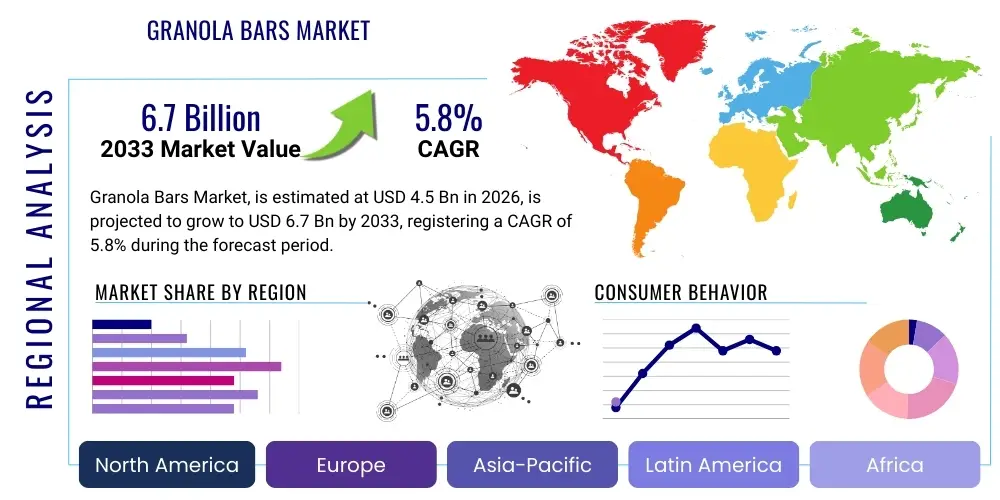

Granola Bars Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 439054 | Date : Dec, 2025 | Pages : 253 | Region : Global | Publisher : MRU

Granola Bars Market Size

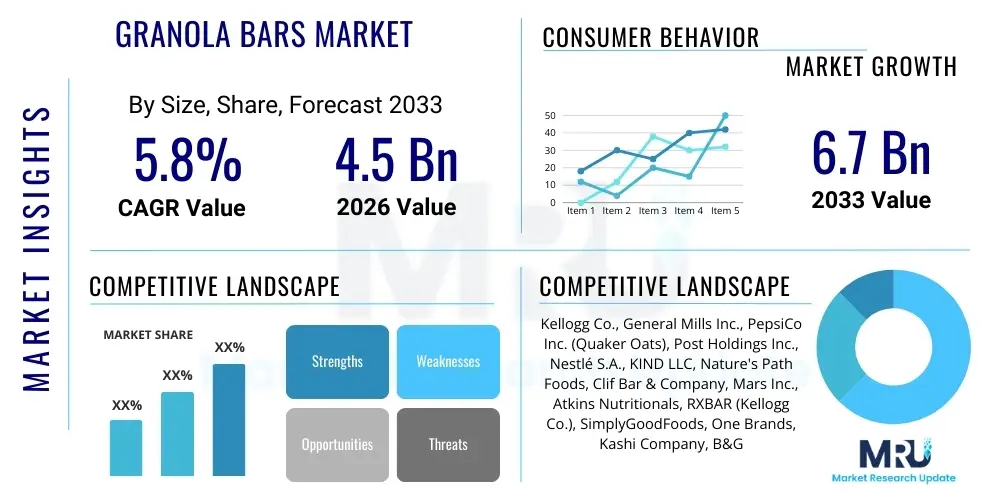

The Granola Bars Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 4.5 Billion in 2026 and is projected to reach USD 6.7 Billion by the end of the forecast period in 2033. This consistent expansion is primarily fueled by the accelerating global shift toward convenient, on-the-go meal replacements and healthier snacking options, particularly among working professionals and younger demographics who prioritize portability and perceived nutritional value in their daily diets. The market growth is also sustained by continuous innovation in product formulations, addressing prevalent consumer concerns regarding high sugar content and artificial ingredients, thereby broadening the appeal beyond traditional consumer bases.

Granola Bars Market introduction

The Granola Bars Market encompasses the manufacturing, distribution, and sale of grain-based, usually oat-based, baked or pressed snack bars that often include honey, nuts, seeds, dried fruits, and other functional ingredients. These products serve as convenient, ready-to-eat snacks, breakfast options, or energy boosters. Major applications include usage in sports nutrition, as a school lunch addition, and as a portable snack for outdoor activities. The primary benefits driving consumption are convenience, relatively high fiber content, and sustained energy release, making them a preferred alternative to confectionery or processed snacks. The market is increasingly driven by consumers seeking products that align with specific dietary requirements, such as gluten-free, organic, high-protein, and reduced-sugar formulations, forcing manufacturers to diversify their product lines substantially.

Product description highlights the versatility of granola bars, ranging from soft, chewy textures to hard, crunchy varieties, often segmented based on their primary functional benefit—such as protein fortification for muscle recovery, or added omega-3s for cognitive health. The market is characterized by intense competition and a rapid pace of innovation, particularly in ingredient sourcing, focusing heavily on plant-based proteins, ancient grains, and sustainable ingredients. Driving factors include urbanization, which necessitates convenient food options; rising health consciousness leading to the rejection of highly processed foods; and robust marketing campaigns that position granola bars as an essential component of an active lifestyle.

Furthermore, the increased focus on clean label ingredients and transparent sourcing practices is fundamentally redefining market dynamics. Consumers are demanding clear information about sugar alcohols, artificial preservatives, and genetically modified organisms (GMOs), pushing major manufacturers to reformulate their flagship products. The rise of private labels and specialized artisan brands focusing exclusively on niche dietary needs (e.g., paleo, keto-friendly) further fragments the market but contributes significantly to overall value growth, demonstrating a robust consumer willingness to pay a premium for perceived quality and functional superiority.

Granola Bars Market Executive Summary

The Granola Bars Market is navigating a period of rapid evolution, marked by significant business trends focusing on sustainability and personalized nutrition. Key business trends include the consolidation of niche healthy snack brands under large corporate portfolios and substantial investment in automated manufacturing processes to meet scalability demands while maintaining ingredient integrity. Regionally, North America and Europe dominate in terms of market value due to established snacking cultures and high disposable incomes, whereas the Asia Pacific region exhibits the highest growth trajectory, fueled by expanding middle classes, westernization of diets, and increasing awareness regarding packaged health foods. Demographic shifts favoring convenient consumption among millennials and Gen Z continue to drive volume sales globally. Companies are prioritizing strategies centered around supply chain resilience against fluctuating commodity prices (especially oats, nuts, and cocoa) and leveraging e-commerce platforms for direct-to-consumer sales, which provides critical consumer feedback and reduces time-to-market for new products.

Segment trends indicate a strong performance for the high-protein and specialized dietary segments, such as organic and gluten-free granola bars, reflecting consumers’ willingness to pay a premium for functional benefits. The chewy segment, while mature, remains the largest contributor to revenue due to its broad appeal and established market penetration, but the crunchy and baked segments are gaining traction through innovative textures and complex flavor profiles. Distribution channels are undergoing transformation, with online retail showing exceptional acceleration, providing smaller, specialized brands the necessary visibility and logistics support to challenge established market leaders. Furthermore, the push towards eco-friendly packaging, specifically biodegradable and recyclable materials, is becoming a non-negotiable factor influencing consumer choice, especially in environmentally conscious markets like Western Europe.

In essence, the market summary underscores a dual focus: minimizing health detractors (sugar, artificial additives) while maximizing functional attributes (protein, fiber, whole grains). This dynamic tension is shaping product development and marketing expenditure. Manufacturers are increasingly utilizing digital platforms to educate consumers about the nutritional benefits of their offerings, often collaborating with health influencers to build trust and credibility. The future growth will hinge on the successful integration of sustainable sourcing practices (addressing deforestation and water usage concerns related to ingredients like palm oil and almonds) and the ability of companies to rapidly adapt flavor profiles to globalizing tastes, incorporating local ingredients and ethnic flavor trends while maintaining the core expectation of convenience and portability.

AI Impact Analysis on Granola Bars Market

Common user questions regarding AI's impact on the Granola Bars Market center around personalization, ingredient quality assurance, and supply chain efficiency. Users frequently inquire about how AI can help manufacturers formulate custom bars tailored to individual nutritional profiles, detect ingredient contaminants with greater speed than traditional methods, and optimize inventory levels to prevent waste and ensure the freshness of perishable components like nuts and dried fruit. There is also significant interest in AI's role in predictive modeling concerning consumer preferences—specifically, identifying emerging flavor combinations or ingredient sensitivities before they become mainstream. The overarching theme is the expectation that AI will drive hyper-efficiency in manufacturing and hyper-specificity in consumer engagement, translating into healthier, safer, and more targeted product offerings while drastically reducing operational waste and optimizing the complex global procurement of raw agricultural commodities.

- AI-powered predictive modeling optimizes demand forecasting, minimizing inventory spoilage of perishable ingredients (nuts, seeds, dried fruits).

- Machine learning algorithms enable hyper-personalized product formulation, matching bar composition (protein, fiber, carbs) to individual consumer health goals or caloric needs tracked via wearables.

- Computer vision systems integrated into production lines rapidly detect foreign contaminants or inconsistencies in bar size and texture, enhancing food safety and quality control.

- AI analyzes massive datasets of consumer reviews and social media trends to identify novel ingredient combinations and flavor profiles, significantly accelerating R&D cycles.

- Supply chain optimization using AI monitors volatile agricultural commodity markets (oats, cocoa, sugar) and suggests optimized purchasing strategies to mitigate cost fluctuations.

- Automated dynamic pricing models leverage real-time sales data and competitor analysis to maximize profit margins across different retail and e-commerce channels.

DRO & Impact Forces Of Granola Bars Market

The market is predominantly driven by increasing consumer preference for healthy, functional, and convenient snacking options compatible with busy lifestyles, coupled with continuous product innovation addressing evolving dietary demands such as gluten intolerance and high-protein requirements. However, growth is tempered by significant restraints, primarily the persistent negative perception associated with high sugar content in many conventional granola bar offerings and intense competition from diverse substitute snack categories like protein bars, nutritional cookies, and fruit snacks. Opportunities lie in expanding into emerging economies where packaged food consumption is rising rapidly, and specializing in sustainable sourcing and packaging initiatives to appeal to environmentally conscious millennials. These forces collectively define the market trajectory, creating dynamic pressure points where manufacturers must balance nutritional efficacy with palatable taste and attractive pricing structures, ensuring compliance with increasingly stringent clean label regulatory requirements across multiple jurisdictions.

Drivers: The shift towards consumption patterns that favor small, frequent meals rather than large, traditional meals significantly boosts demand for portable snacks. Moreover, the increasing adoption of functional foods, where granola bars are fortified with omega-3 fatty acids, probiotics, or specialized plant proteins (e.g., pea, hemp), broadens their medical and athletic application appeal. The robust growth of fitness culture globally necessitates convenient sources of pre- and post-workout energy, positioning specific granola bar variants as essential sports nutrition supplements. Furthermore, strategic marketing campaigns focusing on the natural energy provided by whole grains and fiber resonate strongly with health-aware populations, driving consistent repeat purchasing and brand loyalty.

Restraints: The most prominent constraint remains the industry's struggle to effectively manage sugar reduction without compromising taste and texture, often requiring expensive alternative sweeteners and complex formulations that increase production costs. Regulatory scrutiny over health claims and ingredient transparency, particularly in markets like the European Union and the US, imposes significant compliance hurdles and restricts aggressive health-focused advertising. Additionally, fluctuating costs of key agricultural inputs, exacerbated by climate change and geopolitical instability, directly compress profit margins, particularly for organic and sustainably sourced product lines, forcing delicate pricing strategies to remain competitive against cheaper, conventional snack formats.

Opportunities: Major opportunities exist in geographical expansion, targeting Asia Pacific and Latin American middle-class consumers who are adopting Western dietary habits but often lack access to sophisticated functional snack options. Product innovation focused on allergen-friendly ingredients (e.g., nut-free formulations using seeds like sunflower and pumpkin), and the integration of highly sought-after wellness ingredients like CBD (in permissible markets) or adaptogens (e.g., Ashwagandha) offer high-margin potential. Developing fully compostable or zero-waste packaging is another critical area of opportunity, satisfying consumer ethical demands and creating a distinct brand differentiator in crowded retail environments, contributing to long-term market resilience and positive brand equity.

Impact Forces: The interplay of high demand for convenience (Driver) and the pressure of commodity price volatility (Restraint) results in a continuous force driving technological innovation aimed at cost-effective, high-volume production while maintaining ingredient quality. The growing awareness of sugar-related health risks acts as a powerful restraint, compelling companies towards the Opportunity of specialized low-glycemic formulations. These forces mandate that industry players maintain extreme flexibility in both their supply chain logistics and their consumer-facing communication strategies to effectively manage health perceptions and price sensitivity in a highly competitive market landscape.

Segmentation Analysis

The Granola Bars Market is segmented primarily based on Product Type, Ingredient, Flavor, and Distribution Channel, reflecting the diverse consumer base and complex needs within the convenience food sector. This segmentation highlights the shifting preference from basic cereal bars toward specialized, functional formats. The analysis shows that Ingredient segmentation, particularly the rise of high-protein and organic categories, is the most dynamic area, commanding premium pricing and attracting significant investment in R&D. Product Type remains crucial, distinguishing between Chewy bars (dominant volume) and Crunchy bars (texture appeal), while Flavor profiles continually evolve to incorporate global culinary trends and local tastes, moving beyond traditional chocolate and nut variants.

Distribution analysis confirms the increasing importance of digital channels, especially subscription services and direct-to-consumer models, which offer manufacturers greater control over branding and immediate access to consumer feedback. However, supermarkets and hypermarkets still retain the largest share of sales due to high foot traffic and bulk purchasing habits. Understanding these segments is vital for manufacturers to tailor their product launches, marketing efforts, and logistical planning effectively. The segmentation also provides critical insights into price elasticity, revealing that consumers in the functional ingredient segment are generally less price-sensitive than those purchasing conventional, volume-driven products.

- By Product Type:

- Chewy Granola Bars

- Crunchy Granola Bars

- Others (Soft-baked, Energy/Protein Bars, Breakfast Bars)

- By Ingredient:

- Conventional

- Gluten-Free

- Organic

- High Protein/Functional

- By Flavor:

- Nut and Seed Based

- Fruit Based

- Chocolate and Cocoa

- Spice/Savory

- Mixed/Specialty Flavors

- By Distribution Channel:

- Supermarkets and Hypermarkets

- Convenience Stores

- Online Retail (E-commerce)

- Others (Vending Machines, Specialty Food Stores)

Value Chain Analysis For Granola Bars Market

The Value Chain for the Granola Bars Market begins with complex upstream activities involving the sourcing and processing of raw materials, which are highly sensitive to climate conditions and global agricultural policies. Upstream analysis focuses heavily on the procurement of core ingredients such as oats, nuts (almonds, peanuts), seeds (chia, flax), dried fruits, and natural sweeteners (honey, maple syrup). The critical element here is managing volatility and ensuring sustainable, verifiable sourcing, particularly for high-value organic or non-GMO inputs. Processing requires milling, roasting, and specialized preservation techniques to maintain nutritional integrity and texture. The competitive advantage upstream is secured through long-term contracts with certified farmers and investments in vertical integration to stabilize quality and cost. Specialized suppliers providing proprietary flavor systems or plant-based protein isolates represent a critical point in value addition.

Midstream activities involve sophisticated manufacturing and formulation. This stage includes blending, baking or cold-pressing (depending on the bar type), shaping, and highly automated packaging processes designed for high volume and strict sanitary conditions. Direct distribution involves manufacturers selling directly to major retailers or through their own e-commerce platforms, offering greater control over pricing and shelf placement. Indirect distribution relies heavily on third-party logistics (3PL) providers, food brokers, and large national or international distributors who facilitate market penetration across various retail formats, including gas stations, schools, and corporate cafeterias. The selection of the distribution channel impacts margin structure significantly; while direct-to-consumer (D2C) channels offer higher profitability, indirect channels provide essential market reach and scalability required for mass-market products. Effective inventory management and cold chain logistics, particularly for bars containing fresh ingredients or probiotics, are vital components of this stage to minimize waste and ensure product freshness.

Downstream analysis centers on retail merchandising, consumer outreach, and consumption. Retailers play a decisive role in product visibility, often placing granola bars near checkouts or within dedicated health and wellness sections. Marketing strategies are crucial here, leveraging nutritional labeling, health certifications (e.g., USDA Organic, Gluten-Free), and influencer endorsements to drive consumer demand. The final stage involves consumer feedback and post-purchase engagement, which loops back to R&D for continuous product improvement. Optimization across the entire chain is achieved through predictive analytics that synchronize raw material procurement with anticipated retail demand, ultimately reducing lead times and ensuring market responsiveness to rapidly changing dietary trends and seasonal fluctuations.

Granola Bars Market Potential Customers

The primary end-users and buyers of granola bars are highly diversified, but broadly fall into three major categories: active lifestyle consumers, convenience seekers, and health-conscious consumers with specific dietary needs. Active lifestyle consumers, including athletes and fitness enthusiasts, seek high-protein and energy-dense bars for pre- or post-workout nutrition and sustained fuel during outdoor activities. This group is less price-sensitive and highly attuned to functional ingredients and macronutrient composition. Convenience seekers are often busy professionals, students, and parents looking for quick, portable, and relatively nutritious meal substitutes or snacks that require no preparation and are easily consumed on the go, prioritizing value and ease of availability across various retail formats.

The fastest-growing customer segment is the health-conscious consumer, driven by specific dietary mandates such as veganism, gluten sensitivity, or diabetes management. This group actively seeks out specialized bars, including organic, paleo, keto, or reduced-sugar variants, often engaging directly with brands through D2C channels to ensure ingredient authenticity and transparency. Their purchasing decisions are heavily influenced by certifications, clean label assurances, and ingredient lists that exclude artificial additives or highly refined sugars. These specific dietary needs have necessitated a fragmentation of the market, allowing smaller, agile companies to secure loyal customer bases by catering precisely to these niche requirements with premium offerings.

Institutional buyers, such as schools, hospitals, corporate cafeterias, and airlines, also constitute significant potential customers, often purchasing conventional or slightly customized bars in bulk. These buyers prioritize product shelf stability, adherence to specific caloric or nutritional guidelines, and competitive pricing, often demanding extended contracts and high-volume delivery capabilities. The ongoing evolution of school nutrition standards, particularly in North America and Europe, is a major influence on the product specifications demanded by this institutional end-user segment, driving demand for whole-grain, low-sugar options compliant with regulatory frameworks.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.5 Billion |

| Market Forecast in 2033 | USD 6.7 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Kellogg Co., General Mills Inc., PepsiCo Inc. (Quaker Oats), Post Holdings Inc., Nestlé S.A., KIND LLC, Nature's Path Foods, Clif Bar & Company, Mars Inc., Atkins Nutritionals, RXBAR (Kellogg Co.), SimplyGoodFoods, One Brands, Kashi Company, B&G Foods, GoMacro, LaraBar, Premier Protein, 88 Acres, Bobo's Oat Bars |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Granola Bars Market Key Technology Landscape

The Granola Bars Market relies heavily on advanced food processing and packaging technologies to ensure product safety, extend shelf life, and maintain the integrity of delicate functional ingredients. A crucial technology is High-Pressure Processing (HPP), utilized primarily for bars with higher moisture content or those containing heat-sensitive additives like probiotics, as it pasteurizes the product without high heat, preserving nutrient value and flavor profile. Another fundamental technology involves specialized mixing and blending equipment, specifically precision mixers designed to handle high-viscosity mixtures containing large particulates (nuts, oats) while ensuring homogeneous distribution of expensive ingredients like protein powder or vitamins, which is critical for accurate nutritional labeling and consistent quality. Furthermore, cold-pressing technology is increasingly favored for raw or minimally processed bars, avoiding the textural changes and nutrient degradation associated with baking, which aligns perfectly with the clean label, raw food trend.

In terms of manufacturing efficiency, advanced extrusion and forming techniques are central to high-speed production, allowing manufacturers to create bars of consistent shape and density at high volume. These systems often incorporate automated vision inspection technology (driven by AI analysis) for real-time quality control, checking for size uniformity, inclusion distribution, and potential foreign material contamination before packaging. The continuous requirement for sugar reduction without sacrificing palatability drives technological investment into specialized ingredient handling systems capable of accurately metering and incorporating novel low-calorie sweeteners and alternative fibers (e.g., chicory root fiber, allulose) into the bar matrix, ensuring flavor masking and binding properties are optimized. The transition to plant-based ingredients also necessitates tailored processing equipment to manage the varying water absorption and binding characteristics of different protein sources like pea, rice, or hemp.

Packaging technology is evolving rapidly, driven by sustainability demands. Key innovations include the adoption of multi-layer film packaging that utilizes biodegradable or compostable polymers, reducing the environmental footprint without compromising the oxygen and moisture barrier properties necessary to prevent rancidity (especially of fats and oils in nuts). Automated, high-speed wrapping machines minimize product exposure to the environment and are integrated with advanced sealing techniques to ensure extended shelf stability, crucial for products distributed globally across diverse climate zones. Track-and-trace technologies, often utilizing integrated serialization and digital printing, are also becoming standard practice, enhancing supply chain transparency and product recall management capabilities, thereby bolstering consumer trust in the brand's commitment to safety and quality assurance throughout the product lifecycle.

Regional Highlights

Regional dynamics are critical drivers of market segmentation and growth strategies. North America currently holds the largest market share, predominantly driven by high consumer awareness regarding health and fitness, established snacking habits, and robust availability of specialized products (gluten-free, high-protein). The region features intense competition, characterized by frequent product launches and aggressive marketing aimed at lifestyle positioning. Consumer willingness to pay a premium for convenience and functional benefits sustains market value. However, the market is maturing, leading companies to focus on reformulation (sugar reduction) and sustainable sourcing as key differentiation strategies to maintain consumer loyalty and respond to regulatory scrutiny concerning nutritional claims.

Europe represents the second-largest market, with Western European countries like the UK, Germany, and France dominating revenue. Growth here is primarily driven by the strong emphasis on organic, natural, and clean label products. European consumers often prioritize locally sourced ingredients and strict regulatory compliance regarding additives and contaminants. The market exhibits slower volume growth compared to emerging regions but registers higher average selling prices due to the premium nature of products that adhere to stringent EU food standards. Eastern Europe offers untapped potential, driven by rising disposable incomes and the gradual adoption of packaged snack formats, presenting an opportunity for scaled entry by international brands focusing on affordability and basic functional attributes.

The Asia Pacific (APAC) region is projected to register the fastest growth rate throughout the forecast period. This acceleration is attributed to rapid urbanization, changing dietary habits influenced by Western culture, and the exponential growth of the middle-class population. Countries like China, India, and Southeast Asian nations are seeing increased acceptance of packaged, on-the-go snacks. While traditional snacking remains dominant, the demand for perceived "healthier" options like granola bars is surging, particularly in urban centers. Challenges in APAC include complex distribution networks and the need for localized flavor adaptations (e.g., less sweet, savory options) to appeal to the diverse regional palate. The Middle East and Africa (MEA) region remains a nascent market, but increasing investment in modern retail infrastructure and growing expatriate populations contribute to steady, localized growth, particularly in the UAE and Saudi Arabia, focusing primarily on high-end imported brands.

- North America: Market leader, driven by functional nutrition, established health trends, and high premiumization rates, focusing heavily on protein, Keto, and low-sugar innovations.

- Europe: High average revenue per unit, strong focus on organic certifications, clean label transparency, and locally sourced ingredients; stringent regulatory environment impacts formulation decisions.

- Asia Pacific (APAC): Highest CAGR, growth fueled by urbanization, rising disposable income, and changing dietary patterns, requiring localization of flavors and establishment of efficient cold-chain logistics.

- Latin America (LATAM): Emerging market characterized by increasing consumer awareness and modern retail expansion, with growth centered around affordability and basic nutritional fortification.

- Middle East and Africa (MEA): Growth concentrated in urban hubs and through import channels, focusing on premium, high-quality, and often Halal-certified products catering to high-income consumers.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Granola Bars Market.- Kellogg Co.

- General Mills Inc.

- PepsiCo Inc. (Quaker Oats)

- Post Holdings Inc.

- Nestlé S.A.

- KIND LLC

- Nature's Path Foods

- Clif Bar & Company

- Mars Inc.

- Atkins Nutritionals

- RXBAR (Kellogg Co.)

- SimplyGoodFoods

- One Brands

- Kashi Company

- B&G Foods

- GoMacro

- LaraBar

- Premier Protein

- 88 Acres

- Bobo's Oat Bars

Frequently Asked Questions

Analyze common user questions about the Granola Bars market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary factors driving the growth of the Granola Bars Market?

The primary growth factors are the global increase in consumer demand for convenient, portable, and healthy on-the-go snacks, the rising adoption of functional foods fortified with protein and fiber, and dynamic product innovation focused on catering to specific dietary trends such as gluten-free, organic, and keto-friendly formulations. Urbanization and busy professional lifestyles accelerate this demand significantly.

How is the market addressing the prevalent consumer concern regarding high sugar content in granola bars?

Manufacturers are strategically reformulating products by replacing refined sugars with natural alternatives like allulose, monk fruit, or chicory root fiber, which also adds beneficial dietary fiber. Significant R&D effort is focused on low-glycemic index bars and enhancing sweetness perception through natural flavors without increasing the total sugar count, directly addressing regulatory and consumer health concerns.

Which segmentation category offers the highest growth potential in the next five years?

The Ingredient segmentation, specifically the High Protein and Organic categories, is projected to offer the highest growth potential. This is driven by consumer pursuit of specific functional benefits and a willingness to pay premium prices for ingredients perceived as cleaner, more sustainable, and superior in nutritional value, reflecting a broader trend in personalized and preventive nutrition.

What role does sustainability play in the competitive landscape of the Granola Bars Market?

Sustainability is rapidly transforming from a differentiator to a baseline expectation. It plays a critical role in sourcing (ethically sourced cocoa, sustainable nuts), manufacturing (reduced water and energy usage), and especially in packaging (compostable or fully recyclable wraps). Companies achieving verified sustainability goals gain significant competitive advantage and improved brand equity, particularly with Gen Z consumers.

What is the impact of e-commerce and online retail on the distribution of granola bars?

E-commerce, particularly D2C models and subscription boxes, has fundamentally impacted distribution by offering niche brands access to global audiences and allowing manufacturers to gather immediate consumer data. While supermarkets remain vital for volume, online retail is driving growth in specialized, premium bar sales, offering unparalleled convenience and direct transparency regarding product attributes and origin.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager