Granulator Blade Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435479 | Date : Dec, 2025 | Pages : 241 | Region : Global | Publisher : MRU

Granulator Blade Market Size

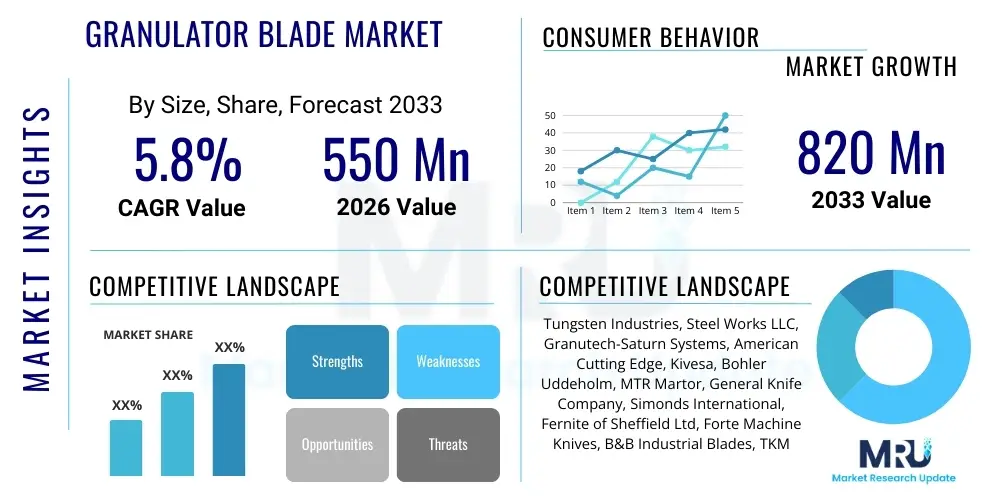

The Granulator Blade Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 550 Million in 2026 and is projected to reach USD 820 Million by the end of the forecast period in 2033. This growth trajectory is strongly influenced by the global expansion of waste management infrastructure, particularly in emerging economies, coupled with stringent environmental regulations mandating higher recycling rates for plastic and other composite materials.

Granulator Blade Market introduction

The Granulator Blade Market encompasses the manufacturing, distribution, and utilization of high-precision cutting tools essential for material size reduction processes within industrial granulators and shredders. Granulator blades, often referred to as knives, are critical consumable components designed to process diverse materials, primarily plastics, rubber, films, and composites, into smaller, uniformly sized particles suitable for recycling, reprocessing, or disposal. These blades function under extreme mechanical stress and abrasive conditions, necessitating specialized material compositions and advanced manufacturing techniques, such as cryogenic treatment and PVD coating, to ensure optimal performance and longevity.

The primary applications of these blades span across various industries, including plastics processing, packaging, automotive, electronics recycling (WEEE), and general waste management facilities. In the plastics industry, granulator blades are indispensable for processing production scrap, sprues, rejects, and bulky waste materials into regrind, which is then fed back into the manufacturing cycle, thereby enhancing resource efficiency and reducing raw material costs. The benefits derived from high-quality granulator blades include superior cutting accuracy, reduced machine downtime due to less frequent blade changes, lower energy consumption during the granulation process, and improved particle size consistency, which directly impacts the quality of the recycled feedstock.

Driving factors propelling the market growth include the robust expansion of the global recycling industry, fueled by governmental policies aiming for circular economies and corporate sustainability commitments. Furthermore, technological advancements in blade materials, such as the increased adoption of Tungsten Carbide and specialized powder metallurgy steels (e.g., PM Steel), offer significantly enhanced wear resistance and edge retention, driving demand for premium replacement blades. The continuous increase in plastic consumption and the resultant surge in plastic waste generation worldwide provide a persistent and expanding need for efficient granulation solutions, positioning the Granulator Blade Market for sustained expansion throughout the forecast period.

Granulator Blade Market Executive Summary

The Granulator Blade Market exhibits dynamic business trends characterized by a significant move towards high-performance and customized solutions, addressing the industry's need for enhanced operational resilience and reduced maintenance costs. Manufacturers are increasingly focused on leveraging advanced metallurgy, including the integration of specialized coatings like Titanium Nitride (TiN) and Aluminum Titanium Nitride (AlTiN), to improve blade hardness, abrasion resistance, and extend service life, particularly when processing highly abrasive materials such as glass-filled polymers or heavily contaminated waste streams. A key business trend involves the shift from transactional sales to integrated service models, where providers offer full lifecycle management, including sharpening, refurbishment, and proactive blade monitoring, enhancing customer value proposition and ensuring recurring revenue streams for market players.

Regionally, the Asia Pacific (APAC) stands out as the dominant and fastest-growing market, primarily driven by substantial industrial expansion, particularly in plastics manufacturing and electronic goods production across China, India, and Southeast Asia. These countries are simultaneously investing heavily in modern waste management and recycling infrastructure to cope with urbanization and regulatory pressures, creating immense demand for granulator machinery and replacement blades. In contrast, markets in North America and Europe are mature but focus intensely on operational efficiency and sustainability; the demand here is concentrated on premium blades, specialized material processing capabilities (e.g., medical plastics, bioplastics), and solutions that integrate seamlessly with Industry 4.0 standards, emphasizing precision engineering and minimal energy usage.

Segment trends indicate that the Rotary Blades segment, crucial for high-speed primary size reduction, is poised for accelerated growth due to its direct correlation with increasing throughput requirements in large-scale recycling facilities. Furthermore, the material segmentation reveals a strong transition away from traditional D2 steel towards Carbide-tipped and high-speed steel (HSS) blades, particularly in applications dealing with high volume or highly contamination feedstock, necessitating tools that maintain integrity and sharpness over longer operational periods. End-use segmentation confirms that the Recycling and Waste Management sector remains the largest consumer, while the niche demand from sectors like automotive shredding and pharmaceutical waste processing offers significant avenues for specialized product diversification and market penetration.

AI Impact Analysis on Granulator Blade Market

Common user inquiries regarding the influence of Artificial Intelligence (AI) on the Granulator Blade Market often center on how predictive technologies can mitigate unplanned equipment failure, optimize blade usage, and enhance overall operational efficiency within granulation processes. Users seek confirmation regarding the feasibility of using AI for real-time monitoring of blade wear patterns, automatically adjusting granulator settings based on input material variability, and guiding the selection of optimal blade materials for specific waste streams. The key themes emerging from this analysis highlight a strong expectation for AI to transition the market from reactive maintenance to highly proactive and data-driven asset management, thereby maximizing blade lifespan and reducing total cost of ownership (TCO). AI is expected to revolutionize aftermarket services by enabling hyper-personalized maintenance schedules and refining blade geometry optimization based on simulated performance data across thousands of operational hours.

- AI-powered Predictive Maintenance: Utilizes sensor data (vibration, temperature, current draw) to forecast blade wear rate and remaining useful life (RUL), scheduling replacement before failure.

- Optimized Process Control: AI algorithms automatically adjust rotor speed and feed rate based on material composition and blade condition, maximizing throughput and reducing energy consumption.

- Enhanced Blade Design: Machine learning models simulate stress distribution and material failure under various load conditions, accelerating the development of superior blade geometries and material combinations.

- Automated Quality Inspection: AI-driven visual systems monitor particle size distribution in real-time post-granulation, ensuring consistency and alerting operators to sub-optimal blade performance or necessary adjustments.

- Inventory Management Optimization: Predictive analytics forecasts demand for specific blade types based on seasonality, customer operational trends, and planned maintenance cycles, improving supply chain efficiency.

DRO & Impact Forces Of Granulator Blade Market

The Granulator Blade Market is governed by a complex interplay of Drivers, Restraints, and Opportunities, which collectively form the Impact Forces shaping its competitive landscape. Key drivers include the global push for a circular economy, regulatory mandates on plastic recycling rates, and the continuous industrial expansion in emerging economies, which necessitates robust size reduction equipment. The substantial capital expenditure by governments and private entities in establishing sophisticated waste sorting and recycling facilities directly translates into heightened demand for durable, high-throughput granulator blades. Simultaneously, the manufacturing sectors, particularly packaging and automotive, are increasingly relying on granulators to handle high volumes of in-house scrap and defective parts, bolstering the aftermarket for specialized replacement blades and maintenance services. This demand is further amplified by continuous material innovation, requiring blades capable of handling increasingly complex, multi-layer, and abrasive composite materials.

However, the market faces significant restraints, notably the intense price pressure exerted by non-branded or low-cost manufacturers, primarily situated in Asia, which challenges the profitability margins of premium blade producers. A major technical restraint lies in the inherent nature of the product: granulator blades are wear items that require frequent replacement and sharpening, leading to high operational costs for end-users, especially when processing highly abrasive materials like PET bottles or contaminated industrial waste. Furthermore, volatility in the pricing and supply chain of critical raw materials, such as high-grade steel alloys (e.g., D2, M2) and Tungsten Carbide powders, presents a persistent challenge to stable production costs and consistent market pricing, necessitating sophisticated inventory and procurement strategies from leading vendors.

Opportunities within this market are concentrated around technological differentiation and strategic market expansion. The development and commercialization of next-generation coatings, such as plasma-enhanced chemical vapor deposition (PECVD) and advanced ceramic coatings, offer manufacturers a substantial opportunity to deliver blades with dramatically improved service lives and superior performance characteristics in niche applications. Furthermore, the integration of blades into IoT ecosystems allows for continuous operational monitoring, offering opportunities for data monetization and the creation of value-added services, such as condition-based maintenance contracts and optimized resharpening services. The ongoing trend towards automated and unattended recycling operations also creates an opportunity for robust, low-maintenance blades designed for maximum intervals between servicing, particularly appealing to high-volume processors seeking operational uptime optimization.

Segmentation Analysis

The Granulator Blade Market is meticulously segmented based on critical functional and material characteristics to address the diverse needs of industrial applications across the value chain. Segmentation enables market players to tailor product offerings, pricing strategies, and distribution channels to specific end-user requirements, ranging from high-volume general plastics recycling to highly specialized applications requiring extreme material hardness or chemical resistance. Key differentiation factors include the blade's mechanism of action (rotary versus stationary), the primary material composition used in manufacturing (dictating durability and edge retention), and the ultimate end-user industry, where operational demands vary drastically.

- By Product Type:

- Rotary Blades (Crucial for high-speed size reduction)

- Stationary Blades (Anvils, fixed counter-blades)

- Screenless Granulator Blades

- By Material:

- High-Speed Steel (HSS)

- D2 Steel (Tool Steel, standard industry material)

- Carbide-Tipped Blades (Offering superior abrasion resistance)

- Powder Metallurgy (PM) Steel

- Tungsten Carbide Blades

- By Application:

- Plastics Recycling (PET, HDPE, PP, PVC films, bulky waste)

- Rubber and Tire Recycling

- Wood and Biomass Processing

- Paper and Cardboard Waste

- E-Waste Recycling (WEEE)

- By End-Use Industry:

- Recycling and Waste Management Facilities

- Plastics Processing and Molding

- Automotive Manufacturing

- Packaging Industry

- Chemical and Pharmaceutical Industry

Value Chain Analysis For Granulator Blade Market

The value chain for the Granulator Blade Market is initiated at the upstream level, characterized by the procurement of highly specialized raw materials, primarily high-carbon, high-chromium tool steels such as D2 and HSS, and increasingly, specialized carbide inserts and powders. Quality control at this stage is paramount, as the metallurgical purity and consistency of the base material directly determine the performance, longevity, and ultimately, the cost of the finished blade. Strategic relationships with tier-one specialty steel suppliers and carbide manufacturers are crucial for securing consistent material flow and negotiating favorable pricing, especially given the global constraints and fluctuations in commodity markets. Advanced processing techniques, including forging, precise heat treatment (which dictates final hardness), and specialized cryogenic processing, are pivotal mid-chain activities that transform raw materials into high-performance blanks ready for finishing.

The mid-stream segment involves the core manufacturing processes, which are technologically demanding and capital-intensive. This includes highly precise CNC machining, surface grinding to achieve micron-level tolerances for seamless fitment in granulators, and the application of advanced wear-resistant coatings (such as PVD or specialized ceramic layers). Precision in manufacturing is non-negotiable, as slight deviations in blade geometry or surface finish can lead to accelerated wear, poor cutting performance, and increased stress on the granulator machine. Companies that invest heavily in automated, high-precision grinding equipment and proprietary heat treatment protocols gain a significant competitive edge by offering superior products with guaranteed consistency and durability.

Downstream activities focus on effective distribution channels, encompassing both direct sales to major Original Equipment Manufacturers (OEMs) and robust aftermarket sales, which typically constitute the largest revenue stream. Direct channels allow manufacturers to serve large recycling corporations and plastics processors with customized solutions and direct technical support. Indirect distribution relies heavily on a network of specialized industrial equipment distributors and local service providers who handle the logistics of replacement parts, resharpening services, and technical consultation. The aftermarket segment is highly competitive and relies on rapid availability and technical expertise; therefore, establishing strong, reliable distribution partnerships globally is essential for maintaining market share and minimizing end-user downtime, ensuring the seamless integration of blade replacement into the client's maintenance cycle.

Granulator Blade Market Potential Customers

Potential customers for granulator blades span a wide range of industrial sectors fundamentally engaged in material processing, size reduction, and recycling efforts. The primary and most significant customer base comprises specialized Material Recycling Facilities (MRFs) and large-scale industrial waste management companies, which operate high-volume granulators designed to process municipal, commercial, and industrial waste streams, focusing particularly on maximizing recovery of recyclable plastics. These facilities require constant replenishment of wear parts and often seek long-term contracts for bulk blade supply and routine maintenance services, prioritizing blade durability and resistance to contamination damage.

Another crucial customer segment includes plastics processors, compounders, and injection molding companies. These end-users utilize granulators primarily to manage internal production scrap, such as runners, sprues, and off-spec parts, converting them back into usable regrind immediately on-site, a process known as closed-loop recycling. For these manufacturing environments, the consistency of the regrind particle size and minimizing contamination are critical factors, driving demand for premium, highly precise blades that minimize dust generation and maximize the value of the reclaimed material. Blade failure in these settings can directly halt production lines, making uptime and reliability key purchasing criteria.

Furthermore, specialized industries such as automotive manufacturing (processing interior components and bumpers), electronics recycling (shredding circuit boards and casings to separate metals and plastics), and specialized pharmaceutical waste disposal (requiring sterile and high-precision cutting) represent high-value potential customers. These sectors often require blades made from unique, often non-standard materials with specific coatings tailored to handle specialized or highly hazardous input materials. The procurement decision in these niche markets is driven less by cost and more by compliance with regulatory standards, material specifications, and the ability of the blade supplier to provide certified, high-performance tools engineered for complex operations.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 550 Million |

| Market Forecast in 2033 | USD 820 Million |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Tungsten Industries, Steel Works LLC, Granutech-Saturn Systems, American Cutting Edge, Kivesa, Bohler Uddeholm, MTR Martor, General Knife Company, Simonds International, Fernite of Sheffield Ltd, Forte Machine Knives, B&B Industrial Blades, TKM GmbH, Zenith Cutter Inc., Hyde Industrial Blade Solutions, Jiangsu Yaofeng Machinery, Shandong Xinxiang Steel, HEKO Ketten GmbH, Schick GmbH, Baucor Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Granulator Blade Market Key Technology Landscape

The technological landscape of the Granulator Blade Market is rapidly evolving, driven by the necessity to enhance wear resistance, extend tool life, and improve energy efficiency during material processing. A core focus lies in advanced metallurgy, specifically the widespread adoption of Powder Metallurgy (PM) steels, which offer a finer, more homogenous microstructure compared to conventionally produced tool steels. This improved structure allows PM steels to hold a sharper edge for longer periods and exhibit superior toughness, making them ideal for high-stress applications involving contaminated or heavily abrasive materials. Furthermore, the use of cryogenic treatment—a deep freezing process applied after traditional heat treatment—is increasingly standard practice among leading manufacturers to stabilize the material structure, converting retained austenite into martensite, thereby significantly enhancing the blade's hardness and dimensional stability under operational temperature fluctuations.

Another crucial technological development revolves around specialized surface engineering and coating technologies. Physical Vapor Deposition (PVD) and Chemical Vapor Deposition (CVD) processes are used to apply ultra-hard, thin-film coatings, such as Titanium Nitride (TiN), Aluminum Titanium Nitride (AlTiN), and proprietary diamond-like carbon (DLC) coatings. These coatings drastically reduce the coefficient of friction, minimizing heat generation during cutting, which is a major contributor to blade dulling and material melting. By minimizing friction and increasing surface hardness, these coatings not only extend the interval between required sharpening cycles but also contribute to lower energy consumption by the granulator, offering significant operational cost savings to the end-user.

In addition to material science, manufacturing technologies are being optimized through the use of high-precision CNC five-axis grinding machines. These machines ensure exceptional dimensional accuracy and parallelism, which are essential for proper blade alignment within the granulator housing. Misalignment, even by a few microns, can lead to uneven wear and catastrophic failure. Moreover, sensor integration technology is emerging as a critical component, with some high-end blades incorporating embedded or external sensors connected to the granulator’s control system. This IoT integration allows for real-time monitoring of vibration, temperature, and current draw, providing valuable data for predictive maintenance algorithms and enabling optimal operational parameters, marking a definitive step toward smart manufacturing in size reduction processes.

Regional Highlights

The global Granulator Blade Market demonstrates strong regional variations influenced by industrial concentration, recycling policies, and the maturity of waste management infrastructure. Asia Pacific (APAC) holds the largest market share and is projected to experience the highest growth rate due to its position as the global hub for plastics manufacturing and electronic goods assembly. Countries like China, India, and Vietnam are simultaneously experiencing rapid industrialization and facing immense pressure to manage mounting plastic waste, leading to substantial governmental investments in high-capacity recycling plants.

- Asia Pacific (APAC): Dominates the market owing to massive manufacturing bases, lower labor costs, high volumes of plastic production and consumption, and increasing adoption of stringent recycling policies, driving demand for both standard and high-performance blades.

- North America: Characterized by a high demand for premium, technologically advanced blades. The market is driven by sophisticated waste management systems, stringent quality requirements in automotive and aerospace recycling, and a focus on minimizing machine downtime through reliable, long-life consumables.

- Europe: Exhibits robust growth fueled by the European Union's Circular Economy Action Plan, which imposes high recycling targets. The region focuses heavily on sustainability, efficiency, and the processing of complex, multi-material waste streams, promoting demand for specialized carbide and coated blades.

- Latin America (LATAM): Represents an emerging market with accelerating growth in industrial infrastructure, particularly in Brazil and Mexico. Demand is increasing rapidly as local governments establish formal recycling programs and scale up plastics processing capacities.

- Middle East and Africa (MEA): Currently the smallest but showing potential, driven by large-scale infrastructure projects, diversification away from oil, and growing investment in local manufacturing and waste management facilities, particularly in the UAE and Saudi Arabia.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Granulator Blade Market.- Tungsten Industries

- Steel Works LLC

- Granutech-Saturn Systems

- American Cutting Edge

- Kivesa

- Bohler Uddeholm

- MTR Martor

- General Knife Company

- Simonds International

- Fernite of Sheffield Ltd

- Forte Machine Knives

- B&B Industrial Blades

- TKM GmbH

- Zenith Cutter Inc.

- Hyde Industrial Blade Solutions

- Jiangsu Yaofeng Machinery

- Shandong Xinxiang Steel

- HEKO Ketten GmbH

- Schick GmbH

- Baucor Inc.

Frequently Asked Questions

Analyze common user questions about the Granulator Blade market and generate a concise list of summarized FAQs reflecting key topics and concerns.What materials are most commonly used for manufacturing high-performance granulator blades?

High-performance granulator blades are predominantly manufactured from specialized tool steels, such as D2 and HSS (High-Speed Steel), due to their balance of hardness and toughness. For applications involving highly abrasive materials like glass-filled polymers or highly contaminated waste, superior wear resistance is achieved using carbide-tipped blades or advanced Powder Metallurgy (PM) steels treated with specialized coatings like AlTiN or DLC (Diamond-Like Carbon).

How does the choice of granulator blade material affect overall operational costs and energy consumption?

Selecting a superior blade material, such as Tungsten Carbide or specialized PM steel, significantly increases initial procurement costs but dramatically reduces long-term operational costs. These high-performance materials offer extended service intervals, requiring less frequent sharpening and replacement, thereby reducing downtime and associated maintenance labor. Furthermore, sharper, more efficient blades require less energy (lower current draw) to process material, leading to substantial energy savings over time.

What role does the aftermarket play in the Granulator Blade Market, and is direct purchasing advisable?

The aftermarket, comprising replacement blades, sharpening services, and refurbishment, constitutes the largest segment of the Granulator Blade Market, as blades are essential consumables. While direct purchasing from manufacturers ensures product authenticity, technical support, and customization options, buying through specialized local distributors is often necessary for rapid fulfillment of emergency replacement parts and quick access to localized sharpening services and technical consultation.

How are technological advancements like IoT and AI influencing the lifespan and maintenance of granulator blades?

IoT and AI are driving the shift toward predictive maintenance. Sensors monitor machine vibrations and power consumption, feeding data to AI algorithms that accurately predict the remaining useful life (RUL) of the blades. This allows operators to schedule maintenance precisely before failure, optimizing blade usage, minimizing unplanned downtime, and integrating blade replacement seamlessly into the overall smart factory maintenance regime.

Which regional market shows the fastest growth potential for granulator blades, and why?

The Asia Pacific (APAC) region is projected to exhibit the fastest growth potential. This rapid expansion is primarily driven by massive governmental and private investments in waste management infrastructure, soaring plastics production volumes across emerging economies, and the increasing implementation of stricter recycling mandates aimed at tackling environmental pollution and resource scarcity.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager