GMP Grade Cytokines Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438826 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

GMP Grade Cytokines Market Size

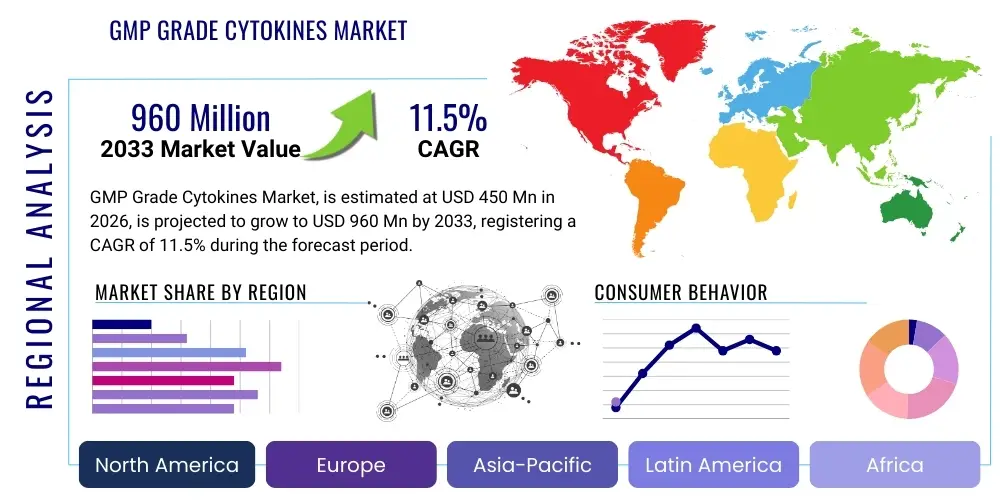

The GMP Grade Cytokines Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 11.5% between 2026 and 2033. The market is estimated at USD 450 million in 2026 and is projected to reach USD 960 million by the end of the forecast period in 2033.

GMP Grade Cytokines Market introduction

The market for Good Manufacturing Practice (GMP) grade cytokines encompasses high-quality, biologically active signaling molecules produced under stringent regulatory conditions specifically mandated for use in clinical applications, especially cell and gene therapy (CGT) manufacturing, tissue engineering, and regenerative medicine. These molecules, which include various interleukins, growth factors, and interferons, are indispensable components for the large-scale expansion, differentiation, and maintenance of therapeutic cells, such such as T-cells, NK cells, and stem cells. Given the direct patient implications, GMP grade cytokines must exhibit exceptional purity, traceability, consistency, and low endotoxin levels, distinguishing them sharply from research-grade reagents used primarily for laboratory experiments. The rigorous quality standards inherent to GMP production ensure batch-to-batch consistency and mitigate the risk of contamination, which is paramount for successful clinical translation and regulatory approval of advanced therapeutic medicinal products (ATMPs).

Major applications driving this market include the flourishing landscape of CAR T-cell therapies, where specific cytokines like IL-2, IL-7, and IL-15 are critical for T-cell activation and proliferation ex vivo. Furthermore, the burgeoning field of induced pluripotent stem cell (iPSC) technology and mesenchymal stem cell (MSC) therapeutic development relies heavily on reliable supplies of GMP growth factors to guide cell fate decisions and maintain pluripotency. The primary benefits of utilizing GMP grade materials stem from enhanced patient safety, reduced regulatory hurdles during Investigational New Drug (IND) submissions, and improved process reliability in high-stakes clinical manufacturing environments. These benefits directly accelerate therapeutic development timelines and enhance the scalability of advanced treatments, making them foundational to the biomanufacturing ecosystem.

Key driving factors propelling market expansion include the exponential increase in global clinical trials for CGT products, the regulatory push toward using compliant raw materials throughout the manufacturing supply chain, and continuous technological advancements in recombinant protein expression and purification techniques. As more ATMPs receive regulatory approval and transition into commercial manufacturing phases, the demand for bulk quantities of cost-effective and highly reliable GMP grade cytokines is escalating significantly. The market is also benefiting from strategic partnerships between cytokine manufacturers and Contract Development and Manufacturing Organizations (CDMOs) focused on standardizing upstream material sourcing, thereby securing the supply chain resilience essential for global cell therapy deployment.

GMP Grade Cytokines Market Executive Summary

The GMP Grade Cytokines Market is characterized by robust growth driven primarily by the global acceleration of cell and gene therapy (CGT) development and commercialization. Business trends emphasize strategic consolidation, vertical integration among key suppliers, and a strong focus on enhancing product formulation stability and reducing production costs through efficient recombinant systems, often utilizing microbial or mammalian expression platforms. The shift toward closed-system manufacturing and the necessity for chemically defined, animal-component-free media formulations are also influencing product innovation, aiming to simplify regulatory compliance and optimize large-scale bioprocessing. Leading market players are investing heavily in expanding their GMP production capacities and geographically diversifying their supply chains to meet the intense, fluctuating demand from biopharmaceutical companies and academic research centers globally, ensuring traceability and securing intellectual property related to proprietary manufacturing methods for critical factors like FGF2, TGF-beta, and various interleukins.

Regional trends indicate North America currently holds the largest market share, predominantly due to the high concentration of advanced biotech companies, extensive R&D investment in oncology and rare disease treatments, and a mature regulatory framework supporting clinical trials and commercialization of ATMPs. Europe follows, buoyed by supportive governmental initiatives like the European Medicines Agency's (EMA) prioritization of ATMPs and the establishment of sophisticated biomanufacturing hubs in countries such as Germany and the UK. However, the Asia Pacific (APAC) region is projected to exhibit the fastest CAGR, fueled by massive government investment in biotechnology infrastructure, increasing numbers of cell therapy clinical trials in China and South Korea, and a growing domestic manufacturing capacity focusing on providing cost-competitive GMP raw materials to global markets. This regional shift is crucial as CGT moves towards broader accessibility and lower-cost manufacturing models.

Segmentation trends highlight that the application segment involving clinical manufacturing, specifically for autologous and allogeneic cell therapies, commands the largest market share, reflecting the high volume needs associated with commercial production and late-stage clinical trials. By product type, recombinant human cytokines dominate, valued for their biological compatibility and defined structure, though novel formulations and engineered factors designed for enhanced stability or specific receptor targeting are gaining traction. Furthermore, there is a distinct trend towards suppliers offering customized cytokine cocktails optimized for specific cell types or disease models, addressing the nuanced requirements of precision medicine and personalized cell therapy manufacturing protocols, thereby cementing the criticality of highly specialized, quality-assured raw material suppliers in the advanced therapeutic pipeline.

AI Impact Analysis on GMP Grade Cytokines Market

Users frequently inquire about the capacity of Artificial Intelligence (AI) and Machine Learning (ML) to mitigate the current challenges faced in GMP cytokine manufacturing, focusing specifically on optimizing yield, ensuring purity, and accelerating the development of novel, stable cytokine analogs. Key concerns revolve around whether AI can truly address batch-to-batch variability, a persistent issue in biomanufacturing, and how AI-driven predictive modeling can reduce the high cost associated with purification processes and rigorous Quality Control (QC) testing necessary for GMP compliance. Expectations are high regarding AI's role in refining upstream fermentation or cell culture processes, where slight shifts in environmental parameters can dramatically affect protein expression and folding. Users anticipate that AI platforms will move beyond simple data analysis to become integral tools for real-time process monitoring, fault detection, and automated adjustment in bioreactors, thereby enhancing overall efficiency and regulatory robustness.

The integration of AI technologies promises a paradigm shift in bioprocess design for GMP cytokines. AI-driven models can analyze complex, high-dimensional datasets derived from cell culture parameters (pH, dissolved oxygen, nutrient levels) and correlate them with downstream protein yield and quality attributes (e.g., glycosylation patterns, aggregation rates). This predictive capacity allows manufacturers to simulate various production scenarios virtually, identifying optimal operating windows and preventing costly failures before they occur in the physical plant. Furthermore, AI contributes significantly to digitalizing QC procedures by utilizing image recognition and advanced analytics for automated cell viability and purity assays, speeding up release testing while reducing human error, which is critical for maintaining GMP standards and accelerating product release cycles in time-sensitive cell therapy logistics.

Another crucial area of AI impact is in the actual design of the cytokine molecules themselves. ML algorithms are being employed to design modified or 'super-agonist' cytokines with improved bioavailability, stability, or target specificity, potentially leading to lower therapeutic dosing and reduced side effects in clinical settings. By analyzing vast databases of protein structure and function, AI can predict the most stable amino acid sequences and optimize codon usage for higher expression levels in chosen host systems (e.g., E. coli or CHO cells). This rational design approach, combined with AI-assisted manufacturing process optimization, ensures that the resulting GMP grade product is not only compliant but also superior in biological function and cost-efficiency, fundamentally supporting the scalability and accessibility goals of the entire advanced therapy market.

- AI optimizes bioreactor operational parameters (temperature, feed rate) to maximize cytokine yield and consistency.

- Machine learning models predict and prevent batch failures by identifying subtle deviations in process variables.

- AI accelerates Quality Control (QC) testing through automated image analysis and predictive analytics for purity and potency assays.

- Computational design platforms facilitate the development of novel, highly stable, or targeted cytokine variants (Superkines).

- Data mining helps refine purification chromatography protocols, reducing raw material waste and lowering production costs.

DRO & Impact Forces Of GMP Grade Cytokines Market

The GMP Grade Cytokines Market is driven by the unprecedented clinical success and commercial proliferation of cell and gene therapies (CGTs), which are inherently dependent on these high-purity raw materials for cell expansion and differentiation. This primary driver is powerfully restrained by the high production cost and complexity associated with meeting stringent global GMP requirements, particularly concerning validation, documentation, and managing complex regulatory submissions across multiple jurisdictions. Significant opportunities arise from the rapid expansion of regenerative medicine applications beyond oncology, including treatments for cardiovascular diseases, diabetes, and neurodegenerative disorders, alongside technological advancements in continuous manufacturing and microfluidic systems that promise to lower unit costs. The key impact forces shaping the market trajectory include intensifying regulatory scrutiny globally, which necessitates continuous investment in quality systems, and the dynamic technological evolution in protein engineering aimed at creating next-generation, more stable and potent signaling molecules.

Drivers include the accelerating transition of numerous CGT candidates from preclinical research into late-stage clinical trials and subsequent commercial manufacturing, demanding exponentially increasing volumes of validated raw materials. The global focus on personalized medicine and the shift towards sophisticated cellular products, which often require specific, complex cytokine cocktails (e.g., cocktails involving IL-2, IL-7, IL-15, and IL-21 for CAR-T cell manufacturing), further solidifies demand. Furthermore, regulatory bodies, such as the FDA and EMA, are increasingly mandating the use of GMP-compliant raw materials early in the development pipeline to ensure product safety and facilitate smoother technology transfer, thereby accelerating market adoption of these high-grade reagents.

Restraints largely center on the technical difficulty and capital investment required for maintaining GMP standards, which translates into premium pricing for the end-user, limiting accessibility for smaller academic research labs. Supply chain vulnerabilities, particularly dependency on specialized purification resins and expression system components, also pose risks, exacerbated by the global need for cold chain logistics and product stability challenges inherent to protein-based materials. Opportunities are vast, primarily through geographical expansion into emerging APAC markets and diversification into novel applications such as exosome-based therapies and synthetic biology applications. The development of robust, cost-effective, and scalable bioprocesses, often through strategic collaborations between raw material suppliers and CDMOs, represents the most critical path toward sustained market growth and overcoming current cost barriers.

Segmentation Analysis

The GMP Grade Cytokines market is primarily segmented based on product type, application, and end-user, reflecting the diverse and specialized requirements of the advanced therapeutics industry. Product segmentation typically includes key categories such as Interleukins, Growth Factors (like FGFs, EGFs, and VEGFs), Chemokines, and Interferons, each serving distinct biological functions essential for specific cell culture protocols. Interleukins, especially those crucial for lymphocyte activation and expansion, hold a dominant position due to the prevalence of T-cell-based therapies. Understanding these segmentation nuances is crucial for suppliers to tailor their portfolio and production volumes to areas experiencing the most significant clinical trial activity and commercial scale-up.

Application segmentation distinguishes between research applications (although diminishing as clinical use accelerates), clinical manufacturing, and drug discovery/toxicology testing. Clinical manufacturing, which encompasses both autologous and allogeneic cell therapy production, is the fastest-growing and highest-value segment, demanding strict compliance and large-batch consistency. The end-user segment is dominated by pharmaceutical and biotechnology companies that conduct the bulk of late-stage clinical trials and commercial production, followed by Contract Development and Manufacturing Organizations (CDMOs) which serve as critical intermediaries by providing outsourced manufacturing services, and, to a lesser extent, academic and research institutes focusing on early-stage translational research.

A notable trend within segmentation is the increasing demand for customized or lyophilized (freeze-dried) cytokine formulations tailored for specific culture media requirements, offering enhanced stability and ease of integration into automated, closed manufacturing systems. Suppliers are moving towards offering comprehensive, integrated solutions, including specialized media and reagents alongside the core cytokine products, effectively streamlining the procurement and validation process for cell therapy developers. This focus on integrated supply chain management and standardized, high-quality kits is vital for maintaining the strict quality assurance required in GMP environments and facilitating global regulatory alignment.

- Product Type:

- Interleukins (e.g., IL-2, IL-7, IL-15)

- Growth Factors (e.g., FGF, EGF, TGF-beta, VEGF)

- Interferons (e.g., IFN-gamma)

- Chemokines

- Colony-Stimulating Factors (CSFs)

- Application:

- Cell and Gene Therapy Manufacturing (Autologous and Allogeneic)

- Stem Cell Research and Regenerative Medicine

- Tissue Engineering

- Drug Discovery and Toxicology Testing

- End-User:

- Biotechnology and Pharmaceutical Companies

- Contract Development and Manufacturing Organizations (CDMOs)

- Academic and Research Institutes

Value Chain Analysis For GMP Grade Cytokines Market

The value chain for the GMP Grade Cytokines market is characterized by several highly specialized, sequential stages, beginning with upstream synthesis and culminating in downstream clinical application. Upstream analysis involves the selection and engineering of expression systems, predominantly utilizing recombinant technology in host cells such as E. coli, yeast, or mammalian cells (like CHO). This stage requires significant intellectual property and expertise in molecular biology and fermentation/cell culture optimization to ensure high yield and purity. Securing reliable, non-animal-derived raw materials for the culture media is a crucial early step, emphasizing the need for suppliers who can maintain closed-loop supply chain control and rigorous raw material screening against potential contaminants, particularly adventitious agents, which is a core GMP requirement.

The midstream stage focuses intensely on the manufacturing and purification processes. This includes large-scale bioreactor operation, followed by complex chromatography and filtration steps designed to isolate the cytokine product and remove host cell proteins, endotoxins, and viral contaminants to meet pharmaceutical-grade specifications. Validation and documentation are paramount at this stage, requiring comprehensive Quality Management Systems (QMS) and strict adherence to FDA and EMA guidelines. The distribution channel involves a mix of direct sales channels, particularly to large biopharma partners and key CDMOs, and indirect distribution through specialized global distributors and authorized resellers who manage cold chain logistics and import/export regulatory complexities. Direct sales often facilitate customized batch requirements and technical support, while indirect channels provide essential geographic reach and localized inventory management, especially in emerging markets where clinical trial activity is expanding.

Downstream analysis focuses on the end-users: pharmaceutical companies, biotechs, and CDMOs who integrate the GMP cytokines into their proprietary cell manufacturing protocols (e.g., T-cell expansion or stem cell differentiation). The quality and consistency of the supplied cytokine directly impacts the success of the advanced therapeutic product, making the supplier a critical partner rather than a mere vendor. The selection process for potential customers is rigorous, focusing heavily on supplier track records, stability data, and the availability of extensive regulatory documentation (e.g., Drug Master Files or DMFs) to support their IND and Biologics License Applications (BLAs). The final stage, clinical application and patient administration, underscores the ultimate necessity for the utmost purity and safety ensured by the initial GMP production process, tying the entire value chain back to patient outcomes.

GMP Grade Cytokines Market Potential Customers

The primary purchasers of GMP Grade Cytokines are entities actively involved in the development, clinical testing, or commercial manufacturing of advanced therapeutic products, particularly those based on cellular components. These end-users require reagents that meet the highest standards of safety, quality, and regulatory compliance, differentiating them significantly from typical research laboratories. The largest customer segment comprises global biotechnology and major pharmaceutical companies who possess substantial pipelines in cell and gene therapy, including developers of commercial CAR T-cell treatments and novel allogeneic therapies. These companies procure large, consistent batches to support their manufacturing scale-up and ensure batch-to-batch homogeneity required for regulatory submission and global market deployment. They frequently seek long-term supply agreements to secure critical raw materials.

Contract Development and Manufacturing Organizations (CDMOs) represent another crucial customer group. As the outsourced manufacturing arm for smaller biotech firms and academic centers, CDMOs require a broad portfolio of GMP cytokines to service diverse client needs, spanning T-cell, Natural Killer (NK) cell, and various stem cell processes. CDMOs prioritize suppliers that offer robust technical support, comprehensive regulatory documentation (such as DMFs), and the capacity for rapid response to fluctuating production demands. Their purchasing decisions are heavily influenced by the ease of integrating the cytokine products into established, automated bioprocessing workflows, which is often facilitated by closed-system packaging and pre-validated reagents.

Finally, leading academic and government-funded translational research centers engaged in early-stage clinical trials (Phase I/II) for novel cell therapies also constitute a significant customer base. While their volume requirements are generally smaller than those of commercial biopharma, their need for compliant, high-quality materials is equally stringent, especially when preparing materials for patient administration under an IND. These customers often require flexibility in order sizing and detailed technical guidance on transitioning from research-grade reagents to GMP grade materials. Collectively, these customer segments prioritize product consistency, comprehensive documentation, competitive pricing for bulk orders, and assurance of long-term supply continuity above all other procurement factors.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 450 million |

| Market Forecast in 2033 | USD 960 million |

| Growth Rate | 11.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Sartorius AG, PeproTech (Bio-Techne), R&D Systems (Bio-Techne), Lonza Group, Miltenyi Biotec, PROMEGA Corporation, Sino Biological, CellGenix GmbH, Corning Inc., Fujifilm Diosynth Biotechnologies, Creative Bioarray, GenScript Biotech, Akron Biotech, Bio-Rad Laboratories, Thermo Fisher Scientific, Waisman Biomanufacturing, BPS Bioscience, Peprotech, AMSBIO, Abcam. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

GMP Grade Cytokines Market Key Technology Landscape

The manufacturing of GMP grade cytokines is deeply intertwined with several advanced biotechnological platforms focused on achieving high yield, exceptional purity, and consistent batch quality necessary for clinical use. The core technology remains recombinant DNA expression, where genes encoding specific human cytokines are introduced into host expression systems. While microbial systems (like E. coli) offer speed and cost-efficiency for simpler proteins, mammalian systems (like CHO cells) are increasingly favored for complex cytokines requiring post-translational modifications, such as glycosylation, which are crucial for native biological activity and prolonged half-life. Continuous technological evolution focuses on optimizing these expression systems, including the use of proprietary vectors and media formulations (chemically defined and animal-component-free) to eliminate biological risks and simplify regulatory validation.

Following expression, the purification stage utilizes highly sophisticated and often expensive chromatographic techniques, including affinity, ion-exchange, and size-exclusion chromatography, rigorously validated to ensure efficient removal of host cell proteins (HCPs), DNA residues, and, most critically, endotoxins to sub-clinical levels. Novel technologies in this space involve single-use (disposable) purification columns and membrane chromatography systems, which minimize cross-contamination risks and significantly reduce the time and expense associated with cleaning-in-place (CIP) and sterilization-in-place (SIP) required in traditional stainless steel facilities. The adoption of single-use bioreactors for upstream production is also standard practice, improving flexibility and accelerating facility changeovers, which is essential in a dynamic market requiring rapid shifts in product mix and volume.

Beyond manufacturing, the technology landscape includes highly sensitive analytical and quality control methodologies essential for certifying the GMP status of the final product. Techniques such as High-Performance Liquid Chromatography (HPLC), Mass Spectrometry (MS), and advanced bioassays (e.g., cell-based proliferation assays) are used to confirm structural integrity, purity, and biological potency. Furthermore, the push towards process analytical technology (PAT) is critical, integrating real-time monitoring sensors and spectroscopic tools directly into the manufacturing line. This allows for continuous quality verification and facilitates data-driven process adjustments, moving the industry toward 'quality by design' (QbD) principles and significantly enhancing compliance with global regulatory mandates for advanced therapeutic raw materials.

Regional Highlights

Regional dynamics play a significant role in shaping the GMP Grade Cytokines market, reflecting disparities in research funding, regulatory maturity, and biomanufacturing capacity.

- North America (U.S. and Canada): North America is the undisputed market leader, driven by the presence of a vast ecosystem of leading biotechnology and pharmaceutical companies, robust governmental and private sector funding for advanced therapies (particularly oncology and rare diseases), and a highly efficient regulatory pathway (FDA) that encourages rapid clinical translation. The U.S. accounts for the majority of global CAR T-cell therapy commercialization and clinical trials, creating unparalleled demand for GMP grade raw materials like IL-2 and IL-15. Innovation is concentrated here, with numerous companies specializing in novel recombinant protein engineering and high-throughput manufacturing solutions.

- Europe (Germany, UK, France): Europe represents the second-largest market, supported by strong academic research in regenerative medicine and cohesive regulatory guidance from the European Medicines Agency (EMA) for ATMPs. Countries like Germany, Ireland, and the UK are key manufacturing and research hubs. The region benefits from public-private partnerships aimed at scaling up cell therapy production, though fragmentation in national healthcare reimbursement systems can sometimes pose a challenge to commercial adoption. European demand emphasizes traceability and adherence to rigorous EU GMP standards.

- Asia Pacific (APAC) (China, Japan, South Korea, India): APAC is projected to be the fastest-growing region, primarily fueled by massive government investment, particularly in China and South Korea, aimed at establishing world-class biomanufacturing capabilities and increasing domestic clinical trial activity. Japan, with its advanced regenerative medicine regulatory framework (SAKIGAKE), is a significant early adopter of advanced therapies, ensuring a high local demand for GMP raw materials. The region's growth is also characterized by increasing capacity for cost-competitive GMP cytokine production, positioning it as a potential global supplier base in the long term.

- Latin America (LATAM), Middle East, and Africa (MEA): These regions currently represent smaller but developing markets, largely reliant on imports for sophisticated GMP reagents. Growth is stimulated by localized efforts to establish cell therapy clinical research in key countries like Brazil and Israel. Market expansion is dependent on improving regulatory harmonization, increasing domestic biopharma investment, and overcoming logistical and cold-chain infrastructure deficits necessary to support the use of sensitive biological raw materials.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the GMP Grade Cytokines Market.- Sartorius AG

- PeproTech (Bio-Techne)

- R&D Systems (Bio-Techne)

- Lonza Group

- Miltenyi Biotec

- PROMEGA Corporation

- Sino Biological

- CellGenix GmbH

- Corning Inc.

- Fujifilm Diosynth Biotechnologies

- Creative Bioarray

- GenScript Biotech

- Akron Biotech

- Bio-Rad Laboratories

- Thermo Fisher Scientific

- Waisman Biomanufacturing

- BPS Bioscience

- Peprotech

- AMSBIO

- Abcam

Frequently Asked Questions

Analyze common user questions about the GMP Grade Cytokines market and generate a concise list of summarized FAQs reflecting key topics and concerns.What defines a cytokine as GMP Grade, and why is this critical for cell therapies?

GMP (Good Manufacturing Practice) grade indicates that the cytokine is produced under strict regulatory guidelines ensuring high purity, traceability, and consistency, with minimal contaminants like endotoxins. This is critical because these raw materials are directly introduced into cell products intended for human patients, necessitating the highest quality standards to guarantee patient safety and regulatory compliance (FDA/EMA) for advanced therapeutic medicinal products (ATMPs).

How does the cost of GMP Grade Cytokines compare to research-grade materials?

GMP grade cytokines are significantly more expensive than research-grade materials due to the substantial investment required for regulatory validation, comprehensive documentation (e.g., DMF support), stringent Quality Control (QC) testing, dedicated GMP facility maintenance, and rigorous supply chain traceability mandated for clinical raw materials. The increased cost reflects the enhanced assurance of safety and quality required for clinical trials and commercial manufacturing.

Which cytokine types are most essential for CAR T-cell manufacturing?

Interleukins (ILs) are the most essential type for CAR T-cell manufacturing. Specifically, IL-2, IL-7, and IL-15, often used in combinations (cytokine cocktails), are crucial for promoting the robust expansion, activation, and long-term persistence of T-cells outside the body, maximizing the therapeutic potential before infusion.

What are the primary technological challenges in scaling up GMP cytokine production?

Primary challenges include maintaining batch-to-batch consistency and high purity at commercial scale, effectively removing trace contaminants such as host cell proteins and endotoxins, and ensuring the protein structure (e.g., correct folding and glycosylation) remains biologically potent and stable across large volumes. The transition from bench-scale to commercial bioreactor volumes requires extensive process optimization and validation.

Which regions are driving the highest demand for GMP Grade Cytokines?

North America (especially the United States) currently drives the highest demand due to its leadership in biopharma R&D, the concentration of clinical trials, and the commercialization of cell and gene therapies. However, the Asia Pacific region, led by China and South Korea, is experiencing the fastest growth rate driven by strong government investment in biotechnology infrastructure and expanding clinical research capabilities.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager