Grocery POS Systems Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432414 | Date : Dec, 2025 | Pages : 248 | Region : Global | Publisher : MRU

Grocery POS Systems Market Size

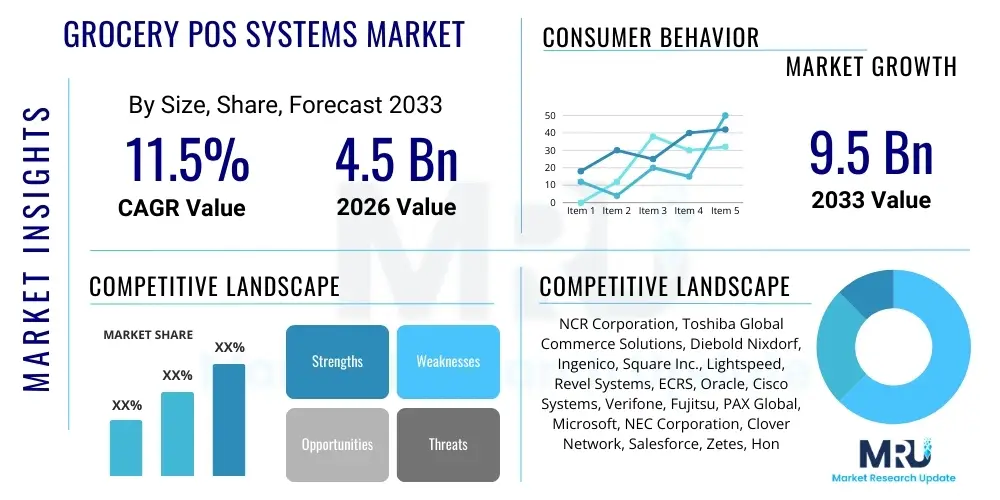

The Grocery POS Systems Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 11.5% between 2026 and 2033. The market is estimated at USD 4.5 Billion in 2026 and is projected to reach USD 9.5 Billion by the end of the forecast period in 2033. This robust expansion is fueled by the accelerating adoption of advanced retail technologies, particularly cloud-based solutions and integrated self-checkout systems, across global grocery chains and independent stores. The imperative for enhancing operational efficiency, minimizing shrinkage, and providing frictionless customer experiences is driving continuous investment in next-generation POS infrastructure.

The transition from legacy, on-premise systems to flexible, modern software-as-a-service (SaaS) models represents a significant structural shift in market expenditure. Grocers are increasingly prioritizing systems that offer superior scalability, real-time data analytics, and seamless integration with Enterprise Resource Planning (ERP) and supply chain management platforms. Furthermore, emerging economies are witnessing rapid modernization of their retail infrastructure, contributing substantially to overall market size expansion and setting the stage for sustained double-digit growth throughout the forecast period, reflecting high demand for retail automation.

Grocery POS Systems Market introduction

The Grocery Point-of-Sale (POS) Systems Market encompasses hardware, software, and integrated solutions designed specifically to manage transaction processing, inventory control, customer relationship management (CRM), and reporting within grocery retail environments, spanning everything from large hypermarkets to small convenience stores. These systems are critical operational tools, facilitating rapid and accurate sales transactions while simultaneously providing the backbone for complex inventory management, weighted item processing, loyalty program administration, and efficient store labor scheduling. The inherent complexity of grocery retail—managing highly perishable goods, varying tax rates, numerous SKUs, and diverse payment methods—necessitates specialized POS solutions capable of handling these high-volume, low-margin transactions with unparalleled reliability and speed.

Major applications of modern Grocery POS systems extend far beyond basic checkout, now including integrated features such as mobile POS terminals for line busting, self-service kiosks that cater to consumer demand for autonomy, and sophisticated back-office modules that provide detailed real-time insights into product performance and promotional effectiveness. The fundamental benefits driving widespread adoption include significant improvements in checkout speed, leading to reduced wait times and enhanced customer satisfaction, better accuracy in pricing and inventory counts which directly mitigates financial losses from shrinkage (spoilage and theft), and comprehensive compliance management related to food safety and regulatory standards. The primary driving factors for market growth revolve around the global shift toward digitalization, the increasing adoption of cloud computing for greater flexibility, and the competitive necessity for grocers to implement omni-channel retail strategies that bridge physical and online shopping experiences seamlessly.

Grocery POS Systems Market Executive Summary

The Grocery POS Systems Market is experiencing robust acceleration driven by pivotal business trends focusing on retail automation, cloud migration, and the consumer demand for self-service options. Key business trends indicate a strong move away from monolithic, proprietary systems toward open API architectures that facilitate rapid integration with specialized third-party applications (such as advanced loyalty platforms or predictive ordering software). Moreover, the intense focus on Total Cost of Ownership (TCO) is making subscription-based SaaS models highly attractive, particularly for small-to-midsize grocery chains seeking enterprise-level functionality without massive upfront capital expenditure. This migration is transforming how grocers manage their infrastructure, prioritizing resilience, security, and the capability to rapidly deploy updates and new features across distributed store networks.

Regionally, North America and Europe maintain dominance, characterized by high technological maturity, stringent regulatory requirements favoring modernization, and substantial capital investment capacities among major grocery retailers. However, the Asia Pacific (APAC) region is projected to register the fastest growth, fueled by rapid urbanization, the proliferation of modern retail formats, and increasing disposable incomes in countries like China and India, where traditional retail infrastructure is being quickly replaced by integrated digital systems. Segment trends highlight the clear ascendancy of cloud-based deployment models due to their inherent scalability and lower infrastructure burden, while within the hardware segment, self-checkout kiosks and mobile POS devices are showing disproportionately high growth rates, directly addressing labor shortages and boosting throughput efficiency during peak shopping hours. Software innovation, particularly incorporating AI for personalized promotions and loss prevention, remains the core differentiator among leading vendors, promising enhanced profitability for retailers.

AI Impact Analysis on Grocery POS Systems Market

Common user questions regarding AI’s impact on Grocery POS Systems center around operational efficiency, fraud prevention, and the personalization of the customer journey. Users frequently ask: "How can AI reduce shrinkage and prevent theft at self-checkout?" and "Will AI automate pricing and promotions in real-time?" A strong theme is the expectation that AI should not only streamline transaction processing but also utilize vast amounts of transactional data to provide actionable, forward-looking insights that human managers cannot easily derive. Key concerns often relate to data security, the ethical use of customer purchasing patterns, and the initial complexity and cost of integrating sophisticated machine learning models into existing POS frameworks. Users anticipate that AI integration will fundamentally shift the POS system from a mere transaction recorder to a proactive, intelligent retail management hub that predicts demand, manages inventory autonomously, and maximizes profitability.

The integration of Artificial Intelligence (AI) and Machine Learning (ML) is rapidly transitioning the Grocery POS system from a passive terminal to an active decision support tool. This evolution is fundamentally driven by the need to optimize profitability in a high-volume, low-margin sector. AI algorithms are being deployed in real-time inventory synchronization, allowing systems to predict demand based on historical sales, seasonal factors, and even local weather patterns, automatically suggesting optimal ordering quantities and significantly minimizing waste, especially for perishable goods. This level of predictive analytics transforms the traditionally reactive inventory control process into a proactive mechanism, ensuring optimal stock levels without tying up excessive capital in warehousing.

Furthermore, AI significantly enhances the fraud and loss prevention capabilities of both staffed and self-checkout environments. Computer vision integrated with the POS system can monitor the checkout process, identifying anomalous behaviors such as ‘pass-unders’ (not scanning items) or weight inconsistencies in bulk items, immediately alerting staff before loss occurs. Beyond security and inventory, AI is crucial for dynamic pricing models and hyper-personalized customer engagement. By analyzing real-time basket data and loyalty history, the POS system can deploy unique, targeted offers to a specific customer mid-transaction, maximizing upsell opportunities and reinforcing brand loyalty, thus maximizing the immediate transaction value and long-term customer lifetime value (CLV).

- Real-time Demand Forecasting: AI optimizes ordering and reduces spoilage risk for perishables.

- Visual Loss Prevention: Computer vision monitors self-checkout for fraud and item recognition errors.

- Dynamic Pricing: Algorithms adjust prices instantly based on competitor activity, inventory levels, and demand elasticity.

- Personalized Checkout Offers: Machine learning delivers hyper-targeted promotions based on instantaneous basket analysis.

- Automated Reporting: AI processes large datasets to generate actionable business intelligence regarding labor efficiency and product performance.

DRO & Impact Forces Of Grocery POS Systems Market

The Grocery POS Systems Market is primarily driven by the critical need for operational efficiency and the continuous pressure on grocers to enhance the customer experience while simultaneously mitigating rising labor costs. Restraints often include the significant initial capital investment required for hardware upgrades, the complexities associated with migrating large volumes of legacy data, and persistent concerns regarding data security and regulatory compliance (such as PCI DSS standards for payment processing). Opportunities abound in the burgeoning demand for highly flexible, modular, and cloud-native solutions that can rapidly adapt to evolving retail models like BOPIS (Buy Online, Pick Up In-Store) and curbside pickup. These systems must offer seamless omni-channel integration, positioning the POS not just as a transaction endpoint but as a central fulfillment hub. The primary impact forces shaping this market include the relentless pace of technological obsolescence, forcing retailers into continuous upgrade cycles, and intense competitive pressure from both established technology vendors and agile SaaS startups offering disruptive cloud-based models.

Key drivers include the global adoption of contactless and mobile payment technologies, necessitating corresponding POS terminal upgrades, and the strategic importance of capturing high-quality customer data to inform marketing strategies and loyalty programs. Grocers recognize that an advanced POS system is the central point of data collection, essential for driving targeted marketing and optimizing store layouts. However, a major restraint is the fragmentation of the retail software ecosystem, where integrating disparate systems (POS, WMS, ERP) often proves challenging, costly, and time-consuming, creating friction in deployment and limiting the full potential of integrated data. This difficulty often delays modernization efforts, especially among small to mid-sized operators who lack extensive IT resources.

The most compelling opportunities lie in leveraging advancements in specialized hardware, such as smart scales and ruggedized mobile devices designed for warehouse and store environments, and the increasing feasibility of self-service technologies, driven by AI, which can reliably handle complex grocery item lookups and identification. The major impact forces are societal—specifically, consumer expectations for a fast, friction-free shopping experience—and economic—the need for automation to counteract shrinking profit margins and labor market pressures. Vendors succeeding in this environment are those offering bundled solutions that include hardware, specialized grocery software, and managed services, providing a single point of accountability and minimizing implementation risk for the grocer.

Segmentation Analysis

The Grocery POS Systems Market is primarily segmented based on the component (Hardware vs. Software), deployment model (Cloud vs. On-Premise), and the type of grocery retail establishment using the system (Application). Analyzing these segments reveals shifting market dynamics, particularly the rapid dominance of cloud-based SaaS solutions over traditional licensed software, driven by demands for scalability, remote management, and lower initial capital outlay. Hardware segmentation reflects the growing investment in non-traditional terminals, such as self-checkout kiosks and mobile POS devices, necessary to address peak traffic volumes and labor optimization goals. Application segmentation confirms that large supermarkets and hypermarkets remain the primary revenue generators, though the fastest growing segment is the small and mid-sized convenience store category, rapidly adopting modern, accessible cloud POS platforms.

- Component

- Hardware (Fixed Terminals, Mobile POS, Self-Checkout Kiosks, Peripherals)

- Software (Operating Systems, Application Software)

- Deployment Model

- Cloud-Based

- On-Premise

- Application

- Supermarkets

- Hypermarkets

- Convenience Stores

- Small Grocery Stores and Specialty Food Retailers

Value Chain Analysis For Grocery POS Systems Market

The value chain for the Grocery POS Systems market begins with Upstream Analysis, which encompasses hardware component manufacturing (semiconductors, displays, enclosures, thermal printers) and core software development (operating systems, database platforms). Key activities here include R&D focusing on ruggedization, miniaturization, and specialized components like high-speed barcode scanners and accurate weighing modules. Efficiency and cost optimization at this stage are crucial, often relying on globalized supply chains. The middle segment involves system integrators and specialized POS software developers who customize generic platforms into industry-specific grocery solutions, focusing on complex functionality such as loyalty integration, perishable item tracking, and omni-channel synchronization. This stage adds immense value through intellectual property and specialized knowledge tailored to the unique demands of grocery operations.

The Downstream Analysis involves the implementation, support, and maintenance of the systems at the retailer level. Distribution Channels are critical, often involving a mix of Direct Sales (for large enterprise contracts with major grocery chains) and Indirect Channels through certified Value-Added Resellers (VARs) and Managed Service Providers (MSPs) who cater primarily to regional chains and independent grocers. Direct distribution ensures deeper client relationships and customized implementation for complex environments, whereas indirect channels provide broader market reach, particularly important for distributing standardized cloud-based SaaS offerings and localized support. The successful delivery of the final product relies heavily on the quality of ongoing technical support, training, and rapid response to operational issues, as POS downtime directly translates to lost sales and severe customer frustration.

The proliferation of cloud models has elevated the importance of the Software-as-a-Service (SaaS) provider in the value chain, shifting the primary revenue stream from one-time license fees to recurring subscription income. This model integrates development, distribution, and maintenance, streamlining the chain and offering grocers predictable operating expenses. However, hardware distribution remains vital; securing efficient logistics for self-checkout kiosks and terminal peripherals is a complex process. The ability of the software vendor to maintain a strong partner ecosystem of payment processors, hardware manufacturers, and regional integrators determines market success and the speed of technology deployment across diverse geographic and regulatory landscapes.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.5 Billion |

| Market Forecast in 2033 | USD 9.5 Billion |

| Growth Rate | CAGR 11.5% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | NCR Corporation, Toshiba Global Commerce Solutions, Diebold Nixdorf, Ingenico, Square Inc., Lightspeed, Revel Systems, ECRS, Oracle, Cisco Systems, Verifone, Fujitsu, PAX Global, Microsoft, NEC Corporation, Clover Network, Salesforce, Zetes, Honeywell International, Custom America. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Grocery POS Systems Market Potential Customers

The primary potential customers and end-users of Grocery POS Systems are diverse entities across the entire spectrum of food and beverage retail, characterized by varying transactional volumes, operational complexity, and budgetary constraints. Large enterprises, specifically multinational supermarket and hypermarket chains, represent the highest value customers, seeking highly robust, centralized, and customizable enterprise solutions capable of managing thousands of SKUs and integrating seamlessly with expansive supply chain networks and complex enterprise resource planning (ERP) systems. These customers prioritize high-speed processing, advanced AI-driven features for loss prevention, and comprehensive reporting capabilities tailored for chain management, viewing the POS system as a strategic asset for market advantage.

Mid-tier customers include regional grocery chains, specialty food stores, organic markets, and large convenience store operators who require scalable, often cloud-based, solutions that minimize reliance on dedicated on-site IT infrastructure. These customers seek affordable, feature-rich systems that can rapidly deploy new capabilities, such as integrated loyalty programs and mobile order fulfillment, without massive upfront costs. For this segment, ease of use, robust integration with local payment processors, and reliable technical support are paramount considerations when making purchasing decisions, often favoring subscription models over large capital expenditures.

The third major segment comprises independent small grocery stores, corner shops, and family-run markets, often characterized by severe budget restrictions and minimal technical expertise. These small businesses are increasingly adopting accessible, user-friendly mobile and tablet POS solutions (mPOS) provided by companies like Square or Lightspeed. Their demand is focused on simplicity, affordability, rapid setup, and essential functions like basic inventory tracking and integrated card processing, enabling them to compete effectively while managing their limited resources. The potential customer base is therefore expanding significantly as technological accessibility lowers the entry barrier for sophisticated systems.

Grocery POS Systems Market Key Technology Landscape

The technological landscape of the Grocery POS Systems Market is defined by a rapid pivot toward integrated, network-centric solutions leveraging cloud infrastructure and mobile computing. The central technological shift involves migrating from proprietary operating systems and locally stored databases to open-source software stacks (like Linux and Android for terminals) and scalable cloud environments (AWS, Azure, Google Cloud). This fundamental change allows for continuous updates, better security management, and significantly enhanced real-time data accessibility across an entire retail enterprise. Furthermore, the integration of specialized peripherals, including advanced 2D imaging scanners capable of reading mobile barcodes and digital coupons, high-speed thermal receipt printers, and secure electronic signature pads, remains essential for facilitating modern customer interactions and high-throughput operations at the checkout lane.

A significant area of technological investment is in Self-Checkout Kiosk (SCO) technology, moving beyond traditional conveyor belt systems to include sophisticated computer vision systems and advanced weight-based security to mitigate unintentional and intentional shrinkage. These SCOs are now often equipped with biometric payment options and sophisticated user interfaces designed for intuitive navigation and quick transaction completion, addressing labor shortages while speeding up service. On the payment side, Near Field Communication (NFC) technology is standard, supporting mobile wallets (Apple Pay, Google Pay) and contactless card transactions, reflecting global shifts in consumer preference towards highly secure and convenient payment methods.

Finally, the development of robust Application Programming Interfaces (APIs) is critical, transforming the modern POS system into a customizable platform rather than a fixed application. These APIs enable seamless integration with third-party software, including sophisticated loyalty management platforms, dedicated labor scheduling systems, and e-commerce fulfillment engines, which is vital for enabling omni-channel grocery operations. Data security remains paramount, driven by adherence to Payment Card Industry Data Security Standard (PCI DSS) compliance, necessitating end-to-end encryption, tokenization of sensitive payment data, and advanced fraud detection layers embedded directly into the POS software architecture, ensuring consumer trust and regulatory adherence across all points of sale.

Regional Highlights

The Grocery POS Systems Market exhibits distinct regional characteristics influenced by economic maturity, consumer behavior, and regulatory environments. North America, encompassing the United States and Canada, represents the largest market share holder, primarily due to the presence of technologically advanced major retail chains, high rates of adoption of self-checkout and mobile POS, and substantial investment in integrated security and AI systems. This region is characterized by high labor costs, making automation solutions like self-service kiosks highly economical. The regulatory focus on payment security (PCI compliance) drives continuous hardware and software replacement cycles, maintaining consistent demand for cutting-edge solutions.

Europe holds a substantial market position, marked by strong demand for compliance-focused systems due to stringent GDPR regulations related to data privacy, especially concerning loyalty program data. Western European countries demonstrate high penetration of specialized, integrated POS solutions that cater to complex loyalty and multi-currency requirements. Central and Eastern Europe are witnessing rapid modernization, transitioning from manual systems to modern electronic POS infrastructure, driven by expanding supermarket and discount store chains. Cloud-based adoption is accelerating across the continent, favored by the flexibility required for cross-border retail operations.

Asia Pacific (APAC) is forecast to be the fastest-growing region during the forecast period. This explosive growth is attributable to rapid urbanization, the swift rise of organized retail formats, and increasing digital literacy, particularly in China, India, and Southeast Asian nations. Governments and private enterprises in these regions are heavily investing in digital payment infrastructure, paving the way for mPOS and integrated POS systems in large hypermarkets and rapidly expanding convenience store networks. Latin America and the Middle East & Africa (MEA) are emerging markets, where growth is currently concentrated in major metropolitan areas and driven by the need for better inventory control and reduced transactional fraud, favoring affordable, highly secure POS systems with robust reporting capabilities suitable for volatile economic conditions.

- North America: Market leader, high adoption of AI and self-checkout, driven by high labor costs and strict PCI compliance standards.

- Europe: Strong focus on data privacy (GDPR compliance), high integration of loyalty programs, and accelerating cloud migration for cross-border operations.

- Asia Pacific (APAC): Fastest growing market, driven by urbanization, expansion of organized retail, and high smartphone penetration driving mPOS usage in countries like China and India.

- Latin America: Growing adoption focused on improving inventory accuracy and combating transactional fraud in major city centers.

- Middle East and Africa (MEA): Emerging market with high growth potential, driven by retail modernization projects in high-growth economies and investment in tourism-related retail infrastructure.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Grocery POS Systems Market.- NCR Corporation

- Toshiba Global Commerce Solutions

- Diebold Nixdorf

- Ingenico

- Square Inc.

- Lightspeed

- Revel Systems

- ECRS

- Oracle

- Cisco Systems

- Verifone

- Fujitsu

- PAX Global

- Microsoft

- NEC Corporation

- Clover Network

- Salesforce

- Zetes

- Honeywell International

- Custom America

Frequently Asked Questions

Analyze common user questions about the Grocery POS Systems market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary benefit of migrating from on-premise to Cloud Grocery POS systems?

The primary benefit is significantly lower Total Cost of Ownership (TCO), enhanced scalability, and the ability to access real-time performance data remotely. Cloud systems facilitate rapid deployment of software updates and new features across multiple store locations with minimal IT intervention, optimizing operational agility.

How is Artificial Intelligence (AI) being integrated into modern Grocery POS for loss prevention?

AI is integrated through computer vision systems at self-checkout kiosks that monitor item scanning and product recognition, automatically detecting discrepancies or fraudulent behavior (such as "banana for avocado" fraud) by analyzing visual and weight data in real-time, significantly reducing shrinkage.

Which segment of the Grocery POS market is expected to show the fastest growth?

The Cloud-Based Deployment segment is expected to show the fastest growth, driven by its affordability for small and mid-sized retailers and the enterprise requirement for flexible, omni-channel retailing capabilities that are easily managed across large, distributed networks.

What are the key security concerns associated with Grocery POS systems?

Key security concerns involve compliance with the Payment Card Industry Data Security Standard (PCI DSS), protecting customer payment data from breaches, ensuring end-to-end encryption and tokenization for all transactions, and securing networked systems against ransomware and malware attacks.

Beyond transactions, what core non-sales functions do modern Grocery POS systems perform?

Modern systems perform critical back-office functions including real-time inventory management, predictive ordering and waste reduction analysis (especially for perishables), detailed sales reporting, staff scheduling and labor management, and integrated customer loyalty program administration.

The Grocery POS Systems Market requires specialized analytical attention due to its highly competitive environment and the mission-critical nature of the technology within retail operations. The evolution of payment methods, coupled with advanced automation demands, necessitates that vendors continually innovate on both hardware durability and software intelligence. Retailers are increasingly demanding solutions that not only process transactions efficiently but also serve as strategic business intelligence centers, capable of optimizing pricing, managing complex promotions, and personalizing the customer experience dynamically. The strategic integration of mobile POS (mPOS) devices further demonstrates the industry's commitment to eliminating friction points within the physical store environment. The global supply chain pressures experienced in recent years have also intensified the focus on POS systems that offer robust supply chain integration, providing real-time visibility into inventory levels from warehouse to shelf. This integration capability is paramount for mitigating stockouts and managing spoilage, especially crucial for fresh food retailers. Consequently, the vendor landscape is becoming highly consolidated yet simultaneously challenged by agile software companies offering purely cloud-native, subscription-based models that appeal strongly to mid-market retailers seeking agility and cost predictability over traditional capital expenditure models. Success in this market is fundamentally tied to providing highly reliable, secure, and data-rich systems that can seamlessly operate within an omni-channel fulfillment environment, ensuring that the physical checkout process aligns perfectly with the digital ordering and delivery experience.

The intense competitive dynamics within the grocery sector, driven by razor-thin margins and heightened consumer expectations, mandates that investment in POS infrastructure be treated as a competitive necessity rather than merely a cost center. Advanced features such as integrated digital coupon validation, self-service technologies with automated loss prevention capabilities, and AI-driven predictive maintenance for hardware components are becoming standard requirements. Regional variations, particularly in emerging markets, highlight the need for flexibility in both system design and pricing strategies. For instance, in areas with unreliable internet connectivity, hybrid POS solutions (combining local processing power with cloud synchronization) offer the necessary operational resilience. Furthermore, the future growth trajectory is heavily reliant on the adoption rate of frictionless store technologies, such as grab-and-go concepts that utilize computer vision and sensor fusion—technologies that often interface directly with, or entirely replace, traditional static POS terminals. Vendors who can successfully navigate the complexities of legacy system replacement while offering cutting-edge automation tools will secure long-term market leadership. The focus remains on data utilization; transforming transactional data into profitable actions is the central value proposition of the next generation of Grocery POS systems, driving efficiency and enhancing the overall profitability of grocery retail operations.

The structural changes impacting the global retail sector are creating unprecedented demand for resilient and adaptive POS infrastructure, specifically tailored for the demanding grocery environment. Modern grocery POS is no longer just a cash register; it is the central nexus for managing customer identity, processing multiple fulfillment streams (in-store, curbside, delivery), and executing intricate promotional strategies instantaneously. Technological advancements in hardware miniaturization and increased processing power enable systems to handle complex tasks, such as on-the-spot preparation of food items with integrated weighing and recipe management, essential for deli and bakery sections. Moreover, the integration of specialized peripheral hardware, such as smart trays and temperature sensors connected directly to the POS network, is enhancing food safety compliance and operational transparency. This holistic approach to store management, powered by a central POS platform, represents the future operational standard for large-scale grocery retailers who are constantly battling against margin erosion and intensifying market competition. This comprehensive digitization effort is further validated by the substantial capital allocated by major retailers globally toward transforming their physical stores into digitally enabled fulfillment centers, ensuring that the POS remains the most crucial retail touchpoint.

In terms of software architecture, the shift towards microservices and API-first design is ensuring that grocery POS systems are highly modular and future-proof. This architecture allows retailers to select best-of-breed components—such as specialized loyalty programs or advanced workforce management tools—and integrate them seamlessly without requiring a complete system overhaul. This flexibility is particularly attractive to large chains that operate diversified formats, from discount stores to high-end specialty markets, allowing them to customize the POS functionality based on specific store needs and local consumer demographics. The commitment to open standards also fosters a richer ecosystem of third-party developers, accelerating innovation in areas like customer feedback capture and personalized digital signage integration at the checkout line. Simultaneously, cybersecurity preparedness has become a core feature, moving beyond simple compliance to include proactive threat detection and real-time security patching, managed centrally via the cloud platform. The investment cycle in grocery POS is now fundamentally driven by obsolescence risk mitigation and the strategic necessity of maintaining a technological edge over competitors, ensuring the platform can support continuous business evolution and rapid response to market changes, such as the sudden pivot to delivery models or the implementation of new regulatory mandates.

The labor challenges facing the grocery sector worldwide are having a profound effect on POS design and implementation. The strategic goal of technology investment is increasingly focused on task automation and labor reallocation. Self-checkout kiosks, mobile scanners linked to customer apps, and automated cash management systems integrated with the main POS terminal are designed to minimize manual intervention and reduce cash handling errors. This automation allows staff to shift from transactional roles to higher-value activities, such as product assistance and specialized customer service, thereby enhancing the overall in-store shopping experience. Furthermore, advanced workforce management modules embedded within the POS software leverage transactional data to predict staffing needs accurately hour-by-hour, ensuring optimal labor deployment and compliance with complex regional labor laws regarding breaks and scheduling. The success metrics for new POS deployments now heavily weigh the impact on labor efficiency and throughput capacity, recognizing that fast, accurate service is a non-negotiable component of modern retail competitiveness. The market's future will be dominated by solutions that effectively merge human expertise with automated technology, optimizing every phase of the grocery purchase cycle from entry to exit. This focus on maximizing operational velocity, supported by intelligent, data-driven POS technology, solidifies the market's high growth forecast.

Regulatory scrutiny around food traceability and inventory compliance, especially following global public health events, is driving new requirements for POS systems. Grocers need systems capable of logging precise information about perishable items—including origin, shelf life, and temperature data—and connecting this information to the final sale transaction. This level of traceability is crucial for rapid recalls and adhering to stricter governmental oversight. Modern POS software must be highly capable of handling complex promotional mechanics, including tiered discounts, loyalty points application, and multi-buy offers, without generating pricing errors, which directly impacts customer trust and regulatory audit outcomes. The increasing proliferation of digital coupons and mobile promotions means that the POS validation engine must be robust and instantaneously connected to central promotional databases. The hardware components are also evolving toward greater modularity, enabling quick component swaps and minimizing Mean Time to Repair (MTTR), which is essential in a high-traffic retail setting where system downtime is unacceptable. The market is thus balancing the need for advanced intelligence (via AI/ML) with the foundational demand for absolute operational reliability and adherence to an ever-expanding list of regulatory standards, underpinning the continued investment necessary for market modernization.

The geographical analysis further emphasizes the difference in technology adoption cycles. While North America focuses on refining AI-driven efficiency and personalization, Asia Pacific is often characterized by leapfrogging older technologies directly into mobile and cloud POS infrastructure, particularly in high-density urban areas. This is often supported by government initiatives promoting digital payments and financial inclusion, providing a massive built-in customer base for vendors offering easy-to-deploy, affordable software solutions. Meanwhile, Latin American and African markets show strong demand for POS systems that offer multi-currency support and robust offline functionality to handle power fluctuations and intermittent connectivity, demonstrating the adaptability required of global market leaders. Strategic success depends on tailoring product offerings and distribution channels to meet these specific regional demands, leveraging VARs and local partners who understand the unique regulatory and infrastructure challenges. The long-term trajectory confirms that the Grocery POS system will remain the single most important technology investment for physical retailers, serving as the gateway for customer interaction, revenue generation, and crucial operational oversight across the entire retail enterprise.

The convergence of physical and digital channels, commonly referred to as omni-channel retail, is placing unprecedented stress on the connectivity and data synchronization capabilities of traditional POS systems. For grocers offering buy-online-pick-up-in-store (BOPIS) or curbside pickup, the POS must seamlessly coordinate inventory availability, order fulfillment status, and payment authorization, regardless of where the initial transaction originated. This necessity is driving the adoption of headless POS architectures, where the front-end user interface is decoupled from the back-end processing logic, allowing for maximum flexibility in connecting various customer touchpoints—from mobile apps to self-service lockers—all feeding into a unified transactional engine. This architectural shift ensures consistent pricing, inventory, and loyalty recognition across all sales channels, addressing one of the most significant complexities of modern grocery retail. The strategic move to open platforms and APIs is foundational to achieving this omni-channel capability, empowering grocers to utilize their POS investment as a central mechanism for achieving total retail visibility and maximizing customer satisfaction across integrated physical and digital journeys.

The rising cost of hardware and the environmental impact of technology waste are slowly beginning to influence purchasing decisions, particularly in environmentally conscious regions like Europe. Grocers are increasingly favoring modular POS designs that allow for easy repair and component upgrades, extending the lifecycle of the hardware and reducing electronic waste. Furthermore, energy efficiency and the use of sustainable materials in terminal manufacturing are emerging as competitive differentiators. This environmental consciousness, combined with economic pressure, strengthens the appeal of cloud-based software models, as they decouple the necessity for frequent, capital-intensive hardware replacements from software upgrades, allowing retailers to maintain cutting-edge functionality on existing, reliable hardware for longer periods. The future of grocery POS design will therefore incorporate principles of circular economy, focusing on durability, repairability, and minimal environmental footprint, in addition to high performance and deep intelligence. This trend necessitates that POS manufacturers invest heavily in modular design and long-term support programs to meet evolving retailer demands for sustainable technology solutions.

Looking ahead, the next phase of innovation in grocery POS will focus heavily on enhancing the employee experience through augmented reality (AR) and sophisticated training modules integrated directly into the POS device. AR could be utilized to guide new employees through complex processes, such as fresh produce identification or handling specific payment types, reducing training time and errors. Simultaneously, the integration of advanced voice recognition and natural language processing (NLP) is enabling faster, hands-free interactions for staff, particularly in highly dynamic environments like the deli counter or meat department, improving both speed and order accuracy. These human-centric technological improvements are vital for addressing ongoing labor skill gaps and improving employee retention, directly translating into better customer service and operational consistency. Thus, the grocery POS system is evolving into a comprehensive workflow management tool that optimizes not only customer interactions but also internal operational efficiency and employee performance, underscoring its pivotal role in the modern retail ecosystem.

The market for specialized POS peripherals continues to grow, adapting to niche requirements within grocery retail. This includes high-precision scales certified for trade, integrated payment terminals capable of processing complex governmental benefits (like WIC/SNAP in the US), and ruggedized handheld terminals for use in chilled or frozen environments for inventory checks. The robustness and reliability of these peripherals, often operating in demanding 24/7 environments, are crucial determinants of overall system quality and retailer satisfaction. Vendors must ensure seamless plug-and-play integration via standardized interfaces, minimizing deployment complexities and operational disruptions. The competitive edge is often held by providers who can offer a full suite of compatible, high-quality hardware components alongside their core software platform, providing grocers with a single, accountable source for their entire POS infrastructure investment. This holistic approach simplifies procurement, deployment, and ongoing maintenance, offering significant value, particularly to large grocery chains seeking standardization across hundreds or thousands of locations globally. This comprehensive approach is essential for large-scale enterprise deployments.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager