Grain Based Food Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432525 | Date : Dec, 2025 | Pages : 248 | Region : Global | Publisher : MRU

Grain Based Food Market Size

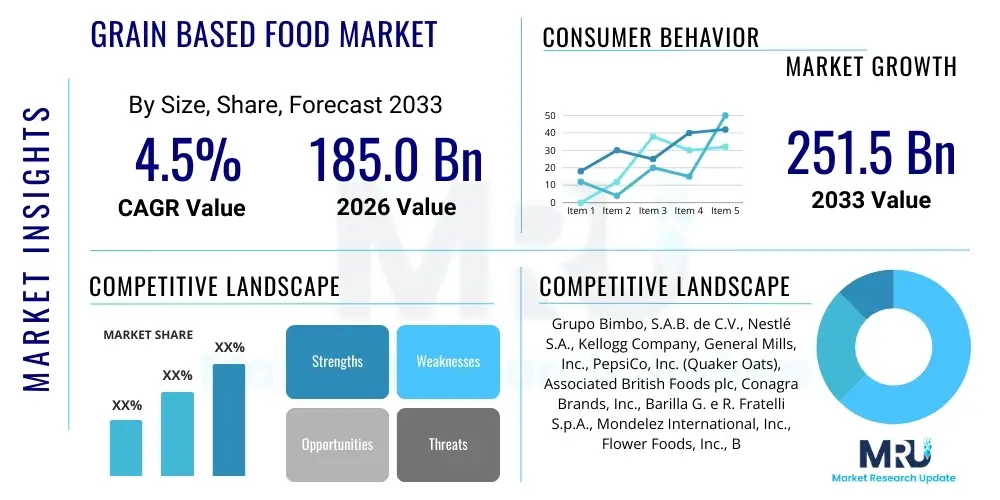

The Grain Based Food Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.5% between 2026 and 2033. The market is estimated at $185.0 Billion in 2026 and is projected to reach $251.5 Billion by the end of the forecast period in 2033.

Grain Based Food Market introduction

The Grain Based Food Market encompasses a vast array of staple and processed food items derived from grains such as wheat, rice, maize, oats, and barley. This sector includes baked goods (bread, cakes, pastries), breakfast cereals, pasta, noodles, snacks (crackers, biscuits), and various ready-to-eat meals utilizing grain bases. The enduring relevance of grain-based foods stems from their fundamental role in global diets, providing essential carbohydrates, fiber, and micronutrients. Modern market dynamics are heavily influenced by shifting consumer preferences towards healthier alternatives, demanding products that are organic, whole grain, gluten-free, or fortified with functional ingredients like proteins and vitamins. This constant innovation ensures the market remains robust despite challenges related to supply chain volatility and increasing scrutiny over processed food ingredients.

Major applications of grain-based foods span household consumption, food service industries (restaurants, cafes), and specialized sectors such as institutional feeding and military rations. The versatility of grains allows for extensive product development, catering to diverse cultural tastes and dietary requirements globally. Driving factors include rapid urbanization, which increases the demand for convenience foods, and growing middle-class populations in emerging economies, leading to higher consumption of packaged and branded grain products. Furthermore, the perceived value and affordability of grain-based staples solidify their market position, especially in regions prioritizing food security.

Key benefits associated with the Grain Based Food Market include widespread accessibility and affordability, making them a cornerstone of global caloric intake. The industry is highly reliant on advancements in processing and preservation technologies, which extend shelf life and maintain nutritional quality. However, the market faces constraints related to rising commodity prices, regulatory pressures concerning sugar and sodium content, and the continuous need for sustainable sourcing practices. Despite these challenges, ongoing product diversification—such as the integration of ancient grains and plant-based proteins—provides sustained momentum for market growth and competitive advantage.

Grain Based Food Market Executive Summary

The Grain Based Food Market demonstrates resilience, driven primarily by evolving business trends focused on health and sustainability. Major manufacturers are prioritizing portfolio optimization, divesting non-core assets while investing heavily in high-growth segments such as whole-grain products, functional snacks, and specialized dietary foods (e.g., keto-friendly and gluten-free offerings). Strategic collaborations across the value chain, particularly between grain processors and technology providers, are accelerating the deployment of automation and quality control systems. Furthermore, private label brands are exerting increased pressure on established players, necessitating enhanced brand loyalty initiatives and premiumization strategies to maintain market share.

Regionally, the market exhibits varied growth trajectories. North America and Europe maintain dominance, characterized by high consumption of convenience and snack foods, coupled with a strong demand for clean label and organic ingredients. The Asia Pacific (APAC) region is poised for the fastest expansion, fueled by population growth, rising disposable incomes, and the increasing westernization of diets, boosting the consumption of packaged bread and breakfast cereals. Latin America and the Middle East and Africa (MEA) are also showing promising growth, primarily driven by investments in local manufacturing capabilities and the rising popularity of fortified baked goods aimed at addressing nutritional deficiencies.

Segmentation trends highlight the increasing importance of the Bakery segment, especially specialized breads, and the continuous expansion of the Ready-to-Eat (RTE) category, capitalizing on consumer demand for quick, nutritious meals. Within the Cereal segment, manufacturers are actively reformulating products to reduce sugar and increase fiber content, aligning with global health mandates. Distribution analysis indicates a critical shift towards e-commerce and direct-to-consumer (D2C) channels, particularly for niche and premium grain products, though traditional grocery retail remains the primary sales mechanism globally. Investment in supply chain transparency and traceability is a pervasive theme across all segments, responding to heightened consumer demand for ethical sourcing.

AI Impact Analysis on Grain Based Food Market

User queries regarding the impact of AI on the Grain Based Food Market predominantly revolve around optimizing supply chain efficiency, enhancing predictive quality control, and developing personalized nutrition. Common concerns include how AI can mitigate the risks associated with volatile commodity pricing (like wheat or corn futures), improve crop yield forecasts for better procurement planning, and streamline complex manufacturing processes such as mixing and baking consistency. Users are particularly interested in AI's role in creating novel product formulations by analyzing vast datasets on ingredient compatibility and consumer flavor preferences, leading to faster product innovation cycles and highly targeted marketing campaigns focused on personalized dietary needs.

- AI-driven Predictive Analytics: Optimizing grain procurement strategies, forecasting future commodity price fluctuations, and mitigating inventory risk for raw materials.

- Automated Quality Control: Implementing computer vision systems and machine learning models on production lines to detect foreign materials, assess product texture, and ensure consistent baking parameters in real-time.

- Supply Chain Optimization: Utilizing AI algorithms for route planning, warehouse management, and demand forecasting, leading to reduced spoilage and lower logistical costs, especially for perishable baked goods.

- Personalized Formulation: Developing new grain-based food recipes tailored to individual health profiles or niche dietary requirements (e.g., low glycemic index, high protein) using deep learning analysis of nutritional science data.

- Consumer Trend Identification: Analyzing social media, search data, and sales patterns using AI to rapidly identify emerging flavor preferences, packaging demands, and specialized ingredient trends (e.g., ancient grain resurgence).

- Enhanced Food Safety and Traceability: Employing blockchain integrated with AI to provide immutable records of grain origin, processing steps, and distribution paths, boosting consumer trust and regulatory compliance.

DRO & Impact Forces Of Grain Based Food Market

The trajectory of the Grain Based Food Market is shaped by powerful Drivers (D), significant Restraints (R), and compelling Opportunities (O), which collectively define the Impact Forces on industry growth. Key drivers include the global population increase, necessitating high-volume staple food production, and the escalating demand for convenient, ready-to-eat breakfast and snack options reflecting modern busy lifestyles. Furthermore, growing awareness regarding the health benefits of whole grains and dietary fiber acts as a strong positive influence, pushing manufacturers towards healthier product reformulation. Restraints primarily involve the high volatility and increasing cost of agricultural commodities, coupled with stringent regulatory scrutiny globally regarding ingredient transparency, sugar content, and allergen labeling, which increases operational complexity and cost.

Opportunities in the market are abundant, focusing heavily on product innovation in niche segments. These include the explosive growth potential within the gluten-free and plant-based grain substitute markets, driven by health trends and dietary restrictions. Technological advancements in food processing, such as high-pressure processing (HPP) and advanced extrusion techniques, allow for the creation of novel textures and improved nutritional profiles. Sustainable sourcing and production (reducing water usage, utilizing recyclable packaging) represent significant opportunities for enhancing brand value and appealing to environmentally conscious consumers. The ongoing expansion into untapped markets in emerging economies, coupled with investment in efficient cold chain logistics for specialized products, further solidifies market potential.

The cumulative effect of these DRO elements defines the core Impact Forces. High impact forces relate to consumer health consciousness, which mandates continuous innovation and reformulation, making product differentiation crucial. Medium impact forces center around supply chain resilience; while volatility presents challenges, technological integration (like AI and IoT) offers substantial mitigation opportunities. Low impact forces pertain to basic staple products where price sensitivity dominates, yet fortification mandates often provide a stable demand floor. Overall, the shift toward value-added, health-oriented products is the most significant sustained impact force steering the market structure.

Segmentation Analysis

The Grain Based Food Market is highly diverse, segmented primarily based on product type, grain source, distribution channel, and application. This granularity allows manufacturers to target specific consumer needs, ranging from daily staples to premium, functional snacks. The core segments reflect foundational consumer consumption habits, while subsegments illustrate the industry’s rapid response to evolving dietary trends, such as the preference for ancient grains like quinoa and millet over traditional wheat in certain applications. Understanding these segments is crucial for strategic market positioning and resource allocation, as growth rates vary significantly across different product categories.

- By Product Type:

- Bread and Bakery Products (e.g., Loaves, Rolls, Cakes, Pastries)

- Cereals (e.g., Hot Cereals, Ready-to-Eat Cereals)

- Pasta and Noodles (e.g., Dry Pasta, Fresh Pasta, Instant Noodles)

- Snacks (e.g., Biscuits, Crackers, Cookies, Extruded Snacks)

- Others (e.g., Tortillas, Pizza Bases, Rice Cakes)

- By Grain Source:

- Wheat

- Rice

- Corn (Maize)

- Oats

- Barley

- Rye

- Ancient Grains (Quinoa, Millet, Sorghum)

- By Distribution Channel:

- Supermarkets and Hypermarkets

- Convenience Stores

- Online Retail (E-commerce)

- Specialty Stores

- Food Service Channels

- By Application/End-User:

- Household/Retail

- Commercial/Food Service

Value Chain Analysis For Grain Based Food Market

The value chain for the Grain Based Food Market is complex, beginning with upstream activities involving agricultural production, moving through intermediate processing, and culminating in downstream distribution and final consumption. Upstream analysis focuses on raw material procurement, dominated by large agricultural companies and grain traders managing global supplies of wheat, rice, and corn. Key challenges at this stage include climate variability, sustainable farming mandates, and the need for efficient storage and initial processing (milling). Direct sourcing relationships with farmers are increasingly valued to ensure quality control, non-GMO status, and environmental compliance, reducing dependence on volatile spot markets.

Midstream activities involve primary food processors (millers) who convert raw grains into flour, starches, and specialized ingredients, which are then used by secondary processors—the grain-based food manufacturers. This stage is capital-intensive, requiring advanced milling, mixing, baking, and extrusion technology. Efficiency gains here are paramount, focusing on reducing waste and optimizing energy usage. Downstream analysis covers the distribution channels, which are highly diversified. Distribution encompasses direct channels (D2C sales of specialized products, manufacturer-owned retail outlets) and indirect channels (supermarkets, hypermarkets, convenience stores, and the massive food service network). Logistics efficiency and cold chain management are critical for maintaining the freshness and shelf life of perishable baked goods.

The proliferation of indirect distribution through large-scale retail chains provides wide market access but often leads to high listing fees and fierce competition, compressing margins. E-commerce platforms are increasingly important for reaching consumers seeking unique, healthy, or niche grain products, offering manufacturers better control over branding and pricing. The overall efficiency of the value chain is increasingly reliant on digitalization and traceability systems, ensuring transparency from farm to fork, which is a non-negotiable requirement for modern consumers and regulatory bodies.

Grain Based Food Market Potential Customers

The primary customer base for the Grain Based Food Market is exceptionally broad, spanning nearly all global demographics, yet key segments offer differentiated growth opportunities. Traditional end-users, represented by households, drive demand for staple products like bread, rice, and breakfast cereals, prioritizing affordability, value, and convenience. The evolving consumer group, characterized by high disposable incomes and a strong focus on health, represents significant potential for premium, functional, and specialized grain products. This includes customers seeking gluten-free alternatives, high-protein snacks, fortified functional foods (e.g., pro-biotic cereals), and products made with organic or ancient grains.

A second major customer segment is the commercial food service sector, including quick-service restaurants (QSRs), full-service restaurants, institutional cafeterias (schools, hospitals), and large-scale industrial caterers. These buyers require consistent, high-volume, and often semi-processed grain ingredients (like frozen dough, par-baked products, or specialized flours) that facilitate efficient meal preparation. The demand in this segment is strongly tied to economic cycles and dining-out trends, emphasizing consistency, bulk purchasing capabilities, and tailored product specifications. Furthermore, manufacturers of other prepared foods, such as savory snacks and ready meals, act as intermediate buyers for specialized grain components.

Another rapidly growing customer segment is the demographic focused on sustainable and ethical consumption, including vegans, vegetarians, and environmentally conscious shoppers. These potential buyers prioritize brands that demonstrate transparent sourcing, sustainable packaging (recyclable or biodegradable materials), and reduced environmental footprint in production. Targeting this group requires robust certification and clear communication regarding corporate social responsibility initiatives. Finally, governments and non-profit organizations often constitute large-scale buyers for essential staple grains and fortified products utilized in aid programs and national nutrition initiatives, focusing heavily on cost-effectiveness and nutritional density.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $185.0 Billion |

| Market Forecast in 2033 | $251.5 Billion |

| Growth Rate | 4.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Grupo Bimbo, S.A.B. de C.V., Nestlé S.A., Kellogg Company, General Mills, Inc., PepsiCo, Inc. (Quaker Oats), Associated British Foods plc, Conagra Brands, Inc., Barilla G. e R. Fratelli S.p.A., Mondelez International, Inc., Flower Foods, Inc., Britannia Industries Limited, Hostess Brands, Inc., Wilmar International Ltd., Cargill, Incorporated, Hain Celestial Group, Bunge Limited, Campbell Soup Company, Gruma S.A.B. de C.V., Waffle House, Inc., Archer Daniels Midland Company (ADM) |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Grain Based Food Market Key Technology Landscape

The technological landscape of the Grain Based Food Market is characterized by continuous innovation aimed at improving efficiency, product quality, shelf stability, and nutritional value. Advanced milling technologies, such as high-speed roller mills and precision sorting equipment, are crucial for optimizing flour yield and maintaining consistent particle size, which is vital for high-quality baking and pasta production. Furthermore, extrusion technology has become central, particularly in the snack and RTE cereal sectors, allowing manufacturers to create complex shapes, textures, and incorporate specialized ingredients like protein isolates and fiber additives under controlled thermal conditions. This technology is key to introducing novel, fortified grain products that meet evolving consumer health demands efficiently.

Beyond core processing, automation and digitization are transforming manufacturing plants. Integration of robotics for tasks like automated kneading, scaling, packaging, and palletizing reduces human error, minimizes contamination risk, and significantly increases throughput speeds, addressing the high-volume nature of this market. Crucially, the deployment of sophisticated sensing technologies, including near-infrared (NIR) spectroscopy, is enabling real-time quality assurance of raw materials and finished products, monitoring moisture content, protein levels, and gluten strength dynamically. This predictive quality control minimizes batch inconsistency and waste, ensuring high product integrity across global supply chains.

Packaging innovation also forms a significant part of the technology landscape, driven by dual objectives: extending shelf life and enhancing sustainability. Modified Atmosphere Packaging (MAP) and advanced barrier films are essential for maintaining the freshness of baked goods and preventing microbial spoilage, reducing the reliance on artificial preservatives. Simultaneously, research into biodegradable and compostable packaging solutions derived from renewable sources is accelerating, aligning the industry with global mandates for reducing plastic waste and improving its environmental performance footprint. Traceability solutions, often leveraging IoT sensors and blockchain, provide the final layer of technological sophistication, ensuring end-to-end supply chain transparency.

Regional Highlights

Regional dynamics play a crucial role in shaping the demand patterns and competitive landscape of the Grain Based Food Market, influenced by local dietary habits, economic development, and regulatory environments.

- North America: Dominates the snack and RTE cereal segments due to established convenience culture and high disposable incomes. The market here is highly mature but innovation-driven, focusing heavily on gluten-free, low-carb, and functional baked goods. Key growth drivers include health and wellness trends and strong investment in plant-based alternatives derived from grains.

- Europe: Characterized by a strong preference for artisanal and traditional bread varieties, coupled with strict food safety and labeling regulations. Growth is concentrated in the organic, whole-grain, and 'clean label' sectors. Western Europe leads in premiumization, while Eastern Europe presents expansion opportunities for packaged goods penetration.

- Asia Pacific (APAC): Expected to register the highest growth rate, primarily driven by China, India, and Southeast Asian nations. Urbanization and rising middle classes are accelerating the shift from traditional, unpackaged staples (like fresh rice) to convenience products (packaged noodles, biscuits, and breakfast cereals). Demand for fortified foods to combat micronutrient deficiencies is also a major market catalyst.

- Latin America (LATAM): Growth is stable, centered around staple consumption, particularly corn-based products (tortillas, flour). Economic stability drives demand for packaged and branded goods, while manufacturers focus on product accessibility and affordability. Brazil and Mexico are the largest markets, investing in modern milling and baking technologies.

- Middle East and Africa (MEA): Emerging market characterized by high consumption of staple bread (flatbreads). Growth is fueled by high population growth and government initiatives promoting food security and nutritional fortification. Significant investment in local manufacturing capacity is required to reduce reliance on imported grains and processed foods.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Grain Based Food Market.- Grupo Bimbo, S.A.B. de C.V.

- Nestlé S.A.

- Kellogg Company

- General Mills, Inc.

- PepsiCo, Inc. (Quaker Oats)

- Associated British Foods plc

- Conagra Brands, Inc.

- Barilla G. e R. Fratelli S.p.A.

- Mondelez International, Inc.

- Flower Foods, Inc.

- Britannia Industries Limited

- Hostess Brands, Inc.

- Wilmar International Ltd.

- Cargill, Incorporated

- Hain Celestial Group

- Bunge Limited

- Campbell Soup Company

- Gruma S.A.B. de C.V.

- Waffle House, Inc.

- Archer Daniels Midland Company (ADM)

Frequently Asked Questions

Analyze common user questions about the Grain Based Food market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is driving the growth of the whole-grain segment in the market?

The growth is primarily driven by mounting scientific evidence linking whole-grain consumption to reduced risks of chronic diseases, coupled with dietary guidelines globally promoting increased fiber intake. Consumer perception of whole grains as a natural source of fiber and essential nutrients boosts sales, especially in mature markets like North America and Europe.

How is sustainability impacting grain sourcing and manufacturing processes?

Sustainability is a critical factor, compelling manufacturers to invest in traceable, ethically sourced grains and adopt circular economy principles. This includes reducing water usage in production, minimizing food waste, and transitioning to eco-friendly, recyclable packaging materials to satisfy consumer and regulatory demands.

Which geographical region is expected to show the highest growth in the Grain Based Food Market?

The Asia Pacific (APAC) region is forecasted to exhibit the highest CAGR through 2033. This growth is attributed to rapid urbanization, increasing disposable incomes, and the rising acceptance of Western-style packaged and convenience grain products, particularly breakfast cereals and packaged bread.

What role does the gluten-free trend play in product innovation?

The gluten-free trend necessitates continuous innovation, driving the adoption of alternative grain sources like rice flour, corn flour, and ancient grains (quinoa, amaranth). Manufacturers are leveraging specialized ingredients and processing techniques to replicate the texture and stability of traditional wheat-based products while adhering to strict allergen controls.

What are the key technological advancements influencing the quality control of baked goods?

Key advancements include the use of AI-driven computer vision systems and in-line Near-Infrared (NIR) spectroscopy. These technologies enable real-time monitoring of critical parameters like moisture content, consistency, and foreign material detection, ensuring high product quality and reducing manufacturing variability efficiently.

The global grain-based food market is undergoing a significant transformation, moving beyond basic staples to encompass a wide range of functional and premium products tailored to specific dietary needs. The demand for convenience, driven by accelerated urbanization and fast-paced lifestyles worldwide, continues to be a paramount market catalyst, particularly boosting segments like ready-to-eat cereals, processed snacks, and frozen baked goods. Simultaneously, demographic shifts, especially the aging population in developed economies, have increased the focus on nutritional density and fortification, prompting manufacturers to innovate extensively in areas like low-sodium bread, high-fiber pastas, and protein-enhanced snack bars. This confluence of convenience and health consciousness defines the competitive dynamics, forcing large corporations to maintain agility in product development while also optimizing their vast, complex supply chains to manage input cost volatility.

Furthermore, the segmentation analysis reveals that while traditional wheat remains the dominant grain source globally, the shift toward alternative grains, including ancient varieties (such as farro, spelt, and freekeh) and non-gluten options (like millet and sorghum), is gaining considerable traction. This diversification is not merely a response to dietary restrictions but also reflects consumer interest in novel flavor profiles and perceived superior nutritional benefits. The supply chain for these specialty grains requires robust certification and traceability systems, often involving direct partnerships with smaller, specialized agricultural cooperatives. Distribution effectiveness is heavily influenced by cold chain capabilities, particularly for fresh and frozen products, underscoring the necessity for integrated logistics planning across various geographical regions, especially as e-commerce penetration grows for high-value items.

In terms of technological integration, the market is leveraging Industry 4.0 concepts to achieve operational excellence. Advanced robotics in high-speed packaging lines minimize labor costs and improve hygiene standards, while Big Data analytics tools are employed to interpret vast datasets derived from consumer purchasing behaviors, enabling predictive modeling of future trends and allowing for highly targeted marketing campaigns. The investment focus remains on technologies that enhance food safety, extend shelf life without chemical preservatives, and contribute measurably to sustainability goals. Manufacturers are proactively engaging in initiatives like optimizing water use in milling and switching to renewable energy sources, recognizing that environmental stewardship is increasingly becoming a non-negotiable component of brand equity and consumer acceptance, thus ensuring long-term market viability and competitive differentiation.

The financial robustness of the Grain Based Food Market is underpinned by its recession-resistant nature, given that grain staples are essential consumer purchases. However, profitability is continually challenged by the narrow margins typical of high-volume packaged goods. To counter this, companies are employing strategies focused on premiumization—introducing higher-priced products with enhanced features, such as organic certification, unique ancient grain blends, or functional health benefits (e.g., probiotics or omega-3 fatty acids). Mergers and acquisitions remain a critical tactic for expanding geographic reach and instantaneously acquiring specialized technology or market share in fast-growing niche segments, such as the burgeoning plant-based bakery sector. The ongoing consolidation allows major players to gain economies of scale in procurement and distribution, offsetting pressures from volatile commodity markets and intense retail competition.

Regional economic development plays a pivotal role in product adoption. In mature markets like the U.S. and Germany, manufacturers focus on small-batch artisan production and specialized dietary items. Conversely, in rapidly developing regions like Southeast Asia, the emphasis remains on expanding access to mass-market, affordable, and fortified packaged goods, transitioning consumers away from unpackaged, informal food channels. Regulatory divergence across regions—ranging from stringent EU directives on nutrient content and labeling to varied fortification standards in Africa—adds a layer of complexity to global operations, necessitating localized product formulations and compliance strategies. The harmonization of global standards, particularly concerning food safety and allergen management, remains a long-term goal for industry stakeholders to facilitate smoother international trade and market entry.

Looking ahead, the role of packaging science in mitigating spoilage and waste is set to become even more pronounced. Innovations in active and intelligent packaging, which can monitor product freshness or release antimicrobial agents, offer a promising avenue for extending the effective shelf life of perishable baked products, a critical concern for D2C and e-commerce distribution models. Furthermore, the integration of consumer feedback loops through digital channels allows for real-time adjustments to product lines and marketing messages, creating a highly responsive and personalized market ecosystem. This responsiveness, coupled with a commitment to sustainable and transparent supply chain practices, will be key differentiators for market leaders seeking to capitalize on the robust growth projected for the latter half of the forecast period.

The competitive landscape is dynamic, characterized by intense rivalry between global conglomerates and highly specialized, agile local producers. Global leaders leverage their scale, extensive distribution networks, and massive marketing budgets to dominate mainstream segments like RTE cereals and mass-market bread. However, smaller entities often excel in niche segments, such as organic, artisan, or ethnic grain products, where authenticity and quick adaptation to specific local preferences provide a competitive edge. Strategic alliances focused on research and development (R&D) are common, allowing large companies to access external innovation without the substantial internal investment, particularly in advanced nutritional science or novel ingredient discovery. Price competition remains fierce in staple categories, compelling manufacturers to continuously seek efficiencies through automation and optimized sourcing, thereby influencing investment decisions toward high-throughput machinery and advanced process controls.

Key to sustainable market performance is the ability to manage resource constraints, especially water and land use associated with grain cultivation. Manufacturers are increasingly partnering with non-governmental organizations and agricultural technology firms to promote climate-smart agriculture (CSA) practices among their sourcing partners. This not only secures long-term raw material supply but also fulfills corporate social responsibility objectives, mitigating reputational risks associated with unsustainable practices. Investment in internal laboratory capabilities for ingredient testing and quality assurance is also rising, essential for ensuring compliance with complex global food safety standards, particularly concerning pesticide residues and mycotoxin levels in stored grains. This rigorous approach to quality is paramount for maintaining consumer trust in a highly scrutinized industry.

The future market trajectory will heavily depend on how effectively the industry navigates the trade-off between health demands and convenience. Successful product lines will be those that offer the speed and ease of preparation demanded by modern consumers, coupled with verifiable health attributes, such as low sugar, high protein, and natural ingredients. The move towards clean label products—those with minimal, recognizable ingredients—is irreversible, compelling a complete overhaul of traditional formulation methodologies that relied heavily on complex additives for texture and preservation. Ultimately, market leadership will be defined by superior innovation speed, efficiency in a digitized supply chain, and an unwavering commitment to both consumer health and environmental sustainability across the entire grain value chain.

Digital transformation within the processing and manufacturing sector is accelerating capital expenditure towards smart factories. These facilities utilize the Industrial Internet of Things (IIoT) to connect machinery, enabling real-time data collection and analysis regarding operational performance, energy consumption, and equipment maintenance needs. Predictive maintenance, powered by AI, minimizes costly downtime by identifying potential equipment failures before they occur, significantly improving overall manufacturing reliability and efficiency. This technological backbone is essential for handling the high complexity and variability inherent in producing diverse grain-based products, from delicate pastries to highly stable extruded snacks. Moreover, the automation extends to packaging lines where high-speed robotics handle delicate products while ensuring accurate weight measurement and quality seals, further optimizing throughput.

The rising prevalence of food allergies and sensitivities globally has institutionalized stringent allergen management as a core operational requirement. Manufacturers are investing heavily in dedicated, segregated production lines for major allergen-free products (e.g., gluten-free, nut-free), which requires substantial capital outlay and meticulous procedural controls. Traceability systems, leveraging blockchain, are employed not just for sourcing transparency but also for minimizing cross-contamination risks by providing an immutable record of ingredients and cleaning protocols throughout the facility. This focus on verifiable safety metrics is a major differentiator in the premium grain products sector, providing assurance to highly sensitive consumer groups and medical institutions.

Economically, global commodity market trends continue to exert primary influence. Climate change and geopolitical instability introduce high volatility in the pricing and availability of core grains (wheat, rice, maize). Manufacturers mitigate this exposure through sophisticated hedging strategies, long-term procurement contracts, and by diversifying the grain types used in their formulations (substitution of grain types based on cost and availability). Successful players are those who demonstrate flexibility in formulation science, allowing them to shift ingredient ratios or adopt alternative starches without compromising the sensory qualities or functional attributes of the final product. This strategic flexibility is vital for maintaining competitive pricing while absorbing commodity market shocks, ensuring stable supply to a price-sensitive global consumer base.

The convergence of retail and technology has made e-commerce a critical growth channel, particularly for specialty grain products that benefit from personalized marketing and direct consumer engagement. D2C models allow manufacturers to collect valuable consumer data, leading to faster product iteration and better inventory management based on real-time demand signals. While traditional supermarkets remain crucial for staples, the online platform offers unique advantages for launching premium, limited-edition, or highly specialized dietary items (e.g., functional protein bars or specialized baking mixes). This omnichannel strategy requires seamless integration of warehousing, logistics, and digital marketing capabilities to ensure brand consistency and efficient fulfillment across all retail touchpoints globally.

Consumer demand for ethical sourcing and fair trade certifications is continuously intensifying, especially in North America and Western Europe. This scrutiny pushes manufacturers beyond mere regulatory compliance towards genuine sustainable practices. Initiatives include supporting regenerative agriculture techniques that improve soil health, minimizing the use of synthetic fertilizers, and ensuring fair labor practices in developing regions where many exotic grains are sourced. These efforts, though initially costly, build significant brand loyalty among millennial and Gen Z consumers, who disproportionately favor brands that align with their ethical values. Transparency reports and public commitments to ESG (Environmental, Social, and Governance) goals are becoming standard practice, indicating that corporate responsibility is now inextricably linked to market performance in the grain-based food industry.

Finally, the challenge of reducing added sugars and unhealthy fats remains central, driven by public health campaigns and looming government taxes on high-sugar products. Manufacturers are investing heavily in developing natural sugar substitutes (like stevia or monk fruit), along with advanced ingredient systems that can mimic the textural and preservative functions of fats and sugars without compromising palatability. This scientific pursuit represents a major R&D focus, crucial for reformulating popular products (such as breakfast cereals and snack cakes) to meet new nutritional benchmarks while maintaining mass consumer appeal and affordability. The successful navigation of these complex health mandates will be a decisive factor in determining market leadership in the coming decade, ensuring that the grain-based food industry remains relevant and responsible in the evolving global dietary landscape.

The market for gluten-free grain-based foods exemplifies the industry’s response to dietary specialization. Beyond celiac disease, many consumers adopt gluten-free diets for perceived digestive benefits, driving substantial growth in products utilizing alternative flours such as chickpea, almond, and tapioca. This segment demands sophisticated processing to overcome the technical challenges of baking without gluten's structural properties, requiring specialized hydrocolloids and emulsification techniques to achieve acceptable texture and mouthfeel. Investment in dedicated, certified gluten-free facilities is mandatory for market entry into this high-margin category, highlighting the need for specialized capital investment tailored to niche consumer groups.

The food service sector's requirements differ markedly from retail. Commercial buyers prioritize operational efficiency and cost-per-serving, leading to high demand for pre-portioned, par-baked, or frozen dough products that minimize on-site labor and ensure product consistency across multiple locations. Key technology in this application involves flash freezing and advanced cryogenics to preserve product quality for extended periods, facilitating national and international supply to large restaurant chains. The rising popularity of plant-based diets in restaurants is also driving demand for specialized grain alternatives (e.g., vegan doughs and plant-protein enriched pasta) tailored for large-scale catering operations, requiring B2B innovation focused on high-performance ingredients.

The regulatory environment, particularly concerning food fortification, is a major regional driver in developing economies. Many governments mandate the addition of essential micronutrients (like iron, folic acid, and B vitamins) to staple grains and flours to combat widespread public health issues. This regulatory framework creates a stable demand floor for large-volume flour millers and processors, provided they adhere to stringent, government-monitored fortification protocols. While this increases production complexity, it secures consistent institutional demand, particularly in regions like South Asia and Sub-Saharan Africa, where staple grain consumption is high and nutritional deficiencies are prevalent, underscoring the market's social relevance.

In terms of upstream efficiency, digitalization is revolutionizing the commodity trading aspect. Data platforms providing real-time weather intelligence, crop health monitoring (via satellite imagery), and logistics tracking are crucial for grain traders and large manufacturers to make instantaneous procurement decisions. This high level of integration minimizes inventory waste and protects against price shocks by allowing for dynamic adjustment of sourcing geographically. This predictive capacity is particularly vital for mitigating risks associated with extreme weather events, which are becoming increasingly frequent due to climate change, directly threatening global grain harvests and supply chain stability.

Finally, labor challenges, particularly the increasing cost and scarcity of skilled labor in high-throughput manufacturing environments, reinforce the strategic imperative for further automation. Investing in robotics and advanced machinery is a necessity, not just for efficiency gains but also for long-term operational sustainability. Training programs focused on integrating human workers with automated systems (e.g., maintenance of robotic arms, monitoring AI-driven quality checks) are becoming crucial for the workforce of the future in the grain-based food manufacturing sector. The market's continued expansion relies heavily on its capacity to efficiently produce mass quantities of safe, nutritious, and appealing products while navigating complex global operational demands.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager