Grain and Seed Cleaning Equipment Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435646 | Date : Dec, 2025 | Pages : 255 | Region : Global | Publisher : MRU

Grain and Seed Cleaning Equipment Market Size

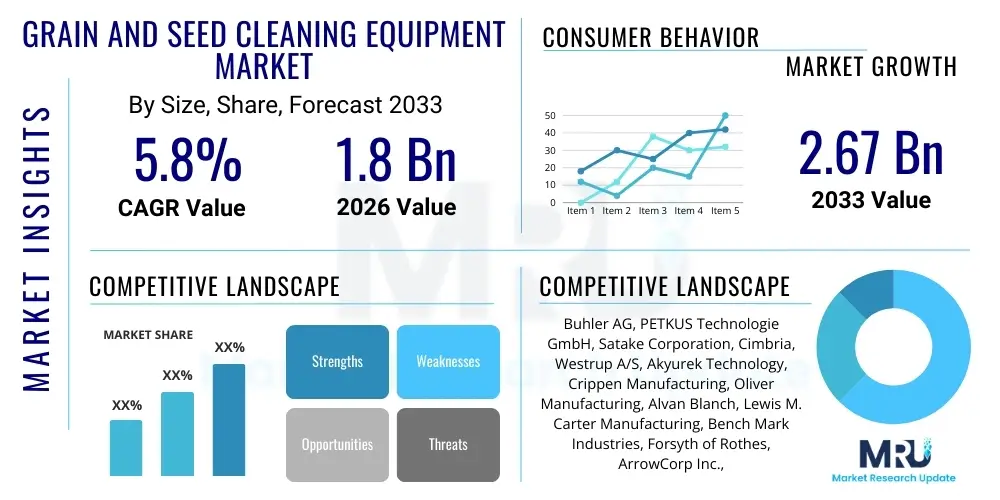

The Grain and Seed Cleaning Equipment Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 1.8 Billion in 2026 and is projected to reach USD 2.67 Billion by the end of the forecast period in 2033.

Grain and Seed Cleaning Equipment Market introduction

The Grain and Seed Cleaning Equipment Market encompasses sophisticated machinery designed for the meticulous removal of impurities, foreign materials, defective kernels, and contaminants from harvested agricultural commodities, including but not limited to cereal grains, oilseeds, pulses, and specialized seeds, thereby ensuring a standardized, high-quality output suitable for direct consumption, subsequent industrial processing, or vital planting applications. These essential systems form a foundational component of the post-harvest management supply chain, directly influencing critical factors such as overall food safety, the feasibility of long-term storage without degradation, the maximization of processing efficiency in mills and breweries, and, fundamentally, the viability and high germination rates of planting seeds. The technical spectrum of this equipment is broad, ranging from robust, high-throughput pre-cleaners, which utilize advanced mechanical screening and powerful aspiration to rapidly eliminate large, coarse debris like straw, stones, dirt clods, and oversized impurities, to highly advanced, precision fine cleaners. These fine cleaners leverage cutting-edge technologies, including complex multi-deck sieving configurations, optimized closed-loop aspiration systems for dust control, precise specific gravity separation tables that differentiate products based on density, and state-of-the-art optical sorting equipment that utilizes high-definition cameras and spectroscopic analysis for minute defect detection. The core applications of this diverse technological portfolio span across large commercial farming operations managing massive acreage, dedicated certified seed processing and breeding centers, large-scale flour and rice milling facilities, industrial malt houses and breweries, and integrated animal feed manufacturers, all of whom share the stringent requirement of achieving non-negotiable quality and purity benchmarks. The inherent and profound benefits derived from utilizing this advanced equipment include drastically minimized post-harvest losses and spoilage due to mold or insect infestation, guaranteed enhancement of product purity far exceeding manual capabilities, critical compliance with increasingly rigorous international and domestic export standards and phytosanitary regulations, and the assurance of maximized efficiency in all subsequent downstream processing activities, directly impacting profitability. Crucially driving the sustained expansion of this market is the escalating global population, which necessitates consistently higher yielding crops and, concurrently, mandates superior input quality to sustain intensive agricultural practices. This demand is coupled with persistently stricter governmental regulations worldwide, especially concerning quality thresholds for agricultural commodities, notably the control of mycotoxins (such as aflatoxins) and permissible levels of extraneous foreign matter in consumer-grade food products. Furthermore, the relentless global push towards comprehensive mechanization within developing economies, transitioning away from historically inefficient and inconsistent manual cleaning methods, is significantly propelling the widespread adoption rate of sophisticated, automated, and semi-automated cleaning solutions, firmly establishing this machinery as indispensable, critical infrastructure for resilient modern agriculture supply chains across the globe. The necessity of protecting expensive, complex downstream processing machinery, such as precision hullers and milling rollers, from damage caused by small stones or metallic contaminants also constitutes a powerful operational driver for investment in highly effective cleaning systems.

Grain and Seed Cleaning Equipment Market Executive Summary

The global Grain and Seed Cleaning Equipment Market is experiencing a period of intense innovation and robust expansion, fundamentally propelled by evolving business paradigms centered on achieving absolute precision in agricultural output and optimizing complex supply chain logistics, which necessitates high-performance machinery capable of achieving exceptional throughput and unparalleled separation accuracy. Current prevailing business trends underscore a strong industry-wide focus on the development of highly modular and scalable equipment architectures; these designs allow agricultural processors and industrial end-users the critical flexibility to rapidly adapt their processing lines to accommodate substantial variations in both incoming crop types and required operational capacity without excessive capital expenditure. Parallel to this, there is an intensifying preference across all geographical markets for machinery that exhibits superior energy efficiency, often incorporating advanced motor controls and optimized air recycling systems, explicitly designed to significantly reduce long-term operational expenditure (OPEX) and align with corporate sustainability mandates. From a regional perspective, the Asia Pacific (APAC) region has decisively emerged as the dominant highest-growth trajectory market globally. This unparalleled expansion is structurally supported by the enormous agricultural output generated by agrarian giants such as India, China, and Indonesia, coupled with a dramatically rising consumer awareness regarding food quality and safety standards within these domestic markets. This confluence of factors is directly driving unprecedented and rapid investment in comprehensive, modern post-harvest infrastructure. Conversely, North America and Western Europe, categorized as established, mature market ecosystems, maintain their competitive advantage through an intense focus on technological superiority; this is evidenced by the deep integration of state-of-the-art AI-powered optical sorters, systems capable of performing exhaustive analysis of minute, difficult-to-detect defects and subtle color anomalies at phenomenal processing speeds, thereby continuously setting ambitious new global benchmarks for product purity and quality assurance. Segmentation analysis distinctly indicates the sustained dominance and anticipated rapid growth of the fine cleaning equipment segment, a necessity imposed by the increasingly stringent quality control requirements associated with certified seed production and highly specialized, premium food products, such as specific varieties of ancient grains or pulses intended for niche markets. Simultaneously, the automation segment, encompassing fully robotic and integrated processing lines, is forecasted to significantly outpace the growth rates of both manual and semi-automatic operations, reflecting the global macro trend of labor replacement and the essential industrial requirement for consistently repeatable, high-accuracy cleaning performance across varied batch sizes. Therefore, the strategic convergence of advanced digital technologies, exemplified by AI and IoT integration, with proven traditional mechanical separation methods is a defining and transformative characteristic of the current market landscape, guaranteeing the delivery of verifiable and sustainable product quality across the entire spectrum of global agricultural environments, from small farms to massive grain terminals.

AI Impact Analysis on Grain and Seed Cleaning Equipment Market

Analytical investigation into common user queries regarding the pervasive impact of Artificial Intelligence (AI) on the Grain and Seed Cleaning Equipment Market reveals a consistent clustering of interests revolving around several pivotal themes: quantification of improved sorting accuracy, the implementation feasibility of real-time comprehensive quality assessment mechanisms, the critical assessment of initial integration costs versus quantifiable long-term benefits, and the transformative operational role of machine learning in facilitating robust predictive maintenance regimes. End-users, including processing plant managers and seed breeders, are demonstrating intense curiosity regarding how sophisticated AI algorithms, specifically those operating through advanced computer vision frameworks and deep neural networks, can dramatically surpass the precision and analytical depth of existing, previous-generation color sorters. This advanced capability is expected to enable the accurate identification of subtle, latent defects, early-stage disease markers, or complex foreign contaminants that are often either invisible or exceptionally challenging to discern utilizing standard, conventional spectroscopy methods or traditional monochrome camera setups. Key commercial concerns frequently raised center on calculating the definitive return on investment (ROI) associated with procuring and commissioning high-capital AI-integrated machinery, alongside addressing the essential necessity for specialized technical training, ongoing software maintenance, and reliable technical support infrastructure required to effectively operate and sustain these intrinsically complex, high-throughput systems. Expectations are universally elevated concerning the transformative capability of AI to instantaneously personalize and optimize cleaning profiles in real-time, based on dynamic analysis of incoming batch quality variability, thereby critically minimizing valuable product loss (yield maximization) and simultaneously maximizing overall operational efficiency. The collective industry consensus strongly affirms that AI is fundamentally transforming grain and seed cleaning from what was once perceived as a standardized mechanical separation process into a highly intelligent, adaptively learning quality assurance and control step, providing unprecedented levels of verifiable precision, granular defect analysis, and end-to-end product traceability. This capability is rapidly becoming an essential and defining prerequisite for high-value agricultural sectors, such as certified seed production, organic processing, and specialized food grain markets, where the smallest variance in purity directly and significantly dictates market pricing and international acceptability.

- AI-powered Optical Sorting: Enables ultra-precise identification and rejection of defective kernels, foreign materials, and subtle color variances using complex deep learning algorithms and multi-spectral imaging analysis, consistently surpassing prior mechanical and earlier optical sorting capabilities.

- Real-time Quality Control: Embedded machine learning models allow continuous, high-speed analysis of the flow of grain, instantaneously triggering micro-adjustments to critical sorting parameters (e.g., air jet sensitivity, threshold tolerances) to rigorously maintain optimal and consistent cleaning performance irrespective of the high inherent variability of the incoming raw material batch quality.

- Predictive Maintenance and Diagnostics: AI systems continuously monitor internal machine operational data, analyzing complex patterns related to component vibration, thermal signatures, and wear indicators, effectively predicting potential equipment failures well in advance of actual occurrence, consequently minimizing costly unplanned downtime, optimizing resource-intensive service schedules, and substantially extending the functional lifespan of high-value machinery assets.

- Automated Recipe Generation: Sophisticated deep learning frameworks analyze extensive historical processing data, integrating it with real-time sensor readings (such as input moisture content, specific contamination level metrics, and ambient temperature) to automatically configure the optimal combination of sieve settings, aspiration fan speeds, and specific gravity table inclination, significantly reducing the reliance on specialized operator expertise.

- Enhanced Supply Chain Traceability: The robust integration of AI facilitates the systematic logging, archival, and complex analysis of precise quality metrics for every single batch processed. This provides comprehensive, verifiable, and auditable data required for critical regulatory compliance, ensuring end-to-end supply chain transparency, and unequivocally demonstrating stringent adherence to increasingly rigorous global food safety and phytosanitary standards, thereby unlocking premium market access.

DRO & Impact Forces Of Grain and Seed Cleaning Equipment Market

The trajectory and inherent volatility of the Grain and Seed Cleaning Equipment Market are intrinsically shaped by a dynamic and powerful confluence of stimulating market drivers, structural restraining challenges, and expansive future growth opportunities, which collectively determine the strategic direction of industry investment, technological research priorities, and competitive positioning. Chief among the core drivers is the intensified global mandate for achieving absolute food security and the critical necessity to drastically reduce the pervasive post-harvest losses, which are effectively and economically mitigated only through highly efficient cleaning, sorting, and storage preparation processes that prevent rapid biological spoilage and devastating insect infestation. Regulatory impact forces represent another significant driver; specifically, the rigorous adherence requirements imposed by influential global organizations and national agencies, such as the U.S. Food and Drug Administration (FDA) and the European Union’s food safety bodies, concerning maximum permissible mycotoxin thresholds and minimum required purity levels, actively compel processors worldwide to immediately upgrade or install new, certified, and demonstrably highly effective cleaning and separation lines. Conversely, the market grapples with substantial structural restraints, most notably the significant initial capital outlay required for the procurement of advanced, high-capacity, and technologically integrated cleaning equipment. This steep financial requirement acts as a considerable barrier to market entry and technology adoption, particularly for small-to-medium-sized agricultural enterprises (SMEs) operating within developing and transition economies where access to credit is often limited. Furthermore, the inherent susceptibility of the agricultural sector to cyclical fluctuations, driven intensely by unpredictable weather patterns, climate change impacts, and volatile global commodity price swings, can introduce substantial uncertainty and intermittently stall major equipment investment decisions and capital expenditure planning. Nevertheless, vast opportunities are emerging, particularly in the rapid development and commercialization of sustainable cleaning technologies explicitly designed to minimize critical resource inputs, such as water and energy consumption, and the immense, largely untapped potential represented by emerging agricultural markets across regions like Africa and Southeast Asia, where systemic modernization of the entire agricultural value chain, from field to port, is accelerating dramatically. These convergent forces collectively dictate the necessary competitive strategies, defining optimal market entry points, and consistently emphasizing superior efficiency, verifiable precision, and comprehensive regulatory compliance as the core competitive differentiators crucial for enduring success within the intricate global agricultural ecosystem.

Segmentation Analysis

Segmentation of the Grain and Seed Cleaning Equipment Market provides a granular view of distinct product categories, operational models, and end-user applications that define market dynamics and growth trajectories. The market is fundamentally segmented based on the type of technology employed, ranging from robust mechanical separators utilizing gravity and air flow dynamics to highly specialized electronic optical sorters, each solution addressing unique cleaning challenges based on the target crop and the specific contaminant profile that needs removal. Operationally, the market is categorized into manual systems, which offer basic functionality and cost effectiveness suitable for smaller enterprises; semi-automatic systems, which balance automation with necessary human oversight; and fully automatic systems, which are high-throughput lines representing the industry standard for large commercial processors seeking consistency and minimal labor input. Understanding these detailed segments is absolutely critical for global manufacturers in effectively tailoring equipment capacity, determining the appropriate level of technological complexity, and setting strategic price points to precisely meet specific regional market needs, thereby ensuring that sophisticated, high-speed equipment deployed for processing large volumes of export wheat in North America differs substantially in specification and cost from scalable, robust seed treatment lines utilized in specialized European organic seed breeding operations or bulk pulse handling in the Indian subcontinent.

- By Type:

- Pre-Cleaners (Separating large impurities like straw, husks, stones, and large debris, protecting fine cleaning machinery)

- Fine Cleaners (Achieving high purity output through optimized fine screening, precise air aspiration, and grading based on size and thickness)

- Specific Gravity Separators (Removing products with similar size but different weights, vital for separating diseased, shriveled kernels, insect-damaged seeds, or dense stones)

- Color Sorters/Optical Sorters (Utilizing high-resolution cameras and advanced sensors—including multi-spectral imaging—to detect and eject items based on subtle color discrepancies, shape abnormalities, or structural defects)

- By Operation:

- Automatic (High-throughput, integrated systems characterized by continuous operation, minimal labor requirement, and reliance on sophisticated digital controls)

- Semi-Automatic (A hybrid blend of mechanized processes and necessary manual oversight, often used in medium-capacity plants or during specialized batch processing)

- Manual (Basic, lower-cost cleaning mechanisms primarily utilized in smaller farms, micro-processing setups, or emerging markets with readily available labor resources)

- By Application:

- Grains (Staple commodities including Wheat, Rice, Corn, Barley, Oats, and Sorghum intended for milling or consumption)

- Seeds (Certified Seeds, Hybrids, Oilseeds like Soybean and Rapeseed, and high-value Vegetable Seeds requiring maximum purity)

- Pulses (Commodities such as Beans, Lentils, Peas, Chickpeas, and specialty legumes)

- Spices and Other Agricultural Products (Including industrial applications like dried herbs, nuts, and various specialized commodities)

- By Capacity:

- Small Capacity (Below 5 Tonnes/Hour, suitable for small mills or farm-level processing)

- Medium Capacity (5 to 20 Tonnes/Hour, standard for regional processing hubs and commercial seed treatment centers)

- High Capacity (Above 20 Tonnes/Hour, required for large-scale grain terminals, export facilities, and major industrial mill operations)

Value Chain Analysis For Grain and Seed Cleaning Equipment Market

The comprehensive Value Chain for the Grain and Seed Cleaning Equipment Market commences decisively at the upstream level with the specialized sourcing of high-grade raw materials. This typically includes precision-engineered industrial metals (such as stainless steel and specialized alloys required for abrasive environments), sophisticated electrical power transmission components, advanced sensory equipment including high-resolution digital cameras and precise laser arrays, and industrial-grade automation parts necessary for complex motion control and sequencing. In this foundational upstream phase, rigorous cost management, ensuring uninterrupted supply stability, and establishing high-tolerance quality control over incoming materials are considered absolutely paramount to the final product's reliability. Key upstream strategic activities further involve intensive Research and Development (R&D), focusing specifically on the structural design, the application of complex computational fluid dynamics (CFD) modeling for optimizing critical air separation efficiency, and rigorous mechanical stress testing to ensure the long-term durability and structural integrity of essential components like sieves and vibrating frames. The critical midstream phase involves the specialized manufacturing process, which centers on high-precision fabrication, complex electromechanical assembly, and rigorous, multi-stage factory acceptance testing (FAT) of the finished machinery. This process often necessitates the use of highly specialized, skilled labor forces, advanced robotics, and high-precision Computer Numerical Control (CNC) machining capabilities to achieve the micron-level tolerances required for effective cleaning separation. Downstream activities revolve around efficient distribution and market access; this segment utilizes a mixed approach incorporating both direct sales channels, which are typically utilized for handling exceptionally large, complex, and customized project orders sold directly to major multinational food processors or government bodies, and highly reliable indirect channels. The indirect network relies heavily on a carefully vetted structure of regional distributors, specialized sales agents, and reputable local agricultural equipment dealers who are responsible for providing essential pre-sales consultation, installation supervision, comprehensive after-sales technical support, and maintaining robust local spare parts inventory management. The inherent efficiency and geographical reach of this multi-layered distribution network critically influence the equipment accessibility, determine the speed of market penetration, especially across geographically dispersed and remote agricultural zones, making the provision of high-quality post-installation technical service, preventative maintenance contracts, and prompt reliable spare parts supply a crucial determinant of long-term customer satisfaction, sustained operational viability, and consistent brand loyalty in this high-stakes industry. Effective, seamless control and optimization across the entirety of this value chain, from the precise specification of raw material inputs to the rapid and reliable delivery of post-sales service, is absolutely essential for manufacturers aiming to maintain a decisive competitive advantage and ensure an immediate and effective response to inevitable technical malfunctions or operational interruptions faced by agricultural clients, particularly during critical, time-sensitive peak harvest seasons, where downtime translates directly into catastrophic economic loss.

Grain and Seed Cleaning Equipment Market Potential Customers

The core customer base for Grain and Seed Cleaning Equipment is structurally diverse, encompassing a wide array of agricultural sector participants who are all uniformly united by the non-negotiable prerequisite for high-purity inputs and outputs throughout their operations, establishing quality assurance as a definitive commercial imperative. The most significant customer segment includes large-scale commercial farming corporations, which are frequently specialized entities focused intensely on high-volume production of primary commodity crops such as corn, soy, and wheat. These operators demand exceedingly high-capacity pre-cleaners and primary fine cleaners capable of handling vast daily harvest volumes with exceptional speed and efficiency, effectively preparing the commodities for subsequent secure bulk storage or efficient logistical transport to market centers. Critically, certified seed processing companies constitute an absolutely vital and technologically demanding customer segment; these specialized firms require equipment offering the maximum possible precision, including advanced electronic specific gravity separators and sophisticated, multi-spectrum optical sorters, specifically mandated to rigorously meet and exceed the extremely stringent germination and minimum purity standards required for certified planting seeds. In this niche, even the smallest percentage of impurity or contaminant presence can dramatically compromise subsequent crop yield and the overall commercial profitability of their seed product line. Further along the industrial value chain, large-volume flour mills, modern rice processing facilities, and dedicated animal feed manufacturers represent consistent and substantial buyers. These industrial entities utilize powerful cleaning equipment not only to achieve final product quality standards but also defensively, to protect their highly expensive and complex downstream milling and processing machinery—such as precision hullers, grinding stones, and milling rollers—from irreversible damage caused by abrasive foreign matter including small stones, metallic debris, or hardened soil clods, while simultaneously ensuring that the final manufactured product rigorously complies with both consumer health and industrial food safety standards. Furthermore, large government-operated strategic grain storage facilities, massive privately owned silos, and pivotal international export terminals located globally represent high-volume institutional customers. These entities necessitate the deployment of reliable, robust, and often custom-engineered high-capacity cleaning solutions specifically designed to efficiently prepare vast quantities of aggregated agricultural commodities for international trade, where verified, consistent adherence to complex global phytosanitary regulations is absolutely paramount for securing market access and facilitating successful, lucrative global transactions, making sophisticated cleaning equipment an integral part of national agricultural export infrastructure.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.8 Billion |

| Market Forecast in 2033 | USD 2.67 Billion |

| Growth Rate | CAGR 5.8% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Buhler AG, PETKUS Technologie GmbH, Satake Corporation, Cimbria, Westrup A/S, Akyurek Technology, Crippen Manufacturing, Oliver Manufacturing, Alvan Blanch, Lewis M. Carter Manufacturing, Bench Mark Industries, Forsyth of Rothes, ArrowCorp Inc., Grain Cleaning LLC, Kaseo, AGCO Corporation, ZK Machinery, SEA Vision SpA, Key Technology (Duravant). |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Grain and Seed Cleaning Equipment Market Key Technology Landscape

The technological landscape characterizing the Grain and Seed Cleaning Equipment Market is currently defined by a relentless drive toward highly integrated, data-centric, and sensor-rich systems, explicitly engineered with the dual objective of maximizing output purity and overall throughput capacity while simultaneously mitigating valuable product damage and substantially reducing specific operational energy consumption per tonne processed. While fundamental mechanical technologies, such as advanced screen cleaners employing multi-deck sieves with complex, dynamically optimized vibration patterns and specialized, high-efficiency aspiration chambers, continue to form the foundational core for effective bulk material separation, their performance metrics are being continuously and dramatically amplified through sophisticated material science advancements. These enhancements include the use of self-cleaning sieve mesh designs, optimized material composition for extended abrasive resistance, and the application of highly precise computational fluid dynamics for achieving superior airflow control and separation efficiency within the aspirator section, significantly minimizing dust carryover and maximizing light impurity removal effectiveness. The most profound and disruptive technological transformation centers on the widespread integration of advanced optical sorting systems. These systems have evolved exponentially, transitioning far beyond basic monochromatic or fixed color differentiation. Modern optical sorters now routinely integrate multi-spectral analysis, Near-Infrared (NIR) spectroscopy, and sophisticated specialized cameras (such as InGaAs sensors) that allow for the chemical composition and moisture content analysis of individual kernels, enabling the precise identification and rejection of subtle chemical compositions, internal structural defects, or invisible early-stage fungal contamination, which is fundamentally critical for processing high-value certified seeds and specialized organic commodities where internal quality defects must be precisely targeted. Moreover, the pervasive application of Internet of Things (IoT) sensors and edge computing devices facilitates truly real-time monitoring of all critical machine operating parameters, enabling plant operators and remote management teams to conduct immediate diagnostics, implement automated process adjustments dynamically, and achieve seamless data integration with comprehensive Enterprise Resource Planning (ERP) and supply chain management (SCM) systems. Noteworthy innovations in specific gravity separation are also accelerating, focusing on the development of highly efficient air tables and precision destoners that utilize complex aerodynamic stratification principles to reliably and cleanly separate materials that share near-identical physical dimensions but possess differing specific densities, ensuring the guaranteed removal of extremely hazardous contaminants such as embedded glass fragments, metal shavings, or heavily contaminated, low-density kernels, thereby directly fulfilling critical global food safety mandates and significantly elevating the market's overall technological sophistication and operational reliability profile.

A crucial and universally adopted design philosophy in the development of contemporary cleaning equipment emphasizes intrinsic modularity, standardized component sizing, and the development of intuitive, highly graphical user interfaces (HMI). Leading global manufacturers are intensively developing component-based processing modules that facilitate rapid, tool-less reconfiguration of entire processing lines, allowing end-users to swiftly switch between handling diverse commodities, which is an invaluable operational feature for facilities processing multiple seasonal crops or managing a complex portfolio of grain types simultaneously. This highly flexible, modular architecture substantially minimizes production changeover time, drastically reduces cleaning and sanitation requirements between batches, and maximizes the overall utilization rate of the capital equipment, thereby demonstrably enhancing long-term economic viability and competitive throughput. Furthermore, the sustained technological push toward incorporating highly durable, fully integrated self-cleaning mechanisms and utilizing advanced, abrasion-resistant ceramic or composite materials is a major trend specifically aimed at drastically extending the functional lifespan of the machinery and substantially reducing the mandatory frequency of resource-intensive preventative maintenance procedures within demanding, continuous-operation industrial processing environments. The mounting global emphasis on environmental sustainability has concurrently spurred crucial innovations in developing highly efficient, closed-loop aspiration and dust management systems. These systems are designed to significantly minimize fugitive dust emissions into the working environment, often capturing and recovering valuable process air, thus contributing decisively to creating superior indoor air quality, enhancing employee safety, and ensuring comprehensive compliance with increasingly strict global environmental protection regulations regarding industrial atmospheric particulate discharge. The strategic synergy and seamless operational integration between advanced mechanical separation, highly precise optical sensing, and robust digital control technologies represent the absolute cutting edge of the market, offering agricultural processors unprecedented granular control over every aspect of final product quality, firmly establishing these sophisticated systems as indispensable capital assets within the fiercely competitive global agricultural trade landscape, where verifiable quality assurance serves as the primary gateway to lucrative premium market segments and sustained export success.

Regional Highlights

The global consumption, deployment, and underlying investment patterns for Grain and Seed Cleaning Equipment exhibit pronounced regional differentiations, fundamentally influenced by variations in the maturity of local agricultural sectors, the stringency of established regulatory frameworks, the availability of specialized labor, and the financial capacity for large-scale capital investment. North America (encompassing the US and Canada) and Europe currently stand as the most technologically advanced and operationally mature market regions, characterized by exceptionally high rates of sophisticated equipment adoption, particularly encompassing fully automated and complex AI-integrated optical sorting and high-capacity fine cleaning systems. The sustained demand within these affluent regions is strategically driven by the existential requirement for ultra-high purity certified seeds crucial for maximizing crop yields, the need to meet extremely stringent quality standards necessary for producing high-value, differentiated food products (such as identity-preserved specialty malts, certified non-GMO verified grains, and organic pulses), and the substantial financial capacity present among large-scale commercial farming consortia and multinational food processing conglomerates. Manufacturers heavily focused on these markets prioritize precision engineering, guaranteed energy efficiency metrics, and comprehensive, validated compliance with rigorous environmental and operational safety standards, effectively positioning these regions at the very forefront of technological innovation and driving the adoption curve for high-cost, ultra-performance machinery. Given the highly developed nature of these markets, the current growth trajectory is primarily derived not from greenfield facility construction, but predominantly from essential equipment upgrades, strategic replacement cycles, and the pervasive adoption of cutting-edge smart technology designed to incrementally optimize and radically enhance the performance of extensive, existing processing infrastructure, focusing keenly on maximizing throughput return on asset (ROA).

In contrast, the Asia Pacific (APAC) region is emphatically forecasted to record the highest Compound Annual Growth Rate (CAGR) and the largest absolute volume growth throughout the entirety of the forecast period, thereby establishing itself as the undisputed central engine driving global market expansion. This anticipated explosive growth trajectory is fundamentally supported by two dominant macroeconomic factors: firstly, the sheer, unparalleled volume of regional agricultural output, particularly concerning staple commodities like rice, staple wheat, and various pulses, and secondly, the swift and proactive governmental policy initiatives across key nations that are intensely focused on comprehensive modernization of the archaic post-harvest infrastructure, aiming critically to curtail massive historical crop losses and dramatically enhance global agricultural export competitiveness. Key countries such as India, the People's Republic of China, and the rapidly developing nations across Southeast Asia are collectively transitioning at an unprecedented pace away from traditional, inefficient, and labor-intensive manual or rudimentary cleaning methods toward the widespread adoption of modern semi-automatic and fully automatic modular machinery. This profound transition is being significantly accelerated by simultaneous forces including relentless urbanization, persistently escalating domestic agricultural labor wages, and substantial governmental policy intervention via direct subsidies and favorable loan schemes actively promoting farm and processing mechanization. Furthermore, the burgeoning middle class across the APAC region, characterized by increasing disposable income and heightened health consciousness, is increasingly demanding superior quality processed food products, which intrinsically necessitates stringent cleaning and quality assurance standards implemented early at the processing level. Latin America, particularly Brazil and Argentina, and the Middle East & Africa (MEA) region are increasingly recognized as high-potential emerging markets. Growth here is primarily stimulated by massive targeted investments in high-capacity, robust equipment specifically engineered and utilized for large-scale production and export preparation of key commodity crops, notably soybeans and corn in South America and staple grains across South Africa and the wider Gulf Cooperation Council (GCC) countries. In these regions, compliance with strict international trade standards decisively dictates the necessary level of equipment sophistication. These rapidly developing markets present compelling long-term strategic opportunities for global manufacturers capable of supplying durable, maintenance-friendly, and highly scalable cleaning solutions that are specifically designed and proven to operate reliably and effectively under widely varying and often extreme climate conditions and successfully handle inconsistent, highly variable quality raw material inputs.

- North America: Focuses intensely on fully automated systems, sophisticated AI optical sorters, and integration with advanced farm management software (FMS) platforms for maximum traceability; market is driven by certified seed production and high-value, highly regulated niche food processing segments.

- Europe: Dominated by stringent European Union (EU) phytosanitary regulations, stringent quality controls, and high corporate environmental responsibility standards; consistent demand for energy-efficient, compact, and precision cleaning machinery specifically tailored for specialized grains, high-grade malts, and organic oilseeds.

- Asia Pacific (APAC): Identified as the clear leader in volume growth and future expansion; characterized by rapid, government-backed infrastructure modernization in major economies like China, India, and ASEAN, driven by the imperative to minimize staggering post-harvest losses and solidify global agricultural export market share.

- Latin America: A rapidly accelerating market propelled by expansive, large-scale commodity farming operations (primarily focusing on high-volume exports of soy, corn, and sugar); the prevailing demand centers exclusively on ultra-high capacity, exceptionally robust pre-cleaning, and primary fine cleaning equipment designed for efficient bulk export preparation and port handling.

- Middle East & Africa (MEA): Represents a key emerging growth area, significantly bolstered by ambitious governmental agricultural development strategies aimed at achieving national food self-sufficiency and substantial upgrades to regional grain handling and storage infrastructure, leading to targeted demand for durable, moderately scaled, and easily serviceable cleaning and sorting solutions.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Grain and Seed Cleaning Equipment Market.- Buhler AG

- PETKUS Technologie GmbH

- Satake Corporation

- Cimbria (AGCO Corporation)

- Westrup A/S

- Akyurek Technology

- Crippen Manufacturing

- Oliver Manufacturing Co.

- Alvan Blanch Development Company Ltd

- Lewis M. Carter Manufacturing

- Bench Mark Industries

- Forsyth of Rothes

- ArrowCorp Inc.

- Grain Cleaning LLC

- Kaseo

- Sortex (Buhler Group)

- SEA Vision SpA

- Key Technology (Duravant)

- AGCO Corporation

- ZK Machinery

Frequently Asked Questions

Analyze common user questions about the Grain and Seed Cleaning Equipment market and generate a concise list of summarized FAQs reflecting key topics and concerns.What specific cleaning technologies offer the highest purity levels for certified seeds?

The highest purity levels for certified seed production are achieved through the sequential use of Specific Gravity Separators (to remove contaminants of similar size but different density, such as diseased kernels or stones) followed by advanced Multi-Spectral Optical Sorters. Optical sorters utilize sophisticated computer vision and NIR technology to detect subtle internal defects or discoloration that traditional sieves and aspirators cannot identify, ensuring compliance with strict germination and purity standards.

How does the integration of IoT and AI impact the operational efficiency and maintenance costs of cleaning equipment?

IoT sensors and AI significantly enhance operational efficiency by enabling real-time performance monitoring and automated adjustments to cleaning parameters, ensuring optimal throughput and minimal product loss. AI-driven predictive maintenance models analyze operational data to forecast component failure, allowing processors to schedule service preemptively, thereby minimizing unplanned downtime and reducing overall maintenance labor costs by up to 30%.

What are the primary challenges restraining market growth in developing regions like Africa and Southeast Asia?

The primary restraints in developing regions include the high initial capital investment required for automated, high-capacity machinery, limited access to reliable financing and credit facilities for small to medium-sized processors, and infrastructural deficits, particularly unreliable power supply and a lack of skilled technical labor necessary for the effective installation, operation, and maintenance of complex modern cleaning systems.

Which segment, by equipment type, is expected to exhibit the fastest growth over the forecast period?

The Color Sorters/Optical Sorters segment is projected to exhibit the fastest growth. This acceleration is driven by the increasing global demand for specialized, defect-free agricultural products (e.g., organic grains, specialty coffee, high-grade pulses) and the continuous reduction in sensor and image processing technology costs, making highly accurate optical sorting systems accessible to a wider range of processors beyond traditional large milling operations.

How do global food safety regulations influence the demand and design requirements for new grain cleaning machinery?

Global food safety regulations, particularly those concerning mycotoxin management (e.g., Aflatoxin), foreign material contamination, and metal detection, are the single biggest driver influencing equipment design. Regulations necessitate cleaning equipment with verifiable performance, requiring designs that are easy to sanitize, possess high-accuracy separation capabilities (especially destoners and specific gravity separators), and offer integrated data logging to ensure full compliance and traceability throughout the processing chain.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Grain and Seed Cleaning Equipment (Grain & Seed Cleaning Equipment) Market Size Report By Type (Pre-Cleaning Type, Fine Cleaning Type), By Application (For Grain, For Seed), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Share, Trends, Outlook and Forecast 2025-2032

- Grain and Seed Cleaning Equipment Market Statistics 2025 Analysis By Application (For Grain, For Seed), By Type (Pre-Cleaning Type, Fine Cleaning Type), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager