Granular Activated Carbon Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432183 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Granular Activated Carbon Market Size

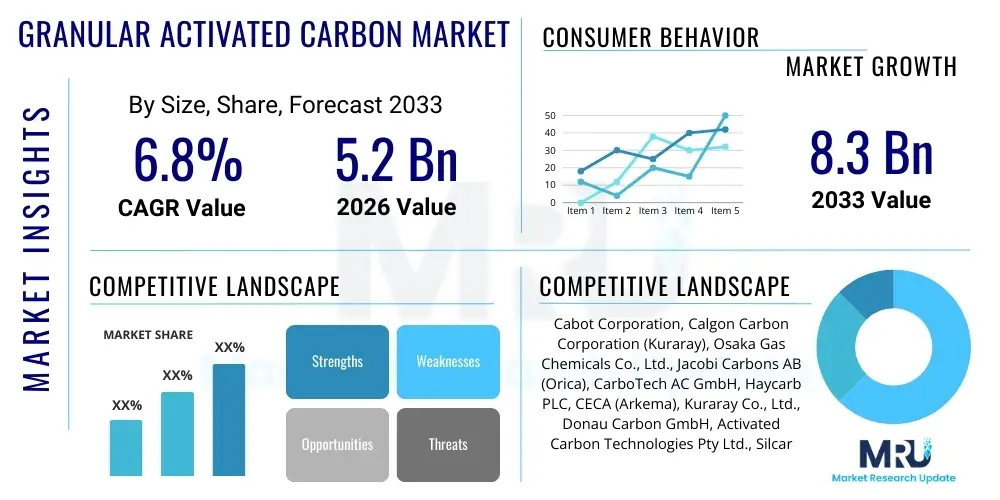

The Granular Activated Carbon Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 5.2 Billion in 2026 and is projected to reach USD 8.3 Billion by the end of the forecast period in 2033.

Granular Activated Carbon Market introduction

Granular Activated Carbon (GAC) is a highly versatile and porous material widely utilized across numerous industrial and environmental applications primarily due to its exceptional adsorption capabilities. GAC is produced through a controlled process involving the carbonization and subsequent activation of raw materials such as coal, coconut shells, wood, and peat. This activation process creates an immense internal surface area, allowing the carbon to effectively capture and remove organic contaminants, chlorine, taste, and odor compounds from liquid and gaseous streams. Its robust physical structure makes it suitable for use in fixed-bed adsorbers, offering longevity and efficiency in large-scale operations.

The primary function of GAC is purification and remediation, making it indispensable in modern infrastructure. Major applications span municipal water treatment, where it ensures the safety and palatability of drinking water, and industrial wastewater management, addressing complex effluents containing persistent organic pollutants (POPs) and heavy metals. Beyond water, GAC plays a critical role in air purification systems, solvent recovery, and specialized industrial processes like food and beverage decolorization and pharmaceutical purification. The inherent benefits of GAC, including high capacity for organic removal, regenerability, and cost-effectiveness over its lifecycle, solidify its position as the preferred adsorbent material.

Market growth is predominantly driven by stringent global environmental regulations mandating cleaner discharge standards for water and air quality. Furthermore, the increasing global population and rapid urbanization, particularly in developing economies, intensify the demand for reliable potable water sources, necessitating advanced filtration technologies like GAC. The material’s ability to treat emerging contaminants, such as PFAS (Per- and polyfluoroalkyl substances) and microplastics, positions it favorably for sustained market expansion as regulatory bodies globally tighten restrictions on these challenging pollutants.

Granular Activated Carbon Market Executive Summary

The Granular Activated Carbon (GAC) market is characterized by robust growth, primarily fueled by the accelerating need for superior water and air treatment solutions amidst increasing industrialization and environmental scrutiny. Key business trends indicate a strong shift towards regenerative GAC systems to enhance sustainability and reduce operational costs, alongside an increased focus on specialized carbon types derived from sustainable sources like coconut shells. Leading market players are strategically expanding production capacities and investing in advanced modification techniques, such as impregnated and catalytic carbons, to target specific pollutants and enhance adsorption efficiency, thereby maintaining a competitive edge in technologically demanding applications like advanced chemical purification and industrial gas cleaning.

Regionally, the Asia Pacific (APAC) dominates the market, exhibiting the highest growth rate due to rapid industrial development, inadequate existing wastewater infrastructure demanding modernization, and government initiatives focused on providing clean drinking water. North America and Europe, while mature markets, continue to show steady demand driven by strict regulatory frameworks concerning disinfection by-products (DBPs) in municipal water and mandatory emissions control in industrial sectors. Emerging markets in Latin America and MEA are experiencing escalating adoption rates as they prioritize infrastructure development related to water security and pollution control, often through large-scale public-private partnerships.

Segment trends highlight the dominance of the Water Treatment application segment, particularly municipal water treatment, which accounts for the largest share due to persistent concerns over waterborne diseases and emerging contaminants. By raw material type, Coconut Shell Based GAC is gaining significant traction due to its high hardness, low dust formation, and environmental perception as a renewable resource, making it highly suitable for high-purity water and food contact applications. The liquid phase adsorption application segment remains paramount, though the vapor phase segment is expected to witness substantial growth, propelled by increasing governmental focus on volatile organic compound (VOC) removal in industrial facilities and indoor air quality standards.

AI Impact Analysis on Granular Activated Carbon Market

User queries regarding AI's influence on the GAC market frequently revolve around how artificial intelligence can optimize the GAC lifecycle, specifically concerning predicting breakthrough times, automating regeneration processes, and enhancing predictive maintenance of large-scale filtration systems. Users are keen to understand if AI can significantly reduce the traditionally high operational expenses associated with GAC monitoring and replacement. Concerns are also raised about the integration challenges of legacy GAC systems with modern AI-driven sensor networks and the accuracy of models trained on diverse and often geographically scattered water quality data. The prevailing expectation is that AI will transition GAC usage from reactive monitoring to proactive, optimized management, thereby extending media life and ensuring consistent contaminant removal efficacy.

- AI-driven Predictive Maintenance: Utilizing machine learning algorithms to analyze flow rates, pressure drops, and effluent quality data to accurately predict the saturation point of the GAC bed, optimizing replacement or regeneration timing.

- Optimized Adsorption Modeling: Employing AI to simulate complex adsorption kinetics based on varying water matrices (pH, temperature, contaminant concentration), allowing for precise GAC selection and system design for targeted pollutants.

- Automated Regeneration Scheduling: Using AI and IoT sensors to trigger and manage the GAC thermal regeneration process automatically, minimizing energy consumption and ensuring maximal reactivation efficiency.

- Supply Chain and Inventory Management: AI assisting GAC manufacturers in forecasting demand for different carbon types (e.g., coconut vs. coal-based) based on global regulatory shifts and raw material availability, leading to reduced holding costs.

- Enhanced Quality Control: Implementing computer vision and machine learning models in production facilities to ensure uniformity in particle size and surface area during the GAC manufacturing and activation stages.

DRO & Impact Forces Of Granular Activated Carbon Market

The market dynamics for Granular Activated Carbon are heavily influenced by the interplay of stringent environmental regulations (Drivers), the substantial capital and operational costs associated with regeneration and disposal (Restraints), and the massive potential presented by treating emerging contaminants like PFAS and pharmaceuticals (Opportunities). These factors collectively generate significant impact forces on market behavior, demanding continuous innovation in activation processes and source material diversification. The push for water security and resource circularity drives market adoption, while the fluctuating costs of precursor materials (coal, coconut shells) and high energy requirements for activation act as persistent limiting factors that manufacturers must constantly mitigate.

Key drivers include globally tightening wastewater discharge standards and rising public awareness regarding water quality, especially in industrialized nations and rapidly urbanizing regions. Governments are increasingly investing in municipal and industrial wastewater treatment plants (WWTPs) that integrate advanced tertiary treatments where GAC is essential. The opportunity landscape is broad, encompassing the development of specialty and engineered carbons designed for highly specific applications, such as targeted gas separation or the highly efficient removal of specific micropollutants that conventional treatments fail to address effectively.

Conversely, significant restraints hinder growth. The high initial capital expenditure required for GAC adsorption systems, combined with the energy-intensive nature of thermal regeneration, particularly limits adoption in smaller industrial facilities or developing economies lacking robust infrastructure. Furthermore, the availability and sustainable sourcing of high-quality raw materials, particularly coconut shell precursors, face supply chain pressures which can lead to price volatility. The ultimate impact forces are pushing the industry towards closed-loop systems, emphasizing regeneration and the development of cost-effective, non-thermal reactivation methods to achieve both economic viability and environmental compliance.

Segmentation Analysis

The Granular Activated Carbon market segmentation provides critical insights into diverse consumption patterns based on raw material source, application type, and phase of use. The segmentation by raw material is crucial as it dictates the physical properties, pore structure, and resulting adsorption characteristics, with coal-based GAC historically dominating due to high availability and low cost, contrasted by coconut shell GAC preferred for high-purity applications requiring specific microporosity. Analyzing the market through the application lens reveals where the greatest demand lies, affirming water treatment (both municipal and industrial) as the primary consumer, driven by pervasive quality requirements and regulatory mandates.

- By Raw Material Type:

- Coal Based GAC

- Coconut Shell Based GAC

- Wood Based GAC

- Others (Peat, Lignite)

- By Application:

- Water Treatment

- Municipal Water Treatment

- Industrial Water Treatment

- Air Purification and Gas Separation

- Food and Beverage Processing

- Medical and Pharmaceutical

- Mining (Gold Recovery)

- Others (Catalyst Support, Chemical Refining)

- Water Treatment

- By End-User:

- Government and Municipalities

- Industrial (Chemicals, Power, Oil & Gas)

- Commercial

- By Phase:

- Liquid Phase Adsorption

- Vapor Phase Adsorption

Value Chain Analysis For Granular Activated Carbon Market

The Granular Activated Carbon value chain begins with the sourcing and preparation of raw materials (upstream analysis), primarily bituminous coal, lignite, coconut shells, and wood. This initial stage is critical, as the quality and characteristics of the precursor material directly influence the final pore structure and surface area of the GAC. Key upstream activities involve collection, drying, and crushing, processes which are often geographically determined, impacting transportation logistics and cost. Manufacturers must secure stable, high-volume supplies of these raw materials, often requiring complex global procurement networks, especially for coconut shell carbon, which is heavily sourced from Southeast Asia.

Midstream activities encompass the complex manufacturing process: carbonization (pyrolysis in inert atmosphere) followed by activation (either thermal or chemical). Thermal activation, the most common method, requires high energy input and specialized rotary kilns to achieve the desired porosity and surface chemistry. Operational efficiency and energy management during this stage are paramount determinants of production cost. Downstream activities involve post-treatment processes such as washing, screening, and, crucially, customized impregnation or modification of the GAC to enhance performance for specialized applications, such as sulfur or mercury removal.

Distribution channels for GAC are multifaceted, involving both direct sales to large, integrated industrial end-users (e.g., major chemical plants or municipal water authorities) and indirect sales through specialized distributors and trading companies. Direct channels are preferred for high-volume, long-term contracts where technical support and custom specifications are necessary. Indirect channels facilitate market penetration into smaller or geographically dispersed markets, offering localized inventory management and just-in-time delivery. The distribution strategy heavily depends on the segment, with bulk deliveries common for municipal use and bagged products for commercial or smaller industrial installations.

Granular Activated Carbon Market Potential Customers

Potential customers for Granular Activated Carbon are highly diverse and segmented across essential public and private sectors requiring advanced filtration and purification solutions. The primary end-users are large municipal water treatment facilities, which consume vast quantities of GAC for primary filtration, chloramine removal, and increasingly, tertiary treatment to address taste, odor, and emergent organic micropollutants. Industrial users form another massive customer base, including petrochemical, chemical processing, pharmaceutical, and power generation sectors, utilizing GAC for solvent recovery, catalyst support, or rigorous wastewater polishing before discharge.

The food and beverage industry represents a significant, high-growth niche customer base, requiring specialized GAC for decolorization, removal of unwanted off-tastes, and ensuring compliance with stringent food safety standards, particularly in sugar refining, brewing, and juice production. Furthermore, the burgeoning indoor air quality market, driven by post-pandemic awareness, presents growing opportunities for commercial and residential applications demanding GAC media for high-efficiency air filtration systems (HVAC and air purifiers) targeting VOCs and gaseous contaminants. Finally, mining operations, particularly gold extraction, are consistent consumers of GAC for the carbon-in-pulp process due to its unique ability to adsorb gold cyanide complexes efficiently.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 5.2 Billion |

| Market Forecast in 2033 | USD 8.3 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Cabot Corporation, Calgon Carbon Corporation (Kuraray), Osaka Gas Chemicals Co., Ltd., Jacobi Carbons AB (Orica), CarboTech AC GmbH, Haycarb PLC, CECA (Arkema), Kuraray Co., Ltd., Donau Carbon GmbH, Activated Carbon Technologies Pty Ltd., Silcarbon Aktivkohle GmbH, Shaanxi Beihai Carbon Co., Ltd., Chemviron Carbon, Active Charcoal Products Pvt. Ltd., Nanjing Jichang Activated Carbon Co., Ltd., China Purification Activated Carbon Co., Ltd., DESOTEC Activated Carbon, FiloPlate activated carbon, Evoqua Water Technologies LLC, Clarimex Group |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Granular Activated Carbon Market Key Technology Landscape

The technological landscape of the Granular Activated Carbon market is rapidly evolving, focusing on optimizing media performance, enhancing sustainability, and improving regeneration economics. Conventional thermal activation, utilizing rotary kilns and multiple hearth furnaces, remains the dominant production method, but technological advancements are concentrating on maximizing energy efficiency during the carbonization and activation phases to reduce production costs and environmental footprint. Innovations include optimized kiln designs that utilize waste heat recovery and precision control systems to ensure uniformity in pore size distribution, critical for high-performance GAC used in micro-pollutant removal.

A significant technological focus is on specialty and impregnated GAC. Manufacturers are developing carbons chemically treated with specific compounds, such as sulfur, potassium permanganate, or metals, to enhance their capacity for chemisorption rather than purely physisorption. These engineered GAC types are highly effective in targeted contaminant removal, particularly for mercury, hydrogen sulfide, ammonia, and other difficult-to-treat pollutants in air and gas streams. This shift from generic GAC to highly customized, purpose-built adsorbents represents a major technological trajectory driving value-added product development.

Furthermore, technology related to GAC regeneration is undergoing transformation. While thermal regeneration is energy-intensive, alternative regeneration methods like microwave heating, electrochemical regeneration, and solvent extraction are being researched and piloted to reduce energy consumption and preserve the carbon structure, thereby extending the media’s useful life. The integration of advanced monitoring technologies, including real-time sensor arrays and data analytics (part of the AI impact), is crucial for enabling proactive and efficient management of GAC beds, ensuring optimal performance throughout the system lifecycle.

Regional Highlights

- Asia Pacific (APAC): APAC is the largest and fastest-growing regional market, propelled by aggressive industrial expansion, necessitating immediate solutions for wastewater and air pollution control. China and India are major contributors, driven by massive infrastructure investments in urban water supply and stringent enforcement of environmental protection laws aimed at cleaning up major rivers and controlling factory emissions. The region also benefits from being a primary sourcing hub for sustainable raw materials like coconut shells.

- North America: North America holds a substantial market share, characterized by high regulatory maturity. Demand is robust, primarily driven by mandatory compliance with the Safe Drinking Water Act (SDWA) and the need to address emerging contaminants (e.g., PFAS, 1,4-Dioxane) in public water systems. The region is a leader in adopting advanced GAC technologies, including proprietary engineered and catalytic carbons for specialized industrial applications, particularly in gas processing and environmental remediation.

- Europe: The European market is mature and highly focused on sustainability and circular economy principles. Growth is spurred by the implementation of the Water Framework Directive and increasing focus on removing pharmaceutical residues and pesticides from water sources. Europe exhibits strong demand for regenerative GAC services, utilizing advanced, centralized reactivation facilities to maximize resource efficiency and minimize environmental impact.

- Latin America (LATAM): LATAM is an emerging market with significant potential. Market growth is closely tied to investment cycles in water and sanitation infrastructure, often supported by international development banks. Key drivers include combating water scarcity and improving municipal water quality, particularly in densely populated countries like Brazil and Mexico, where GAC is seen as a cost-effective tertiary treatment solution.

- Middle East and Africa (MEA): This region is heavily reliant on advanced water treatment technologies due to chronic water scarcity. Desalination brine treatment and oil and gas sector applications (gas purification and produced water treatment) are major consumers of GAC. Market expansion is steady, contingent upon large government-led infrastructure projects focusing on water reuse and industrial emissions control.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Granular Activated Carbon Market.- Cabot Corporation

- Calgon Carbon Corporation (Kuraray)

- Osaka Gas Chemicals Co., Ltd.

- Jacobi Carbons AB (Orica)

- CarboTech AC GmbH

- Haycarb PLC

- CECA (Arkema)

- Kuraray Co., Ltd.

- Donau Carbon GmbH

- Activated Carbon Technologies Pty Ltd.

- Silcarbon Aktivkohle GmbH

- Shaanxi Beihai Carbon Co., Ltd.

- Chemviron Carbon

- Active Charcoal Products Pvt. Ltd.

- Nanjing Jichang Activated Carbon Co., Ltd.

- China Purification Activated Carbon Co., Ltd.

- DESOTEC Activated Carbon

- FiloPlate activated carbon

- Evoqua Water Technologies LLC

- Clarimex Group

Frequently Asked Questions

Analyze common user questions about the Granular Activated Carbon market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary raw materials used to produce Granular Activated Carbon?

The primary raw materials for GAC production are carbon-rich organic substances, including bituminous and sub-bituminous coal, lignite, coconut shells, and wood. Coconut shell-based GAC is preferred for drinking water applications due to its dense, microporous structure, while coal-based GAC is widely used in industrial applications.

How does GAC compare to Powdered Activated Carbon (PAC) in water treatment?

GAC is generally used in continuous filter beds for long-term adsorption, providing efficient removal of stable contaminants like chlorine and persistent organic compounds. PAC, having a smaller particle size, is typically dosed directly into water for seasonal treatment of taste and odor events, requiring subsequent removal via sedimentation or filtration.

What is the current market trend regarding GAC regeneration?

The dominant market trend is a strong focus on enhancing GAC regeneration services to achieve resource circularity and reduce costs. Thermal reactivation remains standard, but there is growing investment in developing and adopting highly efficient, centralized regeneration facilities and researching alternative non-thermal methods like microwave or electrochemical regeneration.

Which application segment drives the highest demand for GAC?

The Water Treatment application segment, specifically Municipal Water Treatment, accounts for the highest volume demand for GAC. This is driven by global regulatory mandates requiring the removal of disinfection by-products (DBPs), naturally occurring organic matter (NOM), and emerging contaminants like PFAS from public water supplies.

How do stringent environmental regulations influence the Granular Activated Carbon Market growth?

Strict environmental regulations, particularly concerning permissible discharge levels of industrial wastewater pollutants and air emissions (VOCs, mercury), act as the primary catalyst for market growth. Compliance necessitates the installation of advanced tertiary treatment systems, positioning GAC as an essential component for meeting these legal requirements globally.

The detailed market analysis confirms that the Granular Activated Carbon sector is fundamentally aligned with global sustainability and purification mandates, ensuring its long-term viability and projected growth trajectory. Innovation in source material utilization, specialized chemical modification techniques, and the integration of AI-driven predictive maintenance are key factors enabling the market to address increasingly complex environmental challenges efficiently and cost-effectively, maintaining GAC’s status as a critical purification medium.

Future market expansion is heavily dependent on regulatory developments concerning emerging contaminants (ECs) globally. The ongoing assessment and subsequent regulation of substances like PFAS in North America and Europe will necessitate significant capital expenditure on GAC filtration infrastructure, presenting substantial opportunities for manufacturers specializing in high-performance engineered carbons. Furthermore, the push towards closed-loop industrial processes and resource recovery will continue to boost demand for GAC capable of selective adsorption and repeatable regeneration across chemical and pharmaceutical manufacturing sectors.

The competitive landscape is dominated by large, integrated global players possessing expansive manufacturing capabilities and established logistics networks, allowing them to serve diverse geographical markets and high-volume industrial clients. However, specialized regional players focusing on sustainable source materials (e.g., coconut shells in APAC) or niche technologies (e.g., impregnated carbons) continue to capture significant market share by offering highly customized, value-added products tailored to specific local environmental challenges and regulatory mandates, promoting healthy competition and continuous product innovation within the global market structure.

The increasing complexity of industrial waste streams, coupled with the need for ultra-pure water in sectors such as microelectronics and pharmaceuticals, mandates the use of highly sophisticated purification methods where GAC often serves as the final polishing step. The adoption of GAC in specialized applications, such as solvent recovery in the printing and automotive sectors, is expanding as industries seek to minimize waste and comply with stricter air quality standards concerning volatile organic compounds (VOCs). The vapor phase segment, while smaller than liquid phase, is projected to see accelerated growth driven by these stringent air pollution control requirements.

Economic restraints, such as volatile energy prices impacting thermal regeneration costs, push end-users to evaluate alternative treatment methods, thus requiring GAC suppliers to continuously demonstrate superior performance and operational longevity compared to competitors. The focus on life cycle assessment (LCA) and total cost of ownership (TCO) is paramount in the procurement decisions of major municipal and industrial consumers. This competitive pressure encourages suppliers to invest heavily in R&D to enhance carbon efficiency, reduce material wastage, and improve the sustainability profile of their products, often leading to proprietary manufacturing processes.

In terms of regional manufacturing strength, the shift towards utilizing renewable raw materials has bolstered the production dominance of Southeast Asian countries, particularly for coconut shell-based carbons. Conversely, North America and Europe maintain strong leadership in the development of advanced catalytic and impregnated GAC, often serving high-value, niche industrial markets requiring exceptional performance against difficult contaminants. Global trade flows are essential for matching specialized GAC products with regional regulatory needs, underlining the significance of robust international supply chain management for key market players.

The intersection of materials science and environmental engineering continues to define the GAC market's technological evolution. Ongoing research into biochar-based activated carbons, derived from agricultural waste, presents a potential disruptive force, offering a sustainable alternative raw material source that could potentially stabilize supply chain volatility associated with traditional sources like coal. If scalability and performance metrics match or exceed conventional GAC, biochar-based activated carbon could significantly alter the upstream supply chain dynamics and improve the overall sustainability credentials of the industry, particularly appealing to European and North American markets focused on green procurement policies.

Furthermore, the development of functionalized carbons—GAC media that incorporate specific functional groups on the surface to selectively target pollutants—is gaining prominence. This advanced customization moves GAC beyond simple broad-spectrum adsorption, allowing for highly efficient and selective removal of complex molecules, such as hormones, pesticides, and specific heavy metal ions. These innovations are particularly valuable in the pharmaceutical and specialty chemical industries where extremely high levels of purity are required, opening new revenue streams for technology leaders in the GAC sector.

The increasing deployment of Industrial Internet of Things (IIoT) sensors and real-time monitoring devices within GAC filtration systems is transforming operational management. These sensors provide continuous data on pressure differential, contaminant loading rates, and breakthrough curves, which, when analyzed by proprietary AI platforms, allow operators to optimize flow rates and predict service life with unprecedented accuracy. This move toward 'smart' activated carbon systems enhances reliability, reduces unscheduled downtime, and ultimately lowers the TCO for the end-user, further cementing GAC's position as a technologically advanced solution in environmental compliance and purification.

The governmental sector, encompassing municipalities and regulatory bodies, acts not only as a massive end-user but also as a fundamental market regulator. Government spending on large-scale infrastructure projects, such as upgrades to urban drinking water treatment plants, directly influences market demand. Policies related to mandatory carbon footprint reporting and water reuse standards also pressure industrial operators to adopt advanced treatment technologies like GAC. These public sector demands ensure a stable, long-term foundational demand for GAC globally, offsetting volatility experienced in specific industrial sectors.

The environmental consulting and engineering sector also plays a vital role as an indirect distribution and influence channel. These firms specify GAC solutions for complex remediation projects (e.g., contaminated groundwater cleanup) and new industrial plant designs. Their technical expertise and influence over purchasing decisions for customized and high-value GAC solutions are crucial for manufacturers focusing on specialized products rather than commodity GAC. Building strong relationships with leading global engineering procurement and construction (EPC) firms is therefore a strategic priority for GAC market leaders.

Finally, the growing consumer demand for high-quality air filtration and point-of-use (POU) water filtration devices represents an often-overlooked commercial segment. While individually small, the aggregate demand from household and commercial applications (e.g., restaurants, office buildings, air purifier manufacturers) for fine-grade GAC media contributes significantly to the overall market volume. This segment requires high standards of quality control and specialized packaging, offering differentiated opportunities for smaller manufacturers capable of meeting specific consumer-grade requirements and certifications.

The structural characteristics of the GAC supply chain emphasize the importance of raw material geographical concentration. For instance, the dependency on Southeast Asia for coconut shell precursors exposes the market to geopolitical and environmental risks (such as extreme weather events impacting coconut harvests). Diversifying raw material sources and improving the efficiency of carbonization processes to utilize lower-grade materials without compromising performance are key strategic focuses for ensuring supply resilience and stable pricing. Manufacturers are increasingly integrating backward into the supply chain or establishing long-term, exclusive contracts with raw material suppliers to mitigate these risks and secure competitive cost structures.

The transportation logistics within the GAC value chain are complicated by the product’s bulk density and the need for specialized storage conditions, particularly for pre-wetted or impregnated carbons, which require careful handling to maintain efficacy. Efficient, multimodal logistics—including bulk shipping, rail transport, and local trucking—are essential to minimize delivery costs, which constitute a significant portion of the final product price, especially when shipping from centralized production hubs to globally dispersed end-users, such as remote mining sites or municipal plants.

Furthermore, the after-sales service component, primarily centered around spent carbon handling, regeneration services, and disposal, is becoming increasingly critical. Companies offering comprehensive closed-loop services—collecting spent carbon, reactivating it, and returning the material—are gaining a significant competitive advantage, particularly in regulated markets like Europe. This service-centric model transitions the relationship from a simple material sale to a long-term operational partnership, enhancing customer retention and recurring revenue streams for the market incumbents.

Within the segmentation analysis, the distinction between liquid phase and vapor phase applications dictates not only the required pore structure of the GAC but also the operational design of the adsorption system. Liquid phase adsorption typically requires a balance of meso- and micropores to handle both larger organic molecules and smaller compounds dissolved in water, demanding high mechanical hardness to withstand hydraulic pressure. Vapor phase adsorption, crucial for VOC removal and gas separation, relies heavily on a highly developed micropore network to efficiently capture gaseous contaminants at low concentrations, often necessitating specialized impregnation for chemical reaction.

The segmentation by raw material (coal, coconut shell, wood) inherently defines the market’s competitive dynamics. Coal-based GAC, often derived from bituminous coal, offers general-purpose adsorption at a lower cost, making it highly competitive in large-scale industrial and municipal primary filtration applications. Conversely, the superior hardness and unique pore profile of coconut shell GAC command a premium price and dominate high-purity markets, emphasizing the importance of specialized product differentiation within the overall GAC portfolio.

As regulations push for better air quality, the Air Purification segment is diversifying rapidly, moving beyond traditional industrial stack emission control into specialized markets such as cabin air filters in vehicles, industrial respiratory protection, and sophisticated cleanroom environments. This expansion demands continuous innovation in GAC particle sizing and surface area optimization, increasingly utilizing technologies like extruded and pelletized carbon formats to maximize density and flow characteristics, signaling a technological pivot in this high-growth application area.

In summary, the market exhibits a trajectory of specialized growth fueled by regulatory necessity and technological advancements aimed at maximizing adsorption efficiency and sustainability. The fundamental role of GAC in ensuring public health through water purification and environmental compliance through emission control guarantees its continuous relevance and expanding market presence across all major geographic regions. Strategic focus areas for market leaders must include securing sustainable raw material supply, investing in specialized product development (impregnated and catalytic carbons), and offering comprehensive cradle-to-grave service models including efficient regeneration, leveraging the significant opportunities presented by global infrastructure modernization and the persistent threat of emerging contaminants.

The competitive landscape is increasingly defined by the ability of companies to manage volatile input costs and integrate advanced digital technologies into their product offerings and operational services. Manufacturers that successfully transition towards providing 'smart' GAC solutions, combining superior media with predictive maintenance analytics, will secure leadership positions, particularly in high-value regulated markets. Furthermore, geographical diversification, particularly capitalizing on the rapid infrastructural development in APAC and the increasing environmental stringency in Europe, remains paramount for maintaining overall global market share and achieving targeted revenue growth throughout the forecast period.

The long-term outlook for GAC remains overwhelmingly positive, underpinned by non-discretionary demand from essential services. While alternative adsorbents, such as specialized resins and membrane technologies, pose localized competitive threats, the cost-effectiveness, robust nature, and wide applicability of GAC ensure its sustained dominance in bulk purification and adsorption applications. Continuous innovation in production efficiency and media customization will be the driving forces enabling the GAC market to maintain its robust growth trajectory through 2033, significantly contributing to global environmental stewardship and public health protection efforts.

The increasing scrutiny on industrial effluent quality has highlighted the limitations of conventional wastewater treatment processes, compelling industries such as textiles, pulp and paper, and chemical manufacturing to integrate GAC filters as a final treatment stage. These industrial applications often require GAC with specific pore size distributions to handle complex and variable chemical loads, unlike municipal applications which often target broader organic removal. The customization of GAC for these specific industrial demands is a key differentiation strategy for manufacturers, enabling them to secure high-margin, technical sales.

Geographically, while developed markets focus on infrastructure modernization and addressing legacy contamination issues, emerging markets are focused on establishing basic access to clean water and sanitation. This dual market dynamic requires GAC suppliers to maintain flexible production capabilities—producing both high-volume commodity carbons for new municipal installations in emerging economies and high-specification, niche carbons for advanced industrial and remediation projects in mature markets. This balance is critical for maximizing global market penetration and revenue stability.

Finally, the growing awareness and regulatory pressure surrounding air quality necessitate the use of GAC in diverse air pollution control devices, from large industrial scrubbers to small, commercial HVAC systems. The ability of GAC to effectively adsorb Volatile Organic Compounds (VOCs) and various hazardous air pollutants (HAPs) positions it as an irreplaceable component in compliance strategies for clean air mandates, ensuring that the vapor phase segment contributes significantly to the overall market growth, particularly in regions implementing aggressive clean air policies.

The process of GAC regeneration, while costly, is a vital part of the market ecosystem, supporting the principles of a circular economy. Effective regeneration services not only reduce the environmental burden associated with disposing of spent carbon but also lower the long-term operational costs for end-users, improving the overall economic attractiveness of GAC technology compared to single-use alternatives. Companies that excel in providing high-efficiency, reliable regeneration services across multiple sites gain significant logistical and competitive advantages, often securing multi-year service contracts with major municipal clients.

Another crucial technological development involves the continuous innovation in the manufacturing of extruded activated carbon. Extruded GAC, formed by agglomerating powdered carbon and binding agents, offers high density and low pressure drop, making it ideal for gas phase applications where aerodynamic efficiency is critical. Advancements in binding agents and extrusion techniques are improving the physical integrity and adsorption performance of these products, allowing them to compete more effectively against pelletized carbons and traditional granular forms in specialized gas treatment processes.

The shift towards localized, decentralized water and wastewater treatment systems, often seen in remote industrial facilities or small communities, is creating demand for modular, skid-mounted GAC filtration units. These plug-and-play systems reduce installation complexity and capital outlay, making GAC technology accessible to a wider range of smaller enterprises and decentralized users. Manufacturers providing turnkey GAC solutions, including installation, commissioning, and media replacement services, are well-positioned to capitalize on this emerging trend toward decentralized environmental management.

Investment in R&D continues to focus on finding methods to increase the activity and efficiency of GAC for emerging contaminants that were not regulated historically. This includes exploring novel surface modification techniques, such as plasma treatment and chemical vapor deposition, to create carbons with tailored surface chemistries capable of highly selective and rapid adsorption of trace organic chemicals. Success in this specialized research area determines which companies will lead the transition into the next generation of advanced purification technologies required for ultra-low contaminant level standards.

The market faces ongoing pressure from competing technologies, particularly membrane filtration (reverse osmosis, ultrafiltration) which can offer superior contaminant removal for certain applications. However, GAC is frequently used synergistically with these membrane systems—acting as a pretreatment step to remove chlorine and organic fouling agents, thus extending the membrane life. This symbiotic relationship ensures that GAC remains a critical component in integrated, multi-barrier purification strategies, rather than being entirely replaced by newer technologies.

The regulatory environment, especially in highly developed regions, is shifting towards risk-based management of chemicals, which requires operators to implement comprehensive monitoring and treatment strategies. GAC's versatility and proven track record across diverse contaminant classes make it a fundamental element of these risk management frameworks, ensuring its continued adoption as a reliable and scalable solution for addressing complex environmental liabilities faced by both public utilities and private industry globally.

In summary, achieving sustainable and profitable growth in the Granular Activated Carbon market necessitates a dual approach: optimizing the cost and efficiency of commodity products (especially coal-based GAC for high volume markets) while simultaneously accelerating the development and commercialization of high-value, niche products (impregnated and engineered carbons) tailored for complex regulatory requirements and specialized industrial processes. The overarching theme remains regulatory compliance, driving non-negotiable demand for effective adsorption solutions globally.

The competitive differentiation will increasingly rely on service provision rather than just product sales. Companies offering comprehensive lifecycle management—from initial system design and material supply to regeneration, reactivation, and ultimate disposal—will secure deeper integration with major end-users. This trend towards integrated service packages mitigates risk for the customer and establishes high barriers to entry for competitors focused purely on material sales.

Ultimately, the Granular Activated Carbon market is poised for robust expansion, driven by immutable global challenges related to water scarcity, population growth, and the imperative of environmental protection. Technological integration, particularly leveraging AI and advanced manufacturing techniques, will solidify GAC’s essential role in future purification and remediation strategies across both public health and industrial compliance sectors.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Carbo Activatus Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Powdered activated carbon (R1, PAC), Granular activated carbon (GAC), Extruded activated carbon, Bead activated carbon (BAC), Others), By Application (Physical reactivation (Steam reactivation), Chemical reactivation, Physical and chemical reactivation), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

- Granular Activated Carbon Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Сосоnut Ѕhеll-Ваѕеd GАС, Соаl-bаѕеd GАС, Nutѕhеll-bаѕеd GАС, Маtеrіаlѕ), By Application (Wаtеr Тrеаtmеnt, Gаѕ Рurіfісаtіоn, Сhеmісаl Іnduѕtrу, Рrіntіng & Dуеіng, Fооd Іnduѕtrу, Еlесtrоnісѕ), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager