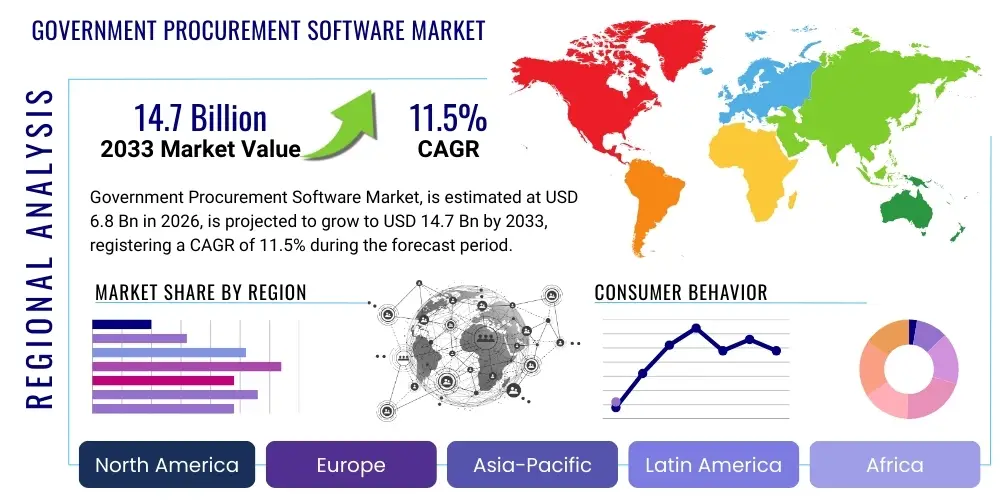

Government Procurement Software Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434806 | Date : Dec, 2025 | Pages : 255 | Region : Global | Publisher : MRU

Government Procurement Software Market Size

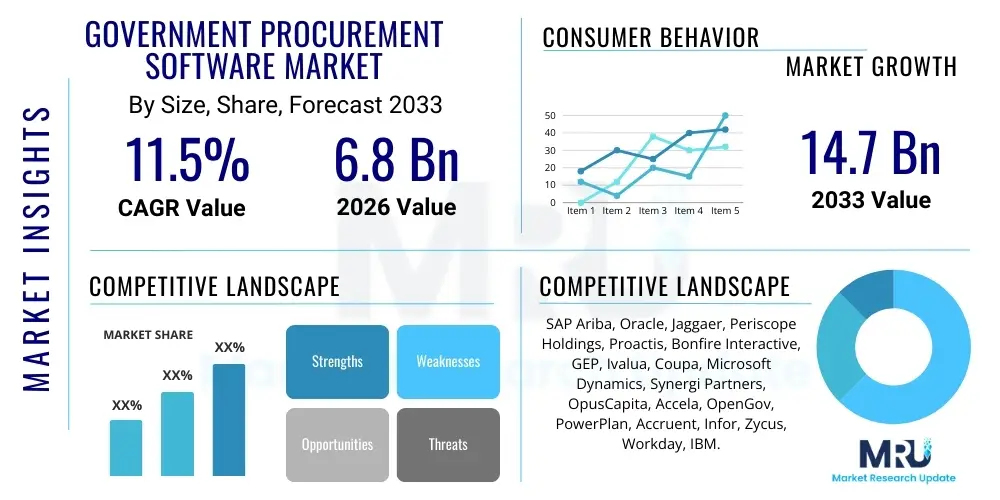

The Government Procurement Software Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 11.5% between 2026 and 2033. The market is estimated at USD 6.8 Billion in 2026 and is projected to reach USD 14.7 Billion by the end of the forecast period in 2033.

Government Procurement Software Market introduction

The Government Procurement Software Market encompasses specialized technological solutions designed to manage and optimize the entire public sector purchasing lifecycle, from requisition and solicitation to contract management and supplier governance. These platforms digitize traditional paper-based processes, ensuring transparency, compliance with stringent regulatory frameworks (such as federal acquisition regulations), and achieving demonstrable cost savings for governmental entities at all levels—federal, state, and local. The core objective of these solutions is to enhance efficiency, reduce opportunities for fraud and error, and provide real-time visibility into spending patterns, thereby improving public accountability and budgetary control.

Key applications of government procurement software include electronic tendering (e-Tendering), supplier relationship management (SRM), spend analysis, e-Invoicing, and contract lifecycle management (CLM). The demand for these systems is being fundamentally driven by global mandates for digital transformation within public services, coupled with increasing public scrutiny regarding the efficient use of taxpayer money. Furthermore, the complexities inherent in public sector purchasing—characterized by competitive bidding rules, mandatory socio-economic requirements, and complex auditing standards—make specialized, compliant software indispensable for modern governance.

The primary benefits derived from adopting robust procurement software include standardization of procedures, faster cycle times for solicitations, enhanced risk mitigation through automated compliance checks, and improved engagement with small and medium enterprises (SMEs) through centralized registration portals. Driving factors for market expansion are predominantly rooted in the legislative push for transparent and accountable governance, the need to modernize legacy IT infrastructures, and the growing recognition that centralized digital procurement yields substantial operational efficiencies and supports strategic public policy objectives, such such as sustainability and diversity in contracting.

Government Procurement Software Market Executive Summary

The Government Procurement Software market is experiencing robust expansion driven by mandatory digital initiatives across OECD nations and developing economies seeking to combat corruption and enhance fiscal management. Current business trends indicate a strong shift toward integrated, modular Source-to-Pay (S2P) suites, moving away from disparate, siloed systems. Vendors are intensely focused on embedding Artificial Intelligence (AI) and Machine Learning (ML) capabilities, particularly in areas like predictive spend forecasting, contract risk assessment, and automated compliance monitoring, transforming procurement officers from transactional processors into strategic advisors. Furthermore, the demand for user-friendly, cloud-based (SaaS) deployments is surging, reflecting governments' desire for scalable, cost-effective solutions that require minimal on-premise infrastructure investment and facilitate rapid deployment cycles.

Regionally, North America maintains the largest market share, characterized by high adoption rates due to established federal regulations requiring standardized digital processes and significant investment in robust cybersecurity features necessary for handling sensitive public sector data. Asia Pacific (APAC) is projected to exhibit the highest growth rate, fueled by extensive public sector modernization programs in countries like India, China, and Southeast Asian nations aiming to improve infrastructure transparency and streamline bureaucratic purchasing processes. European markets are also maturing, driven by EU directives promoting cross-border public procurement standardization and sustainability criteria integration into tendering processes, thereby necessitating advanced software functionality.

Segment trends reveal that the Cloud-based segment is dominating deployment preference due to its inherent flexibility, lower Total Cost of Ownership (TCO), and easier regulatory compliance management updates. Functionality-wise, Contract Management and Spend Analysis modules are witnessing particularly high growth, as governments prioritize mitigating contract-related legal risks and gaining actionable insights into historical and projected expenditures. End-user demand is broad, though Federal and National governments remain the largest consumers, while Local and Municipal governments represent a significant, untapped opportunity requiring tailored, simplified solutions suitable for smaller budgets and less complex organizational structures.

AI Impact Analysis on Government Procurement Software Market

Common user questions regarding AI's impact on government procurement software revolve primarily around trust, security, efficiency gains, and regulatory compliance. Users frequently inquire: "How can AI ensure unbiased vendor selection?" or "Will AI automate away the need for human procurement officers?" and "Is AI-driven predictive modeling reliable for budget allocation in volatile economic environments?" There are significant expectations for AI to drastically reduce manual processing time, automate the tedious checking of regulatory checklists, and identify fraudulent activities or suspicious bidding patterns far more effectively than traditional methods. However, concerns persist regarding data privacy, the potential for algorithmic bias in tender evaluation, and the need for clear legislative frameworks governing AI use in public spending decisions, necessitating explainable AI (XAI) features to maintain transparency and public trust.

- AI-driven spend classification: Automatically categorizes millions of transactions with high accuracy, enabling granular spend visibility and identifying opportunities for volume discounts across disparate agencies.

- Intelligent contract risk assessment: Utilizes Natural Language Processing (NLP) to analyze contract language, highlighting non-standard clauses, potential risks, and compliance deviations before execution.

- Predictive demand forecasting: Employs Machine Learning (ML) algorithms to anticipate future procurement needs based on historical trends, budgetary cycles, and external economic indicators, optimizing inventory and timing purchases.

- Automated compliance monitoring: Continuously cross-references vendor documents and bid submissions against dozens of complex, mandatory federal and state regulations, reducing human error and audit failures.

- Fraud and anomaly detection: Identifies unusual vendor behavior, collusion patterns, or inflated pricing through real-time data monitoring, significantly strengthening anti-corruption efforts.

- Chatbots and conversational interfaces: Improves accessibility and speed for internal users (requisitioners) and external suppliers seeking information on tender status or system usage.

DRO & Impact Forces Of Government Procurement Software Market

The market trajectory is primarily driven by global mandates for public sector digital transformation and the imperative to increase governmental spending transparency, acting as the major force for adoption. Restraints include the inherent bureaucratic complexity and resistance to change often found within public administration, alongside the substantial initial capital investment required for implementing comprehensive S2P solutions and the critical need for sophisticated data security measures. Opportunities abound in targeting local and municipal governments, which are rapidly recognizing the need to modernize, and in developing specialized modules focusing on sustainable and social procurement mandates (ESG compliance). These factors interact under the force of intense public and regulatory pressure for accountability, necessitating compliant, verifiable, and efficient digital procurement ecosystems.

The primary Drivers include the legislative environment promoting transparency (e.g., Freedom of Information Acts requiring digital records), the necessity to harmonize disparate agency purchasing processes following mergers or centralization efforts, and the continuous pressure to achieve budgetary efficiencies and cost savings in taxpayer-funded operations. Furthermore, the COVID-19 pandemic highlighted the critical weakness of relying on manual processes and accelerated the need for resilient, flexible digital supply chain management within government, particularly concerning emergency purchasing. The increasing sophistication of cyber threats also forces governments to seek out robust, certified software solutions that can protect sensitive tender data and financial information.

Key Restraints involve the notoriously long procurement cycles and budgetary approval processes common in the public sector, which delay software implementation and adoption. Integration challenges are significant, as new software must interface seamlessly with legacy Enterprise Resource Planning (ERP) systems that are often outdated and difficult to modify. The scarcity of specialized IT talent within government agencies capable of managing and maintaining complex procurement software also poses a considerable barrier. Lastly, the stringent regulatory environment means that software vendors must navigate diverse and constantly evolving rules across different jurisdictions, increasing development complexity and compliance costs.

Significant Opportunities lie in the emerging demand for integrated Environmental, Social, and Governance (ESG) scoring and tracking tools within procurement software, enabling governments to fulfill mandated sustainability goals through purchasing decisions. There is also a major market potential in providing managed services and specialized outsourcing for government entities that lack the internal resources for full system maintenance. The focus on modular solutions tailored for specific needs (e.g., grant management or construction contract administration) allows vendors to address niche requirements and penetrate smaller governmental units that cannot afford full enterprise suites. The overarching Impact Force is the global trend toward "Smart Government" initiatives, pushing all public administrative functions, including procurement, toward fully integrated, data-driven digital platforms.

Segmentation Analysis

The Government Procurement Software Market is segmented based on component type, deployment model, end-user type, and core functional application, providing granular insight into adoption patterns across the public sector landscape. The component segmentation differentiates between the core software platform itself and the essential services required for successful implementation and ongoing operation. Deployment preference highlights the significant industry shift toward cloud architectures, while the end-user split illustrates where the major spending capacity resides, encompassing federal, state, and local entities. Functional segmentation reveals the primary needs governments seek to address, such as reducing contract risk or optimizing internal purchasing processes.

- Component:

- Software (Platform and Modules)

- Services (Consulting, Implementation, Training, Support, Maintenance)

- Deployment Model:

- Cloud-based (SaaS)

- On-premise

- End-User:

- Federal/National Government

- State/Provincial Government

- Local/Municipal Government

- Public Sector Utilities and Education

- Defense and Aerospace Agencies

- Functionality:

- Source-to-Contract (S2C)

- Procure-to-Pay (P2P)

- Spend Analysis

- Contract Lifecycle Management (CLM)

- Supplier Relationship Management (SRM)

- E-Tendering and E-Auctioning

Value Chain Analysis For Government Procurement Software Market

The Value Chain for Government Procurement Software begins with Upstream Analysis, focusing on the core technological inputs—software development expertise, cloud infrastructure providers (e.g., AWS, Azure), data analytics engines (including AI/ML development), and specialized regulatory compliance knowledge essential for building the initial product. This phase is characterized by intensive R&D to ensure the software meets stringent security standards and is adaptable to various jurisdictional rules. Successful vendors invest heavily in securing robust platform architectures that can handle massive transaction volumes and integrate securely with existing government enterprise systems.

The Midstream phase involves the core activities of product development, customization, and deployment. Given the bespoke nature of governmental requirements, implementation and integration services are critical components, often involving complex data migration and process re-engineering consulting. Distribution Channels are typically a mix of Direct Sales to large Federal agencies, utilizing specialized government contracting teams, and Indirect Channels, which involve partnerships with Global System Integrators (GSIs), regional IT consulting firms, and value-added resellers (VARs) who possess localized market expertise and pre-existing government clearances or contracting vehicles.

The Downstream Analysis focuses on the end-user adoption and post-implementation support. This includes ongoing maintenance, regulatory update management (as government rules change frequently), training of public sector employees, and continuous system optimization based on agency feedback. The success of the software is measured by its ability to deliver measurable benefits like reduced acquisition costs and faster cycle times, requiring vendors to provide extensive, high-quality technical support tailored to the unique operational hours and security protocols of government entities, thus closing the feedback loop for future software enhancements.

Government Procurement Software Market Potential Customers

The primary potential customers and end-users of Government Procurement Software span the entire spectrum of public administration, driven by the universal need for fiscal accountability and modernized purchasing practices. Federal or National governments represent the largest potential customers, characterized by high spending volumes, complex security demands, and the need for enterprise-wide integration across numerous departments (e.g., Defense, Health, Transportation). These entities require highly scalable, customized solutions capable of handling multi-billion dollar contracts and adhering to the strictest regulatory compliance mandates.

State and Provincial governments constitute the second major segment, often seeking solutions that facilitate cooperative purchasing agreements among various sub-agencies and manage state-specific mandates, such as requirements for local business participation or minority-owned enterprise inclusion. These customers typically prioritize functionality that streamlines inter-departmental collaboration and provides centralized reporting for legislative oversight bodies. Their purchasing decisions are often influenced by state-level procurement mandates and budgetary cycles, necessitating flexible pricing models.

Local and Municipal governments, including cities, counties, and local school districts, represent a high-growth customer segment. While their individual budgets are smaller, the sheer volume of these entities provides a massive cumulative market opportunity. Their software requirements lean towards user-friendliness, rapid deployment via SaaS models, and solutions tailored to handle less complex, high-volume transactions, such as purchasing office supplies, infrastructure maintenance services, and small construction projects. The overarching goal for all potential customers is achieving greater efficiency, verifiable transparency, and robust anti-corruption measures in public spending.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 6.8 Billion |

| Market Forecast in 2033 | USD 14.7 Billion |

| Growth Rate | 11.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | SAP Ariba, Oracle, Jaggaer, Periscope Holdings, Proactis, Bonfire Interactive, GEP, Ivalua, Coupa, Microsoft Dynamics, Synergi Partners, OpusCapita, Accela, OpenGov, PowerPlan, Accruent, Infor, Zycus, Workday, IBM. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Government Procurement Software Market Key Technology Landscape

The technological landscape of the Government Procurement Software market is rapidly evolving, moving far beyond simple electronic catalog systems. The foundational technology remains the robust, secure, and highly scalable enterprise resource planning (ERP) platforms that form the backbone of the procurement suite, often delivered via a Software as a Service (SaaS) model to ensure accessibility and continuous updates. Critical technology integration includes advanced cryptographic protocols and multi-factor authentication systems to meet stringent government security requirements (such as FedRAMP compliance in the US). Furthermore, mobile accessibility through secure applications is becoming standard, enabling remote procurement approvals and real-time vendor management.

The leading edge of innovation is dominated by intelligent automation technologies. Artificial Intelligence (AI) and Machine Learning (ML) are being deployed for data normalization, automated invoice processing (using OCR and NLP), and predictive analytics to forecast budgetary consumption and supplier risk scores. Blockchain technology is also emerging as a niche but highly impactful tool, offering immutable ledger capabilities to enhance the transparency and auditability of high-value government contracts and bidding histories, thereby reinforcing trust and mitigating corruption risks by creating a permanent, verifiable record of transactions and decisions.

Furthermore, integration capabilities—specifically robust Application Programming Interfaces (APIs)—are paramount, allowing the procurement software to seamlessly communicate with existing government financial systems, supplier databases, and specialized inventory management platforms. This interoperability ensures a unified view of spend and eliminates data silos, a chronic issue in public sector IT. The focus on developing intuitive User Interfaces (UI) and improved User Experience (UX) is also vital, as government users often have varied technical proficiencies, making ease of use a critical factor in adoption success across diverse agencies.

Regional Highlights

- North America: Dominates the market share due to highly mature federal procurement systems (e.g., US GSA, DoD) and stringent regulatory requirements mandating transparency and digital compliance, driving demand for enterprise-grade, secure, cloud-based solutions.

- Europe: Characterized by high penetration driven by European Union directives pushing for standardized, cross-border public procurement processes and the mandated adoption of e-Invoicing, fueling rapid growth in CLM and e-Tendering segments.

- Asia Pacific (APAC): Expected to be the fastest-growing region, powered by significant government investment in digital infrastructure modernization, particularly in populous nations like India and China, aimed at reducing bureaucratic delays and combating pervasive corruption through digitized bidding.

- Latin America (LATAM): Growth is primarily fueled by governments' proactive efforts to enhance institutional transparency and integrity, with increasing adoption of open-source or modular SaaS solutions tailored for public sector reform and financial oversight.

- Middle East and Africa (MEA): Market growth is concentrated in the Gulf Cooperation Council (GCC) countries, driven by Vision 2030 initiatives and similar modernization programs focusing on diversifying economies and establishing world-class public administration standards requiring advanced procurement automation.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Government Procurement Software Market.- SAP Ariba

- Oracle

- Jaggaer

- Periscope Holdings

- Proactis

- Bonfire Interactive

- GEP

- Ivalua

- Coupa

- Microsoft Dynamics

- Synergi Partners

- OpusCapita

- Accela

- OpenGov

- PowerPlan

- Accruent

- Infor

- Zycus

- Workday

- IBM

Frequently Asked Questions

Analyze common user questions about the Government Procurement Software market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary driver for the adoption of Government Procurement Software?

The primary driver is the global legislative and public mandate for transparency and accountability in government spending, coupled with the critical need for digital transformation to replace outdated, inefficient manual processes and ensure compliance with complex regulatory frameworks.

Is Cloud-based (SaaS) deployment preferred over On-premise solutions in the public sector?

Yes, Cloud-based (SaaS) deployment is overwhelmingly preferred due to its lower initial cost, faster implementation time, easier scalability, and continuous security and regulatory updates, which are vital for government agencies facing rapid technological and legislative changes.

How does AI contribute to increasing transparency in government tenders?

AI enhances transparency by automatically analyzing millions of data points to detect potential fraud, conflict of interest, or algorithmic bias in bidding evaluations, ensuring a standardized, objective assessment process that is highly auditable and reduces human intervention in critical decision points.

Which functional segment is showing the highest growth potential?

Contract Lifecycle Management (CLM) and Spend Analysis are exhibiting high growth potential, as governments prioritize mitigating legal and financial risks associated with complex contracts and require sophisticated data tools to gain real-time, actionable insights into budgetary performance.

What are the biggest challenges faced during the implementation of Government Procurement Software?

The biggest challenges include integrating the new software with disparate, often archaic legacy Enterprise Resource Planning (ERP) systems, navigating slow bureaucratic approval and funding cycles, and overcoming institutional resistance to adopting new standardized digital workflows.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager