Gravity Belt Concentrator Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 431982 | Date : Dec, 2025 | Pages : 245 | Region : Global | Publisher : MRU

Gravity Belt Concentrator Market Size

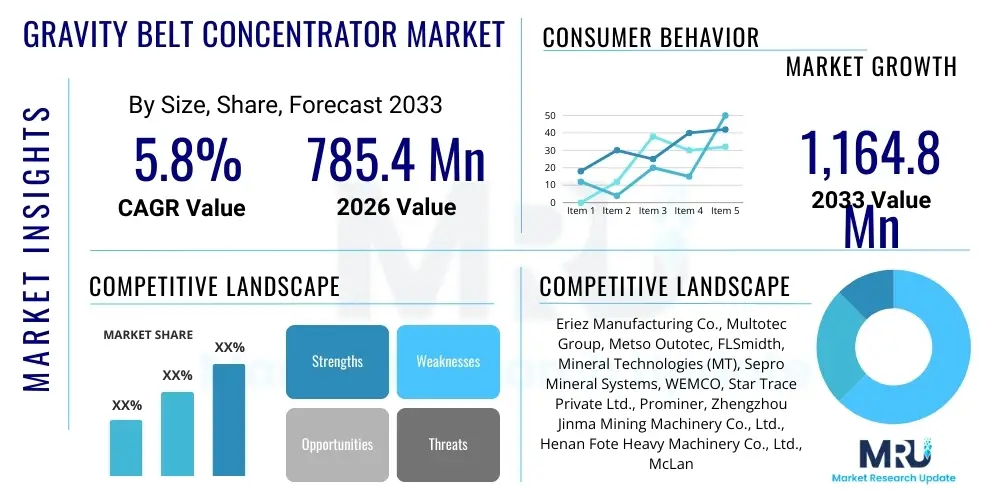

The Gravity Belt Concentrator Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at $785.4 Million in 2026 and is projected to reach $1,164.8 Million by the end of the forecast period in 2033. This growth is primarily driven by the increasing global demand for mineral processing efficiency and the necessity for sustainable recovery methods across diverse sectors, including mining, aggregates, and recycling operations. The robust infrastructural development in emerging economies further fuels the deployment of these high-capacity concentration systems, particularly for low-grade ore processing where maximizing yield is paramount.

Gravity Belt Concentrator Market introduction

The Gravity Belt Concentrator Market involves the deployment of specialized machinery designed to separate particulate solids based on differences in specific gravity. These systems utilize a continuous, inclined belt surface combined with wash water to achieve separation, effectively concentrating valuable heavy minerals while washing away lighter gangue materials. The product, fundamentally an industrial separation technology, is crucial in primary mineral extraction (such as gold, iron ore, and tin), but also finds extensive application in the aggregates industry for quality control and environmental remediation, particularly in processing fine materials that are difficult to handle with traditional technologies. The primary benefits of utilizing gravity belt concentrators include high recovery rates, minimal environmental footprint compared to chemical separation methods, operational simplicity, and low operating costs due to reduced energy and reagent consumption. Key driving factors accelerating market expansion include stringent environmental regulations promoting physical separation over chemical leaching, the exhaustion of high-grade mineral deposits necessitating efficient concentration of low-grade ores, and sustained investment in global mining and infrastructure projects requiring large volumes of processed materials.

Gravity Belt Concentrator Market Executive Summary

The Gravity Belt Concentrator Market is characterized by a strong emphasis on operational efficiency and sustainable practices, positioning it for consistent growth throughout the forecast period. Business trends indicate a shift toward fully automated, high-throughput concentrator units capable of handling complex feed streams with high variability in particle size and density. The primary strategic focus for market leaders involves integrating advanced sensor technology and sophisticated control systems to optimize recovery rates in real time, catering to the evolving demands of large-scale mining operations and specialized recycling ventures. Geographically, the market expansion is highly concentrated in the Asia Pacific region, driven by massive investments in iron ore and coal mining in countries like Australia, China, and India, coupled with significant infrastructure development requiring construction aggregates. Segment-wise, the fixed-plant systems segment dominates the market due to their superior capacity and durability required for major mineral processing sites, while the modular/portable units are gaining traction, especially in exploration and small-scale operations requiring flexibility and rapid deployment capabilities. Technological advancements aimed at improving belt materials and wash water recycling systems are defining the competitive landscape, ensuring that gravity belt concentration remains a cost-effective and environmentally sound method for material separation.

AI Impact Analysis on Gravity Belt Concentrator Market

User inquiries regarding the influence of Artificial Intelligence (AI) on the Gravity Belt Concentrator Market overwhelmingly focus on two main themes: achieving predictive maintenance to minimize costly downtime, and utilizing real-time data analytics for dynamic process optimization. Users are keen to understand how machine learning models can process complex sensor data—such as belt tension, water flow rates, feed composition, and particle distribution—to predict component failure before it occurs, thereby enhancing overall equipment effectiveness (OEE). Furthermore, there is significant interest in AI's capacity to adjust operational parameters instantaneously based on fluctuating ore grades or feedstock variability, ensuring maximum recovery efficiency without requiring constant human oversight, a critical factor for remote mining operations where skilled labor availability is limited. These expectations highlight a transition from conventional, static control methodologies to proactive, intelligent systems that can adapt to the inherently variable nature of gravity separation processes, ultimately driving down operational costs and increasing the sustainability of material extraction.

The implementation of sophisticated AI and machine learning algorithms is set to revolutionize the efficiency and reliability of Gravity Belt Concentrators. By leveraging deep learning models trained on years of operational data, manufacturers can offer systems capable of autonomously optimizing parameters like belt speed, wash water volume, and deck angle in response to subtle shifts in slurry characteristics. This dynamic optimization ensures that the separation process operates at its peak thermodynamic efficiency, resulting in significant improvements in valuable mineral recovery, particularly for fine or ultra-fine particles that traditionally prove challenging for gravity methods. Beyond process control, AI contributes substantially to quality assurance by analyzing output material characteristics in real-time, instantly flagging deviations from specified concentrate grade and allowing immediate corrective action.

Furthermore, AI-driven digital twins of concentrator plants are emerging as powerful tools for simulation and training. These virtual environments allow operators to test different scenarios, predict the long-term wear patterns of critical components like belt surfaces and rollers, and simulate the effects of processing new or highly variable mineral feeds. This capability reduces the risk associated with process changes and accelerates the commissioning of new plants. The integration of AI thus transforms the gravity belt concentrator from a purely mechanical device into a highly intelligent separation system, guaranteeing superior operational transparency and reduced total cost of ownership over the equipment lifecycle, thereby becoming a key differentiator in the competitive market space.

- Predictive Maintenance: AI algorithms analyze vibration, temperature, and current draw data to forecast mechanical failure, drastically reducing unplanned downtime.

- Real-Time Optimization: Machine Learning models dynamically adjust operating parameters (e.g., wash water pressure, belt velocity) based on feed characteristics for maximum yield.

- Energy Efficiency Enhancement: AI optimizes motor load and pump operation, minimizing energy consumption relative to throughput.

- Automated Quality Control: Vision systems combined with AI verify concentrate purity, ensuring compliance with off-take agreements.

- Digital Twin Integration: Creation of virtual models for process simulation, risk assessment, and operator training.

DRO & Impact Forces Of Gravity Belt Concentrator Market

The dynamics of the Gravity Belt Concentrator Market are shaped by a complex interplay of Drivers, Restraints, and Opportunities, which collectively determine the market's growth trajectory and vulnerability to external pressures. The dominant driving force remains the global shift towards sustainable mineral processing, particularly the increased scrutiny on tailings management and the reduction of chemical usage in flotation and leaching circuits. Gravity methods offer a greener alternative, which aligns perfectly with corporate Environmental, Social, and Governance (ESG) mandates and regulatory frameworks worldwide, particularly in jurisdictions imposing strict limits on wastewater discharge. Concurrently, the necessity to process vast quantities of lower-grade ores, often containing fine mineralization, mandates the use of highly efficient, low-cost separation technologies like gravity belts that can maintain throughput while maximizing recovery from challenging feeds, thus directly supporting the security of critical mineral supply chains.

However, the market faces significant restraints that temper its explosive growth potential. A primary challenge is the capital intensity associated with installing large-scale fixed concentrator plants, requiring substantial initial investment that can deter smaller mining companies or delay project approvals, especially in uncertain economic climates. Furthermore, the inherent limitations of gravity separation methods mean they are only effective for minerals with a significant density differential from the gangue; materials requiring complex liberation or exhibiting minimal density contrast are unsuitable, which restricts the addressable market size compared to flotation technologies. The operational requirement for precise control over feed consistency and wash water quality also presents a technical hurdle, as variability in these inputs can significantly undermine separation efficiency, requiring advanced instrumentation and skilled personnel for continuous monitoring.

Despite these restraints, significant opportunities are emerging that promise substantial market expansion. The growing global focus on urban mining and recycling—specifically the recovery of valuable materials from waste streams, slag, and incinerator bottom ash—is creating new, previously untapped application areas for gravity concentration technology. Belt concentrators are ideally suited for these applications due to their ability to handle heterogenous feed materials and recover metals (like copper, aluminum, and even trace precious metals) without reliance on polluting chemical reagents. Moreover, technological advancements, including the development of multi-stage concentration systems and enhanced belt surface designs that improve fine particle capture, are mitigating the historical limitations regarding particle size, opening the door to processing ultrafine tailings and enhancing overall resource utilization, thereby securing the long-term relevance of gravity belt concentration in the future of sustainable resource management.

Segmentation Analysis

The Gravity Belt Concentrator Market is systematically analyzed across multiple axes, including operational type, material handling capacity, end-user application, and geographical region. Understanding these segments is crucial for identifying areas of high growth and technological focus. The segmentation by operational type, dividing the market into Fixed-Plant Systems and Portable/Modular Units, reflects distinct investment strategies and deployment requirements across the mining lifecycle, with fixed plants dominating large, long-life mines and modular units catering to pilot projects and remote exploration sites. Analysis by capacity delineates the market based on throughput, directly correlating with the scale of the mining or processing operation. End-user segmentation provides insight into the primary market drivers, highlighting the critical roles of Metal Mining (e.g., Iron Ore, Gold), Industrial Minerals, and Recycling & Aggregates sectors in demanding these separation technologies.

- By Operational Type:

- Fixed-Plant Systems

- Portable/Modular Units

- By Capacity (Tons Per Hour - TPH):

- Low Capacity (Up to 5 TPH)

- Medium Capacity (5 TPH - 25 TPH)

- High Capacity (Above 25 TPH)

- By End-User Application:

- Metal Mining (Iron Ore, Gold, Tin, Tungsten)

- Industrial Minerals & Aggregates

- Recycling and Waste Processing (Urban Mining, Slag Recovery)

- Coal Processing

- By Region:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America (LATAM)

- Middle East and Africa (MEA)

Value Chain Analysis For Gravity Belt Concentrator Market

The value chain for the Gravity Belt Concentrator Market is structured efficiently, starting from the design and manufacturing of specialized components, extending through integration and distribution, and culminating in the highly specialized after-sales service provided to the end-users. The upstream segment is dominated by specialized material suppliers for high-performance conveyor belts (requiring chemical and abrasion resistance), precision engineering companies providing structural steel frames, and component manufacturers focusing on high-efficiency pump systems and variable speed drives. Innovation at this stage focuses heavily on material science to enhance belt lifespan and separation efficacy. Manufacturing and assembly form the core midstream activity, where equipment fabrication, quality control, and system integration occur, transforming raw components into functional, customized concentrator units tailored to specific mineral characteristics and client throughput requirements. Strong relationships with high-quality, reliable suppliers are paramount for maintaining competitive manufacturing costs and ensuring the durability of the final product.

The downstream segment encompasses distribution, installation, commissioning, and long-term maintenance. Distribution channels are typically a combination of direct sales for major global mining contracts, leveraging specialized engineering procurement and construction (EPC) firms, and indirect sales through regional distributors or agents who possess localized market knowledge and established customer relationships. Direct channels are preferred for highly customized, high-capacity fixed plants, allowing direct control over specifications and implementation support. Indirect channels are more frequently utilized for standardized, modular units targeting smaller operations or aggregate producers. Post-sale support, including spare parts supply, technical training, and predictive maintenance contracts, constitutes a crucial revenue stream, emphasizing the long operational life of the equipment.

Effective value chain management hinges on the ability to deliver comprehensive, localized support while maintaining technological leadership in separation efficiency. Companies that vertically integrate key component manufacturing or establish regional assembly hubs closer to high-demand mining centers (like Western Australia or South America) gain a competitive advantage by reducing logistics costs and accelerating delivery times. Furthermore, the increasing complexity of control systems necessitates strong partnerships between concentrator manufacturers and industrial automation specialists to ensure seamless integration into existing plant infrastructure, thus optimizing the entire resource processing workflow from mine face to finished concentrate product.

Gravity Belt Concentrator Market Potential Customers

The primary end-users and potential customers of Gravity Belt Concentrators are concentrated within industries focused on bulk material processing where density-based separation is technically feasible and economically advantageous. The largest consumer segment consists of major global mining corporations and mid-tier explorers involved in the extraction of high-density metallic minerals, most notably iron ore, which relies heavily on physical separation techniques to upgrade feed quality, and precious metals like alluvial gold and placer deposits, where gravity concentration is the traditional and preferred method of initial recovery. These customers require high-capacity, rugged, and reliable fixed-plant systems capable of continuous 24/7 operation in harsh environments, making system robustness and operational efficiency paramount purchasing criteria. Demand is also strong among tin, tungsten, and chromite miners, where gravity concentration provides superior separation results for these specific heavy minerals.

Beyond traditional metallic mining, a growing contingent of potential customers is emerging from the industrial minerals and aggregates sector, particularly those dealing with sand and gravel purification, as well as specialized construction materials requiring precise density separation to meet quality specifications. Furthermore, the rapidly expanding recycling and environmental remediation industry represents a critical growth segment. Companies specializing in 'urban mining'—recovering valuable metals from industrial waste streams, electronics scrap, or incinerator bottom ash (IBA)—are increasingly adopting gravity belt concentrators as a low-cost, environmentally friendly primary separation tool, replacing or complementing energy-intensive magnetic and sensor-based sorting techniques. These customers often prioritize modular, flexible units that can be quickly deployed and adapted to variable feedstock composition.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $785.4 Million |

| Market Forecast in 2033 | $1,164.8 Million |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Eriez Manufacturing Co., Multotec Group, Metso Outotec, FLSmidth, Mineral Technologies (MT), Sepro Mineral Systems, WEMCO, Star Trace Private Ltd., Prominer, Zhengzhou Jinma Mining Machinery Co., Ltd., Henan Fote Heavy Machinery Co., Ltd., McLanahan Corporation, Savana Equipment, Tongli Heavy Machinery Co., Ltd., Shicheng Hongxing Mineral Processing Equipment Manufacturing Co., Ltd., China Metallurgical Group Corporation (MCC). |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Gravity Belt Concentrator Market Key Technology Landscape

The technological landscape of the Gravity Belt Concentrator Market is currently defined by innovations aimed at enhancing separation efficiency, particularly for fine particles, increasing overall throughput, and integrating digital control systems. A significant technological advancement involves the development of specialized belt surfaces, including those incorporating riffles or complex profile patterns designed using Computational Fluid Dynamics (CFD) modeling. These improved surface geometries optimize the laminar flow of the wash water across the deck and enhance the entrapment mechanics of heavy mineral particles, mitigating the common issue of losing valuable fines. Furthermore, materials science is playing a pivotal role, with manufacturers utilizing advanced polymer composites and rubber blends for the belts to dramatically increase abrasion resistance and chemical durability, thereby extending the operational lifespan and reducing maintenance cycles, which is critical in highly abrasive mineral processing environments like iron ore and aggregates.

Another crucial technological frontier is the move towards high-capacity, multi-stage systems. Modern concentrators are increasingly integrated into multi-stage gravity circuits that often combine initial concentration with subsequent cleaning stages, sometimes incorporating spirals or shaking tables. This holistic approach ensures comprehensive recovery across various particle sizes and densities. Furthermore, the adoption of sophisticated automation and sensing technologies is revolutionizing operational control. High-resolution sensors monitor variables like slurry density, solid content, flow rate, and wash water turbidity in real-time. This sensor data feeds into Process Logic Controllers (PLCs) and, increasingly, AI-driven control loops, enabling instantaneous and precise adjustments to belt speed, angle, and water injection points, thereby stabilizing the separation process against inherent variability in the ore feed and maximizing sustained recovery rates.

The pursuit of water efficiency is also driving technological innovation. Given the reliance of gravity separation on significant volumes of process water, manufacturers are focused on developing closed-loop wash water recycling systems integrated directly into the concentrator unit. These systems incorporate advanced flocculation and clarification techniques to reuse the process water with minimal quality degradation, significantly reducing the environmental footprint and operational costs, especially in water-scarce mining regions. The confluence of material durability, integrated circuit design, and smart automation ensures that gravity belt concentration remains a highly relevant, competitive, and forward-looking separation technology capable of meeting modern mining sustainability and efficiency demands.

Regional Highlights

The global distribution of the Gravity Belt Concentrator Market exhibits distinct regional dynamics, primarily driven by localized mining activity, environmental regulatory frameworks, and infrastructural investment patterns. The Asia Pacific (APAC) region currently holds the largest market share and is projected to experience the highest growth rate during the forecast period. This dominance is attributed to the substantial presence of large-scale mining operations, particularly in Australia (iron ore, gold), China (coal, iron ore, industrial minerals), and India (coal, aggregates). APAC governments are heavily investing in infrastructure and resource extraction capabilities, demanding high-throughput, reliable processing equipment. Furthermore, strict environmental policies in countries like China are incentivizing the move away from toxic chemical processes towards sustainable physical separation technologies, directly benefiting the demand for gravity concentrators. The vast quantities of low-grade iron ore being processed in this region necessitate efficient pre-concentration methods, making gravity belts indispensable tools for maximizing yield before expensive refining stages.

North America, encompassing the mature markets of the United States and Canada, represents a significant segment characterized by high technological adoption and a focus on operational longevity and automation. The demand here is driven by the necessity for efficient processing of critical minerals, particularly in existing and newly commissioned gold and copper mines. North American operators prioritize systems with integrated AI and monitoring capabilities to maximize uptime and minimize labor costs. The market growth, while stable, is supported by replacement cycles and upgrades to existing processing facilities to comply with increasingly stringent worker safety and environmental standards. The maturity of the industrial minerals and aggregates sector also contributes steady demand for quality control applications using gravity separation techniques.

Europe and Latin America (LATAM) exhibit moderate but strategic growth. European demand is primarily focused on the recycling and urban mining sectors, adhering to ambitious circular economy goals. Strict environmental legislation throughout the European Union compels processing facilities to utilize the most environmentally benign separation methods available, fueling the adoption of belt concentrators for waste processing and secondary material recovery. In LATAM, the market is highly correlated with the volatile but robust production of iron ore and copper in Brazil, Chile, and Peru. Despite economic fluctuations, the consistent need for efficient, low-cost processing solutions for dense ores ensures sustained investment in high-capacity gravity concentration equipment across these major resource-rich nations, with an increasing focus on modular units for remote, high-altitude mining sites.

- Asia Pacific (APAC): Dominant market share fueled by robust iron ore, coal, and aggregates mining sectors in Australia, China, and India; high growth driven by infrastructure spending and sustainability mandates.

- North America: Stable growth driven by technological upgrades, emphasis on critical mineral processing (gold, copper), and high automation integration in mature mining operations.

- Europe: Growth concentrated in the recycling, waste processing, and urban mining segments, highly influenced by stringent EU environmental and circular economy regulations.

- Latin America (LATAM): Strategic demand linked to large-scale iron ore and copper extraction in South America, prioritizing rugged, high-capacity equipment for continuous operation.

- Middle East and Africa (MEA): Emerging market primarily linked to gold, phosphate, and industrial mineral projects, with increasing investment supported by global commodity price stability and infrastructure development funds.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Gravity Belt Concentrator Market.- Eriez Manufacturing Co.

- Multotec Group

- Metso Outotec

- FLSmidth

- Mineral Technologies (MT)

- Sepro Mineral Systems

- WEMCO (A brand within FLSmidth)

- Star Trace Private Ltd.

- Prominer

- Zhengzhou Jinma Mining Machinery Co., Ltd.

- Henan Fote Heavy Machinery Co., Ltd.

- McLanahan Corporation

- Savana Equipment

- Tongli Heavy Machinery Co., Ltd.

- Shicheng Hongxing Mineral Processing Equipment Manufacturing Co., Ltd.

- China Metallurgical Group Corporation (MCC)

- BHP Group (As major end-user and technology adopter)

- Rio Tinto (As major end-user and technology adopter)

- TATA Steel

- Outotec (Pre-Metso merger entity's legacy)

Frequently Asked Questions

Analyze common user questions about the Gravity Belt Concentrator market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary function of a Gravity Belt Concentrator and where is it most effectively used?

The primary function is to separate particles based on specific gravity differences using an inclined, oscillating belt and wash water. It is most effectively used in mining for concentrating heavy minerals like gold, iron ore, tin, and aggregates, especially where the utilization of chemical reagents must be minimized or avoided for environmental reasons.

How does the implementation of AI affect the operating costs of Gravity Belt Concentrators?

AI significantly lowers operating costs by enabling predictive maintenance, drastically reducing unplanned downtime and major component failure expenses. It also optimizes process parameters in real-time, reducing energy consumption per ton of material processed and maximizing mineral recovery, thereby improving overall economic efficiency.

Which geographical region leads the market growth for Gravity Belt Concentrators?

The Asia Pacific (APAC) region leads the market growth, primarily driven by extensive mining activities, particularly in iron ore and coal processing in countries like China and Australia, coupled with increased governmental investment in critical infrastructure development demanding high-capacity processing equipment.

What are the main alternatives to gravity belt concentration technology?

The main alternatives include flotation cells (chemical separation), magnetic separation (for ferromagnetic materials), shaking tables, and spiral concentrators. Gravity belt concentrators are generally preferred over chemical methods when dealing with materials where sufficient density contrast exists and environmental constraints prohibit chemical leaching.

What is the typical lifespan and maintenance requirement for the critical belt component?

The typical lifespan of the specialized belt component varies based on material composition and abrasiveness of the feed, ranging from 1 to 3 years. Maintenance requirements focus on regular inspections for wear, precise tension adjustments, and ensuring consistent wash water quality to prevent buildup and maximize separation integrity.

Are Gravity Belt Concentrators suitable for recycling and urban mining applications?

Yes, Gravity Belt Concentrators are highly suitable for recycling and urban mining. They are effective in separating various materials, including non-ferrous metals, from incinerator bottom ash (IBA) and other waste streams, offering a robust, non-chemical method to recover valuable secondary resources efficiently.

What is the difference between Fixed-Plant Systems and Portable Units?

Fixed-Plant Systems are large, permanent installations designed for high throughput and long operational lifecycles, typical of major mining sites. Portable/Modular Units are smaller, skid-mounted systems designed for flexibility, rapid deployment, and use in exploration projects or temporary/remote processing sites requiring mobility.

How do environmental regulations impact market demand?

Strict environmental regulations globally strongly favor gravity-based separation technologies over chemical methods (like cyanide or acidic leaching) due to reduced water pollution and lower tailings toxicity. This regulatory pressure acts as a major driver for the increased adoption of environmentally compliant Gravity Belt Concentrators across the mining and aggregate sectors.

What is the key technological focus area for manufacturers in the coming years?

The key technological focus is on improving fine particle recovery efficiency (for particles less than 75 microns) through advanced belt surface geometries and integrating advanced sensor technology and AI control systems to handle feed variability and maximize recovery yields autonomously.

What material handling capacity range defines a High Capacity concentrator?

In the context of Gravity Belt Concentrators, a High Capacity unit is generally defined as one capable of processing slurry throughput rates above 25 Tons Per Hour (TPH), suitable for large-scale mining operations requiring continuous, industrial-scale processing volumes.

What are the key components of a typical Gravity Belt Concentrator system?

The system comprises an inclined rubber or polymer belt surface, a drive mechanism for controlled movement, a feed distribution system (pulp delivery), high-pressure wash water sprays, and an integrated system for collecting the heavy mineral concentrate and the lighter tailing stream.

How does the density differential requirement restrict market adoption?

Gravity concentration methods fundamentally require a significant density difference between the valuable mineral and the gangue material. If the specific gravity contrast is too small (e.g., less than 1.0 g/cm³ difference), other methods like flotation or magnetic separation must be utilized, thus restricting the addressable market for gravity belts to specific mineral types.

What role does industrial minerals processing play in the market?

Industrial minerals processing utilizes gravity belt concentrators primarily for purification and quality control, ensuring materials like specific sands, clays, or aggregates meet required density and purity standards for high-specification construction, glass manufacturing, or filler applications, driving steady, non-mining related demand.

Is financing for capital-intensive equipment a significant market restraint?

Yes, the high capital expenditure (CapEx) required for acquiring and installing large, fixed-plant Gravity Belt Concentrators acts as a significant restraint, particularly for mid-tier or junior mining operations, requiring complex financial planning and often delaying adoption compared to less capital-intensive alternatives.

How are manufacturers addressing the issue of water consumption in gravity concentration?

Manufacturers are addressing water consumption by integrating advanced, closed-loop water recycling systems directly into the concentrator design. These systems employ flocculation, settling, and filtration techniques to reuse wash water multiple times, minimizing fresh water intake and waste discharge.

What impact does the increasing focus on ESG compliance have on the market?

The increasing focus on ESG (Environmental, Social, and Governance) compliance strongly favors gravity concentrators because they reduce reliance on hazardous chemical reagents and minimize the toxic impact of tailings, aligning perfectly with corporate sustainability goals and investor requirements.

What are the typical end-user sectors for low-capacity Gravity Belt Concentrators?

Low-capacity concentrators (up to 5 TPH) are typically utilized by exploration companies for bulk sampling, pilot testing in feasibility studies, small-scale alluvial or artisanal mining operations, and specialized laboratory environments needing high-precision separation.

How important is the after-sales service segment in the value chain?

After-sales service, including technical support, spare parts supply, and predictive maintenance contracts, is extremely important. Given the continuous, abrasive nature of mineral processing, reliable service ensures maximum uptime and operational longevity, often forming a significant portion of the total revenue stream for equipment providers.

What is the difference between direct and indirect distribution channels in this market?

Direct distribution involves manufacturers selling and implementing equipment directly to major mining companies, often for highly customized fixed plants. Indirect distribution utilizes regional agents or distributors to sell standardized, modular units, leveraging local market knowledge and smaller-scale project contacts.

Why is efficiency in fine particle recovery a key technological challenge?

Fine particles are notoriously difficult to separate using gravity methods because hydrodynamic forces (like drag) often overcome gravitational forces, leading to the loss of valuable minerals in the tailings. Manufacturers are thus focusing R&D on specialized belt surfaces and control systems to maximize capture rates for ultra-fines.

What role does the recovery of critical minerals play in driving market growth?

The global race for critical minerals (such as tungsten and tin) essential for high-tech industries drives demand, as Gravity Belt Concentrators are highly effective in processing these specific heavy ores efficiently, ensuring stable supply chains and supporting technological self-sufficiency in key nations.

How do variations in ore grade affect the concentrator's performance?

Significant variations in ore grade and feed composition can negatively impact performance, requiring constant manual or automated adjustments to operating parameters (like water flow and belt speed) to maintain optimal separation efficiency and prevent losses, highlighting the need for advanced sensor and AI integration.

What is the expected long-term trend regarding portable versus fixed systems?

While fixed systems will maintain dominance in established, large-scale mines, the trend points toward increased adoption of portable and modular systems due to their flexibility, ease of relocation, and suitability for remote or fluctuating resource projects, particularly within emerging markets and the recycling sector.

What impact does the price volatility of key minerals have on market investment?

Price volatility can cause short-term restraint, as high capital investment projects (like new fixed plants) may be delayed during low price cycles. However, consistent long-term demand for high-efficiency equipment remains strong, as operators must maximize recovery to maintain profitability regardless of price fluctuations.

What safety features are prioritized in modern concentrator designs?

Modern designs prioritize features such as fully enclosed moving parts to prevent access, automated shutdown mechanisms triggered by process anomalies or safety breaches, and ergonomic access points for maintenance, adhering to stringent global mining safety standards (e.g., MSHA, OHSAS).

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager