Greaseproof Sheets Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432400 | Date : Dec, 2025 | Pages : 248 | Region : Global | Publisher : MRU

Greaseproof Sheets Market Size

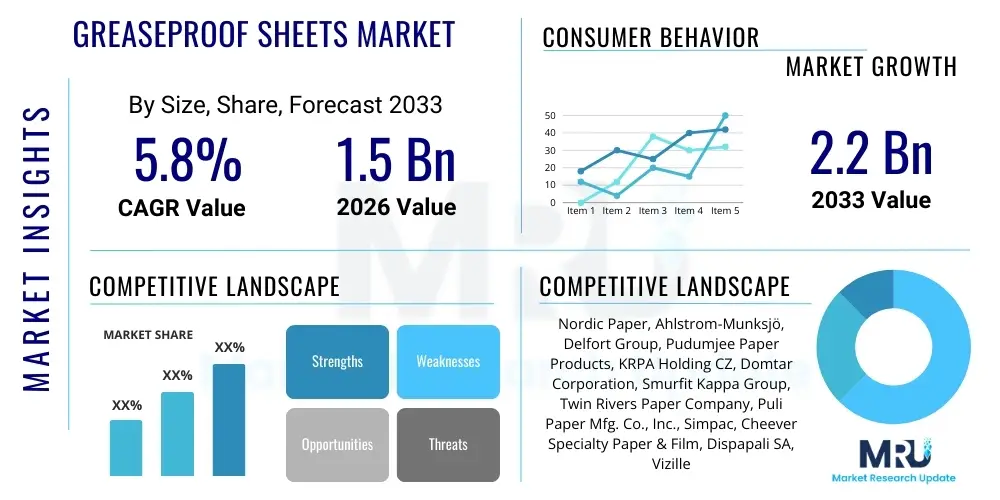

The Greaseproof Sheets Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 1.5 Billion in 2026 and is projected to reach USD 2.2 Billion by the end of the forecast period in 2033.

The steady expansion of the greaseproof sheets market is primarily fueled by the burgeoning global food service industry and the increasing demand for safe, hygienic, and convenient food packaging solutions. As consumer lifestyles become more dynamic, the reliance on quick-service restaurants (QSRs), packaged baked goods, and takeout services has escalated significantly, directly driving the consumption of specialized food contact materials. Furthermore, stringent global regulations regarding food safety and hygiene standards necessitate the use of materials that prevent oil migration and maintain food integrity, positioning greaseproof sheets as an indispensable component in both commercial and household cooking and packaging environments. The shift towards biodegradable and compostable materials also contributes positively to market valuation, as manufacturers innovate to meet sustainability demands without compromising barrier properties.

Geographic market growth is unevenly distributed, with Asia Pacific exhibiting the highest growth potential, attributed to rapid urbanization, expanding middle-class disposable incomes, and the modernization of the food retail sector. North America and Europe, while mature markets, continue to register stable growth driven by high-volume usage in industrial bakeries and prepared meal segments, coupled with consistent innovation in specialty coatings and sustainable substrate development. The market’s future is intrinsically linked to advancements in barrier technology, moving away from traditional treatments towards bio-based and fiber-based alternatives that satisfy both performance requirements and environmental mandates set by governments and corporate sustainability initiatives worldwide. Investment in manufacturing efficiency and supply chain optimization remains a key strategic focus for major players aiming to capitalize on scale economies.

Greaseproof Sheets Market introduction

The Greaseproof Sheets Market encompasses the production and distribution of specialized paper and paper-based materials engineered to resist the penetration and migration of oil, grease, and fats. These sheets are crucial components in food preparation, storage, and packaging processes, maintaining product quality, preventing staining of outer packaging, and enhancing hygiene. Products typically fall under categories such as Glassine, Parchment Paper, Wax Paper (though technically wax-coated rather than purely greaseproof), and highly engineered fluorochemical-treated or silicone-coated papers, with a significant trend favoring fluorochemical-free and sustainable options. Major applications span the baking industry, QSRs for wrapping burgers and sandwiches, institutional catering for handling fried foods, and household use for cooking and preserving. The primary benefits include superior barrier protection, non-stick properties (especially in baking), extended shelf life for certain foods, and enhanced presentation, making them essential for high-quality food service operations globally.

Driving factors propelling market expansion include the exponential growth of the e-commerce sector for food delivery and packaged goods, which demands robust and aesthetic packaging solutions. Regulatory pressures, especially in developed economies, mandate the separation of food items from packaging inks and external contaminants, bolstering the demand for certified food-safe greaseproof barriers. Furthermore, changing consumer perceptions focusing on health and cleanliness post-pandemic have increased the demand for individually wrapped and safely packaged food items. The transition towards sustainable materials is another powerful driver; manufacturers are investing heavily in producing sheets that utilize recycled pulp, are compostable, or feature innovative bio-coatings derived from natural sources, ensuring the market aligns with global circular economy goals.

The inherent versatility of greaseproof sheets allows for widespread adoption across diverse segments, ranging from industrial-scale manufacturing (e.g., lining trays in large bakeries) to highly customized uses in artisanal food preparation. The continued development of materials capable of withstanding high heat, such as those used in oven cooking and microwave reheating, further cements their market position. The challenge lies in balancing performance (grease resistance, strength) with cost and sustainability, a tension that dictates research and development priorities across the competitive landscape. As packaging innovation accelerates, greaseproof sheets are increasingly becoming multi-functional, incorporating features like heat-sealability and customized branding capabilities.

Greaseproof Sheets Market Executive Summary

The Greaseproof Sheets Market is characterized by robust business trends driven by sustainability mandates and the rapid expansion of the global Quick Service Restaurant (QSR) and food delivery sectors. Key strategic shifts include the aggressive adoption of fluorochemical-free alternatives and the integration of recycled and bio-based fibers into production processes, responding directly to tightening EU and North American chemical regulations. Companies are focusing on optimizing their supply chains for lighter, yet stronger, barrier papers that reduce logistical costs and environmental footprint. Competitive strategy revolves around product differentiation through customization (printability, size variants) and securing long-term contracts with major food processing and packaging conglomerates, ensuring stable high-volume demand. The digital transformation also impacts the market, with sophisticated inventory management systems optimizing stock levels for perishable raw materials and finished goods.

Regionally, Asia Pacific is the undeniable epicenter of growth, supported by massive populations, increasing penetration of Western-style fast food chains, and burgeoning domestic bakery industries in countries like China and India. North America and Europe maintain high market shares, primarily driven by strict food safety compliance and a mature infrastructure for high-throughput automated packaging lines; these regions are leading the technological transition towards sustainable coatings. Latin America and MEA show promising growth prospects, albeit from a smaller base, spurred by modernization of retail infrastructure and increasing foreign investment in the food service supply chain. Regulatory alignment across regions concerning food contact materials is increasingly becoming a critical factor influencing trade flows and manufacturing localization decisions.

Segmentation trends highlight the dominance of the commercial application segment (industrial bakeries, QSRs) due to sheer volume, while the household segment shows steady, incremental growth, particularly in specialized baking parchment products. Material-wise, Glassine paper is gaining traction due to its recyclability and transparency, competing effectively with traditional parchment and coated papers. The strong demand for sheets categorized by high basis weight (gsm) indicates a preference for durability and multi-use capabilities in industrial settings. Overall, the market remains highly fragmented but is consolidating around providers who can offer both cost-effective, high-volume products and specialized, environmentally compliant premium materials necessary for brand differentiation in consumer-facing packaging.

AI Impact Analysis on Greaseproof Sheets Market

User queries regarding the impact of Artificial Intelligence (AI) on the Greaseproof Sheets Market predominantly focus on optimizing manufacturing efficiency, enhancing predictive quality control, and developing next-generation sustainable materials. Common questions revolve around how AI can reduce raw material waste (pulp and coatings), forecast demand fluctuations more accurately for perishable packaging materials, and accelerate the R&D cycle for bio-based barrier technologies. Users are particularly interested in AI's role in maintaining stringent food safety compliance by monitoring continuous production parameters and identifying micro-defects in coatings that could compromise grease resistance. The consensus expectation is that AI will not fundamentally change the product itself but will revolutionize the manufacturing process, supply chain synchronization, and inventory management, leading to significant cost reductions and improved sustainability performance.

AI’s influence is projected to extend across the entire value chain, starting from optimized forestry management and pulp sourcing, where AI models can predict yield and quality variations. In the coating and conversion phase, machine learning algorithms are utilized for real-time adjustments of application thickness and temperature, ensuring maximum barrier uniformity while minimizing costly material overuse. For supply chain logistics, AI drives predictive maintenance for high-speed converting machinery, minimizing unplanned downtime which is crucial in high-volume, low-margin packaging production. Furthermore, consumer demand forecasting, driven by advanced predictive analytics analyzing seasonal trends and promotional impact, allows manufacturers to optimize production runs, drastically reducing excess inventory and subsequent material obsolescence, thereby strengthening market efficiency and responsiveness.

- AI-driven optimization of pulp blending and refining processes for improved fiber structure.

- Machine Learning (ML) enabled quality control systems detecting minute flaws in greaseproof coatings (AEO focus: enhanced barrier integrity).

- Predictive maintenance schedules for high-speed paper converting machinery, increasing uptime and throughput.

- Advanced demand forecasting using external variables (e-commerce growth, food inflation) to minimize inventory waste.

- AI-assisted material science R&D, accelerating the discovery and scaling of novel bio-degradable barrier formulations (GEO focus: sustainable packaging innovation).

- Automated energy management systems in production facilities, lowering the cost of high-temperature drying processes.

DRO & Impact Forces Of Greaseproof Sheets Market

The Greaseproof Sheets Market is primarily driven by the escalating demand from the food service sector, particularly quick-service restaurants and industrial bakeries seeking cost-effective and compliant food handling solutions. A major restraint involves the reliance on virgin wood pulp in many conventional products, leading to high raw material cost volatility and environmental concerns, pushing manufacturers towards recycled and sustainable fibers. Opportunities are abundant in developing and commercializing fully biodegradable, compostable, and fluorochemical-free greaseproof papers, capitalizing on consumer and corporate sustainability commitments. These market dynamics are significantly influenced by impact forces such as stringent government regulations on food contact safety, the global growth of e-commerce food delivery (which requires high-integrity packaging), and volatile energy prices affecting the energy-intensive paper manufacturing process. The confluence of regulatory push for safety and consumer pull for sustainability shapes strategic decisions in material innovation and production optimization.

The core drivers are deeply rooted in demographic shifts and lifestyle changes. Urbanization and increased disposable income globally translate to higher consumption of convenience food, fueling the demand for packaging like greaseproof sheets. Furthermore, the imperative for hygiene, especially in developing markets, mandates the use of disposable food-contact materials. However, restraints include the technical challenge of achieving high levels of grease resistance without using traditional, potentially environmentally detrimental chemical treatments. Another significant restraint is the logistical complexity and cost associated with transporting bulky paper products across continents, pressuring localized production strategies. The market must continuously address the balance between achieving high barrier properties—often requiring dense or coated paper—and maintaining sustainability certifications, a complex trade-off influencing product pricing and availability across diverse markets.

Key opportunities center on expanding the application base beyond traditional baking and wrapping to specialized uses, such as moisture-absorbing layers in refrigerated packaging or specialized liners for pet food packaging, where fat migration is a major concern. Furthermore, the digitalization of the packaging industry offers opportunities for customized, small-batch runs of printed greaseproof sheets for boutique food brands, facilitated by advancements in digital printing technology. Impact forces also include the fluctuating price of petrochemical derivatives, which are often used in specialty coatings, necessitating a rapid pivot towards naturally derived polymer alternatives. Overall, the market trajectory is strongly determined by the industry’s ability to innovate sustainable, high-performance barriers that are cost-competitive against traditional plastic films and standard coated papers, while navigating complex international chemical and food safety compliance landscapes.

Segmentation Analysis

The Greaseproof Sheets Market is segmented across several critical dimensions, including Material Type, Application, Basis Weight, and End-User. This segmentation allows for precise market sizing and strategic targeting based on specific functional requirements. The Material Type segment differentiates between commodity papers like Glassine and highly specialized products like Parchment (often silicone-treated) and chemically treated barriers, reflecting variations in cost and performance characteristics such as heat resistance and release properties. Application segmentation highlights the difference in consumption volume and specification required between large-scale industrial baking operations and the needs of QSRs for wrapping. The analysis demonstrates a strong correlation between segment growth and the adoption of sustainable packaging policies across global food industry leaders, favoring segments offering recyclable or compostable options.

In terms of Basis Weight (GSM), the market is typically divided into lighter weights suitable for simple sandwich wrapping and heavier weights preferred for tray lining in industrial ovens or deep-freeze applications where material strength is paramount. This metric is essential as it directly impacts both material cost and performance integrity. End-User analysis reveals a bifurcated market structure, with the Commercial sector (bakeries, QSRs, catering) dominating volume due to routine, high-volume operational use, and the Household sector maintaining a steady, demand-elastic contribution, often driven by seasonal baking trends and specialized cooking needs. Strategic investments are currently concentrated on developing materials optimized for high-speed automatic packaging machinery, characteristic of the commercial segment, thus ensuring operational efficiency for large clients.

- By Material Type:

- Parchment Paper (Siliconized and Non-Siliconized)

- Glassine Paper

- High-Density Greaseproof Paper (HDGP)

- Wax Paper

- Specialty Coated Paper (Fluorochemical-free)

- By Application:

- Baking and Roasting Liners

- Food Wrapping (Sandwiches, Burgers, Delicatessen)

- Tray Liners (Industrial and Commercial)

- Separation Sheets (e.g., separating meats, frozen goods)

- By Basis Weight (GSM):

- Less than 40 GSM (Lightweight)

- 40 GSM to 80 GSM (Standard/Medium Weight)

- Above 80 GSM (Heavy Duty)

- By End-User:

- Commercial Food Service (QSRs, Restaurants, Catering)

- Industrial Bakeries and Food Processing

- Household/Retail Consumers

- Institutional (Hospitals, Schools)

Value Chain Analysis For Greaseproof Sheets Market

The value chain for greaseproof sheets is highly integrated and begins with the sourcing of raw materials, primarily specialized wood pulp (often virgin, high-density sulfate or sulfite pulp chosen for fiber length and purity) or increasing quantities of recycled fibers. The upstream segment involves pulp mills and chemical suppliers providing essential components like sizing agents, wet strength resins, and specialty coatings (e.g., silicone, bio-polymers, or traditional fluorochemicals). Efficiency in this stage is dictated by sustainable sourcing certifications (e.g., FSC, PEFC) and minimizing commodity price volatility, especially for virgin pulp, which represents a significant portion of the final product cost.

The midstream involves the core manufacturing process, where paper is produced on specialized machines, followed by conversion processes such as supercalendering (for Glassine), chemical treatment (for grease resistance), and cutting into sheets or rolls. Key players invest heavily in high-speed, precision conversion equipment to maintain thin paper consistency and apply flawless coatings necessary for performance integrity. Downstream activities involve distribution, which is bifurcated into direct channels serving large industrial clients (e.g., major food processors, bakery conglomerates) and indirect channels utilizing packaging distributors and wholesalers to reach smaller QSRs, retail stores, and household consumers. Logistics complexity is high due to the volume and bulkiness of the finished product, favoring regional distribution centers.

The distribution channel dynamics are crucial; large volume orders for industrial use often require customized sizes and direct negotiation, emphasizing reliability and certification. Conversely, the retail sector relies on strong branding, shelf appeal, and partnerships with major retail chains and e-commerce platforms. The trend toward customized printing and branding on greaseproof sheets necessitates closer collaboration between converters and end-users, pushing customization further down the value chain. Ultimately, optimizing the value chain requires tight control over raw material procurement and highly efficient, automated converting operations to maintain competitive pricing in the commodity-driven segments while offering high-margin specialization in the premium, sustainable segments.

Greaseproof Sheets Market Potential Customers

The primary end-users and buyers of greaseproof sheets span across the entire food preparation and packaging ecosystem, driven by the necessity for hygienic, fat-resistant barriers. The largest volume consumers are industrial bakeries and large-scale food processing companies that utilize these sheets extensively as tray liners, interleaving sheets for frozen dough products, and as components in multi-layer packaging systems. Quick-service restaurants (QSRs) and fast-casual chains constitute another major customer base, using sheets for wrapping sandwiches, burgers, and lining baskets, demanding products that are both visually appealing and compliant with global food safety standards, often requiring custom printing and specific performance characteristics.

Institutional catering services, including airlines, hospitals, and educational facilities, rely on greaseproof sheets for hygienic portion control and serving prepared meals. Beyond the food service sector, specialty food manufacturers, particularly those dealing with high-fat content items like chocolates, confectioneries, and processed meats, use them as interleaving materials to prevent sticking and oil bleeding. The growth in specialized dietary needs and artisanal food production also fuels demand among smaller, independent businesses that prioritize eco-friendly and premium greaseproof options to align with their brand ethos, seeking sheets certified as bio-degradable or compostable. The household segment, served through retail channels, remains a consistent consumer, primarily purchasing parchment paper for baking and general cooking applications.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.5 Billion |

| Market Forecast in 2033 | USD 2.2 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Nordic Paper, Ahlstrom-Munksjö, Delfort Group, Pudumjee Paper Products, KRPA Holding CZ, Domtar Corporation, Smurfit Kappa Group, Twin Rivers Paper Company, Puli Paper Mfg. Co., Inc., Simpac, Cheever Specialty Paper & Film, Dispapali SA, Vizille, SAGA Papers, Asia Pulp & Paper (APP), Mondi Group, Dunn Paper, Griff Paper and Film, T.P. International, and WestRock Company |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Greaseproof Sheets Market Key Technology Landscape

The technology landscape in the greaseproof sheets market is primarily focused on overcoming the trade-off between performance and environmental sustainability. Traditional grease resistance relied heavily on fluorochemicals (PFCs/PFAS), but regulatory pressure has accelerated the development of fluorochemical-free alternatives. Key technological advancements include surface sizing techniques and the use of bio-polymers (like PLA or natural waxes) to create an effective barrier. Manufacturers are leveraging nanotechnology to create ultra-thin, highly organized cellulose fibers that inherently resist fat penetration without heavy chemical loads. Furthermore, advancements in supercalendering processes are enabling the production of extremely dense, smooth papers (like Glassine) that offer natural grease resistance through fiber compaction, reducing the need for extensive chemical treatments while maintaining excellent recyclability and printability characteristics.

Another crucial area of innovation is in the development of specialized release coatings for baking applications, specifically silicone-based formulations that are heat-stable and non-stick. The shift, however, is towards bio-based silicone alternatives or specialized bio-resins that decompose faster after use. Processing technologies, such as high-precision curtain coating and extrusion coating, are being refined to ensure uniform application of these new sustainable barriers at high speeds, minimizing waste and guaranteeing consistent product quality, especially vital for automated industrial packaging lines. Material science research is also concentrating on improving the wet-strength properties of recycled pulp, allowing for the use of more circular materials without compromising the structural integrity required when exposed to moisture or hot fats.

The integration of digital manufacturing tools, including advanced sensors and robotics, represents the operational technology layer. These tools monitor paper tension, coating viscosity, and temperature in real-time, ensuring optimal production parameters and reducing variability, which is critical for maintaining the high standards required for food contact materials. Furthermore, research into lignin-based additives, derived as a by-product of pulping, aims to utilize this natural polymer to enhance barrier properties and reduce reliance on synthetic additives. The overall technological direction is clear: a move toward high-performance, fiber-based barriers utilizing sustainable chemistry and optimized through smart manufacturing processes, ensuring compliance with global regulatory demands for safety and environmental stewardship.

Regional Highlights

- Asia Pacific (APAC): APAC is the fastest-growing region, driven by massive consumption growth stemming from increasing population density, rapid expansion of fast-food culture, and modernization of the food retail sector, especially in emerging economies like China, India, and Southeast Asia. The focus is increasingly shifting from cost-effectiveness to compliance and sustainability as multinational food chains enforce global standards locally.

- North America: A mature and high-value market characterized by stringent food safety regulations (FDA compliance) and high consumer demand for convenience food. The region leads in the adoption of specialized, high-performance parchment papers and is a primary driver for innovation in fluorochemical-free greaseproof solutions, responding to state-level restrictions on certain chemicals.

- Europe: This region is defined by highly advanced sustainability mandates, notably concerning plastic reduction and chemical use (REACH regulations). Demand is strong for certified compostable and biodegradable greaseproof papers. European manufacturers often set the global benchmark for environmentally friendly paper packaging, making innovation in bio-coatings a strategic necessity.

- Latin America (LATAM): Growth is steady, primarily fueled by urbanization and the expansion of organized retail and international QSR brands. Market penetration is increasing, with a strong preference for cost-efficient, medium-weight greaseproof sheets, although demand for branded and customized wrapping is rising in major urban centers like Brazil and Mexico.

- Middle East and Africa (MEA): Emerging market characterized by high import reliance for specialty papers. Growth is stimulated by tourism, increased disposable income in GCC countries, and growing awareness of food hygiene standards, leading to higher adoption of packaged and wrapped food items in commercial settings.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Greaseproof Sheets Market.- Nordic Paper

- Ahlstrom-Munksjö

- Delfort Group

- Pudumjee Paper Products

- KRPA Holding CZ

- Domtar Corporation

- Smurfit Kappa Group

- Twin Rivers Paper Company

- Puli Paper Mfg. Co., Inc.

- Simpac

- Cheever Specialty Paper & Film

- Dispapali SA

- Vizille

- SAGA Papers

- Asia Pulp & Paper (APP)

- Mondi Group

- Dunn Paper

- Griff Paper and Film

- T.P. International

- WestRock Company

Frequently Asked Questions

Analyze common user questions about the Greaseproof Sheets market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is driving the market shift towards fluorochemical-free greaseproof sheets?

The primary driver is stringent global regulation, particularly in North America and Europe, concerning the use of Per- and Polyfluoroalkyl Substances (PFAS/PFCs) in food contact materials due to documented environmental and health risks. Consumer preference for sustainable packaging further accelerates this transition to bio-polymer or fiber-based barriers.

How does the growth of QSRs impact the demand for greaseproof paper?

The rapid expansion of Quick Service Restaurants (QSRs) and food delivery services significantly increases the volume demand for customized wrapping and lining sheets. QSRs require high-volume, performance-consistent, and often branded greaseproof materials to ensure product quality during transit and maintain hygiene standards.

What is the primary difference between Glassine and Parchment paper in this market?

Glassine is typically translucent and achieves grease resistance through extreme fiber compaction (supercalendering) without heavy chemical coating, making it highly recyclable. Parchment paper (often siliconized) is designed specifically for non-stick, high-heat applications like baking and roasting, offering superior release properties.

Which geographical region exhibits the highest growth potential for greaseproof sheets?

Asia Pacific (APAC) shows the highest growth potential, fueled by rapid economic development, urbanization, massive growth in the organized food sector, and increasing awareness of packaged food hygiene across populous nations such as China and India.

How are manufacturers addressing sustainability concerns in the greaseproof sheet production process?

Manufacturers are focusing on utilizing certified sustainable pulp (FSC/PEFC), increasing the integration of recycled content, developing compostable bio-based coatings, and optimizing water and energy usage through AI-driven production controls to minimize the overall environmental footprint.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager