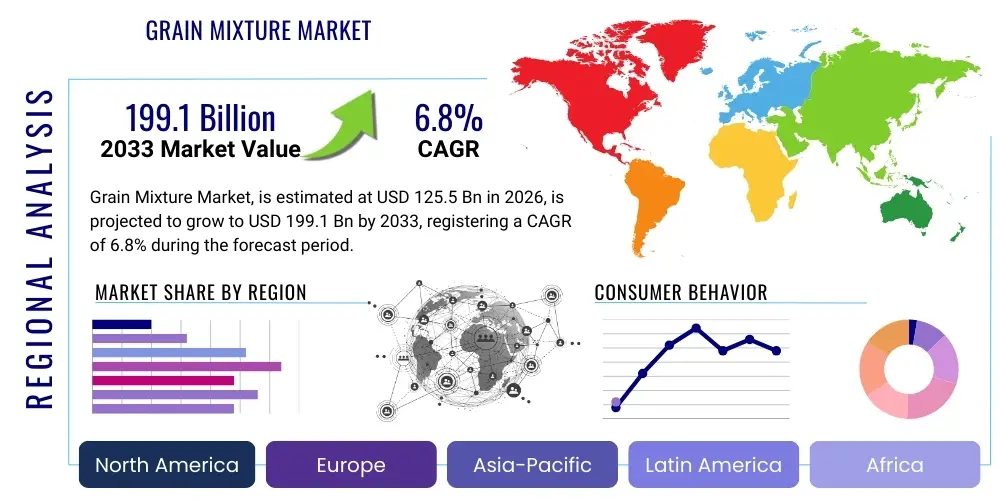

Grain Mixture Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438748 | Date : Dec, 2025 | Pages : 251 | Region : Global | Publisher : MRU

Grain Mixture Market Size

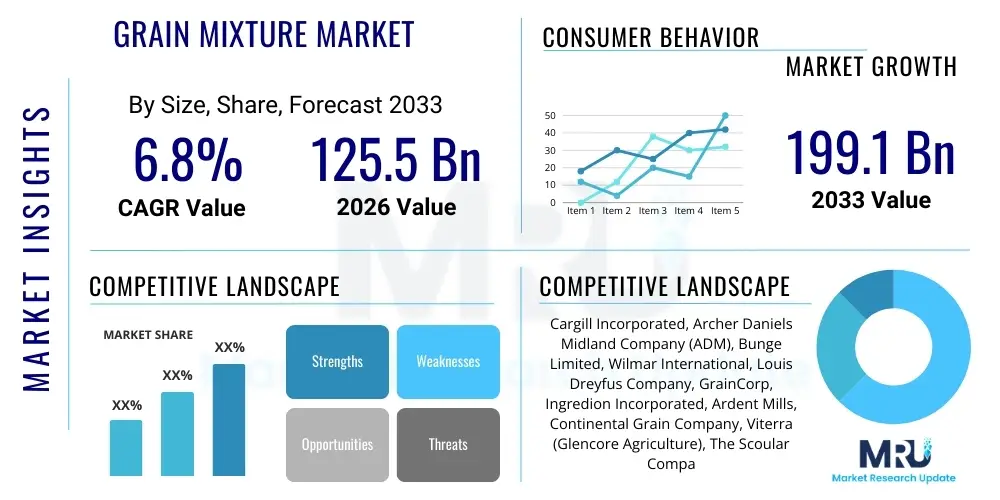

The Grain Mixture Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 125.5 Billion in 2026 and is projected to reach USD 199.1 Billion by the end of the forecast period in 2033.

Grain Mixture Market introduction

The Grain Mixture Market encompasses a diverse range of blended grain products designed for human consumption, animal feed, and industrial applications such as baking and brewing. These mixtures combine various staple grains (like wheat, corn, rice, barley, and oats) with specialty or ancient grains (quinoa, millet, spelt, amaranth) to achieve specific nutritional profiles, texture, flavor, and functional properties. The core value proposition of grain mixtures lies in convenience, enhanced nutritional density through complementary protein and fiber sources, and cost-effective bulk production tailored to end-user specifications.

Major applications of grain mixtures span across the global food system. In the human nutrition segment, they are foundational ingredients for breakfast cereals, ready-to-eat meals, instant baking mixes, and health-focused snack bars. For the livestock industry, grain mixtures form the bulk of compounded animal feed, optimized for poultry, swine, and cattle to maximize growth rates and efficiency. The rising consumer awareness regarding gut health, clean labels, and the benefits of whole grains is a significant driving factor, pushing manufacturers to innovate with complex, multi-grain formulations that appeal to health-conscious demographics seeking nutrient diversity.

Key benefits driving market adoption include improved food security through utilization of diverse grain sources, enhanced flavor complexity compared to single-grain products, and the ability to fortify foods with essential micronutrients during the blending process. Furthermore, the market is responding to global sustainability trends by incorporating drought-resistant or locally sourced grains, diversifying the agricultural portfolio, and minimizing reliance on monocultures. The driving factors are intrinsically linked to population growth, expanding livestock production, and an accelerating shift in developed economies toward preventative health diets emphasizing high fiber and complex carbohydrates.

Grain Mixture Market Executive Summary

The Grain Mixture Market is currently experiencing robust momentum, primarily fueled by shifting consumer preferences toward whole, ancient, and non-GMO grains, alongside sustained demand from the globally expanding animal feed sector. Business trends indicate a strong move towards vertical integration among major agricultural players, aiming to control quality and stabilize supply chains amidst increasing global climate volatility. There is a marked emphasis on functional grain mixtures, incorporating ingredients like flaxseed, chia, and specialized pulses, positioning the blends as essential components in functional foods and nutraceuticals. Strategic partnerships between large food processors and specialty grain suppliers are becoming commonplace to ensure consistent access to niche, high-value ingredients, thereby minimizing price exposure risks inherent in staple commodity markets.

Regionally, the Asia Pacific (APAC) stands out as the primary growth engine, driven by rapid urbanization, substantial population density, and expanding middle-class consumption patterns, particularly in packaged and convenience foods. Simultaneously, North America and Europe maintain a stronghold in the premium and specialty segment, focusing heavily on certified organic, gluten-free, and personalized nutrition blends. Regulatory frameworks concerning food safety and traceability, particularly in the European Union, are significantly influencing processing standards and ingredient sourcing, compelling manufacturers to invest in advanced blending and segregation technologies. This regional divergence in regulatory requirements and consumer priorities necessitates tailored product development strategies for multinational corporations.

Segmentation trends reveal that the animal feed segment, particularly mixtures dedicated to poultry and aquaculture, remains the largest revenue contributor due to intensive farming practices globally. However, the fastest-growing segment is anticipated to be the human consumption category focused on fortified and functional baked goods, capitalizing on the demand for convenient, health-boosting breakfast and snack options. Furthermore, the market is observing segmentation by grain type, with ancient grain mixtures gaining traction over traditional blends, reflecting a consumer willingness to pay a premium for perceived health and heritage benefits. Technology adoption, particularly in precision blending and real-time quality assurance, is key to managing the complexity of multi-ingredient mixtures and ensuring consistent final product quality across diverse segment requirements.

AI Impact Analysis on Grain Mixture Market

User inquiries concerning the impact of Artificial Intelligence (AI) on the Grain Mixture Market primarily center on optimizing resource efficiency, enhancing quality control, and enabling personalization. Users are keenly interested in how AI can manage the volatility of commodity pricing and logistics, specifically asking how predictive algorithms can forecast optimal blending ratios based on fluctuating ingredient costs while maintaining targeted nutritional specifications. Concerns also revolve around AI’s role in traceability systems, ensuring transparency regarding the origin of each grain component in complex mixtures, and reducing human error in large-scale processing environments. Expectations are high regarding AI-driven crop yield forecasting, which promises greater supply chain resilience and better inventory management for grain procurement managers, ultimately leading to more stable product pricing for end consumers.

The implementation of AI is revolutionizing the production of grain mixtures by optimizing blending algorithms. Machine learning models analyze vast datasets encompassing ingredient nutritional metrics, current market pricing, processing equipment constraints, and consumer demand forecasts to determine the most cost-effective and nutritionally precise formulation in real-time. This capability drastically reduces waste and raw material expenditure, while ensuring that mixtures consistently meet stringent regulatory and client specifications. Furthermore, computer vision systems, powered by deep learning, are being integrated into processing lines to perform instant quality assessments, detecting foreign materials, inspecting grain size uniformity, and identifying contaminated batches with unparalleled speed and accuracy, thereby elevating overall food safety standards.

AI's influence extends deeply into demand forecasting and personalized product development. By analyzing purchasing patterns, dietary restrictions, and regional taste preferences, AI assists manufacturers in identifying optimal niche markets for customized grain mixtures, such as low-glycemic or high-protein blends for specific demographic groups. In the agricultural upstream, AI-driven climate models and yield predictions allow processors to lock in favorable supply contracts, mitigating risks associated with extreme weather events or pest outbreaks, ensuring a continuous and predictable flow of raw materials necessary for large-volume mixture production. This technological integration transforms traditional batch processing into a highly dynamic, data-driven operation, capable of rapid adaptation to external pressures.

- AI-powered predictive analytics optimize blend formulations based on real-time commodity pricing and nutritional targets, ensuring cost efficiency.

- Machine learning algorithms enhance traceability by mapping the origin and processing history of every batch component.

- Computer vision systems enable rapid, non-destructive quality control, detecting defects and contaminants during mixing and packaging.

- AI improves supply chain resilience by providing accurate, probabilistic forecasts of crop yields and geopolitical risks affecting grain availability.

- Personalized nutrition trends are supported by AI models that recommend and develop customized grain mixtures tailored to individual health requirements.

DRO & Impact Forces Of Grain Mixture Market

The dynamics of the Grain Mixture Market are governed by a complex interplay of drivers, restraints, and opportunities, collectively shaping the direction and pace of growth. A primary driver is the accelerating global shift toward preventative health and wellness, which positions whole grains and complex carbohydrates as essential components of a balanced diet, directly boosting demand for multi-grain mixtures in packaged foods. Simultaneously, the sustained expansion of the intensive animal farming industry, particularly in developing economies, guarantees a high-volume demand floor for cost-effective, nutritionally balanced feed mixtures. The impact force of demographic shifts, specifically population growth and urbanization, reinforces these drivers by increasing the need for convenient, scalable, and stable food sources.

However, the market faces significant restraints. High price volatility in key commodity markets (e.g., wheat and corn) due to climate change, geopolitical conflicts, and energy cost fluctuations poses substantial financial risks to processors, making consistent pricing difficult. Furthermore, stringent and varied food safety regulations across different countries necessitate costly compliance measures and complex segregation logistics, particularly when dealing with cross-contamination concerns like gluten or allergens. These restraints are compounded by the negative impact force of consumer skepticism regarding highly processed foods, demanding clearer labeling and verification of ingredient purity, pushing up operational costs related to sourcing and certification.

Opportunities for growth primarily lie in technological advancements and product diversification. The rising popularity of plant-based diets and the search for sustainable protein sources offer avenues for developing novel, high-protein grain and pulse mixtures that serve as meat or dairy alternatives. Furthermore, expanding into fortified and functional segments, such as mixtures enriched with probiotics, vitamins, or specialized fibers (e.g., resistant starch), allows manufacturers to capture higher profit margins. The strong impact force of technological innovation, particularly in advanced milling and extrusion techniques, enables the creation of products with superior bioavailability and shelf stability, meeting the needs of modern retail and e-commerce supply chains and allowing the market to effectively counteract some of the prevailing restraints.

Segmentation Analysis

The Grain Mixture Market is broadly segmented based on application (human consumption vs. animal feed), grain type (traditional, ancient, specialty), form (whole, flaked, ground), and distribution channel. Understanding these segments is crucial for strategizing market penetration and resource allocation. The segmentation by application reveals a dual-speed market: the high-volume, cost-sensitive animal feed sector provides market stability, while the human consumption sector offers higher growth and margin potential through premiumization and differentiation based on health attributes like organic certification or specific functional ingredients. The demand for customized blends is increasing across all segments, necessitating flexible manufacturing capabilities.

A detailed analysis of segmentation by grain type shows a distinct divergence from conventional staple grains. While traditional mixtures (dominated by wheat and corn) still constitute the bulk in terms of volume, the specialty and ancient grain mixtures (including quinoa, millet, buckwheat, and teff) are experiencing exponential growth. This trend is driven by heightened consumer education regarding the nutritional superiority, non-GMO status, and perceived purity of ancient varieties. Manufacturers are strategically introducing these novel grains into existing mixtures to enhance market appeal and command premium pricing, often marketing them with clear provenance and sustainability stories.

Segmentation by form indicates a strong demand for processed forms, such as flaked or ground mixtures, particularly in the ready-to-eat and industrial baking sectors, due to the ease of incorporation into final products and reduced preparation time. However, the whole grain mixture segment retains importance, catering to consumers who prefer maximum nutritional integrity and perform their own milling or preparation. The rise of private label brands is also influencing distribution segmentation, increasing competition in retail channels and forcing traditional brand manufacturers to innovate rapidly to maintain market share against lower-cost alternatives.

- By Application:

- Human Consumption (Baking, Breakfast Cereals, Snacks, Ready Meals)

- Animal Feed (Poultry, Swine, Cattle, Aquaculture)

- Industrial (Brewing, Starch Production)

- By Grain Type:

- Traditional Grains (Wheat, Corn, Rice, Barley, Oats)

- Ancient and Specialty Grains (Quinoa, Millet, Amaranth, Spelt, Teff)

- By Form:

- Whole Grain Mixtures

- Flaked/Rolled Mixtures

- Ground/Flour Mixtures

- Extruded Pellets

- By Distribution Channel:

- Direct Sales (B2B Industrial Contracts)

- Indirect Sales (Supermarkets, Hypermarkets, Online Retail)

Value Chain Analysis For Grain Mixture Market

The value chain for the Grain Mixture Market is intricate, beginning with upstream agricultural production and culminating in distribution to end-users. Upstream activities involve cultivation, harvesting, and primary processing (drying, cleaning) of diverse grain inputs, often sourced globally. A critical aspect of the upstream analysis is ensuring sustainable sourcing and traceability, particularly for specialty and ancient grains, which require specialized farming techniques. Grain procurement managers must navigate volatile commodity markets, relying on sophisticated hedging and storage logistics to ensure a stable supply of raw materials, which represents the highest cost component of the value chain. Failures in upstream quality control can significantly impact the safety and nutritional integrity of the final mixture.

The midstream stage, which involves the actual processing, is where value addition primarily occurs. This includes cleaning, sorting (often utilizing optical sorters to remove foreign matter), milling, and crucially, precision blending. Advanced blending facilities use automated systems to mix multiple grains according to proprietary formulations, ensuring homogenous distribution of ingredients and nutritional components. Quality assurance (QA) protocols, including pathogen testing and allergen management, are stringent at this stage. The efficiency of the blending process directly dictates the manufacturer's profitability, making investment in high-throughput, flexible blending technology essential for competitive advantage.

Downstream activities focus on packaging, marketing, and distribution. Distribution channels are highly segregated: large industrial customers (e.g., feed mills, large bakeries) receive bulk shipments via direct contract, minimizing intermediary costs. Conversely, human consumption mixtures targeted at retail are distributed indirectly through national and international wholesalers, distributors, and ultimately, supermarket chains or e-commerce platforms. The complexity of downstream logistics increases with product differentiation, requiring specialized packaging (e.g., modified atmosphere packaging for shelf stability) and temperature-controlled transport, particularly for fresh or ready-mix products. Effective marketing, emphasizing health benefits and provenance, is key to driving demand in the competitive retail environment.

Grain Mixture Market Potential Customers

The Grain Mixture Market serves a broad spectrum of end-users, reflecting the fundamental role of grains in global nutrition and commerce. The largest volume buyers are the integrated industrial feed manufacturers and livestock producers, including large-scale poultry, swine, and aquaculture operations that require massive quantities of consistent, energy-dense, and protein-balanced mixtures for optimal animal health and productivity. These customers prioritize cost-efficiency, bulk delivery, and strict adherence to nutritional guarantees specified by veterinarians and livestock scientists. Long-term supply contracts and customization based on regional climate and specific animal life stages are standard business practices in this segment.

Another major category of potential customers includes large commercial bakeries, breakfast cereal manufacturers, and CPG (Consumer Packaged Goods) companies. These entities utilize grain mixtures as primary ingredients for bread, pastas, snack foods, and ready-to-eat products. Their purchasing decisions are heavily influenced by blend consistency, functional properties (e.g., specific water absorption rates, gluten quality), and the ability of the mixture to align with clean label or health claims (e.g., 'source of whole grain,' 'high fiber'). They require mixtures in highly processed forms like flours or flaked materials and often demand co-development of specialized blends for unique product launches.

The fastest-growing segment consists of health food retailers, specialty food processors, and direct-to-consumer meal kit services. These customers seek premium, certified grain mixtures, often organic, gluten-free, or featuring ancient grains, targeting health-conscious consumers willing to pay a premium. Additionally, institutional buyers such as hospitals, schools, and military commissaries represent stable, high-volume purchasers, guided by nutritional standards and budgetary constraints. Finally, exporters and trading houses serve as important buyers, aggregating local mixtures for international markets, thereby expanding the geographical reach of regional producers.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 125.5 Billion |

| Market Forecast in 2033 | USD 199.1 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Cargill Incorporated, Archer Daniels Midland Company (ADM), Bunge Limited, Wilmar International, Louis Dreyfus Company, GrainCorp, Ingredion Incorporated, Ardent Mills, Continental Grain Company, Viterra (Glencore Agriculture), The Scoular Company, ADM Milling, Tate & Lyle PLC, SunOpta, SEMO Milling |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Grain Mixture Market Key Technology Landscape

The technological landscape of the Grain Mixture Market is rapidly evolving, moving beyond traditional batch mixing to highly sophisticated, continuous blending systems that ensure precision and speed. Key technologies focus on minimizing segregation of components after mixing, enhancing ingredient bioavailability, and ensuring stringent quality and safety standards. Continuous flow blending systems, often employing gravimetric feeders and advanced sensor arrays, are critical for maintaining tight tolerance on component ratios, which is vital for specialized nutritional mixtures like balanced animal feed or fortified flours. These systems reduce labor costs and increase production throughput compared to older volumetric mixing methods.

Processing technologies applied to raw grains before mixing are also pivotal. Micronization and specialized milling techniques, such as air-jet milling, are used to achieve extremely fine and uniform particle sizes for enhanced texture and better absorption in the final food product. Furthermore, extrusion technology remains crucial, particularly for producing breakfast cereals, snacks, and pelletized animal feed. Modern extruders utilize precise temperature and pressure controls to gelatinize starches, destroy anti-nutritional factors, and form products into desired shapes, significantly impacting the nutritional value and shelf life of the resulting grain mixture product. The integration of advanced drying technologies, like vacuum drying, helps preserve the nutritional integrity of sensitive grains and extends storage duration.

In terms of quality control and supply chain management, advanced sorting technologies dominate the landscape. High-resolution optical sorters equipped with NIR (Near-Infrared) spectroscopy and advanced camera sensors analyze each grain for color, shape, and chemical composition, efficiently removing defects, mycotoxins, and foreign materials before blending. This non-destructive testing ensures only pristine raw materials enter the mixture. Furthermore, the rising use of Blockchain technology is beginning to address complex traceability requirements, creating an immutable ledger that tracks every grain component from the farm to the blending facility, providing transparency essential for satisfying increasingly rigorous consumer and regulatory demands, particularly concerning organic or non-GMO certifications.

Regional Highlights

The Grain Mixture Market exhibits distinct regional consumption patterns and growth drivers, necessitating localized strategic approaches for global manufacturers. Asia Pacific (APAC) dominates the market in terms of volume and is projected to demonstrate the highest CAGR during the forecast period. This growth is underpinned by substantial demand for packaged convenience foods driven by urbanization, increasing disposable incomes, and the massive scale of the regional livestock industry, particularly in China and India. The focus here is balanced between cost-competitive animal feed mixtures and rapidly growing demand for health-oriented human consumption products, including local grain staples and modern snack foods.

North America is a mature but highly innovative market, characterized by strong consumer preference for specialty, functional, and premium grain mixtures, such as organic, gluten-free, and ancient grain blends. The region boasts advanced food processing infrastructure and high regulatory standards for food safety and labeling. Market growth is driven by product innovation in the breakfast cereal, baking mix, and nutritional bar sectors, alongside a steady demand from large, centralized animal feeding operations utilizing technologically sophisticated feed formulations to maximize efficiency.

Europe represents a crucial market segment defined by strict quality control, rigorous traceability requirements, and a strong emphasis on sustainability and Non-GMO verification. European consumers are highly receptive to novel grains and plant-based protein mixtures. The focus in Europe is less on volume expansion and more on high-value, differentiated products that cater to specialty bakeries and the burgeoning clean-label food movement. The Middle East and Africa (MEA) and Latin America (LATAM) markets, while currently smaller, offer substantial untapped potential driven by rapid population expansion, modernization of agricultural practices, and increasing reliance on imported or regionally blended convenience foods.

- Asia Pacific (APAC): Highest volume and growth rate, driven by urbanization, expanding middle class, and massive animal feed sector in China and India.

- North America: Focus on premiumization, functional blends (e.g., high protein, specialty fiber), and technological adoption in processing.

- Europe: Characterized by stringent food safety regulations, strong demand for certified organic and sustainable ingredients, and high value attached to traceability.

- Latin America (LATAM): Emerging potential fueled by population growth and increasing investment in modern food production and livestock farming techniques.

- Middle East and Africa (MEA): Growth driven by increased food security initiatives, modernization of local diets, and reliance on imported packaged mixtures.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Grain Mixture Market.- Cargill Incorporated

- Archer Daniels Midland Company (ADM)

- Bunge Limited

- Wilmar International

- Louis Dreyfus Company

- GrainCorp

- Ingredion Incorporated

- Ardent Mills

- Continental Grain Company

- Viterra (Glencore Agriculture)

- The Scoular Company

- ADM Milling

- Tate & Lyle PLC

- SunOpta

- SEMO Milling

- AgriPure Processing

- General Mills (Ingredients Division)

- Bay State Milling Company

- Conagra Brands (Ingredient Solutions)

- Perdue Farms

Frequently Asked Questions

Analyze common user questions about the Grain Mixture market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary factors driving the growth of the Grain Mixture Market globally?

The primary drivers include escalating consumer interest in whole grains and functional foods for improved health outcomes, sustained high-volume demand from the global animal feed industry, and the need for cost-effective, nutritionally complete ingredients in mass food production across developing economies.

How does the volatile pricing of agricultural commodities impact the production of grain mixtures?

Commodity price volatility necessitates sophisticated hedging strategies and real-time algorithmic blending optimization. Manufacturers use technology (including AI) to dynamically adjust input ratios and source alternative, cost-effective grains to maintain stable product pricing and target nutritional profiles without compromising quality.

Which grain mixture segment is expected to show the highest growth rate during the forecast period?

The human consumption segment, specifically mixtures incorporating ancient and specialty grains (such as quinoa and millet) for use in fortified baked goods and functional snacks, is projected to exhibit the highest Compound Annual Growth Rate due to premiumization and clean label demand.

What role does traceability technology play in the modern Grain Mixture Market supply chain?

Traceability, often enabled by technologies like Blockchain, is critical for verifying the origin, quality, and processing history of each ingredient. This satisfies stringent regulatory requirements (especially in Europe) and meets consumer demand for transparency regarding organic, non-GMO, and allergen-free certifications, minimizing contamination risk.

What are the main regional growth opportunities for grain mixture manufacturers?

Asia Pacific (APAC) offers the largest volume growth potential driven by rapidly expanding population and consumption shifts. North America and Europe offer high-margin opportunities through innovation in specialty, premium, and personalized nutrition blends targeting specific health and dietary needs.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager