Gold Jewelry Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432969 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Gold Jewelry Market Size

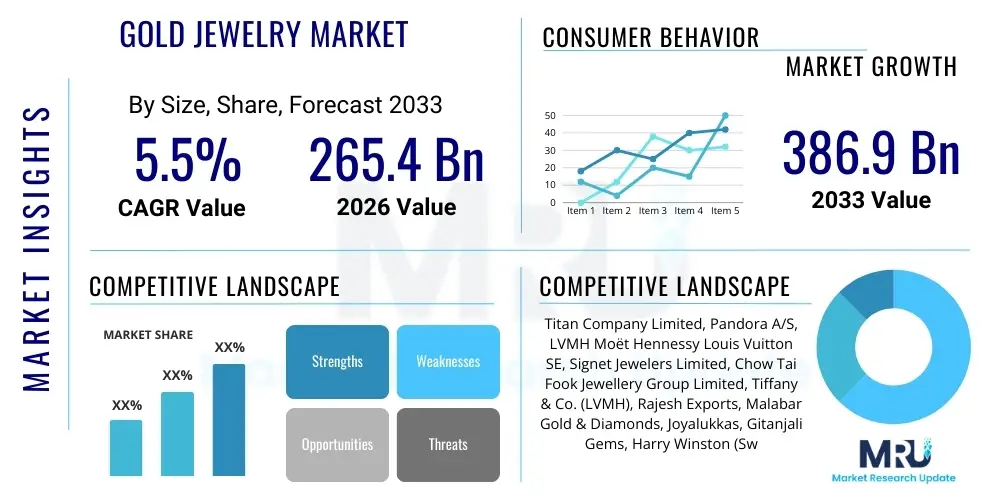

The Gold Jewelry Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.5% between 2026 and 2033. The market is estimated at USD 265.4 Billion in 2026 and is projected to reach USD 386.9 Billion by the end of the forecast period in 2033.

Gold Jewelry Market introduction

The global Gold Jewelry Market encompasses the manufacturing, distribution, and sale of ornaments created primarily from gold, ranging from high-purity (24-karat) investment pieces to fashion jewelry (18-karat and below) often combined with gemstones or other materials. This market is fundamentally driven by cultural significance, particularly in Asian countries where gold serves as both a traditional adornment and a hedge against inflation. The product spectrum is vast, including rings, necklaces, bracelets, earrings, and pendants, catering to various socioeconomic classes and occasions, such as weddings, festivals, and personal milestones. The inherent intrinsic value of gold ensures a persistent demand despite short-term price volatility, distinguishing it from general luxury goods.

Major applications of gold jewelry span personal adornment, gifts, and investment diversification. In regions like India and China, gold is deeply intertwined with religious ceremonies and marriage customs, establishing sustained institutional demand. The increasing disposable incomes in emerging economies, coupled with sophisticated marketing by global luxury brands, are expanding the consumer base beyond traditional buyers. Furthermore, gold jewelry offers significant benefits, including portability of wealth, recognized global liquidity, and resilience against macroeconomic instability, making it an attractive asset class for wealthy individuals and traditional consumers alike.

Driving factors propelling market expansion include the rapid proliferation of e-commerce platforms, enabling brands to reach previously untapped rural and international markets, alongside technological advancements in manufacturing like Computer-Aided Design (CAD) and 3D printing, which allow for quicker production of complex and customized designs. Additionally, the growing preference among Millennials and Gen Z for lightweight, contemporary, and ethically sourced gold jewelry is forcing traditional jewelers to innovate their product offerings and supply chain transparency. The convergence of fashion trends with traditional investment motives continues to solidify the market's long-term growth trajectory.

Gold Jewelry Market Executive Summary

The Gold Jewelry Market is undergoing a significant transformation, characterized by a dual focus on preserving traditional craftsmanship and adopting digital-first retail strategies. Current business trends indicate a strong shift towards sustainability and ethical sourcing, driven by consumer scrutiny over mining practices and labor standards. Leading market players are investing heavily in traceable supply chains (e.g., blockchain technology for tracking gold origin) and launching collections that emphasize recycled or ethically sourced gold, thereby mitigating reputational risks and appealing to environmentally conscious Western consumers. This pivot necessitates substantial capital expenditure in compliance and certification, reshaping the competitive landscape towards large, vertically integrated organizations capable of meeting rigorous transparency demands.

Regionally, the market dynamics are highly polarized. The Asia Pacific region, led by China and India, maintains its dominance in volume and value, fueled by cultural demand for 22-karat gold for weddings and festivals. Conversely, North America and Europe emphasize design innovation, brand storytelling, and the luxury appeal of lower-karat (14K or 18K) gold jewelry often set with diamonds or precious stones. A key emerging trend is the rapid maturation of the Middle Eastern market, driven by high net worth individuals seeking bespoke, intricate designs, positioning the Gulf Cooperation Council (GCC) countries as critical hubs for premium gold trade. These regional variances necessitate highly localized marketing and inventory strategies for global brands.

Segment-wise, the online distribution channel is exhibiting the fastest growth, drastically accelerating its market share post-2020, challenging the traditional dominance of physical retail stores. Within the product segment, lightweight, daily-wear items such as minimalistic necklaces and stackable rings are seeing increased demand among younger demographics, contrasting with the stagnant growth of heavy, traditional bridal sets outside of key Asian geographies. Furthermore, the rise of the 'Men's Jewelry' segment, previously niche, is becoming a mainstream focus, driven by influential celebrities and luxury brands introducing sophisticated designs targeted at male consumers, ensuring diversification beyond the historically dominant 'Women's' segment.

AI Impact Analysis on Gold Jewelry Market

User inquiries regarding the impact of Artificial Intelligence (AI) on the Gold Jewelry Market primarily revolve around three core themes: customization, retail efficiency, and supply chain integrity. Consumers are keenly interested in how AI can facilitate hyper-personalized jewelry design based on predictive analytics of fashion trends and individual preference data ("How can AI design a unique ring just for me?"). Retailers are focused on leveraging AI for inventory management, fraud detection in online sales, and enhancing the virtual try-on experience ("Will AI improve inventory forecasting and reduce stockouts?"). A pervasive concern is the use of AI in verifying the provenance and ethical sourcing of gold and gemstones, ensuring transparency in a market historically prone to opacity.

AI's influence is profoundly visible in transforming the customer experience and operational backbone of the jewelry industry. In the design phase, Generative AI models can produce thousands of novel design iterations almost instantly, significantly cutting down the time from concept to prototype, allowing jewelers to respond to fast-changing consumer tastes with unprecedented agility. Furthermore, AI-powered predictive maintenance and quality control systems are being integrated into manufacturing processes, using computer vision to identify flaws in castings or finishing, thereby reducing material waste and maintaining high standards of craftsmanship essential for luxury goods.

In the retail domain, AI algorithms are instrumental in optimizing dynamic pricing strategies based on fluctuating gold commodity prices and real-time competitor analysis. Virtual reality (VR) and augmented reality (AR) try-on solutions, often powered by AI for accurate mapping and fit analysis, minimize the barriers to purchasing high-value items online by bridging the gap between digital visualization and physical assurance. This technological integration not only enhances customer engagement but also provides robust data feedback loops that inform future design choices and merchandising strategies, creating a highly responsive and data-driven luxury retail environment.

- AI-driven personalized design generation and customization based on user data and trend forecasting.

- Enhanced virtual try-on experiences (AR/VR) powered by AI for accurate product fit and visualization, reducing online returns.

- Optimization of retail inventory management and dynamic pricing strategies in response to real-time commodity price fluctuations.

- Implementation of machine learning for advanced fraud detection in high-value e-commerce transactions.

- AI algorithms utilized in supply chain traceability (often with blockchain) to verify the ethical sourcing and provenance of gold.

- Automated quality control systems in manufacturing using computer vision to detect microscopic flaws in finished pieces.

- AI-powered customer service chatbots providing immediate, expert advice on investment-grade jewelry specifications and care.

DRO & Impact Forces Of Gold Jewelry Market

The dynamics of the Gold Jewelry Market are shaped by a complex interplay of Drivers (D), Restraints (R), Opportunities (O), and internal and external Impact Forces. Key drivers include the deep cultural resonance of gold in emerging markets, rapid urbanization leading to increased access to retail outlets, and sustained consumer confidence in gold as a long-term asset protecting against currency devaluation. Restraints predominantly involve the high volatility of global gold prices, which can deter immediate consumer purchases, coupled with increasing regulatory burdens concerning metal origin and ethical sourcing, adding compliance costs to manufacturers. Opportunities lie in the massive untapped potential of the millennial consumer base through innovative, affordable, and digitally marketed lines, alongside geographical expansion into lucrative, high-growth regions like Southeast Asia and specific African nations experiencing rapid wealth accumulation.

Impact forces exert significant pressure on market evolution. On the external front, macroeconomic conditions, such as inflation rates, interest rate hikes, and geopolitical instabilities (which often boost gold's appeal as a safe haven), directly influence consumer investment sentiment. Internal forces, crucial for brand competitiveness, involve the rapid adoption of sustainable manufacturing practices (e.g., using recycled gold), the investment in digital retail infrastructure, and the constant need for design innovation to differentiate products in a crowded luxury space. The balance between maintaining perceived intrinsic value and offering trendy, fashionable designs dictates pricing power and brand loyalty in different geographical segments.

The primary impact force remains the fluctuation in the global gold commodity price; while high prices can suppress volume demand, they simultaneously increase the perceived value of existing inventory, impacting manufacturer profit margins and inventory valuation. Furthermore, shifting consumer preferences towards transparency, particularly among younger, affluent buyers, acts as a powerful transformative force, penalizing companies that lag in ethical sourcing disclosure and rewarding those who establish clear, verifiable provenance narratives. Successfully navigating these forces requires integrated risk management strategies encompassing both commodity hedging and rigorous compliance frameworks.

Segmentation Analysis

The Gold Jewelry Market is critically segmented based on product type, purity level, distribution channel, and end-user, providing a multifaceted view of consumer behavior and market potential. Segmentation analysis is essential for identifying high-growth niches, understanding regional demand patterns, and tailoring product development strategies. The granularity of demand varies significantly; for instance, high-carat gold (22K and 24K) dominates the demand in price-sensitive but tradition-bound Asian markets, whereas branded, lower-carat, designer jewelry is the preference in mature Western markets, reflecting differing motives for purchase—investment versus fashion.

The distribution channel segmentation highlights the accelerating structural shift in retail. While traditional brick-and-mortar stores remain vital for high-value transactions due to the need for physical inspection and trust, the rapid growth of the online segment is fundamentally changing consumer accessibility and purchasing habits, especially for standardized or lower-value gold items. This necessitates substantial investment in secure logistics and robust e-commerce platforms by both established legacy brands and disruptive online retailers.

Further analysis by product type, such as rings, earrings, and necklaces, reveals cyclical demand patterns often tied to cultural events like wedding seasons. Necklaces and pendants, offering high versatility in design and material combination (e.g., layering), continue to be strong performers across all geographies and demographic groups. Understanding these segmental dynamics is vital for effective inventory deployment, ensuring optimal alignment between regional consumer preferences and specific product offerings across the value chain.

- By Product Type: Rings, Necklaces, Earrings, Bracelets, Pendants, Others (e.g., Brooches, Anklets).

- By Purity: 24 Karat, 22 Karat, 18 Karat & Below (including 14K and 10K).

- By Distribution Channel: Offline Retail (Exclusive Brand Stores, Multi-Brand Outlets, Independent Jewelers), Online Retail (E-commerce Platforms, Brand Websites).

- By End-User: Women, Men, Unisex/Children.

Value Chain Analysis For Gold Jewelry Market

The Gold Jewelry market value chain is extensive, beginning with upstream activities centered around raw material procurement. This phase involves complex processes of gold mining (primary source) or recycling (secondary source). Upstream analysis is increasingly focused on the compliance and sustainability of sourcing, as consumers demand conflict-free and ethically mined materials. Major integrated companies often manage their own refineries or establish long-term contracts with certified responsible mining operations. The high capital expenditure required for responsible sourcing and refining acts as a barrier to entry, concentrating upstream power among large, regulated entities and international bullion banks that provide financing and hedging instruments.

Midstream processes involve refining, alloy preparation, and manufacturing, utilizing advanced techniques like Computer-Aided Manufacturing (CAM), casting, and setting. Distribution channels, both direct and indirect, represent the crucial link to the final consumer. Direct distribution involves owned exclusive brand stores (EBOs) and official brand websites, offering maximum control over branding, pricing, and customer experience. This channel is favored by luxury giants. Indirect distribution relies on wholesalers, authorized multi-brand retailers, and large e-commerce marketplaces, enabling wider geographic penetration, albeit with shared margin structures and potentially diluted brand control.

Downstream analysis focuses on retail and post-sale services. Modern retail strategies emphasize experiential shopping, personalization services (engraving, custom design), and robust after-sales support, including cleaning, repair, and buy-back schemes, which are vital for retaining customer loyalty in high-value purchases. The shift towards online retail necessitates sophisticated secure logistics, high-definition visualization tools, and transparent return policies to maintain customer trust. Successful optimization of the entire value chain requires seamless integration, especially between manufacturing (midstream) and retail (downstream) to efficiently manage demand volatility and maintain inventory turnover.

Gold Jewelry Market Potential Customers

Potential customers for the Gold Jewelry Market span diverse socioeconomic groups and are typically categorized based on their primary motivation for purchase: investment, traditional gifting, or personal fashion adornment. The primary end-user base remains women across all age groups, purchasing for self-adornment, fashion statements, and lifecycle events such as engagements and anniversaries. Within emerging economies, particularly India and China, the largest segment comprises traditional families who purchase gold as a store of value and essential dowry components, prioritizing high purity (22K) and weight over intricate design or brand novelty.

A rapidly growing segment includes affluent millennials and Gen Z consumers in developed markets. This demographic seeks lightweight, ethically sourced, and versatile 14K or 18K gold pieces suitable for daily wear and stacking. They are highly brand-conscious, digitally native, and prioritize sustainability and design aesthetics, making them the target for branded luxury houses focusing on digital marketing and modern collections. Furthermore, the men's jewelry segment, previously marginalized, is gaining momentum, focusing on sophisticated accessories like cufflinks, rings, and chains that convey status and personal style. These buyers often prioritize brand reputation and contemporary, understated luxury designs.

Finally, institutional buyers and high-net-worth individuals (HNWIs) constitute the investment segment. While they might primarily acquire gold bullion or coins, a significant portion of their wealth diversification includes bespoke, high-value, designer jewelry which retains high liquidity and artistic value. These customers are driven by prestige, rarity, and the confidence in recognized global jewelry houses. Effective market engagement requires segmentation based not only on demographics but also on psychographic factors related to their motivation (fashion vs. investment) and desired level of craftsmanship.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 265.4 Billion |

| Market Forecast in 2033 | USD 386.9 Billion |

| Growth Rate | CAGR 5.5% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Titan Company Limited, Pandora A/S, LVMH Moët Hennessy Louis Vuitton SE, Signet Jewelers Limited, Chow Tai Fook Jewellery Group Limited, Tiffany & Co. (LVMH), Rajesh Exports, Malabar Gold & Diamonds, Joyalukkas, Gitanjali Gems, Harry Winston (Swatch Group), Lao Feng Xiang Co. Ltd., Luk Fook Holdings (International) Limited, Damas Jewellery, Popley Group, Graff Diamonds, Mikimoto, Buccellati, Cartier (Richemont), Swarovski |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Gold Jewelry Market Key Technology Landscape

The technological evolution within the Gold Jewelry Market is centered on enhancing precision, accelerating customization, and improving supply chain transparency. Computer-Aided Design (CAD) and Computer-Aided Manufacturing (CAM) have become indispensable, allowing designers to create highly complex and precise geometric forms that were previously impossible or extremely time-consuming to execute manually. This technology significantly reduces errors and ensures consistency, which is paramount for high-volume production. Furthermore, advanced laser welding and micron-level polishing equipment are utilized to ensure impeccable finishing, meeting the rigorous quality standards expected in the luxury segment. The adoption of these digital design and manufacturing tools allows for faster iteration and reduced lead times, enabling brands to align production closely with real-time market trends.

Additive manufacturing, specifically 3D printing technologies (such as wax-based stereolithography or DLP), is revolutionizing prototyping and custom jewelry creation. Jewelers can quickly print detailed models for investment casting, drastically lowering the cost and time associated with mold creation for one-off or limited-edition pieces. This accessibility to rapid prototyping democratizes the design process and fuels the trend toward hyper-personalization, enabling small ateliers and large brands alike to offer bespoke services efficiently. Concurrently, material science innovation, focusing on developing new gold alloys, allows manufacturers to achieve specific characteristics such as increased hardness, unique color variations (e.g., green or blue gold), and hypo-allergenic properties, expanding product versatility.

Beyond the manufacturing floor, digital technologies are redefining retail and supply chain management. Blockchain technology is emerging as a critical tool for ensuring ethical sourcing and provenance. By creating an immutable, distributed ledger, blockchain tracks gold from the mine (or recycling source) through refining, manufacturing, and finally to the consumer, providing verifiable proof of origin—a key competitive differentiator. Coupled with Artificial Intelligence (AI) and Machine Learning (ML) used for predictive demand forecasting and sophisticated customer relationship management (CRM) systems, the technology landscape ensures operational efficiency, enhanced consumer trust, and optimized retail experiences across both physical and digital channels.

Regional Highlights

- Asia Pacific (APAC): APAC is the global powerhouse for the Gold Jewelry Market, commanding the largest share in both volume and value. The demand is structurally driven by cultural traditions, notably weddings and major festivals (e.g., Diwali in India, Lunar New Year in China), where gold is viewed as an essential component of wealth transfer and cultural expression. India and China are the primary growth engines; India dominates the high-carat (22K) traditional jewelry segment, while China leads in consumption related to wealth management and branded designer jewelry. The rising middle class across Southeast Asia (Vietnam, Indonesia) represents significant future growth potential, favoring modern, lightweight gold pieces and international brands.

- North America: This region is characterized by a high preference for designer, lower-karat gold (14K, 18K), often combined with gemstones, focusing heavily on brand value and fashion trends rather than solely investment purity. The market is highly segmented and sophisticated, driven by strong retail performance from major chains and independent luxury boutiques. E-commerce penetration is among the highest globally, compelling retailers to invest heavily in omnichannel strategies, virtual try-ons, and secure digital platforms. Marketing efforts are heavily focused on aesthetic appeal and ethical sourcing narratives.

- Europe: Europe, particularly Western Europe (France, Italy, UK), is a center for luxury jewelry design and craftsmanship, prioritizing heritage, artisanal quality, and bespoke items. Italian gold jewelry manufacturing maintains a global reputation for innovation and quality. Similar to North America, the preference leans towards 18K gold and high-end branded pieces. The market is mature but stable, characterized by slow, steady growth anchored by affluent consumers seeking investment-grade artistry and authenticated provenance. Sustainability and recycled gold initiatives are particularly strong market drivers here.

- Middle East and Africa (MEA): The Middle Eastern segment, concentrated in the GCC nations (UAE, Saudi Arabia), is a critical market hub known for exceptional high-carat gold consumption and intricate, high-weight traditional designs, driven by high disposable incomes and a strong cultural affinity for gold display. Dubai, in particular, serves as a major global trading and manufacturing center. The African market, while nascent in organized retail, offers significant long-term opportunities, especially in South Africa and Nigeria, fueled by increasing urbanization and emerging affluent classes.

- Latin America: This region presents moderate growth, often hampered by economic volatility, but shows localized pockets of strong demand, particularly in countries like Brazil and Mexico. Consumers often prefer 18K gold and are increasingly responsive to international luxury brands establishing physical retail presence. The market is characterized by a strong demand for classic designs and a developing shift towards organized retail chains replacing traditional small family-owned jewelers.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Gold Jewelry Market.- Titan Company Limited

- Pandora A/S

- LVMH Moët Hennessy Louis Vuitton SE (including Tiffany & Co.)

- Signet Jewelers Limited

- Chow Tai Fook Jewellery Group Limited

- Rajesh Exports

- Malabar Gold & Diamonds

- Joyalukkas

- Gitanjali Gems (Subject to operational changes)

- Harry Winston (Swatch Group)

- Lao Feng Xiang Co. Ltd.

- Luk Fook Holdings (International) Limited

- Damas Jewellery

- Popley Group

- Graff Diamonds

- Mikimoto

- Buccellati

- Cartier (Richemont)

- Swarovski

- Chopard

Frequently Asked Questions

Analyze common user questions about the Gold Jewelry market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving gold jewelry demand in Asia Pacific?

The primary driver is the deep-rooted cultural and traditional significance of gold, particularly its use as essential elements in weddings, dowries, and festive gifting in countries like India and China, where it serves as both adornment and a crucial vehicle for wealth storage and transfer.

How does gold price volatility affect consumer purchasing behavior?

High gold price volatility typically restrains volume purchases in the short term, especially for non-essential items, as price-sensitive consumers postpone discretionary buying. However, sustained high prices can boost the market's value perception, encouraging purchases among consumers seeking investment diversification and a hedge against inflation.

Which gold purity level is most popular globally, and why?

While 18 Karat gold (75% purity) is highly popular in Western luxury markets due to its durability and suitability for setting diamonds, 22 Karat gold (91.6% purity) dominates high-volume markets in Asia, such as India and the Middle East, primarily due to cultural preference for maximum purity as a reliable store of value and traditional asset.

What is the role of blockchain technology in the gold jewelry supply chain?

Blockchain is crucial for enhancing supply chain transparency and ethical sourcing. It provides an immutable digital ledger to track gold from its origin (mine or recycler) to the final consumer, guaranteeing verifiable provenance and assuring buyers that the gold is conflict-free and responsibly sourced, meeting growing consumer demand for sustainability.

How are e-commerce platforms changing the distribution landscape of gold jewelry?

E-commerce is driving rapid growth in the distribution channel by offering greater accessibility, especially for modern, lightweight, and standardized gold items. The use of advanced features like AI-powered virtual try-ons and secure logistics minimizes purchase barriers, accelerating online penetration for both branded luxury houses and mass-market retailers globally.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager