Grab Bar Assist Devices Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434652 | Date : Dec, 2025 | Pages : 245 | Region : Global | Publisher : MRU

Grab Bar Assist Devices Market Size

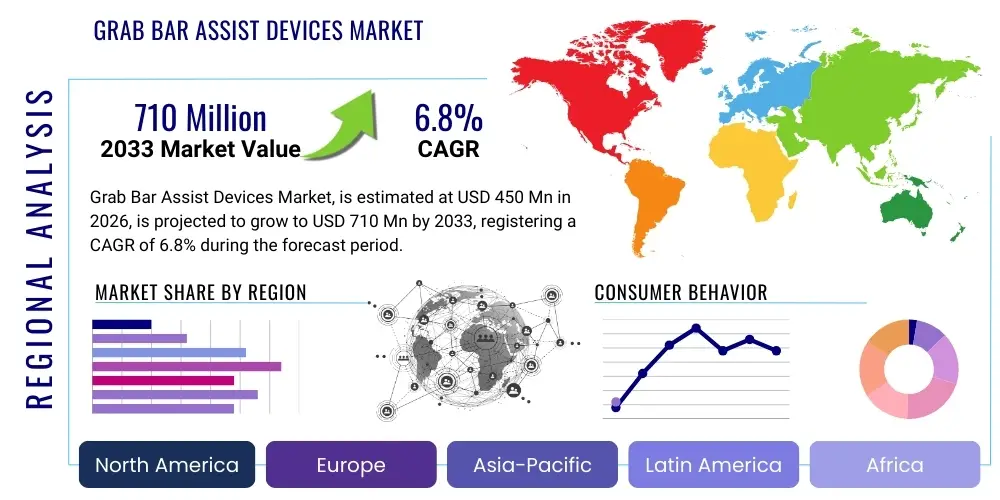

The Grab Bar Assist Devices Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 450 Million in 2026 and is projected to reach USD 710 Million by the end of the forecast period in 2033. This consistent expansion is fundamentally driven by the global demographic shift toward an aging population, coupled with increasing governmental and regulatory emphasis on fall prevention in both residential and institutional settings. The rise in awareness regarding home safety modifications, particularly in bathrooms and near stairwells, solidifies the market's robust trajectory.

Grab Bar Assist Devices Market introduction

The Grab Bar Assist Devices Market encompasses specialized safety equipment designed to provide support, stability, and leverage for individuals with mobility challenges, including the elderly, disabled, and post-operative patients. These devices are crucial components in promoting independent living and significantly reducing the risk of accidental falls, particularly in high-risk zones such as wet environments like showers and bathtubs. Products range from permanent, wall-mounted stainless steel or chrome bars capable of supporting high weight capacities, to temporary, suction-cup-based portable options, catering to diverse consumer needs, installation preferences, and clinical requirements across various application settings. The primary function of these bars is to stabilize movement transitions, such as sitting down, standing up, or moving laterally within confined spaces.

Major applications for grab bar assist devices span residential settings, where installation is often driven by aging-in-place initiatives, and institutional sectors, including hospitals, nursing homes, assisted living facilities, and specialized rehabilitation centers. The benefits derived from these devices are profound, centering on enhanced user safety, improved autonomy, and reduced healthcare costs associated with fall-related injuries. Furthermore, modern grab bars often integrate aesthetic designs and advanced ergonomic features, transitioning them from purely utilitarian aids to essential, yet visually discrete, components of safe living spaces. Regulatory standards, such as those imposed by ADA (Americans with Disabilities Act) or similar international bodies, dictate crucial installation requirements related to load-bearing capacity and placement, ensuring maximum effectiveness and user confidence.

Key driving factors accelerating market adoption include the increasing prevalence of chronic conditions leading to mobility impairment, such as arthritis, obesity, and cardiovascular diseases, necessitating reliable stability aids. Additionally, governmental subsidies and insurance reimbursements for home modifications aimed at disability and age-related safety are substantially lowering the financial barrier for consumers. The continuous innovation in materials—focusing on anti-microbial coatings, improved grip textures, and enhanced corrosion resistance—also plays a pivotal role in sustaining market momentum, ensuring long-term product durability and hygiene in demanding environments.

Grab Bar Assist Devices Market Executive Summary

The Grab Bar Assist Devices Market is currently characterized by strong growth in the institutional sector, driven by stringent safety regulations and the accreditation requirements for healthcare facilities, while the residential segment is rapidly expanding due to the global aging-in-place movement. Business trends highlight a pronounced shift towards aesthetically pleasing, designer grab bars that blend seamlessly with modern bathroom decor, moving away from purely clinical appearances. Furthermore, manufacturers are focusing heavily on developing modular and adaptable systems, offering greater flexibility in installation across various structural environments, including specialized bariatric options capable of supporting higher weights, reflecting the diverse needs of the global population. Strategic partnerships between hardware manufacturers and home safety assessment specialists are emerging to provide holistic, custom solutions to end-users.

Regional trends indicate North America and Europe retaining dominant market shares due to well-established healthcare infrastructure, high awareness levels regarding assistive devices, and favorable reimbursement policies for safety installations. However, the Asia Pacific region, particularly countries like China, India, and Japan, is projected to register the highest Compound Annual Growth Rate (CAGR). This acceleration is attributed to rapidly increasing geriatric populations in these nations, coupled with improving healthcare spending and increasing urbanization leading to smaller living spaces where optimized safety solutions are paramount. Government initiatives promoting elderly care infrastructure development are serving as a significant catalyst for institutional demand in these emerging economies.

Segment trends reveal that the permanent installation (wall-mounted) category dominates the market, favored for its superior reliability and load-bearing capacity, essential in high-stress areas like the shower. Within material types, stainless steel remains the material of choice due to its durability, resistance to corrosion, and ease of cleaning, satisfying critical hygiene standards in clinical settings. The end-user analysis confirms that assisted living facilities and hospitals constitute the largest consumer base, although direct-to-consumer sales through e-commerce platforms, targeting the residential segment, are witnessing the most significant proportional growth, indicating changing consumer purchasing habits favoring convenience and anonymity when acquiring mobility aids.

AI Impact Analysis on Grab Bar Assist Devices Market

User queries regarding the intersection of AI and grab bar assist devices primarily focus on transforming static safety equipment into proactive, smart monitoring systems. Consumers and healthcare providers are keenly interested in how Artificial Intelligence can move beyond simple physical support to offer predictive analytics, real-time risk assessment, and immediate emergency response capabilities. Common questions revolve around the integration of IoT sensors within grab bars to monitor vital signs, detect unusual behavioral patterns indicative of an impending fall (such as prolonged time spent standing or unsteady grip pressure), and automatically trigger alerts to caregivers or emergency services. The core theme is the expectation for AI to significantly enhance user autonomy while simultaneously lowering the risk profile associated with independent living, thereby offering a higher level of personalized safety assurance.

The primary impact of AI adoption is expected to materialize through the development of "smart grab bars." These devices incorporate embedded sensors—including pressure sensors, accelerometers, and potentially optical sensors—that continuously collect data on user interaction, including force applied, grip location, duration of use, and movement speed during transfers. AI algorithms analyze this data stream, establishing a baseline of normal activity for the user. Any deviation from this norm, such as a sudden, sharp application of force or a failure to apply expected force during a routine transfer, can be interpreted as a precursor to a fall or an actual fall incident. This predictive capability allows intervention before a severe accident occurs, moving the technology from passive support to active monitoring.

Furthermore, AI facilitates predictive maintenance and usage optimization. In large institutional settings, data aggregated from numerous smart grab bars can be analyzed to identify high-risk zones within a facility, optimize staffing levels based on peak usage times, and inform facility management decisions regarding optimal placement and design for future installations. For individual users, the AI-driven analysis of movement kinetics can be relayed to physical therapists, allowing for personalized rehabilitation protocols and better monitoring of recovery progress. The integration of voice activation and connectivity to wider smart home ecosystems also represents a key AI benefit, allowing users to call for help using only their voice, even if a fall prevents them from reaching a traditional emergency pull cord.

- AI-Powered Predictive Fall Detection: Algorithms analyze grip pressure and movement kinetics to anticipate and prevent falls.

- Real-time Vital Sign Monitoring: Integration of sensors to track heart rate and respiration during high-stress activities.

- Automated Emergency Alerting: Immediate notification to caregivers or emergency services upon detecting a fall incident or distress signal.

- Personalized Safety Baselines: Machine learning establishes individual user profiles to detect subtle, concerning deviations in mobility.

- Optimized Facility Management: Data analytics informing placement, durability requirements, and resource allocation in institutional settings.

- Integration with Smart Home Ecosystems: Voice-activated assistance and connectivity with other safety and security platforms.

- Diagnostic Data for Therapy: Providing physical therapists with detailed data on patient stability and rehabilitation adherence.

DRO & Impact Forces Of Grab Bar Assist Devices Market

The market dynamics are governed by a complex interplay of Drivers, Restraints, and Opportunities, collectively forming significant Impact Forces. Key drivers include the overwhelming global trend of aging populations, which inherently increases the demand for assistive devices necessary for maintaining independence and safety at home. Simultaneously, stringent governmental regulations, notably in developed nations, mandating accessible design standards for public and private healthcare facilities, enforce widespread adoption. The primary restraints facing the market involve aesthetic resistance from homeowners who perceive grab bars as purely institutional or unattractive, alongside the challenge of ensuring correct, professional installation—improperly installed bars pose significant safety risks, leading to potential liability and undermining consumer confidence. Opportunities lie heavily in technological advancements, specifically the development of smart, IoT-enabled grab bars that offer active monitoring, and market penetration into rapidly expanding emerging economies where infrastructure development is accelerating.

The dominant Impact Force is the demographic shift towards longevity. As life expectancies rise worldwide, the number of individuals requiring permanent assistance devices increases exponentially, ensuring a consistent and growing consumer base for the next several decades. This demographic pressure outweighs many of the current restraints, compelling manufacturers to innovate not just in function but also in form, addressing the aesthetic concerns through modern, disguised, or decorative designs. Furthermore, the rising cost of long-term institutional care serves as a powerful economic driver, making the investment in home safety modifications, like grab bars, an increasingly attractive and cost-effective alternative for consumers committed to aging in place.

Another crucial impact force is the regulatory environment and standardization. Compliance requirements from bodies such as the ADA, ISO, and various national building codes compel large-scale consumers, particularly commercial real estate developers, hospitality chains, and healthcare providers, to integrate grab bars into all relevant architectural blueprints. This institutional demand provides market stability and predictability, contrasting with the more fragmented and awareness-dependent residential market. The continuous threat of potential litigation stemming from fall incidents also motivates facilities to exceed minimum safety standards, further boosting the adoption of robust, high-quality assistive devices, thereby favoring established, certified manufacturers.

Segmentation Analysis

The Grab Bar Assist Devices Market is intricately segmented based on Type, Material, End-User, and Distribution Channel, reflecting the diverse application needs and consumer preferences across the global landscape. Analysis of these segments is vital for understanding market dynamics and identifying high-growth pockets. The segmentation based on Type distinguishes between fixed (permanent, wall-mounted), fold-down (or hinged), and portable (suction-cup or clamp-based) bars, with fixed bars typically leading in market value due to their perceived stability and mandatory usage in institutional settings. Material segmentation highlights the dominance of stainless steel, prized for hygiene and strength, followed by chrome-plated brass and specialized polymers, which are often used in residential settings where aesthetic appeal or non-metal environments are preferred.

The End-User segment is critical, separating consumption between the residential sector, characterized by individual purchases driven by personal safety needs, and the institutional sector, which includes bulk procurement by hospitals, nursing homes, and rehabilitation centers, driven by regulatory compliance and clinical necessity. Geographically, the market is dissected into major regions—North America, Europe, Asia Pacific, Latin America, and Middle East & Africa—each presenting unique growth patterns influenced by population structure, healthcare expenditure, and regulatory maturity. Understanding these segment interactions allows manufacturers to tailor product development, pricing strategies, and distribution networks to effectively penetrate target markets.

- By Type:

- Fixed (Wall-Mounted) Grab Bars

- Portable Grab Bars (Suction Cup)

- Folding/Hinged Grab Bars

- Floor-to-Ceiling Poles

- By Material:

- Stainless Steel

- Chrome-Plated Brass

- Polymer/Plastic Composites

- Other Metals (e.g., Aluminum)

- By End-User:

- Hospitals and Clinics

- Nursing Homes and Assisted Living Facilities

- Residential (Home Care)

- Rehabilitation Centers

- Commercial Facilities (Hotels, Public Restrooms)

- By Distribution Channel:

- Online Retail/E-commerce

- Specialty Medical Stores (DME Providers)

- Pharmacies and Drug Stores

- Direct Sales (B2B Institutional)

Value Chain Analysis For Grab Bar Assist Devices Market

The value chain for grab bar assist devices begins with upstream activities focused on raw material sourcing, predominantly high-grade stainless steel, brass, and specialized engineering polymers. Manufacturers require reliable access to metals that possess excellent anti-corrosion properties and high tensile strength to meet stringent load-bearing safety standards, making material quality control a paramount concern at this initial stage. Efficient procurement, combined with specialized manufacturing processes such as cutting, welding, polishing, and specialized coating applications (e.g., anti-microbial treatments), dictates the final production cost and quality. Manufacturers often invest heavily in robotic welding and automated precision machining to ensure consistency and compliance with safety certifications, thereby adding significant value before product distribution.

Midstream activities involve the primary manufacturing and assembly of the finished devices, including the integration of modern components for smart grab bars, such as sensors and connectivity modules. Following manufacturing, products move into the downstream phase, which focuses on logistics and distribution. The distribution channel is bifurcated into direct and indirect routes. Direct distribution involves B2B sales primarily targeting institutional customers (hospitals and nursing homes) through specialized sales teams, ensuring large volume orders and installation compliance support. This channel is characterized by long-term contracts and negotiated bulk pricing, offering stability to the manufacturer.

The indirect distribution channel caters predominantly to the residential market and relies heavily on Durable Medical Equipment (DME) specialty retailers, large e-commerce platforms, and general hardware stores. Online retail has become increasingly crucial for the residential segment, providing convenience, competitive pricing, and privacy for consumers purchasing sensitive medical aids. DME providers add value by offering professional advice, product fitting, and installation services, which are critical for ensuring the safe operation of the devices. Optimized logistics and robust inventory management across these diverse channels are essential to meet varied demand patterns and minimize lead times, maintaining a high level of customer satisfaction and market access.

Grab Bar Assist Devices Market Potential Customers

Potential customers for grab bar assist devices are primarily concentrated within two broad categories: high-dependency institutional buyers and individual residential end-users characterized by mobility impairment or advanced age. Institutional buyers, including hospitals and nursing homes, represent the largest volume purchasers, driven by regulatory mandates and the critical need to mitigate liability risks associated with patient falls. These entities require high-load capacity, specialized bariatric models, and anti-microbial surfaces, often purchasing through direct B2B contracts to ensure compliance and reliable supply chains. Their purchasing decisions are heavily influenced by durability, cleaning protocols, and industry certifications, valuing long-term cost-effectiveness over upfront price.

The second major group, residential end-users, comprises elderly individuals opting for aging-in-place solutions, individuals recovering from surgery or injury (temporary mobility issues), and people with permanent disabilities. This customer segment often seeks products through DME retail outlets, pharmacies, and increasingly, e-commerce platforms. Their decision-making process is highly influenced by ease of installation (especially for portable models), aesthetic compatibility with home decor, and personal budget constraints. Families purchasing for elderly relatives also constitute a significant sub-segment, seeking reliable solutions that ensure the safety and dignity of their loved ones within the home environment, often guided by advice from occupational therapists.

A growing niche segment of potential customers includes specialized rehabilitation centers and commercial facilities such as hotels, airports, and public sector buildings that must comply with accessibility legislation (e.g., ADA standards). Rehabilitation centers use grab bars in clinical settings for physical therapy exercises, requiring adjustable and adaptable systems. Commercial facilities, while driven by compliance, also emphasize design integration and high traffic durability. Understanding the distinct needs—clinical reliability for hospitals, ease of use for residential, and aesthetic compliance for commercial—allows manufacturers to fine-tune marketing messages and product specifications to maximize market penetration across all viable buyer groups.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 450 Million |

| Market Forecast in 2033 | USD 710 Million |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Moen Incorporated, Kohler Co., Invacare Corporation, Etac AB, Drive DeVilbiss Healthcare, Handicare Group AB, Bariatric Solutions, Graham-Field Health Products, Medical Depot Inc. (Medline), Performance Health, NRS Healthcare, Prism Medical Ltd., RCN Medizin, Arjo, Freedom Alert, Great Grips Inc., TOTO Ltd., Cardinal Health, Jacuzzi Group, Delta Faucet Company. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Grab Bar Assist Devices Market Key Technology Landscape

The technology landscape for grab bar assist devices extends beyond basic mechanical engineering to encompass advanced material science and smart electronics. Core technological advancements center on developing highly durable and corrosion-resistant materials, specifically focusing on surgical-grade stainless steel (often 304 or 316 series) and specialized polymers that offer superior tensile strength while being warm to the touch and anti-slip. Furthermore, coating technology is essential; manufacturers are increasingly utilizing anti-microbial coatings, particularly silver-ion based formulas, to inhibit the growth of bacteria and pathogens, a critical requirement for institutional installations and mitigating hospital-acquired infections (HAIs). Design technologies, such as concealed flange mounts and modular systems, improve aesthetic integration and simplify professional installation, ensuring compliance with architectural standards without compromising safety integrity.

The most significant emerging technological trend is the integration of Internet of Things (IoT) and sensor technology, giving rise to smart grab bars. These devices are equipped with sophisticated electronics, including highly sensitive load cells and pressure sensors that monitor user weight distribution and grip stability. This real-time data collection allows the bar to detect abnormal weight shifts or the onset of a fall. The collected information is processed via embedded microcontrollers and transmitted wirelessly (using Wi-Fi or Bluetooth Low Energy) to a central monitoring system or a caregiver's mobile device, enabling rapid emergency response. This technological evolution transforms the product from a passive mechanical aid into an active safety and monitoring platform, addressing the growing need for continuous, non-invasive home monitoring for high-risk individuals.

Further technological innovations include specialized mechanical systems such as pneumatic assist mechanisms in folding grab bars, which utilize gas springs or dampers to ensure smooth, controlled movement when raising or lowering the bar, preventing accidental slamming or sudden shifts. For portable devices, advancements in vacuum-sealing technology have led to high-integrity suction cups that include visual indicators (color changing) to alert users if the seal integrity is compromised, significantly improving the reliability of temporary installations. Overall, the technological direction is focused on increasing safety margin through active monitoring, enhancing hygiene through advanced coatings, and improving user experience through ergonomic and aesthetic designs, ultimately driving higher market acceptance and premium product pricing.

Regional Highlights

The global market for Grab Bar Assist Devices exhibits distinct regional consumption and growth patterns influenced by demographic structure, healthcare policy, and economic maturity. North America, encompassing the United States and Canada, currently holds the largest market share. This dominance is attributed to a highly advanced healthcare system, mandatory compliance with accessibility standards (such as the ADA), high levels of disposable income facilitating investment in home modifications, and a substantial, well-informed aging population. The regional market is mature but remains stable, driven by ongoing infrastructure renovations and the continuous push toward comprehensive fall prevention programs in hospitals and senior care facilities. Demand here is increasingly focused on smart technology integration and premium, designer products.

Europe represents the second-largest market, characterized by government support for aging-in-place initiatives, strong regulatory frameworks (e.g., EU accessibility directives), and well-established long-term care facilities, particularly in Western European nations like Germany, the UK, and France. Scandinavian countries are leaders in implementing universal design principles, driving steady demand for high-quality, durable assistive technology. However, the Asia Pacific (APAC) region is projected to be the fastest-growing market during the forecast period. This exponential growth is fueled by massive demographic shifts, particularly in Japan, China, and South Korea, where the rate of population aging is among the highest globally. Increasing public health expenditure, expanding insurance coverage for medical devices, and rapid urbanization demanding standardized accessibility features in new infrastructure projects are major growth catalysts.

Latin America (LATAM) and the Middle East & Africa (MEA) currently hold smaller market shares but offer considerable long-term potential. Growth in these regions is heavily reliant on improving economic conditions, increased healthcare infrastructure investment, and evolving cultural acceptance of assistive devices. In the MEA region, oil-rich nations are dedicating significant capital to building high-quality, accessible healthcare and hospitality infrastructure, driving institutional demand. LATAM is seeing rising demand primarily from private healthcare facilities and an emerging middle class increasingly prioritizing home safety and geriatric care, although market penetration is often hampered by price sensitivity and less comprehensive regulatory enforcement compared to North America and Europe.

- North America: Market leader, driven by rigorous ADA standards, high healthcare spending, and substantial elderly population demanding smart safety devices.

- Europe: Strong second position, supported by favorable government policies for aging-in-place and mandatory universal design codes across public and private infrastructure.

- Asia Pacific (APAC): Highest projected CAGR, propelled by rapid demographic aging in East and Southeast Asia and increasing investments in healthcare infrastructure development.

- Latin America (LATAM): Emerging market, growth concentrated in private sector hospitals and urban residential areas prioritizing enhanced safety features.

- Middle East & Africa (MEA): Growth potential linked to large-scale infrastructure projects and governmental efforts to modernize healthcare and accessibility standards.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Grab Bar Assist Devices Market.- Moen Incorporated

- Kohler Co.

- Invacare Corporation

- Etac AB

- Drive DeVilbiss Healthcare

- Handicare Group AB

- Bariatric Solutions

- Graham-Field Health Products

- Medical Depot Inc. (Medline)

- Performance Health

- NRS Healthcare

- Prism Medical Ltd.

- RCN Medizin

- Arjo

- Freedom Alert

- Great Grips Inc.

- TOTO Ltd.

- Cardinal Health

- Jacuzzi Group

- Delta Faucet Company

Frequently Asked Questions

Analyze common user questions about the Grab Bar Assist Devices market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary factors driving the growth of the Grab Bar Assist Devices Market?

Market growth is predominantly driven by the accelerating global aging population, resulting in a higher incidence of mobility impairment and fall risk. This demographic shift is compounded by stringent government regulations mandating accessibility features in public and healthcare facilities, and increasing consumer preference for aging-in-place home safety solutions.

How does the integration of IoT and AI technology impact grab bar functionality?

IoT and AI transform grab bars from passive aids into active safety devices. They enable real-time monitoring of user stability and grip pressure, offering predictive fall detection capabilities. Smart grab bars can automatically trigger emergency alerts, provide data for physical therapy, and optimize safety management in institutional environments, significantly enhancing user protection.

Which material segment dominates the Grab Bar Assist Devices Market, and why?

Stainless steel dominates the market material segment. Its prevalence is due to its superior durability, high load-bearing capacity, resistance to corrosion in wet environments, and ease of sterilization, which are critical requirements for both institutional settings (hospitals) and long-term residential use.

What are the key differences between fixed and portable grab bars for consumers?

Fixed (wall-mounted) grab bars offer maximum stability, highest weight capacity, and permanent assurance, making them ideal for high-risk areas like showers. Portable (suction-cup) grab bars offer temporary assistance, require no tools for installation, and are suitable for travel or low-risk areas, but they have lower load limits and require careful seal maintenance.

Which geographical region is anticipated to show the fastest market growth, and what are the reasons?

The Asia Pacific (APAC) region is projected to exhibit the fastest growth (highest CAGR). This acceleration is fueled by the region's rapidly expanding elderly demographic, significant governmental investment in geriatric care infrastructure, and increasing per capita healthcare spending across major economies like China and India.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager