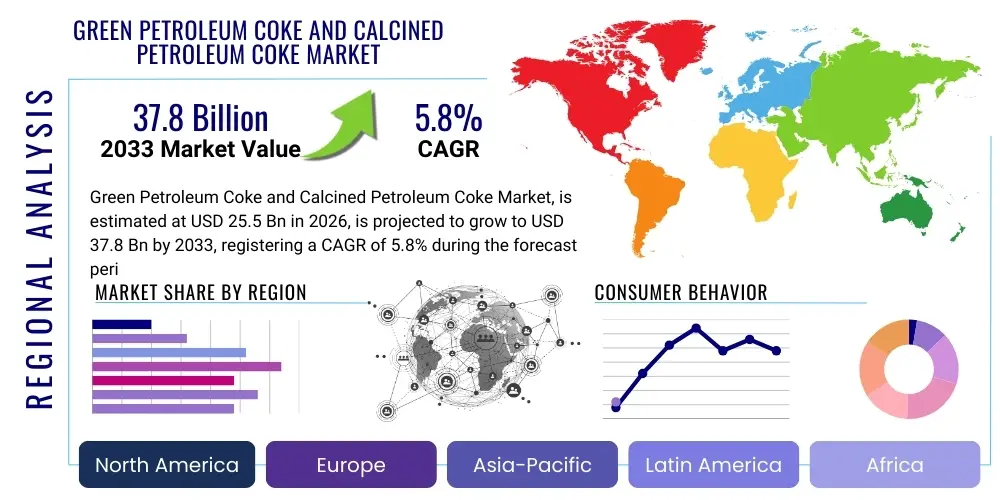

Green Petroleum Coke and Calcined Petroleum Coke Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436990 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Green Petroleum Coke and Calcined Petroleum Coke Market Size

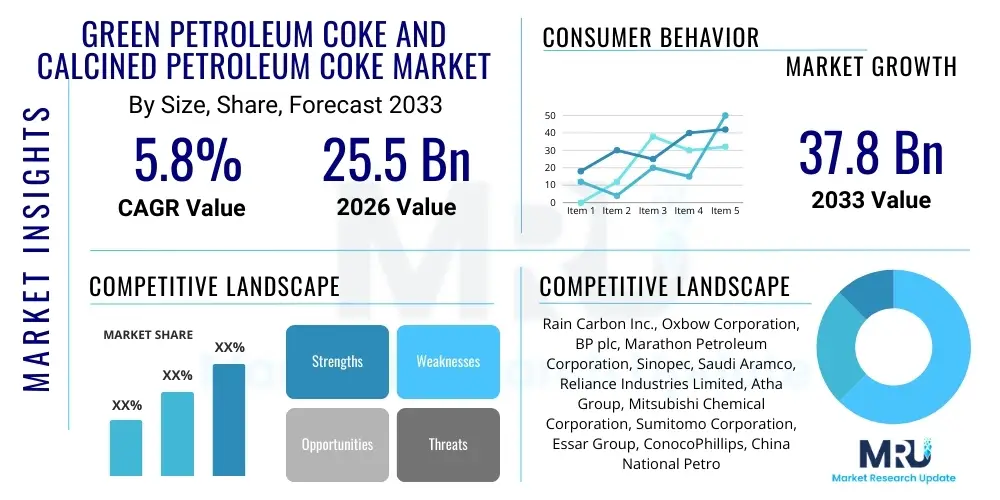

The Green Petroleum Coke and Calcined Petroleum Coke Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 25.5 Billion in 2026 and is projected to reach USD 37.8 Billion by the end of the forecast period in 2033.

Green Petroleum Coke and Calcined Petroleum Coke Market introduction

Green Petroleum Coke (GPC) is a solid carbonaceous residue derived from the oil refining process, specifically during the delayed coking of heavy crude oil fractions. GPC typically contains high levels of sulfur, ash, and volatile matter, making its primary use as a high-BTU fuel source, particularly in cement kilns and power generation facilities equipped with suitable emission control systems. Its value is highly dependent on its sulfur and metal content; lower-sulfur GPC is reserved for upgrading into Calcined Petroleum Coke (CPC), while high-sulfur grades are predominantly used for energy applications.

Calcined Petroleum Coke (CPC) is produced by heating GPC to temperatures exceeding 1200°C in a process known as calcination, which drives off moisture, volatile materials, and reduces electrical resistivity. This thermal treatment transforms GPC into a highly pure carbon product essential for the production of anodes used in the electrolytic smelting of aluminum (Hall-Héroult process). CPC serves as the critical raw material for manufacturing pre-baked anodes and Soderberg anodes, accounting for the vast majority of demand in the high-quality segment of the market. The quality of CPC, particularly its density and low impurity levels, directly influences the efficiency and lifespan of aluminum production cells.

The primary driving factor for this market is the robust and increasing global demand for aluminum, driven by growth in the automotive, aerospace, and construction sectors, particularly in Asia Pacific economies. Furthermore, CPC is indispensable in the production of titanium dioxide and specialty graphite products, broadening its industrial application base. Benefits associated with CPC include its exceptional electrical conductivity and chemical inertness at high temperatures, which are necessary for high-current metallurgical processes. However, market dynamics are often influenced by the volatility of crude oil prices, which directly impacts GPC supply, and increasingly strict environmental regulations concerning sulfur dioxide emissions from GPC combustion.

Green Petroleum Coke and Calcined Petroleum Coke Market Executive Summary

The global Green Petroleum Coke and Calcined Petroleum Coke market is undergoing significant transformations characterized by increasing geographical bifurcation in supply and demand centers. Business trends indicate a movement toward stricter quality control for GPC feedstock, as refining complexity increases and heavy oil processing becomes more prevalent, influencing the yield of anode-grade coke. Strategic investments are focused on capacity expansion, especially for calcining facilities located near major aluminum smelters in Asia, aiming to minimize logistical costs and secure long-term supply agreements. Furthermore, key players are investing in sulfur removal technologies for fuel-grade GPC to comply with escalating environmental standards, simultaneously creating new revenue streams from purified byproducts.

Regional trends highlight the dominance of the Asia Pacific (APAC) region, primarily driven by China and India, which are the largest producers and consumers of primary aluminum globally, thereby creating immense demand for high-quality CPC. North America remains a crucial supplier of premium, low-sulfur GPC, leveraging advanced coking technologies, although domestic consumption patterns are shifting. Europe exhibits stable, yet moderate growth, focusing increasingly on sustainable sourcing and carbon reduction in aluminum production, which pressures CPC suppliers to demonstrate environmentally sound practices. The Middle East and Africa (MEA) region is emerging as a critical growth hub due to significant investments in new aluminum smelting capacity, positioning the region as both a major consumer and a potential future calcination hub.

Segment trends demonstrate the superior growth trajectory of the Calcined Petroleum Coke segment over GPC, primarily due to its high value-add application in the aluminum industry. Within GPC, the fuel-grade segment maintains higher volume but faces severe pricing pressure and regulatory constraints related to emissions. The anode-grade coke sub-segment is highly sensitive to fluctuations in the aluminum market, exhibiting strong demand resilience due to the lack of viable substitutes in the Hall-Héroult process. Innovations are also observed in specialized coke grades utilized in the steel and foundry industries, focusing on materials with extremely low trace metal content for high-performance specialty applications, thus diversifying the market beyond traditional aluminum use.

AI Impact Analysis on Green Petroleum Coke and Calcined Petroleum Coke Market

User inquiries regarding the impact of Artificial Intelligence (AI) in the petroleum coke sector often revolve around operational efficiency, supply chain stability, and quality prediction, particularly given the variable nature of GPC feedstock. Key user concerns include how AI can be deployed to optimize the delayed coking process in refineries, ensuring maximum yield of high-grade GPC despite fluctuating crude inputs. Furthermore, users frequently question AI’s capability in predictive maintenance for critical, high-temperature equipment like calcining kilns, which are susceptible to severe wear. Another significant area of interest is the use of machine learning algorithms to predict final CPC quality characteristics (such as resistivity and real density) based on initial GPC properties, thereby improving batch consistency and reducing quality control failures in the anode manufacturing stage.

The implementation of AI and machine learning models offers substantial opportunities to enhance profitability and reliability across the petroleum coke value chain. In the refinery setting, AI-driven process control systems can analyze vast quantities of real-time operational data—including temperature profiles, flow rates, and pressure readings—to dynamically adjust coking parameters. This results in optimized coke drum cycles, minimized downtime, and higher certainty regarding the physical and chemical properties of the resulting green coke. Such precision is vital for maximizing the output of valuable anode-grade material while managing energy consumption efficiently.

Downstream, in the calcination plants, AI contributes significantly to predictive maintenance protocols. By analyzing sensor data, vibration patterns, and historical failure records, AI models can accurately forecast potential equipment breakdowns in rotating kilns or cooler systems, allowing for scheduled interventions rather than reactive repairs, thus maximizing operational uptime. Moreover, AI is beginning to be integrated into supply chain management, using sophisticated forecasting models to predict aluminum industry demand swings, refining feedstock availability, and logistical bottlenecks, enabling suppliers to optimize inventory levels and transportation routes for both GPC and CPC globally, mitigating price volatility and ensuring timely deliveries.

- AI-driven optimization of delayed coking parameters to maximize high-quality GPC yield.

- Predictive maintenance analytics for high-temperature calcining kilns, reducing unexpected downtime.

- Machine learning models for real-time quality prediction of GPC characteristics based on crude oil input.

- Enhanced supply chain forecasting and logistics optimization for global GPC and CPC movements.

- Automation of visual inspection and material handling processes using computer vision systems.

- Improved energy efficiency in the calcination process through AI-controlled burner management and heat recovery.

DRO & Impact Forces Of Green Petroleum Coke and Calcined Petroleum Coke Market

The market for Green Petroleum Coke and Calcined Petroleum Coke is powerfully influenced by a confluence of macroeconomic drivers, stringent environmental restraints, and compelling technological opportunities. A primary driver is the inexorable growth of the global aluminum industry, particularly in developing economies, where urbanization and infrastructure expansion necessitate massive quantities of lightweight and durable metals. Since CPC constitutes approximately 40% of the cost of raw materials for primary aluminum production, its demand is directly coupled with the aluminum smelting rate, ensuring robust underlying growth for the anode-grade segment. Additionally, the tightening of high-sulfur fuel oil regulations in the maritime sector indirectly increases the supply of refinery residual streams suitable for coking, which, while beneficial for GPC supply, requires careful management of quality variables.

Conversely, the market faces significant restraints, chiefly stemming from increasingly severe environmental regulations worldwide, primarily focused on sulfur dioxide (SOx), nitrogen oxides (NOx), and particulate matter emissions. The combustion of fuel-grade GPC, which typically carries high sulfur content, is heavily restricted, leading to reduced overall demand for this segment or necessitating substantial investment in expensive flue gas desulfurization (FGD) equipment. Furthermore, the volatility of crude oil prices introduces instability in GPC supply economics, as refinery operating decisions regarding coking unit utilization fluctuate based on refining margins. Locational challenges related to transporting dense, bulky material over long distances also contribute to regional price disparities and logistical complexities.

Opportunities in the market center around the development of advanced processing technologies and expansion into niche applications. Technological opportunities include the refinement of low-sulfur processing techniques to upgrade currently restricted high-sulfur GPC into usable industrial fuel or even specialty carbon products, reducing waste and increasing resource efficiency. Geographically, opportunities arise from capacity shifts, such as the strategic relocation of calcining plants closer to large, integrated aluminum production clusters, particularly in the Middle East and Southeast Asia, minimizing the carbon footprint associated with transport. Impact forces shaping the market equilibrium include supply chain integration, where refiners, calcining operators, and aluminum producers collaborate closely to ensure consistent quality, and the increasing push for circular economy initiatives that seek to reuse or valorize high-ash coke residues.

Segmentation Analysis

The Green Petroleum Coke and Calcined Petroleum Coke market is comprehensively segmented based on its physical properties, primary intended use, and the subsequent processing steps involved. The primary segmentation criterion is the type, differentiating between Green Petroleum Coke (GPC) and Calcined Petroleum Coke (CPC), reflecting their respective positions in the value chain and their vastly different market prices and applications. GPC is further categorized by grade—Anode Grade and Fuel Grade—based on its sulfur and metals content, which determines its suitability for calcination. CPC, the value-added product, is predominantly characterized by its application in the metallurgical sector, particularly aluminum smelting, which mandates strict quality specifications.

Segmentation by application reveals the substantial influence of the Aluminum Industry on the CPC segment, serving as the dominant end-user. Other significant applications include the manufacturing of Titanium Dioxide (TiO2), which uses specific grades of coke as a reducing agent, and the production of graphite electrodes vital for the electric arc furnace (EAF) steelmaking process. The fuel grade GPC market is segmented by end-use sectors such as power generation (co-fired boiler systems) and cement production, where GPC provides a cost-effective, high-BTU fuel source, provided emission controls are robustly in place. This application segmentation highlights the divergent market dynamics, where the anode segment is driven by global metal demand, while the fuel segment is sensitive to energy pricing and environmental regulations.

Further segmentation often occurs based on sulfur content—critical for regulatory compliance and application suitability. Low-sulfur coke (typically below 2% S) commands a significant price premium and is essential for anode production, ensuring minimal sulfur contamination of the aluminum bath. Medium and high-sulfur coke (above 3% S) are usually relegated to the fuel market or require specialized pre-treatment before calcination, leading to diverse pricing structures and regional market segmentation based on local availability of low-sulfur crude sources. Understanding these segmentations is paramount for market participants to tailor production strategies and optimize procurement processes efficiently.

- By Type:

- Green Petroleum Coke (GPC)

- Calcined Petroleum Coke (CPC)

- By Grade (GPC):

- Anode Grade

- Fuel Grade

- By Sulfur Content (GPC/CPC):

- Low Sulfur (0.5% - 2.0%)

- Medium Sulfur (2.0% - 4.0%)

- High Sulfur (4.0% +)

- By Application (CPC):

- Aluminum Industry (Anode Production)

- Titanium Dioxide Production

- Graphite Electrodes

- Other Metallurgical Uses (e.g., Foundry Carburizers)

- By End-Use (GPC Fuel Grade):

- Cement Production

- Power Generation

- Industrial Boilers

Value Chain Analysis For Green Petroleum Coke and Calcined Petroleum Coke Market

The Green Petroleum Coke and Calcined Petroleum Coke value chain begins upstream with crude oil refining, specifically the delayed coking unit where heavy residuals are thermalized to produce GPC as a byproduct. The quality of the GPC is critically dependent on the type of crude oil feedstock processed; refineries handling low-sulfur, light sweet crude typically produce superior, low-sulfur GPC suitable for anode production, commanding premium pricing. This upstream linkage means that refinery utilization rates and crude sourcing decisions significantly influence the supply quantity and quality profile of the raw material entering the coke market. Key upstream activities include feedstock selection, coking process optimization, and initial quality assessment of the raw green coke product.

The midstream phase involves transportation and, crucially, the calcination process. GPC destined for calcining is transported to specialized plants, which may be independently operated or integrated within large refinery or aluminum production complexes. Calcination is an energy-intensive process that requires high thermal precision to remove volatile matter and achieve the required density and low electrical resistivity for CPC. This stage adds significant value and transforms a low-value commodity into a high-specification industrial raw material. The distribution channel for CPC is often direct or semi-direct, moving from the calciner to the aluminum smelters, frequently under long-term supply contracts to ensure reliability for the smelters’ continuous operations.

Downstream analysis focuses on the end-use sectors, predominantly the aluminum smelting industry, which consumes the vast majority of high-grade CPC. The distribution channel for CPC serving the aluminum industry is characterized by high integration and long-term relationships, necessary because the specifications for anode material are extremely stringent. Direct sales are common from large calcination units to multinational aluminum producers. For fuel-grade GPC, the distribution channel is more fragmented, often involving traders and bulk handlers who supply industrial users (cement kilns and power plants) via rail or marine transport. Indirect channels, involving global commodity traders, play a key role in balancing regional supply and demand disparities for both GPC and CPC, ensuring product flow from major exporting regions like the US Gulf Coast and China to deficit regions.

Green Petroleum Coke and Calcined Petroleum Coke Market Potential Customers

The primary and most lucrative potential customers for high-quality Calcined Petroleum Coke are large-scale aluminum smelting companies, which utilize the Hall-Héroult process to produce primary aluminum. These customers require massive volumes of CPC daily, as it is consumed as the anode during the electrolytic process. Aluminum producers, such as integrated multinational metal corporations, prioritize long-term contractual stability and absolute product consistency to maintain uninterrupted operations and cell efficiency. Their purchasing decisions are driven primarily by CPC quality metrics, including real density, electrical resistivity, and especially trace metal contamination (such as vanadium, nickel, and iron), which can poison the smelting bath. These customers seek suppliers capable of consistently providing anode-grade coke with sulfur levels typically below 2%.

A secondary, yet rapidly growing customer segment for CPC includes manufacturers of specialized carbon products, most notably graphite electrode producers used in the Electric Arc Furnace (EAF) steelmaking process. These customers require ultra-pure grades of CPC, sometimes alongside specialty pitch coke, to ensure the final graphite electrodes exhibit high mechanical strength and exceptional thermal stability necessary for the extreme heat and corrosive environment of EAFs. Similarly, the producers of titanium dioxide (TiO2), utilizing the chloride process, constitute a critical, albeit smaller, customer base that requires high-purity carbon materials as a necessary reducing agent during the conversion phase.

For Green Petroleum Coke (GPC), the largest customer base lies within the industrial energy sector, specifically cement manufacturers and power generation facilities. Cement kilns often utilize high-sulfur GPC as a cost-effective, high-calorific alternative to coal, leveraging the alkaline nature of cement dust to partially neutralize sulfur emissions. These customers prioritize price and calorific value, though their ability to purchase is directly constrained by local air quality regulations and their investment in flue gas desulfurization infrastructure. Procurement for fuel-grade GPC is highly price-sensitive and frequently involves short-term tenders and bulk commodity trading, differing significantly from the strategic, long-term procurement typical in the aluminum industry.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 25.5 Billion |

| Market Forecast in 2033 | USD 37.8 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Rain Carbon Inc., Oxbow Corporation, BP plc, Marathon Petroleum Corporation, Sinopec, Saudi Aramco, Reliance Industries Limited, Atha Group, Mitsubishi Chemical Corporation, Sumitomo Corporation, Essar Group, ConocoPhillips, China National Petroleum Corporation (CNPC), Petrocoke LLC, Shandong Light House Chemical Co., Ltd., Hindustan Petroleum Corporation Ltd. (HPCL), Phillips 66, Ampco Koks- und Mineralölprodukte GmbH, Lianyungang Jinqiao Petrochemical Co., Ltd., GrafTech International Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Green Petroleum Coke and Calcined Petroleum Coke Market Key Technology Landscape

The technological landscape surrounding the Green Petroleum Coke and Calcined Petroleum Coke market is primarily driven by the need for quality enhancement, emission reduction, and energy efficiency. In the refining sector, continuous advancements are seen in Delayed Coking Unit (DCU) design, specifically focused on improving heater efficiency and controlling coking reaction kinetics to maximize the yield of low-sulfur, anode-grade GPC from increasingly heavy or sour crude inputs. Specialized coke cutting and handling systems are also crucial for ensuring the physical integrity and minimizing contamination of the green coke before it is shipped for calcination. Refiners are increasingly adopting proprietary additives and operational protocols designed to mitigate metal contamination during the coking process, directly impacting the final quality of the CPC used in aluminum production.

Within the calcining industry, the primary technology remains the rotary kiln calciner, but optimization efforts focus on enhancing thermal efficiency and uniformity. Emerging technologies include the adoption of Fluidized Bed Calcination (FBC), which offers superior heat transfer and more uniform product quality compared to traditional kilns, potentially leading to lower calcination temperatures and reduced energy consumption. Furthermore, environmental technology is paramount; this includes advanced flue gas treatment systems (FGD, SCR) implemented at fuel-grade GPC consuming facilities (e.g., power plants and cement kilns) to capture sulfur and nitrogen oxides, thereby addressing the regulatory constraints that restrict high-sulfur coke utilization. Specialized coke de-sulfurization technologies, though currently expensive, represent a critical area of R&D aimed at valorizing currently low-value, high-sulfur material.

The integration of advanced monitoring and control systems represents a significant technological shift. Modern calcination plants employ sophisticated thermal imaging, continuous emission monitoring systems (CEMS), and real-time process analyzers to monitor volatile matter removal and final product quality metrics such as coefficient of thermal expansion (CTE) and electrical resistivity. Digital twin technology is increasingly being explored to model and simulate the coking and calcining processes, allowing operators to predict the impact of feedstock changes and optimize operational setpoints without physical testing. This focus on digitalization and precise process control is essential for meeting the exacting quality requirements of the global aluminum industry and maintaining competitive production costs.

Regional Highlights

- Asia Pacific (APAC): APAC represents the largest and fastest-growing market for both GPC and CPC globally, overwhelmingly driven by China, which dominates global aluminum production. The region's demand is fueled by massive infrastructure projects, burgeoning automotive production, and sustained urbanization across emerging economies like India and Southeast Asia. While China is a major producer of CPC, relying heavily on domestic and imported GPC, increasing environmental clampdowns are forcing the closure of smaller, inefficient calcining plants, leading to greater reliance on high-quality imports from regions like North America and the Middle East. India is also expanding its aluminum capacity, positioning it as a key growth node for CPC consumption. The regional dynamics are defined by a supply deficit in premium anode-grade CPC, contrasted with an oversupply of fuel-grade GPC.

- North America: North America is characterized by its role as a key exporter of high-quality, low-sulfur GPC, primarily due to the region's access to light sweet crude oils and advanced coking technologies. The U.S. Gulf Coast refineries are crucial global suppliers of anode-grade green coke, supporting aluminum industries worldwide. Although domestic aluminum smelting capacity has declined compared to historical peaks, the region maintains a significant market presence through sophisticated calcining operations and strong integration with global commodity markets. The market here focuses heavily on optimizing logistics and ensuring environmental compliance during production, setting high quality standards for international trade.

- Europe: The European market for CPC is mature and stable, driven by established aluminum and specialty carbon production industries. Consumption is relatively stable but is under intense pressure to decarbonize. European customers show a strong preference for sustainably sourced materials and are driving innovation in terms of traceability and reduced carbon footprint in the supply chain. Import dependence for both GPC and CPC is high, making the market sensitive to geopolitical and trade barriers. Regulatory focus on limiting high-sulfur GPC usage in industrial boilers and power generation is particularly strict, effectively limiting the scope of the fuel-grade segment.

- Middle East and Africa (MEA): MEA is rapidly emerging as a critical growth region, characterized by significant state-backed investments in large-scale, integrated aluminum smelter complexes, particularly in Gulf Cooperation Council (GCC) countries (e.g., UAE, Bahrain, Saudi Arabia). These integrated facilities often include captive calcination plants situated near the smelters, securing long-term, cost-effective CPC supply. The region benefits from access to low-cost energy for the calcination process and strategic geographic proximity to major Asian markets. Africa, particularly South Africa, also contributes to specialized carbon markets, though the primary growth driver remains the GCC's aluminum expansion.

- Latin America: Latin America is a moderate but important consumer, with key demand centers in countries like Brazil, which hosts significant primary aluminum production capacity. The market dynamics are largely influenced by domestic economic stability and the availability of refinery residuals. The region typically sources GPC from local refineries and supplements with imported CPC to meet high-grade anode requirements. Market growth is cyclical, tied directly to investment in the regional automotive and construction sectors.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Green Petroleum Coke and Calcined Petroleum Coke Market.- Rain Carbon Inc.

- Oxbow Corporation

- BP plc

- Marathon Petroleum Corporation

- Sinopec

- Saudi Aramco

- Reliance Industries Limited

- Atha Group

- Mitsubishi Chemical Corporation

- Sumitomo Corporation

- Essar Group

- ConocoPhillips

- China National Petroleum Corporation (CNPC)

- Petrocoke LLC

- Shandong Light House Chemical Co., Ltd.

- Hindustan Petroleum Corporation Ltd. (HPCL)

- Phillips 66

- Ampco Koks- und Mineralölprodukte GmbH

- Lianyungang Jinqiao Petrochemical Co., Ltd.

- GrafTech International Ltd.

- Shell plc

Frequently Asked Questions

Analyze common user questions about the Green Petroleum Coke and Calcined Petroleum Coke market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between Green Petroleum Coke (GPC) and Calcined Petroleum Coke (CPC)?

GPC is the raw carbonaceous byproduct from oil refining, high in volatiles, moisture, and impurities, primarily used as a high-BTU fuel. CPC is the thermally upgraded form of GPC, processed at over 1200°C to remove volatiles, resulting in high purity, low electrical resistance carbon essential for aluminum smelting anodes.

Which industrial sector accounts for the largest demand for Calcined Petroleum Coke?

The aluminum industry is the largest consumer of CPC, utilizing it almost exclusively for manufacturing the sacrificial anodes required in the Hall-Héroult electrolytic process used to produce primary aluminum. Demand is directly proportional to global aluminum production rates.

How do environmental regulations affect the market for Green Petroleum Coke?

Environmental regulations, particularly those targeting sulfur dioxide (SOx) emissions, severely restrict the use of high-sulfur, fuel-grade GPC in power generation and industrial applications unless advanced flue gas desulfurization systems are employed. This pressure depresses the price and demand for high-sulfur coke segments.

What key quality metrics determine if GPC can be classified as anode grade?

Anode-grade GPC must exhibit extremely low levels of sulfur (typically below 2.0%) and trace metals (especially vanadium, nickel, and iron). These impurities must be minimal because they contaminate the aluminum electrolyte bath during the calcined stage, reducing efficiency and product quality.

Why is the Asia Pacific region projected to be the fastest-growing market?

The Asia Pacific region, led by China and India, dominates global primary aluminum production. This continuous, large-scale metallurgical activity drives unparalleled demand for high-quality CPC anodes, supported by sustained economic development and infrastructure expansion across the region.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager