Grain Carts Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434348 | Date : Dec, 2025 | Pages : 255 | Region : Global | Publisher : MRU

Grain Carts Market Size

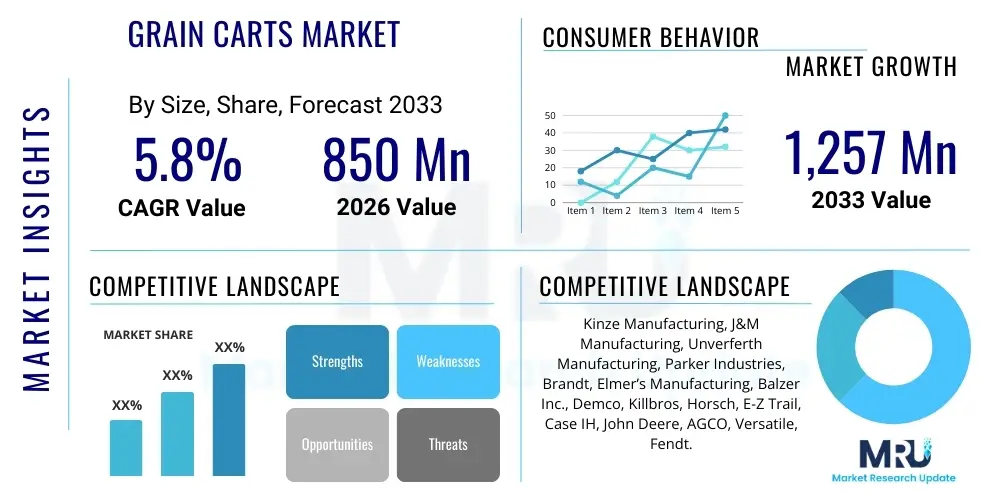

The Grain Carts Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 850 million in 2026 and is projected to reach USD 1,257 million by the end of the forecast period in 2033.

Grain Carts Market introduction

Grain carts, also known as grain wagons or chaser bins, are specialized agricultural equipment designed for high-capacity, efficient transfer of harvested crops (such as corn, soybeans, wheat, and rice) from the combine harvester directly to semi-trailer trucks or storage facilities located at the edge of the field. These carts serve as a crucial intermediate link in the harvesting chain, minimizing combine downtime by allowing continuous operation, thereby significantly increasing overall farm productivity. Modern grain carts are engineered for durability, large volume capacity, and speed, often featuring sophisticated technological integrations like high-speed auger systems, electronic weighing scales, and precision guidance compatibility.

The primary application of grain carts lies in large-scale commercial farming operations across major agricultural regions, notably North America, Europe, and parts of Asia Pacific. Their deployment is intrinsically linked to the adoption of high-capacity combine harvesters, where the speed of unloading becomes a bottleneck without an efficient transfer mechanism. Benefits derived from using these specialized carts include substantial reductions in harvest time, minimized soil compaction (especially when utilizing tracked systems), and enhanced accuracy in yield monitoring through integrated weighing technology. Furthermore, the capacity to quickly cycle grain out of the field allows farmers to capitalize on optimal weather windows, mitigating risks associated with crop spoilage.

Key driving factors propelling the growth of this market include the global trend toward farm consolidation, increasing average farm size, and the subsequent demand for high-capacity machinery capable of maximizing efficiency during peak seasons. Furthermore, the rising adoption of precision agriculture techniques necessitates equipment capable of providing granular data on harvest metrics, making technologically advanced grain carts—equipped with GPS and yield mapping capabilities—increasingly indispensable tools for modern farming enterprises aiming for optimized resource utilization and higher economic returns.

Grain Carts Market Executive Summary

The Grain Carts Market is exhibiting robust growth, driven primarily by macroeconomic trends favoring large-scale, industrialized agriculture and the widespread need for maximizing harvest efficiency under stringent timelines. Business trends indicate a strong focus on innovation related to cart capacity and running gear, with manufacturers increasingly offering tracked systems to address environmental concerns related to soil compaction, particularly in regions with heavier soils or unpredictable weather patterns. Furthermore, competition is intensifying in the ancillary services market, including telemetry and data integration packages offered alongside physical carts, transforming the purchase decision from a purely mechanical acquisition to a strategic technology investment focused on data management and operational analytics.

Regionally, North America maintains its dominance due to the presence of vast farmlands, high mechanization rates, and an established infrastructure supporting large agricultural machinery. However, Asia Pacific, particularly countries like Australia, India, and China, is projected to demonstrate the fastest growth rate, fueled by government initiatives promoting farm modernization, increasing labor costs necessitating mechanization, and the rising global demand for staple crops. European markets show stable demand, characterized by strict regulations regarding road safety and axle load limits, pushing manufacturers to develop lightweight yet high-strength steel solutions and specialized transport modes.

Segment trends highlight a significant shift towards the High Capacity segment (1500+ Bushels), reflecting the increasing size and efficiency of modern combine harvesters that require faster unloading solutions. The technology segment encompassing Carts with Weight Scales and Telemetry is gaining considerable traction, driven by the farmer’s need for real-time yield data validation and inventory management, critical components of comprehensive farm management systems. The integration of advanced sensor technology is transitioning the grain cart from a simple transport vehicle to an active data collection point within the digital farm ecosystem.

AI Impact Analysis on Grain Carts Market

Common user questions regarding AI's influence on the Grain Carts Market frequently center on how autonomous navigation, predictive maintenance, and data harmonization will revolutionize harvest logistics. Users are primarily concerned with the feasibility and return on investment of fully autonomous grain cart operations, asking if AI can effectively synchronize cart movement with combine speed and location in real-time, especially across uneven or complex field geometries. There is also substantial interest in AI-driven predictive analytics that can forecast equipment failure, optimize maintenance schedules, and manage fleet utilization across multiple fields, reducing costly downtime during the critical harvest window. The underlying expectation is that AI integration will ultimately lead to fully automated harvest processes, minimizing reliance on skilled labor and maximizing operational throughput.

AI is poised to transform grain cart operation by moving beyond simple sensor integration to complex logistical control systems. AI algorithms can process live data feeds from combines (yield rate, location, speed) and trucks (destination, capacity, travel time) to generate optimal routing and dispatching decisions for the grain cart fleet. This level of synchronization, often termed 'harvest automation,' ensures that combines are never waiting to unload, thereby maintaining peak harvesting efficiency. Furthermore, in situations requiring multiple grain carts, AI can manage traffic flow within the field, preventing bottlenecks and optimizing pathways to minimize soil disruption and fuel consumption based on dynamic field conditions.

Another crucial area of AI impact is in enhanced data veracity and compliance. Modern grain carts already employ digital scales, but AI introduces the ability to cross-reference weight data with GPS location and time stamps to automatically identify potential yield anomalies or loading errors. This AI-driven auditing capability is vital for farmers involved in advanced traceability programs or contract farming agreements requiring precise documentation. Predictive maintenance is also leveraging machine learning models trained on vibration, temperature, and usage data collected from auger mechanisms and running gear, allowing the system to alert operators to potential failures days or weeks in advance, transitioning repairs from reactive to proactive measures.

- Autonomous path planning and real-time synchronization with combine movement.

- AI-driven predictive maintenance modeling for augers, tracks, and gearboxes.

- Optimized fleet management and dispatching across large farming operations.

- Enhanced yield data validation and auditing through machine learning integration.

- Development of fully autonomous grain cart prototypes (A-carts) requiring minimal human oversight.

DRO & Impact Forces Of Grain Carts Market

The Grain Carts Market is fundamentally shaped by a combination of strong drivers centered on productivity, inherent structural restraints related to capital expenditure and regional limitations, and significant opportunities arising from technological advancements, collectively generating powerful impact forces on market direction. The primary drivers revolve around the necessity for large farms to minimize combine idle time during harvest, coupled with the increasing integration of precision agricultural technologies that require accurate, on-the-go data collection, which modern carts facilitate through advanced weighing and telemetry systems. However, the market faces restraints such as the high initial investment required for high-capacity or tracked carts, making adoption challenging for smaller farming enterprises, and the regulatory heterogeneity across global regions concerning machinery size and road transport weight limits.

Opportunities for growth are abundant, particularly in the development and adoption of track systems, which address the critical issue of soil compaction, an increasing environmental and economic concern for farmers globally. Further opportunities lie in the integration of connectivity solutions, enabling carts to seamlessly communicate with farm management software, combines, and autonomous vehicle control systems. The development of lighter, more durable materials, such as advanced high-strength steels and composites, presents an avenue for manufacturing carts that adhere to road transport regulations while maintaining high operational capacity, thereby opening new markets in densely populated agricultural regions.

The predominant impact force influencing the market is the continuous increase in combine harvester capacity, demanding commensurately larger and faster grain carts to keep pace, creating a perpetual cycle of innovation focused on unloading speed and volume. Another significant impact force is the volatile nature of global crop prices and farm incomes; when commodity prices are high, capital investment in efficiency-boosting equipment like advanced grain carts accelerates, while low prices lead to deferred purchasing decisions, making market expansion cyclical and highly sensitive to agricultural economic performance. Furthermore, the growing scarcity of skilled farm labor drives demand for automated and easy-to-operate machinery, reinforcing the value proposition of technologically advanced grain carts.

Segmentation Analysis

The Grain Carts Market is comprehensively segmented based on three primary categories: Capacity, Axle Type, and Technology. These segments reflect the diverse operational needs of farms globally, ranging from small-scale operations requiring standard equipment to vast commercial enterprises demanding high-capacity, specialized, and data-integrated solutions. Capacity segmentation is vital as it directly relates to combine efficiency and farm size, while Axle Type dictates mobility, stability, and crucial factors like soil compaction. The Technology segmentation showcases the market's shift toward precision farming, where data accuracy and real-time connectivity are key purchasing differentiators.

- By Capacity

- Low Capacity (Below 1000 Bushels)

- Medium Capacity (1000 - 1500 Bushels)

- High Capacity (Above 1500 Bushels)

- By Axle Type

- Single Axle

- Tandem Axle

- Track System

- By Technology

- Standard Carts (No Scale)

- Carts with Weight Scales

- Carts with Telemetry and Data Integration

Value Chain Analysis For Grain Carts Market

The value chain for the Grain Carts Market begins with upstream activities involving the sourcing of raw materials, primarily specialized high-strength steel, axles, running gear components, and complex hydraulic systems. Key upstream suppliers include steel manufacturers and specialized component producers who must meet stringent quality and durability standards required for heavy agricultural machinery. Manufacturers invest heavily in R&D to optimize cart design, focusing on structural integrity, auger efficiency, and integrating sophisticated electronic and sensor systems. The competitive advantage at this stage often lies in vertical integration or securing robust, long-term supply agreements for critical, high-cost materials like rubber tracks and high-tensile steel.

Mid-stream activities encompass the core manufacturing and assembly processes, where differentiation is achieved through patented auger designs that maximize unloading speed while minimizing grain damage, and the incorporation of advanced welding and assembly techniques to ensure structural longevity. Distribution is managed through both direct sales channels, typically utilized by major original equipment manufacturers (OEMs) for large fleet buyers or national accounts, and, more commonly, through an extensive network of regional agricultural equipment dealerships. These dealerships provide crucial services, including sales consultation, financing options, maintenance, and replacement parts, acting as the primary point of contact for the end-user farmer.

Downstream activities focus on the end-user adoption and post-sales support, which includes maintenance, repair, and the provision of aftermarket upgrades, particularly related to precision agriculture technology retrofits such as digital scales or GPS systems. The trend towards data integration means that the value chain now extends to software providers and agronomy consultants who utilize the data generated by the grain carts (e.g., yield mapping data) to inform future planting and management decisions. This digital layer significantly enhances the overall value proposition of the cart, transforming it from mere hardware into an indispensable data collection tool. The strength of the indirect channel, specifically the local dealer network, remains paramount for delivering reliable service and building customer loyalty in this specialized equipment sector.

Grain Carts Market Potential Customers

The primary customer base for the Grain Carts Market consists of large-scale commercial farming operations, often characterized by monoculture farming across expansive tracts of land. These farms rely heavily on efficiency maximization during the narrow harvest window and are the most sensitive to combine idle time, making high-capacity grain carts essential capital investments. This segment includes corporate farming entities, agribusiness consortia, and institutional investors managing agricultural assets across major commodity crop belts in North America, South America (especially Brazil and Argentina), and Eastern Europe.

A secondary, yet rapidly growing, customer segment includes custom harvesting businesses and agricultural cooperatives. Custom harvesters, who travel across regions providing harvesting services to multiple smaller farms, demand robust, easily transportable, and multi-functional equipment to maximize their service throughput. Cooperatives purchase grain carts centrally to be shared among their members, often prioritizing reliability and standardization. For both these segments, the return on investment (ROI) is calculated based on minimizing operational expenditure and maximizing time efficiency across a diverse portfolio of clients or member farms.

The emerging segment comprises farms in developing economies, particularly in Asia Pacific and Africa, that are undergoing rapid mechanization transitions. While these farms traditionally favored lower capacity equipment, increasing labor costs and government subsidies encouraging farm modernization are driving demand for mid-capacity and standard technology carts. Furthermore, precision agriculture enthusiasts and technologically advanced small-to-medium enterprises (SMEs) are targeted buyers for carts equipped with integrated weighing systems and telemetry, viewing the data collection capability as a pivotal tool for enhancing farm profitability and resource management.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 850 Million |

| Market Forecast in 2033 | USD 1,257 Million |

| Growth Rate | CAGR 5.8% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Kinze Manufacturing, J&M Manufacturing, Unverferth Manufacturing, Parker Industries, Brandt, Elmer’s Manufacturing, Balzer Inc., Demco, Killbros, Horsch, E-Z Trail, Case IH, John Deere, AGCO, Versatile, Fendt. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Grain Carts Market Key Technology Landscape

The technological landscape of the Grain Carts Market is rapidly evolving, shifting focus from merely transport mechanisms to sophisticated data collection and control platforms. The most significant advancement lies in the development and proliferation of hydraulic track systems, which replace traditional wheels, dramatically reducing ground pressure and minimizing soil compaction, a factor directly correlating to future crop yields. These track systems incorporate advanced suspension technology, allowing for smoother operation and greater stability on uneven terrain, enabling higher speed in-field transfer. Furthermore, electronic control modules manage track tension and alignment, optimizing longevity and efficiency while enhancing overall cart maneuverability, which is vital during tight maneuvers alongside combines.

Integrated weighing and telemetry systems represent the second critical technology adoption wave. Modern carts feature high-accuracy load cell systems integrated into the chassis, providing instantaneous, verifiable weight measurements as the combine unloads. This data, coupled with GPS coordinates, is captured by onboard telemetry units and transmitted wirelessly (via cellular or radio frequency networks) to cloud-based farm management software. This allows farm managers to monitor yield data in real-time, instantly confirm load weights for regulatory compliance or inventory purposes, and accurately calculate the yield based on specific field segments. This seamless data flow is foundational to implementing precision agriculture strategies.

Beyond weighing and running gear, manufacturers are investing in advanced automation features and connectivity protocols. Technologies include automated auger folding/unfolding systems, self-lubricating chains, and integration with ISOBUS standards, allowing the grain cart to communicate directly and seamlessly with the tractor and combine cab displays, regardless of brand. The future trajectory includes the commercialization of sensor fusion technology, where LIDAR and computer vision systems assist in the autonomous docking and alignment of the cart spout beneath the combine auger, further reducing the operator workload and minimizing spillage, paving the way for eventual fully autonomous operation in controlled field environments.

Regional Highlights

North America, encompassing the United States and Canada, stands as the dominant market for grain carts, primarily due to the vast acreage dedicated to staple crops (corn, soybeans, wheat) and the highly mechanized nature of farming operations. The region is characterized by early adoption of large-capacity carts (1500+ bushels) and track systems, reflecting the necessity for maximum efficiency on large corporate farms. High commodity prices and strong agricultural investment cycles consistently drive demand for replacement and technologically advanced units, particularly those featuring integrated precision agriculture solutions like real-time yield mapping and data telemetry.

The Asia Pacific (APAC) region is projected to register the highest growth rate during the forecast period. This growth is spurred by rapid farm modernization in countries like China, India, and Australia. While Australia already employs high-capacity equipment similar to North America, developing economies within APAC are increasingly adopting mid-capacity grain carts to replace manual labor and improve logistical throughput as farm holdings consolidate and government policy supports agricultural mechanization. However, market penetration is sensitive to local subsidy schemes and the fragmented nature of land ownership in some sub-regions.

Europe and Latin America represent mature and emerging markets, respectively, each with unique operational demands. European demand is stable, driven by replacement cycles, but heavily influenced by stringent regulations on axle load limits and overall vehicle dimensions, favoring lightweight, robust designs and tandem axle configurations. Latin America, particularly the agricultural powerhouses of Brazil and Argentina, shows significant potential, characterized by vast, export-oriented soybean and corn farms. The region is quickly transitioning toward larger capacity carts and adopting track systems to manage the challenging soil conditions and maximize throughput during intense harvest periods.

- North America: Dominant market share; driven by high-capacity demand, track system adoption, and precision agriculture technology integration.

- Asia Pacific (APAC): Fastest growing region; driven by farm mechanization, government support, and rising adoption in Australia, China, and India.

- Europe: Stable growth; focused on regulatory compliance (size and weight) and specialized lightweight designs for road transport.

- Latin America: High potential market; characterized by large-scale commodity farming and increasing investment in large-capacity, durable equipment.

- Middle East & Africa (MEA): Nascent market; selective growth tied to large commercial agricultural projects and state-sponsored farming initiatives.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Grain Carts Market.- Kinze Manufacturing

- J&M Manufacturing

- Unverferth Manufacturing

- Parker Industries

- Brandt

- Elmer’s Manufacturing

- Balzer Inc.

- Demco

- Killbros

- Horsch

- E-Z Trail

- Case IH

- John Deere

- AGCO

- Versatile

- Fendt

- Claas Group

- Honeybee Manufacturing

- Wishek Manufacturing

- Meridian Manufacturing

Frequently Asked Questions

Analyze common user questions about the Grain Carts market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the current demand for high-capacity grain carts?

The main driver is the continuous increase in the size and harvesting speed of modern combine harvesters. Larger combines necessitate equally large and fast grain carts to maintain non-stop operation, minimizing idle time and maximizing overall harvest efficiency across extensive farm acreage.

How significant is the impact of track systems versus traditional wheeled carts on soil health?

Track systems significantly reduce ground pressure compared to traditional wheeled carts, leading to drastically minimized soil compaction. Reduced compaction enhances soil permeability, improves root development, and ultimately contributes to higher crop yields in subsequent seasons, making tracks a critical investment for sustainable farming.

Which technology segment is expected to show the highest growth rate in the near future?

The segment encompassing Carts with Telemetry and Data Integration is expected to experience the fastest growth. This is driven by the global shift toward precision agriculture, where farmers require real-time, accurate yield data and verifiable inventory records for management, regulatory compliance, and optimization purposes.

What major challenges restrict the adoption of advanced grain carts in developing regions?

The primary restriction is the high initial capital investment required for high-capacity or advanced technology carts. Furthermore, fragmented land ownership, limited access to financing, and insufficient infrastructure for maintaining complex machinery pose significant barriers to widespread adoption in many developing economies.

How does AI integration affect the operational labor requirements for grain carts?

AI integration, through features like autonomous synchronization, optimal path planning, and automated docking, drastically reduces the reliance on highly skilled operators. This technology streamlines the in-field logistics, moving operations closer to full autonomy and helping farms manage the pervasive challenge of skilled agricultural labor scarcity.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager