Graphitized Cathode Block Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433305 | Date : Dec, 2025 | Pages : 251 | Region : Global | Publisher : MRU

Graphitized Cathode Block Market Size

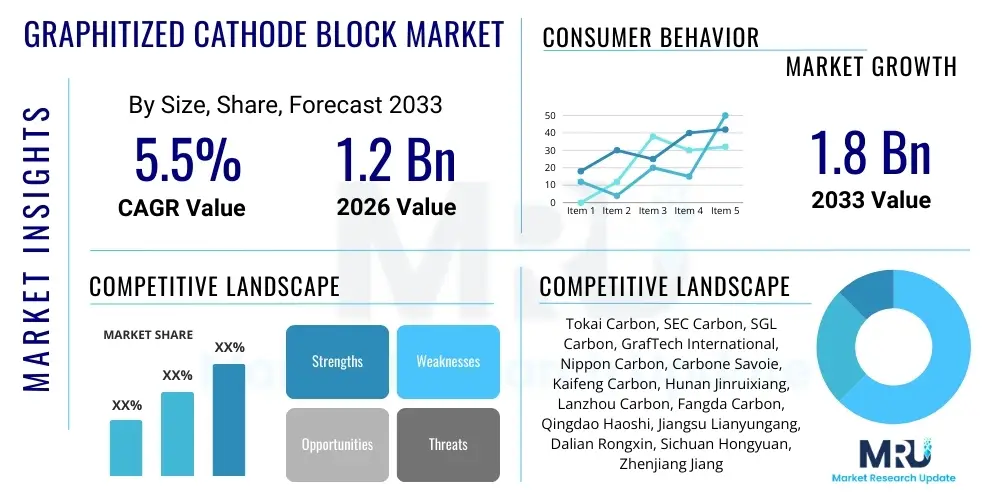

The Graphitized Cathode Block Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.5% between 2026 and 2033. The market is estimated at $1.2 Billion in 2026 and is projected to reach $1.8 Billion by the end of the forecast period in 2033.

Graphitized Cathode Block Market introduction

The Graphitized Cathode Block Market encompasses the production and supply of highly specialized carbon materials essential for the aluminum smelting process. These blocks, manufactured through meticulous processing of petroleum coke and coal tar pitch followed by graphitization at extremely high temperatures, serve as the negative electrode in Hall-Héroult cells. Their primary function is to conduct electricity and withstand the harsh, corrosive environment of molten cryolite and aluminum, ensuring efficient and continuous aluminum production. The quality and longevity of these cathode blocks directly impact the energy efficiency and operational costs of smelters globally.

Graphitized cathode blocks are characterized by superior electrical conductivity, enhanced thermal shock resistance, and low porosity compared to semi-graphitized or amorphous carbon blocks. This makes them indispensable for modern, high-amperage smelting technologies seeking to minimize voltage drop and maximize cell life. Major applications are overwhelmingly concentrated in the primary aluminum industry, where ongoing capacity expansion, particularly in Asia Pacific and the Middle East, fuels sustained demand for high-performance cathode materials. The structural integrity and chemical inertness of these blocks are critical differentiators, allowing them to resist degradation caused by sodium intercalation and fluorination during electrolysis.

Key driving factors supporting market expansion include the global increase in aluminum demand, driven by automotive lightweighting, aerospace applications, and infrastructural development. Furthermore, stricter environmental regulations in various regions are prompting smelters to upgrade to more energy-efficient cell designs, favoring high-quality graphitized blocks that contribute to lower specific energy consumption (SEC). The persistent focus on extending pot life, thereby reducing the frequency of costly cell replacements, strongly incentivizes the adoption of premium graphitized solutions over standard carbon alternatives.

Graphitized Cathode Block Market Executive Summary

The Graphitized Cathode Block Market is characterized by robust growth, primarily anchored by the sustained expansion of the global primary aluminum sector and technological advancements aimed at improving smelting efficiency. Business trends indicate a strong focus on supply chain resilience, vertical integration among key manufacturers to secure raw material access (especially high-grade calcined coke), and significant investment in R and D to enhance material properties such as reduced electrical resistivity and improved thermal expansion coefficients. The market structure remains moderately consolidated, with a few large multinational corporations dominating the high-specification segment, while regional players compete fiercely on cost and proximity to major aluminum production hubs. Pricing dynamics are highly correlated with input costs, including energy prices and raw carbon material availability, leading to volatility that necessitates sophisticated inventory and risk management strategies across the value chain.

Regional trends highlight the Asia Pacific (APAC) region, particularly China and India, as the dominant force in both production and consumption, owing to massive existing and planned aluminum smelting capacities. This region dictates global demand patterns and exerts significant influence on pricing structures. The Middle East remains a crucial high-growth area, driven by governmental strategies to diversify economies through energy-intensive industries like aluminum, demanding premium graphitized blocks for their large, modern smelters. Conversely, mature markets in North America and Europe focus more on replacement demand, technological upgrades, and the maintenance of existing capacity rather than large-scale expansion, prioritizing sustainable and low-carbon production methods which align well with the performance attributes of graphitized materials.

Segment trends underscore the increasing preference for High Purity graphitized cathode blocks, driven by the desire of aluminum producers to achieve longer pot life (up to 8-10 years) and higher current efficiencies. While standard purity blocks maintain a steady share in older or less technologically advanced smelters, the technological trajectory strongly favors materials optimized for high-amperage operation. Furthermore, there is a distinct trend towards customized block geometries and joint sealing solutions, responding directly to the specific design requirements of next-generation smelting technologies. Application-wise, aluminum smelting remains the overwhelmingly primary segment, though niche applications in other electro-metallurgical processes provide secondary demand opportunities, often requiring highly specialized and smaller volume orders.

AI Impact Analysis on Graphitized Cathode Block Market

Common user inquiries concerning the influence of Artificial Intelligence (AI) on the Graphitized Cathode Block Market center on how digital technologies can optimize the manufacturing process, improve quality control, and predict material failure in active smelters. Users are keen to understand the application of predictive maintenance algorithms to cathode wear rates, the role of machine learning in optimizing graphitization furnace temperature profiles, and how AI-driven process control can reduce energy consumption during production. Key themes revolve around leveraging AI for defect detection in raw material inspection, enhancing the consistency of complex carbonaceous mixtures, and creating digital twins of smelting pots to simulate cathode degradation under various operational parameters, thereby maximizing operational lifespan and reducing unexpected downtime. The overriding expectation is that AI will shift the industry towards preventative maintenance and higher material efficiency.

- AI-powered Predictive Maintenance: Utilized to forecast the remaining useful life of cathode blocks within active reduction cells, minimizing sudden failures and optimizing replacement schedules.

- Manufacturing Process Optimization: Machine Learning algorithms refine baking and graphitization cycles, ensuring optimal material structure, density, and electrical resistivity with reduced energy input.

- Quality Control and Defect Detection: AI vision systems analyze raw materials and finished blocks to detect subtle structural defects (cracks, voids, non-uniformity) far more effectively than traditional methods.

- Supply Chain and Inventory Management: AI enhances forecasting of demand from aluminum smelters and optimizes raw material procurement (e.g., calcined coke), buffering against volatile input costs.

- Smelter Digital Twins: Creation of high-fidelity simulations that model thermal stress, current density distribution, and corrosion patterns on cathode surfaces, aiding in product design improvement.

DRO & Impact Forces Of Graphitized Cathode Block Market

The Graphitized Cathode Block Market dynamics are predominantly shaped by the relentless global demand for aluminum (Driver), which necessitates continuous operation and enhancement of smelting capacity worldwide. However, this growth is significantly constrained by the highly volatile and supply-constrained availability of specialized raw materials, specifically high-grade petroleum coke and coal tar pitch (Restraint). The major opportunity lies in the development and commercialization of next-generation cathode materials, such as titanium diboride composites or hybrid solutions, which promise radically extended pot life and superior energy efficiency, potentially disrupting the traditional graphitized block segment. The key impact force centers on environmental scrutiny; increasing global mandates for lower carbon footprint production force aluminum producers to adopt high-efficiency materials that reduce specific energy consumption and waste generation, directly influencing the preference for premium graphitized blocks.

Segmentation Analysis

The Graphitized Cathode Block Market is comprehensively segmented based on material composition purity (High Purity and Standard Purity), and the final application where the block is utilized. Segmentation is crucial for understanding specific market niches, technological adoption rates, and regional pricing differences. High Purity blocks dominate the revenue share due to their superior performance characteristics—such as lower electrical resistance and enhanced resistance to alkali attack—making them essential for modern, high-efficiency smelters. Conversely, Standard Purity blocks serve as a cost-effective option for older smelters or those in regions with less stringent energy efficiency targets. The application segmentation clearly demonstrates the market's heavy reliance on the primary aluminum industry, though other electro-metallurgical processes require specialized small-batch orders.

- By Type:

- High Purity Graphitized Cathode Block

- Standard Purity Graphitized Cathode Block

- By Application:

- Aluminum Smelting

- Other Industrial Applications (e.g., Chemical Processing, Electro-metallurgy)

- By Region:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America

- Middle East and Africa (MEA)

Value Chain Analysis For Graphitized Cathode Block Market

The value chain for Graphitized Cathode Blocks is complex and capital-intensive, starting with the upstream sourcing of crucial raw materials. Upstream analysis involves securing long-term contracts for high-quality calcined petroleum coke (CPC), anthracite, and coal tar pitch (CTP). This segment is heavily influenced by the petroleum refining and coal industries, and material quality directly dictates the final performance of the cathode block. Manufacturers must maintain stringent quality control over blending, mixing, and pressing processes before the materials proceed to the intensive baking and graphitization stages, which require massive energy inputs. Key strategic considerations at this stage involve process technology ownership and energy cost management.

The midstream process focuses on manufacturing, where companies transform raw materials into finished graphitized cathode blocks. This involves homogenization, shaping, high-temperature baking (carbonization), and the ultimate graphitization process, where temperatures often exceed 2,500 degrees Celsius to achieve the desired crystalline structure. High-tech infrastructure and specialized furnace technology are necessary for efficient graphitization. Direct distribution channels, where manufacturers sell directly to major aluminum smelters through long-term supply agreements, dominate the market. This direct approach ensures technical compatibility and tailored logistics for large, heavy components.

The downstream analysis primarily concerns the end-users—large aluminum smelting corporations. These buyers prioritize product consistency, guaranteed electrical properties, and dimensional accuracy to ensure optimal performance within their potlines. Indirect distribution channels, though less common for standard blocks, sometimes involve specialized trading houses or distributors managing smaller, regional procurement needs or serving niche electro-metallurgical applications. The end-use phase also includes technical support and post-sale services related to installation, handling, and understanding cathode wear mechanisms, emphasizing the highly technical nature of the product and the strong relationship between producer and smelter.

Graphitized Cathode Block Market Potential Customers

The primary and overwhelming customers for Graphitized Cathode Blocks are the operators of primary aluminum reduction plants, utilizing the Hall-Héroult process. These entities are typically large, multinational aluminum producers characterized by immense production capacity and significant capital investment in their smelting operations. These customers are highly sensitive to energy efficiency and pot life extension, viewing the cathode block as a critical investment rather than a disposable commodity. Procurement decisions are governed by technical specifications, proven performance records, and the supplier's ability to maintain consistent, high-volume supply over multiple years. Geographically, major potential customers are concentrated in regions with abundant, affordable power supply, such as China, the Middle East (e.g., UAE, Bahrain, Saudi Arabia), and Russia.

Secondary potential customers include specialized metallurgical and chemical processing plants that require high-purity, inert carbon electrodes for electrolysis or high-temperature furnaces. While these applications represent a smaller volume share, they often demand bespoke shapes or ultra-high purity specifications. Additionally, engineering and construction firms specializing in building or refurbishing aluminum smelters represent an indirect, yet critical, customer segment, as they often dictate the choice of materials during the project phase. Manufacturers must therefore maintain close relationships not only with the end-user smelters but also with the major engineering, procurement, and construction (EPC) contractors globally.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $1.2 Billion |

| Market Forecast in 2033 | $1.8 Billion |

| Growth Rate | 5.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Tokai Carbon, SEC Carbon, SGL Carbon, GrafTech International, Nippon Carbon, Carbone Savoie, Kaifeng Carbon, Hunan Jinruixiang, Lanzhou Carbon, Fangda Carbon, Qingdao Haoshi, Jiangsu Lianyungang, Dalian Rongxin, Sichuan Hongyuan, Zhenjiang Jianglong, Shanxi Hadsen, Gansu Lanke, Liaoning Dajin. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Graphitized Cathode Block Market Key Technology Landscape

The technological landscape of the Graphitized Cathode Block market is defined by continuous incremental improvements in material science and process engineering aimed at maximizing performance and minimizing cost. A primary technological focus is on optimizing the graphitization process itself. Modern manufacturers employ highly sophisticated Acheson furnaces or longitudinal graphitization furnaces, often coupled with advanced energy recovery systems, to achieve the necessary crystalline structure while reducing the exorbitant energy input traditionally required. Innovations include utilizing alternative heating methods and optimizing furnace loading techniques to ensure uniform temperature distribution across large batches, thereby guaranteeing material consistency—a vital requirement for long pot life in high-amperage smelting cells.

Another critical area of innovation lies in raw material refinement and mixing techniques. Manufacturers are increasingly utilizing specialized binders, impregnating agents (such as pitch and resins), and customized raw carbon mixtures (coke, anthracite) to achieve specific properties like ultra-low porosity, enhanced thermal conductivity, and reduced sodium expansion. The development of anti-oxidation coatings or specialized joint sealants that minimize cathode block corrosion at the interface between the block and the molten cryolite electrolyte is also gaining traction. These technological enhancements are crucial for meeting the demands of newer generation smelters operating at current densities exceeding 400 kA.

Furthermore, digital technologies are becoming integrated into the manufacturing landscape. Advanced robotic handling systems ensure precise dimensional accuracy after machining, while sophisticated sensor technologies monitor temperature and pressure throughout the baking and graphitization cycles. The adoption of non-destructive testing (NDT) methodologies, such as ultrasonic inspection and advanced radiography, ensures the structural integrity of the final product, detecting internal microcracks or density variations that could lead to premature failure in the harsh smelting environment. The goal of these technological investments is to consistently deliver cathode blocks that can withstand increasingly demanding operational parameters and extend pot life beyond the traditional seven-year benchmark.

Regional Highlights

- Asia Pacific (APAC): The APAC region is the undisputed leader in both consumption and production of aluminum and, consequently, graphitized cathode blocks. China drives the majority of regional demand due to its status as the world’s largest aluminum producer. Strong industrialization and infrastructural development in India and Southeast Asian nations further solidify APAC's dominance. The region is characterized by high volume manufacturing capability, intense cost competition, and rapid adoption of new smelting technologies that require high-purity blocks.

- Middle East and Africa (MEA): MEA is defined by significant greenfield investment and high growth potential, particularly in the Gulf Cooperation Council (GCC) countries. These nations leverage low energy costs to operate some of the world's largest, most technologically advanced aluminum smelters. Consequently, MEA demand is concentrated heavily on premium, high-specification graphitized blocks designed for optimal energy efficiency and maximum pot lifespan.

- Europe: The European market is characterized by replacement demand in established smelters and a strong emphasis on sustainability and energy conservation. Strict regulatory environments pressure smelters to optimize performance, favoring European and globally certified suppliers focusing on low-emission production processes. Although production capacity is generally stable, the demand for specialized, highly engineered graphitized blocks for efficiency upgrades remains robust.

- North America: Similar to Europe, North America is a mature market driven primarily by replacement cycles. Demand here is stable and high-quality focused, with smelters prioritizing reliable, long-lasting products to manage high labor and operating costs. The focus is on maintaining efficiency in older facilities and integrating high-performance materials in any modernization efforts.

- Latin America: The market in Latin America is relatively fragmented, experiencing moderate growth linked to regional economic stability and domestic industrial demand. Key demand centers exist in Brazil and other South American countries with established aluminum industries. Procurement decisions are often sensitive to pricing and import logistics, balancing quality with cost-effectiveness.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Graphitized Cathode Block Market.- Tokai Carbon

- SEC Carbon

- SGL Carbon

- GrafTech International

- Nippon Carbon

- Carbone Savoie

- Kaifeng Carbon

- Hunan Jinruixiang

- Lanzhou Carbon

- Fangda Carbon

- Qingdao Haoshi

- Jiangsu Lianyungang

- Dalian Rongxin

- Sichuan Hongyuan

- Zhenjiang Jianglong

- Shanxi Hadsen

- Gansu Lanke

- Liaoning Dajin

- Fujian Longrui Carbon

- Shandong Sinocarbon

Frequently Asked Questions

Analyze common user questions about the Graphitized Cathode Block market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary function of graphitized cathode blocks in aluminum production?

Graphitized cathode blocks function as the negative electrode (cathode) in the Hall-Héroult electrolytic cell. They conduct electricity into the molten cryolite bath and must withstand high temperatures and chemical attack to facilitate the reduction of alumina to primary aluminum metal efficiently.

How do graphitized blocks differ from amorphous carbon blocks in performance?

Graphitized blocks possess a highly ordered crystalline structure resulting from high-temperature treatment (graphitization), providing significantly lower electrical resistivity, higher thermal conductivity, and superior resistance to chemical degradation (sodium attack), leading to extended pot life and greater energy efficiency compared to amorphous carbon blocks.

Which factors are driving the demand for High Purity Graphitized Cathode Blocks?

Demand for high purity blocks is driven by the industry's focus on maximizing efficiency and extending pot life. High Purity blocks enable smelters to operate at higher current densities with lower voltage drops, thereby reducing specific energy consumption (SEC) and minimizing costly downtime associated with cell replacements.

What raw materials are essential for manufacturing graphitized cathode blocks?

The primary raw materials include high-quality calcined petroleum coke (CPC), sometimes combined with metallurgical coke or specialized anthracite, and a carbon binder, typically coal tar pitch (CTP). The purity and quality of these inputs critically determine the performance of the final graphitized product.

How does the volatile price of raw materials impact the market?

Volatility in the prices of key raw materials like CPC and CTP significantly impacts the production costs of graphitized cathode blocks. Since these inputs are oil and coal derivatives, market price fluctuations necessitate complex inventory management and supply chain contracts to maintain stable profitability for manufacturers.

What is the typical lifespan expected from a modern graphitized cathode block?

A modern, high-specification graphitized cathode block, utilized in an optimized aluminum reduction cell, is typically engineered to achieve a pot life of 7 to 10 years. This longevity is crucial for minimizing the operational expenditure (OPEX) of the aluminum smelter.

How is Asia Pacific positioned within the global Graphitized Cathode Block Market?

Asia Pacific is the largest regional market due to China's dominant role in global aluminum production. The region not only consumes the majority of cathode blocks for existing and expanding smelters but also hosts numerous major manufacturing facilities, influencing global supply and pricing dynamics.

What technological advancements are optimizing the graphitization process?

Key technological advancements include the use of advanced Acheson or Longitudinal furnaces with energy recovery systems, AI-driven process control for optimized temperature profiles, and non-destructive testing (NDT) methods to ensure structural uniformity and detect internal defects, leading to higher quality and consistency.

Do environmental regulations influence the adoption of graphitized cathode blocks?

Yes, environmental regulations strongly influence adoption. Policies targeting reduced carbon emissions and improved energy efficiency incentivize smelters to adopt premium graphitized blocks, as their low electrical resistance directly contributes to a lower specific energy consumption (SEC) per ton of aluminum produced, thus improving the overall environmental footprint.

Who are the main end-users for these blocks outside of the aluminum industry?

Outside of primary aluminum smelting, end-users include specialized electro-metallurgical plants, particularly those involved in producing other metals or chemicals via electrolysis, and certain high-temperature furnace applications requiring chemically inert and highly conductive electrodes.

What role does the Value Chain Analysis play in understanding market dynamics?

Value Chain Analysis highlights critical pinch points, such as the upstream dependence on high-quality calcined coke supply and the capital-intensive nature of the midstream graphitization process. Understanding these elements is essential for assessing pricing structures, profit margins, and supply risk.

How does AI contribute to predictive maintenance for cathode blocks?

AI utilizes sensor data from active reduction cells (e.g., voltage fluctuations, temperature readings) and applies machine learning models to predict the rate of cathode wear and potential failure points. This allows smelter operators to schedule replacements precisely, maximizing operational uptime and preventing catastrophic cell failure.

Why is customization important in the graphitized cathode block market?

Smelters utilize varied cell designs (e.g., potline capacity, current load). Customization of block size, geometry, and specific material properties (like thermal expansion coefficients) ensures optimal fit and performance within specific cell architectures, crucial for maximizing efficiency and lifespan.

What challenges do manufacturers face regarding energy consumption?

The graphitization phase is extremely energy-intensive, requiring temperatures above 2,500 degrees Celsius. Manufacturers face challenges related to high operating costs and meeting sustainability targets, necessitating ongoing investment in energy-efficient furnace technology and waste heat recovery systems.

What is the significance of thermal shock resistance in cathode blocks?

Thermal shock resistance is vital because cathode blocks are exposed to rapid temperature changes, particularly during the initial start-up and cooling cycles of the reduction cell. High resistance minimizes cracking and spalling, maintaining structural integrity and extending the effective life of the cathode system.

How do competitive dynamics vary between high-purity and standard-purity segments?

The high-purity segment is dominated by a few global players leveraging proprietary technology and vertical integration, competing primarily on performance and quality. The standard-purity segment is more fragmented, with regional players competing fiercely on cost and proximity to localized smelters.

What opportunities exist for new market entrants?

Opportunities for new entrants primarily lie in developing disruptive technologies, such as advanced hybrid carbon materials or specialized additives that offer superior performance characteristics. Furthermore, focusing on niche markets or regions with developing aluminum infrastructure can offer entry points, although the capital barrier remains high.

How does the Middle East influence the demand landscape?

The Middle East influences demand significantly due to its investment in large, energy-efficient 'mega-smelters'. These modern facilities mandate the highest quality, most technologically advanced graphitized blocks, setting a high standard for global suppliers in terms of product specifications and performance guarantees.

What is sodium intercalation, and why must cathode blocks resist it?

Sodium intercalation is the damaging process where molten sodium, produced as a byproduct in the aluminum cell, penetrates and expands within the carbon structure of the cathode block. Resistance to this process is crucial as intercalation causes internal stress and cracking, leading to premature cell failure and reduced pot life.

What role do specialized binders and impregnating agents play?

Binders (like CTP) hold the carbon particles together before baking. Impregnating agents, often pitch or specialized resins, are forced into the baked block structure under pressure to fill pores. This significantly increases density, reduces porosity, and improves both electrical conductivity and resistance to chemical attack, enhancing overall block performance.

Why is the quality of calcined petroleum coke critical?

Calcined petroleum coke forms the backbone of the cathode block structure. Its quality, particularly sulfur content, graphitizability, and trace impurity levels (e.g., vanadium, iron), directly impacts the final purity, electrical resistance, and structural integrity of the graphitized block, making it the most critical raw material input.

What market restraint is most challenging for manufacturers?

The most significant market restraint is the volatile pricing and supply chain instability of high-grade raw materials, primarily needle coke and coal tar pitch. These materials are subject to fluctuations in the crude oil and coal markets, making long-term strategic planning and cost management extremely challenging for block manufacturers.

How are logistics handled for graphitized cathode blocks?

Logistics are complex because cathode blocks are large, heavy, and susceptible to damage. Distribution typically relies on specialized freight handling and often involves direct shipping from the manufacturer to the smelter under strict logistical protocols to ensure the integrity of the dimensionally sensitive blocks upon arrival and installation.

What are the implications of high-amperage smelting technologies on block requirements?

High-amperage smelting technologies (400 kA and above) demand cathode blocks with extremely low electrical resistivity and exceptional thermal stability. These severe operating conditions necessitate the use of high-purity, fully graphitized blocks to minimize energy losses and prevent rapid material degradation under intense electrical and thermal stress.

How do manufacturers ensure the dimensional accuracy of the final product?

Dimensional accuracy is maintained through highly controlled pressing and molding techniques, followed by precision machining and grinding of the final baked and graphitized block. Advanced laser and robotic measuring systems are often employed to ensure the blocks meet the rigorous specifications required for integration into the aluminum cell structure.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Graphitized Cathode Block Market Statistics 2025 Analysis By Application (300 KA), By Type (Bottom Block, Side Block), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

- Graphitized Cathode Block Market Statistics 2025 Analysis By Application (300 KA), By Type (Semi-Graphitic, Graphitic, Graphitized), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

- Graphitized Cathode Block Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Bottom Block, Side Block), By Application (<15 kw, 15-25kw, >25 kw), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager