Grease Pump Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432247 | Date : Dec, 2025 | Pages : 253 | Region : Global | Publisher : MRU

Grease Pump Market Size

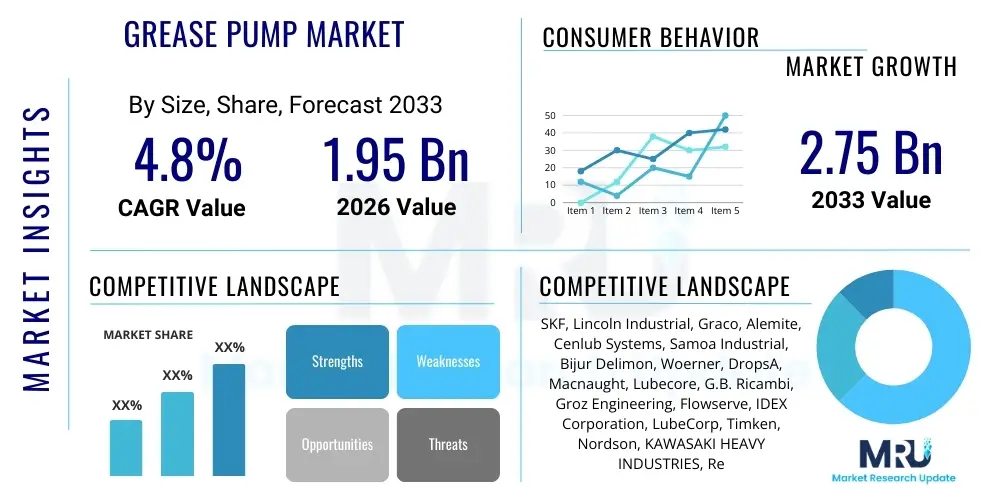

The Grease Pump Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.8% between 2026 and 2033. The market is estimated at $1.95 Billion in 2026 and is projected to reach $2.75 Billion by the end of the forecast period in 2033. This consistent expansion is primarily fueled by the increasing mechanization and automation across heavy industries globally, necessitating reliable and efficient lubrication solutions to maximize operational uptime and minimize component wear. The trend towards centralized lubrication systems, especially in high-stress environments like mining and cement production, significantly contributes to the rising demand for robust grease pumps, driving both volume and value growth in the specialized equipment segment. The continuous replacement cycles and modernization initiatives in developed economies further solidify this market trajectory.

Grease Pump Market introduction

The Grease Pump Market encompasses the manufacturing, distribution, and utilization of specialized pumping equipment designed to deliver lubricating grease from a reservoir to critical machine points under pressure. These devices are fundamental components of centralized lubrication systems (CLS) and essential for manual maintenance, ensuring the longevity and optimal performance of industrial machinery, heavy vehicles, and construction equipment. The product range is broad, spanning from small, manually operated pumps used in workshops to large, fully automated, electric or pneumatic systems integrated into complex manufacturing assembly lines. The primary function is to provide precise, timely, and contamination-free application of lubricant, thereby reducing friction, managing heat, and preventing premature failure of bearings, gears, and other moving parts. The technological evolution within this sector is focused on enhancing pump reliability, improving volumetric efficiency, and integrating digital monitoring capabilities for predictive maintenance.

Major applications of grease pumps are pervasive across virtually all capital-intensive sectors. They are indispensable in the automotive manufacturing sector for robotic lubrication, essential in the mining industry for powering heavy earth-moving equipment, and crucial for maintaining high-speed turbines and conveyors in the cement and steel industries. Furthermore, the construction sector relies heavily on portable and high-pressure grease pumps for servicing cranes, excavators, and dump trucks in harsh operational environments. The fundamental benefit provided by these pumps is enhanced operational efficiency and substantial cost savings realized through minimized downtime, reduced labor requirements for manual lubrication, and extended machine lifespan. Automated systems, in particular, guarantee that lubrication schedules are strictly adhered to, eliminating human error and ensuring uniform distribution of grease, which is critical for compliance in regulated industrial settings.

Driving factors propelling market growth include the global expansion of manufacturing activities, particularly in emerging economies undergoing rapid industrialization, which mandates the installation of new machinery requiring consistent lubrication. Furthermore, stringent regulatory standards focusing on environmental protection and worker safety increasingly favor closed-loop, automated lubrication systems that minimize grease wastage and prevent manual exposure to moving parts. The continuous evolution of industrial machinery, demanding higher pressures and greater precision in lubrication delivery, compels end-users to upgrade to advanced, high-performance grease pump models. The increasing focus on predictive maintenance strategies, facilitated by the integration of sensors and IoT capabilities into modern lubrication systems, provides a strong impetus for investment in premium, technologically advanced pumping solutions, thereby accelerating market penetration across all industrial verticals seeking to optimize their maintenance expenditure and achieve World-Class Manufacturing (WCM) standards.

Grease Pump Market Executive Summary

The Grease Pump Market demonstrates robust business trends characterized by significant technological shifts towards digitalization and automation, moving away from traditional manual methods toward sophisticated centralized lubrication systems (CLS). Key business activities include strategic acquisitions by large multinational corporations aiming to consolidate market share and integrate complementary technologies, specifically targeting smaller innovative firms specializing in smart pump monitoring and control interfaces. The market is witnessing a strong preference for electric and hydraulic pumps over pneumatic counterparts due to enhanced energy efficiency and consistent pressure delivery required by modern heavy machinery. Supply chain resilience, particularly concerning specialized raw materials like high-strength steel and advanced polymers used in pump construction, remains a critical operational consideration, driving companies to diversify their supplier base to mitigate geopolitical and logistical risks.

Regionally, Asia Pacific (APAC) stands out as the primary growth engine, driven by massive infrastructure spending, booming automotive production, and expanding mining operations in countries like China, India, and Indonesia. This region's rapid industrialization fuels both the initial installation of new systems and the aftermarket demand for replacement components and service contracts. North America and Europe, characterized by highly mature industrial bases, focus predominantly on technology upgrades, retrofitting existing machinery with advanced, IoT-enabled grease pumps to comply with Industry 4.0 standards and pursue maximum energy optimization. The Middle East and Africa (MEA) are emerging due to significant investments in oil & gas, petrochemicals, and construction, creating niche but high-value opportunities for heavy-duty, corrosion-resistant pump solutions capable of operating reliably in extreme temperatures and dusty environments.

Segmentation trends indicate that electrically powered grease pumps are capturing the largest market share due to their ease of integration into automated control systems, superior pressure control, and high operational reliability compared to manual or pneumatic alternatives. Within the End-Use segmentation, the Mining and Construction sectors collectively represent the most substantial demand pool, given the constant, high-volume lubrication needs of heavy mobile and stationary equipment operating under extreme loads. Furthermore, within the Type segmentation, progressive centralized systems, which utilize grease pumps to accurately divide and distribute lubricant to multiple points, are experiencing accelerated adoption over traditional single-line systems, reflecting the industry's increasing demand for precise metering and real-time fault detection capabilities in complex machinery layouts.

AI Impact Analysis on Grease Pump Market

Common user questions regarding AI's impact on the Grease Pump Market center on how Artificial Intelligence can fundamentally transform preventive maintenance schedules, optimize lubricant consumption, and predict equipment failure. Users frequently inquire about the feasibility and ROI of integrating machine learning algorithms for real-time analysis of pump performance data, vibration metrics, and pressure readings. Key themes include the shift from scheduled maintenance to predictive maintenance (PdM), the role of AI in diagnosing subtle faults within the pump mechanism or the lubrication lines, and the potential for AI-driven systems to automatically adjust grease delivery volumes based on actual operational load and environmental conditions, thereby minimizing waste and maximizing component lifespan. The expectation is that AI will move grease pumps from simple mechanical devices to highly intelligent, self-optimizing system components.

The implementation of AI/ML models is specifically designed to interpret vast datasets generated by sensors embedded in modern grease pumps, including flow meters, pressure transducers, and temperature sensors located near critical lubrication points. This data allows algorithms to establish highly accurate baseline operational profiles. Any deviation from these profiles, often imperceptible to human monitoring or standard alert systems, triggers a predictive warning, allowing maintenance teams to intervene well before catastrophic failure occurs. This capability dramatically reduces unscheduled downtime, which is the single most significant operational cost factor in heavy industries. AI-enhanced systems are moving beyond simple data logging, offering actionable insights and recommendations, such as suggesting the optimal type or volume of grease needed for specific, upcoming operational cycles based on historical data patterns and forecasted load requirements, thus optimizing overall lubricity management.

The long-term impact of AI lies in creating truly autonomous lubrication ecosystems. Imagine a grease pump system that not only detects an anomaly but automatically increases pressure or adjusts flow rate temporarily to compensate for an identified transient load spike, and subsequently logs the event for future model training and failure analysis. This level of self-correction and continuous learning enhances system resilience and reduces reliance on human operators for nuanced adjustments. For manufacturers, AI analysis of aggregated field data across thousands of installed units informs better product design, identifying common failure modes and optimizing pump component specifications for durability and efficiency, ensuring that future generations of grease pumps are inherently more reliable and easier to maintain, further solidifying the link between lubrication management and overall machinery health management.

- AI enables predictive maintenance (PdM) by analyzing vibration and pressure signatures.

- Machine learning optimizes grease consumption by dynamically adjusting delivery based on real-time load and temperature.

- AI algorithms detect subtle anomalies in pump performance, preventing catastrophic failures.

- Integration of smart sensors and IoT gateways facilitates centralized, AI-driven monitoring of lubrication health.

- Automated fault diagnosis reduces maintenance time and improves first-time fix rates for complex CLS issues.

- AI assists in inventory management by forecasting grease demand based on projected equipment utilization schedules.

DRO & Impact Forces Of Grease Pump Market

The Grease Pump Market is driven by the escalating demand for centralized lubrication systems in heavy machinery, particularly within the construction, mining, and steel industries, where reliability and minimizing downtime are paramount operational objectives. The continuous global push for automation (Industry 4.0) and the necessity to adhere to increasingly stringent occupational safety standards necessitate the adoption of automated grease pumps, moving labor away from hazardous manual lubrication points. Conversely, the market faces significant restraints, primarily stemming from the high initial capital investment required for implementing complex, multi-point centralized systems, which can be prohibitive for small and medium-sized enterprises (SMEs). Furthermore, the dependency on fluctuating global prices for key raw materials like specialized steel alloys, electric motors, and advanced sealing materials introduces cost volatility that can impact profit margins for pump manufacturers and influence end-user purchasing decisions.

Opportunities for expansion are predominantly focused on technological innovation and geographical penetration. The development and deployment of ‘smart pumps’ incorporating IoT connectivity, enabling remote diagnostics, real-time condition monitoring, and integration with broader plant maintenance software (CMMS/ERP), present a high-growth avenue. Furthermore, vast, untapped market potential exists in developing nations across Southeast Asia, Africa, and Latin America, where rapid infrastructure development projects and modernization of aging industrial facilities are creating substantial demand for robust and affordable lubrication solutions. The emphasis on sustainable operations also creates opportunities for high-efficiency, energy-saving pump designs and systems engineered to minimize lubricant leakage and waste, aligning with corporate environmental, social, and governance (ESG) goals.

Impact forces governing the market trajectory are multifaceted, primarily centered around technological disruption and competitive intensity. The shift towards electrification (electric pumps replacing pneumatic) is a major force reshaping product offerings and manufacturing capabilities. Economic volatility, particularly recessions affecting capital expenditure in manufacturing and construction, serves as a significant limiting force, potentially delaying large-scale system upgrade projects. Moreover, competitive pressure from global and regional players leads to continuous product differentiation based on pump durability, maintenance simplicity, and technological integration, forcing all market participants to invest heavily in R&D to maintain relevance. Regulatory mandates concerning industrial safety and environmental waste management also exert a powerful impact, dictating design specifications and accelerating the adoption of enclosed and monitored lubrication systems that require high-precision grease pumps.

Segmentation Analysis

The Grease Pump Market is comprehensively segmented based on Type, Operating Power Source, Flow Rate, Pressure Rating, and critical End-Use Industries, providing a detailed framework for understanding market dynamics and specialized product demands. The segmentation by Type, specifically distinguishing between Manual, Pneumatic, Hydraulic, and Electric pumps, highlights the fundamental differences in operational scale, precision requirements, and application environments. The electric pump segment generally dominates revenue generation due to its suitability for large-scale centralized systems, superior control, and seamless integration with industrial control networks. Conversely, Manual and Pneumatic pumps maintain strong market positions in localized maintenance tasks and non-electrified or hazardous environments where robust, simple operation is prioritized over continuous automation.

A crucial perspective is offered by the End-Use segmentation, which delineates demand patterns across diverse sectors such as Mining, Construction, Automotive, Metals & Steel, Cement, and Marine. Each sector presents unique challenges regarding dust exposure, operational temperature extremes, vibration levels, and grease viscosity requirements, thereby mandating specific pump designs—for instance, heavy-duty, high-pressure pumps in mining versus precision, lower-volume pumps in high-speed manufacturing environments. This differentiation drives specialization among manufacturers and dictates their target market strategies. The sustained capital investment cycles in infrastructure development worldwide ensure the continued high demand from the Construction and Mining segments, making them the cornerstone of market growth. Detailed analysis across these segments provides insights into emerging product specifications and regional investment priorities.

- By Type:

- Manual Grease Pumps

- Pneumatic Grease Pumps

- Electric Grease Pumps

- Hydraulic Grease Pumps

- By Operating Pressure:

- Low-Pressure Pumps (Up to 200 Bar)

- High-Pressure Pumps (Above 200 Bar)

- By Flow Rate:

- Low Flow (Under 0.5 kg/min)

- Medium Flow (0.5 kg/min to 2 kg/min)

- High Flow (Above 2 kg/min)

- By End-Use Industry:

- Automotive & Transportation

- Mining & Quarrying

- Construction & Earthmoving

- Metals & Steel Manufacturing

- Cement & Power Generation

- Marine & Offshore

- Other Industrial Applications (e.g., Robotics, Food Processing)

Value Chain Analysis For Grease Pump Market

The Grease Pump Market value chain commences with upstream analysis, which involves the sourcing of critical raw materials and components, including high-grade steel, specialty alloys, precision electric motors, gears, specialized seals (elastomers and polymers), and electronic control units. Key upstream suppliers include steel mills, motor manufacturers, and complex machining component providers. Maintaining high quality and minimizing material variability at this stage is crucial, as the performance and longevity of grease pumps are highly dependent on the precision and durability of internal moving parts subject to immense pressure. Effective supply chain management focuses on securing competitive pricing for raw materials while ensuring the availability of specialized, high-tolerance components necessary for reliable high-pressure operation. Disruptions in the supply of microcontrollers or motors, often sourced from highly concentrated global markets, pose notable upstream risks that must be continuously monitored and mitigated through diversification strategies.

The midstream segment involves the core manufacturing, assembly, and testing of the pumps. Manufacturers must possess advanced capabilities in CNC machining, heat treatment, precise assembly of complex hydraulic/pneumatic circuits, and rigorous quality assurance testing to meet international performance standards (e.g., ISO specifications for pressure equipment). Product differentiation often occurs here through proprietary pump designs (e.g., piston pump configurations, sealing technologies) that offer superior efficiency, reduced maintenance, or enhanced compatibility with specific types of lubricating greases (NLGI grades). Post-manufacturing, the distribution channel plays a vital role. Direct distribution is common for large, customized centralized lubrication projects where manufacturers offer turnkey solutions, installation, and ongoing maintenance contracts. Indirect distribution relies heavily on specialized industrial distributors, MRO (Maintenance, Repair, and Operations) suppliers, and regional dealer networks who provide local stock, technical support, and immediate availability of spare parts for aftermarket needs.

Downstream analysis focuses on the end-use adoption, service, and recycling phases. The successful application of grease pumps hinges on proper system integration, commissioning, and regular maintenance, often performed by certified technical service providers employed by the manufacturer or authorized distributors. Aftermarket services—including spare parts, replacement cartridges, system diagnostics, and lubrication consulting—constitute a significant and stable revenue stream, often exceeding initial equipment sales revenue over the life cycle of a major industrial asset. Direct customer feedback from major end-users (e.g., mining companies, large automotive plants) drives continuous improvement in product design, focusing on robustness, connectivity, and ease of field maintenance. The overall value chain emphasizes high-value services and long-term customer relationships rather than purely transactional sales, especially as centralized systems require specialized ongoing support.

Grease Pump Market Potential Customers

Potential customers for grease pumps span the entire industrial landscape, but the primary high-volume buyers are large, capital-intensive organizations in heavy industry sectors that operate extensive fleets of machinery or continuous manufacturing processes. The end-users or buyers of these products include Chief Engineers and Plant Managers responsible for operational reliability and asset uptime in sectors such as iron and steel production, where continuous casting and rolling mills require non-stop, centralized lubrication. Mining companies, operating massive fleets of haul trucks, excavators, and conveyor systems in remote and challenging conditions, are critical customers demanding rugged, high-capacity, automated pumps designed for extreme environments. Similarly, major construction and infrastructure firms purchasing or leasing heavy earth-moving equipment constitute a substantial client base, prioritizing robust, mobile, or vehicle-mounted lubrication systems.

Beyond the heavy process industries, the automotive manufacturing sector, including Tier 1 and Tier 2 suppliers, represents a crucial customer segment focused on precision and automation. These plants use grease pumps extensively in robotic arms, stamping presses, and general assembly lines, requiring high-precision electric pumps capable of delivering minute, metered quantities of grease repeatedly. Furthermore, Original Equipment Manufacturers (OEMs) of machinery (e.g., wind turbines, agricultural equipment, machine tools) are indirect but essential customers, as they integrate lubrication systems, including the specified grease pumps, directly into their machinery before it reaches the final end-user. This OEM channel is critical for manufacturers aiming for high-volume sales and setting industry standards for integrated lubrication solutions.

A growing niche segment comprises companies focused on industrial maintenance and repair services (MRO) who purchase manual, pneumatic, and smaller electric pumps for servicing clients across various smaller industrial or workshop settings. These service providers require versatile, reliable, and easily portable pump solutions. The underlying factor uniting all potential customers is the financial impact of machine downtime; consequently, the purchasing decision for a grease pump is driven not merely by cost, but overwhelmingly by reliability, technical support, the pump's compatibility with their existing system infrastructure, and its contribution to achieving zero unplanned downtime targets. Therefore, sales are heavily influenced by performance guarantees, service contracts, and proven field reliability in high-stress applications.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $1.95 Billion |

| Market Forecast in 2033 | $2.75 Billion |

| Growth Rate | 4.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | SKF, Lincoln Industrial, Graco, Alemite, Cenlub Systems, Samoa Industrial, Bijur Delimon, Woerner, DropsA, Macnaught, Lubecore, G.B. Ricambi, Groz Engineering, Flowserve, IDEX Corporation, LubeCorp, Timken, Nordson, KAWASAKI HEAVY INDUSTRIES, Retech Systems |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Grease Pump Market Key Technology Landscape

The technology landscape for the Grease Pump Market is rapidly evolving, moving decisively towards smart, interconnected lubrication solutions that minimize human intervention and maximize operational visibility. A core technological trend is the proliferation of IoT-enabled sensors integrated directly into the pump and dispensing lines. These sensors measure critical parameters such as pump cycling rate, outlet pressure, reservoir levels, and even the temperature and viscosity characteristics of the dispensed grease. This data is transmitted via wireless protocols (e.g., Bluetooth, cellular networks) to a central gateway and then to cloud-based monitoring platforms, allowing maintenance teams to track the entire lubrication system performance in real-time, facilitating true predictive maintenance rather than reactive repairs. This shift requires expertise not only in hydraulic and mechanical design but also in software and data analytics to process the massive streams of operational data generated by distributed pump networks across a factory or mine site.

Another significant technological advancement centers on pump mechanics and control precision, particularly evident in sophisticated electric grease pumps. Modern pumps increasingly utilize precise servo or stepper motor controls coupled with multi-piston or progressive divider valve systems to ensure extremely accurate volumetric output regardless of ambient temperature or back pressure fluctuations. This precision is essential in industries like robotics and aerospace manufacturing, where the lubrication dose must be highly repeatable and infinitesimally small. Furthermore, manufacturers are focusing heavily on materials technology, employing advanced ceramics and surface treatments to improve the durability of pistons, gears, and seals, extending pump life while enabling compatibility with environmentally friendly synthetic greases that might have different chemical properties than traditional petroleum-based lubricants. Innovation in modular design also allows for easier field repair and customization, reducing mean time to repair (MTTR) and minimizing inventory complexity for end-users.

Finally, the integration of lubrication systems with broader industrial control systems (ICS) is paramount. Modern grease pumps are being developed with standardized industrial communication protocols (e.g., Ethernet/IP, PROFINET, Modbus TCP) to allow seamless interfacing with plant-wide supervisory control and data acquisition (SCADA) systems and enterprise resource planning (ERP) software. This interconnectivity allows the lubrication schedule to be dynamically adjusted based on the production schedule or real-time machinery load, ensuring optimal machine health. Future technological developments are anticipated to include self-diagnostic capabilities, where the pump’s onboard controller can identify internal wear or blockage, signal the need for service, and even communicate with nearby pump units to reroute lubrication delivery temporarily, ensuring continuous operation even in the event of a minor sub-system failure. This systemic resilience driven by advanced controls defines the next generation of grease pump technology.

Regional Highlights

- Asia Pacific (APAC): APAC represents the largest and fastest-growing market globally, driven primarily by extensive infrastructure development, booming automotive production across China, India, and Southeast Asia, and massive investment in mining operations in Australia and Indonesia. Countries like China and India are rapidly transitioning from manual lubrication practices to centralized and automated systems to enhance manufacturing quality and output efficiency, creating immense demand for high-flow electric and hydraulic grease pumps. The sheer scale of new factory construction and heavy equipment purchases in these economies ensures that APAC will maintain its dominance throughout the forecast period. The competitive landscape here is diverse, featuring both large international players and strong regional manufacturers offering cost-competitive solutions tailored to local operational requirements and maintenance practices. The regional trend is marked by a focus on robust solutions capable of enduring dusty and high-temperature operating conditions typical in large-scale projects.

- North America: North America is characterized by high adoption rates of advanced, smart grease pumps and centralized lubrication systems, driven by high labor costs and strict regulatory compliance requirements emphasizing worker safety and environmental protection. The market here focuses heavily on technology replacement and system upgrades rather than entirely new installations. Key demand drivers include the large installed base of heavy machinery in the oil & gas, forestry, and construction sectors, and the rapid integration of Industry 4.0 principles across manufacturing facilities, necessitating IoT-enabled pumps for real-time monitoring and integration into facility-wide maintenance platforms. Manufacturers operating in this region emphasize reliability, energy efficiency, and sophisticated diagnostic capabilities to appeal to a highly mature and technologically savvy industrial customer base willing to pay a premium for systems that deliver quantifiable reductions in unplanned downtime.

- Europe: The European market demonstrates strong demand, particularly in Germany, Italy, and the UK, propelled by a focus on sustainable manufacturing practices, precision engineering, and adherence to rigorous quality standards (e.g., machinery directives). Europe is a leader in adopting advanced electric and progressive lubrication systems designed for minimal lubricant consumption and maximum energy efficiency, aligning with the region's strong environmental mandates. The automotive and aerospace manufacturing sectors are key consumers, requiring pumps with extreme volumetric accuracy for robot lubrication. Furthermore, significant investment in renewable energy infrastructure, such as offshore wind farms, drives demand for specialized, corrosion-resistant automatic grease pumps capable of performing reliably in challenging marine environments for extended periods without servicing. Competitive strategies often focus on offering integrated service packages and specialized lubricants alongside the pump hardware.

- Latin America (LATAM): The LATAM market, while smaller than APAC or North America, shows promising growth linked to substantial natural resource extraction activities (mining in Chile, Brazil, Peru) and burgeoning infrastructure projects. The demand is often for durable, robust pumps suitable for high-wear environments and remote operations where maintenance access is challenging. Price sensitivity is generally higher here compared to North America or Europe, leading to a strong market for reliable, mid-range pneumatic and electric pumps. Political and economic volatility can occasionally impede large capital projects, but the fundamental need for lubrication solutions to maintain key economic sectors like agriculture, mining, and oil & gas ensures a steady underlying market demand. Distributors play a crucial role in providing local support and training, overcoming logistical complexities inherent in the region's vast geography.

- Middle East and Africa (MEA): The MEA region is expanding, fueled by major investments in the oil and gas sector (upstream and downstream), petrochemical processing, and mega-construction projects, particularly in the GCC countries. The harsh climate, characterized by high temperatures and pervasive sand, necessitates specialized grease pumps built for extreme durability and resistance to thermal stress and ingress of contaminants. The high value of assets in the energy sector ensures a willingness to invest in premium, high-pressure hydraulic and electric pumps that guarantee system uptime. Africa's market growth is highly concentrated around mining operations (e.g., South Africa, West Africa), driving demand for mobile and centralized heavy-duty lubrication systems. The market is primarily served by established international manufacturers leveraging local partnerships for distribution and servicing to navigate regulatory and operational complexities.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Grease Pump Market. The strategic positioning of these companies, marked by continuous R&D investment in smart technology and geographical expansion, defines the competitive landscape. These players offer comprehensive portfolios ranging from manual grease guns to sophisticated centralized automatic lubrication systems, catering to diverse industrial needs globally. Their primary focus includes enhancing pump efficiency, integrating IoT functionality for predictive diagnostics, and broadening service networks to support complex installations in heavy machinery sectors.- SKF

- Lincoln Industrial (a SKF group company)

- Graco

- Alemite

- Cenlub Systems

- Samoa Industrial

- Bijur Delimon

- Woerner

- DropsA

- Macnaught

- Lubecore

- G.B. Ricambi

- Groz Engineering

- Flowserve

- IDEX Corporation

- LubeCorp

- Timken

- Nordson

- KAWASAKI HEAVY INDUSTRIES

- Retech Systems

Frequently Asked Questions

Analyze common user questions about the Grease Pump market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary driving factor for the growth of the automated grease pump market?

The primary driver is the global industrial shift towards centralized lubrication systems (CLS) and Industry 4.0 standards, focusing on minimizing machine downtime and reducing maintenance costs through predictive maintenance (PdM) enabled by IoT-integrated automated pumps.

How do electric grease pumps differ fundamentally from pneumatic pumps in industrial use?

Electric grease pumps offer superior control over volume and pressure, higher energy efficiency, and easier integration with PLC/SCADA systems for automation, making them ideal for precision applications and large centralized systems, whereas pneumatic pumps are preferred for hazardous areas or simple mobile operations lacking consistent electrical access.

Which end-use industry holds the largest market share for high-pressure grease pumps?

The Mining and Construction industries collectively dominate the market for high-pressure grease pumps, as their heavy machinery (excavators, haul trucks, crushers) operates under extreme loads requiring high-viscosity grease delivered at pressures exceeding 4,000 psi to overcome line resistance and ensure adequate lubrication of massive components.

What role does Artificial Intelligence play in modern grease pump management?

AI is increasingly utilized to analyze sensor data from smart pumps to detect subtle operational anomalies, predict potential pump or machine component failures before they occur, and optimize the precise timing and quantity of grease delivery based on real-time operational loads, thereby maximizing component lifespan and reducing grease wastage.

What key technology is driving competitive differentiation among major grease pump manufacturers?

Key competitive differentiation is driven by the integration of IoT and cloud connectivity features, enabling remote monitoring, real-time diagnostics, and seamless integration with Enterprise Asset Management (EAM) and Computerized Maintenance Management Systems (CMMS), transforming the pump into an intelligent data node.

The strategic dynamics within the global Grease Pump Market are intensely focused on leveraging technology to enhance reliability and precision, aligning with the industrial imperative to achieve zero unplanned downtime. Manufacturers are not only competing on mechanical performance but increasingly on the intelligence and connectivity features embedded within their products, making software integration and data services critical components of their value proposition. For instance, companies like SKF and Graco continue to invest heavily in developing proprietary control algorithms that can automatically compensate for temperature-induced changes in grease viscosity, ensuring consistent delivery volumes even in extreme thermal environments, a crucial differentiator in sectors like offshore marine and Arctic mining operations. This focus on adaptive intelligence represents a significant technological barrier to entry for smaller, less sophisticated manufacturers, driving market consolidation.

Furthermore, sustainability and environmental compliance are emerging as powerful influence factors, particularly in European and North American markets. End-users are actively seeking grease pumps and centralized systems that are certified to minimize lubricant leakage and waste, contributing to cleaner factory floors and reduced environmental footprint. This preference pushes manufacturers toward developing closed-loop systems with integrated filtration and automated leak detection features, ensuring that the lubricant is optimally utilized and contained. The need for pumps capable of handling specialized biodegradable and synthetic greases, which often require different internal pump tolerances and sealing materials compared to conventional mineral greases, also necessitates continuous material science research and development among leading market players. The adherence to strict standards, such as those related to pressure equipment and hazardous materials handling, further strengthens the position of established companies with certified manufacturing processes.

In terms of geographical expansion, while APAC remains the volume growth leader, strategic focus is shifting toward establishing robust service infrastructure in emerging markets like Southeast Asia and parts of Africa. This is not just about selling the hardware but about providing the specialized training and technical support required to maintain complex automated lubrication systems in regions where highly skilled labor might be scarce. Companies are partnering with local engineering firms to ensure prompt response times for maintenance and spares delivery, acknowledging that superior after-sales service is a key factor in winning long-term contracts. The competitive interplay between pricing for entry-level pumps demanded by smaller industrial customers and the high-margin, technologically advanced solutions favored by multinational corporations defines the dual nature of market strategy across different economic zones, demanding highly flexible and segmented product portfolios to capture maximum market share efficiently.

The regulatory framework surrounding industrial machinery safety and operational health continues to evolve, directly impacting grease pump design. Mandates related to machine guarding and minimizing worker exposure to moving parts indirectly encourage the adoption of centralized, automatic lubrication systems, which inherently require robust, high-performance pumps. This regulatory push provides a consistent, non-cyclical driver for automated pump sales, forcing industries that traditionally relied on manual grease application to upgrade their maintenance protocols. The complexity of these automated systems, which integrate reservoirs, pumps, distribution lines, metering devices, and electronic controls, also increases the demand for comprehensive system integrators rather than simple component suppliers. Therefore, leading grease pump manufacturers are increasingly positioning themselves as full-service solution providers, offering everything from system design consultation and installation to long-term monitoring and maintenance contracts, thereby locking in revenue streams and maximizing customer lifetime value within this highly specialized industrial equipment market.

The evolution of pump components, such as sophisticated metering devices (injectors and progressive distributors), is intrinsically linked to the capabilities of the grease pump itself. High-precision metering devices rely on the pump to deliver a consistent, pulsation-free supply of grease under varying load conditions. Manufacturers are developing pumps with improved dampening systems and refined flow characteristics to ensure the accuracy of these downstream components, which is critical for preventing both over-lubrication (waste) and under-lubrication (failure). This synergy between the pump and the metering system is central to achieving the high level of reliability expected in modern, expensive industrial assets. Future technological advancements are anticipated to focus on self-calibration features within the pump system, allowing the pump to automatically adjust its output to maintain specified pressure and flow rates despite wear or changing operational parameters, further reducing the need for manual calibration and system validation during routine maintenance checks.

Finally, the growing trend of modularity in pump design is improving market accessibility and serviceability. Modular pumps allow end-users to easily swap out components such as the motor, reservoir size, or control interface, rather than replacing the entire unit, thereby reducing total cost of ownership (TCO) and simplifying inventory management for maintenance departments. This design philosophy caters directly to the MRO segment, where adaptability and quick fixes are highly valued. The ability to integrate different power sources (e.g., swapping an electric motor for an air motor in a confined space application) using the same core pump mechanism provides flexibility that appeals to diverse industrial settings. This modular approach is being aggressively pursued by top-tier manufacturers seeking to broaden the application range of their core pump technologies while simultaneously optimizing their own manufacturing efficiency through component standardization across various product lines and pressure ratings, creating a powerful competitive edge in a market increasingly focused on lifecycle cost optimization and operational agility.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager