Graduated Cylinder Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 431635 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Graduated Cylinder Market Size

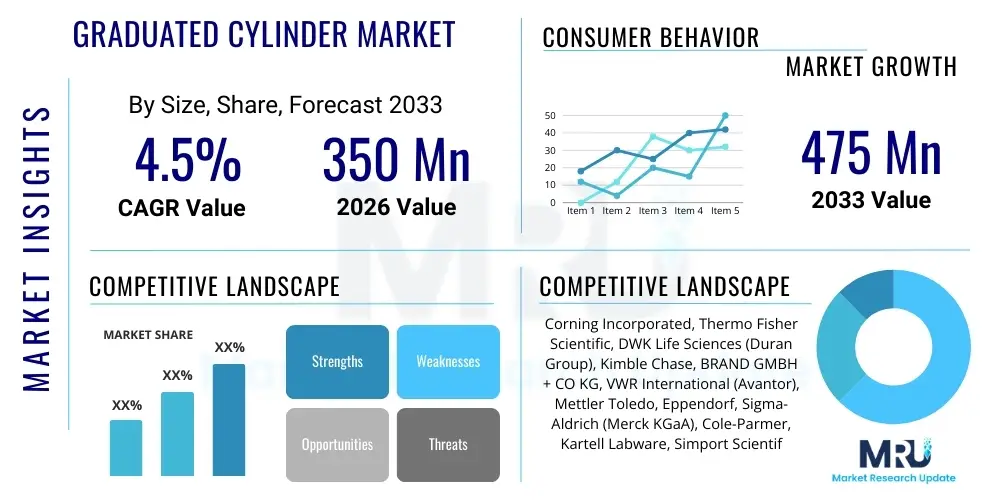

The Graduated Cylinder Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.5% between 2026 and 2033. The market is estimated at USD 350 Million in 2026 and is projected to reach USD 475 Million by the end of the forecast period in 2033.

Graduated Cylinder Market introduction

The Graduated Cylinder Market encompasses the global trade and utilization of laboratory glassware and plasticware designed specifically for accurately measuring volumes of liquid. These cylinders are essential tools across numerous scientific and industrial disciplines, serving as primary equipment for routine volumetric measurements, solution preparation, and qualitative analysis in laboratory settings. The core product is a cylindrical vessel with etched or printed markings (graduations) that indicate the volume contained. These tools are manufactured from materials such as borosilicate glass, which offers high chemical resistance and thermal stability, or various plastics like polypropylene (PP) and polymethylpentene (PMP), which provide robustness and reduced breakage risk.

Major applications of graduated cylinders span fundamental research, quality control, manufacturing processes, and specialized diagnostics. In pharmaceutical and biotechnology laboratories, they are crucial for preparing buffers, media, and reagent solutions with controlled precision. Chemical and petrochemical industries rely on them for titration setup and precise volumetric transfers during material testing and synthesis. Furthermore, academic institutions utilize them extensively for teaching practical laboratory skills and conducting experimental procedures. The sustained demand is underpinned by the continuous expansion of global R&D activities and the increasing regulatory requirement for standardized, repeatable measurements across highly controlled environments.

The primary benefits driving the market include their cost-effectiveness, ease of use, and versatility. While advanced automated liquid handlers are available, graduated cylinders remain indispensable for measuring larger volumes (typically 50 ml to 2000 ml) quickly and reliably where high precision is not mandatory, but good accuracy is required. Key driving factors include the proliferation of diagnostic testing laboratories globally, rising investments in life science research, and the inherent necessity for basic volumetric apparatus in every new or expanding laboratory infrastructure. Material innovation, particularly in high-clarity plastics (PMP) that offer glass-like transparency coupled with excellent chemical resistance, continues to stimulate market growth, addressing concerns related to fragility and safety in high-throughput environments.

Graduated Cylinder Market Executive Summary

The Graduated Cylinder Market exhibits steady and sustainable growth, largely propelled by stable business trends characterized by consistent investment in global healthcare infrastructure, pharmaceutical manufacturing capacity, and academic research funding. Key business trends show a significant pivot towards safety and compliance, driving demand for plastic cylinders in educational and industrial settings where breakage is a major concern. The market is bifurcating, with high-end, certified Class A glass cylinders serving calibration and critical volumetric tasks, while cost-effective plastic alternatives dominate general-purpose laboratory applications. Suppliers are focusing on expanding their global distribution networks and integrating digital tools for streamlined procurement, recognizing that purchasing decisions are increasingly centralized within large research institutions and contract research organizations (CROs).

Regionally, the market dynamics are heavily influenced by scientific expenditure. North America and Europe currently represent the largest revenue generators due to mature pharmaceutical and biotechnology sectors and well-established research ecosystems. However, the Asia Pacific (APAC) region is poised for the highest growth rate, driven by rapid establishment of R&D centers in countries like China, India, and South Korea, coupled with massive government initiatives to boost domestic manufacturing of active pharmaceutical ingredients (APIs) and specialized chemicals. Latin America and the Middle East & Africa (MEA) offer emerging opportunities, focusing primarily on basic laboratory setup and educational segment procurement, showing a higher preference for durable, cost-effective plastic options.

Segment trends reveal a continued dominance of the plastic segment by volume, fueled by safety protocols and bulk purchasing in industrial settings. The large capacity segment (250 ml and above) maintains steady growth as industrial processes and large-scale solution preparation remain fundamental. End-user segmentation shows that the Pharmaceutical & Biotechnology sector generates the highest value revenue due to strict quality standards necessitating frequent replacement and procurement of certified equipment, while the Academia & Research segment leads in terms of volume consumption. Technological improvements, such as enhanced anti-static coatings on plastic cylinders and high-precision laser etching on glass, further support incremental market value improvements within these segments.

AI Impact Analysis on Graduated Cylinder Market

User inquiries regarding the influence of Artificial Intelligence (AI) on the Graduated Cylinder Market frequently revolve around the potential for complete replacement by automation, optimization of laboratory workflows, and improvements in volumetric measurement accuracy through digital integration. Key themes include concerns about whether advanced liquid handling robots, often supported by AI scheduling and optimization algorithms, will render manual equipment obsolete. Users are also keen on understanding how AI can optimize inventory management for consumable labware like cylinders, predicting usage based on experimental throughput, thereby minimizing waste and stockouts. Furthermore, interest exists in leveraging computer vision (an AI subdomain) coupled with smart scales to verify the meniscus reading and reduce human error, effectively enhancing the accuracy of manual measurements without fully automating the process.

- AI drives demand for integrated lab environments, potentially reducing the need for manual, low-precision volume measurement.

- Predictive maintenance and inventory systems powered by AI optimize stock levels of graduated cylinders, reducing procurement costs for end-users.

- AI-enhanced laboratory management software integrates usage data from graduated cylinders (when linked to digital logging systems) to track experimental repeatability.

- Computer vision systems utilizing AI can automatically read the meniscus line on a cylinder, offering higher consistency and reducing inter-operator variability.

- AI accelerates research discovery, indirectly increasing the number of experiments performed, thus maintaining a baseline demand for essential lab tools like cylinders.

DRO & Impact Forces Of Graduated Cylinder Market

The market for graduated cylinders is shaped by a balance of fundamental requirements for basic laboratory tasks and the increasing push towards advanced automation. Drivers include the global expansion of pharmaceutical R&D activities, particularly the rapid drug discovery and vaccine development efforts worldwide, which necessitate large volumes of standardized labware. Furthermore, the mandatory requirements for quality control (QC) testing across various regulated industries, such as food safety and environmental monitoring, ensure a consistent baseline demand. Restraints primarily involve the market penetration of sophisticated automated liquid handling systems (pipetting robots and dispensers) that offer superior speed and precision, particularly for small-volume measurements, potentially displacing high-end cylinder usage. Additionally, the challenge of disposing of non-recyclable plastic cylinders and the inherent fragility of glass variants impose logistical and cost restraints.

Opportunities in the market center on capitalizing on emerging economies' infrastructure build-out and the development of specialized cylinder designs. There is a growing opportunity for manufacturers to introduce calibrated, disposable plastic cylinders that meet Class A tolerances, appealing to safety-conscious laboratories requiring high accuracy without the risks associated with glass. Furthermore, strategic opportunities exist in integrating graduated cylinders into the "smart lab" ecosystem, perhaps through RFID tagging or associated digital logging systems, making them traceable assets. The impact forces indicate that technological substitution remains the primary threat, balanced by the strong and stable requirement for cost-effective, large-volume measurement tools that automation cannot yet fully replace economically across all applications.

Segmentation Analysis

The Graduated Cylinder Market is systematically segmented based on material, capacity, and end-user, reflecting the diverse application needs across different scientific and industrial settings. Segmentation by material is critical, defining trade-offs between chemical resistance, thermal stability, cost, and durability, leading to distinct purchasing patterns. Capacity segmentation directly correlates with the scale of laboratory operations, from micro-scale chemistry requiring 10 ml cylinders to bulk industrial solution preparation demanding capacities up to 2000 ml. End-user segmentation highlights the varying quality, certification, and volume demands placed by key vertical industries such as pharmaceuticals, academia, and specialized testing laboratories, where regulatory compliance and budget constraints significantly influence procurement decisions.

- By Material:

- Glass (Borosilicate Glass, Soda-Lime Glass)

- Plastic (Polypropylene (PP), Polymethylpentene (PMP), Polyethylene (PE))

- By Capacity:

- Up to 50 ml (10 ml, 25 ml)

- 51 ml to 250 ml (100 ml, 200 ml, 250 ml)

- 251 ml to 1000 ml (500 ml, 1000 ml)

- Above 1000 ml (2000 ml, custom sizes)

- By End-User:

- Pharmaceutical & Biotechnology Companies

- Academic & Research Institutions

- Chemical & Petrochemical Industry

- Food & Beverage Testing Laboratories

- Environmental Testing Laboratories

- Hospitals & Diagnostic Centers

Value Chain Analysis For Graduated Cylinder Market

The value chain for the Graduated Cylinder Market starts with upstream activities involving raw material procurement, specifically specialized glass (borosilicate) and high-grade laboratory polymers (PP, PMP). Manufacturers specializing in precision forming, molding, and calibration then transform these materials into finished products. Upstream analysis focuses on securing high-quality raw materials that meet strict ISO standards for volumetric accuracy and chemical inertness. Key considerations include the stable supply of borosilicate tubing and medical-grade plastic pellets, where price fluctuations can impact final product costs. Efficient manufacturing processes, including automated etching and calibration technologies, are crucial for maintaining consistency and scalability in production, especially for certified Class A instruments.

Downstream activities involve distribution, sales, and end-user consumption. The distribution channel is robust and multi-layered, relying heavily on specialized scientific equipment distributors (such as Avantor/VWR and Thermo Fisher Scientific's distribution arms) that handle complex logistics, inventory, and customer support for a vast array of lab consumables. Direct sales are typically reserved for large, volume contracts with major pharmaceutical companies or government laboratories. Indirect channels, including regional dealers and e-commerce platforms, facilitate access for smaller academic institutions and independent testing facilities. Efficient inventory management and global supply chain resilience are paramount in the downstream segment to meet the constant, though often unpredictable, demands of laboratory operations globally. The final delivery and usage lifecycle heavily emphasize packaging integrity to prevent breakage during transit, a crucial factor for the glassware segment.

Graduated Cylinder Market Potential Customers

Potential customers for graduated cylinders are defined by any organization requiring precise, routine volumetric measurement of liquids, spanning sectors that prioritize scientific rigor and quality assurance. The largest volume consumers are educational and academic research laboratories, which utilize cylinders daily across multiple teaching labs and fundamental research experiments due to their necessity in basic chemistry and biology protocols. The highest value customers, however, reside in the highly regulated pharmaceutical and biotechnology industry, encompassing drug manufacturers, CROs, and vaccine producers, where the constant need for media preparation, quality control checks, and solution standardization drives continuous, certified-grade equipment procurement.

Other significant end-users include specialized testing facilities such as environmental monitoring agencies and food and beverage quality control labs, which rely on graduated cylinders for sample preparation and standardized testing protocols. Furthermore, hospitals and large diagnostic centers utilize them for preparing large batches of reagents and diluents. The demand from the chemical and petrochemical industries remains strong for large-capacity cylinders used in industrial synthesis, material testing, and process control. Marketing strategies must be tailored to address the specific needs of each group: cost-effectiveness and durability for academic users, and precision, certification, and traceability for pharmaceutical clients.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 350 Million |

| Market Forecast in 2033 | USD 475 Million |

| Growth Rate | 4.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Corning Incorporated, Thermo Fisher Scientific, DWK Life Sciences (Duran Group), Kimble Chase, BRAND GMBH + CO KG, VWR International (Avantor), Mettler Toledo, Eppendorf, Sigma-Aldrich (Merck KGaA), Cole-Parmer, Kartell Labware, Simport Scientific, Assistent, Labware 360, Isolab. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Graduated Cylinder Market Key Technology Landscape

The core technology surrounding graduated cylinders remains centered on precision manufacturing and calibration, ensuring compliance with international standards such as ISO 1042 or ASTM specifications for Class A and Class B accuracy. For glass cylinders, the key technology involves specialized borosilicate glass manufacturing processes that ensure thermal shock resistance, chemical durability, and high transparency. Advanced laser etching techniques are employed to provide durable, easily readable graduations that resist laboratory solvents and wear. Furthermore, sophisticated annealing processes are necessary to minimize internal stress in the glass, ensuring long-term structural integrity and calibration stability, which are critical factors for quality assurance laboratories.

In the plastic cylinder segment, technological advancements focus on material science and molding precision. Manufacturers utilize high-precision injection molding techniques, often employing advanced polymers like PMP (Polymethylpentene), which offers superior chemical resistance and clarity comparable to glass, alongside high autoclavability. The technology landscape also includes the application of anti-static treatments to plastic surfaces to prevent meniscus distortion caused by static charge when measuring non-aqueous solutions, thus enhancing measurement reliability. Calibration verification technologies, including automated optical inspection systems, are integral to ensuring that both glass and plastic cylinders meet the stated volumetric tolerances before reaching the end-user.

Emerging technologies impact the market indirectly but significantly through standardization and digital integration. The adoption of unique identification systems, such as 2D barcoding or RFID tagging on certified cylinders, allows for seamless digital tracking of equipment usage, calibration history, and regulatory compliance within a Laboratory Information Management System (LIMS). This integration facilitates easier audit trails and improves overall lab efficiency. While the cylinder itself is low-tech, its interface with the high-tech lab environment is evolving, particularly as laboratories move toward paperless systems and require verifiable data inputs from all measurement tools. This shift drives the necessity for manufacturers to ensure their products are compatible with modern data acquisition and laboratory management infrastructure.

Regional Highlights

- North America: North America, particularly the United States, holds a dominant position in the Graduated Cylinder Market, attributed to the immense concentration of leading pharmaceutical and biotechnology companies, extensive government and private funding for R&D, and the presence of world-class academic institutions. The market here is characterized by a high demand for premium, certified Class A glass cylinders for regulated tasks and a large consumption of high-grade plastic cylinders in teaching and non-critical industrial applications. Stringent quality control requirements in the US and Canada ensure continuous demand for frequent replacement of labware.

- Europe: Europe represents another significant market hub, driven by major pharmaceutical clusters in Germany, Switzerland, and the UK, and robust academic research across the European Union. The European market emphasizes standardization (ISO norms) and sustainability, leading to a strong demand for durable borosilicate glass and recyclable or eco-friendly plastic options. Regional growth is stable, supported by continuous investment in life sciences infrastructure and clinical diagnostics.

- Asia Pacific (APAC): The APAC region is the fastest-growing market, primarily fueled by the massive expansion of healthcare spending, the establishment of numerous contract manufacturing and research organizations (CMOs/CROs), and increasing foreign investment in domestic pharmaceutical production in countries like China and India. The market here is highly price-sensitive but shows rapidly increasing demand for quality, certified labware as regulatory standards mature, balancing between cost-effective bulk plastic options and specialized glass needs.

- Latin America: Latin America presents a steadily developing market, focusing on expanding basic healthcare access and strengthening regional educational infrastructure. Demand is concentrated in major economies like Brazil and Mexico, characterized by a preference for durable, cost-efficient laboratory supplies, predominantly plastic cylinders, to equip new educational and public health laboratories.

- Middle East and Africa (MEA): The MEA market is fragmented but growing, spurred by investments in oil and gas sector testing (requiring specialized cylinders) and governmental efforts to diversify economies by strengthening local healthcare and scientific research capabilities, particularly in the UAE and Saudi Arabia. Market maturity varies significantly, with procurement often reliant on international aid or large-scale government tenders favoring global distributors.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Graduated Cylinder Market.- Corning Incorporated

- Thermo Fisher Scientific Inc.

- DWK Life Sciences GmbH (Duran Group)

- Kimble Chase LLC

- BRAND GMBH + CO KG

- VWR International (Avantor Inc.)

- Mettler Toledo

- Eppendorf AG

- Sigma-Aldrich (Merck KGaA)

- Cole-Parmer Instrument Company

- Kartell Labware

- Simport Scientific Inc.

- Assistent Labor- und Feinwerktechnik GmbH

- Labware 360

- Isolab Laborgeräte GmbH

- Axygen Scientific (Corning Subsidiary)

- Pyrex (Corning brand)

- Hirschmann Laborgeräte GmbH

- Glassco Laboratory Equipments

- Bel-Art Products (SP Scienceware)

Frequently Asked Questions

Analyze common user questions about the Graduated Cylinder market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the projected growth rate (CAGR) for the Graduated Cylinder Market?

The Graduated Cylinder Market is anticipated to demonstrate stable growth, projecting a Compound Annual Growth Rate (CAGR) of 4.5% between 2026 and 2033, driven by sustained global investment in life sciences R&D and quality control testing.

Which material segment dominates the graduated cylinder market share?

While borosilicate glass remains the standard for chemical resistance and high precision (Class A), the Plastic segment, particularly polypropylene (PP) and PMP, currently dominates the market by volume and unit sales due to lower cost, enhanced safety, and durability in academic and general industrial settings.

How do automated liquid handling systems affect the demand for graduated cylinders?

Automated liquid handling systems primarily impact the demand for small-volume, high-precision graduated cylinders (under 50 ml). However, graduated cylinders retain essential status for cost-effective, large-volume solution preparation (over 100 ml) where extreme precision is not required, ensuring stable baseline demand.

Which region is expected to show the fastest growth in this market?

The Asia Pacific (APAC) region is projected to experience the highest growth rate, fueled by substantial governmental investments in healthcare infrastructure, the rapid expansion of domestic pharmaceutical manufacturing capabilities, and increasing educational enrollment requiring laboratory equipment.

What are the primary differentiating factors between Class A and Class B graduated cylinders?

Class A graduated cylinders offer higher accuracy and are certified to strict standards, often featuring permanent serial numbers and conformity certificates, making them suitable for regulatory compliance and critical volumetric measurements. Class B cylinders are intended for general-purpose use, offering lower accuracy but greater cost efficiency for routine, non-critical laboratory tasks.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager