to current niche and mainstream consumer preferences. This optimization, from feedstock sourcing to final product launch, cements AI’s position as a transformative force in both the manufacturing precision and strategic market positioning of glycine-based amino acid surfactants.

- AI-driven acceleration of novel glycine derivative discovery through computational chemistry modeling.

- Optimization of fermentation and synthesis processes using machine learning for enhanced yield and purity.

- Predictive analysis of surfactant compatibility and stability within complex cosmetic formulations.

- Real-time quality control and process parameter adjustment in manufacturing facilities to reduce batch variability.

- Enhanced consumer trend forecasting and personalized ingredient matching based on large-scale data analysis.

DRO & Impact Forces Of Glycine Based Amino Acid Surfactant Market

The dynamics of the Glycine Based Amino Acid Surfactant Market are fundamentally shaped by a robust interplay of Drivers, Restraints, and Opportunities, which collectively determine the overall Impact Forces acting upon market growth. The principal driver remains the overwhelming consumer demand for natural, sulfate-free, and mild cosmetic ingredients, positioning these surfactants as essential components for ethical and sensitive skin product lines. This is strongly reinforced by continuous advancements in sustainable sourcing and green chemistry, making high-performance glycine derivatives more accessible and economically viable across various application fields, including household care. However, the market faces significant restraints, primarily stemming from the relatively high production cost compared to commodity surfactants like SLES, which requires substantial upfront capital investment in specialized production technologies, and the challenges associated with complex large-scale production ensuring consistent purity.

Opportunities for growth are vast, particularly in leveraging untapped markets such as specialized industrial cleaning, textile auxiliaries, and agricultural formulations where the need for mild, non-toxic, and highly biodegradable surfactants is escalating. Furthermore, the increasing acceptance of multi-functional surfactants that offer cleansing, conditioning, and emulsifying properties simultaneously presents a key avenue for innovation and premium pricing. Strategic mergers and acquisitions aimed at consolidating supply chain control and intellectual property relating to novel amino acid synthesis methods will also unlock new competitive advantages and accelerate market penetration globally. The shift toward solid and concentrated product formats (e.g., shampoo bars) represents a niche, high-growth opportunity where these surfactants excel due to their superior structuring capabilities and mildness in high-concentration environments.

The Impact Forces, categorized by market pull and supply push, are heavily weighted towards factors supporting expansion. Regulatory push for green chemicals acts as a powerful external force compelling large CPG companies to reformulate their product portfolios, prioritizing ingredients like SCG and PCG. Supply chain disruptions and volatility in feedstock (fatty acid) prices pose a moderating restraint, demanding robust risk management strategies from manufacturers. Overall, the positive influence of sustainability mandates and premium consumer demand significantly outweighs the high-cost barrier, propelling sustained, value-based growth throughout the forecast period, emphasizing quality and environmental performance over simple cost metrics.

- Drivers (D): Accelerating consumer shift towards mild, natural, and biodegradable cosmetic ingredients; increasing regulatory restrictions on synthetic surfactants (e.g., sulfates, ethoxylates); superior performance characteristics (creamy foam, low irritation) appealing to premium segments.

- Restraints (R): High production cost and complexity compared to conventional commodity surfactants; limited production capacity compared to market demand, leading to supply bottlenecks; challenges in formulation stability with certain cationic polymers.

- Opportunity (O): Expansion into non-personal care sectors like specialty industrial cleaning and agrochemicals; development of novel, ultra-concentrated product formats; technological advancements in biotechnology lowering production costs and enhancing scalability.

- Impact Forces: High sustainability demand (Positive, High Impact); Cost Differential vs. Commodity Surfactants (Negative, Medium Impact); R&D Investment in Green Synthesis (Positive, Medium Impact).

Segmentation Analysis

The Glycine Based Amino Acid Surfactant Market segmentation provides a granular view of the industry structure, primarily categorized by Product Type, Application, and Geography. This detailed breakdown is crucial for manufacturers to tailor their product offerings, distribution strategies, and pricing models to specific end-user requirements. The market is highly segmented based on the specific fatty acid chain length and the cation used (Sodium, Potassium), which dictates the foaming profile, solubility, and ultimately, the suitability for diverse applications ranging from sensitive facial cleansers to heavy-duty laundry detergents. Understanding these segments is key to identifying niche areas of rapid growth, such as the increasing demand for ultra-mild Potassium Cocoyl Glycinate (PCG) in premium anti-aging and baby care products.

The Application segmentation reveals the Personal Care and Cosmetics industry as the dominant consumer, driven by the ongoing 'sulfate-free' movement and the rise of 'clean beauty' brands globally. Within personal care, skin care accounts for the largest share due to the daily use nature of facial cleansers and body washes where mildness is paramount. However, the Household Care segment is rapidly gaining momentum as consumers extend their preference for non-toxic, eco-friendly ingredients from their personal routines to home cleaning products, demanding biodegradable surfactants in dishwashing liquids and surface cleaners. This segment’s growth highlights the expanding scope of glycine derivatives beyond traditional cosmetic applications.

Geographically, the segmentation confirms the global reach of the market, with Asia Pacific exhibiting the highest growth potential due to expanding manufacturing bases and rapidly evolving consumer preferences in emerging economies. The strategic importance of segmentation lies in enabling companies to allocate R&D resources effectively, focusing on developing new glycine derivatives that specifically address performance gaps in emerging segments, such as creating more stable, high-foaming options for cold-process manufacturing or highly concentrated formulas compatible with eco-friendly packaging solutions.

- By Product Type:

- Sodium Cocoyl Glycinate (SCG)

- Potassium Cocoyl Glycinate (PCG)

- Sodium Lauroyl Glycinate (SLG)

- Potassium Lauroyl Glycinate (PLG)

- Others (e.g., customized blends, specialty derivatives)

- By Application:

- Personal Care & Cosmetics

- Skin Care (Facial Cleansers, Body Washes)

- Hair Care (Shampoos, Conditioners)

- Oral Care (Toothpastes, Mouthwashes)

- Baby Care Products

- Household Care

- Dishwashing Liquids

- Laundry Detergents

- Surface Cleaners

- Industrial & Institutional (I&I) Cleaners

- Agricultural Formulations

- Personal Care & Cosmetics

- By Region:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America (LATAM)

- Middle East and Africa (MEA)

Value Chain Analysis For Glycine Based Amino Acid Surfactant Market

The value chain for Glycine Based Amino Acid Surfactants starts with upstream activities involving the sourcing and processing of core raw materials: Glycine (derived typically from synthetic routes or fermentation) and Fatty Acids (primarily Lauric and Myristic acids, often sourced from palm kernel or coconut oil). Quality control and sustainability certification at the raw material stage are critical, as the purity of glycine and the sustainability of the fatty acid sourcing significantly impact the final product’s performance and marketability, particularly for 'green' labels. The chemical transformation—the acylation process—is the most crucial manufacturing step, requiring specialized equipment and high levels of expertise to ensure yield optimization and product purity, establishing the foundation for competitive differentiation.

The downstream analysis focuses on formulation and distribution. Once manufactured, the refined surfactants are sold, often in concentrated liquid or powder form, to compounders and specialized formulators. These entities incorporate the surfactants into final consumer products, blending them with other active ingredients, thickeners, and preservatives tailored to specific applications (e.g., adjusting pH for a skin cleanser vs. a shampoo). Distribution channels are predominantly indirect, involving a network of specialized chemical distributors and agents who manage logistics, regulatory compliance, and localized technical support for CPG manufacturers. Direct sales are typically reserved for very large volume contracts between top-tier manufacturers and multinational cosmetic houses.

The efficiency of the distribution channel, particularly in regions like APAC where complex regulatory landscapes exist, plays a major role in market penetration. Direct channels offer better pricing control and deeper technical support but limit reach, while indirect channels provide extensive market coverage and speed of delivery. The overall value chain is highly integrated vertically in large firms that control both raw material processing and final surfactant synthesis, offering greater cost control. For smaller players, strategic reliance on robust distribution networks and specializing in niche, high-purity grades often compensates for the lack of vertical integration, focusing on speed and customization to meet the specialized demands of clean beauty brands.

Glycine Based Amino Acid Surfactant Market Potential Customers

The primary consumers and end-users of glycine-based amino acid surfactants are multinational and localized companies operating within the consumer packaged goods (CPG) sector, particularly those focused on premium, natural, and sensitive skin formulations. Large cosmetic manufacturers (e.g., L’Oréal, Unilever, Procter & Gamble) are major buyers, integrating these mild surfactants into flagship lines marketed for superior skin and hair health benefits. Furthermore, specialized "clean beauty" brands and artisanal cosmetic producers constitute a rapidly growing customer base, often preferring high-purity, certified natural grades to align with their brand ethos, resulting in robust demand for small-to-medium batch customization.

Beyond personal care, the market extends significantly to household care product manufacturers. These customers, including those specializing in eco-friendly household cleaners, require surfactants that offer powerful cleaning ability combined with non-toxicity and rapid environmental degradation. The increasing consumer awareness regarding the environmental impact of chemicals used in the home means that glycine derivatives are becoming a standard requirement for premium, green-labeled detergents and dishwashing liquids, positioning the household sector as a critical area for future volume growth.

A third, emerging segment includes specialty industrial and institutional (I&I) cleaning suppliers and agricultural chemical formulators. In the I&I sector, customers seek mild surfactants for use in areas where surface integrity and user safety are paramount (e.g., hospital cleaning, food processing plants). In agriculture, they are utilized as mild dispersants and wetting agents for biocontrol and organic pesticide formulations, where the environmental compatibility and low phytotoxicity of amino acid surfactants offer a significant advantage over conventional chemical additives. These diverse buyer segments underscore the multifunctional appeal and broad applicability of glycine-based amino acid surfactants.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 450 Million |

| Market Forecast in 2033 | USD 765 Million |

| Growth Rate | 7.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Ajinomoto Co. Inc., BASF SE, Croda International Plc, Kao Corporation, Sino Lion USA, Galaxy Surfactants Ltd., Clariant AG, Stepan Company, Spec-Chem Industry Inc., Berg + Schmidt GmbH & Co. KG, Innospec Inc., Jarchem Industries Inc., Alzo International Inc., Colonial Chemical, Inc., Miwon Commercial Co., Ltd., Solvay S.A., Resperse, Guangzhou Tinci Materials Technology Co., Ltd., Schill + Seilacher GmbH, Wuxi Huayang Chemical Co., Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Glycine Based Amino Acid Surfactant Market Key Technology Landscape

The technology landscape for the Glycine Based Amino Acid Surfactant Market is characterized by a strong focus on two main areas: optimizing chemical synthesis (acylation) for yield and purity, and leveraging biotechnology for sustainable sourcing and novel derivative creation. Traditional production involves the reaction of fatty acid chlorides with glycine under alkaline conditions. Recent technological advances focus on continuous flow reactors and micro-reactor technology, which enhance reaction kinetics, minimize side product formation, and ensure higher scalability while maintaining rigorous quality standards necessary for cosmetic applications. This move toward precision manufacturing significantly addresses the historical challenge of high batch variability and inconsistency in purity, thus stabilizing the supply of premium-grade surfactants.

A burgeoning technological trend is the adoption of biocatalysis and fermentation processes to produce glycine and specific fatty acid precursors, shifting away from petrochemical routes and unsustainable sourcing. Utilizing engineered microorganisms to synthesize bio-glycine or specific chain-length fatty acids is critical for meeting the stringent 'natural origin' index requirements of the cosmetic industry. Furthermore, enzyme-catalyzed synthesis (enzymatic acylation) is emerging as a potentially greener and milder alternative to traditional chemical methods, reducing energy consumption and eliminating the need for harsh solvents, although these processes are still subject to scale-up challenges and higher initial catalyst costs compared to traditional synthesis.

Innovation also extends into formulation technology, where specialized encapsulation and dispersion techniques are employed to maximize the effectiveness of glycine-based surfactants, especially in complex product matrices such as shampoos containing conditioning polymers or solid bar formats. Technology focusing on reducing water content in formulations (waterless beauty) utilizes specialized powder processing and agglomeration technologies, allowing these mild surfactants to be incorporated efficiently while preserving their functional properties. The continuous pursuit of patents related to greener synthetic routes and novel performance characteristics indicates a highly competitive technological environment aimed at improving both the economic viability and the environmental footprint of these specialized ingredients.

Regional Highlights

- Asia Pacific (APAC): APAC is the epicenter of future growth, largely driven by the cosmetic powerhouses of China, Japan, and South Korea. South Korea and Japan, in particular, are global leaders in developing and utilizing amino acid surfactants due to their highly advanced cosmetic R&D and strong consumer preference for gentle, non-irritating formulations (e.g., K-Beauty trends favoring mild cleansers). China’s immense domestic market and its rapidly expanding manufacturing capabilities are critical for both supply and demand, contributing significantly to the regional market volume. The region benefits from increasing disposable incomes and a high adoption rate of international cosmetic standards and trends.

- North America: This region represents a mature and highly profitable market, characterized by high consumer awareness regarding ingredient safety and sustainability. Demand is heavily concentrated among mid-to-high-end personal care brands that explicitly market their products as 'clean,' 'sulfate-free,' and 'natural.' Regulatory pressure, particularly in states like California, reinforces the shift away from petrochemical-derived chemicals. The presence of major CPG headquarters and large R&D hubs ensures continuous innovation and rapid adoption of advanced, high-purity glycine derivatives.

- Europe: Europe is defined by stringent environmental and cosmetic regulations (REACH, EU Cosmetics Regulation), creating a mandatory framework for sustainable and non-toxic ingredients. The demand for glycine-based surfactants is exceptionally strong, driven by Western European countries (Germany, France, UK) where ecological labels and sustainability certifications hold significant sway over purchasing decisions. The market focus here is on product traceability, sustainable sourcing of fatty acids (e.g., RSPO certification), and high-performance in specialized segments like certified organic cosmetics.

- Latin America (LATAM): This region shows significant potential for growth, particularly in Brazil and Mexico, fueled by expanding local manufacturing and a growing middle class increasingly prioritizing premium personal care items. Market penetration is currently lower than in Europe or North America, but increasing foreign investment and local development of sustainable product lines are set to accelerate adoption, focusing initially on hair care and body wash segments.

- Middle East and Africa (MEA): Growth in MEA is more nascent but accelerating, particularly in the UAE and Saudi Arabia, driven by rapid urbanization and rising luxury consumer segments demanding high-quality international brands. The market is often served by imports, though local manufacturing initiatives are slowly emerging, catering primarily to the burgeoning regional hair care and prestige beauty sectors.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Glycine Based Amino Acid Surfactant Market.- Ajinomoto Co. Inc.

- BASF SE

- Croda International Plc

- Kao Corporation

- Sino Lion USA

- Galaxy Surfactants Ltd.

- Clariant AG

- Stepan Company

- Spec-Chem Industry Inc.

- Berg + Schmidt GmbH & Co. KG

- Innospec Inc.

- Jarchem Industries Inc.

- Alzo International Inc.

- Colonial Chemical, Inc.

- Miwon Commercial Co., Ltd.

- Solvay S.A.

- Resperse

- Guangzhou Tinci Materials Technology Co., Ltd.

- Schill + Seilacher GmbH

- Wuxi Huayang Chemical Co., Ltd.

Frequently Asked Questions

Analyze common user questions about the Glycine Based Amino Acid Surfactant market and generate a concise list of summarized FAQs reflecting key topics and concerns.What defines glycine based amino acid surfactants as "mild" and environmentally friendly?

Glycine based amino acid surfactants, such as Sodium Cocoyl Glycinate (SCG), are defined as mild because their molecular structure mimics natural skin components (amino acids), resulting in low critical micelle concentration, reduced denaturation of skin proteins, and minimal irritation to the eyes and skin barrier. They are environmentally friendly due to their rapid and complete biodegradability, typically derived from natural sources like coconut oil and glycine.

How do the costs of glycine based surfactants compare to traditional surfactants like SLS or SLES?

Glycine based amino acid surfactants generally have a significantly higher cost structure compared to commodity surfactants like Sodium Lauryl Sulfate (SLS) or Sodium Laureth Sulfate (SLES). This premium pricing is attributed to the complex, multi-step synthesis process, the higher purity requirements for cosmetic grade materials, and the need for specialized production equipment, although technological advances are continuously working to narrow this price gap.

Which application segment currently drives the highest demand for these surfactants globally?

The Personal Care and Cosmetics segment drives the highest demand globally, specifically within facial cleansers, body washes, and sulfate-free shampoos. The market share leadership is attributed to the high consumer preference for the creamy, dense foam profile and the gentle cleansing action provided by these ingredients, which are essential for premium 'clean beauty' product positioning.

What are the primary differences between Sodium Cocoyl Glycinate (SCG) and Potassium Cocoyl Glycinate (PCG)?

The primary difference lies in the counter-ion used: Sodium vs. Potassium. SCG typically offers a slightly creamier and more voluminous foam and is often preferred for solid bar formats, but it can be less soluble in hard water. PCG generally exhibits superior water solubility and is easier to formulate into liquid products at high concentrations, often lending itself better to ultra-mild liquid cleansers and shampoos.

What major regulatory factor is accelerating the adoption of glycine-based surfactants in developed markets?

The major accelerating factor is the implementation of stringent regulatory and consumer mandates in regions like the EU and North America to restrict or eliminate 1,4-dioxane contamination and petrochemical-derived ingredients like sulfates (SLS/SLES) and ethoxylated compounds. This regulatory shift compels manufacturers to reformulate products using safer, readily biodegradable alternatives like glycine based amino acid surfactants to ensure market compliance and consumer acceptance.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager