GMP Cell Banking Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432928 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

GMP Cell Banking Market Size

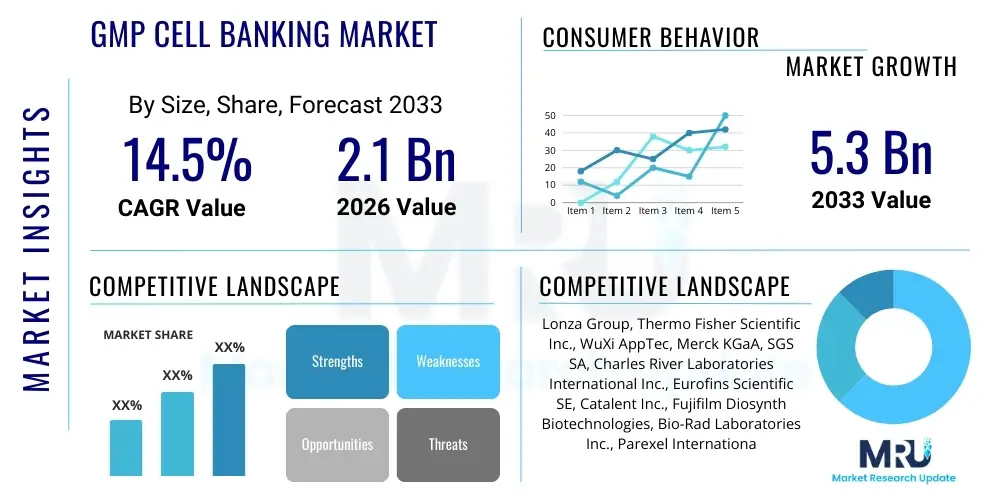

The GMP Cell Banking Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 14.5% between 2026 and 2033. The market is estimated at USD 2.1 Billion in 2026 and is projected to reach USD 5.3 Billion by the end of the forecast period in 2033.

GMP Cell Banking Market introduction

The GMP Cell Banking Market encompasses the specialized processes of generating, characterizing, and storing cell banks (Master Cell Banks and Working Cell Banks) under strict Good Manufacturing Practice (GMP) guidelines. These cell banks serve as the foundation material for the production of biological therapeutics, including monoclonal antibodies, gene therapies, cell therapies, and vaccines. The primary product is a well-characterized, homogeneous population of cells maintained under conditions that ensure genetic stability, viability, and sterility, crucial for maintaining product quality and regulatory compliance throughout the drug development lifecycle.

Major applications of GMP cell banking span clinical research, commercial manufacturing, and biopharmaceutical discovery, supporting the burgeoning fields of regenerative medicine and personalized therapeutics. The rigor of GMP ensures that the cellular material used in drug production is safe, traceable, and consistent, minimizing the risk of contamination or genetic drift that could compromise the final drug product's efficacy or safety profile. As the global pipeline for advanced therapies expands, the demand for high-quality, regulatory-compliant cell banking services escalates rapidly.

Key driving factors include the substantial increase in R&D investment in cell and gene therapy, the rising prevalence of chronic diseases necessitating complex biologic treatments, and stringent global regulatory requirements mandating GMP compliance for all starting biological materials. Benefits derived from utilizing outsourced or specialized in-house GMP cell banks include risk mitigation, scalability, standardization of production, and accelerated time-to-market for novel therapeutics. The robustness and security offered by specialized cell banking facilities are fundamental to the success of modern biomanufacturing.

GMP Cell Banking Market Executive Summary

The GMP Cell Banking Market is characterized by robust growth driven primarily by the global surge in cell and gene therapy clinical trials and subsequent commercial approvals. Key business trends include consolidation among Contract Development and Manufacturing Organizations (CDMOs) offering integrated cell banking services, significant investments in automation to enhance throughput and reduce human error, and a technological shift towards closed-system processing to maintain higher sterility assurance. Strategic partnerships between emerging biotech companies and established cell bank providers are also prevalent, aimed at securing critical starting material supply chains.

Regionally, North America maintains market dominance due to its highly developed biopharmaceutical infrastructure, leading number of clinical studies, and early adoption of advanced manufacturing technologies. However, the Asia Pacific region is demonstrating the fastest growth trajectory, fueled by increasing government support for biotechnology, expanding local manufacturing capabilities in countries like China and South Korea, and lower operational costs attracting global outsourcing activities. Europe remains a strong market due to stringent regulatory frameworks (EMA guidelines) and a large presence of innovative pharmaceutical companies focused on novel therapies.

Segment-wise, the Master Cell Bank (MCB) segment holds a vital position due to its foundational role and high regulatory scrutiny, while the Working Cell Bank (WCB) segment shows substantial volume growth correlating directly with increased commercial manufacturing scales. Application-wise, commercial manufacturing is expected to drive the highest revenue as more advanced therapeutic candidates transition from clinical trials into widespread market use, necessitating large-scale, consistent WCB production. Furthermore, the cell type segmentation is seeing rapid expansion in specialized primary and induced pluripotent stem cell (iPSC) banking, moving beyond traditional CHO and microbial cell lines.

AI Impact Analysis on GMP Cell Banking Market

Users frequently inquire about how Artificial Intelligence (AI) can enhance the reliability, efficiency, and characterization aspects of GMP cell banking. Common user questions revolve around AI’s role in predicting cell line stability, optimizing cryopreservation protocols, automating quality control (QC) testing, and ensuring data integrity and regulatory compliance (21 CFR Part 11). The core themes summarized indicate high expectations for AI to minimize batch failures, accelerate the establishment phase of cell banks, and provide deeper, non-subjective insights into cell viability and genetic consistency, ultimately improving the speed and safety of biopharmaceutical production.

- AI-powered predictive modeling for assessing long-term genetic stability and viability of cell lines, reducing the need for extensive real-time testing.

- Automation of image analysis and flow cytometry data interpretation for high-throughput Quality Control (QC) and cell counting processes.

- Optimization of cryopreservation media composition and freezing protocols using machine learning algorithms to maximize cell recovery rates.

- Implementation of AI in monitoring environmental conditions within cell storage units, predicting potential equipment failures, and ensuring continuous GMP compliance.

- Enhanced data management and integrity systems (Data Lakes) using AI to track cell lineage, audit trails, and harmonize documentation required for regulatory submissions.

- Robotics and AI integration in aseptic filling and vialing processes, minimizing human intervention and subsequent contamination risk during bank preparation.

- Faster identification of microbial or adventitious agent contamination through sophisticated pattern recognition in sequencing or culture data.

DRO & Impact Forces Of GMP Cell Banking Market

The GMP Cell Banking Market is primarily driven by the exponential growth in the global biologics and advanced therapies pipeline, demanding rigorously controlled starting materials. Regulatory mandates, particularly those set by the FDA and EMA regarding traceability and purity of therapeutic components, act as strong market drivers, compelling manufacturers to invest in high-standard GMP facilities. Conversely, the market is restrained by the extremely high initial capital investment required to establish GMP-compliant facilities and the scarcity of highly specialized personnel capable of managing complex cell banking protocols. Opportunities lie in developing advanced automation platforms, offering novel, customized cell banking solutions for niche cell types (e.g., patient-specific iPSCs), and geographical expansion into developing markets.

Impact forces currently shaping the market include the significant push towards digitalization and data integrity management to streamline regulatory audits and the persistent need for supply chain resilience in the face of global logistical challenges. Furthermore, the market is being shaped by environmental sustainability goals, prompting the adoption of energy-efficient cryostorage and banking processes. The overall impact of these forces is a trajectory towards increased complexity, specialization, and integration across the biomanufacturing value chain, where compliance and efficiency are paramount competitive advantages.

The inherent regulatory bottleneck faced during the characterization phase, which can extend timelines and increase costs, remains a critical restraint. However, the opportunity provided by standardization efforts—such as those led by organizations aiming to harmonize global cell banking practices—presents a substantial lever for future growth and risk reduction. The convergence of these drivers (high demand for biologics), restraints (regulatory complexity, cost), and opportunities (automation, standardization) defines the dynamic competitive landscape of the GMP Cell Banking Market.

Segmentation Analysis

The GMP Cell Banking Market is segmented based on the type of cell bank, the cell type being banked, and the primary application of the banked cells. This comprehensive segmentation allows stakeholders to analyze market penetration across the biopharmaceutical lifecycle, from early-stage research to large-scale commercial production. The increasing complexity of advanced therapy medicinal products (ATMPs) necessitates highly specialized segmentation, particularly concerning specialized cell lines like T-cells for CAR-T therapies or sophisticated viral vectors, influencing pricing strategies and technological requirements within each segment.

- By Type: Master Cell Bank (MCB), Working Cell Bank (WCB)

- By Cell Type: Mammalian Cells (e.g., CHO, HEK 293), Microbial Cells (e.g., E. coli, Yeast), Stem Cells (e.g., iPSCs, MSCs), Primary Cells, Insect Cells

- By Application: Clinical Development (Phase I, II, III), Commercial Manufacturing, Drug Discovery & Research

- By End User: Pharmaceutical and Biopharmaceutical Companies, Contract Manufacturing Organizations (CMOs)/Contract Development and Manufacturing Organizations (CDMOs), Research Institutes and Academic Centers

- By Geography: North America, Europe, Asia Pacific, Latin America, Middle East & Africa

Value Chain Analysis For GMP Cell Banking Market

The GMP Cell Banking value chain begins with upstream activities focused on cell line development (CLD), selection, and optimization, often involving specialized intellectual property rights regarding the parental cell line. This stage is critical for ensuring the inherent quality and productivity of the cell source. Midstream activities encompass the actual preparation of the Master Cell Bank (MCB) and subsequent Working Cell Bank (WCB) under stringent GMP protocols, including cell culture expansion, bulk harvesting, filling, and cryopreservation. Rigorous Quality Control (QC) and Quality Assurance (QA) testing for identity, purity, viability, and sterility are integral parts of this core manufacturing phase, incurring significant compliance costs.

Downstream analysis involves the long-term secure storage of the banked cells, typically using validated vapor-phase liquid nitrogen freezers, often managed by specialized biorepositories or third-party logistics providers. Distribution channels are highly controlled and require specialized cold chain logistics to transport WCBs to manufacturing sites globally. Direct distribution channels involve the cell bank provider supplying the material directly to the end-user (e.g., a large biopharma client's manufacturing site), offering better control and traceability. Indirect channels might involve logistics partners or specialized couriers managing international shipments, requiring validated packaging and temperature monitoring systems to maintain the integrity of the frozen product.

The integration of the value chain, particularly the seamless transition from CLD to GMP banking, is a key competitive differentiator. Companies that offer integrated services (CDMOs) reduce transfer complexity and regulatory burden for clients. The shift towards decentralized manufacturing for cell therapies also influences the distribution channels, requiring faster, smaller-scale, and highly localized distribution of WCBs or even pre-cursors, enhancing the need for robust, specialized distribution networks capable of managing ultra-low temperatures globally.

GMP Cell Banking Market Potential Customers

Potential customers and end-users of GMP cell banking services are fundamentally the organizations responsible for developing, manufacturing, and commercializing biological therapeutic products. The largest segment comprises multinational pharmaceutical and biopharmaceutical companies that require vast, high-quality, and globally accessible cell banks to support their expansive product pipelines, including blockbuster monoclonal antibodies and increasingly, advanced therapies. These entities frequently outsource specialized banking services to leverage external expertise, validated infrastructure, and regulatory compliance assurances.

A rapidly growing segment includes emerging biotech companies and startups, particularly those focused on novel cell and gene therapies, which often lack the necessary in-house GMP manufacturing infrastructure. These smaller entities rely heavily on Contract Development and Manufacturing Organizations (CDMOs) for establishing their foundational MCBs and scaling up WCB production to support clinical trials and early commercialization phases. Their buying decision is often driven by technical competency, regulatory track record, and speed of service delivery.

Furthermore, academic research institutes and major hospital systems engaged in translational medicine, especially in the context of personalized medicine and allogeneic cell therapies, represent significant consumers. While academic needs may sometimes involve non-GMP research-grade banks, the shift toward investigator-initiated clinical trials (IITs) increasingly necessitates collaboration with GMP banking providers to ensure that starting materials meet regulatory standards for human use. This diverse customer base ensures sustained high demand across the entire drug development spectrum.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 2.1 Billion |

| Market Forecast in 2033 | USD 5.3 Billion |

| Growth Rate | 14.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Lonza Group, Thermo Fisher Scientific Inc., WuXi AppTec, Merck KGaA, SGS SA, Charles River Laboratories International Inc., Eurofins Scientific SE, Catalent Inc., Fujifilm Diosynth Biotechnologies, Bio-Rad Laboratories Inc., Parexel International Corporation, Danaher Corporation (via subsidiaries), CryoPort Inc., Azenta Life Sciences (formerly Brooks Automation), BioNTech SE, Cytiva (part of Danaher), LGC Biosearch Technologies, Syngene International Ltd., Aldevron, Vigene Biosciences. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

GMP Cell Banking Market Key Technology Landscape

The technological landscape of the GMP Cell Banking market is rapidly evolving, driven by the need for enhanced sterility, consistency, and scale-up capacity. A pivotal technology involves advanced cell culture systems, moving away from traditional static culture plates toward bioreactors, including single-use and perfusion systems, which allow for high-density cell expansion while maintaining closed-system integrity. Furthermore, sophisticated cryopreservation techniques, such as controlled-rate freezers utilizing optimized freezing curves and media free from animal-derived components (xeno-free media), are standard practice to maximize post-thaw viability and meet stringent regulatory requirements for human safety.

Automation and robotic systems are critical for maintaining GMP standards during the labor-intensive processes of cell harvesting, counting, and vialing. Fully automated liquid handling workstations reduce the risk of cross-contamination and human error, offering high precision and repeatability essential for WCB production at large scale. Integration of sensors and real-time monitoring systems is also essential, providing continuous data capture on environmental parameters (temperature, humidity, pressure differentials) within cleanrooms and storage facilities, ensuring full traceability and audit readiness required by regulatory bodies like the FDA.

Beyond manufacturing, the QC and characterization technologies are highly sophisticated. High-throughput sequencing (NGS) and digital PCR (dPCR) are increasingly used for exhaustive characterization of cell identity, genetic stability, and adventitious agent testing, offering significantly higher sensitivity than traditional methods. Data management platforms, leveraging cloud computing and validated electronic batch record systems, constitute the essential digital backbone, ensuring compliance with data integrity regulations such as 21 CFR Part 11 and supporting seamless transfer of information between the cell bank provider and the drug manufacturer.

Regional Highlights

Regional dynamics play a crucial role in shaping the GMP Cell Banking market, primarily driven by the concentration of biopharmaceutical activity, regulatory infrastructure, and investment flow into life sciences.

- North America (Dominance and Innovation): North America, led by the United States, commands the largest market share due to unparalleled R&D spending, a high volume of active clinical trials (especially in gene and cell therapies), and the presence of major biopharma headquarters and leading CDMOs. The strict regulatory environment established by the FDA sets a global benchmark for GMP cell banking quality, driving continuous technological innovation in the region.

- Europe (Steady Growth and Regulatory Alignment): Europe represents a mature market with significant capacity, particularly in countries like Germany, the UK, and Switzerland. Growth is sustained by strong governmental support for biotechnology and harmonization of manufacturing standards across the European Medicines Agency (EMA) member states. Strategic partnerships and focus on specialized ATMP banking are key regional trends.

- Asia Pacific (Fastest Growth and Outsourcing Hub): APAC, driven by China, Japan, and South Korea, is projected to exhibit the highest CAGR. This growth is attributable to massive investments in domestic biomanufacturing capabilities, supportive government policies aimed at reducing reliance on Western imports, and the region's emergence as a highly competitive outsourcing destination for Western biopharma seeking cost efficiencies in cell banking and large-scale manufacturing.

- Latin America (Emerging Regulatory Frameworks): The market in Latin America is nascent but growing, primarily focused on establishing localized manufacturing capabilities and adapting global GMP standards. Brazil and Mexico are key growth nodes, driven by domestic vaccine production needs and increasing foreign investment in clinical research infrastructure.

- Middle East and Africa (Infrastructure Development): The MEA region represents the smallest market but shows potential, particularly within the Gulf Cooperation Council (GCC) nations, which are actively investing in healthcare infrastructure and biotechnology hubs to diversify their economies. The focus is currently on vaccine production and establishing basic GMP compliance capabilities through international collaboration.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the GMP Cell Banking Market.- Lonza Group

- Thermo Fisher Scientific Inc.

- WuXi AppTec

- Merck KGaA

- SGS SA

- Charles River Laboratories International Inc.

- Eurofins Scientific SE

- Catalent Inc.

- Fujifilm Diosynth Biotechnologies

- Bio-Rad Laboratories Inc.

- Parexel International Corporation

- Danaher Corporation (via subsidiaries)

- CryoPort Inc.

- Azenta Life Sciences (formerly Brooks Automation)

- BioNTech SE

- Cytiva (part of Danaher)

- LGC Biosearch Technologies

- Syngene International Ltd.

- Aldevron

- Vigene Biosciences

- GenScript Biotech Corporation

- Cellero

- Precision Biosciences

Frequently Asked Questions

Analyze common user questions about the GMP Cell Banking market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between a Master Cell Bank (MCB) and a Working Cell Bank (WCB)?

The Master Cell Bank (MCB) is the primary seed stock generated directly from the qualified cell line, established in large quantity under GMP conditions, and used solely to generate the WCB. The Working Cell Bank (WCB) is derived from the MCB and is the material used routinely for initiating commercial or clinical production batches. The MCB is reserved for critical situations, ensuring the availability of the original, high-quality material.

Why is GMP compliance critical for cell banking used in drug manufacturing?

GMP compliance ensures that the cell banks meet stringent regulatory standards for identity, purity, viability, and genetic stability. This rigor is crucial because the cell bank is the starting material for therapeutic biologics; any contamination or genetic drift could compromise the safety and efficacy of the final drug product, leading to regulatory rejection or patient harm.

Which sectors are driving the highest demand in the GMP Cell Banking Market?

The cell and gene therapy sector is the primary driver of current market demand. The rapid increase in complex advanced therapy medicinal products (ATMPs), such as CAR-T therapies and viral vector production, requires specialized, ultra-high-quality GMP cell banking services to support both clinical development and commercial-scale manufacturing efforts globally.

What are the key technological advancements improving cell banking efficiency?

Key technological advancements include the widespread adoption of automation and robotic systems for high-throughput processing, the use of closed-system single-use bioreactors for expansion, and advanced analytical methods (like NGS and dPCR) for ultra-sensitive characterization and quality control testing, minimizing human intervention and maximizing consistency.

How does outsourcing cell banking services benefit biopharmaceutical companies?

Outsourcing allows biopharma companies, particularly smaller biotechs, to leverage specialized expertise, established GMP infrastructure, and validated cryostorage capacity without the significant capital investment required for in-house facilities. This reduces regulatory risk, accelerates project timelines, and ensures access to state-of-the-art technologies and specialized cold chain logistics.

What major regulatory hurdles impact the establishment of GMP cell banks?

Major regulatory hurdles include demonstrating complete genetic stability across maximum passage levels, comprehensive testing for adventitious agents and viruses specific to the cell type and species of origin, ensuring robust data integrity (21 CFR Part 11 compliance) throughout the characterization and storage process, and successful regulatory submission documentation (CMC section).

How are environmental sustainability concerns influencing the market?

Environmental concerns are driving demand for more energy-efficient cryostorage solutions, such as high-density automated repositories that reduce the physical footprint and consumption associated with traditional liquid nitrogen storage. Furthermore, there is a push towards optimizing single-use plastic consumption within the manufacturing and banking process to minimize waste generation.

What role do CDMOs play in the GMP Cell Banking value chain?

CDMOs are central to the value chain, offering integrated services spanning cell line development, MCB/WCB establishment, rigorous QC testing, cryostorage, and global distribution. They serve as strategic partners, providing the scalability, regulatory documentation expertise, and operational flexibility necessary for companies ranging from small startups to large pharmaceutical corporations.

What risks are associated with long-term storage of GMP cell banks?

Primary risks include mechanical failure of cryostorage equipment (leading to temperature excursions and cell death), loss of cell viability due to suboptimal freezing/thawing protocols, cross-contamination, and administrative errors leading to misidentification or loss of critical documentation. Mitigation requires dual redundancy, rigorous monitoring, and validated inventory systems.

How is the adoption of iPSCs changing the requirements for GMP cell banking?

The banking of Induced Pluripotent Stem Cells (iPSCs) introduces unique challenges related to maintaining pluripotency, controlling differentiation, and managing complex sourcing/ethics. GMP requirements for iPSCs are extremely high, demanding specialized, highly controlled media (defined, xeno-free) and advanced characterization assays to confirm identity and safety across extended culture periods required for therapeutic application.

What is the significance of closed systems in modern cell banking?

Closed systems, where cell manipulation occurs without exposure to the external environment, significantly minimize the risk of microbial and adventitious contamination. This technology is becoming a regulatory expectation, especially for high-risk cell and gene therapy starting materials, as it provides a superior level of sterility assurance compared to traditional open processing methods.

How is standardization improving the global market?

Standardization efforts, particularly in QC testing methodologies and data reporting formats, are critical for improving international comparability and facilitating regulatory submissions across different jurisdictions (e.g., FDA, EMA, NMPA). Standardized processes reduce variance, improve efficiency, and lower the barriers for global outsourcing and distribution.

What are the current challenges related to cold chain logistics in cell banking distribution?

Challenges include maintaining ultra-low temperatures (often below -150°C) consistently during transit, managing customs clearance complexities for biological materials across international borders, ensuring real-time temperature monitoring and data logging throughout the journey, and securing validated packaging solutions capable of protecting sensitive cell vials during potential shipping delays.

Which region is exhibiting the highest growth rate and why?

The Asia Pacific (APAC) region is demonstrating the highest growth rate, primarily driven by substantial government investment in local biomanufacturing capabilities (especially in China and South Korea), lower operating costs attracting global CDMO investment, and a rapidly expanding domestic biopharma pipeline focusing on biosimilars and novel therapies.

How does genetic drift pose a concern in cell banking, and how is it addressed?

Genetic drift refers to spontaneous mutations or phenotypic changes in the cell line over successive passages, potentially altering the productivity or efficacy of the resulting therapeutic. It is addressed by establishing a tightly controlled cell banking system (MCB and WCB), strictly limiting the passage number used for manufacturing, and employing rigorous genetic stability testing (e.g., karyotyping, sequencing) to compare WCBs against the original MCB.

What specific QC tests are mandatory for GMP-compliant cell banks?

Mandatory QC tests include tests for sterility (absence of bacteria, fungi), mycoplasma detection, adventitious viral agents (e.g., retroviruses), cell line identity verification (e.g., STR analysis), viability and recovery rate post-thaw, and determination of the maximum in vitro cell age/passage limit used for manufacturing.

What impact does the growth of personalized medicine have on cell banking?

Personalized medicine, especially autologous cell therapies (e.g., CAR-T), necessitates distributed, smaller-scale, and rapid GMP cell banking services for patient-specific material. This drives demand for flexible, high-security facilities capable of managing unique, low-volume batches with extreme traceability requirements, shifting the market focus toward decentralized production models.

What role does digitalization play in maintaining GMP compliance?

Digitalization ensures compliance by providing electronic batch records, validated data acquisition systems, and secure audit trails that meet regulatory requirements for data integrity (ALCOA+ principles). Digital platforms streamline data review, minimize transcription errors, and facilitate rapid retrieval of documentation during regulatory inspections.

How is the market addressing the shortage of specialized labor?

The market is addressing the labor shortage through increased investment in automation and AI-driven systems that reduce reliance on manual, highly skilled technicians. Additionally, leading CDMOs are implementing comprehensive in-house training programs and forming academic partnerships to develop a pipeline of professionals specialized in advanced biomanufacturing and GMP quality assurance.

What is the expected long-term trend regarding cell banking ownership (in-house vs. outsourced)?

The long-term trend favors increased outsourcing, particularly among emerging biotech and established biopharma seeking specialized services for complex ATMPs and requiring global capacity. While large pharma may retain some in-house capacity for foundational MCBs, the scalability, speed, and reduced regulatory burden offered by expert CDMOs will continue to drive market share toward outsourcing models.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager