Granite and Quartz Sinks Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438829 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Granite and Quartz Sinks Market Size

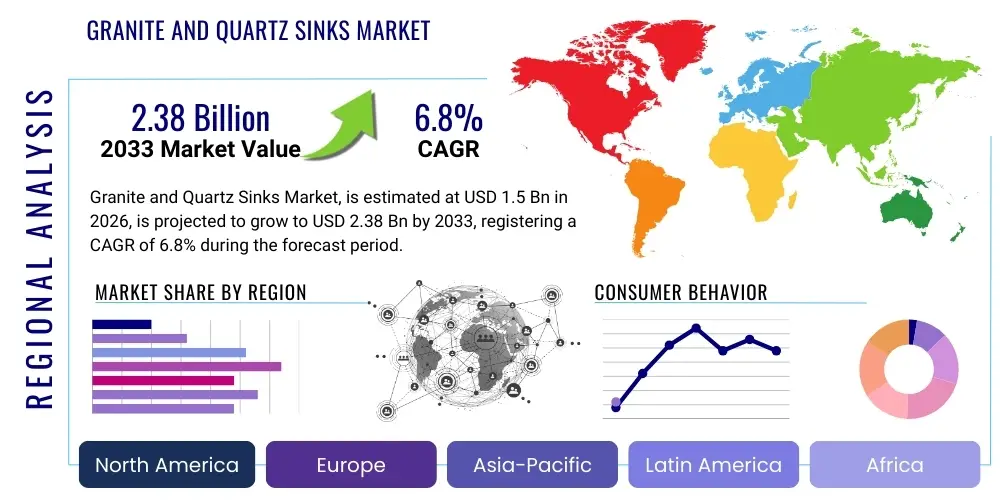

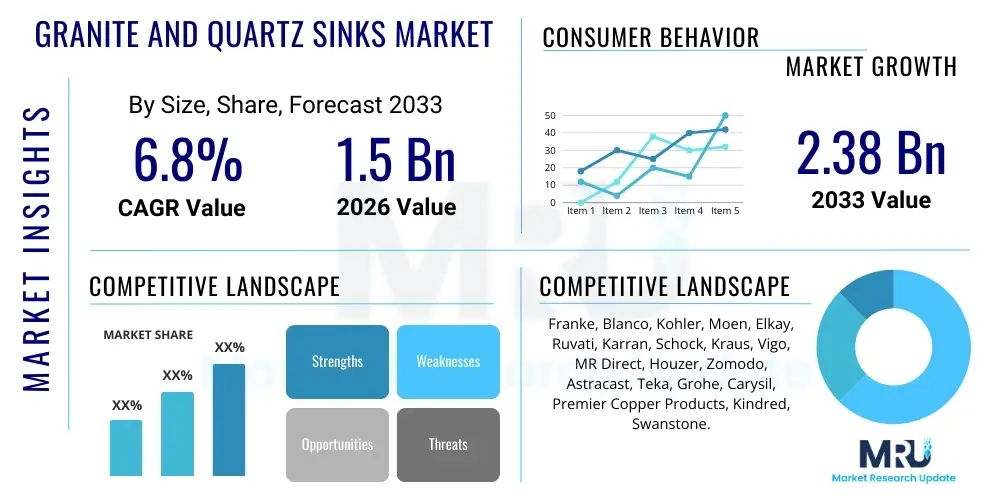

The Granite and Quartz Sinks Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 1.5 Billion in 2026 and is projected to reach USD 2.38 Billion by the end of the forecast period in 2033.

Granite and Quartz Sinks Market introduction

The Granite and Quartz Sinks Market encompasses the manufacturing, distribution, and sale of kitchen and utility sinks constructed primarily from composite materials combining natural granite or quartz particles with high-grade acrylic resins. These materials offer superior durability, resistance to heat, scratching, and chipping compared to traditional stainless steel or ceramic options, positioning them as premium solutions in modern kitchen design. The intrinsic aesthetic appeal, characterized by a range of color options and a natural stone look, drives consumer preference in both new construction and renovation projects globally. The product scope spans various designs, including single bowl, double bowl, and farmhouse configurations, catering to diverse functional and stylistic requirements across residential and commercial sectors. The manufacturing process often involves complex compression molding techniques to ensure a non-porous and hygienic surface, enhancing the long-term value proposition for end-users.

Major applications for granite and quartz composite sinks reside predominantly within the residential remodeling segment, where homeowners seek high-performance, aesthetically pleasing fixtures that complement high-end countertops made of similar stone materials. Furthermore, the commercial sector, including hospitality (hotels), multi-family housing, and sophisticated office kitchenettes, represents a significant application area, valuing the material's resilience and ease of maintenance in high-traffic environments. These sinks are integral components of modern kitchen architecture, serving both utilitarian purposes and acting as focal design elements. The market's growth is inherently linked to global trends in housing starts, disposable income levels, and the increasing consumer willingness to invest in durable and visually appealing kitchen infrastructure.

Key driving factors fueling market expansion include heightened consumer awareness regarding the benefits of composite materials, notably their resistance to staining and bacterial growth, which is a major advantage over older sink technologies. The ongoing trend towards open-plan living and gourmet kitchens necessitates fixtures that are both functional and visually integrated with the overall interior design. Moreover, technological advancements in resin formulas and coloring techniques allow manufacturers to offer a broader spectrum of textures and colors, appealing to a wider demographic and design palette. The longevity and reduced need for replacement associated with these composite sinks provide a strong economic justification for their premium pricing, supporting sustained market growth.

Granite and Quartz Sinks Market Executive Summary

The Granite and Quartz Sinks Market is defined by robust growth, driven primarily by favorable macroeconomic conditions in residential construction and a sustained consumer focus on kitchen aesthetics and longevity. Business trends indicate a strong move toward product diversification, with manufacturers investing heavily in R&D to enhance composite material properties, such as improved UV resistance and antimicrobial characteristics. Strategic partnerships between sink producers and countertop fabricators are becoming common to offer bundled solutions, simplifying the procurement process for builders and remodelers. Furthermore, the increasing adoption of e-commerce platforms has widened market accessibility, allowing niche brands to compete effectively with established industry leaders, thereby intensifying competitive dynamics and fostering price optimization across various product lines. Sustainability remains a crucial trend, with companies exploring methods to incorporate recycled content into composite formulations.

Regionally, the market exhibits strong expansion potential in the Asia Pacific (APAC) area, propelled by rapid urbanization, increasing middle-class income, and extensive government investments in housing infrastructure, particularly in countries like China and India. North America and Europe maintain dominance in terms of market value, characterized by mature renovation markets and a high consumer propensity for premium home upgrades. These regions are setting trends for high-end features, such as integrated drainboards and customized color palettes. Conversely, emerging markets in Latin America and the Middle East and Africa (MEA) are seeing accelerated adoption rates as design preferences align with global premium standards, albeit constrained occasionally by volatility in construction cycles and raw material supply chains.

In terms of segment trends, the Undermount installation segment holds a commanding position, favored for its seamless integration with modern stone countertops, facilitating easier cleanup and providing a sleek, uninterrupted counter surface. Material segmentation shows that quartz composite sinks are rapidly gaining traction, often preferred for their slightly more uniform appearance and vibrant color options compared to the traditional, textured look of granite composite. The double bowl configuration continues to dominate the residential market, providing optimal functionality for multitasking during food preparation and dishwashing. The commercial segment is exhibiting increased demand for customized, large-format sinks capable of handling intensive use, driving innovation in material resilience and structural integrity.

AI Impact Analysis on Granite and Quartz Sinks Market

User inquiries regarding the intersection of AI and the Granite and Quartz Sinks Market frequently center on themes of enhanced manufacturing efficiency, personalized consumer experience, and streamlined supply chain logistics. Users commonly question how AI might optimize material mixing ratios to achieve superior strength or thermal resistance in composite formulations, moving beyond traditional trial-and-error methods. Concerns also emerge regarding the potential for AI-driven design tools to influence aesthetic trends, predicting future popular colors, shapes, and textures before they enter the mass market. Furthermore, a significant cluster of questions addresses the deployment of AI in quality control (QC), using machine vision systems to detect microscopic flaws or irregularities in sink surfaces immediately post-molding, thereby ensuring a higher final product standard and reducing waste. These themes highlight a strong expectation that AI will primarily serve as an optimization tool for production and an analytical engine for demand forecasting and consumer preference modeling.

- AI-Powered Manufacturing Optimization: Utilizing machine learning algorithms to optimize the precise mixture of granite/quartz particles and resin, leading to enhanced material strength, reduced porosity, and minimized material consumption during molding processes.

- Predictive Maintenance: AI tools monitoring the performance of high-pressure molding equipment, identifying anomalies, and scheduling maintenance preemptively, reducing downtime and extending the lifespan of critical machinery.

- Automated Quality Control (AQC): Implementing AI-driven computer vision systems on assembly lines to instantly scan sink surfaces for defects (scratches, uneven pigmentation, air bubbles) with greater accuracy and speed than human inspectors.

- Personalized Design Recommendations: AI systems analyzing consumer purchasing data and interior design trends to recommend bespoke sink configurations, colors, and installation types, enhancing the conversion rate for online retailers.

- Demand Forecasting and Supply Chain Efficiency: Using predictive analytics to model seasonal fluctuations in renovation and construction activity, enabling manufacturers to optimize inventory levels of raw materials (granite dust, resins, pigments) and finished goods, thereby minimizing storage costs and mitigating stockouts.

DRO & Impact Forces Of Granite and Quartz Sinks Market

The market trajectory is heavily influenced by a balanced interplay of robust drivers, significant restraints, and emerging opportunities, collectively defining the impact forces on the granite and quartz sinks sector. Key drivers include the growing consumer preference for premium, aesthetically superior kitchen fixtures, coupled with the proven longevity and low maintenance requirements of composite materials. The global surge in renovation and remodeling activities, especially in developed economies where kitchens are treated as primary social spaces, provides consistent upward momentum. Conversely, major restraints include the high initial production cost associated with sourcing high-grade materials and utilizing specialized manufacturing equipment, which translates into higher retail prices compared to stainless steel alternatives, potentially limiting adoption in budget-conscious segments. Furthermore, the market's dependence on construction cycles renders it susceptible to macroeconomic downturns and fluctuating raw material costs, particularly petrochemical derivatives used in the resin components.

Opportunities for growth are abundant, notably through geographical expansion into high-growth developing markets where disposable incomes are rising and modern housing standards are being adopted. Product innovation offers another fertile ground, focusing on developing sustainable composite formulations utilizing bio-based resins or recycled content to appeal to environmentally conscious consumers. Furthermore, diversification into utility rooms, laundry spaces, and specialized outdoor kitchen applications allows manufacturers to broaden their total addressable market beyond conventional kitchen installations. The potential for strategic acquisitions of smaller, technologically innovative firms also exists, allowing larger players to quickly integrate new manufacturing patents or gain immediate access to novel distribution networks, particularly in regional specialty markets. The strategic management of these forces is paramount for long-term sustainable growth.

The impact forces are driven by substitution risk and competitive intensity. The substitution threat is moderate, primarily stemming from advanced stainless steel technologies (thicker gauges, sound dampening) and specialized ceramics (fireclay), though composite sinks retain an aesthetic edge. Competitive intensity is high due to the presence of global giants and numerous local composite specialists, necessitating constant innovation in design, features (e.g., integrated cutting boards, custom fittings), and pricing strategies. The bargaining power of buyers remains moderate, as they have alternatives but are often locked into specific material choices once the countertop decision is made. Supplier power is also moderate, contingent on the volatile pricing of key raw materials like specialized resins and high-purity quartz aggregates, requiring robust procurement strategies to mitigate cost fluctuations and ensure supply stability. Ultimately, market acceleration is contingent upon sustained consumer confidence in housing investments.

Segmentation Analysis

The Granite and Quartz Sinks Market is comprehensively segmented based on material composition, installation method, bowl configuration, and end-use application, allowing for targeted product development and marketing strategies. Segmentation by material is critical, differentiating between granite composite, which typically offers a rougher, more natural texture, and quartz composite, often favored for a smoother finish and brighter color options. Installation method segmentation highlights the dominant position of Undermount sinks in premium projects, contrasted with the ease of installation associated with Drop-in (top-mount) models prevalent in mass-market renovations. Analyzing these segments provides a clear pathway for manufacturers to align production capacities with specific consumer demands in regional markets, recognizing that aesthetic trends often dictate material and installation preferences.

The segmentation by bowl configuration, which includes single bowl, double bowl, and specialty configurations (e.g., low-divide), directly reflects the functional requirements of the user base. Single bowls are preferred for maximizing usable washing space, especially for large pots and pans, while double bowls offer multi-functionality, allowing for simultaneous washing and rinsing or dirty and clean separation. End-use segmentation, encompassing residential and commercial sectors, further refines the market understanding, noting that commercial applications prioritize extreme durability and resistance to harsh cleaning agents over purely aesthetic considerations. This detailed breakdown ensures that market forecasts accurately reflect the specific dynamics influencing each product variant, supporting strategic decision-making for pricing and inventory management across the value chain.

- By Material:

- Granite Composite

- Quartz Composite

- By Installation:

- Drop-in (Top-Mount)

- Undermount

- Apron Front (Farmhouse)

- By Bowl Configuration:

- Single Bowl

- Double Bowl

- Other (Triple Bowl, Low-Divide)

- By End-Use:

- Residential (New Construction, Remodeling)

- Commercial (Hospitality, Office, Healthcare)

Value Chain Analysis For Granite and Quartz Sinks Market

The value chain for the Granite and Quartz Sinks Market begins with the upstream procurement of specialized raw materials, primarily high-quality quartz or granite aggregate, acrylic or polyester resins, and specialized color pigments. The upstream phase is crucial as the quality and consistency of these inputs directly determine the final product's durability, heat resistance, and aesthetic finish. Key upstream activities involve mining and purification of the natural stone components and the chemical synthesis of proprietary resin blends. Suppliers operating in this segment often require high capital expenditure for processing and quality control, resulting in moderate supplier bargaining power, particularly for high-performance resins that offer specific material properties like enhanced UV stability or antimicrobial features. Efficient sourcing and establishing long-term contracts with reliable chemical suppliers are vital for manufacturers to stabilize production costs and ensure continuous supply of consistent material grades.

The midstream phase focuses on manufacturing, where the composite mixture is molded, typically using highly sophisticated high-pressure injection or vacuum-casting techniques, followed by curing, sanding, and polishing. This stage is characterized by significant investment in proprietary molding technology and rigorous quality assurance protocols to maintain the non-porous and homogenous structure of the sink. Downstream activities involve distribution and sales. The distribution channel is multifaceted, relying heavily on direct sales to large construction and remodeling contractors (B2B) and indirect sales through kitchen and bath showrooms, specialty distributors, and major home improvement retail chains (B2C). The shift toward e-commerce is transforming the downstream, allowing specialized sink brands to bypass traditional showrooms and reach end-consumers directly, necessitating refined logistics and customer service models.

The direct channel, involving direct procurement by major home builders or large commercial project developers, offers manufacturers higher volume sales and more predictable demand. The indirect channel relies on architectural and design specifications influenced by showroom displays and distributor recommendations; therefore, marketing efforts focused on influencing design professionals are critical for success in this route. The final stage involves installation and post-sales service, which, while not adding monetary value to the product itself, is crucial for reputation management and brand loyalty. Optimized logistics, minimizing breakage during transit, and comprehensive warranty programs solidify the perceived value of premium granite and quartz sinks, distinguishing market leaders from general suppliers. Effective management across all these stages ensures cost efficiency and maintains the premium positioning of the product category.

Granite and Quartz Sinks Market Potential Customers

The primary potential customers for granite and quartz sinks fall into two major categories: the residential sector, driven by new construction and, more significantly, the remodeling and upgrade market, and the commercial sector, which seeks durability and aesthetic continuity across large-scale projects. Within the residential segment, the affluent homeowner engaging in custom kitchen renovations represents the highest value customer, as they prioritize high-end materials, custom colors, and feature-rich designs (e.g., low-divide double bowls or integrated drain systems) regardless of cost constraints. Mid-market homeowners undertaking standard kitchen updates also constitute a massive potential customer base, typically seeking undermount, double-bowl configurations in neutral, popular colors like black, gray, or white, balancing quality with affordability for long-term home value enhancement. Furthermore, property developers specializing in luxury multi-family units are substantial bulk buyers, demanding consistent quality and supply chain reliability for large order volumes.

In the commercial domain, the hospitality industry, particularly high-end hotels and resorts, represents a significant customer base, valuing the sinks’ ability to withstand heavy use while maintaining a sophisticated appearance in guest suites and communal kitchenettes. Healthcare facilities and high-traffic office buildings are also potential buyers, driven by the non-porous and hygienic characteristics of composite materials, which aid in infection control and ease of deep cleaning. The crucial differentiator for commercial buyers, compared to residential consumers, is the emphasis on compliance with commercial-grade durability standards and the requirement for robust warranties covering prolonged heavy usage. Targeting these commercial segments requires specialized sales teams focused on specifications, bulk pricing, and adherence to complex construction schedules, distinguishing this customer acquisition strategy from direct-to-consumer marketing.

Therefore, the market’s potential is maximized by concurrently engaging specialized interior designers and architects who influence premium residential selections, and large-scale procurement officers in commercial and institutional development. Marketing content must be tailored to address the core needs of each segment: aesthetic appeal and long-term investment value for the residential user, and industrial durability, sanitation, and scalable supply for the commercial buyer. Effective customer acquisition strategies often involve collaborating directly with countertop fabricators, who serve as trusted advisors in both customer ecosystems, recommending composite sinks that seamlessly integrate with popular stone counter materials, thereby securing incremental sales through mutual partnership agreements and referrals.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.5 Billion |

| Market Forecast in 2033 | USD 2.38 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Franke, Blanco, Kohler, Moen, Elkay, Ruvati, Karran, Schock, Kraus, Vigo, MR Direct, Houzer, Zomodo, Astracast, Teka, Grohe, Carysil, Premier Copper Products, Kindred, Swanstone. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Granite and Quartz Sinks Market Key Technology Landscape

The technological landscape of the Granite and Quartz Sinks Market is centered on proprietary composite formulation and advanced casting methods designed to maximize product performance, durability, and aesthetic versatility. Key to manufacturing is the development of specialized acrylic or polyester resins (often thermoset polymers) that effectively bind the high volume of mineral particles (typically 70% to 80% quartz or granite) while maintaining superior non-porosity and resistance to thermal shock. Innovative curing techniques, such as vacuum-assisted casting or high-temperature compression molding, are crucial for ensuring the composite mixture achieves maximum density and structural integrity, eliminating microscopic air pockets that could otherwise compromise the sink's surface and harbor bacteria. Furthermore, advancements in nano-technology are being integrated, with some manufacturers applying surface treatments or embedding nano-silver particles during the molding phase to achieve permanent antimicrobial properties, enhancing the hygiene factor, a crucial selling point in both residential and commercial sectors.

Coloration technology represents another significant area of innovation, moving beyond simple uniform pigmentation to achieve complex, textured finishes that mimic natural stone variations more accurately. Manufacturers are utilizing advanced pigment dispersion techniques and UV stabilization technologies to ensure the colors remain vibrant and resistant to fading, particularly for sinks installed near windows or in environments subjected to strong light exposure. The integration of precision digital modeling and 3D printing in the prototyping phase allows for rapid iteration of new sink designs, optimizing ergonomics, drainage performance, and ease of installation before committing to expensive production tooling. These design technologies are essential for creating the complex shapes required for integrated features like customized ledges for accessories or unique apron-front styles that align with contemporary interior architecture trends.

In addition to core material and molding technologies, manufacturing efficiency is being enhanced through automation. Robotic handling systems are increasingly used for pouring, trimming, and polishing stages, which improves labor efficiency and, crucially, ensures highly uniform quality control across vast production runs. Investment in environmentally friendly manufacturing processes, such as closed-loop water usage systems and processes minimizing volatile organic compound (VOC) emissions from resins, is also a growing technological requirement driven by regulatory compliance and consumer preference for sustainable products. These sustained technological advancements ensure that composite sinks remain competitive against traditional materials by continuously pushing the boundaries of durability, aesthetic sophistication, and functional integration within the modern kitchen ecosystem, driving premium pricing and market differentiation.

Regional Highlights

North America maintains a dominant position in the Granite and Quartz Sinks Market, characterized by high consumer expenditure on home renovation projects and a strong preference for large, high-quality kitchen installations. The United States and Canada exhibit mature markets where composite sinks have penetrated the premium segment extensively, largely replacing stainless steel in custom and semi-custom housing developments. The regional demand is heavily influenced by prevailing interior design trends, particularly the demand for undermount installation types in neutral or darker composite colors that complement popular quartz and marble countertops. Housing starts and the resale market dynamics are crucial indicators for this region, with renovation cycles often driving short-term demand spikes. Regulatory standards relating to material safety and environmental compliance also dictate product formulation requirements within this highly regulated and quality-conscious consumer environment.

Europe represents another cornerstone of the global market, particularly Western European nations such as Germany, Italy, and the UK, which have long-standing traditions of quality kitchen manufacturing and design excellence. European consumers prioritize functional design, water efficiency, and durable materials, making granite and quartz composites highly appealing. Germany, in particular, is a significant manufacturing and consumption hub, where brands focus on ergonomic features and technological innovation, such as sinks with integrated waste management systems or heat-resistant properties suitable for commercial environments. The regional market growth is steady, supported by high disposable income and a culture of long-term investment in home infrastructure, though economic instability in Southern Europe occasionally acts as a dampener on construction activity. Manufacturers often adapt designs to suit smaller, more compact kitchen layouts common in dense urban centers.

The Asia Pacific (APAC) region is projected to register the fastest growth rate during the forecast period, fueled by rapid infrastructural development, escalating urbanization, and the proliferation of modern residential projects across densely populated economies. Countries like China and India are experiencing a massive transition from traditional ceramic or low-grade stainless steel sinks to durable composite options, driven by rising affluence and exposure to Western design standards through global media and e-commerce. While the market is highly fragmented in terms of pricing, there is a strong emerging appetite for mid-to-high end products, particularly in Tier 1 and Tier 2 cities. Supply chain management and localized distribution networks are critical challenges and opportunities in this region, requiring adaptation to diverse local tastes, including specific size requirements for varied kitchen layouts.

Latin America shows nascent but significant potential, with growth concentrated in economically stable areas like Brazil and Mexico. Market adoption is currently driven by luxury residential developments and high-end remodeling projects where developers aim to differentiate their properties with premium fixtures. The market here is sensitive to economic and currency fluctuations, which can impact the cost of imported raw materials and finished goods. However, the increasing availability of locally manufactured composite sinks, driven by global companies establishing regional production facilities, is helping to stabilize prices and accelerate market penetration, particularly targeting the expanding middle class which is increasingly focused on quality home improvements and modern aesthetics over cost-saving measures.

The Middle East and Africa (MEA) region presents a highly diversified market landscape. Growth is robust in the Gulf Cooperation Council (GCC) countries, driven by mega-construction projects, including luxury hotels, bespoke residential towers, and large-scale public housing initiatives. The high heat resistance of composite sinks is a notable advantage in the challenging environmental conditions of the Middle East, contributing to their high adoption rate in premium projects. In the African segment, market penetration remains low but is improving in South Africa and key urban centers, where infrastructure modernization is taking place. The demand in MEA is often segmented, with high-end projects demanding specific European-style designs and the broader market prioritizing basic durability and readily available, imported standard composite models. Managing complex logistics and navigating varied import duties are key considerations for regional success.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Granite and Quartz Sinks Market.- Franke

- Blanco

- Kohler

- Moen

- Elkay

- Ruvati

- Karran

- Schock

- Kraus

- Vigo

- MR Direct

- Houzer

- Zomodo

- Astracast

- Teka

- Grohe

- Carysil

- Premier Copper Products

- Kindred

- Swanstone

Frequently Asked Questions

Analyze common user questions about the Granite and Quartz Sinks market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the projected growth rate (CAGR) for the Granite and Quartz Sinks Market?

The Granite and Quartz Sinks Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% during the forecast period of 2026 to 2033, driven by increasing residential remodeling activities and rising consumer preferences for durable kitchen fixtures.

What are the primary advantages of granite and quartz composite sinks over stainless steel?

Composite sinks offer superior resistance to scratching, chipping, and thermal shock, possess a non-porous surface that inhibits bacterial growth, and provide diverse aesthetic options (colors and textures) that seamlessly integrate with modern stone countertops.

Which segment holds the largest share in the Granite and Quartz Sinks Market based on installation type?

The Undermount installation segment currently holds the largest market share, particularly in premium and remodeling projects, due to its sleek aesthetic, ease of cleaning, and ability to create a seamless transition between the sink and the countertop material.

How does the increasing trend toward smart homes influence the composite sinks market?

The smart home trend drives demand for highly integrated kitchen fixtures. Composite sinks benefit by offering sophisticated designs suitable for high-tech kitchens, often integrating features like motion-sensor faucets and optimized draining systems, aligning with high-value technology installations.

Which geographical region is expected to show the fastest market growth?

The Asia Pacific (APAC) region is anticipated to demonstrate the fastest growth rate, propelled by rapid urbanization, significant infrastructure development, and increasing disposable incomes leading to greater adoption of premium kitchen fixtures in countries like China and India.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager