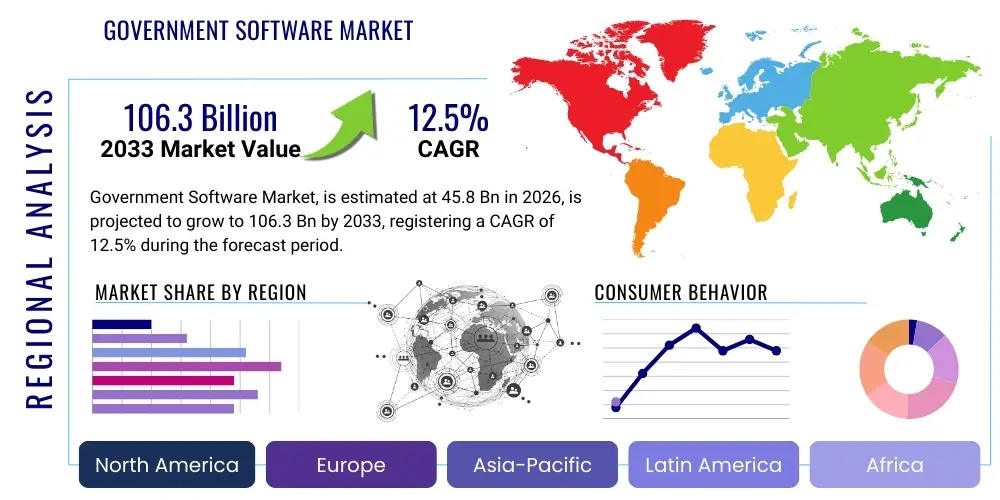

Government Software Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 439358 | Date : Jan, 2026 | Pages : 249 | Region : Global | Publisher : MRU

Government Software Market Size

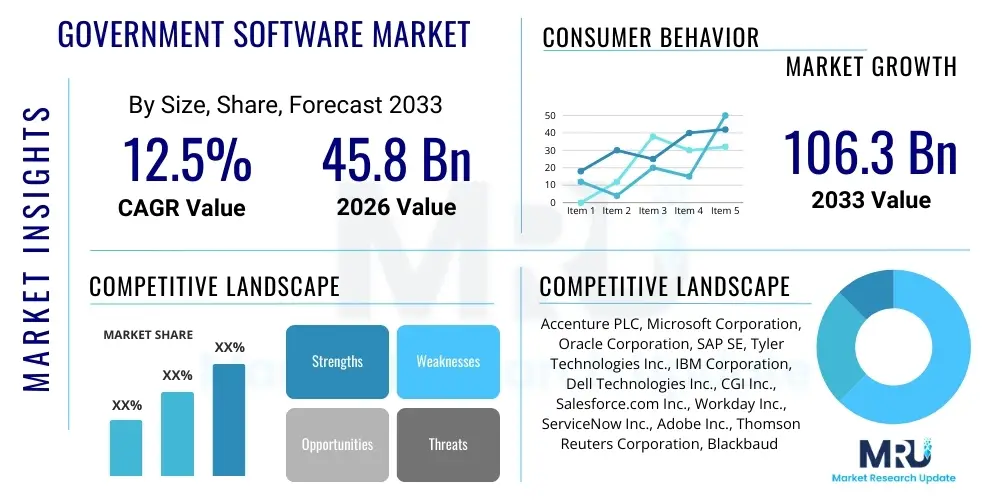

The Government Software Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 12.5% between 2026 and 2033. The market is estimated at USD 45.8 billion in 2026 and is projected to reach USD 106.3 billion by the end of the forecast period in 2033.

Government Software Market introduction

The Government Software Market encompasses a wide array of specialized digital solutions meticulously designed to meet the unique operational, administrative, and service delivery needs of public sector entities across all tiers—local, state, provincial, and federal. These sophisticated software applications facilitate everything from routine back-office functions, such as financial management, human resources, and procurement, to critical front-line services like citizen engagement platforms, emergency response systems, and infrastructure management. The core objective of these technological deployments is to enhance governmental efficiency, optimize resource allocation, ensure regulatory compliance, improve data security, and ultimately elevate the quality and accessibility of public services for citizens and businesses alike, driving a significant transformation in public administration.

Product descriptions within this market span a diverse portfolio, including enterprise resource planning (ERP) systems tailored for government, customer relationship management (CRM) solutions for citizen services, geographical information systems (GIS) for urban planning, cybersecurity platforms, regulatory compliance software, and cloud-based infrastructure services. Each solution is often highly customized to integrate with existing legacy systems and adhere to stringent governmental standards regarding data privacy, security protocols, and accessibility. The continuous evolution of digital government initiatives, coupled with the increasing demand for transparency and efficiency from constituents, further propels the innovation and adoption of these specialized software offerings, making them indispensable tools for modern public administration.

Major applications of government software extend across virtually every public sector domain, impacting areas such as public safety and justice, healthcare and social services, education, transportation, environmental protection, and economic development. The benefits derived from implementing these advanced software solutions are multifaceted, including significant cost reductions through process automation, improved decision-making capabilities informed by robust data analytics, enhanced inter-agency collaboration, and a more responsive, citizen-centric approach to governance. Driving factors for market growth include the global push for digital transformation, increasing investments in smart city initiatives, the imperative for improved cybersecurity defenses, and the ongoing need to manage complex public data efficiently while ensuring stringent compliance with evolving regulations, all contributing to a robust and expanding market landscape.

Government Software Market Executive Summary

The Government Software Market is currently undergoing a transformative period characterized by a convergence of technological advancements, evolving public expectations, and a global commitment to digital governance. Key business trends indicate a strong shift towards cloud-based solutions, Software-as-a-Service (SaaS) models, and the integration of advanced analytics and artificial intelligence to enhance operational efficiencies and deliver more personalized public services. Government agencies are increasingly seeking scalable, interoperable, and secure platforms that can adapt to dynamic policy changes and emerging societal needs, fostering a competitive environment among vendors to provide comprehensive, agile, and compliance-driven solutions that address both legacy system modernization and future digital imperatives.

Regionally, the market exhibits diverse growth trajectories influenced by varying levels of digital maturity, governmental investment capacities, and regulatory frameworks. North America and Europe represent mature markets with high adoption rates of advanced government software, driven by well-established digital infrastructure and substantial budgetary allocations for public sector modernization. Conversely, the Asia Pacific, Latin America, and Middle East & Africa regions are emerging as high-growth markets, propelled by rapid urbanization, increasing governmental focus on e-governance initiatives, and a burgeoning digital-first population demanding streamlined public services. These emerging markets offer significant opportunities for software providers to introduce innovative solutions that cater to nascent digital infrastructures and unique socio-economic contexts.

From a segmentation perspective, the market is broadly categorized by deployment model (cloud, on-premise, hybrid), application area (ERP, CRM, cybersecurity, data analytics, civic engagement), and end-user type (federal, state/provincial, local governments). The cloud deployment model is experiencing accelerated growth due to its inherent flexibility, cost-effectiveness, and scalability, appealing to governments keen on reducing IT infrastructure overheads and accelerating digital service delivery. Furthermore, the increasing complexity of data management and the heightened threat of cyberattacks are driving substantial investments in specialized data analytics and robust cybersecurity software, reflecting critical trends in protecting sensitive public information and ensuring the resilience of governmental digital ecosystems.

AI Impact Analysis on Government Software Market

Common user questions regarding the impact of Artificial Intelligence (AI) on the Government Software Market frequently revolve around how AI can enhance public service delivery, automate administrative processes, improve data-driven decision-making, and address critical societal challenges. Users are keen to understand AI's potential to personalize citizen interactions, predict resource needs, and detect fraud, while simultaneously expressing concerns about data privacy, algorithmic bias, job displacement within the public sector, and the ethical implications of AI deployment. The overarching expectation is that AI will revolutionize government operations, making them more efficient, responsive, and intelligent, but with a strong emphasis on ensuring transparency, fairness, and accountability in its application to public governance.

The integration of AI within government software solutions promises a paradigm shift in how public services are delivered and managed. AI-powered tools can significantly enhance predictive analytics capabilities, allowing governments to anticipate future needs in areas like infrastructure maintenance, public health emergencies, or social welfare programs, thereby enabling proactive rather than reactive policy interventions. Moreover, AI can automate repetitive tasks across various departments, from processing permits and licenses to responding to routine citizen inquiries, freeing up human resources to focus on more complex problem-solving and personalized engagement, leading to a substantial increase in operational efficiency and a reduction in administrative burdens.

However, the deployment of AI in the public sector also necessitates careful consideration of ethical frameworks and robust regulatory oversight. Ensuring the fairness and transparency of AI algorithms, mitigating potential biases that could disproportionately affect certain demographics, and safeguarding citizen data privacy are paramount concerns. Governments must invest in developing clear guidelines, robust testing protocols, and public engagement strategies to build trust and ensure that AI serves the public good responsibly. The balance between leveraging AI's transformative potential and addressing its inherent challenges will define the trajectory of its impact on the government software market, driving innovation while demanding ethical diligence and robust governance.

- Enhanced Predictive Analytics: AI enables governments to forecast trends in public health crises, infrastructure failures, and economic shifts, allowing for proactive policy development and resource allocation. For instance, AI algorithms can analyze historical data to predict areas susceptible to natural disasters, optimizing emergency response planning.

- Automated Administrative Processes: Routine governmental tasks such as document processing, permit applications, and data entry can be significantly automated using AI, reducing manual errors, improving turnaround times, and freeing public employees for more strategic work. This streamlines operations and boosts productivity.

- Personalized Citizen Services: AI-powered chatbots and virtual assistants can provide 24/7 support, offering tailored information and guidance to citizens, improving accessibility and responsiveness of public services, and enhancing overall citizen satisfaction through customized interactions.

- Improved Cybersecurity and Fraud Detection: AI algorithms can analyze vast datasets to identify anomalous patterns indicative of cyber threats or fraudulent activities, bolstering government security infrastructures and protecting public funds and sensitive data with advanced detection capabilities.

- Data-Driven Policy Making: AI provides sophisticated tools for analyzing complex datasets from various government sources, generating actionable insights that support evidence-based policy formulation and more effective governance strategies, leading to better societal outcomes.

- Optimized Resource Management: AI can help optimize the allocation of public resources by analyzing usage patterns, demand forecasts, and operational efficiencies across departments, ensuring that funding and personnel are deployed where they can have the greatest impact.

- Ethical AI Frameworks and Governance: The increased adoption of AI necessitates the development of robust ethical guidelines and governance frameworks to ensure AI applications are fair, transparent, accountable, and free from bias, building public trust in AI-driven government initiatives.

DRO & Impact Forces Of Government Software Market

The Government Software Market is profoundly influenced by a complex interplay of Drivers, Restraints, and Opportunities, which collectively shape its growth trajectory and competitive landscape. Key drivers include the relentless global pursuit of digital transformation across public sectors, spurred by a recognition that modern, efficient governance hinges on advanced technological infrastructure. Governments worldwide are under increasing pressure to enhance transparency, improve accountability, and deliver more responsive, citizen-centric services, all of which necessitate robust software solutions. The imperative to modernize outdated legacy systems, which often impede efficiency and pose security risks, further fuels demand for contemporary government software. Additionally, the rising sophistication of cyber threats mandates continuous investment in cutting-edge security software, making cybersecurity a foundational driver for market expansion.

Despite significant growth drivers, the market faces several notable restraints. The often lengthy and intricate procurement processes within government agencies, characterized by bureaucratic hurdles and stringent regulatory requirements, can delay or complicate software adoption. Budgetary constraints and the challenge of securing adequate funding for large-scale IT projects, particularly in developing economies, also present significant barriers. Furthermore, the inherent resistance to change within large public sector organizations, coupled with a shortage of skilled IT personnel capable of implementing and managing advanced software solutions, can hinder widespread deployment. Data privacy concerns and the complexity of ensuring compliance with diverse national and international data protection regulations add another layer of challenge for both software providers and government entities.

However, these challenges are often counterbalanced by compelling opportunities. The emergence of Smart City initiatives globally creates a vast potential market for integrated government software that manages urban infrastructure, public services, and citizen engagement within interconnected digital ecosystems. The growing trend towards cloud-based and Software-as-a-Service (SaaS) models offers opportunities for cost-effective and scalable solutions, appealing to governments seeking agility and reduced operational overheads. Moreover, the increasing demand for data analytics and artificial intelligence (AI) tools presents avenues for innovation, allowing governments to leverage big data for improved decision-making, predictive policing, and personalized citizen services. As governments prioritize digital resilience and sustainability, opportunities for specialized software in these domains are also expanding, fostering a dynamic environment for market growth and technological advancement.

Segmentation Analysis

The Government Software Market is intricately segmented across various dimensions to provide a granular understanding of its diverse landscape, reflecting the multifaceted needs of public sector entities globally. This segmentation typically includes analysis by deployment model, application type, end-user vertical, and even by the nature of the solution (e.g., commercial off-the-shelf vs. customized). Understanding these segments is crucial for both vendors tailoring their offerings and governments making informed procurement decisions, as each segment represents distinct operational requirements, technological preferences, and budgetary considerations. The market's complexity demands a comprehensive view, allowing for targeted strategies and specialized product development to meet specific governmental demands.

The deployment model segmentation categorizes solutions based on how they are hosted and accessed, primarily distinguishing between on-premise, cloud-based, and hybrid models. Cloud computing, particularly Software-as-a-Service (SaaS), is rapidly gaining traction due to its scalability, reduced upfront costs, and ease of maintenance, enabling governments to adopt modern solutions without heavy infrastructure investments. Application type segmentation delves into the functional areas addressed by the software, ranging from core enterprise resource planning (ERP) systems that manage internal operations to specialized applications for civic engagement, regulatory compliance, public safety, and infrastructure management. This detailed breakdown highlights the breadth of needs within the public sector, from fundamental administrative tasks to highly specialized service delivery.

End-user vertical segmentation is equally critical, differentiating between federal, state/provincial, and local government agencies. Each tier of government has distinct scales of operation, regulatory environments, and citizen interaction patterns, which dictate the type and complexity of software required. For instance, federal agencies often demand highly secure and robust systems capable of managing national data, while local governments prioritize solutions for community engagement and municipal service delivery. This nuanced segmentation allows market players to identify specific niches and tailor their marketing and product development efforts to resonate with the unique priorities and challenges faced by different governmental levels, fostering a more targeted and effective market approach.

- By Deployment Model:

- On-Premise: Software installed and run on computers located at the government agency's physical site, offering maximum control and security but requiring significant IT infrastructure investment and maintenance.

- Cloud-Based: Software hosted on external servers and accessed over the internet, providing scalability, flexibility, reduced IT overhead, and often a subscription-based pricing model. This includes SaaS, PaaS, and IaaS specifically tailored for government.

- Hybrid: A combination of on-premise and cloud solutions, allowing governments to leverage the benefits of both, often used for migrating legacy systems or managing highly sensitive data on-premise while utilizing cloud for less critical applications.

- By Application Type:

- Enterprise Resource Planning (ERP): Integrated suite of software managing core business processes such as finance, human resources, procurement, and asset management for government agencies.

- Customer Relationship Management (CRM) for Citizen Services: Systems designed to manage and analyze citizen interactions and data throughout the public service lifecycle, improving responsiveness and engagement.

- Business Intelligence & Analytics: Tools for collecting, analyzing, and transforming raw data into meaningful and actionable insights to support informed decision-making in policy and operations.

- Cybersecurity & Risk Management: Software solutions focused on protecting government information systems from cyber threats, ensuring data integrity, confidentiality, and availability, and managing regulatory compliance.

- Geographical Information Systems (GIS): Software for capturing, storing, manipulating, analyzing, managing, and presenting all types of geographical data, crucial for urban planning, emergency services, and environmental management.

- Constituent/Civic Engagement Platforms: Digital tools facilitating communication and interaction between government agencies and citizens, including online portals, feedback mechanisms, and service request management.

- Regulatory Compliance & Case Management: Software to help government agencies adhere to various laws, regulations, and internal policies, as well as manage legal cases, permits, and licensing processes.

- Public Safety & Justice: Specialized software for law enforcement, emergency services, courts, and corrections, including dispatch systems, records management, and criminal justice information sharing platforms.

- Financial Management & Procurement: Solutions for budgeting, accounting, treasury management, expense tracking, and e-procurement processes within government entities.

- Human Capital Management (HCM): Software for managing human resources functions such as payroll, benefits administration, talent acquisition, and performance management for government employees.

- By End-User Vertical:

- Federal/National Government: Software solutions for national-level ministries, departments, and agencies, often characterized by large-scale deployments, high security requirements, and complex data integration.

- State/Provincial Government: Software tailored for regional administrative bodies, focusing on state-specific regulations, public services like health and education, and inter-departmental coordination.

- Local Government/Municipalities: Solutions for city and county administrations, emphasizing citizen services, urban planning, public works, and local regulatory compliance.

Value Chain Analysis For Government Software Market

The value chain for the Government Software Market is a complex ecosystem, starting from upstream activities that involve research and development, intellectual property creation, and the foundational technological infrastructure. This segment is characterized by software developers, independent software vendors (ISVs), and technology platforms that provide the core components, libraries, and frameworks upon which government-specific applications are built. These upstream players invest heavily in cutting-edge technologies like artificial intelligence, blockchain, and advanced analytics to ensure their foundational offerings can meet the rigorous demands of governmental security, scalability, and data integrity. The innovation emanating from this segment directly impacts the capabilities and features available downstream, dictating the potential for future-proof solutions within the public sector.

Moving downstream, the value chain encompasses the development, customization, and integration of these foundational technologies into bespoke or specialized government software solutions. This phase is dominated by systems integrators, specialized government software vendors, and consulting firms that adapt generic software platforms or build new applications to address the unique functional requirements, compliance mandates, and operational workflows of various government agencies. These entities are responsible for not only coding and configuring the software but also ensuring seamless integration with existing legacy systems, data migration, and robust testing to meet stringent public sector standards. The ability to navigate complex governmental procurement processes and tailor solutions to specific legislative and administrative contexts is a critical differentiator in this part of the value chain.

The final stages of the value chain involve distribution channels, implementation, and ongoing support services, which are crucial for market penetration and long-term customer satisfaction. Distribution channels can be direct, where software vendors sell and implement their solutions directly to government clients, or indirect, involving channel partners, value-added resellers (VARs), and government-approved contractors. Post-implementation, ongoing support, maintenance, training, and continuous updates are paramount to ensure the software remains operational, secure, and compliant with evolving regulations. The strong emphasis on long-term relationships and comprehensive service provision throughout the entire lifecycle of the software highlights the commitment required by vendors in the government sector, ensuring optimal performance and maximizing the public value derived from these significant technological investments.

Government Software Market Potential Customers

The potential customers for Government Software are exceptionally diverse, spanning the entire breadth of public administration from the smallest local councils to the largest federal departments. These end-users, or buyers of the product, encompass any entity tasked with governance, public service delivery, or regulatory enforcement. At the federal or national level, customers include ministries of finance, defense, justice, health, education, and various regulatory bodies that require sophisticated enterprise-level software for managing national finances, large-scale databases, defense logistics, intelligence operations, and nationwide public service programs. These organizations demand highly secure, scalable, and interoperable solutions capable of handling massive volumes of sensitive data and supporting complex inter-agency collaboration.

At the state and provincial levels, potential customers comprise a wide array of agencies responsible for regional administration, including departments of transportation, environmental protection agencies, social services, state police, and legislative bodies. These entities typically seek software solutions that enable efficient regional planning, resource management, public safety coordination, and the delivery of state-specific services to their constituents. Their needs often involve integrating with both local and federal systems, necessitating flexible and adaptable software that can accommodate varying regional regulations and operational scales. The focus at this level is often on optimizing citizen engagement, streamlining administrative processes, and ensuring compliance with both state and federal mandates.

Local governments and municipalities form another significant segment of potential customers, encompassing city councils, county administrations, public utilities, police and fire departments, and local school boards. Their software requirements are typically centered around community-level services such as property tax management, permitting and licensing, waste management, parks and recreation, and direct citizen communication. These buyers prioritize user-friendly interfaces, mobile accessibility, and solutions that foster transparency and direct public involvement. Across all these tiers, the underlying motivation for adopting government software is universally to enhance operational efficiency, improve public accountability, bolster security, and ultimately provide a higher quality of service to the citizens they serve, making the public sector a perpetually significant and evolving market for software innovation.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 45.8 billion |

| Market Forecast in 2033 | USD 106.3 billion |

| Growth Rate | 12.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Accenture PLC, Microsoft Corporation, Oracle Corporation, SAP SE, Tyler Technologies Inc., IBM Corporation, Dell Technologies Inc., CGI Inc., Salesforce.com Inc., Workday Inc., ServiceNow Inc., Adobe Inc., Thomson Reuters Corporation, Blackbaud Inc., CentralSquare Technologies, Granicus Inc., NIC Inc. (now a part of Tyler Technologies), Infor, GovPilot, OpenGov Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Government Software Market Key Technology Landscape

The Government Software Market is characterized by a rapidly evolving technology landscape, where innovation is paramount to addressing the complex and diverse needs of public sector entities. Cloud computing, particularly Software-as-a-Service (SaaS) and Platform-as-a-Service (PaaS) models, stands as a foundational technology, enabling governments to access scalable, secure, and cost-efficient infrastructure without the burdens of traditional on-premise hardware management. This shift to the cloud facilitates faster deployment of new applications, reduces operational expenditures, and enhances data accessibility for distributed governmental teams, representing a critical technological advancement that underpins modern digital government initiatives and fosters greater agility in public administration.

Another pivotal technology shaping this market is Artificial Intelligence (AI) and Machine Learning (ML). These capabilities are being integrated into government software to automate repetitive administrative tasks, enhance data analytics for predictive policy-making, improve cybersecurity threat detection, and personalize citizen services through intelligent chatbots and virtual assistants. Furthermore, advanced data analytics and Business Intelligence (BI) tools are becoming indispensable, allowing government agencies to process vast datasets from various sources, extract actionable insights, and make evidence-based decisions for resource allocation, urban planning, and public health interventions, thereby significantly enhancing governmental efficacy and responsiveness.

Beyond AI and cloud, the technology landscape includes robust cybersecurity solutions, vital for protecting sensitive citizen data and critical infrastructure from ever-evolving cyber threats. This involves advanced encryption, multi-factor authentication, threat intelligence platforms, and compliance management software. Blockchain technology is also gaining traction for applications requiring immutable record-keeping, such as land registries, supply chain transparency, and digital identity management, offering enhanced security and trust. Finally, the development of Low-Code/No-Code platforms empowers government agencies to rapidly develop and deploy custom applications with minimal programming expertise, accelerating digital transformation efforts and making technology more accessible to non-technical personnel, contributing significantly to innovation and operational flexibility across the public sector.

Regional Highlights

- North America: This region stands as a dominant force in the Government Software Market, driven by substantial government investments in digital transformation initiatives, a mature technological infrastructure, and a strong emphasis on cybersecurity and data analytics. The United States, in particular, leads in adoption, with federal, state, and local agencies extensively implementing cloud-based solutions, ERP systems, and AI-powered tools to enhance efficiency, citizen engagement, and regulatory compliance. Canada also shows consistent growth, focusing on modernizing public services and integrating smart city technologies.

- Europe: Characterized by diverse national digital agendas, Europe is a significant market for government software. Countries like the United Kingdom, Germany, France, and Nordic nations are actively investing in e-governance, digital identity solutions, and cloud adoption to streamline public services and comply with stringent data privacy regulations like GDPR. There is a strong regional push towards interoperability and cross-border digital service delivery, driving demand for robust and compliant software platforms.

- Asia Pacific (APAC): This region is emerging as the fastest-growing market, propelled by rapid urbanization, increasing governmental focus on digital infrastructure, and large-scale smart city projects in countries like China, India, Singapore, and Australia. Governments are heavily investing in citizen-centric platforms, public safety software, and advanced analytics to manage vast populations and accelerate economic development, making APAC a hotbed for innovation and new market opportunities.

- Latin America: The Latin American market is experiencing steady growth, with governments increasingly prioritizing digital modernization to combat corruption, improve public transparency, and enhance service delivery. Brazil, Mexico, and Argentina are leading the charge, adopting solutions for financial management, e-procurement, and citizen engagement. Challenges related to economic stability and digital infrastructure disparities remain, but the long-term outlook is positive with continued governmental commitment to digital transformation.

- Middle East and Africa (MEA): The MEA region presents a dynamic and evolving market, particularly driven by ambitious national visions and smart government initiatives in the Gulf Cooperation Council (GCC) countries such as the UAE and Saudi Arabia. These nations are making substantial investments in cutting-edge technologies like AI, blockchain, and cloud computing to create highly efficient, futuristic public sectors. In Africa, while adoption is slower, there's a growing emphasis on foundational e-governance solutions to improve administrative efficiency and public service access.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Government Software Market.- Accenture PLC

- Microsoft Corporation

- Oracle Corporation

- SAP SE

- Tyler Technologies Inc.

- IBM Corporation

- Dell Technologies Inc.

- CGI Inc.

- Salesforce.com Inc.

- Workday Inc.

- ServiceNow Inc.

- Adobe Inc.

- Thomson Reuters Corporation

- Blackbaud Inc.

- CentralSquare Technologies

- Granicus Inc.

- NIC Inc. (now a part of Tyler Technologies)

- Infor

- GovPilot

- OpenGov Inc.

Frequently Asked Questions

Analyze common user questions about the Government Software market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is government software and why is it crucial for public administration?

Government software refers to specialized digital tools designed to support public sector operations, ranging from financial management and citizen engagement to public safety and infrastructure planning. It is crucial for modern administration because it enhances efficiency, improves transparency, ensures regulatory compliance, and enables the delivery of more effective and accessible public services, fundamentally transforming how governments operate and interact with their constituents.

What are the primary benefits of implementing cloud-based government software solutions?

Cloud-based government software offers numerous benefits, including enhanced scalability, reduced upfront infrastructure costs, improved data accessibility from any location, and stronger disaster recovery capabilities. It allows agencies to deploy solutions more rapidly, receive automatic updates, and reduce the burden on internal IT teams, leading to greater agility and cost-efficiency in public sector operations.

How does government software contribute to citizen engagement and public transparency?

Government software significantly boosts citizen engagement by providing user-friendly online portals, mobile applications, and feedback mechanisms that facilitate direct communication and service requests. For transparency, it enables easier access to public records, financial reports, and policy updates, fostering trust and accountability between government bodies and the populace by making information readily available.

What are the main challenges faced by government agencies in adopting new software solutions?

Key challenges include complex and lengthy procurement processes, budgetary constraints, resistance to change among government employees, and the difficulty of integrating new systems with existing legacy infrastructure. Data security and privacy concerns, along with the need for specialized IT talent, also pose significant hurdles to the smooth adoption and implementation of modern software solutions within the public sector.

What role does Artificial Intelligence (AI) play in the future of government software?

AI is set to revolutionize government software by automating routine administrative tasks, enabling advanced predictive analytics for policy-making, and enhancing cybersecurity measures. It will also personalize citizen interactions through intelligent chatbots and improve resource allocation, ultimately leading to more efficient, responsive, and data-driven public services, while demanding careful ethical considerations and robust governance frameworks.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager