Grocery Stores Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438649 | Date : Dec, 2025 | Pages : 245 | Region : Global | Publisher : MRU

Grocery Stores Market Size

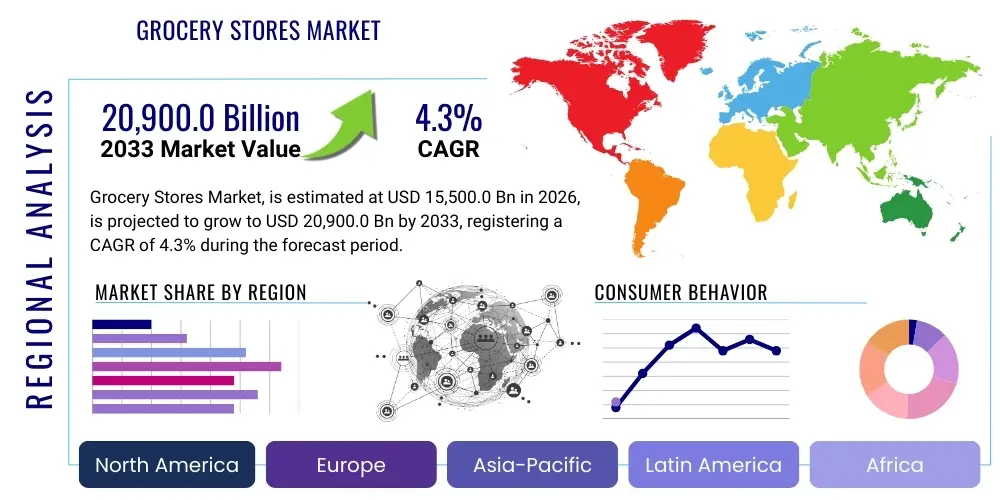

The Grocery Stores Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.3% between 2026 and 2033. The market is estimated at $15,500.0 Billion USD in 2026 and is projected to reach $20,900.0 Billion USD by the end of the forecast period in 2033.

Grocery Stores Market introduction

The global Grocery Stores Market encompasses all retail outlets involved in the sale of food and beverage products, household essentials, and certain non-food items primarily intended for consumption or use within the home. This expansive sector includes various formats such as supermarkets, hypermarkets, convenience stores, and the rapidly growing segment of online grocery platforms. The market serves as a fundamental pillar of global commerce, driven by non-discretionary consumer spending on necessity goods, ensuring consistent demand regardless of minor economic fluctuations. Key product offerings span fresh produce, dairy, frozen foods, packaged goods, and beverages, reflecting diverse consumer dietary habits and lifestyle needs worldwide.

Major applications of grocery retail extend beyond simple transaction points; modern grocery stores are evolving into integrated service hubs, offering prepared meals, pharmaceutical services, and increasingly sophisticated delivery and pickup options (click-and-collect). The market is characterized by high volume, low margin, and intense competition, necessitating continuous innovation in logistics, pricing strategy, and customer experience. Benefits for the consumer include enhanced accessibility to a broad range of products, price transparency due to competitive environments, and increasing convenience facilitated by digital integration and store format optimization. The ability of modern grocery chains to rapidly adapt their inventory to local tastes and global supply chain shifts is a critical factor defining success.

Driving factors propelling market growth include sustained global population increase, rapid urbanization, particularly in emerging economies, and the rising consumer demand for convenience and ready-to-eat options, reflecting faster-paced modern lifestyles. Furthermore, technological advancements, such as the adoption of sophisticated supply chain management systems and the proliferation of e-commerce platforms, are expanding market reach and operational efficiency. The strategic focus on private label brands, offering higher margins and appealing to price-sensitive shoppers, also serves as a significant growth driver, enabling retailers to differentiate themselves and capture greater market share in highly saturated retail landscapes globally. The confluence of demographic shifts and technological transformation underscores the robust expansion trajectory of the grocery retail sector.

Grocery Stores Market Executive Summary

The Grocery Stores Market is undergoing significant structural transformation, driven by an accelerating shift toward omnichannel retail and sustainable sourcing practices. Business trends highlight strategic investments in digital infrastructure, primarily focused on enhancing last-mile delivery capabilities and personalized customer engagement via mobile applications. Consolidation remains a defining feature, with major global players acquiring smaller regional chains or specialized online delivery platforms to rapidly expand market presence and logistical networks. Price competition is intensifying due to the growth of discounters (e.g., Aldi, Lidl) and the expansion of private labels, compelling traditional supermarkets to optimize operational efficiencies through automation and improved inventory forecasting utilizing advanced analytics.

Regional trends indicate that the Asia Pacific (APAC) region is poised for the most dynamic growth, fueled by rising disposable incomes, rapid urbanization, and an expanding middle-class population eager for Western-style hypermarket experiences coupled with localized e-commerce solutions. North America and Europe, characterized by market maturity, are focusing heavily on integrating technology, notably AI for inventory optimization and automation of in-store tasks, alongside robust growth in the premium and organic food segments. Conversely, Latin America and MEA show potential, driven by infrastructure improvements and the gradual formalization of the retail sector, moving consumers from traditional markets to modern grocery formats.

Segmentation trends reveal that the Online Grocery segment is the fastest-growing, driven by pandemic-induced habits becoming permanent consumer behaviors, requiring significant capital expenditure in fulfillment centers and cold chain logistics. Within store formats, Convenience Stores maintain resilience due to their proximity and speed of service, catering effectively to immediate consumption needs. Product category analysis shows strong growth in fresh, locally sourced, and plant-based foods, indicating a growing consumer awareness of health, sustainability, and ethical consumption. This trend is compelling retailers to restructure their procurement and shelf allocation strategies to favor environmentally responsible and transparently sourced merchandise.

AI Impact Analysis on Grocery Stores Market

Common user questions regarding AI's impact on the Grocery Stores Market center on several critical themes: how AI enhances inventory accuracy, its role in automating labor-intensive processes, and the potential for personalized marketing to boost customer loyalty. Users frequently inquire about the feasibility of fully autonomous stores (like Amazon Go) and the ethical implications of using AI for dynamic pricing and consumer surveillance. Furthermore, there is significant interest in how AI can mitigate food waste through more precise demand forecasting, a major cost and sustainability concern for the industry. The key concern revolves around the balance between efficiency gains, job displacement among store associates, and the necessary cybersecurity infrastructure required to manage vast amounts of customer data securely and ethically. Users expect AI to deliver substantial improvements in shopping convenience, personalization, and operational cost reduction, fundamentally reshaping the retail experience and supply chain dynamics.

- AI-driven demand forecasting significantly reduces food waste and optimizes inventory levels across complex supply chains.

- Implementation of computer vision for monitoring shelf stock levels, ensuring product availability, and preventing out-of-stock situations in real-time.

- Personalized marketing and recommendation engines, using machine learning to analyze purchasing history, driving higher basket sizes and loyalty program effectiveness.

- Automated checkout systems (e.g., 'Just Walk Out' technology) minimizing queuing times and reducing the need for human cashiers, enhancing store throughput.

- Robotics and automation used in warehouse management and micro-fulfillment centers (MFCs) to speed up online order picking and packing processes.

- Dynamic pricing strategies powered by algorithms that adjust product prices instantly based on competitor pricing, local demand signals, and product freshness/expiry dates.

- Optimization of store layouts and spatial planning using AI to track customer movement and dwell times, maximizing sales conversion in high-traffic areas.

- Predictive maintenance for refrigeration units and store infrastructure, minimizing downtime and protecting perishable goods investments.

- Enhanced security and loss prevention through AI-powered video analytics to detect and flag potential instances of shoplifting or internal theft.

- Integration of conversational AI (chatbots) for customer service inquiries, personalized dietary suggestions, and seamless order modifications via digital channels.

DRO & Impact Forces Of Grocery Stores Market

The Grocery Stores Market is propelled by strong structural Drivers, predominantly demographic shifts, the pervasive consumer demand for convenience, and technological infrastructure improvements enabling e-commerce expansion. Restraints include the extremely high operational costs associated with maintaining cold chain logistics and last-mile delivery, intense price wars fueled by discounters, and the significant environmental scrutiny placed on packaging and food waste. Opportunities are abundant, centered on exploiting the high-growth potential of private label segments, integrating advanced automation within micro-fulfillment centers, and capitalizing on the rising consumer preference for sustainable, organic, and ethically sourced products. These forces collectively dictate market trajectory, pushing retailers toward technologically advanced, yet economically lean, operating models.

Impact forces create substantial pressure points across the entire grocery value chain. The bargaining power of major global retailers (Buyers) remains extremely high due to fragmented sourcing and high volume purchases, allowing them to dictate terms to suppliers. Conversely, the threat of new entrants is moderate; while physical store networks are capital-intensive barriers, online pure-plays and specialized meal kit services represent disruptive, lower-barrier threats. Supplier bargaining power is fragmented, except in specialized, unique, or rare agricultural commodities, which can exert price pressure. The intensity of competitive rivalry is exceptionally high, marked by frequent price matching, aggressive store expansion, and high investment in loyalty programs across established geographic areas, making margin protection a core challenge for all participants.

Moreover, macroeconomic factors and governmental regulations heavily influence operational feasibility. Changes in minimum wage laws, stringent food safety standards, and increasing requirements for carbon footprint transparency necessitate substantial capital and procedural adjustments. The industry must continuously balance the need for speed and convenience against regulatory compliance and sustainability mandates. Successful market players are those that effectively harness technology to transform internal processes, mitigating the impact of rising labor and energy costs while simultaneously leveraging the Opportunities presented by personalized consumer experiences and the lucrative potential of digital channels.

Segmentation Analysis

The global Grocery Stores Market is segmented comprehensively based on Store Format, distinguishing between traditional physical retail models and contemporary digital channels; by Product Category, reflecting the composition of goods sold; and by Location, indicating geographic and population density influences on consumption patterns. This multi-dimensional segmentation allows for granular analysis of consumer behavior, competitive intensity, and regional growth pockets. The most dynamic segmentation remains the shift between Supermarkets/Hypermarkets and the emerging dominance of Online Grocery platforms, which demands distinct supply chain solutions and marketing strategies. Analyzing these segments is critical for stakeholders seeking to allocate capital effectively across the diverse global grocery landscape, identifying niches such as discount retail or premium specialty foods.

The segmentation by Product Category, covering categories such as Perishables (fresh meat, produce, dairy) versus Non-Perishables (canned goods, processed foods, staples), provides insights into supply chain fragility and inventory management complexity. Perishables require sophisticated cold chain infrastructure and rapid turnover, whereas Non-Perishables often rely on economies of scale in distribution. Furthermore, the segmentation by ownership structure—corporate chains versus independent stores—highlights varying levels of price leverage and technology adoption. Independent stores often focus on local sourcing and community ties, while large chains leverage scale for centralized procurement and advanced analytics. Understanding these differences informs strategic planning for market entry and competitive positioning globally.

- By Store Format

- Supermarkets (Large self-service stores offering a wide variety of food and non-food items)

- Hypermarkets (Very large stores combining grocery and department store sections)

- Convenience Stores (Small stores offering limited range of high-turnover items for immediate consumption)

- Discounters (Stores focusing on low prices, limited assortments, and often private label goods)

- Online Grocery/E-commerce (Pure-play online retailers, click-and-collect services, and delivery apps)

- Specialty Stores (Focusing on specific items like organic, ethnic, or frozen foods)

- By Product Category

- Perishables

- Fresh Produce (Fruits, Vegetables)

- Meat, Poultry, and Seafood

- Dairy Products and Eggs

- Non-Perishables

- Packaged and Canned Goods

- Baking and Grains (Flour, Rice, Pasta)

- Frozen Foods

- Snacks and Confectionery

- Beverages

- Non-Alcoholic (Water, Juices, Sodas)

- Alcoholic (Beer, Wine, Spirits, regulated by local laws)

- Household Goods and Non-Food Items

- Cleaning Supplies

- Personal Care and Hygiene Products

- Pet Food and Supplies

- Perishables

- By Ownership Structure

- Corporate Chains

- Independent Grocery Stores

- Franchise Operations

- By Location

- Urban Areas (High density, high turnover)

- Suburban Areas (Medium density, family-focused shopping)

- Rural Areas (Low density, often relying on convenience or smaller format stores)

Value Chain Analysis For Grocery Stores Market

The Grocery Stores market value chain begins with upstream activities involving primary producers—farmers, processors, and manufacturers—who transform raw commodities into consumer-ready goods. Upstream analysis focuses on securing stable, cost-effective sources of supply, managing volatility in agricultural markets, and ensuring compliance with increasing sustainability and ethical sourcing standards (e.g., fair trade, organic certification). Retailers exert significant negotiating power in this phase, often driving down procurement costs, but they must also invest in robust traceability systems to ensure product quality and consumer trust, especially for perishable items. Key relationships here are long-term contracts and strategic partnerships designed to secure high-demand products like fresh produce and specific private label manufacturing capacity.

The core of the value chain involves midstream logistics and distribution, where efficiency is paramount. This stage encompasses warehousing, inventory management, cold chain maintenance, and transportation networks, which must integrate seamlessly to minimize shrinkage and spoilage. Direct distribution channels, where retailers operate their own massive distribution centers, offer greater control over inventory flow and faster shelf restocking, maximizing freshness. Indirect distribution involves using third-party logistics (3PL) providers, which is often favored by smaller chains or for accessing highly specialized or geographically distant markets. Optimizing the flow of goods from distribution centers to the physical store or the micro-fulfillment center (for online orders) is a continuous exercise in cost reduction and speed enhancement.

Downstream activities focus heavily on the final consumer interaction, covering the physical store operations, merchandising, pricing, customer service, and the rapidly growing digital interface. Direct interaction channels include the physical supermarket environment, where store layout and checkout efficiency directly impact customer satisfaction. Indirect channels are dominated by e-commerce platforms, mobile applications, and third-party delivery services (e.g., Instacart, Deliveroo). Success downstream is determined by the seamless integration of omnichannel capabilities—allowing customers to transition effortlessly between online browsing, in-store pickup, and home delivery—alongside compelling loyalty programs and highly localized product assortments that cater specifically to the immediate community's demographic profile and tastes. Retailers must manage this final stage with a strong focus on data analytics to personalize the shopping journey and drive repeat purchases.

Grocery Stores Market Potential Customers

The primary potential customers and end-users of the Grocery Stores Market encompass virtually the entire global population, segmented broadly into Household Consumers and Commercial Buyers, each with distinct purchasing motivations and requirements. Household consumers, the largest segment, range from single-person households and young professionals prioritizing convenience and ready-to-eat meals, to large families focused on bulk purchases, value, and nutritional needs. Demographic factors such as income level, age, family size, and cultural background significantly influence purchasing patterns, driving demand for specific store formats (discounters for budget-conscious; specialty stores for affluent consumers) and product categories (organic, ethnic foods). Effective marketing to this group relies heavily on loyalty programs and personalized digital engagement.

Commercial buyers represent a smaller but significant segment, including institutions such as restaurants, hotels, catering services (HoReCa), schools, hospitals, and small independent convenience stores that purchase inventory for resale or food preparation in large quantities. These B2B customers prioritize bulk pricing, reliability of supply, credit terms, and stringent quality control standards, particularly for fresh produce and specialty ingredients. Retailers strategically address this segment through dedicated wholesale divisions or specialized formats (like Costco Business Centers), offering tailored logistics solutions and dedicated sales support to manage complex, large-volume orders, ensuring steady revenue streams outside typical household shopping hours.

Furthermore, the emerging customer segment of digitally native shoppers, spanning all ages but particularly strong among Gen Z and Millennials, are increasingly demanding hyper-convenience, instant gratification, and transparency regarding product sourcing and ethical practices. This segment drives demand for rapid fulfillment options, subscription services, and highly sustainable packaging solutions. Retailers must invest heavily in understanding these evolving consumer expectations, leveraging data analytics to predict shifting dietary trends (e.g., plant-based diets, allergen-free products) and ensure that their procurement and merchandising strategies align with the fast-changing values and lifestyle demands of contemporary grocery shoppers globally.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $15,500.0 Billion USD |

| Market Forecast in 2033 | $20,900.0 Billion USD |

| Growth Rate | 4.3% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Walmart Inc., Amazon (Whole Foods Market), The Kroger Co., Costco Wholesale Corporation, Tesco PLC, Carrefour S.A., Aldi, Lidl, 7-Eleven Inc., Sainsbury's, Ahold Delhaize, Metro AG, Target Corporation, Loblaw Companies Limited, Woolworths Group, Publix Super Markets, Edeka Group, Schwarz Gruppe, Rewe Group, AEON Co., Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Grocery Stores Market Key Technology Landscape

The Grocery Stores Market is being fundamentally redefined by technologies aimed at automating complex processes, enhancing the speed of fulfillment, and creating highly personalized customer experiences both in-store and online. Core technologies include sophisticated Enterprise Resource Planning (ERP) systems coupled with advanced Supply Chain Management (SCM) platforms that integrate data from point-of-sale (POS) systems, distribution centers, and suppliers. The strategic deployment of Artificial Intelligence (AI) and Machine Learning (ML) algorithms is crucial for predictive analytics, driving superior demand forecasting, dynamic pricing optimization, and automated promotional targeting, reducing both waste and operational expenditure. Furthermore, the reliance on robust cloud infrastructure facilitates scalability and rapid deployment of new digital services, crucial for maintaining competitiveness in the fast-moving e-commerce environment. Retailers are actively moving towards unified commerce platforms that seamlessly integrate all sales channels.

In-store technology adoption is centered on labor efficiency and customer convenience. This includes the widespread integration of self-checkout kiosks and computer vision systems that automate product identification and monitor shelf status, alerting staff to restocking needs immediately. The rise of micro-fulfillment centers (MFCs), often integrated into or adjacent to existing store footprints, utilizes robotics and automated storage and retrieval systems (AS/RS) to dramatically speed up the picking process for online orders, making same-day and sub-hour delivery economically viable. RFID technology is increasingly used for accurate, real-time inventory tracking, minimizing manual audits and improving shrinkage prevention. These deployments require significant initial capital but offer substantial long-term returns through reduced labor costs and improved stock rotation.

The digital front end is dominated by mobile applications that serve as the primary interface for customer engagement. These apps leverage proximity-based technologies (e.g., beacons) for location-specific promotions, facilitate seamless mobile payment, and integrate sophisticated loyalty platforms driven by big data analytics. Furthermore, the infrastructure supporting last-mile delivery, including optimized route planning software and the experimental use of drone or autonomous vehicle delivery in select urban corridors, represents a critical technological frontier. The continued evolution of the Internet of Things (IoT) sensors for continuous cold chain monitoring and asset tracking ensures product integrity from farm to fork, reinforcing consumer trust and meeting stringent food safety regulations globally, highlighting technology's role as a non-negotiable component of modern grocery operations.

Regional Highlights

- North America (NA): This region is characterized by high market maturity, dominated by large corporate chains (Walmart, Kroger) and membership clubs (Costco). Growth is primarily driven by technological adoption, particularly in e-commerce fulfillment (Amazon's influence) and the rapid scaling of micro-fulfillment centers. There is significant consumer spending on premium, organic, and locally sourced products. Regulatory focus on food safety and labor practices is high.

- Europe: Europe exhibits a highly fragmented and competitive market landscape, split between traditional supermarkets (Tesco, Carrefour) and exceptionally dominant discounters (Aldi, Lidl, Schwarz Gruppe). Key trends include aggressive expansion of private label brands and intense governmental pressure to reduce food waste and enhance sustainable supply chains. Germany and the UK lead in leveraging technology for operational efficiency, while Eastern Europe presents moderate growth opportunities through modernization of retail infrastructure.

- Asia Pacific (APAC): APAC is the fastest-growing region, fueled by massive population bases (China, India), rapid urbanization, and increasing middle-class disposable income. The market is highly diverse, ranging from advanced e-commerce penetration in South Korea and China (Alibaba, JD.com) to traditional wet markets in Southeast Asia. Strategic investments are concentrated on building robust cold chain logistics and developing hybrid offline-to-online (O2O) retail models tailored to dense urban environments.

- Latin America (LATAM): Growth is driven by the formalization of retail, with consumers moving away from informal local markets toward modern supermarket formats. Economic volatility and infrastructure challenges (especially logistics outside major cities) are significant constraints. Brazil and Mexico represent the largest markets, focusing on expanding discount formats and improving inventory management to mitigate currency fluctuation risks.

- Middle East and Africa (MEA): This region is characterized by high variance. The GCC countries (Middle East) show strong demand for luxury and imported goods, with significant investment in technologically advanced hypermarkets and air-freight logistics. Africa's market growth is concentrated in major urban centers, driven by population growth and foreign investment in modern retail infrastructure, though challenges related to regulatory environments and cold chain reliability persist.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Grocery Stores Market.- Walmart Inc.

- Amazon (Whole Foods Market)

- The Kroger Co.

- Costco Wholesale Corporation

- Tesco PLC

- Carrefour S.A.

- Aldi

- Lidl (Schwarz Gruppe)

- 7-Eleven Inc.

- Sainsbury's

- Ahold Delhaize

- Metro AG

- Target Corporation

- Loblaw Companies Limited

- Woolworths Group

- Publix Super Markets

- Edeka Group

- Rewe Group

- AEON Co., Ltd.

- Lotte Shopping Co., Ltd.

Frequently Asked Questions

Analyze common user questions about the Grocery Stores market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving growth in the Grocery Stores Market?

The most significant driver is the increasing consumer demand for convenience and speed, primarily facilitated by the rapid expansion of digital channels, advanced last-mile delivery services, and the prevalence of small-format, proximity-focused convenience stores. This convenience factor is coupled with global urbanization trends and rising demand for time-saving meal solutions.

How is technology reshaping the competitive landscape of grocery retail?

Technology, particularly AI and automation, is fundamentally reshaping operations by enabling superior demand forecasting, minimizing food waste, and optimizing supply chains. It also intensifies competition by empowering dynamic pricing strategies and facilitating highly personalized marketing and loyalty programs, setting high operational efficiency standards for market entry.

Which geographical region holds the highest growth potential for grocery retail?

The Asia Pacific (APAC) region is projected to exhibit the highest growth potential. This is driven by massive population density, expanding middle-class demographics, increasing disposable income levels, and the ongoing modernization of retail infrastructure supporting both physical and advanced e-commerce grocery platforms across major economies like China and India.

What are the key challenges faced by established supermarkets?

Established supermarkets face acute pressure from two sides: intense price competition from discount retailers (Aldi, Lidl) and the accelerating necessity to invest heavily in expensive, complex e-commerce fulfillment infrastructure and last-mile delivery capabilities to compete with digital pure-plays like Amazon. Managing high labor costs and environmental sustainability mandates further adds to operational complexity.

What role do private label brands play in the Grocery Stores Market?

Private label brands are strategically crucial for grocery retailers. They offer higher profit margins compared to national brands, enhance retailer differentiation, and provide price-sensitive consumers with value alternatives, thereby significantly boosting customer loyalty and competitive standing against rivals, particularly discounters.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager