Gold Bullion Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436394 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Gold Bullion Market Size

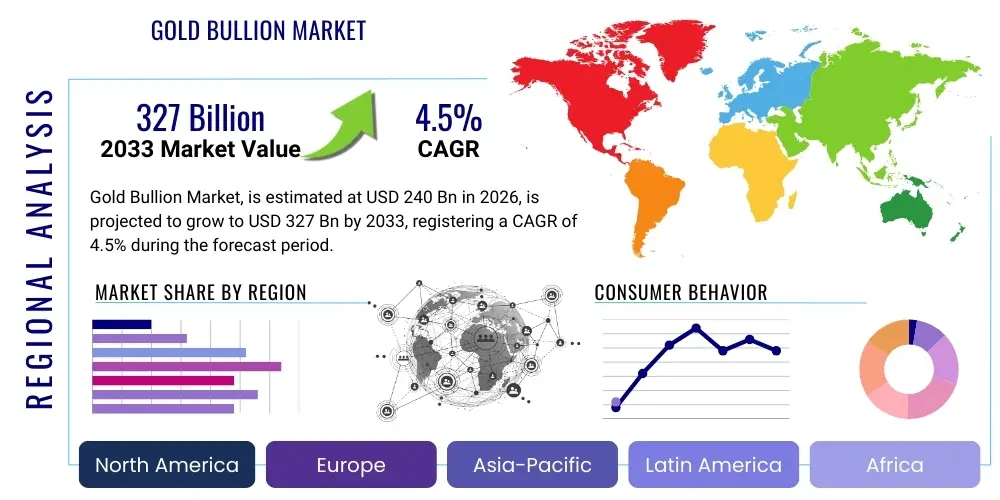

The Gold Bullion Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.5% between 2026 and 2033. The market is estimated at USD 240 billion in 2026 and is projected to reach USD 327 billion by the end of the forecast period in 2033.

Gold Bullion Market introduction

The Gold Bullion Market encompasses the trade of physical gold in high-purity, standardized forms, primarily bars and coins, used overwhelmingly for investment and monetary reserve purposes. Bullion is defined by its metallic purity, generally requiring a minimum fineness of 99.5% for bars and often 99.99% for investment-grade products, making it distinct from industrial or jewelry gold. Key applications involve leveraging gold as a reliable store of value, an inflation hedge, and a critical component of national foreign reserves held by central banks globally. This market is intrinsically linked to macroeconomic stability, geopolitical tensions, and global monetary policy decisions, specifically concerning interest rates and quantitative easing measures implemented by major economic entities such as the US Federal Reserve and the European Central Bank.

Market dynamics are primarily driven by the universal perception of gold as a safe-haven asset, which significantly amplifies demand during periods of financial uncertainty, geopolitical conflicts, or systemic risks within traditional equity and debt markets. The underlying economic principle fueling demand is gold's lack of counterparty risk and its finite supply, maintaining its intrinsic value across various economic cycles. Furthermore, increasing wealth accumulation in emerging economies, particularly across the Asia Pacific region, translates into sustained retail investment demand for physical gold, driven by both cultural preference and the need for long-term capital preservation against localized currency devaluation.

Major driving factors include persistent global inflationary pressures eroding the purchasing power of fiat currencies, coupled with continued high-volume purchases by central banks diversifying away from dollar-denominated assets. The market benefits from increased accessibility through specialized physical gold ETFs and standardized digital gold products, broadening the investor base beyond traditional institutional players and high-net-worth individuals (HNWIs). However, the market remains sensitive to fluctuations in the US dollar index and sudden shifts in real interest rates, which directly impact the opportunity cost of holding a non-yield-bearing asset like gold bullion.

Gold Bullion Market Executive Summary

The Gold Bullion Market is currently navigating a period characterized by heightened macroeconomic volatility and significant technological integration. Business trends reveal a pronounced shift toward enhanced supply chain transparency, driven by investor demand for ethically sourced and authenticated gold, leading to wider adoption of blockchain-based tracking systems. Regional trends underscore the dominance of Asia Pacific as the primary consumer base for physical bullion, driven by cultural demand and rapid economic growth, while North America and Europe maintain supremacy in institutional trading and the deployment of gold-backed financial instruments like Exchange Traded Funds (ETFs). Segment trends highlight the growing preference for standardized small bars and coins among retail investors due to liquidity and affordability, alongside the persistent importance of large good delivery bars for central bank reserves and institutional custodians, reflecting a bifurcated market demand structure optimized for different scales of investment and storage.

Regulatory developments, specifically concerning anti-money laundering (AML) and know-your-customer (KYC) compliance, are exerting significant pressure on refiners and dealers, necessitating advanced verification protocols that standardize global trade practices. This regulatory rigor, while increasing operational costs, ultimately enhances the market’s integrity and attractiveness to institutional capital. Furthermore, the integration of digital platforms facilitating the purchase, storage, and fractional ownership of physical gold is transforming accessibility, catering particularly to millennial investors who prioritize ease of transaction and low entry barriers. This digital acceleration is forcing traditional bullion dealers to invest heavily in robust e-commerce and secure vaulting technologies to remain competitive in a rapidly evolving financial landscape.

Looking ahead, the market's trajectory will be heavily influenced by the speed of global economic recovery and the future trajectory of global debt levels. Elevated sovereign debt and sustained fiscal expansion programs across developed nations reinforce the strategic necessity of holding gold as a hedge against systemic risk. Key stakeholders, including major bullion banks and refining houses, are focusing their strategies on sustainability reporting and responsible sourcing initiatives, aiming to secure long-term contracts with ethical mining operations and satisfy the increasingly stringent ESG (Environmental, Social, and Governance) mandates imposed by institutional fund managers globally. This alignment with sustainability criteria is becoming a crucial differentiator in the competitive landscape.

AI Impact Analysis on Gold Bullion Market

Common user questions regarding AI's impact on the Gold Bullion Market overwhelmingly revolve around its capability to enhance price prediction accuracy, mitigate trading risks through algorithmic execution, and ensure the authenticity and provenance of physical assets. Users are primarily concerned with whether AI can reliably forecast short-term market movements better than traditional quantitative models, thereby creating an arbitrage opportunity, and how AI-driven analytics might standardize the detection of fraudulent activities, such as counterfeiting or money laundering within the supply chain. Expectations center on AI applications improving operational efficiency, particularly in refining quality control and personalized investment advising, while key concerns involve data privacy, the potential for market manipulation via sophisticated algorithms, and the democratization of predictive tools that might erode the informational edge previously held by large bullion banks.

The integration of advanced Artificial Intelligence and Machine Learning (ML) models is fundamentally transforming the operational and investment aspects of the gold bullion market. AI is increasingly used for sophisticated high-frequency trading (HFT) strategies, allowing bullion banks to execute complex trades based on instantaneous processing of global economic indicators, geopolitical news sentiment analysis, and cross-asset correlation movements that are computationally infeasible for human traders. These algorithmic tools improve liquidity and reduce latency, ensuring more efficient price discovery mechanisms in major gold trading hubs like London, New York, and Shanghai. Furthermore, AI-powered systems are being developed to analyze geological data and refine optimal mining strategies, potentially impacting the long-term supply dynamics and extraction costs of primary gold resources, though their direct impact on existing bullion stock values is currently secondary to macroeconomic factors.

In the physical supply chain, AI is pivotal in enhancing security and provenance verification. Machine vision systems coupled with deep learning are being deployed in refining operations to automate the quality control and assaying processes, ensuring consistent purity levels compliant with Good Delivery standards, minimizing human error, and accelerating throughput. Crucially, AI algorithms analyze vast datasets generated by blockchain-based tracking platforms, identifying anomalies or suspicious transfer patterns that could indicate unauthorized melting, refining, or diversion of certified bullion. This analytical capability strengthens the market's integrity against counterfeit gold and improves compliance with stringent international regulatory frameworks aimed at combating illicit financing activities linked to precious metals trading.

- AI-driven algorithmic trading optimizes execution speed and leverages macro-economic data for predictive price modeling.

- Machine Learning models enhance risk management by identifying extreme volatility and potential market shocks across gold futures and spot markets.

- Advanced analytics strengthen supply chain integrity by flagging suspicious transactions and verifying the provenance of certified gold bullion through blockchain data review.

- AI improves operational efficiency in refining through automated quality control and machine vision systems for precise assaying.

- Natural Language Processing (NLP) is used for sentiment analysis of financial news and social media to gauge investor confidence and immediate market bias.

DRO & Impact Forces Of Gold Bullion Market

The Gold Bullion Market is driven primarily by its function as an inflation hedge and a stable store of wealth during global economic instability, amplified by consistent accumulation by central banks seeking reserve diversification. Restraints include the absence of yield, which makes gold less attractive during periods of high real interest rates, and the significant costs associated with secure storage, insurance, and transportation of physical assets. Opportunities are expanding through the digitalization of gold ownership, enabling fractional investment and easier access for retail buyers, and increasing demand from industrial applications requiring high purity gold. These forces collectively shape the market's trajectory: geopolitical risks and inflationary expectations create positive momentum (Drivers), while monetary policy tightening and logistical challenges exert downward pressure (Restraints), leading to market equilibrium defined by new financial technology platforms (Opportunities) that optimize investment efficiency and accessibility.

Drivers are deeply rooted in macroeconomic conditions. High levels of government debt across major economies and the consequent risk of currency devaluation solidify gold’s position as a foundational reserve asset. The cyclical nature of geopolitical tension, from regional conflicts to trade wars, consistently boosts safe-haven demand, often overriding technical trading indicators. Furthermore, the persistent growth of the middle class in populous nations such as China and India generates reliable, high-volume retail demand for bars and coins, driven by deep-seated cultural significance and traditional savings mechanisms. This stable base demand provides a crucial floor for market pricing, mitigating extreme volatility induced by financial market speculation.

Conversely, significant Restraints challenge sustained growth. The most prominent constraint is the impact of rising real interest rates, which increase the opportunity cost of holding non-yielding gold compared to treasury bonds or other fixed-income securities. Additionally, the increasing regulatory scrutiny surrounding the origin of gold, particularly the implementation of international conflict mineral regulations, imposes substantial compliance burdens on refiners and distributors. Opportunities, however, present a path for future expansion; the development of regulated digital gold tokens and secure, standardized platforms for fractional ownership lowers entry barriers, attracting a new generation of investors who prefer dematerialized assets but require the underlying security of physical bullion. Advances in blockchain technology specifically offer the chance to solve legacy issues related to provenance and auditability, significantly increasing investor confidence in the authenticity of purchased bullion.

Segmentation Analysis

The Gold Bullion Market is comprehensively segmented based on its physical form, purity grade, primary application, and the end-user profile, allowing for granular analysis of demand patterns and pricing differentials. Segmentation by product type primarily separates the market into standardized bars and minted coins, with bars dominating institutional holdings due to their high volume and low premium, while coins cater more effectively to the retail investor seeking recognized, easily tradable units. Further differentiation occurs based on fineness, categorizing bullion into 995 fine (minimum institutional standard) and 9999 fine (premium investment grade), impacting both pricing and suitability for specific applications like central bank reserves versus industrial technology integration, ensuring precise market targeting and product development alignment.

Application segmentation distinguishes between investment (the largest segment), use as official monetary reserves, and minor allocations in technology sectors requiring ultra-pure gold for specialized electronics and medical devices. The investment category is further subdivided into physical custody (vaulted storage) and synthetic investment (ETFs, futures), reflecting differing risk appetites and jurisdictional preferences among investors. Geographically, the market displays clear regional disparities, with APAC driving consumer demand for physical transfer and North America leading in financialization and the trade of derivative products, necessitating regional specialization in supply chain and distribution strategies to cater efficiently to these divergent market needs.

End-user analysis is critical, separating central banks, institutional investors (including sovereign wealth funds and hedge funds), private wealth managers, and individual retail investors. Central banks prioritize liquidity and counterparty risk mitigation, exclusively dealing in large, accredited bars. In contrast, retail investors focus on portability, lower transactional premiums, and familiarity, driving demand for smaller bars (1 oz, 100g) and specific government-minted coins (e.g., American Eagle, Canadian Maple Leaf). This multi-faceted segmentation structure is essential for bullion dealers and refiners to optimize their inventory, compliance procedures, and marketing efforts across the global landscape.

- By Product Type:

- Bars (Good Delivery, Kilobars, Smaller Retail Bars)

- Coins (Sovereign Mints, Non-Sovereign Mints)

- By Purity/Fineness:

- 0.995 Fine (Standard Institutional Grade)

- 0.9999 Fine (Premium Investment Grade)

- By Application:

- Investment (Physical Ownership, Digital Ownership, Financial Derivatives)

- Monetary Reserves (Central Bank Holdings)

- Technology and Industrial Use (Minority Share)

- By End-User:

- Central Banks and Monetary Authorities

- Institutional Investors (ETFs, Mutual Funds, Hedge Funds)

- High Net Worth Individuals (HNWIs)

- Retail Investors (Physical and Digital)

- By Region:

- North America (U.S., Canada)

- Europe (U.K., Germany, Switzerland)

- Asia Pacific (China, India, Japan)

- Latin America (Brazil, Mexico)

- Middle East & Africa (UAE, South Africa)

Value Chain Analysis For Gold Bullion Market

The Gold Bullion Value Chain is a complex sequence beginning with upstream activities, encompassing mining and initial extraction, followed by essential midstream processes of refining and minting, culminating in highly specialized downstream distribution channels. Upstream activities are dominated by major mining corporations that extract ore, often subject to stringent environmental and social governance (ESG) standards, which directly influence the input costs for refiners. The midstream, centered in major refining hubs like Switzerland and London, transforms Dore bars into high-purity, standardized investment-grade bullion (Good Delivery bars), ensuring compliance with international accreditation standards set by organizations like the London Bullion Market Association (LBMA). Transparency and ethical sourcing audits are critical at this refining stage, linking the origin of the gold to the final product.

Downstream activities involve specialized global distribution networks, which are highly regulated due to the monetary value and security implications of the product. Distribution occurs primarily through a bifurcated system: Direct and Indirect channels. Direct channels involve large bullion banks and primary dealers selling directly to central banks, sovereign wealth funds, and major institutional clients, often involving secure, non-transferable custodial arrangements. Indirect channels serve the vast network of retail investors and smaller institutional buyers, utilizing specialized precious metals dealers, secure e-commerce platforms, and gold-backed Exchange Traded Funds (ETFs) that hold physical bullion as collateral.

The efficiency of the distribution channel is heavily reliant on secure logistics and accredited vaulting infrastructure, which are often provided by specialized security firms. Bullion banks act as crucial intermediaries, facilitating trade, providing liquidity, and managing the global movement of physical gold. The integrity of the entire chain, from mine to vault, is now increasingly dependent on digital tracking technologies like blockchain, which aim to provide immutable records of custody and provenance, thereby mitigating the risks associated with unverified or conflict-sourced gold. This rigorous value chain structure ensures that only certified, high-quality physical gold enters the global investment market.

Gold Bullion Market Potential Customers

The Gold Bullion Market serves a diverse range of high-value customers, broadly categorized into governmental, institutional, and private entities, all seeking the inherent value preservation and liquidity characteristics offered by physical gold. Central banks and national treasuries represent the most significant sovereign end-users, maintaining gold as a core strategic reserve asset to stabilize national currencies, hedge against global economic crises, and diversify international holdings away from specific fiat currencies. Their purchasing decisions are driven by long-term monetary policy and geopolitical stability considerations, focusing exclusively on large, accredited bars meeting the highest global standards for purity and accreditation.

Institutional investors form the second major customer base, encompassing diverse entities such as Exchange Traded Funds (ETFs), pension funds, sovereign wealth funds (SWFs), and large hedge funds. These customers utilize gold primarily as a portfolio diversification tool, aiming to reduce overall portfolio volatility and capture non-correlated returns during market downturns. ETFs, in particular, democratize institutional investment, allowing smaller investors to gain exposure to physical gold without managing the complexities of physical storage and security, driving demand for specific, accredited gold bars held in secure vaults by custodian banks.

Finally, High Net Worth Individuals (HNWIs) and general retail investors constitute a critical segment, driven by wealth preservation, inheritance planning, and hedging against localized inflation or currency risks. While HNWIs may access institutional-grade bars through private wealth managers, retail investors overwhelmingly prefer smaller, more liquid units, such as 1 oz coins and small bars. The growth of digital gold platforms has further expanded the retail customer base, allowing individuals to acquire fractional ownership easily and securely, without the premium associated with physical delivery and home storage, ultimately broadening the market's reach into younger and more tech-savvy demographics.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 240 Billion |

| Market Forecast in 2033 | USD 327 Billion |

| Growth Rate | 4.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | MKS PAMP, Rand Refinery, Valcambi, Royal Mint, Perth Mint, Heraeus, Metalor, Tanaka Kikinzoku Kogyo, Argor-Heraeus, Istanbul Gold Refinery (IGR), Nadir Metal Refinery, UBS Group AG, JP Morgan Chase & Co., HSBC Holdings plc, ICBC Standard Bank, Royal Bank of Canada (RBC), Scotiabank, Newmont Corporation, Barrick Gold Corporation, Freeport-McMoRan. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Gold Bullion Market Key Technology Landscape

The Gold Bullion Market’s technological landscape is rapidly evolving, driven primarily by the need for enhanced security, transparency, and transactional efficiency across the entire supply chain. Core technological adoption focuses on three main areas: immutable digital ledger technology (Blockchain), advanced physical identification systems, and sophisticated digital trading platforms. Blockchain implementation is crucial for establishing irrefutable digital records of gold provenance, tracking the metal from the mine site, through the refining process, and into secure vaults. This technology addresses critical market demands for ethical sourcing and anti-counterfeiting measures, moving beyond paper-based certificates to provide real-time, tamper-proof audit trails for high-volume institutional investors and regulatory bodies, increasing overall confidence in the authenticity of certified bullion.

Physical security and authentication rely heavily on advanced spectroscopic techniques and proprietary marking systems. Techniques such as unique laser etching, non-destructive assaying (NDA), and the integration of microscopic identifiers within the bullion bars themselves ensure that the physical asset matches its digital record. This is vital for high-security storage facilities and inter-bank transfers, minimizing the risk of unauthorized substitutions or the introduction of fake bars into the ecosystem. Furthermore, sophisticated biometric and multi-factor authentication systems are standardizing access control for secure vaulting services, significantly reducing risks associated with internal theft and unauthorized physical access to stored bullion holdings globally, enhancing custodian responsibilities.

On the transactional front, specialized electronic trading platforms (ETPs) have revolutionized liquidity and accessibility. These proprietary platforms offer sophisticated API integrations, enabling high-frequency trading and algorithmic execution of large gold orders across major financial centers. The development of regulated tokenized gold products, utilizing distributed ledger technology (DLT), is a burgeoning trend that allows for fractional ownership and instantaneous settlement, bypassing traditional legacy settlement systems that can introduce time delays and counterparty risk. This confluence of secure physical identification, decentralized digital tracking, and high-speed trading infrastructure defines the modern technological framework of the gold bullion trading ecosystem.

Regional Highlights

The global Gold Bullion Market exhibits distinct regional consumption patterns and investment behaviors, primarily categorized across five major geographical segments. Asia Pacific (APAC) dominates global physical demand due to centuries-old cultural ties to gold as a primary savings vehicle, particularly in China and India. This region's demand is highly sensitive to seasonal factors, such as festivals and wedding seasons, resulting in consistent, high-volume retail purchases of small bars and coins. Conversely, North America, spearheaded by the United States, is the financial hub for gold trading, leading in the creation and circulation of paper gold instruments like gold ETFs and derivatives, reflecting a highly financialized approach to investment where large institutional flows dictate short-term price movements and liquidity provision globally.

Europe, driven by nations like Switzerland (a major refining hub) and the UK (home to the LBMA and extensive vaulting services), plays a crucial role in the processing, accreditation, and institutional trade of Good Delivery bars. European demand often reflects safe-haven seeking behavior during regional political instability or currency concerns, maintaining a robust market for physical ownership among conservative wealth managers. The Middle East and Africa (MEA) are pivotal due to their significant gold mining output (Africa) and robust regional trading and jewelry manufacturing sectors (Middle East), often serving as important transit points for gold flowing toward major consumption centers in Asia. MEA's market dynamics are highly influenced by local government policies on mineral extraction and international trade agreements regulating gold export.

Latin America contributes substantially to the supply side through significant gold mining activities, though the local demand for investment-grade bullion remains modest compared to the export volumes, often focusing on industrial use and local inflationary hedges. The global trade flow is thus characterized by the movement of raw gold from MEA and Latin America to the refining centers in Europe (Switzerland), from where high-purity investment bullion is dispatched to the high-demand centers of APAC for retail consumption and North American vaults for institutional collateral. Understanding these intra-regional dynamics is essential for bullion banks and logistical providers to optimize the highly secure and expensive global transportation network required for this asset class.

- Asia Pacific (APAC): Highest volume consumer market driven by China and India; demand highly sensitive to cultural events and localized inflation. Focus on physical bars and coins for saving and wealth transfer.

- North America: Dominant financial center for gold derivatives and ETFs; institutional investment flows and central bank operations dictate market liquidity and short-term price discovery.

- Europe: Key global refining and accreditation hub (Switzerland, UK); strong institutional base for secure vaulting services and high demand for safe-haven physical assets during regional economic uncertainty.

- Middle East & Africa (MEA): Critical source region for mined gold (Africa); regional demand often linked to petrodollar recycling and luxury trade, serving as a significant transit point for global gold movement.

- Latin America: Primary focus on gold production and mining exports; investment demand is relatively localized, though growing in response to high domestic inflation rates.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Gold Bullion Market.- MKS PAMP

- Rand Refinery

- Valcambi

- Royal Mint

- Perth Mint

- Heraeus

- Metalor

- Tanaka Kikinzoku Kogyo

- Argor-Heraeus

- Istanbul Gold Refinery (IGR)

- Nadir Metal Refinery

- UBS Group AG

- JP Morgan Chase & Co.

- HSBC Holdings plc

- ICBC Standard Bank

- Royal Bank of Canada (RBC)

- Scotiabank

- Newmont Corporation

- Barrick Gold Corporation

- Freeport-McMoRan

Frequently Asked Questions

Analyze common user questions about the Gold Bullion market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving current Gold Bullion prices?

The primary factor driving current gold bullion prices is the real interest rate environment, which reflects the yield offered by competing assets, coupled with prevailing geopolitical risk premiums. When real interest rates are low or negative, the opportunity cost of holding non-yielding gold decreases, stimulating investment demand. Additionally, escalating global conflicts or systemic financial crises often trigger immediate safe-haven buying, significantly boosting short-term prices as investors prioritize capital preservation over return generation.

How does the digitalization of gold affect traditional physical bullion investment?

Digitalization, through tokenized gold and fractional ownership platforms, increases market accessibility for retail investors and improves transactional efficiency. While it does not replace the intrinsic need for physical bullion (as the digital tokens are backed by allocated physical gold in vaults), it reduces storage premiums and enables instantaneous trading and settlement, broadening the investor base and integrating gold into modern financial technology ecosystems, making it a more liquid asset.

What role do central banks play in the Gold Bullion Market?

Central banks are crucial long-term buyers, holding gold as an essential monetary reserve asset for macroeconomic stability and currency diversification. Their large-scale, consistent purchasing or selling decisions significantly influence global demand and supply dynamics. Their holdings act as a stabilizer against national currency volatility and provide critical liquidity during international financial stress, reinforcing gold's status as the ultimate zero-risk reserve asset recognized globally.

What is Good Delivery status and why is it important for the bullion market?

Good Delivery status is an accreditation granted by the London Bullion Market Association (LBMA) to refiners whose bars meet stringent requirements for purity, weight, and ethical sourcing. This status is vital because it establishes a universal standard for institutional trade (central banks, bullion banks) and ensures market integrity. Only Good Delivery certified bars are accepted by major global custodians and clearing systems, guaranteeing the metal's quality and verifiable provenance throughout the high-value supply chain.

How does geopolitical instability impact demand for gold bullion?

Geopolitical instability directly increases demand for gold bullion as investors flee perceived riskier assets, particularly equities and emerging market debt, seeking refuge in a universally accepted safe haven. This demand manifests as a 'fear premium,' often overriding conventional valuation models. Sustained conflict or political uncertainty encourages institutional investors and high-net-worth individuals (HNWIs) to increase their allocation to physical gold to mitigate systemic risk and preserve purchasing power.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager