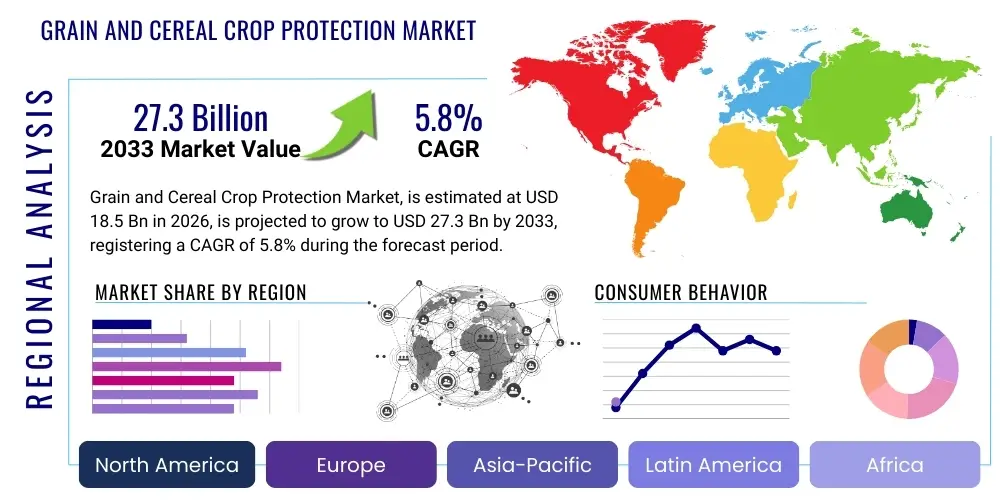

Grain and Cereal Crop Protection Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435495 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Grain and Cereal Crop Protection Market Size

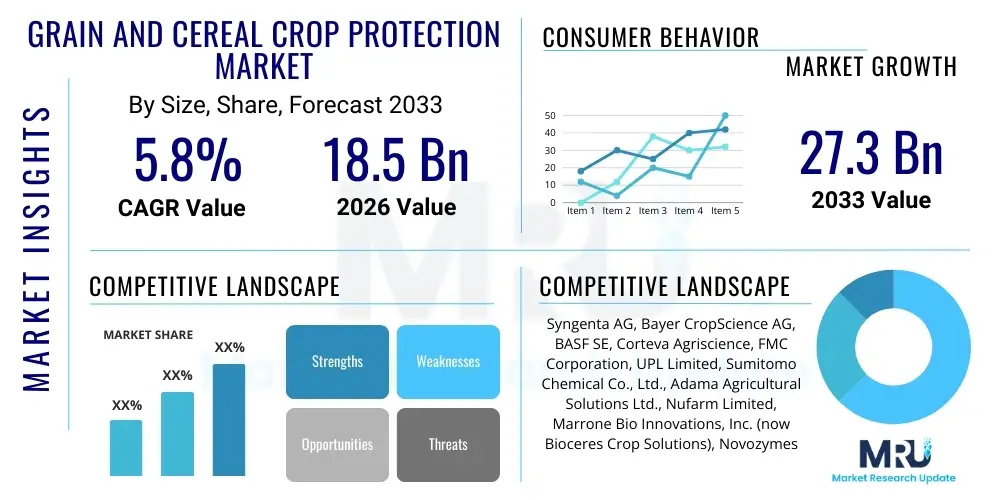

The Grain and Cereal Crop Protection Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 18.5 Billion in 2026 and is projected to reach USD 27.3 Billion by the end of the forecast period in 2033.

Grain and Cereal Crop Protection Market introduction

The Grain and Cereal Crop Protection Market encompasses the sale and application of chemical and biological products designed to shield major staple crops—including wheat, rice, maize, barley, and oats—from detrimental pests, weeds, and diseases. These protective solutions are crucial for maximizing yield efficiency and ensuring global food security, especially in the face of increasing climatic volatility and shrinking arable land. Products range from synthetic pesticides (herbicides, insecticides, fungicides) to advanced biological control agents and seed treatments, tailored to specific crop cycles and local pest pressures. Major applications span across pre-planting, planting, and post-emergence stages, focusing on integrated pest management (IPM) strategies to reduce reliance on conventional chemicals while ensuring sustainable agricultural practices. The primary benefits derived from these products include substantial reduction in pre- and post-harvest losses, improved grain quality, and enhanced farm profitability.

The core driving factors propelling this market include the escalating global demand for food driven by rapid population growth, coupled with continuous advancements in biotechnology leading to the development of highly selective and less toxic crop protection agents. Furthermore, the persistent threat posed by herbicide-resistant weeds and the emergence of new crop diseases necessitate ongoing innovation in product formulations and application techniques. Regulatory pressures, particularly in developed regions like Europe, are simultaneously pushing manufacturers towards greener, more sustainable solutions, accelerating the adoption of bio-pesticides and precision agriculture tools for targeted delivery. The increasing mechanization of farming and adoption of high-yielding crop varieties further enhance the uptake of effective crop protection regimes necessary to secure optimal productivity.

Grain and Cereal Crop Protection Market Executive Summary

The global Grain and Cereal Crop Protection Market is undergoing significant transformation, characterized by a fundamental shift towards sustainable and precision-based solutions. Business trends indicate strong investment in R&D focusing on biologicals, biostimulants, and digital farming tools that enable site-specific application of inputs, optimizing efficiency and minimizing environmental footprint. Mergers and acquisitions remain a consistent theme as major agricultural science companies consolidate portfolios to gain access to novel chemistries and advanced delivery technologies. The market structure is increasingly bifurcated, balancing the robust demand for cost-effective conventional products in emerging economies with the rapid adoption of premium, environmentally friendly alternatives in mature markets.

Regional trends highlight Asia Pacific (APAC) as the largest and fastest-growing region, driven by intensive cereal farming practices in countries like India and China, and government initiatives aimed at boosting local grain production. North America and Europe, while mature, lead in technological adoption, particularly in precision agriculture and integrated pest management (IPM) implementation, spurred by stringent regulatory environments favoring residue reduction. Segment trends show that herbicides dominate the product type landscape due to widespread issues with weed resistance, but the biologicals segment (including bioherbicides and biofungicides) is exhibiting the highest Compound Annual Growth Rate (CAGR), reflecting producer responsiveness to environmental concerns and consumer demand for sustainably grown food. Seed treatment segments are also showing robust growth as they offer prophylactic protection and efficient input utilization from the start of the crop cycle.

AI Impact Analysis on Grain and Cereal Crop Protection Market

User queries regarding the impact of Artificial Intelligence (AI) in the crop protection sector frequently revolve around how AI can enhance efficiency, reduce input costs, and address environmental sustainability. Common themes include the efficacy of AI-driven scouting systems, the role of machine learning in predicting pest outbreaks, and the development of autonomous spraying equipment. Users are primarily concerned with the practical implementation challenges, such as data infrastructure requirements, cost-effectiveness for smallholder farms, and the reliability of predictive models across diverse climatic zones. There is high expectation that AI will revolutionize dosage recommendations and application timing, moving away from calendar-based spraying to real-time, needs-based intervention, thereby optimizing the use of pesticides and minimizing off-target effects.

AI’s influence is profound, fundamentally altering how crop protection strategies are devised and executed. By leveraging satellite imagery, drone surveillance, and ground sensor data, AI algorithms can analyze vast datasets to identify specific areas within a field afflicted by pests or diseases with extraordinary accuracy. This capability facilitates variable rate technology (VRT) applications, ensuring that chemicals or biologicals are only applied where necessary, significantly reducing overall product consumption and associated costs. Furthermore, machine learning models are being developed to predict the timing and severity of pathogen or pest infestations based on weather patterns and historical data, allowing farmers to implement preventative treatments proactively rather than reactively, maximizing treatment efficacy.

- AI enhances precision agriculture through real-time disease detection and automated anomaly flagging in cereal fields.

- Machine learning models predict pest migration and outbreak severity, optimizing the timing of control measures (Predictive Intelligence).

- AI powers autonomous sprayers and robotics, enabling spot-spraying or micro-dosing to minimize chemical overuse (Variable Rate Technology - VRT).

- Data analytics driven by AI improves efficacy tracking, helping farmers select the most appropriate crop protection product for specific resistance challenges.

- AI facilitates the development of novel biological formulations by accelerating the identification and testing of potential active ingredients derived from natural sources.

DRO & Impact Forces Of Grain and Cereal Crop Protection Market

The Grain and Cereal Crop Protection Market is significantly shaped by several critical dynamic forces: rising global food demand acts as a primary Driver, necessitating maximized yields from limited land resources. Simultaneously, the increasing prevalence of pest resistance to established chemical classes serves as a strong Restraint, compelling costly R&D investment into new modes of action. Opportunities are abundant in the rapid commercialization of sustainable biological solutions and the integration of digital technologies for precision application. These forces create a complex interplay where regulatory stringency (an impact force) pushes innovation towards greener products, while the urgent need for productivity (another impact force) keeps conventional chemistries relevant, particularly in cost-sensitive markets. Navigating this dynamic landscape requires companies to balance high efficacy with environmental stewardship.

The market is primarily driven by the imperative to increase crop productivity per hectare, fueled by global population growth, which is projected to reach 9.7 billion by 2050. This demand pressure, coupled with volatile weather patterns exacerbating pest and disease threats, solidifies the requirement for reliable crop protection. However, a major restraint is the increasing regulatory burden, particularly in the European Union, which has led to the withdrawal of several highly effective active ingredients (AIs), resulting in fewer tools for farmers and higher costs for registering new, safer compounds. Additionally, the development and proliferation of resistant weeds (e.g., glyphosate-resistant pigweed) and insects necessitate continuous formulation changes and expensive research into alternative products, placing significant financial pressure on manufacturers and end-users alike.

Opportunities lie predominantly in the biologicals sector (bioherbicides, biofungicides, bioinsecticides), which align perfectly with sustainability goals and evolving consumer preferences for residue-free food. Furthermore, the convergence of agricultural inputs with digital tools—such as remote sensing, drone mapping, and decision support systems (DSS)—presents immense potential to optimize input use. Impact forces include shifting governmental policies promoting Integrated Pest Management (IPM) techniques globally, high volatility in raw material and energy costs impacting manufacturing prices, and intense competition from generic agrochemical manufacturers, particularly after patent expiration of blockbuster molecules. These factors collectively mandate agility and innovation across the entire value chain to maintain competitiveness and meet the evolving needs of the global cereal farming sector.

Segmentation Analysis

The Grain and Cereal Crop Protection Market is extensively segmented based on the type of product used, the crop treated, the type of formulation, and the mode of application. Product type segmentation provides insight into the dominance of herbicides, which address the most pervasive agricultural problem globally—weed competition—but also highlights the exponential growth of biological segments, reflecting market adaptation to sustainability demands. Crop segmentation confirms the centrality of major global staples like wheat, maize, and rice in driving market volumes, while formulation analysis tracks the preference for easy-to-use liquid and dry formulations. Application method analysis reveals the increasing sophistication of seed treatment and foliar spray technologies, crucial for enhancing product effectiveness and reducing environmental dispersal.

Detailed analysis of these segments is vital for stakeholders to identify high-growth niches and tailor product development strategies. For instance, within the application segmentation, the shift from traditional broadcast spraying to precision delivery methods (VRT) using drones or smart equipment signifies a technological premium opportunity. Geographically, segmentation helps in allocating resources based on regional agricultural intensity, regulatory climate, and local pest profiles, acknowledging that disease pressure is often higher in humid rice-growing regions of Asia compared to temperate wheat-growing regions of North America. Understanding the interplay between these segments provides a holistic view of current consumption patterns and future innovation trajectories.

- By Product Type:

- Herbicides (Selective, Non-selective)

- Fungicides (Triazoles, Strobilurins, Methoxy acrylates)

- Insecticides (Neonicotinoids, Pyrethroids, Organophosphates)

- Biologicals (Biopesticides, Biostimulants)

- By Crop Type:

- Maize (Corn)

- Wheat

- Rice

- Barley

- Oats and Sorghum

- By Formulation Type:

- Liquid Formulation (Suspension Concentrates - SC, Emulsifiable Concentrates - EC)

- Dry Formulation (Wettable Powders - WP, Water-Dispersible Granules - WDG)

- By Application Method:

- Seed Treatment

- Foliar Spray

- Soil Treatment

- Post-Harvest Application

Value Chain Analysis For Grain and Cereal Crop Protection Market

The value chain of the Grain and Cereal Crop Protection Market begins with extensive upstream activities encompassing R&D, patent protection, and the sourcing of complex chemical and biological intermediates. The discovery phase is extremely capital-intensive and time-consuming, requiring significant investment to identify new active ingredients (AIs) that meet both efficacy and stringent safety standards. Key upstream suppliers include bulk chemical manufacturers and specialty producers of inert ingredients necessary for formulation stability and effectiveness. Robust IP protection is fundamental at this stage to recoup the high R&D costs associated with bringing a new molecule to market. The intermediate step involves formulation—converting AIs into commercially viable products (e.g., ECs, WDG)—ensuring shelf stability and compatibility with field equipment.

Midstream activities involve large-scale manufacturing and quality control, followed by distribution channels. The distribution network is complex, often relying on global, regional, and local distributors and retailers who manage inventory, logistics, and farmer training. Direct distribution channels are increasingly used by major multinational corporations for large commercial farms, offering specialized advisory services and integrated solutions (e.g., bundled seed, chemical, and digital platforms). Indirect channels, utilizing wholesalers and smaller farm supply stores, remain critical for reaching smaller agricultural holdings, especially in Asia and Latin America. The efficiency of this distribution network is crucial, as crop protection products are often time-sensitive commodities requiring rapid deployment during specific planting or growing seasons.

Downstream activities culminate at the farm level, involving end-users (farmers) who purchase and apply the products. Technical support and training provided by distributors or manufacturers are crucial for ensuring correct dosage and application timing, maximizing efficacy, and maintaining regulatory compliance. Market feedback gathered downstream informs upstream R&D priorities, particularly regarding emerging resistance issues and preferences for new product formats (e.g., low-drift formulations). The modern value chain is characterized by a strong push toward digitalization, integrating point-of-sale data and application metrics back into the system to refine forecasting and improve inventory management across the entire supply chain, connecting input manufacturers directly with real-world application needs.

Grain and Cereal Crop Protection Market Potential Customers

The primary customers and end-users of Grain and Cereal Crop Protection products are commercial farmers and large agricultural enterprises engaged in the cultivation of staple cereals globally. These entities rely heavily on effective protection measures to safeguard their significant investment in seeds and land, ensuring they meet high production targets necessary for local consumption, export, or supply to the food processing industry. Customers can be broadly categorized based on farm size, ranging from massive industrial farms in North America and Brazil utilizing highly advanced precision application equipment and integrated digital platforms, to smaller, resource-constrained farmers in developing nations who often rely on basic, cost-effective formulations purchased through local cooperatives and retailers.

Beyond the direct farm level, other key customers include government agricultural agencies and commodity purchasing boards that often procure large quantities of crop protection products for distribution programs aimed at enhancing national food security or supporting distressed farming sectors. Additionally, seed production companies are significant buyers, as many modern high-yielding seeds are sold pre-treated with protective fungicides and insecticides to provide early-season defense against soil-borne pathogens and initial insect pressure. These customers value reliability, efficacy, regulatory compliance, and increasingly, verifiable sustainability credentials, driving demand for advanced formulations that offer targeted action with minimal environmental persistence.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 18.5 Billion |

| Market Forecast in 2033 | USD 27.3 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Syngenta AG, Bayer CropScience AG, BASF SE, Corteva Agriscience, FMC Corporation, UPL Limited, Sumitomo Chemical Co., Ltd., Adama Agricultural Solutions Ltd., Nufarm Limited, Marrone Bio Innovations, Inc. (now Bioceres Crop Solutions), Novozymes A/S, Isagro S.p.A., Gowan Company, Certis USA LLC, Arysta LifeScience (now part of UPL), Koppert Biological Systems, Lier Chemical Co., Ltd., Chemtura Corporation, Albaugh LLC, Dow AgroSciences (now part of Corteva). |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Grain and Cereal Crop Protection Market Key Technology Landscape

The technological landscape of the Grain and Cereal Crop Protection Market is rapidly evolving, driven by the need for enhanced efficacy, reduced environmental impact, and greater compliance with Integrated Pest Management (IPM) principles. A central shift involves the miniaturization and optimization of delivery systems. Microencapsulation and nanotechnology are increasingly used to formulate active ingredients, providing controlled release mechanisms that prolong the effectiveness of the product, reduce the required dosage, and minimize exposure to non-target organisms. These advanced formulations improve photostability and rain-fastness, translating directly into better performance under adverse field conditions, which is crucial for maximizing returns on high-value cereal crops.

Another dominant technological trend is the rise of biological solutions, including microbial pesticides (based on bacteria, fungi, or viruses) and natural extracts. Investment is heavily directed towards high-throughput screening and genomics to discover and optimize novel biological entities that offer specific pest control without leaving harmful residues. Complementary to this is the focus on biostimulants, which, while not direct protection agents, enhance the plant's natural defense mechanisms and resilience against abiotic stresses, thereby improving overall crop health and resistance to pathogens. This shift supports the sustainability goals of large agricultural corporations and meets growing consumer and regulatory demand for safer food production systems.

Furthermore, digital technologies represent the third pillar of modern crop protection. Precision application technologies, including drone-based variable rate spraying and sensor-driven decision support systems (DSS), allow for real-time monitoring and highly localized treatment. This technology minimizes chemical drift and optimizes application efficiency, reducing input costs significantly. The integration of AI and IoT sensors allows farmers to generate predictive models for disease risk based on localized microclimates and soil conditions. This technological convergence ensures that crop protection is transitioning from a prophylactic, broad-spectrum approach to a highly targeted, data-driven methodology, enhancing profitability and environmental stewardship simultaneously.

Regional Highlights

Regional dynamics play a crucial role in shaping the demand, product mix, and regulatory environment of the Grain and Cereal Crop Protection Market. Each major geographical area presents unique challenges related to pest pressure, farming practices, and market maturity, necessitating localized product development and marketing strategies. The market is broadly divided into mature markets (North America, Europe) focused on precision and sustainability, and high-growth markets (APAC, Latin America) where volume demand and productivity gains are the primary focus.

- North America (U.S. and Canada): This region is characterized by large-scale, highly mechanized farming operations, leading to robust demand for high-efficacy, broad-spectrum herbicides (especially for maize and wheat) due to extensive issues with weed resistance. The market here is a leader in adopting precision agriculture technologies, integrating digital mapping, and Variable Rate Technology (VRT) with crop protection inputs. Regulatory oversight focuses heavily on worker safety and environmental non-target effects, driving significant investment in advanced biological and seed treatment solutions, particularly in corn and soybean protection.

- Europe: The European market, especially the EU-27 nations, is defined by the most stringent regulatory framework globally, exemplified by the Farm to Fork strategy, which mandates a reduction in chemical pesticide use and promotes IPM. This regulatory climate severely restricts the use of many conventional active ingredients, positioning Europe as the foremost driver of biological and low-risk product innovation. Fungicides are highly critical for protecting high-value wheat and barley crops from prevalent diseases like Septoria. Market growth relies heavily on novel, residue-free products and integrated digital decision support systems.

- Asia Pacific (APAC): APAC represents the largest and fastest-growing regional market due to the massive acreage dedicated to rice and wheat cultivation, supporting the world's largest population base. Factors driving demand include high incidence of insect pests and fungal diseases in humid climates, fragmented land holdings, and governmental subsidies promoting modernization of agriculture (especially in India and China). While chemical consumption remains high, driven by the need for quick yield gains, there is rapid, policy-driven growth in the adoption of bio-pesticides and quality-focused inputs, particularly in advanced economies like Japan and South Korea.

- Latin America (LATAM): LATAM is a critical market, dominated by large-scale soybean, maize, and sugarcane production (though cereals are substantial). Brazil and Argentina are pivotal players, characterized by high disease and pest pressure that necessitate intensive use of insecticides and fungicides year-round. The region remains a volume-driven market where efficacy and cost-effectiveness are paramount. Growth is supported by expanding arable land and the rapid deployment of double-cropping systems, necessitating durable, multi-season crop protection strategies, although regulatory processes can be slower than in other large markets.

- Middle East and Africa (MEA): This region faces severe abiotic stresses, including drought and extreme heat, making crop protection challenging yet essential for food security, particularly for wheat and coarse grains. Market size is smaller relative to others but is growing steadily, fueled by government initiatives to modernize farming techniques and secure domestic food supply (e.g., in Saudi Arabia and Egypt). Demand is highly localized, focusing on products effective against specific regional threats like locusts and various rust diseases, with reliance on imported products and increasing interest in water-efficient seed treatments.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Grain and Cereal Crop Protection Market.- Syngenta AG (Part of ChemChina)

- Bayer CropScience AG

- BASF SE

- Corteva Agriscience

- FMC Corporation

- UPL Limited

- Sumitomo Chemical Co., Ltd.

- Adama Agricultural Solutions Ltd.

- Nufarm Limited

- Koppert Biological Systems

- Marrone Bio Innovations, Inc. (now Bioceres Crop Solutions)

- Novozymes A/S (Part of Novozymes-Chr. Hansen)

- Gowan Company

- Certis USA LLC (Part of Mitsui & Co.)

- Arysta LifeScience (now integrated into UPL)

- Lier Chemical Co., Ltd.

- Albaugh LLC

- Isagro S.p.A.

- Wynca Group

- Jiangsu Good Harvest-Weien Agrochemical Co., Ltd.

Frequently Asked Questions

Analyze common user questions about the Grain and Cereal Crop Protection market and generate a concise list of summarized FAQs reflecting key topics and concerns.What factors are primarily restraining the growth of the crop protection market for cereals and grains?

The primary restraints include increasingly stringent global regulations, especially in the EU, leading to the withdrawal of several established active ingredients. Additionally, the rapid evolution of pest and weed resistance to existing chemistries necessitates costly and prolonged R&D cycles for new product development, hindering immediate market expansion.

How significant are biologicals (biopesticides) in the future trajectory of grain and cereal protection?

Biologicals are critically significant and represent the fastest-growing product segment. Driven by consumer demand for sustainable farming practices and the urgent need for residue reduction, biopesticides offer targeted, environmentally friendly alternatives that are essential for successful Integrated Pest Management (IPM) strategies in high-value cereal crops.

Which application method is expected to see the highest growth rate during the forecast period?

The seed treatment application method is projected to exhibit robust growth. Seed treatments offer efficient, prophylactic protection from planting, minimizing the required overall input volume and providing effective defense against early-season soil-borne pathogens and pests, maximizing germination success and crop establishment.

How does precision agriculture technology impact the usage of traditional agrochemicals in cereal production?

Precision agriculture, utilizing AI and VRT systems, significantly optimizes the application of traditional agrochemicals. By enabling site-specific spot-spraying rather than broad application, precision technology reduces the overall volume of chemicals needed, improves efficacy by targeting treatment precisely, and minimizes environmental contamination and chemical wastage.

Which geographical region holds the largest market share in the Grain and Cereal Crop Protection Market?

The Asia Pacific (APAC) region currently holds the largest market share, predominantly driven by the vast cultivated areas dedicated to rice and wheat in countries like China and India, coupled with high pest and disease pressures associated with intensive farming systems and humid climates, necessitating high input consumption.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager