Grain Farming Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 431579 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Grain Farming Market Size

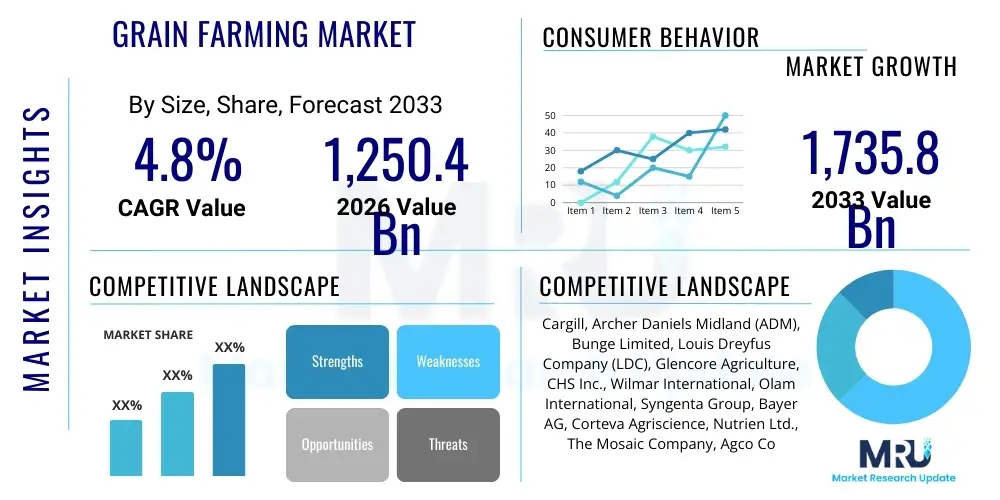

The Grain Farming Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.8% between 2026 and 2033. The market is estimated at $1,250.4 Billion in 2026 and is projected to reach $1,735.8 Billion by the end of the forecast period in 2033. This robust expansion is primarily fueled by increasing global population demand for staple food sources, coupled with rising adoption of advanced agricultural technologies designed to maximize yields and enhance sustainability under volatile climatic conditions. Furthermore, the growing industrial applications of grains, particularly in biofuel production and animal feed sectors, continue to solidify the market's expansive trajectory across key agricultural regions globally.

Grain Farming Market introduction

The Grain Farming Market encompasses the cultivation, harvesting, and initial processing of various grain types, serving as the foundational pillar of the global food supply chain. Grains are defined broadly to include cereal grains (such as wheat, rice, maize, and barley), oilseeds (like soybeans and sunflower), and pulses (including lentils and chickpeas). These products are critical commodities, providing essential dietary calories and nutrients, making their stable and efficient production a global economic and security priority. The core agricultural processes involved increasingly rely on sophisticated machinery, advanced genetic seeds, and complex resource management systems to maintain viability and scale in the face of environmental pressures and resource scarcity.

Major applications of harvested grains are diverse, spanning human consumption, animal feed, and industrial utilization. For human consumption, grains are processed into flours, oils, starches, and beverages, forming the base of many global cuisines. The animal feed industry consumes a significant portion, particularly maize and soybeans, to support the growing demand for meat and dairy products globally. Industrially, grains are vital raw materials for producing biofuels, biodegradable plastics, textiles, and various biochemicals. The increasing global focus on renewable energy sources, especially ethanol derived from maize and sugarcane, further accelerates the demand for high-yield grain cultivation practices, integrating the farming sector more tightly with the energy market.

The market benefits from high resilience due to the non-negotiable nature of food demand, coupled with driving factors such as rapid urbanization and the subsequent increase in packaged food consumption. Key drivers also include technological innovations such as precision agriculture tools, which enhance productivity per hectare, and the development of climate-resilient crop varieties. However, the market faces inherent challenges related to geopolitical instability impacting trade flows, increasing frequency of extreme weather events, and the necessity to transition towards environmentally sustainable farming methods that reduce carbon footprint and water usage without compromising yield, requiring significant investment in research and infrastructure.

Grain Farming Market Executive Summary

The Grain Farming Market is exhibiting sustained growth, underpinned by significant shifts in global business trends, driven largely by consolidation among major agribusiness firms and the rapid integration of digital farming solutions. Business trends emphasize vertical integration, where grain producers form stronger partnerships or merge with seed technology providers, processing plants, and distribution networks to optimize the supply chain efficiency and margin capture. There is also a pronounced trend toward sustainable sourcing commitments from major food and beverage corporations, compelling grain farmers to adopt certified sustainable practices, such as reduced tillage and integrated pest management (IPM), which influences input purchasing decisions and operational expenditures globally. Investment in logistics and storage infrastructure, particularly in emerging economies, is another critical business trend facilitating smoother market access and reducing post-harvest losses, enhancing overall market profitability.

Regionally, the market dynamics are characterized by differential growth rates and varying levels of technological maturity. North America and Europe remain major contributors to global grain production and technology innovation, focusing on maximizing yields through highly automated systems and advanced genetic engineering. Asia Pacific (APAC), particularly China and India, presents the highest growth opportunity due to massive domestic consumption needs and government initiatives aimed at achieving food self-sufficiency, leading to substantial investment in modernizing farming techniques and irrigation infrastructure. Latin America, dominated by Brazil and Argentina, serves as a crucial global exporter of soybeans and maize, where market expansion is tied closely to global trade agreements and biofuel production demands. These regional variances necessitate customized market strategies concerning seed development, machinery deployment, and export policies.

Segment trends highlight the burgeoning importance of specialized grain production, specifically high-protein pulses and identity-preserved (IP) non-GMO grains, catering to niche consumer health and sustainability preferences. While cereal grains like rice and wheat maintain dominance in volume, the oilseeds segment, driven by soaring demand for vegetable oils and animal feed protein, is experiencing accelerated value growth. Furthermore, the technology segment within grain farming is witnessing a decisive shift towards subscription-based software services and advanced sensor systems, replacing traditional capital expenditure models. Farmers are increasingly adopting data analytics platforms that leverage satellite imagery, drone data, and soil sensors to make highly localized decisions on fertilization and irrigation, optimizing resource usage and enhancing resilience against weather variability, thus driving the segment's efficiency and profitability.

AI Impact Analysis on Grain Farming Market

Common user inquiries concerning Artificial Intelligence (AI) in grain farming revolve primarily around themes of predictive efficiency, resource optimization, and operational risk mitigation. Users frequently question how AI algorithms can accurately predict yield outcomes under fluctuating weather conditions, the effectiveness of machine learning in diagnosing and managing localized pest and disease outbreaks before they escalate, and the return on investment (ROI) for integrating complex AI-driven sensor systems and autonomous machinery. Key concerns often focus on data ownership, privacy, the digital divide preventing smaller farmers from adopting these expensive technologies, and the reliability of AI models trained on limited regional data sets. Users expect AI to fundamentally transform decision-making processes, leading to significant reductions in input costs (fertilizers, water, pesticides) and ensuring higher, more predictable crop quality, thereby securing future food supply.

The integration of AI technologies is fundamentally reshaping the operational landscape of the Grain Farming Market, moving it from reactive management to predictive agriculture. AI-powered analytics leverage vast datasets, including historical climate records, current soil moisture levels, satellite imagery, and specific crop performance metrics, to generate highly precise recommendations for planting, watering, and nutrient application. This transition allows farmers to move away from broad-acre treatment approaches towards microscopic, localized interventions, significantly reducing waste and environmental impact. For instance, sophisticated AI systems can differentiate between healthy plants and those showing early signs of stress or disease, enabling robotic systems or variable-rate sprayers to apply treatments only where necessary, thus ensuring targeted resource deployment.

Beyond field operations, AI enhances supply chain robustness and market intelligence. Machine learning models are being developed to predict future commodity price fluctuations based on macroeconomic factors, geopolitical events, and forecasted weather patterns, allowing large farming operations and traders to make more informed hedging and sales decisions. Furthermore, AI contributes significantly to the development of new seed varieties by accelerating genomic analysis and predicting desirable trait combinations (like drought resistance or higher protein content), drastically shortening the time required for R&D. While the initial investment in AI infrastructure is substantial, the long-term benefits in terms of maximized yields, minimized operational risks, and enhanced sustainability metrics are positioning AI as an indispensable tool for maintaining global competitiveness in grain production.

- AI-driven predictive analytics optimize planting schedules and input application rates.

- Machine learning algorithms enhance early detection and identification of crop diseases and pests.

- Autonomous farm machinery utilizes computer vision and AI for highly precise navigation and harvesting.

- Advanced robotics powered by AI performs complex tasks such as weeding and selective harvesting, minimizing human labor costs.

- AI systems predict climate impacts and market price volatility, aiding risk management and supply chain planning.

- Genomic AI accelerates the breeding of climate-resilient and high-yield grain varieties.

- Real-time sensor data processed by AI provides micro-level soil and plant health diagnostics.

DRO & Impact Forces Of Grain Farming Market

The Grain Farming Market is profoundly influenced by a complex interplay of Drivers, Restraints, and Opportunities (DRO), collectively constituting the core impact forces shaping its trajectory. Key drivers include persistent global population growth, which directly necessitates increased grain output, and the expanding biofuel industry, which mandates high volumes of feedstocks like corn and soybean. Restraints largely center on environmental volatility, such as unpredictable climate change leading to droughts or floods, and high volatility in input costs, especially for fertilizers and energy, which squeeze farmer margins. Opportunities arise primarily from technological advancements, specifically precision agriculture and vertical farming models, offering paths to mitigate resource scarcity and improve operational efficiency. These interconnected forces dictate investment priorities, regulatory frameworks, and technological adoption rates across all major grain-producing regions, determining the long-term sustainability and profitability of the sector.

Specific drivers propelling the market include shifting dietary patterns in developing nations towards protein-rich foods, thereby increasing demand for feed grains, and strong governmental support, especially in strategic markets, through subsidies and research funding aimed at securing domestic food supplies. The imperative to reduce post-harvest losses, currently estimated to be substantial in many regions, also drives investment in better storage, drying, and logistics technologies, indirectly boosting available market supply. Conversely, severe restraints include pervasive regulatory complexities related to genetic modification (GM) technologies, water scarcity issues intensifying competition between agriculture and urban needs, and land degradation resulting from intensive farming practices over decades. These restraints necessitate innovative solutions focused on resource efficiency and environmental stewardship, often requiring significant capital investment or policy changes.

Opportunities are numerous and centered on disruptive technologies and changing consumer preferences. The growing consumer demand for organic and non-GMO grains offers significant premium market opportunities for specialized producers willing to meet stringent certification standards. Furthermore, the adoption of satellite imagery, IoT sensors, and big data analytics—the core components of precision agriculture—presents a major opportunity to optimize yields while reducing operational costs and environmental footprints. Impact forces such as geopolitical tensions (e.g., trade wars or regional conflicts) and global supply chain disruptions have a high impact, creating volatility in commodity prices and trade flows, necessitating robust, diversified sourcing and risk management strategies for market stability. The convergence of climate adaptation pressure and technological advancement defines the primary competitive landscape.

Segmentation Analysis

The Grain Farming Market segmentation provides a granular view of market structure based on the specific type of grain cultivated, its primary application, and the prevailing farming method employed. Understanding these segments is crucial for agribusinesses, input suppliers, and policymakers to target resources effectively and respond to differential demand patterns. The market is fundamentally segmented by product type into cereal grains, which represent the largest volume segment; oilseeds, which capture substantial value due to high industrial and feed demand; and pulses, which are experiencing growth driven by health trends and sustainable farming mandates. Each segment exhibits distinct characteristics regarding required growing conditions, technological adoption rates, and global trading patterns, influencing profitability margins.

Further analysis of segmentation by application reveals the critical interconnectedness of the farming sector with various downstream industries. The Human Consumption segment demands high quality, often identity-preserved, grains, dictating specific storage and handling protocols. The Animal Feed segment, driven by the expanding livestock and poultry industries, focuses on bulk volumes and nutritional composition (protein and energy density). Meanwhile, the Industrial Application segment, encompassing biofuels, brewing, and material production, often prioritizes specific chemical properties or starch content. The dynamics within these application segments are heavily influenced by global policy decisions, such as renewable energy mandates (biofuels) and international health standards (food safety), making them inherently sensitive to regulatory changes.

Segmentation also involves the differentiation between conventional farming methods and sustainable/organic practices. While conventional farming dominates acreage due to high-yield efficiency, the organic and sustainable farming segments are growing rapidly, commanding price premiums and reflecting consumer and regulatory desires for environmentally conscious food production. This shift drives demand for specific inputs, such as biological pest control and specialized machinery for precision application and soil health management. Strategic planning within the grain market requires a deep understanding of these segmentation dynamics to capitalize on high-growth niche markets while maintaining efficiency in the dominant volume segments.

- By Product Type:

- Cereal Grains (Wheat, Rice, Maize, Barley, Oats, Sorghum, Rye)

- Oilseeds (Soybean, Rapeseed, Sunflower, Cottonseed, Palm Kernel)

- Pulses (Lentils, Chickpeas, Beans, Peas)

- By Application:

- Human Consumption (Flour, Baking, Brewing, Direct Food)

- Animal Feed (Livestock, Poultry, Aquaculture)

- Industrial Use (Biofuel Production, Starch Manufacturing, Textiles)

- By Farming Method:

- Conventional Farming

- Sustainable and Organic Farming

- Precision Agriculture/Smart Farming

Value Chain Analysis For Grain Farming Market

The value chain for the Grain Farming Market is extensive, starting with upstream activities and extending through complex distribution channels to reach end-users. The upstream segment involves critical input providers, including agricultural equipment manufacturers (tractors, harvesters), seed producers (conventional and genetically modified seeds), and chemical companies supplying fertilizers, pesticides, and herbicides. These upstream suppliers are crucial determinants of farming efficiency and cost structures, and their technological innovations, particularly in high-performance seeds and precision machinery, directly influence farm productivity. The pricing power in this segment is often concentrated among a few global players, which creates market dependence for individual farmers.

Midstream activities encompass the actual cultivation, harvesting, storage, and primary processing (e.g., drying and cleaning) carried out by the grain farmers themselves. Post-harvest handling is critical to maintaining grain quality and reducing spoilage before it enters the trading and logistics phases. Downstream activities involve large-scale commodity traders (like Cargill and ADM), bulk transportation networks (rail, shipping), and further processing facilities, which transform raw grains into finished goods such as flours, oils, and feed pellets. This downstream segment connects the farm gate output with final consumption, and the efficiency of transportation and processing dictates the final market price and accessibility of grain products globally, often being subject to volatile commodity market pricing.

Distribution channels are multifaceted, relying on both direct and indirect routes. Direct distribution involves large farms selling directly to local mills, ethanol plants, or specialized feedlots under contract, ensuring stable pricing and reliable supply. Indirect channels, which dominate global trade, utilize extensive networks of brokers, cooperatives, and international commodity trading houses that manage the global movement of grains across borders and regulatory environments. Cooperatives play a vital role in enabling smaller farmers to achieve economies of scale in storage, marketing, and sales, effectively competing in the broader market. Technology, particularly digital platforms for commodity trading, is increasingly streamlining these distribution channels, enhancing transparency and reducing transaction costs.

Grain Farming Market Potential Customers

The primary customers and buyers in the Grain Farming Market are highly diversified, reflecting the multiple applications of grain commodities. The largest and most consistent customer base consists of industrial processors, including flour mills, oil crushers, starch and sweetener producers, and beverage manufacturers (brewers and distillers). These entities purchase large volumes of specific grain types—such as high-protein wheat for baking or high-starch corn for ethanol—as their core raw materials. Contract farming arrangements are common in this sector, ensuring quality specification adherence and providing farmers with predictable revenues, while processors secure stable supply chains necessary for continuous operation and economies of scale.

Another major category of potential customers is the global animal feed industry, comprising integrated livestock operations, commercial feed mills, and aquaculture farms. These customers require high volumes of energy-rich grains (like maize and barley) and protein-rich oilseeds (primarily soybean meal) to formulate balanced animal diets. The demand from this segment is directly tied to global consumption patterns for meat, poultry, and fish, exhibiting strong growth in emerging markets where protein consumption is rapidly increasing. Stability in this customer segment is paramount, as livestock rearing relies on consistent and cost-effective feed supply, making feed producers sensitive to fluctuations in grain commodity prices and quality.

Furthermore, the market serves specialized niche customer segments, including health food manufacturers, organic food distributors, and biofuel producers. Biofuel refineries, particularly those producing ethanol, are major purchasers of coarse grains, and their demand is highly responsive to global crude oil prices and government mandates promoting renewable energy. Health-conscious consumers and specialized food companies drive demand for identity-preserved (IP), non-GMO, and organic grains, willing to pay significant price premiums. Governmental and humanitarian agencies also act as major buyers, procuring substantial grain reserves for food aid, national strategic reserves, and managing public distribution systems, representing a vital, though often policy-dependent, customer base.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $1,250.4 Billion |

| Market Forecast in 2033 | $1,735.8 Billion |

| Growth Rate | 4.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Cargill, Archer Daniels Midland (ADM), Bunge Limited, Louis Dreyfus Company (LDC), Glencore Agriculture, CHS Inc., Wilmar International, Olam International, Syngenta Group, Bayer AG, Corteva Agriscience, Nutrien Ltd., The Mosaic Company, Agco Corporation, John Deere, CNH Industrial, Bühler Group, Viterra, Seaboard Corporation, Gavilon Group |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Grain Farming Market Key Technology Landscape

The technological landscape of the Grain Farming Market is rapidly evolving, driven by the need for enhanced efficiency, resource conservation, and yield optimization. Central to this transformation is the adoption of Precision Agriculture, which utilizes a suite of integrated technologies to manage farms on a meter-by-meter basis rather than a whole-field approach. Key components include Global Positioning Systems (GPS) integrated into farm machinery, Geographic Information Systems (GIS) for mapping and data analysis, and sophisticated sensors—both ground-based (soil moisture, nutrient levels) and aerial (drones, satellite imagery)—providing real-time, actionable data. This technological shift allows for variable rate application (VRA) of inputs like seeds, fertilizers, and pesticides, ensuring resources are deployed only where needed, which translates directly into lower operational costs and reduced environmental impact, marking a significant departure from traditional generalized farming practices.

Beyond precision tools, advanced biotechnology and genetic engineering are fundamental to the modern technology landscape. Continuous innovation in hybrid seeds, particularly those engineered for drought resistance, pest resilience, and higher nutritional value, ensures crop viability in challenging environments and boosts per-hectare productivity. Digital farming platforms and farm management software (FMS) integrate all data streams—from weather forecasting to machinery telemetry—into cohesive decision-making dashboards. These FMS systems are increasingly incorporating artificial intelligence and machine learning models to generate predictive analytics regarding disease risk, optimal harvesting times, and financial performance projections. The seamless connectivity enabled by IoT devices and 5G networks is crucial for transmitting the vast quantities of data generated by these connected technologies across large agricultural fields in real-time.

Furthermore, the rise of automation and robotics is changing the labor dynamics in grain farming. Autonomous tractors and planters, guided by high-accuracy GPS systems, operate with minimal human intervention, allowing for continuous operations and precise field work. Robotics is also being deployed in specialized tasks, such as micro-weeding and localized crop monitoring, improving efficiency beyond what traditional, large-scale machinery can achieve. This trend towards automation addresses critical labor shortages in many developed agricultural economies while ensuring higher levels of operational accuracy. The convergence of these technologies—biotech, digital platforms, automation, and sensors—forms a resilient, integrated ecosystem designed to meet the increasing global demand for grains efficiently and sustainably.

Regional Highlights

Regional dynamics play a crucial role in the global Grain Farming Market, reflecting variations in climate, policy support, technological adoption, and consumer demand. North America, encompassing the United States and Canada, stands as a global powerhouse, characterized by large-scale mechanized farming, extensive use of genetically modified (GM) crops, and early adoption of precision agriculture techniques. The region is a massive exporter of maize, soybeans, and wheat, heavily influencing global commodity prices and setting benchmarks for technological implementation and high productivity yields. Continued investment in infrastructure and research ensures its dominant position in terms of both volume and technological leadership, focusing heavily on sustainability metrics and advanced supply chain traceability.

The Asia Pacific (APAC) region is the largest consumer and producer of grains globally, driven primarily by India and China, which account for the vast majority of rice and wheat production necessary for domestic consumption. Market growth in APAC is explosive, propelled by governmental mandates focused on food security, population density, and rapidly rising disposable incomes leading to diversified diets. While farming operations are often fragmented and smaller in scale compared to the Americas, rapid modernization, including subsidized access to irrigation systems and high-yield seeds, is transforming the sector. The region also presents significant challenges related to water management and arable land scarcity, driving innovation in intensive farming practices and climate-resilient crop development.

Europe maintains a strong focus on high-quality, sustainably produced grains, largely dictated by the stringent regulations set forth by the European Union regarding pesticide use, GM crops, and environmental stewardship (e.g., the Common Agricultural Policy). Western European countries prioritize traceability and premium organic grain production, while Eastern Europe (e.g., Ukraine and Russia) are critical global exporters of wheat and barley, driven by vast acreage and competitive pricing. Latin America, particularly Brazil and Argentina, is essential to the global oilseeds and feed grain market, operating large-scale, mechanized operations focused on soybean and maize exports. The Middle East and Africa (MEA) region remains a net importer, facing severe water stress, necessitating substantial investments in imported grain supplies and limited, localized development of high-tech indoor or vertical farming solutions to enhance food autonomy.

- North America (U.S., Canada): Leader in technology adoption, large-scale mechanized farming, and major exporter of maize and soybeans.

- Europe (EU-27, Russia, Ukraine): Focus on stringent quality control, sustainable practices, and major contributor to global wheat and barley exports.

- Asia Pacific (China, India, Southeast Asia): Highest production and consumption volume; rapid modernization and investment in achieving food self-sufficiency.

- Latin America (Brazil, Argentina): Primary global source for oilseeds (soybean) and feed grains, heavily reliant on export markets.

- Middle East and Africa (MEA): Significant net importer; high growth potential for climate-smart agriculture technologies to mitigate water scarcity.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Grain Farming Market.- Cargill, Incorporated

- Archer Daniels Midland (ADM)

- Bunge Limited

- Louis Dreyfus Company (LDC)

- Glencore Agriculture

- CHS Inc.

- Wilmar International

- Olam International

- Syngenta Group

- Bayer AG

- Corteva Agriscience

- Nutrien Ltd.

- The Mosaic Company

- Agco Corporation

- John Deere (Deere & Company)

- CNH Industrial N.V.

- Bühler Group

- Viterra (formerly Glencore Agriculture)

- Seaboard Corporation

- Gavilon Group, LLC

Frequently Asked Questions

Analyze common user questions about the Grain Farming market and generate a concise list of summarized FAQs reflecting key topics and concerns.What primary factors are currently driving the growth of the global Grain Farming Market?

The market is primarily driven by persistent global population expansion, which guarantees foundational demand, coupled with rising global consumption of meat requiring high volumes of feed grains (maize, soy). Additionally, the mandated expansion of the biofuel industry and the rapid adoption of productivity-enhancing precision agriculture technologies are key economic accelerators for the sector.

How is climate change impacting the future stability and profitability of grain production?

Climate change introduces significant volatility, manifesting as increased frequency of extreme weather events like droughts, floods, and unpredictable frost patterns, which directly reduce expected yields and increase operational risk. This impact necessitates substantial investment in climate-resilient crop genetics, advanced irrigation systems, and comprehensive crop insurance schemes to maintain supply chain stability.

What role does Artificial Intelligence (AI) play in enhancing grain farming efficiency?

AI is crucial for predictive agriculture, utilizing machine learning algorithms to analyze vast datasets from sensors and satellites for optimal resource management. AI enables variable rate application of fertilizers and pesticides, advanced disease detection, and yield forecasting, resulting in optimized input costs and minimized environmental impact across large-scale farming operations.

Which geographical region represents the largest market share in grain farming and why?

The Asia Pacific (APAC) region typically holds the largest market share in terms of volume of production and consumption, driven overwhelmingly by the sheer scale of rice and wheat production in countries like China and India, necessary to feed their vast populations and meet fundamental food security objectives.

What are the key differences between conventional and sustainable/organic grain farming methods in terms of market value?

Conventional farming focuses on high volume and efficiency using synthetic inputs, dominating the bulk commodity market. Sustainable and organic methods, conversely, prioritize soil health and environmental conservation, use natural inputs, and, while having lower yields, command significantly higher price premiums due to specific consumer demand and specialized market certifications.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager