Ground Maneuvering Camera Systems Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434489 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Ground Maneuvering Camera Systems Market Size

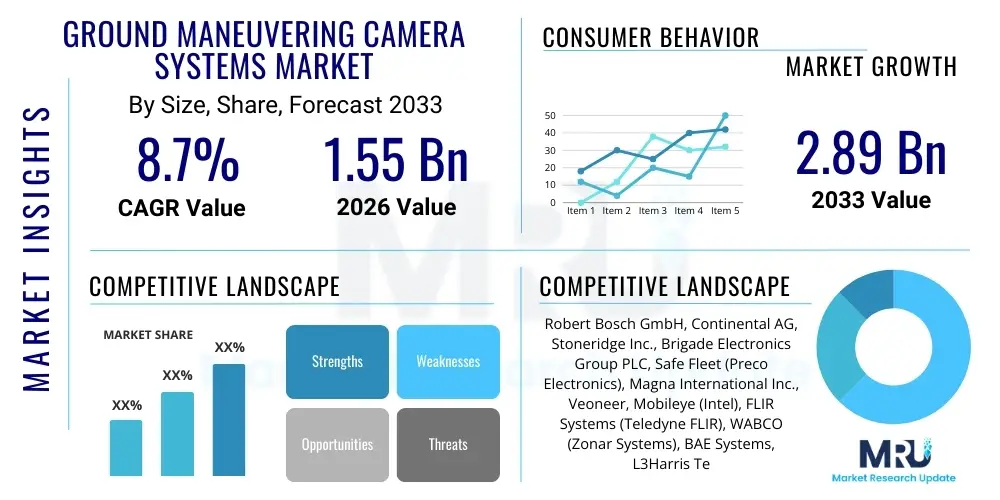

The Ground Maneuvering Camera Systems Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.7% between 2026 and 2033. The market is estimated at USD 1.55 Billion in 2026 and is projected to reach USD 2.89 Billion by the end of the forecast period in 2033.

Ground Maneuvering Camera Systems Market introduction

The Ground Maneuvering Camera Systems Market encompasses advanced visual aids designed to enhance the situational awareness and safety of operators in large vehicles, heavy machinery, military platforms, and complex infrastructure environments. These systems, fundamentally crucial for applications requiring precision movement in confined or zero-visibility conditions, integrate high-resolution cameras, robust processing units, and intuitive display interfaces to provide real-time, comprehensive, and often stitched 360-degree views surrounding the asset. The primary function of these sophisticated installations is to systematically eliminate traditionally problematic blind spots inherent in large equipment design, thereby significantly mitigating risks associated with human error, preventing costly collisions with infrastructure or personnel, improving overall operational efficiency, and ensuring strict adherence to increasingly stringent global safety regulations across critical industrial and defense sectors. The foundational technology has evolved substantially, moving beyond simple rearview installations to complex, multi-camera arrays leveraging advanced optics and specialized environmental casings designed to withstand extreme operational duress, establishing them as essential components for modern heavy asset management and safety protocols.

The application spectrum for these advanced camera systems is remarkably broad and spans mission-critical industries globally, including large-scale mining operations, intricate construction sites, complex port logistics, and high-stakes defense maneuvers. In environments such as deep open-pit mining and aggregate extraction, heavy earthmoving equipment, including colossal haul trucks and hydraulic shovels, relies critically on these visual systems for precise material handling, safe navigation of congested haul roads, and precise interaction with conveying and loading infrastructure, particularly when visibility is compromised by dust, darkness, or adverse weather. Similarly, in logistics and port environments, systems are indispensable for safely maneuvering specialized container handling equipment like straddle carriers and reach stackers within densely packed container yards, where precision measured in mere inches is necessary to prevent costly damage to high-value cargo and ensure uninterrupted terminal throughput. The increasing complexity of urban construction further drives demand, requiring detailed, low-latency visual feeds to guide machinery operating in proximity to public spaces and tight urban confines.

The economic and safety benefits derived from the implementation of Ground Maneuvering Camera Systems serve as primary market accelerators. Key benefits include a documented and substantial reduction in workplace accidents, minimized operational downtime resulting from equipment damage caused by avoidable collisions, and measurable improvements in productivity stemming from faster and more confident execution of complex maneuvers by operators. Furthermore, the regulatory environment, particularly in highly mechanized economies, continues to tighten, mandating improved visibility and situational awareness standards for new heavy equipment, effectively acting as a powerful, non-negotiable factor accelerating market adoption globally. Continuous technological refinement focuses intensely on the integration of supplementary technologies such as high-performance thermal imaging for nighttime operations, achieving significantly increased video resolution (4K and beyond), and reducing system latency to near-instantaneous levels. These continuous improvements ensure that maneuvering camera systems remain indispensable tools for guaranteeing operational integrity, maximizing equipment lifespan, and upholding the highest safety standards in high-risk heavy asset maneuvering scenarios across all key vertical markets, solidifying their role as essential capital investments.

Ground Maneuvering Camera Systems Market Executive Summary

The global Ground Maneuvering Camera Systems market is currently experiencing a trajectory of robust expansion, underpinned by several converging business, technological, and regulatory drivers. A fundamental trend observed across the commercial landscape is the rapid adoption of integrated sensor packages, moving beyond singular visual cameras to sophisticated, fused systems incorporating radar, LiDAR, and ultrasonic sensors. This shift is driven by the necessity for fail-safe, holistic situational awareness data, which is crucial for supporting advanced driver-assistance systems (ADAS) and foundational for tele-operated or fully autonomous heavy vehicle programs. Market dynamics indicate a strong pivot towards Original Equipment Manufacturers (OEMs) incorporating these advanced vision systems as standard, factory-fitted components, which offers superior integration quality, warranty coverage, and performance reliability compared to traditional aftermarket installations. This trend compels specialized system providers to increasingly focus on supplying cutting-edge sensor components and advanced software algorithms directly to major vehicle manufacturers.

From a regional perspective, the market continues to exhibit high maturity and revenue generation in established economic powerhouses, particularly North America and Western Europe, where safety regulations are rigorously enforced, and significant capital expenditure is allocated towards infrastructure maintenance and renewal. These regions dictate technological sophistication, often being the first to adopt AI-enabled and highly networked camera solutions. However, the Asia Pacific (APAC) region is strategically positioned to generate the highest Compound Annual Growth Rate (CAGR) throughout the forecasted period. This dramatic acceleration is fueled by the massive scale of industrialization, rapid expansion of modern logistics infrastructure (e.g., automated ports), and concerted government efforts in countries like China and India to modernize their extensive commercial vehicle fleets and construction equipment to meet emerging international safety norms. Emerging markets, including Latin America and MEA, demonstrate specialized demand, focusing primarily on highly ruggedized, durability-focused systems for application in extreme mining and oilfield environments.

Analysis of market segmentation reveals distinct trends impacting future investment strategies. While the hardware component segment (cameras and displays) currently accounts for the largest revenue share, the software segment, comprising image processing, AI, and fusion algorithms, is projected to command the fastest growth rate, reflecting the increasing importance of intelligent data analysis over mere visual capture. Vehicle type analysis indicates sustained high demand from the Construction and Mining sectors, which represent the largest volume purchasers. Nevertheless, the Military and Defense segment, though smaller in unit volume, remains critically important due to the premium pricing, specialized technology requirements (e.g., thermal and stealth maneuvering capabilities), and long-term modernization cycles, which demand ultra-reliable and customized integration solutions. This balanced growth across segments highlights a market that is simultaneously broadening its commercial footprint while deepening its technological complexity in high-security and mission-critical applications.

AI Impact Analysis on Ground Maneuvering Camera Systems Market

User inquiries regarding the profound influence of Artificial Intelligence (AI) and Machine Learning (ML) on the Ground Maneuvering Camera Systems Market consistently revolve around the transition from simple visual monitoring to active, predictive operational support. Common concerns addressed include how AI reliably distinguishes between critical and non-critical environmental obstacles (e.g., classifying a human worker versus stationary debris), ensuring algorithmic performance consistency in challenging visual conditions (such as heavy snow, dense fog, or during dust storms), and assessing the reliability and certification pathway for systems enabling higher levels of vehicle autonomy. The overwhelming user expectation is that AI integration will fundamentally transcend the traditional role of a camera system, enabling proactive hazard warnings, automated decision-making support, and reducing the operator's mental workload, thereby creating safer, more efficient, and eventually fully driverless operations across hazardous heavy industrial sites, maximizing asset utilization and minimizing liability exposure.

The incorporation of AI algorithms, specifically deep learning and convolutional neural networks (CNNs), is dramatically enhancing the functional scope of ground maneuvering systems, transforming them into intelligent perception engines. These advanced computational models enable sophisticated real-time image processing that performs highly accurate object classification, precise tracking of dynamically moving elements, and the accurate generation of predictive trajectory overlays onto the operator's display. This level of granular analysis allows the system not only to identify the presence of obstacles but also to categorize them (person, vehicle, static structure) and issue context-sensitive, proactive warnings well before a conventional system would react. This capability is absolutely vital in rapidly changing, highly stochastic work environments such as massive open-pit mines or busy port logistics areas, where collision avoidance at high equipment inertia is a matter of critical safety and economic imperative, offering a significant competitive advantage to system providers.

Beyond immediate situational awareness, AI integration also profoundly impacts system maintenance and operational longevity. Machine Learning models are increasingly utilized for sophisticated image analysis aimed at predictive maintenance, autonomously identifying subtle signs of component degradation, detecting lens fouling (e.g., accumulation of mud or dust), or recognizing camera misalignment caused by operational shock. By flagging these performance inhibitors automatically, the system ensures data reliability and maximizes operational uptime. This technological shift pushes the market firmly towards creating a cognitive environment for heavy vehicle operation, providing essential data integrity for sophisticated tele-operation and accelerating the industry's inexorable movement towards complete autonomy, particularly beneficial in dangerous applications like trenching, heavy lifting, and underground mining. The ability to guarantee high data fidelity and operational redundancy justifies the increased investment required for these next-generation AI-enabled maneuvering camera systems, positioning them as central pillars of industrial safety architectures globally.

- AI enhances real-time object detection and classification (e.g., accurately distinguishing human workers from general static debris).

- Machine learning algorithms enable sophisticated predictive hazard identification and precise collision trajectory forecasting, minimizing reaction time.

- AI supports the development of sophisticated 360-degree 'bird's-eye view' systems through highly accurate automated image stitching, distortion correction, and view blending.

- Integrated neural networks facilitate advanced low-light or severe poor-weather image enhancement, including complex denoising, fog removal, and glare reduction.

- AI drives the market transition towards enabling higher levels of semi-autonomous maneuvering functions and reliable remote control applications by providing validated, enriched environmental perception data.

- Predictive maintenance ML models monitor camera performance and cleanliness, automatically alerting operators to required service interventions, ensuring continuous functionality.

- Edge computing implementation of AI allows for ultra-low latency processing, critical for instantaneous reaction times in high-speed or precision maneuvering scenarios.

DRO & Impact Forces Of Ground Maneuvering Camera Systems Market

The sustained expansion of the Ground Maneuvering Camera Systems market is fundamentally propelled by the confluence of legislative mandates and rapid technological progress. Key drivers include increasingly stringent global regulations focused on workplace safety, particularly requiring enhanced visibility zones around heavy-duty and non-road mobile machinery (NRMM) operating in civil, mining, and military theaters. These governmental and organizational mandates force fleet operators to upgrade their visual technology to comply, creating mandatory market demand. Simultaneously, the accelerating rate of technological advancements, notably the commercialization of low-cost, high-resolution digital cameras (CMOS sensors), advanced system-on-chips (SoCs) for processing, and reliable industrial networking solutions (e.g., robust CAN bus and Ethernet protocols), consistently drives down the unit cost while drastically improving system performance metrics such as video quality, latency, and environmental resilience, making adoption more economically viable across diverse fleet sizes.

However, the market faces significant restraining elements that impede uniform adoption speed. A primary constraint is the substantial high initial capital outlay required for purchasing and installing fully integrated, highly ruggedized maneuvering camera systems, especially those incorporating multiple sensors and AI-driven processors, which poses a considerable barrier for small to medium-sized enterprises (SMEs) with tighter capital budgets. Furthermore, the inherent complexity involved in successfully integrating diverse camera solutions and standardized networking protocols with vast legacy fleets of older heavy equipment, which were not originally designed for digital sensory input, often necessitates costly, bespoke customization and extensive downtime for installation and certification. The need to meet extremely rigorous reliability and ruggedization standards (e.g., resistance to extreme temperatures, severe shock, and prolonged vibration) in sectors like mining and defense adds complexity and cost, limiting the rapid deployment of standardized, off-the-shelf commercial solutions.

Significant opportunities for market participants lie in capitalizing on the massive, ongoing global trend toward autonomous heavy equipment and the increasing necessity for reliable remote operation capabilities in hazardous and inaccessible environments, such as deep-sea energy projects or highly mechanized production lines. Maneuvering camera systems are the fundamental sensory organs for these nascent autonomous platforms, guaranteeing sustained, long-term growth as the robotics and automation sectors continue their rapid expansion across industrial verticals. Furthermore, the development and commercialization of highly advanced spectral imaging techniques, which fuse visual, thermal, and potentially multispectral data, alongside the powerful utilization of integrated AI for predictive risk mitigation, present clear and differentiated avenues for manufacturers to capture higher-margin, premium market segments focused on absolute operational safety and reliability. Lastly, the consistent and accelerating modernization cycles of global military vehicle fleets provide a steady and high-value stream of specialized contracts demanding the highest levels of technological advancement, environmental sealing, and secured network integration, pushing the entire industry's capability ceiling.

Segmentation Analysis

The Ground Maneuvering Camera Systems market is meticulously dissected across multiple strategic dimensions, including the underlying technology deployed, the specific type of components utilized, the category of vehicle equipped, the primary application environment, and the geographical region of deployment. This detailed segmentation is essential for manufacturers to accurately calibrate their research and development efforts, tailor product feature sets, and optimize their go-to-market strategies by focusing on specialized performance characteristics such as the required field of view, minimum operational temperature range, mandated video resolution standards, and overall environmental durability specifications. The overarching trend observed within this segmentation analysis is the market's decisive movement from providing basic, low-cost safety adherence aids toward offering highly specialized, data-rich operational enhancers, a transition particularly acute in the rapidly expanding segments utilizing advanced thermal and complex autonomous vehicle integration technologies, demonstrating significant growth metrics far exceeding traditional visual systems.

Segmented by Component, the market is structurally divided into the physical Hardware elements (which include the camera modules, robust interconnecting cables, operator displays, and centralized processing units) and the crucial Software layer (encompassing complex image processing algorithms, advanced AI/ML tools, and system diagnostics suites). The relative value contribution of the software segment is undergoing rapid acceleration, emphatically underscoring the market's evolving priority toward intelligent systems that derive maximum actionable insights from visual data through sophisticated algorithmic analysis, rather than merely capturing raw images. Differentiation by Vehicle Type is critical for product design, as it dictates precise requirements for ruggedization and specific sensor placement: Construction Equipment (e.g., large wheeled loaders and hydraulic excavators) demands systems resilient to dust and shock; Mining Machinery (e.g., massive surface haul trucks) requires highly durable systems for 24/7 operation and integration with mine management software; Military Vehicles (e.g., Armored Personnel Carriers) require MIL-SPEC compliance for extreme conditions and secure data transmission; and Logistics/Port Vehicles (e.g., terminal tractors) prioritize high-speed, high-resolution feeds for quick, precise maneuvers.

The dominance of industrial applications stems directly from the immense volume of heavy machinery globally utilized in infrastructure and commodity extraction, establishing it as the largest single end-use category by unit volume. However, the defense application segment, although characterized by significantly lower procurement volumes, commands a high degree of technological sophistication and premium pricing due to non-negotiable requirements for ultra-high reliability, advanced passive night vision capabilities, and mandatory secure integration with proprietary battle management systems (BMS) and vehicle sensor arrays. Future market growth prospects are intrinsically linked to significant global governmental spending on major infrastructure renewal and expansion projects, particularly concentrated in emerging economies across APAC and LATAM. This expenditure will simultaneously generate robust demand for both construction-focused and specialized logistics-centric camera solutions. Strategic market planning must therefore effectively navigate the regional variances in regulatory compliance, specific operational climate demands, and existing technology standards to maximize sustained market penetration and technological leadership across all relevant geographic sectors.

- By Technology:

- Standard Visual Cameras (High-Definition CMOS/CCD)

- Thermal Imaging Cameras (Critical for 24/7 and poor visibility operations)

- Night Vision/Infrared Cameras (Passive and Active illumination variants)

- 3D Sensing Cameras (e.g., Stereo Vision, Structured Light, Time-of-Flight systems)

- Sensor Fusion Systems (Combining visual, thermal, radar, and LiDAR data)

- By Component:

- Hardware (Camera Modules, Rugged Displays, ECUs/Processors, Wiring Harnesses, Specialized Mounts)

- Software (Image Processing and Stitching Algorithms, AI/ML Detection Libraries, Diagnostic and Calibration Tools)

- By Vehicle Type:

- Construction Equipment (Excavators, Loaders, Cranes, Dump Trucks)

- Mining Machinery (Large Haul Trucks, Drills, Continuous Miners)

- Military Vehicles (APCs, Tanks, Logistics Support, Engineering Vehicles)

- Material Handling and Logistics Vehicles (Forklifts, Reach Stackers, Port Cranes, Terminal Tractors)

- Specialty Vehicles (Waste Management Trucks, Fire Trucks)

- By Application:

- Industrial & Commercial Safety (Blind Spot Monitoring, Object Proximity Warning)

- Defense & Military Situational Awareness (Closed-Hatch Operation, Stealth Maneuvering)

- Autonomous Vehicle Enabling Systems (Perception Layer for Robotics)

- By Region:

- North America (USA, Canada, Mexico)

- Europe (Germany, UK, France, Scandinavia)

- Asia Pacific (APAC) (China, India, Japan, South Korea)

- Latin America (LATAM) (Brazil, Chile, Argentina)

- Middle East & Africa (MEA) (UAE, Saudi Arabia, South Africa)

Value Chain Analysis For Ground Maneuvering Camera Systems Market

The intricate value chain of the Ground Maneuvering Camera Systems Market commences with a highly specialized upstream segment focused on the sourcing and manufacturing of core technological inputs. This phase involves major suppliers of high-performance electronic components, including advanced CMOS image sensors—the critical component determining resolution and low-light capability—sophisticated microprocessors (DSPs and dedicated AI accelerators) necessary for real-time processing, high-quality optical components (lenses designed for harsh environments), and specialized raw materials essential for fabricating extremely durable, sealed, and ruggedized camera housings designed to meet IP69K dust and water ingress standards. A persistent challenge at this foundational stage involves securing consistent supply and managing the volatility inherent in the global semiconductor market, alongside meeting the non-standardized, high-specification requirements demanded by defense and severe industrial application clients, necessitating rigorous quality control and specialized component hardening processes.

The crucial middle segment of the value chain is dedicated to system integration, advanced manufacturing, and software development, performed by both specialized camera system vendors and major automotive/heavy equipment Tier 1 suppliers. These entities focus intensively on integrating the disparate hardware components, calibrating multi-camera arrays for highly accurate 360-degree viewing, and developing proprietary, advanced software stacks that incorporate AI for features like automatic distortion correction and predictive collision modeling. Distribution strategies bifurcate effectively: Direct sales channels are predominantly utilized for securing large-volume OEM contracts and highly sensitive military tenders. This direct engagement model facilitates deep, customized technical integration into new vehicle platforms, ensures critical compliance documentation is managed correctly, and provides necessary long-term, specialized after-sales technical support essential for mission-critical deployments where system failure is unacceptable.

Conversely, the indirect distribution network plays an indispensable role in penetrating the vast aftermarket and retrofit segments, catering to existing fleets operated by smaller construction companies, independent logistics firms, and public works departments. This network relies on specialized distributors, well-trained value-added resellers (VARs), and certified installation centers that manage inventory, provide localized installation services, and offer technical training on system operation and maintenance. Downstream activities are centered on professional installation, field servicing, and long-term maintenance, often requiring highly specialized technical teams to perform precise calibration of complex sensor arrays and execute regular software updates to maintain functional safety certifications. The end-users—ranging from multinational energy corporations to municipal fleet managers—ultimately govern demand based on their regulatory compliance burdens, measurable return on investment in safety improvements, and the perceived durability and ease of maintenance of the chosen systems, providing a continuous feedback loop crucial for future R&D prioritization within the highly competitive manufacturing tier.

Ground Maneuvering Camera Systems Market Potential Customers

The core customer segment for advanced Ground Maneuvering Camera Systems is comprised of global enterprises and governmental bodies that rely heavily on the operation of massive, complex, and potentially dangerous machinery where enhanced visibility is a prerequisite for safety and efficiency. This segment includes world-leading multinational mining corporations (e.g., Rio Tinto, BHP Billiton) and specialized resource extraction companies that manage extensive fleets of enormous earth-moving equipment (haul trucks exceeding 300 tons, hydraulic excavators, and drilling rigs) operating continuously in harsh, often remote, and dangerous environments. These clients require the highest levels of ruggedization, superior reliability in extreme conditions (dust, deep water, high heat), and the seamless integration of thermal imaging capabilities for mandated 24/7 continuous operational coverage, prioritizing systems that integrate directly with mine safety protocols and centralized fleet management software platforms.

A second, substantially large customer base encompasses the major global and regional construction and infrastructure development companies responsible for large-scale public and private works (e.g., road construction, commercial building, utility installation). These organizations acquire camera systems for a diverse array of equipment including tower cranes, bulldozers, graders, and cement mixers, operating within highly congested and dynamically changing urban and suburban environments where the risk of injury to personnel or damage to surrounding property is acute. For this segment, system requirements focus on high-definition video clarity, precise proximity sensing capabilities for pedestrian safety zones, and adherence to specific regional governmental safety mandates. The demand here is often bifurcated, spanning both high-volume factory installation for new purchases and a strong aftermarket requirement for retrofitting existing, compliant fleets to meet evolving safety standards without prematurely retiring assets.

Crucially, the defense and national security sector represents a premium customer segment, including the procurement arms of major global militaries (e.g., US DoD, NATO nations) requiring highly customized maneuvering vision systems for armored fighting vehicles (AFVs), main battle tanks (MBTs), and specialized logistics convoys. These systems enable essential closed-hatch operation, providing crew members with full 360-degree external visibility while remaining protected against ballistic and blast threats. Requirements for these customers are extremely rigorous, demanding MIL-SPEC certification for environmental and electromagnetic compatibility (EMC), secure data architecture to prevent interception, and specialized low-profile designs that minimize the visible footprint and signature of the equipment. These contracts typically involve highly complex integration and long service lifetimes, representing high-value, sustained relationships for specialized defense contractors within the market.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.55 Billion |

| Market Forecast in 2033 | USD 2.89 Billion |

| Growth Rate | 8.7% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Robert Bosch GmbH, Continental AG, Stoneridge Inc., Brigade Electronics Group PLC, Safe Fleet (Preco Electronics), Magna International Inc., Veoneer, Mobileye (Intel), FLIR Systems (Teledyne FLIR), WABCO (Zonar Systems), BAE Systems, L3Harris Technologies, Axis Communications, Sensata Technologies, Gentex Corporation, ZF Friedrichshafen AG, Denso Corporation, Samvardhana Motherson Group, I-Sight Safety Systems, Commercial Vehicle Group (CVG), Hella KGaA Hueck & Co., Delphi Technologies (Aptiv), Visteon Corporation, Mitsubishi Electric Corporation, Advanced Navigation, Smart Eye AB, Autoliv Inc., Ficosa International S.A., Daimler Truck AG. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Ground Maneuvering Camera Systems Market Key Technology Landscape

The technological core of the Ground Maneuvering Camera Systems market is undergoing a swift and fundamental transformation, primarily driven by the imperative for higher data fidelity, reduced latency, and enhanced environmental resilience. This evolution is spearheaded by the transition from outdated analog camera standards to advanced digital high-definition (HD) systems, predominantly utilizing sophisticated CMOS image sensors. These modern sensors deliver vastly superior video clarity, possess a dramatically wider dynamic range for handling extreme light variations, and exhibit significantly improved performance characteristics in low-light and high-contrast environments compared to their predecessors. Furthermore, the reliable communication backbone is being redefined by the adoption of robust, high-bandwidth Ethernet-based communication standards, such as Automotive Ethernet and standardized military interface protocols. This infrastructure is rapidly replacing restrictive analog video links, ensuring the requisite high-speed, ultra-low-latency transfer of massive visual data streams, which is absolutely essential for real-time situational awareness and effective integration with centralized vehicle electronic control units (ECUs) and complex fleet telematics platforms, optimizing data flow and integrity.

A crucial technological trajectory involves the deep integration and processing of data derived from Sensor Fusion. Leading market manufacturers are strategically combining the input from traditional visual camera feeds with non-visual sensory data streams originating from thermal cameras, short-range radar modules, and high-resolution LiDAR units. This synergistic approach significantly enhances system reliability and robustness, particularly when operational visibility is severely degraded by challenging environmental factors such as intense precipitation, dense atmospheric fog, or excessive dust propagation—conditions under which purely optical systems often become unreliable. Thermal imaging technology, specifically, is experiencing rapidly increased adoption across the defense sector and continuous 24/7 mining operations, owing to its unparalleled ability to reliably detect the minute heat signatures of living beings (personnel) or critical engine components regardless of the ambient illumination levels. The complex output derived from these fused sensor arrays is managed and interpreted by powerful onboard Electronic Control Units (ECUs) which operate specialized operating systems optimized for achieving functional safety standards (ISO 26262) and ensuring mission criticality, often relying on redundant processing pathways for fail-safe operation.

The overall usability and human-machine interface (HMI) design are also experiencing significant technological advancement, moving away from rudimentary, small dedicated displays to large-format, high-resolution integrated displays that are often seamlessly incorporated directly into the vehicle's ergonomic dashboard design. Increasingly, these displays utilize sophisticated Augmented Reality (AR) overlays, which present the highly processed visual information directly alongside crucial operational metrics, such as real-time speed data, predicted vehicle trajectories, and automatically highlighted risk zones, thereby effectively minimizing visual clutter and substantially reducing the overall cognitive load placed upon the vehicle operator during complex maneuvers. Furthermore, a substantial investment is being made in developing highly robust, rapid, and automatic calibration systems. This capability simplifies the initial installation process and significantly reduces long-term maintenance requirements, guaranteeing that the highly critical 360-degree stitched views remain consistently accurate, perfectly aligned, and free from critical geometric distortion throughout the system's demanding operational lifespan, offering substantial long-term cost reduction and efficiency gains for enterprise fleet management.

Regional Highlights

Regional disparities exert a decisive influence over the Ground Maneuvering Camera Systems market, shaped by variances in prevailing regulatory environments, specific industrial activity concentrations, and differing capital investment priorities in heavy equipment and defense modernization cycles. North America, anchored by the rigorous enforcement of Occupational Safety and Health Administration (OSHA) regulations and massive, sustained investment into both extractive (mining, oil & gas) and massive commercial construction projects, maintains its position as a highly mature and technologically dominant market segment. The region's inherent high technological readiness, coupled with the early and aggressive adoption of sophisticated Advanced Driver-Assistance Systems (ADAS) across commercial heavy goods vehicles and the strong presence of influential military vehicle manufacturers, ensures a persistent, robust demand stream for highly customized, high-specification camera systems. This includes leading-edge solutions incorporating deep AI integration for supporting autonomy in mining operations and stringent cybersecurity protocols for defense contracts, with innovation emanating from the U.S. often setting key global industry benchmarks for sensor integration and system performance.

The European market structure closely parallels North America in its maturity and regulatory focus, driven powerfully by mandatory EU safety directives and machinery regulations which enforce rigorous blind spot visibility standards for all new heavy machinery. This region exhibits a strong preference for ultra-high-quality, factory-fitted camera solutions supplied directly by major European heavy equipment Original Equipment Manufacturers (OEMs). The market shows a high penetration rate of advanced technology, specifically high-resolution thermal and infrared maneuvering systems, fueled by both demanding construction timelines and substantial, coordinated defense spending across key member states such as Germany, the UK, and France. A growing regional emphasis on environmental responsibility and the increasing push toward electric or hybrid heavy machinery designs translates into a specific demand requirement for vision systems that are energy-efficient, lightweight, and engineered for seamless, low-power integration, thereby optimizing battery life and minimizing the overall environmental footprint of the operating vehicle.

The Asia Pacific (APAC) region is decisively projected to achieve the highest Compound Annual Growth Rate (CAGR) globally over the forecast period, representing the epicenter of future market expansion. This explosive growth dynamic is underpinned by extraordinary government-led investment into massive urbanization projects, new infrastructure development across critical economic corridors, and the rapid, large-scale industrialization witnessed across China, India, and various rapidly developing Southeast Asian nations, generating unprecedented demand for construction, material handling, and specialty logistics equipment. While historically focused on cost-efficiency, the market is rapidly migrating towards the adoption of premium, high-resolution, internationally compliant safety solutions, propelled by the increasing entry of international corporations and localized modernization efforts. Furthermore, the burgeoning logistics sector's intense focus on port and warehouse automation makes APAC a critical, high-potential growth hub. Concurrently, smaller but strategically important markets in Latin America and the Middle East & Africa (MEA) are characterized by localized, high-specification demands—such as extreme temperature resilience for mining in Chile or specialized dust-proof systems for oil & gas infrastructure in the UAE—which are often secured through direct, high-value contracts with state-owned enterprises or government bodies demanding bespoke, field-proven solutions.

- North America: Market dominance is fundamentally driven by strict regulatory adherence (e.g., OSHA, FMCSA), high capital availability for advanced technology adoption, and significant military procurement cycles. The major technological focus remains on integrated AI for enabling full or semi-autonomous operations, especially within the large mining and construction enterprise segments, and robust cybersecurity integration.

- Europe: Characterized as a mature, technologically sophisticated market sustained by strong OEM supply chains, mandatory EU-wide safety directives, and a preference for highly integrated, quality-certified systems used in civil construction, forestry, and defense modernization. Strong emphasis on low-power consumption and seamless vehicle bus integration (e.g., CAN, Ethernet).

- Asia Pacific (APAC): Forecasted to exhibit the highest CAGR due to rapid urbanization, massive infrastructure development initiatives (e.g., Belt and Road Initiative), and large-scale industrial fleet modernization efforts across China, India, and emerging economies. Market demand is transitioning from basic compliance to volume procurement of high-resolution digital sensing solutions.

- Latin America (LATAM): Growth is primarily concentrated around the extensive, resource-intensive mining and large-scale agricultural sectors. Demand is specialized, requiring extremely resilient and cost-effective maneuvering camera systems capable of performing reliably in rugged, often isolated terrains and environments subjected to heavy vibration and humidity.

- Middle East and Africa (MEA): Market growth is intrinsically linked to government-backed mega-infrastructure and giga-projects (e.g., NEOM, economic diversification plans) and sustained high investments in the regional oil & gas sector. This drives a necessity for highly specialized camera systems designed specifically to withstand severe environmental challenges such as extreme heat, penetrating sand, and persistent dust exposure, frequently requiring military-grade sealing.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Ground Maneuvering Camera Systems Market, encompassing major Tier 1 suppliers, specialized sensor technology companies, and key defense contractors globally.- Robert Bosch GmbH

- Continental AG

- Stoneridge Inc.

- Brigade Electronics Group PLC

- Safe Fleet (Preco Electronics)

- Magna International Inc.

- Veoneer

- Mobileye (Intel)

- FLIR Systems (Teledyne FLIR)

- WABCO (Zonar Systems)

- BAE Systems

- L3Harris Technologies

- Axis Communications

- Sensata Technologies

- Gentex Corporation

- ZF Friedrichshafen AG

- Denso Corporation

- Samvardhana Motherson Group

- I-Sight Safety Systems

- Commercial Vehicle Group (CVG)

- Hella KGaA Hueck & Co.

- Delphi Technologies (Aptiv)

- Visteon Corporation

- Mitsubishi Electric Corporation

- Advanced Navigation

- Smart Eye AB

- Autoliv Inc.

- Ficosa International S.A.

- Daimler Truck AG

Frequently Asked Questions

Analyze common user questions about the Ground Maneuvering Camera Systems market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary factors driving the growth of the Ground Maneuvering Camera Systems Market?

The market is primarily driven by increasingly strict global safety regulations (e.g., governmental mandates requiring enhanced visibility for heavy machinery, like ISO 5006 standards), the widespread institutional adoption of advanced driver-assistance systems (ADAS) in commercial vehicle fleets, and the continuous technological advancement in sensor fusion and AI-enabled object detection, which collectively improves operational efficiency, minimizes personnel injury risks, and drastically reduces equipment collision damage in complex industrial environments.

How does AI technology specifically enhance the utility of these maneuvering camera systems?

AI integrates sophisticated machine learning algorithms (CNNs) for precise real-time object classification, predictive hazard analysis, and dynamic trajectory path generation, effectively transforming passive camera feeds into proactive decision-support systems. This enables automated critical features like trajectory-based collision warning, highly accurate differentiation between human workers and inanimate obstacles, and complex image enhancement processes in severe low-light or poor weather conditions, which is essential for safely enabling higher levels of vehicle autonomy.

Which end-user segment contributes most significantly to market revenue and why?

The Industrial and Commercial segment, specifically encompassing large-scale construction, mining, and material handling operations, contributes the highest volume of unit sales and thus the largest overall market revenue share. This dominance stems from the massive global fleet size of machinery utilized in these sectors and the critical, mandatory requirement for safety compliance and damage reduction associated with operating high-value, high-inertia equipment in constantly shifting and high-risk operational zones.

What are the main regional differences in the adoption of Ground Maneuvering Camera Systems?

North America and Europe represent mature markets that prioritize the highest specification, factory-fitted, highly integrated systems driven by stringent, well-established labor safety laws and high technology budgets. Conversely, the Asia Pacific (APAC) region is the most rapidly expanding growth market, focusing on high-volume adoption fueled by vast infrastructure investment, rapidly modernizing fleets, and a transition from basic compliance systems toward adopting globally recognized high-resolution digital and networked sensing solutions for long-term fleet standardization.

What major technological challenges currently restrain market growth?

Key restraining factors include the substantial initial capital investment required for deploying complex, multi-sensor, AI-integrated and ruggedized systems, which poses a significant economic barrier for smaller fleet operators. Further technical challenges involve the inherent difficulty and cost associated with successfully integrating advanced digital camera architectures and network protocols with large, aging fleets of legacy analog equipment, and ensuring guaranteed system durability and functional reliability against extreme environmental variables such as corrosive agents, severe shock, and intense thermal cycling.

How significant is the military and defense segment to the overall market?

While the military and defense segment represents a lower volume share compared to commercial industrial applications, it is critically significant due to the high-value nature of contracts and the technological demands. Defense applications necessitate extreme ruggedization (MIL-SPEC), guaranteed secure communications, advanced thermal and night vision capabilities for closed-hatch operations, and integration into existing vehicle management systems (VMS), driving premium pricing and pushing the limits of system reliability and technological advancement for the entire industry.

What role does sensor fusion play in enhancing system reliability?

Sensor fusion is vital for achieving operational reliability, particularly in low-visibility environments. By combining visual camera data with inputs from complementary sensors like thermal imagers, radar, and ultrasonic units, the system mitigates the weaknesses of any single sensor type. For instance, radar and thermal data provide robust object detection and ranging capabilities through dust, fog, or complete darkness, which overcomes the limitations of purely visual optical systems, ensuring continuous situational awareness and fail-safe operation.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager