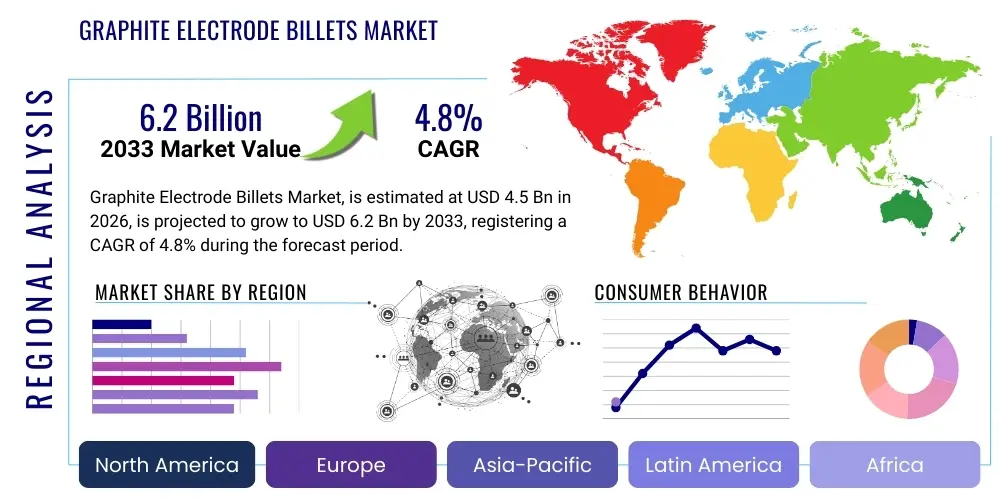

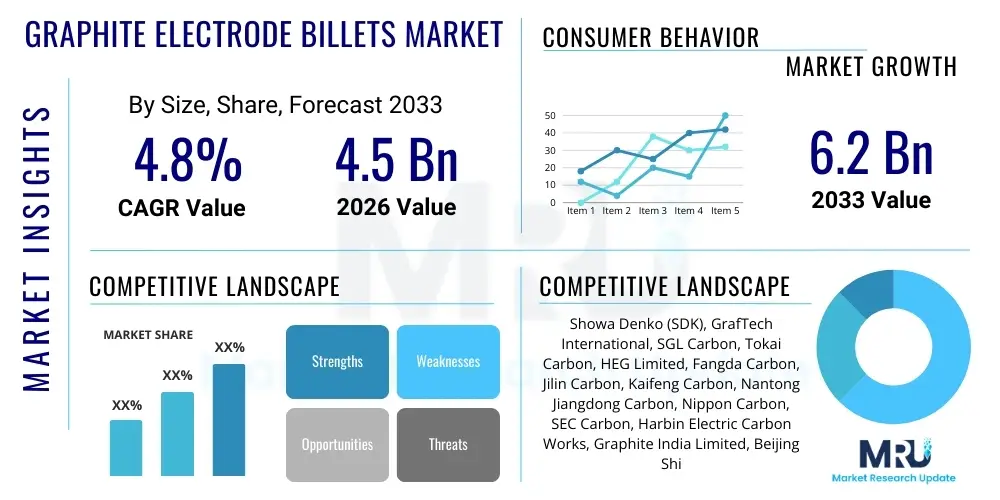

Graphite Electrode Billets Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438860 | Date : Dec, 2025 | Pages : 242 | Region : Global | Publisher : MRU

Graphite Electrode Billets Market Size

The Graphite Electrode Billets Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.8% between 2026 and 2033. The market is estimated at USD 4.5 Billion in 2026 and is projected to reach USD 6.2 Billion by the end of the forecast period in 2033.

Graphite Electrode Billets Market introduction

The Graphite Electrode Billets Market forms a critical segment within the broader carbon and graphite products industry, serving primarily as the raw material precursor for manufacturing graphite electrodes. These electrodes are indispensable components used predominantly in Electric Arc Furnaces (EAFs) and Ladle Furnaces (LFs) within the steel and ferroalloy industries. Graphite electrode billets are dense, highly conductive cylindrical shapes derived from petroleum coke and coal tar pitch, which undergo stringent processing including forming, baking, impregnation, graphitization, and often purification. The quality of the billet directly dictates the final performance characteristics—such as low electrical resistance, high thermal shock resistance, and minimal oxidation—required of Ultra High Power (UHP) and High Power (HP) electrodes.

The core application of these billets lies in the conversion into finished graphite electrodes, which facilitate the melting of scrap metal and virgin iron materials in EAFs via intense electrical current. This process is central to modern, sustainable steelmaking practices, as EAF production offers significant environmental advantages, notably lower energy consumption and reduced CO2 emissions compared to traditional blast furnace (BF) operations. The increasing global focus on decarbonization and the circular economy, which promotes the use of recycled steel scrap, fundamentally links the growth trajectory of the graphite electrode billets market to the expansion and technological advancement of the EAF steel sector.

Key driving factors for market expansion include escalating worldwide steel production, particularly the growing share of EAF technology in emerging economies like India and Southeast Asia, and continuous technological advancements aimed at improving electrode performance. Benefits derived from high-quality billets include reduced consumption rates during steel refining, enhanced furnace efficiency, and decreased operational downtime for steel producers. The consistency and purity of billets, especially those intended for UHP applications, are paramount, requiring specialized needle coke feedstocks and highly controlled graphitization processes to meet the demanding operational environment of modern, high-intensity steel mills.

Graphite Electrode Billets Market Executive Summary

The Graphite Electrode Billets Market exhibits robust growth propelled by major structural shifts in the global steel industry, specifically the accelerated adoption of Electric Arc Furnace (EAF) technology over traditional Basic Oxygen Furnace (BOF) methods. Business trends indicate strong capital expenditure in Asia Pacific, particularly China and India, focusing on integrating sustainable steel production methods, which directly elevates the demand for high-quality Ultra High Power (UHP) graphite electrodes and, consequently, their billets. Suppliers are focused on enhancing operational efficiencies, optimizing the complex graphitization process, and securing long-term contracts for essential raw materials like premium needle coke, leading to strategic vertical integration initiatives aimed at stabilizing production costs and maintaining consistent supply reliability.

Regionally, Asia Pacific dominates the market both in production capacity and consumption, driven by massive infrastructure projects and the region's concentration of leading steel manufacturers. North America and Europe demonstrate mature market demand characterized by stringent quality requirements and a rapid transition toward premium UHP grades necessary for sophisticated EAF operations utilizing high scrap loads. Emerging markets in Latin America and the Middle East and Africa (MEA) are also showing significant potential as local steel production capacity increases and industrialization accelerates, creating new pockets of demand for graphite billets, though often focusing initially on High Power (HP) and Regular Power (RP) grades.

Segment trends reveal a pronounced shift favoring UHP-grade billets, which command the highest price premium and are critical for maximizing throughput and efficiency in modern, large-capacity EAFs. While the application segment remains dominated by EAF steel production, demand from secondary applications, such as silicon metal and ferroalloy production, contributes steady, specialized growth. Manufacturers are actively investing in R&D to develop billets with superior microstructure, ensuring higher oxidation resistance and thermal shock stability, addressing the increasing operational intensity and current loads placed on electrodes in contemporary steel melting processes.

AI Impact Analysis on Graphite Electrode Billets Market

Common user questions regarding AI's impact on the Graphite Electrode Billets Market frequently revolve around optimizing high-temperature processes, predicting raw material price volatility, and enhancing quality control during production. Users are keen to understand how Artificial Intelligence can minimize defects, especially during the crucial baking and graphitization phases, which are highly energy-intensive and prone to structural imperfections if process parameters drift. Concerns also center on the use of predictive maintenance models to extend the lifespan of expensive furnace linings and production equipment, thereby reducing downtime and stabilizing overall production output. Furthermore, there is significant interest in using AI for advanced demand forecasting in the highly cyclical steel industry, enabling billet manufacturers to manage complex inventory levels of needle coke and final product more effectively in response to fluctuating global steel cycles.

The adoption of AI and machine learning (ML) technologies is poised to revolutionize the manufacturing precision and supply chain efficiency within the graphite electrode billets sector. By integrating sensors and real-time data analytics across the various production stages—mixing, molding, baking, and graphitization—AI algorithms can identify subtle deviations in temperature, pressure, and chemical composition far faster and more accurately than human operators. This advanced process control capability directly leads to improved billet consistency, reduced scrap rates, and higher yields of highly demanding UHP grades. Furthermore, AI-driven simulations can optimize furnace loading patterns and power consumption during graphitization, significantly reducing the massive energy costs associated with high-temperature processing, ultimately improving profitability and competitiveness in a capital-intensive industry.

- AI-enhanced Predictive Maintenance: Reducing unplanned equipment failure in high-temperature kilns and graphitization furnaces.

- Optimized Process Control: Real-time adjustment of baking and graphitization parameters to minimize structural defects and ensure uniform density.

- Demand Forecasting and Supply Chain Management: Using ML to predict steel market cyclicality, optimizing needle coke procurement and finished billet inventory.

- Quality Assurance Automation: Employing computer vision and sensor data to automatically inspect billet surfaces and internal microstructure for quality inconsistencies.

- Energy Consumption Reduction: AI algorithms optimizing power usage during the highly energy-intensive graphitization phase.

DRO & Impact Forces Of Graphite Electrode Billets Market

The Graphite Electrode Billets Market is strongly influenced by a combination of powerful drivers, significant restraints, and emerging opportunities, which collectively determine its growth trajectory and competitive landscape. The primary driver is the accelerating global shift towards sustainable steel production, where the EAF method, reliant on graphite electrodes, continues to expand its market share relative to conventional methods. Opportunities arise from technological advancements focusing on reducing electrode consumption rates and the strategic potential for recycling spent graphite material. Conversely, the market faces inherent restraints, most notably the high volatility and cyclical nature of raw material prices, particularly needle coke, and the immense capital expenditure and energy costs associated with establishing and running high-pspecification manufacturing facilities, creating substantial barriers to entry. These elements establish a complex matrix of impact forces dictating production profitability and long-term strategic viability for market participants.

The core impact forces are centered around supply chain vulnerability and environmental mandates. The market's heavy reliance on highly specialized, petroleum-derived needle coke means supply disruptions or geopolitical tensions affecting oil refining directly impact production costs and stability. Simultaneously, global climate policies pushing for decarbonization serve as a powerful tailwind, ensuring sustained long-term demand growth from the steel sector. Furthermore, the market structure is heavily influenced by the intensive energy requirements for the graphitization stage, making manufacturers acutely sensitive to electricity pricing and regulatory frameworks governing energy usage, particularly in regions like China which possess significant, low-cost capacity but face evolving environmental controls.

Effective navigation of the market requires manufacturers to prioritize securing reliable, high-purity needle coke supply through long-term agreements or backward integration, while simultaneously investing in energy-efficient technologies (e.g., advanced heat recovery systems) to mitigate operational risks. The balance between meeting the stringent quality demands of UHP applications and managing volatile input costs defines the competitive success in this specialized industrial domain. Opportunities for new entrants, though limited by high capital requirements, are often found in niche areas such as advanced purification technologies or specialized grades tailored for non-steel applications like aerospace or nuclear industries.

Segmentation Analysis

The Graphite Electrode Billets market is comprehensively segmented based on three primary criteria: Grade, which dictates performance characteristics; Application, which identifies the end-use industry; and Region, reflecting geographical consumption patterns. The Grade segment—Ultra High Power (UHP), High Power (HP), and Regular Power (RP)—is the most critical differentiator, as UHP billets require the highest purity needle coke and the most intensive processing, catering primarily to large-scale, modern Electric Arc Furnaces (EAFs) focused on efficiency and high throughput. The market structure is heavily tilted towards the UHP grade due to global modernization efforts in steel production. The Application segment is dominated by EAF Steel Production, but secondary uses in ladle furnaces and non-ferrous metal refining provide crucial stability to demand, while the regional analysis underscores the pivotal role of Asia Pacific as both the manufacturing hub and the largest consumer base.

- Grade

- Ultra High Power (UHP)

- High Power (HP)

- Regular Power (RP)

- Application

- EAF Steel Production

- Ladle Furnace (LF) Refining

- Ferroalloy Production

- Silicon Metal Manufacturing

- Others (e.g., Non-ferrous metal smelting)

- Region

- North America

- Europe

- Asia Pacific (APAC)

- Latin America

- Middle East & Africa (MEA)

Value Chain Analysis For Graphite Electrode Billets Market

The value chain for Graphite Electrode Billets is complex, capital-intensive, and starts significantly upstream with the sourcing of specialized carbon materials. The upstream segment is dominated by petrochemical refiners and coal processors who produce the necessary raw materials: premium calcined petroleum needle coke and coal tar pitch binder. The quality and purity of the needle coke—which determines the final electrode characteristics—are critical bottlenecks, often requiring long-term supply contracts, and this segment is highly consolidated among a few global producers. Following raw material procurement, the manufacturing process involves intensive steps like mixing, molding, baking (carbonization), impregnation, rebaking, and the extremely high-temperature graphitization phase, which constitutes the most significant operational cost, typically consuming vast amounts of electrical energy.

The midstream process, centered on the billet production itself, requires specialized facilities capable of maintaining extremely tight tolerances and high-purity environments, especially for UHP billets. Logistics and distribution channels then move the finished billets to downstream converters or directly to large electrode manufacturing plants. Distribution often relies on specialized shipping logistics due to the size, weight, and fragility of the billets, utilizing both direct sales models for major steel groups and indirect channels through specialized industrial distributors. The proximity of billet production facilities to major steelmaking regions, particularly in Asia, has a significant impact on logistical costs and delivery timelines.

The downstream analysis focuses on the end-users, primarily integrated steel producers utilizing Electric Arc Furnaces (EAFs). The demand is highly inelastic in the short term, as steel manufacturers cannot easily substitute graphite electrodes. Direct sales dominate the UHP and HP segments, facilitated by long-term strategic supply agreements between electrode manufacturers (the primary buyers of billets) and large steel mills. The performance feedback from end-users regarding electrode consumption rates and failure analysis directly influences the R&D and quality control parameters applied during the billet manufacturing phase. The efficiency of the entire chain is predicated on minimizing defects and maximizing the thermal and electrical performance of the final electrode product.

Graphite Electrode Billets Market Potential Customers

The primary customers and end-users of Graphite Electrode Billets are large-scale, integrated manufacturers of finished graphite electrodes, who subsequently supply the steel industry. These customers include global carbon product giants who purchase billets either semi-finished or as raw forms to complete the final machining, nipple attachment, and packaging process before sale to steel mills. These specialized manufacturers require consistent quality, particularly UHP grades, as electrode performance directly affects their contractual relationships with high-volume steel producers. The purchasing decision is driven by stringent specifications regarding density, resistivity, thermal expansion coefficient, and availability of large diameters essential for modern, high-capacity EAFs. Establishing a reliable supplier base is crucial for these customers due to the high costs associated with production delays caused by material inconsistency.

A significant, though smaller, customer base includes integrated steel mills that may have internal operations for manufacturing or machining electrodes, or specialized foundries producing ferroalloys and silicon metal. For these non-steel applications, the required billet specifications can vary, often focusing on High Power (HP) or specialized grades suited for slightly different metallurgical processes. In these scenarios, the procurement process is often highly technical, involving extensive pre-qualification and performance testing. The ultimate demand is intrinsically linked to global industrial production indices, infrastructural investment, and automotive manufacturing output, which dictates the production rates of the steel mills that consume the final electrodes.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.5 Billion |

| Market Forecast in 2033 | USD 6.2 Billion |

| Growth Rate | 4.8% ( Include CAGR Word with % Value ) |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Showa Denko (SDK), GrafTech International, SGL Carbon, Tokai Carbon, HEG Limited, Fangda Carbon, Jilin Carbon, Kaifeng Carbon, Nantong Jiangdong Carbon, Nippon Carbon, SEC Carbon, Harbin Electric Carbon Works, Graphite India Limited, Beijing Shichang High-Tech Carbon, RESORBENT, IBIDEN Co. Ltd., Mitsubishi Chemical Corporation, Ameri-Source Specialty Products, Baofeng Carbon. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Graphite Electrode Billets Market Key Technology Landscape

The technology landscape governing the production of Graphite Electrode Billets is defined by sophisticated processes aimed at achieving ultra-high density, superior thermal conductivity, and structural integrity under extreme heat and mechanical stress. Central to this landscape is the pressing and molding technology, which determines the initial density and homogeneity of the green billet. Advanced vibrating molding and isostatic pressing techniques are increasingly utilized, particularly for UHP grades, to ensure uniform grain structure and eliminate voids, crucial steps that directly influence the final resistivity of the electrode. Furthermore, precise control during the baking phase, often involving complex ring furnace systems, is essential to minimize shrinkage and cracking as the coal tar pitch binder undergoes carbonization, demanding highly sensitive temperature profiling and atmospheric control.

The most critical technological differentiator lies in the graphitization process, where baked carbon artifacts are converted into crystalline graphite at temperatures exceeding 2800 degrees Celsius, typically utilizing the Acheson process or variations thereof, such as the Castner furnace method. Innovations in graphitization focus heavily on energy efficiency and achieving higher levels of purity through advanced thermal insulation and customized power application curves. Manufacturers are investing heavily in technologies that optimize current distribution across the billet stack to ensure uniform graphitization throughout the entire volume. Furthermore, specialized purification technologies, including halogen purification systems, are sometimes employed post-graphitization to reduce trace impurities (like vanadium and silicon) to extremely low parts-per-million levels, a necessity for ultra-premium billets used in specialty steel and high-purity metallurgical applications.

Modern billet manufacturing also relies heavily on automated quality control systems, utilizing non-destructive testing (NDT) methods like ultrasonic inspection and eddy current testing to assess internal defects and measure electrical resistivity before final machining. Technological advancements also extend to the composition of the raw materials themselves, with continued research into synthetic graphite precursors and pitch formulations designed to improve bonding characteristics and oxidation resistance. The ongoing objective is the production of larger diameter, longer billets with enhanced thermal shock resistance, allowing steel producers to operate EAFs at maximum current loads for sustained periods without electrode failure, driving down overall consumption rates per ton of steel produced.

Regional Highlights

The geographical distribution of the Graphite Electrode Billets market is highly concentrated, with demand fundamentally tied to regional steel production capacities and technological maturity.

- Asia Pacific (APAC): Dominates the global market, accounting for the largest share in both production and consumption. This dominance is driven primarily by China, which is the world's largest steel producer and has invested massively in EAF capacity expansion as part of its environmental mandate shift. India and Southeast Asia are also key growth regions due to rapid industrialization and infrastructure development, sustaining high demand for all grades, with increasing penetration of UHP grades. APAC manufacturers benefit from local access to raw materials and competitive energy prices, although they often face intense pricing pressure.

- North America: Characterized by a highly technologically advanced steel industry focused almost exclusively on EAFs. This region is a major consumer of UHP billets and electrodes, prioritizing quality, performance consistency, and long-term supply security over raw cost. Demand is stable, reflecting the mature nature of the domestic steel market and its focus on premium steel grades, supported by strong recycling infrastructure.

- Europe: Similar to North America, Europe maintains high demand for UHP grades driven by strict environmental regulations pushing steel producers towards EAF technologies. The region faces comparatively higher energy costs, placing a premium on high-efficiency, low-consumption billets. Manufacturers in this region focus heavily on innovative, sustainable production methods and securing supply chains that adhere to rigorous European quality and environmental standards.

- Latin America (LATAM): Represents an emerging market with significant growth potential, particularly Brazil and Mexico, which are expanding their steel industries to meet domestic infrastructure and manufacturing needs. Demand is currently strong for HP and RP grades but is steadily moving towards UHP as steel mills modernize their older EAF facilities.

- Middle East & Africa (MEA): Growth in the MEA region is driven by the establishment of new, often vertically integrated, steel production facilities, especially in the Gulf Cooperation Council (GCC) countries. These regions often have access to competitive energy, making local EAF production economically viable and creating specialized demand pockets for high-quality billets necessary for large-scale operations.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Graphite Electrode Billets Market.- Showa Denko (SDK)

- GrafTech International

- SGL Carbon

- Tokai Carbon

- HEG Limited

- Fangda Carbon

- Jilin Carbon

- Kaifeng Carbon

- Nantong Jiangdong Carbon

- Nippon Carbon

- SEC Carbon

- Harbin Electric Carbon Works

- Graphite India Limited

- Beijing Shichang High-Tech Carbon

- RESORBENT

- IBIDEN Co. Ltd.

- Mitsubishi Chemical Corporation

- Ameri-Source Specialty Products

- Baofeng Carbon

- Toray Carbon Fibers America, Inc.

Frequently Asked Questions

Analyze common user questions about the Graphite Electrode Billets market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the demand for Ultra High Power (UHP) Graphite Electrode Billets?

The primary driver is the global increase in the adoption rate of Electric Arc Furnaces (EAFs) for steel production. UHP billets are essential for manufacturing the high-performance electrodes required to sustain the intense current loads and high throughput demands of modern, efficient EAF operations, particularly as the industry pushes towards decarbonization and higher scrap utilization rates.

How does the price volatility of needle coke affect the profitability of billet manufacturers?

Needle coke, a highly specialized petroleum-based raw material, is the largest component of production cost and is subject to significant price swings tied to petrochemical market cycles and supply concentration. High volatility directly impacts the gross margins of billet manufacturers, necessitating sophisticated inventory management and long-term procurement strategies to stabilize costs and maintain competitiveness.

Which region dominates the consumption and production of Graphite Electrode Billets globally?

Asia Pacific (APAC), particularly China, dominates both the production and consumption of Graphite Electrode Billets. This leadership position is due to the immense scale of the region's steel industry, ongoing governmental investment in modern EAF capacity, and the presence of several of the world's largest integrated carbon manufacturers.

What technological advancements are critical for improving billet quality in the near future?

Critical technological advancements include optimizing the energy-intensive graphitization process for higher thermal uniformity and purity, implementing advanced non-destructive testing (NDT) for internal defect detection, and utilizing sophisticated mixing and molding techniques (such as isostatic pressing) to achieve superior density and structural homogeneity in the green billets.

What are the main application segments for Graphite Electrode Billets besides EAF steelmaking?

Although EAF steel production is the largest consumer, significant secondary application segments include the production of Ferroalloys (such as ferrosilicon and ferrochrome), the manufacturing of Silicon Metal, and specialized refining processes conducted in Ladle Furnaces (LFs), which require high-purity graphite electrodes for precise temperature control and alloying.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager