Green Powder Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435519 | Date : Dec, 2025 | Pages : 253 | Region : Global | Publisher : MRU

Green Powder Market Size

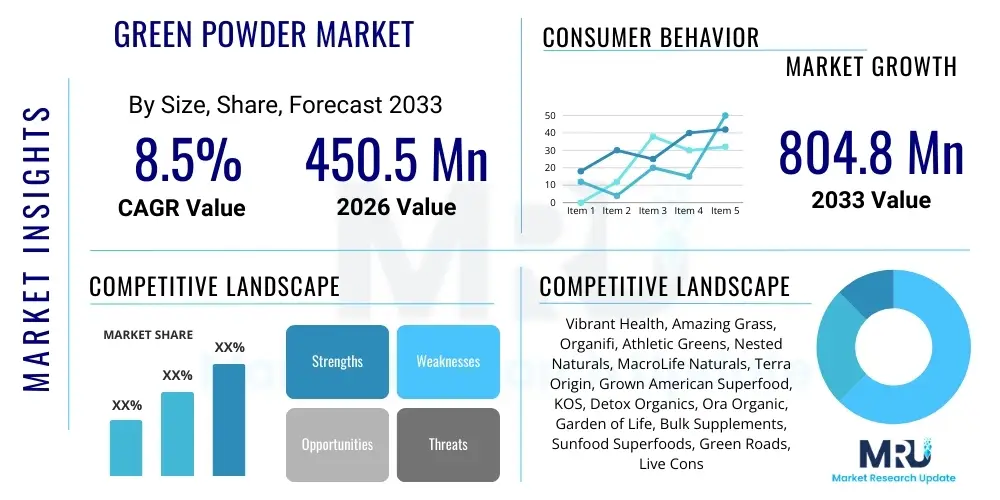

The Green Powder Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2026 and 2033. The market is estimated at USD 450.5 Million in 2026 and is projected to reach USD 804.8 Million by the end of the forecast period in 2033.

Green Powder Market introduction

The Green Powder Market encompasses the production and distribution of dietary supplements formulated from dehydrated and powdered raw vegetables, fruits, grasses, algae, and other nutrient-dense superfoods. These products are typically marketed as comprehensive nutritional supplements designed to enhance energy levels, support detoxification, improve gut health, and boost overall immune function, providing a convenient method for consumers to increase their daily intake of vitamins, minerals, and antioxidants. The primary product category includes blends based on ingredients such as spirulina, chlorella, wheatgrass, barley grass, and a variety of functional mushrooms and probiotic cultures, often mixed with natural flavorings to improve palatability and consumer acceptance. The versatility of green powders allows them to be mixed with water, juices, smoothies, or incorporated into various recipes.

Major applications for green powders center on daily nutritional supplementation for individuals with low consumption of fresh produce, weight management programs requiring high nutrient density with low caloric impact, and athletic recovery regimens demanding quick absorption of micronutrients. The growing emphasis on preventative healthcare and the rising prevalence of digestive disorders have significantly amplified the adoption of these supplements. They serve as a crucial component of holistic wellness routines, driven by consumer desire for natural and plant-based solutions that actively support complex body functions without synthetic additives or artificial ingredients. This functional benefit positioning solidifies their role in the modern supplement landscape.

The market is predominantly driven by escalating consumer awareness regarding the profound link between diet and chronic disease prevention, particularly among younger and middle-aged demographics actively seeking 'superfood' solutions. Furthermore, the convenience factor associated with green powders—providing concentrated nutritional value in a single scoop—appeals strongly to fast-paced lifestyles. Marketing efforts focused on gut health benefits (due to high fiber and probiotic content) and the alkaline properties of ingredients are crucial driving factors, positioning these products not merely as supplements but as essential functional foods for maintaining optimal physiological balance.

Green Powder Market Executive Summary

The Green Powder Market demonstrates robust growth, primarily fueled by shifting consumer preferences toward preventative nutrition, the increasing acceptance of plant-based diets, and the substantial convenience these supplements offer in demanding modern lifestyles. Key business trends indicate a strong focus on ingredient transparency, sourcing sustainability, and the integration of specialized functional ingredients such as adaptogens (e.g., ashwagandha, medicinal mushrooms) and high-potency probiotics to enhance product efficacy and differentiation. Companies are heavily investing in direct-to-consumer (DTC) digital channels and subscription models, capitalizing on the recurring nature of supplement purchases, which optimizes customer lifetime value and builds brand loyalty through continuous engagement and personalized nutritional recommendations. Formulation innovation, specifically addressing taste masking challenges, remains a critical area of competitive investment across the industry.

Regionally, North America maintains the dominant market share, attributed to established health and wellness trends, high disposable incomes, and sophisticated digital marketing infrastructures promoting specialized supplements. However, the Asia Pacific (APAC) region is forecasted to exhibit the highest Compound Annual Growth Rate (CAGR), driven by rapid urbanization, rising health consciousness in major economies like China and India, and increasing penetration of Western lifestyle dietary practices. European markets are characterized by stringent regulatory environments, necessitating higher standards for ingredient sourcing and claims verification, yet showing steady growth particularly in countries prioritizing organic and clean-label certifications. Regional trends uniformly point towards a consumer demand for certified organic, non-GMO, and third-party tested products, reflecting a global convergence toward higher quality assurance in the functional food space.

Segmentations analysis reveals that the Online Distribution Channel segment is experiencing the fastest expansion, leveraging e-commerce platforms and social media influence to reach geographically dispersed consumers efficiently. By Application, Nutritional Supplementation remains the largest segment, but the Weight Management and Energy Enhancement segments are growing rapidly, driven by targeted marketing campaigns appealing to fitness enthusiasts and professional athletes. Furthermore, the Microalgae ingredient sub-segment, encompassing Spirulina and Chlorella, is witnessing accelerated adoption due to its exceptionally high protein and micronutrient content, positioning it as a foundational element in many premium green powder formulations seeking to deliver superior efficacy and value proposition to the health-conscious buyer.

AI Impact Analysis on Green Powder Market

User queries regarding the intersection of Artificial Intelligence (AI) and the Green Powder Market primarily revolve around personalized nutrition, supply chain optimization, and predictive consumer behavior modeling. Consumers and stakeholders are keen to understand how AI algorithms can analyze individual health data, including genetics, microbiome profiles, and lifestyle metrics, to recommend highly customized green powder formulations tailored to specific deficiencies or wellness goals—moving beyond general "one-size-fits-all" blends. Another dominant theme is the application of AI in ensuring ingredient authenticity and quality control, addressing key concerns about product efficacy and contamination through advanced image processing and machine learning in raw material verification. Furthermore, users frequently inquire about AI's role in optimizing vertical farming techniques for key ingredients like barley grass or microalgae, potentially stabilizing supply and reducing production costs, thereby impacting the final consumer price and sustainability footprint of green powder products.

The integration of AI is expected to revolutionize customer engagement and product discovery within the Green Powder Market. AI-powered diagnostic tools and chatbots are increasingly used to analyze customer feedback, track product usage patterns, and provide instant, tailored nutritional advice, significantly enhancing the overall consumer experience and fostering deeper brand relationships. For instance, AI algorithms can process vast amounts of clinical literature and anecdotal evidence to refine product claims and guide R&D toward ingredients with maximized bioavailability and synergistic effects. This capability allows manufacturers to anticipate emerging ingredient trends with greater accuracy, reducing time-to-market for innovative, next-generation superfood blends that resonate strongly with niche consumer demands for specialized health outcomes, such as enhanced cognitive function or specific detoxification support.

Operationally, AI offers profound efficiency gains in complex supply chain management, particularly critical for sourcing globally diverse, seasonally dependent, and perishable raw materials used in green powders. Machine learning models can predict demand fluctuations with precision, optimize inventory levels across multiple distribution hubs, and manage complex logistics, minimizing waste and ensuring product freshness. This predictive capacity is vital in maintaining the nutrient integrity of the powdered ingredients, which are susceptible to degradation. By employing AI for quality assurance, monitoring processing parameters (like low-heat drying methods), and rapidly identifying potential supply chain disruptions, manufacturers can ensure a consistent, high-quality final product, thereby reinforcing consumer trust in a market often scrutinized for ingredient potency and source reliability.

- AI-driven Personalized Formulation: Algorithms match optimal green powder ingredient ratios to individual user health data (genomics, lifestyle, goals).

- Enhanced Ingredient Traceability: Machine learning verifies the authenticity and origin of raw materials, mitigating fraud and ensuring purity standards.

- Predictive Demand Forecasting: AI optimizes inventory, reducing spoilage of perishable ingredients and stabilizing supply chain costs.

- Automated Quality Control: Computer vision systems monitor production processes (e.g., drying temperature, particle size) to maintain nutrient density.

- Targeted Marketing and Education: AI chatbots and platforms deliver customized usage protocols and nutritional education to consumers, improving adherence.

DRO & Impact Forces Of Green Powder Market

The Green Powder Market is fundamentally shaped by powerful dynamics of Drivers, Restraints, and Opportunities, which collectively influence market trajectory and competitive intensity. A primary driver is the accelerating consumer shift towards holistic wellness and preventative health methodologies, compounded by the increasing popularity of plant-based and vegan dietary patterns globally, positioning green powders as an accessible, nutrient-dense solution for dietary gaps. Conversely, a significant restraint is the prevalent consumer skepticism regarding the high price point of premium products and the highly variable taste profile associated with natural, unflavored greens, which often leads to reduced repurchase rates among first-time buyers. Opportunities abound in technological advancements related to microencapsulation and taste masking, allowing manufacturers to overcome palatability issues, and through strategic expansion into developing economies where nutritional deficiencies are more common and demand for convenient fortification is high.

Impact forces within this market are substantial and often originate from regulatory scrutiny and consumer advocacy. The increasing demand for transparency—driven by sophisticated consumers seeking clean labels, non-GMO, and certified organic sourcing—exerts significant upward pressure on production costs and compliance standards. This force compels manufacturers to invest heavily in third-party testing and supply chain audits, enhancing consumer trust but simultaneously creating high barriers to entry for new, less established players. Furthermore, the intense competition from alternative functional foods and beverages, such as specialized smoothies and fortified beverages, acts as a continuous moderating force, requiring green powder brands to constantly innovate and articulate distinct competitive advantages related to bioavailability and ingredient synergy to maintain market share.

Specifically, market growth is powerfully driven by the efficacy of digital health influencers and direct-to-consumer (DTC) marketing strategies that effectively educate consumers on the specific benefits of superfoods like adaptogens and specific microalgae species, creating immediate demand cycles. However, the market faces strong headwinds from regulatory ambiguities in different jurisdictions regarding health claims; vague or unsubstantiated claims can lead to product recalls and erosion of consumer confidence, which acts as a major restraint on market expansion velocity. Exploiting opportunities in functional product diversification—such as creating blends specifically for cognitive support, sleep optimization, or children's nutrition—allows companies to target highly profitable niche segments, demonstrating that strategic, needs-based innovation is a key success factor in navigating the intense competitive landscape shaped by these dynamic DRO elements.

Segmentation Analysis

The Green Powder Market is systematically segmented across several dimensions, including Product Type, Ingredient Base, Distribution Channel, Application, and End-User, enabling companies to precisely target marketing efforts and optimize product portfolios based on distinct consumer needs and consumption habits. This multi-dimensional analysis reveals that consumer choice is highly correlated with specific desired health outcomes, ranging from simple nutritional fortification to specialized functional support like detoxification or enhanced physical performance. Understanding these segments is paramount for strategic market penetration, particularly as competition intensifies and niche demand dictates specific formulation requirements, such as high-fiber blends for digestive health or high-protein microalgae blends for fitness enthusiasts.

A deep dive into Ingredient Segmentation highlights the dominance of cereal grasses (wheatgrass, barley grass) due to their foundational role and cost-effectiveness, though the fastest growth is observed in the Microalgae segment (Spirulina, Chlorella), which is favored for its high concentration of plant-based protein, chlorophyll, and essential fatty acids, appealing directly to the premium wellness market. Distributionally, the clear and accelerating shift towards Online channels—encompassing brand websites, dedicated e-commerce platforms, and subscription services—underscores the importance of digital presence and streamlined logistics, particularly for brands focusing on recurring purchases and personalized consumer interactions, significantly outpacing traditional brick-and-mortar retail growth.

The segmentation by Application confirms that general Nutritional Supplementation remains the bedrock of the market, accounting for the largest volume share, yet specialized segments like Weight Management and Energy Enhancement are emerging as high-value, rapid-growth areas. These niche applications benefit from highly focused advertising that links product consumption directly to tangible, measurable lifestyle goals. Furthermore, End-User segmentation shows that while Adults represent the primary consumer base, increasing parental awareness about child nutrition and the unique dietary needs of the Geriatric Population are opening up highly promising, albeit currently underdeveloped, segments demanding age-specific, gentle, and highly bioavailable formulations.

- Product Type: Alkalizing, Detoxifying, High-Fiber, Protein-Enriched

- Ingredient: Cereal Grasses (Wheatgrass, Barley Grass), Microalgae (Spirulina, Chlorella), Fruits and Vegetables, Botanical and Mushroom Blends, Probiotics and Enzymes

- Distribution Channel: Online (E-commerce, Brand Websites), Offline (Pharmacies, Supermarkets, Specialty Stores)

- Application: Nutritional Supplementation, Weight Management, Energy Enhancement, Immune Support, Detoxification

- End-User: Adults, Geriatric Population, Children

Value Chain Analysis For Green Powder Market

The Green Powder Market value chain is intricate, commencing with highly specialized upstream activities involving the sourcing and cultivation of diverse raw botanical ingredients, many of which require highly specific climatic and soil conditions, demanding rigorous quality control from the outset. Upstream analysis focuses heavily on sustainable farming practices, often involving organic certification, vertical farming techniques for certain greens, and meticulous harvesting timing to maximize nutrient potency before dehydration. The efficiency of the primary processing stage, including washing, drying (often via low-heat dehydration or freeze-drying to preserve thermolabile nutrients), and precise milling into ultra-fine powder, is critical and directly impacts the final product quality and consumer acceptance regarding solubility and texture.

The midstream of the value chain is dominated by manufacturing, formulation, and packaging activities. Formulators blend various ingredients—including foundational greens, functional adaptogens, flavoring agents, and binding elements—to meet specific nutritional profiles and taste requirements. This stage involves complex inventory management due to the large number of unique SKUs and the varying shelf life of powdered components. Downstream activities focus intensely on branding, third-party testing for contaminants (heavy metals, pesticides), and compliance with international food safety standards. Effective marketing, emphasizing scientific backing and transparency (clean label claims), is essential here to differentiate products in a crowded functional food sector and justify the premium pricing associated with quality sourcing.

Distribution channels are broadly bifurcated into direct and indirect routes. Direct distribution, predominantly through branded e-commerce websites and subscription services, offers higher profit margins, greater control over brand messaging, and crucial direct access to customer data for personalized marketing and loyalty programs. Indirect distribution leverages large-scale retailers, specialized health food stores, and major online marketplaces (like Amazon or dedicated vitamin retailers), providing broad market reach and volume sales capacity. The selection of the optimal channel mix is strategically dependent on the brand's maturity, target demographic, and capital resources, with most successful market leaders employing an omnichannel strategy to maximize both profit retention and market penetration across diverse consumer access points.

Green Powder Market Potential Customers

The primary cohort of potential customers for green powders comprises health-conscious millennials and Gen Z individuals who actively seek convenient solutions to maintain optimal nutrition amidst demanding schedules and are highly influenced by digital wellness trends and preventative healthcare philosophies. These end-users are characterized by a proactive interest in functional foods, a willingness to pay a premium for organic and ethically sourced products, and a strong engagement with online research and peer recommendations before purchase. They view green powders not just as supplements, but as essential daily investments in longevity, energy maintenance, and gut health optimization, making them ideal targets for subscription-based sales models focusing on convenience and ongoing nutritional support.

A second major segment consists of athletes and fitness enthusiasts, including both professional and recreational participants, who require highly bioavailable and easily digestible sources of micronutrients and protein for accelerated recovery, inflammation reduction, and performance enhancement. For this group, green powders are positioned as functional performance enhancers, often valued for their alkalizing properties which are believed to counteract the acidity generated during intense physical activity, thereby aiding muscle recovery and reducing fatigue. Marketing to this segment often utilizes detailed specifications regarding protein content, amino acid profiles, and certified testing for banned substances, emphasizing efficacy and compliance with sports nutrition standards.

The third, rapidly growing customer base includes individuals with specific dietary restrictions or nutritional deficiencies, notably vegans, vegetarians, and those suffering from conditions that impair nutrient absorption or require specific dietary adjustments, such as chronic digestive issues. For these buyers, green powders bridge critical nutritional gaps (like Vitamin B12, Iron, or specific essential fatty acids) often present in restricted diets. This segment is highly reliant on product claims related to purity, hypoallergenic status, and the inclusion of specific functional ingredients like digestive enzymes or targeted probiotic strains, viewing green powders as essential therapeutic dietary aids rather than general wellness supplements.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 450.5 Million |

| Market Forecast in 2033 | USD 804.8 Million |

| Growth Rate | 8.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Vibrant Health, Amazing Grass, Organifi, Athletic Greens, Nested Naturals, MacroLife Naturals, Terra Origin, Grown American Superfood, KOS, Detox Organics, Ora Organic, Garden of Life, Bulk Supplements, Sunfood Superfoods, Green Roads, Live Conscious, Patriot Health Alliance, Boku Superfood. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Green Powder Market Key Technology Landscape

The technological landscape supporting the Green Powder Market is characterized by advancements focused on maximizing nutrient preservation, enhancing bioavailability, and improving the sensory profile of the final product. A critical technology is low-temperature processing, specifically freeze-drying (lyophilization) and low-heat dehydration methods, which are essential for removing moisture while minimizing the thermal degradation of heat-sensitive micronutrients, enzymes, and antioxidants naturally present in the raw greens. This preservation technology directly impacts product efficacy, allowing manufacturers to make robust claims regarding the 'raw' or 'live' nutritional content, which is a significant differentiator in the premium segment and satisfies the consumer demand for minimally processed foods.

Another pivotal technological area involves advanced milling and particle size reduction techniques. Ultra-fine milling, utilizing methods like jet milling or cryogenic grinding, results in powdered ingredients with dramatically increased surface area. This ultra-fine particle size improves solubility and dispersion when mixed with liquids, addressing the primary consumer complaint regarding clumping and gritty texture, thereby enhancing the overall user experience. Furthermore, smaller particle sizes are theorized to improve nutrient bioavailability, allowing for faster and more efficient absorption in the digestive tract, reinforcing the product's functional benefits and driving repeat purchases among discerning consumers focused on maximum nutritional uptake.

The application of Microencapsulation technology represents a significant leap forward, particularly in protecting sensitive ingredients and mitigating unpleasant natural flavors. Microencapsulation involves coating key components—such as specific probiotics, digestive enzymes, or bitter-tasting microalgae extracts—with a thin, protective layer, often composed of edible polymers or lipids. This technique shields the ingredients from degradation during processing and storage, ensures targeted delivery in the gut, and crucially, allows manufacturers to mask the natural bitterness of ingredients like wheatgrass or chlorella, making the product significantly more palatable and accessible to a wider consumer base that prioritizes taste alongside health benefits.

Regional Highlights

- North America (Dominant Market Leader): North America, led by the United States and Canada, holds the largest market share due to exceptionally high consumer awareness regarding superfoods, a deeply entrenched culture of dietary supplementation, and substantial expenditure on health and wellness products. The region benefits from a sophisticated e-commerce infrastructure that facilitates easy distribution and powerful digital marketing campaigns promoting personalized nutrition and lifestyle integration. High penetration of key brands and a focus on specialized, high-cost formulations containing adaptogens and specific functional extracts define this market, with consumers actively seeking clinical validation and third-party testing certifications.

- Europe (Steady Growth and Clean Label Focus): The European market demonstrates steady growth, driven by increasing public health initiatives and a strong consumer preference for organic, locally sourced, and 'clean label' products, particularly in Western European nations such as Germany, the UK, and France. Regulatory standards, especially those dictated by the European Food Safety Authority (EFSA), are rigorous, mandating substantial clinical evidence for health claims, which favors established brands that invest heavily in research and sourcing transparency. The market dynamic is characterized by the adoption of sophisticated extraction technologies and a focus on non-GMO verified sourcing.

- Asia Pacific (APAC) (Fastest Growth Trajectory): APAC is projected to be the fastest-growing regional market, propelled by rapidly increasing disposable incomes, accelerated urbanization, and a burgeoning middle class adopting Western health trends. Key economies like China, India, and Japan are seeing a surge in demand driven by concerns over air pollution and dietary imbalances, positioning green powders as essential detoxification and fortification tools. Market expansion is heavily reliant on effective localized marketing strategies and navigating complex, varying regulatory landscapes across different nations, focusing on affordability and convenience for the large consumer base.

- Latin America (Emerging Potential): The Latin American market remains nascent but offers significant long-term potential, primarily focused on staple nutritional supplementation rather than highly specialized functional blends. Growth is spurred by regional economic improvements and increased internet penetration, facilitating access to information about global wellness trends. Market challenges include volatile economic conditions and logistical complexities in distribution, requiring strategies focused on developing cost-effective, high-volume products optimized for regional distribution chains.

- Middle East and Africa (MEA) (Niche Penetration): The MEA region exhibits specialized demand, largely concentrated in affluent urban centers within the Gulf Cooperation Council (GCC) countries, where high disposable incomes support premium imports. Demand is typically driven by fitness communities and expatriate populations seeking familiar Western health supplements. Market expansion is constrained by cultural preferences and complex importation logistics, making partnerships with local specialized retailers and focusing on certified Halal products critical for successful penetration.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Green Powder Market.- Vibrant Health

- Amazing Grass

- Organifi

- Athletic Greens

- Nested Naturals

- MacroLife Naturals

- Terra Origin

- Grown American Superfood

- KOS

- Detox Organics

- Ora Organic

- Garden of Life

- Bulk Supplements

- Sunfood Superfoods

- Green Roads

- Live Conscious

- Patriot Health Alliance

- Boku Superfood

Frequently Asked Questions

Analyze common user questions about the Green Powder market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary health benefits associated with consuming green powders?

Green powders are primarily utilized for enhancing immune function, supporting detoxification processes, and improving gut health due to their high concentration of antioxidants, chlorophyll, fiber, and often, added probiotics and digestive enzymes. They serve as a highly convenient method to increase the daily intake of essential micronutrients and help regulate the body's pH balance toward a more alkaline state, which is commonly sought for overall wellness and reduced inflammation.

How does the quality of the ingredients in green powders impact their effectiveness and pricing?

Ingredient quality is critical, directly correlating with product efficacy and its premium market price. Products utilizing certified organic, non-GMO, and sustainably sourced raw materials—especially those employing low-temperature processing technologies like freeze-drying—retain higher nutritional potency and bioavailability. Consumers prioritize transparency regarding third-party testing for heavy metals and pesticides, directly influencing purchasing decisions and establishing the product's position in the high-end functional food segment.

Is the use of Artificial Intelligence (AI) influencing the future development of green powder formulations?

Yes, AI is increasingly impacting the green powder market by enabling hyper-personalized nutrition. AI algorithms analyze consumer health data, genetic predispositions, and lifestyle patterns to recommend or create customized ingredient blends optimized for individual needs, moving beyond standard formulations. Furthermore, AI assists in optimizing supply chain logistics and verifying ingredient authenticity to ensure consistent product quality and ethical sourcing.

Which distribution channel is exhibiting the fastest growth in the Green Powder Market, and why?

The Online Distribution Channel, encompassing brand-specific e-commerce sites and major marketplaces, is currently demonstrating the fastest growth. This acceleration is driven by the convenience of subscription models, the ability for brands to engage directly with consumers through educational content and targeted marketing, and the comprehensive access to detailed product information and peer reviews, which are highly valued by health-conscious consumers.

What major challenges (restraints) are inhibiting the broader adoption of green powders globally?

The two main restraints are the high cost of premium formulations, which limits accessibility for budget-conscious consumers, and the challenge of palatability, as the natural, intense taste of super greens often deters new users, leading to high initial churn rates. Overcoming these restraints requires technological investments in taste-masking and formulation efficiency, alongside clearer, research-backed evidence to justify the value proposition against cost.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager