GPS Positioner Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432778 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

GPS Positioner Market Size

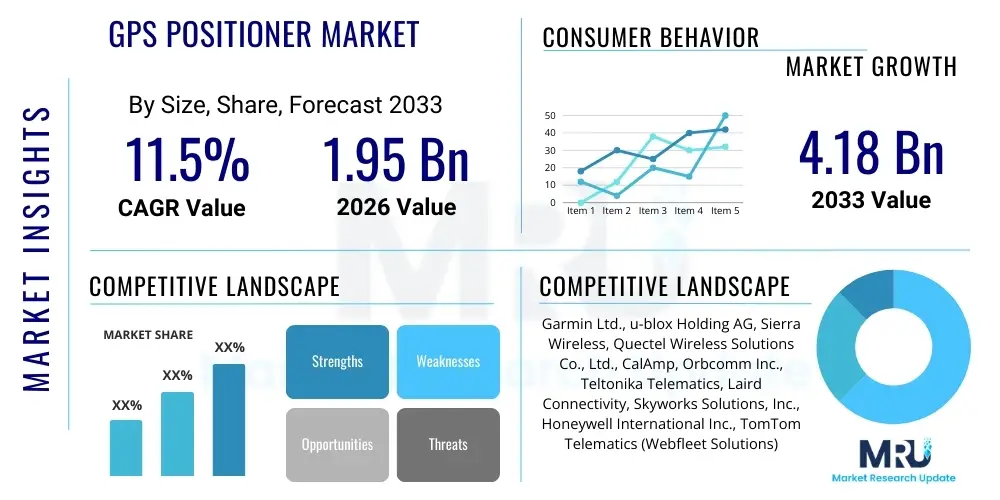

The GPS Positioner Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 11.5% between 2026 and 2033. The market is estimated at $1.95 Billion in 2026 and is projected to reach $4.18 Billion by the end of the forecast period in 2033.

GPS Positioner Market introduction

The GPS Positioner Market encompasses the technologies, devices, and services centered around Global Positioning System (GPS) capabilities, designed specifically to determine the precise location of an object, person, or asset across diverse environments. These systems have evolved significantly beyond basic geographical coordinates, now integrating advanced features such as real-time tracking, geo-fencing, sophisticated data analytics, and seamless integration with broader Internet of Things (IoT) ecosystems. GPS positioners are essential tools for modern industry, enabling high-precision navigation, enhanced security protocols, and optimization of operational efficiencies across numerous sectors.

Major applications of GPS positioners span critical areas including fleet management in logistics and transportation, asset tracking in construction and mining, personal safety, telematics for insurance providers, and critical infrastructure monitoring. The core benefit derived from these technologies is the ability to provide actionable location intelligence, which directly translates into reduced operational costs, improved supply chain visibility, enhanced driver safety, and effective recovery of stolen assets. The versatility of positioning technology allows deployment in harsh industrial settings as well as in sophisticated consumer electronics, driving widespread adoption.

The market is primarily driven by the escalating demand for asset visibility in complex global supply chains, stringent regulatory mandates necessitating tracking capabilities (such as eCall in Europe), and the rapid proliferation of IoT devices that require precise location data for contextual operations. Furthermore, advancements in satellite technology, including the modernization of Global Navigation Satellite Systems (GNSS) like Galileo and BeiDou, alongside the development of high-precision technologies such as Real-Time Kinematic (RTK) positioning, are constantly expanding the capabilities and accuracy of GPS positioners, thereby fueling market growth across both developed and emerging economies.

GPS Positioner Market Executive Summary

The GPS Positioner Market is experiencing robust expansion, fundamentally propelled by deep integration into commercial applications, particularly in logistics and the burgeoning sector of autonomous navigation. Business trends indicate a strong shift toward Software-as-a-Service (SaaS) models for location intelligence, where high-margin services revolving around predictive maintenance, route optimization, and data security are becoming the primary revenue drivers rather than hardware sales alone. Furthermore, miniaturization, enhanced battery life, and the development of positioners resilient to signal jamming are defining the competitive landscape, pushing manufacturers to innovate rapidly in hardware design and chip integration.

Regionally, Asia Pacific (APAC) stands out as a high-growth market due to massive investments in smart city infrastructure, rapid industrialization, and the sheer scale of fleet operations in countries like China and India. North America and Europe, while being mature markets, maintain high revenue shares driven by strict regulatory requirements, early adoption of advanced telematics, and a higher willingness to invest in high-precision (RTK/PPK) positioning systems necessary for autonomous vehicle testing and high-accuracy construction surveying. The Middle East and Africa (MEA) and Latin America are showing accelerating adoption, largely focused on securing high-value industrial assets in sectors like oil and gas, and mining.

Segment trends reveal that the asset tracking category is dominating revenue due to its wide applicability across diverse sectors, including cold chain monitoring and specialized equipment tracking. Technology-wise, the integration of cellular connectivity, especially 5G, alongside traditional GPS/GNSS modules, is critical, enabling faster data transmission and reduced latency, which is paramount for real-time applications. The automotive segment, focusing on in-vehicle navigation and advanced driver-assistance systems (ADAS), remains a foundational, high-value consumer of positioner technology, increasingly demanding highly reliable and secure embedded positioning modules.

AI Impact Analysis on GPS Positioner Market

Common user questions regarding AI's impact on GPS positioners often revolve around how artificial intelligence enhances accuracy, particularly in urban canyon environments where signal degradation is common. Users are highly interested in AI's role in predictive analytics—specifically, optimizing complex fleet routes based on real-time traffic, weather, and historical demand patterns, and predicting potential hardware failures within the positioner unit itself. A key concern frequently raised is data utilization and security: how is the massive amount of high-frequency location data generated by modern positioners managed, and how do AI algorithms ensure privacy while extracting valuable operational insights? Finally, the reliance of autonomous systems, such as drones and self-driving vehicles, on AI-enhanced positioning for mission-critical decisions is a major theme, underscoring the shift from simple localization to contextual awareness provided by integrated AI processing.

The consensus emerging from these inquiries suggests that AI is transforming GPS positioners from passive data transmitters into intelligent, decision-making nodes. AI algorithms are crucial for sensor fusion, where data from GPS, Inertial Measurement Units (IMUs), LiDAR, and cameras are combined to maintain positioning integrity even when GNSS signals are unavailable or compromised. This integration provides unparalleled resilience and reliability, which are non-negotiable requirements for safety-critical applications. Furthermore, the ability of machine learning to detect anomalies and preemptively flag deviations from planned routes or geofences significantly enhances the security and operational efficiency of tracked assets.

This intelligent augmentation is redefining the value proposition of positioners. Manufacturers are now competing on the sophistication of their embedded AI rather than just hardware specifications. AI allows for highly personalized and dynamic user experiences, such as automatic adjustment of positioning frequency based on movement patterns to conserve battery, or using reinforcement learning to optimize logistical networks across vast territories. Ultimately, the adoption of AI ensures that positioning data moves beyond simple location reporting to become the foundational layer for automated and highly efficient operational systems.

- AI optimizes sensor fusion, maintaining high accuracy in challenging environments (e.g., urban canyons, tunnels).

- Machine learning algorithms enhance predictive maintenance capabilities of positioner hardware, reducing downtime.

- AI facilitates advanced route optimization and dynamic scheduling for logistics based on real-time traffic and historical data.

- Increased data privacy risk mitigation through on-device processing and differential privacy techniques applied to location data.

- Enables sophisticated behavioral analysis for driver monitoring and insurance telematics, moving beyond simple speed tracking.

- Critical for high-fidelity situational awareness in autonomous vehicles and robotics, ensuring safety and navigation integrity.

DRO & Impact Forces Of GPS Positioner Market

The GPS Positioner Market is shaped by a confluence of accelerating drivers and constraining factors, balanced by significant emerging opportunities that define its growth trajectory. The primary driving forces include the rapid global adoption of the Internet of Things (IoT), which mandates accurate location context for billions of connected devices, alongside the societal move towards autonomous technologies across transportation, agriculture, and construction. However, the market faces inherent limitations, particularly the vulnerability of satellite signals to jamming, spoofing, and interference, which introduces operational risk, alongside the persistently high initial capital expenditure required for high-precision GNSS equipment and the complex regulatory fragmentation across different nations regarding location data governance and use. These constraining forces necessitate robust anti-jamming measures and strategic hardware design.

Impact forces currently exerting the most influence include technological innovation surrounding multi-constellation support (utilizing GPS, GLONASS, Galileo, BeiDou) to improve coverage and reliability globally, and the relentless pressure from commercial sectors, particularly e-commerce and logistics, to achieve near-perfect supply chain transparency. This demand for real-time, tamper-proof tracking is forcing advancements in battery technology and embedded security. Opportunities are largely concentrated in the development and commercialization of seamless indoor positioning solutions, utilizing technologies like Wi-Fi, Bluetooth Low Energy (BLE), and Ultra-Wideband (UWB) to complement GPS when satellite signals are blocked, thereby addressing a crucial limitation of traditional systems. Furthermore, the deployment of new Low Earth Orbit (LEO) satellite constellations promises enhanced resilience and lower latency, unlocking new high-precision applications.

The market’s momentum is strongly sustained by the increasing recognition that precise positioning is a fundamental utility, analogous to connectivity, for modern economies. This realization is pushing governments and large enterprises to mandate the use of certified positioners for enhanced safety (e.g., vehicle crash detection) and fiscal accountability (e.g., usage-based taxation). While the threat of signal insecurity remains a persistent restraint, the massive potential market in drone delivery, advanced agricultural robotics (precision farming), and specialized industrial monitoring ensures consistent investment in overcoming these technical hurdles. The interplay between regulatory stimulus (safety standards) and commercial pull (efficiency gains) maintains a strong, positive net impact force on market expansion.

Segmentation Analysis

The GPS Positioner Market is primarily segmented across product type, application, and end-user vertical, reflecting the varied technological requirements and deployment scales across industries. Analyzing the market through product types reveals a critical distinction between hardware modules (chipsets, standalone devices, integrated systems) and the complementary software and services sector (mapping, analytics, fleet management platforms, APIs). The hardware segment is highly competitive and cost-sensitive, while the software and services segment captures the highest value-added margin, offering recurring revenue streams based on data subscription and advanced platform features. This differentiation underscores the market's evolution from a hardware commodity focus to a data-centric service model.

Segmentation by application highlights the prevalence of asset tracking, which includes tracking everything from shipping containers and heavy machinery to smaller high-value tools, and the high-demand vehicle tracking segment, crucial for logistics, ride-sharing, and private vehicle safety. Additionally, the increasing need for personnel tracking, particularly in high-risk environments like mining and remote fieldwork, forms a smaller but rapidly growing niche. End-user analysis categorizes demand from sectors such as transportation and logistics (the largest consumer), construction and mining (driven by equipment utilization and theft prevention), government and defense (for strategic assets and personnel), and consumer electronics (smartwatches and fitness trackers).

The granular nature of segmentation allows manufacturers and service providers to tailor their offerings precisely, from ruggedized, long-life battery positioners designed for remote mining operations to highly integrated, low-power modules for consumer wearables. The software layer facilitates this customization, offering APIs that enable integration with enterprise resource planning (ERP) systems or custom fleet telematics dashboards. As technologies like RTK become more accessible, a new segmentation focus on "accuracy level" is emerging, differentiating standard accuracy solutions from centimeter-level precision systems required by machine control and autonomous operations.

- Product Type:

- GPS Positioner Devices (Standalone, Integrated, Portable)

- Software and Service Solutions (Cloud-based Telematics, Analytics Platforms, APIs)

- Modules and Chipsets (GNSS Receivers)

- Application:

- Asset Tracking (Fixed and Movable Assets)

- Fleet Management and Vehicle Tracking

- Personal Tracking and Safety

- Container and Cargo Monitoring (Cold Chain)

- Emergency Services and Rescue

- End-User Vertical:

- Transportation and Logistics

- Construction and Mining

- Government and Defense

- Automotive (OEM and Aftermarket)

- Oil and Gas

- Healthcare

- Technology:

- Standard Positioning Systems

- High-Precision Positioning Systems (RTK, PPK)

- Indoor Positioning Systems (IPS Integration)

Value Chain Analysis For GPS Positioner Market

The value chain of the GPS Positioner Market is intrinsically complex, starting with highly specialized upstream component manufacturing and culminating in diverse, sector-specific downstream service delivery. The upstream segment is dominated by semiconductor giants and specialized module providers who design and produce the core GNSS chipsets, antennas, microprocessors, and communication components (like 4G/5G modems). Success in this stage is heavily reliant on research and development (R&D) prowess to achieve high accuracy, low power consumption, and multi-constellation compatibility. Key relationships at this stage involve partnerships with global navigation satellite system operators and licensing agreements for precise positioning algorithms. Cost efficiency and technological superiority in chipset design directly influence the final product cost and performance, making this segment a critical determinant of market dynamics.

Midstream activities involve the manufacturing and assembly of the positioner devices. This includes integrating the core components into ruggedized enclosures suitable for various operating environments, rigorous testing, and system integration with ancillary sensors such as accelerometers, temperature sensors, and IMUs (Inertial Measurement Units). System integrators play a crucial role here, customizing firmware and hardware configurations for specific applications, such as integrating theft recovery features or specific industrial compliance protocols. The transition from manufacturing to distribution is executed through both direct sales to large Original Equipment Manufacturers (OEMs) in the automotive sector and indirect channels utilizing regional distributors and value-added resellers (VARs) who provide localized installation and support services.

Downstream analysis focuses on the delivery of the final solution to the end-users. Direct distribution is common for large-scale enterprise deployments, such as major logistics companies purchasing fleet management systems directly from the solution provider. However, indirect channels—primarily telematics service providers (TSPs) and Managed Service Providers (MSPs)—are crucial for small-to-midsize enterprises (SMEs) and complex installations requiring ongoing maintenance and data services. The highest value addition in the downstream segment comes from the recurring subscription revenue generated by software platforms that process location data into actionable business intelligence, driving operational improvements, compliance, and risk management for the potential customers.

GPS Positioner Market Potential Customers

The customer base for GPS Positioner Market solutions is extremely broad, spanning virtually every sector that requires asset visibility, mobility tracking, or navigational support. Primary consumers include large multinational logistics and trucking companies that utilize complex telematics systems for route planning, driver behavior monitoring, fuel efficiency analysis, and regulatory compliance (like Hours of Service logging). These buyers focus on large-scale, enterprise-grade solutions that offer high integration capabilities with their existing supply chain management and ERP systems, making reliability and data security paramount concerns in the purchasing decision.

A rapidly expanding segment of potential customers includes specialized industrial sectors such as construction, mining, and agriculture (precision farming). Construction firms purchase positioners to track expensive heavy equipment, prevent theft, and monitor utilization hours for billing and maintenance scheduling. The mining industry relies on highly robust, often underground-capable, positioning systems for vehicle guidance and safety tracking of personnel in harsh environments. In agriculture, precision positioners (often RTK-enabled) are critical for autonomous tractors and efficient application of seeds and fertilizers, aiming for centimeter-level accuracy to maximize yield and minimize waste, representing a high-value consumer segment.

Furthermore, government and defense agencies remain significant buyers, demanding highly secure, anti-jamming positioners for strategic asset tracking, military logistics, and emergency response fleet management. The consumer market, though often served by embedded smartphone GPS, drives demand for dedicated wearable positioners, pet trackers, and specialized personal safety devices, purchased primarily based on form factor, battery life, and associated monthly service costs. Insurance companies also act as indirect customers, driving adoption through usage-based insurance (UBI) models that mandate the installation of telematics devices in vehicles to monitor driving patterns.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $1.95 Billion |

| Market Forecast in 2033 | $4.18 Billion |

| Growth Rate | 11.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Garmin Ltd., u-blox Holding AG, Sierra Wireless, Quectel Wireless Solutions Co., Ltd., CalAmp, Orbcomm Inc., Teltonika Telematics, Laird Connectivity, Skyworks Solutions, Inc., Honeywell International Inc., TomTom Telematics (Webfleet Solutions), Trimble Inc., Qualcomm Incorporated, SOTI Inc., Geotab Inc., LoJack (a Solera company), NovAtel Inc. (Hexagon), Spire Global, Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

GPS Positioner Market Key Technology Landscape

The technology landscape of the GPS Positioner Market is rapidly shifting towards enhanced precision, ubiquitous connectivity, and seamless integration with non-satellite positioning techniques. Modern positioners are defined by their ability to leverage multiple Global Navigation Satellite Systems (GNSS) concurrently—including GPS (USA), GLONASS (Russia), Galileo (EU), and BeiDou (China)—significantly improving signal availability, reliability, and accuracy, especially in areas with limited visibility. The critical advancement in this space is the commercialization of Real-Time Kinematic (RTK) and Post-Processed Kinematic (PPK) technologies, which use carrier phase measurements and ground-based reference stations or correction services to achieve centimeter-level accuracy, previously limited to specialized surveying equipment. This sub-centimeter accuracy is now essential for autonomous applications in agriculture, drones, and sophisticated construction machine control systems, representing a major technological hurdle being rapidly overcome by miniaturization and cost reduction.

Another defining technology is sensor fusion, which addresses the inherent weakness of GPS systems in indoor environments and urban canyons. Positioners are increasingly incorporating Inertial Measurement Units (IMUs)—composed of gyroscopes and accelerometers—to enable dead reckoning, allowing the device to maintain accurate positioning estimates during temporary GPS signal loss based on movement data. When coupled with specialized algorithms, sensor fusion enhances the robustness required for mission-critical applications like ADAS (Advanced Driver-Assistance Systems) and self-driving platforms. Furthermore, the integration of connectivity technologies like 5G and LPWAN (Low Power Wide Area Networks, e.g., LoRaWAN and NB-IoT) is crucial, allowing for high-bandwidth data transmission (for complex map updates and high-frequency tracking) or extremely low-power operation (for assets tracked over several years).

The future of positioning technology is heavily influenced by next-generation connectivity infrastructure, particularly the advent of Low Earth Orbit (LEO) satellite constellations, such as those deployed by SpaceX (Starlink) and OneWeb. These constellations promise to deliver global high-speed connectivity and, potentially, enhanced positioning services with lower latency compared to traditional GEO satellites. This transformation also includes the development of sophisticated security mechanisms, such as anti-spoofing and anti-jamming hardware and algorithms, crucial for maintaining signal integrity in contested environments. These technological convergences—high precision, seamless connectivity, and robust security—are driving the evolution from simple location reporting devices to complex, reliable navigation engines.

Regional Highlights

- North America: North America represents a mature, high-value market characterized by early adoption of advanced telematics and a strong regulatory environment promoting vehicle safety and fleet efficiency. The United States and Canada are leading consumers of GPS positioners, driven by massive logistics operations, extensive oil and gas exploration requiring asset security, and significant investment in autonomous vehicle technology, which demands high-precision RTK positioning. The region has a high density of key technology providers and integrators, focusing heavily on value-added services such as predictive maintenance and advanced supply chain analytics, translating into high average revenue per unit (ARPU) for service providers. Regulatory compliance related to commercial driving (e.g., Electronic Logging Devices, ELD mandates) provides continuous structural demand for compliant positioner systems.

- Europe: The European market is heavily shaped by stringent governmental regulations and a strong focus on environmental sustainability. Mandates like the eCall system, which requires vehicles to automatically transmit location data to emergency services after an accident, have driven high penetration in the automotive sector. Furthermore, the European Union's investment in the Galileo GNSS constellation promotes technological independence and high localization accuracy. Key growth sectors include complex intra-European logistics, where cross-border tracking requires reliable multi-GNSS compatibility, and agriculture, particularly in Western Europe, where precision farming techniques utilize high-accuracy positioners extensively for optimizing crop yield and resource usage.

- Asia Pacific (APAC): APAC is the fastest-growing region globally, fueled by rapid industrialization, massive infrastructure projects, and the explosive growth of the e-commerce and logistics sectors, particularly in China, India, and Southeast Asia. The region benefits from increasing penetration of indigenous GNSS systems like BeiDou (China), which boosts regional security and accuracy. Demand is characterized by large volume procurement of cost-effective positioners for basic fleet tracking and asset management. Government investment in smart city initiatives and the development of massive commercial transportation corridors are creating unparalleled opportunities for vendors offering scalable, robust, and moderately priced solutions.

- Latin America (LATAM): The LATAM market growth is predominantly driven by acute security concerns related to vehicle and cargo theft, which mandates the use of GPS positioners for tracking and recovery. Brazil and Mexico are key markets, where insurance companies and fleet operators frequently require the installation of specialized tracking devices for risk mitigation. The market is often focused on affordable, robust hardware solutions with anti-tampering features, utilized extensively across mining, construction, and high-risk cargo transportation routes.

- Middle East and Africa (MEA): Growth in MEA is highly concentrated in the Gulf Cooperation Council (GCC) countries, focusing on large-scale construction, infrastructure development, and managing extensive oil and gas assets spread across vast, often harsh, remote territories. GPS positioners are essential here for security, remote monitoring, and optimizing logistics in geographically challenging environments. Africa presents significant long-term potential driven by increasing mobile connectivity and the necessity for asset visibility in emerging economies, though infrastructure challenges can sometimes restrain rapid adoption.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the GPS Positioner Market.- Garmin Ltd.

- u-blox Holding AG

- Trimble Inc.

- CalAmp

- Quectel Wireless Solutions Co., Ltd.

- Sierra Wireless

- Orbcomm Inc.

- Teltonika Telematics

- Geotab Inc.

- TomTom Telematics (Webfleet Solutions)

- Honeywell International Inc.

- Qualcomm Incorporated

- NovAtel Inc. (Hexagon)

- Laird Connectivity

- Skyworks Solutions, Inc.

- Spire Global, Inc.

- SOTI Inc.

- LoJack (a Solera company)

- Continental AG

- Xexun Technology Co., Ltd.

Frequently Asked Questions

Analyze common user questions about the GPS Positioner market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between GPS and GNSS positioning systems?

GPS (Global Positioning System) is the specific satellite navigation system operated by the United States. GNSS (Global Navigation Satellite System) is the overarching term encompassing all global systems, including GPS, Russia’s GLONASS, Europe’s Galileo, and China’s BeiDou. Modern positioners are typically GNSS-enabled, utilizing multiple constellations for superior accuracy and reliability.

How is AI impacting the accuracy and resilience of GPS positioners?

AI significantly enhances positioning accuracy by enabling robust sensor fusion, seamlessly combining data from GPS/GNSS, IMUs, and other sensors to maintain location integrity when satellite signals are compromised, such as in tunnels or dense urban areas. AI also optimizes filtering algorithms to mitigate signal noise and jamming effects.

Which industrial sectors are driving the highest demand for high-precision GPS (RTK)?

High-precision positioning systems, such as RTK (Real-Time Kinematic), are predominantly driven by the autonomous vehicle sector, precision agriculture (for automated steering and resource application), and construction/surveying (for machine control and infrastructure mapping), where centimeter-level accuracy is required for operational viability.

What are the major challenges restraining the growth of the GPS Positioner Market?

The primary restraints include the vulnerability of satellite signals to malicious jamming and spoofing, which poses security risks, and the high initial cost and complexity associated with integrating advanced, multi-constellation, and high-precision positioning hardware into existing operational fleets and infrastructure.

What role does 5G connectivity play in the future of GPS Positioner technology?

5G enables ultra-low latency and high-bandwidth data transmission, which is crucial for real-time applications like autonomous driving and immediate remote diagnostics. Furthermore, 5G infrastructure supports specialized positioning techniques (e.g., network-based positioning) that can augment or provide backup for traditional satellite systems, improving overall reliability.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager