Grounding Rods Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434440 | Date : Dec, 2025 | Pages : 257 | Region : Global | Publisher : MRU

Grounding Rods Market Size

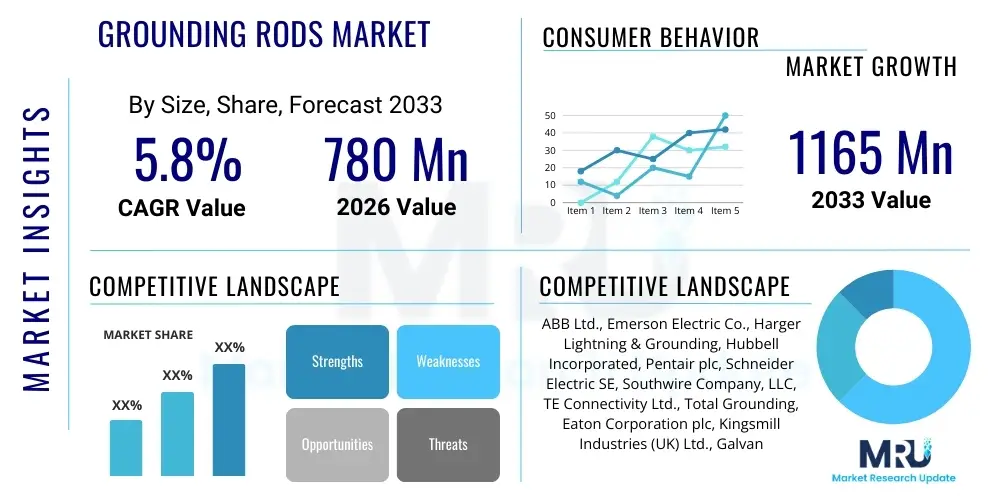

The Grounding Rods Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at $780 Million in 2026 and is projected to reach $1165 Million by the end of the forecast period in 2033.

Grounding Rods Market introduction

The Grounding Rods Market encompasses the manufacture, distribution, and utilization of conductive rods specifically designed to provide a low-resistance path to the earth, ensuring the safety and functional reliability of electrical systems. These rods, typically made of copper, copper-clad steel, or galvanized steel, are essential components in lightning protection systems and electrical grid infrastructure globally. Their primary function is to dissipate dangerous electrical surges, such as those caused by lightning strikes or transient faults, thereby protecting sensitive electronic equipment, human life, and structural integrity. The increasing complexity of modern power distribution networks and the stringent regulatory mandates concerning electrical safety are major catalysts driving sustained market growth, particularly in rapidly urbanizing economies and areas prone to severe weather events. Grounding rods are crucial not just for large-scale utility operations but also for residential and commercial constructions, forming the foundational element of safe electrical installations.

Grounding rods are utilized across a spectrum of critical applications, including power generation stations, transmission and distribution substations, industrial manufacturing facilities, data centers, telecommunications infrastructure, and residential buildings. The increasing demand for reliable energy sources, coupled with significant investments in smart grid technologies, necessitates robust grounding solutions to mitigate system downtime and operational risks. Furthermore, the proliferation of renewable energy sources, such as solar farms and wind power installations, which require extensive grounding systems to handle variable power input and potential surge events, presents a high-growth avenue for the market. The fundamental benefit delivered by high-quality grounding rods is enhanced operational resilience, reducing costly equipment failure and adhering to international safety standards like those set by the IEEE and NEC.

Key driving factors propelling the market include global infrastructure expansion, particularly in emerging economies modernizing their electrical grids, and the continuous growth of data center infrastructure, which demands absolute power stability and protection. Technological advancements in rod coatings and installation techniques, improving corrosion resistance and conductivity, also contribute positively to market expansion. Moreover, escalating concerns over electrical hazards and the implementation of stricter building codes worldwide solidify the irreplaceable role of grounding rods in maintaining public safety and asset integrity. The market is characterized by ongoing innovation focused on optimizing conductivity and longevity under diverse soil conditions and environmental stressors.

Grounding Rods Market Executive Summary

The Grounding Rods Market is experiencing robust growth driven predominantly by global infrastructural upgrades, the rapid build-out of telecommunications networks including 5G installations, and increasing regulatory pressure for robust electrical safety standards across industrial and residential sectors. A key business trend involves manufacturers focusing on advanced materials, particularly copper-clad steel, which offers an optimal balance of cost efficiency, conductivity, and corrosion resistance compared to pure copper or galvanized options. Market players are also observing a shift towards modular and pre-fabricated grounding systems that simplify installation and reduce overall project timelines, meeting the demand from high-volume construction and utility projects. Strategic mergers and acquisitions are common, aimed at consolidating regional distribution networks and integrating specialized manufacturing capabilities, enhancing global supply chain efficiency and responsiveness to fluctuating commodity prices.

Regionally, Asia Pacific (APAC) stands out as the highest-growth market, fueled by massive government investments in power generation capacity, smart city development, and extensive rural electrification programs across countries like China, India, and Southeast Asia. North America and Europe, while mature, maintain steady demand due to continuous grid modernization, replacement of aging infrastructure, and the stringent adoption of renewable energy projects which require sophisticated grounding matrices. Trends in these developed regions often center on premium products and smart grounding solutions integrated with monitoring capabilities. The Middle East and Africa (MEA) are also emerging as significant markets, driven by large-scale commercial construction projects, especially related to oil and gas infrastructure and rapidly expanding urban centers requiring reliable power distribution.

In terms of segmentation, the Utilities sector remains the dominant end-user, accounting for the largest share due to continuous necessity for grounding high-voltage transmission lines and substation equipment. However, the Commercial and Industrial segment, particularly data centers and manufacturing facilities, is projected to exhibit the fastest growth owing to their zero-tolerance policy for power disruption and strict grounding requirements for sensitive machinery. Material-wise, copper-clad steel rods are gaining market share over traditional galvanized steel due to superior performance attributes and lower lifetime cost. The competitive landscape is moderately fragmented, with large international players dominating the premium segment and numerous regional manufacturers serving localized construction and utility needs, leading to continuous price and innovation competition.

AI Impact Analysis on Grounding Rods Market

Common user questions regarding AI's influence on the Grounding Rods Market generally revolve around how artificial intelligence can optimize the design and predictive maintenance of grounding systems, particularly in complex grid environments. Users inquire about the application of machine learning for analyzing soil resistivity data and predicting corrosion rates, which directly impacts rod selection and system longevity. Furthermore, there is significant interest in using AI algorithms to model and simulate lightning strike behavior and fault current paths in large substations, ensuring optimal placement and sizing of grounding rods for maximum safety and efficiency. The key themes summarized from user inquiries indicate high expectations for AI to transform grounding from a reactive, empirical process into a proactive, data-driven discipline, lowering installation costs, improving system reliability, and standardizing global best practices through advanced predictive modeling.

- AI-powered predictive maintenance models for monitoring grounding system integrity and predicting corrosion lifespan.

- Machine learning algorithms optimizing grounding rod design parameters based on real-time geographical and geological data inputs.

- Enhanced simulation and modeling of transient faults and lightning strikes using AI to determine optimal rod placement in complex substations.

- Automation of quality control and inspection processes during the manufacturing of copper-clad and galvanized steel rods.

- Integration of smart sensors with grounding systems (IoT) monitored by AI for real-time performance assessment and anomaly detection.

- Improved logistics and supply chain optimization for grounding rod distribution, adapting to infrastructure project timelines using predictive analytics.

DRO & Impact Forces Of Grounding Rods Market

The Grounding Rods Market is primarily driven by significant global investments in energy infrastructure, mandatory safety regulations, and the expansion of sensitive electronic infrastructure such as data centers and telecommunication towers. These drivers collectively necessitate high-quality, reliable grounding systems to protect assets and ensure continuous operation. Simultaneously, the market faces restraints rooted mainly in volatile raw material costs, particularly copper and steel, which directly impact manufacturing margins and end-product pricing, and the challenge of highly varied soil conditions globally that necessitate customized solutions, complicating standardization. Opportunities abound through the widespread adoption of renewable energy sources, which inherently require extensive grounding systems, and the development of innovative composite materials offering improved conductivity and longevity, positioning the market for technological advancement and expansion into previously challenging geographical areas. These forces create a dynamic environment where regulatory compliance and material innovation are central to competitive success, requiring manufacturers to maintain operational efficiency amidst fluctuating commodity markets.

Key drivers include the global push for smart grid implementation, which requires meticulously grounded digital infrastructure, and the escalating frequency of severe weather events globally, increasing the perceived need for robust lightning protection systems across all asset classes. Another significant driver is the enforcement of stricter electrical codes and standards by international bodies and local governments, making the installation of certified grounding solutions non-negotiable for new construction and substantial retrofitting projects. These drivers establish a baseline demand that is resistant to minor economic downturns, as electrical safety remains a paramount concern. Furthermore, the rapid industrialization in developing nations creates a massive backlog of demand for reliable power distribution infrastructure, integrating grounding rods into large-scale utility expansion projects, ensuring sustained volume growth over the forecast period. The increasing consciousness among industrial operators regarding asset protection and minimized operational downtime further accelerates the adoption cycle.

Restraints are notably complex, involving not only commodity price fluctuations but also competition from alternative grounding technologies, albeit niche, and the challenge of improper installation practices in certain regions that can undermine product performance and lead to regulatory scrutiny. High-quality grounding rod manufacturing requires specialized processes to ensure uniform cladding and minimal resistance, demanding significant capital investment which can limit the entry of new players. The ongoing trade disputes and tariffs affecting global steel and copper flows also introduce market unpredictability, forcing manufacturers to diversify sourcing strategies. Opportunities are strongly linked to innovation in material science, focusing on cost-effective alternatives to copper while maintaining high conductivity, and the penetration of advanced monitoring systems that can assess grounding performance remotely. The growing focus on environmental sustainability also opens opportunities for reusable or sustainably sourced grounding materials, aligning with corporate environmental, social, and governance (ESG) goals and attracting investments from ecologically conscious infrastructure funds.

Segmentation Analysis

The Grounding Rods Market segmentation provides a granular view of demand patterns based on material composition, application sector, and installation type, reflecting the varied requirements of end-users across global infrastructure projects. Material segmentation, covering Copper, Copper-Clad Steel (CCS), and Galvanized Steel, highlights the trade-offs between conductivity, longevity, and cost, with CCS emerging as a significant growth area due to its superior cost-to-performance ratio. Application analysis reveals the high demand originating from the utilities sector for grid infrastructure, alongside the high-growth trajectory observed in the specialized needs of data centers and telecommunication facilities that demand premium, high-reliability grounding solutions. Understanding these segments is critical for manufacturers to tailor their production lines and strategic positioning, focusing either on high-volume, cost-sensitive projects (Galvanized Steel for general construction) or high-specification, critical infrastructure projects (CCS and Copper for utility substations and data centers).

Segmentation by application clearly delineates the market consumption profile, showing that while industrial and commercial constructions utilize standard solutions, the utility and energy sectors drive demand for large-diameter, highly durable rods capable of handling massive fault currents. The residential segment, though highly volume-dependent on housing starts, typically uses lower-specification rods for standard electrical panels. This variance dictates different sales strategies and distribution channels; for instance, utility segment sales often require direct negotiation and long-term supply contracts, while residential products rely heavily on electrical wholesalers and retail hardware chains. Furthermore, the method of installation—driven or modular/chemical—also forms a key segment, reflecting advancements aimed at simplifying setup in challenging terrains like rocky soil or areas with extremely high soil resistivity.

The complexity introduced by diverse environmental factors means that geographical segmentation heavily influences product choice. Regions with high humidity or corrosive soil environments exhibit greater demand for pure copper or heavily protected CCS rods, justifying higher expenditure for long-term system integrity. In contrast, drier, non-corrosive environments might utilize more galvanized steel rods. The forecast emphasizes that segment growth will be disproportionately driven by technological convergence, where modular, easily installable systems that leverage advanced materials will capture market share from traditional, labor-intensive installation methods, signifying a critical shift in product innovation focus over the forecast period.

- By Material:

- Copper Grounding Rods

- Copper-Clad Steel (CCS) Grounding Rods

- Galvanized Steel Grounding Rods

- Stainless Steel Grounding Rods

- By Application:

- Utilities and Energy Sector (Substations, Transmission Lines)

- Industrial (Manufacturing, Petrochemical, Mining)

- Commercial (Data Centers, Hospitals, Airports)

- Residential

- Telecommunications (5G Infrastructure, Cell Towers)

- By Installation Type:

- Driven Rods (Standard Installation)

- Modular and Chemical Grounding Systems

- By Diameter/Size:

- Standard Diameter (1/2 inch, 5/8 inch)

- Large Diameter (3/4 inch, 1 inch and above)

Value Chain Analysis For Grounding Rods Market

The value chain for the Grounding Rods Market starts with the sourcing of primary raw materials, primarily copper, steel, and zinc (for galvanization). Upstream analysis is dominated by major global commodity suppliers, where price volatility directly impacts the downstream manufacturing costs. Key activities at this stage include refining and specialized cladding processes, where steel cores are electroplated or continuously cast with copper, demanding high precision and quality control to ensure uniform thickness and adherence, critical for conductivity and longevity. Manufacturers then convert these raw materials into finished rods, accessories (clamps, couplings), and grounding systems. Production involves cutting, threading, pointing, and rigorous testing to comply with international standards such as UL and IEC, focusing heavily on anti-corrosion treatments and mechanical strength.

Midstream activities primarily involve manufacturing and assembly. This stage is characterized by moderate capital intensity due to the specialized machinery required for copper cladding and threading. Manufacturers often specialize by material type or application focus, leveraging economies of scale for high-volume products like standard CCS rods, or offering customized engineering services for complex utility projects. Effective inventory management is paramount here, balancing the supply of high-cost raw materials with the fluctuating demands of construction and infrastructure cycles. Success at this stage relies heavily on patented cladding technology and efficient waste reduction strategies to manage the inherently high material costs associated with conductive metals.

The downstream component involves distribution and sales, which are bifurcated into direct and indirect channels. Direct sales are common for large utility contracts, where manufacturers interact directly with energy companies or major EPC (Engineering, Procurement, and Construction) firms, often requiring customized product lengths and specific certifications. Indirect sales utilize broad networks of electrical wholesalers, specialized equipment distributors, and retailers (for residential and smaller commercial projects). Distribution is highly regionalized, emphasizing the importance of logistics and warehousing to serve geographically diverse construction sites efficiently. Service provision, including technical support and site-specific grounding analysis, adds significant value at the end of the chain, improving customer loyalty and ensuring correct product application, thereby mitigating safety risks associated with improper installations.

Grounding Rods Market Potential Customers

Potential customers for grounding rods span a wide array of sectors, fundamentally encompassing any entity that requires robust electrical safety and surge protection for their infrastructure or operations. The primary buyers are large utility companies, including state-owned electric grid operators and private power transmission entities, which utilize grounding rods extensively in high-voltage substations, power plants, and along lengthy transmission corridors to ensure grid stability and protect sensitive operational assets. Additionally, major EPC companies executing large-scale infrastructure projects—such as new industrial parks, major transport systems, and large commercial real estate developments—are critical intermediaries that purchase grounding rods in bulk as part of their turnkey electrical installation packages. The requirement for grounding is universally mandated in these construction projects, ensuring steady B2B demand for quality products.

Beyond the traditional utility sector, specialized infrastructure sectors represent high-value potential customers. Data center operators, telecommunications companies (especially those rolling out 5G networks requiring grounding for thousands of new small cells and macro towers), and oil and gas facilities (for pipeline and equipment protection) demand premium, highly reliable grounding systems. These customers prioritize performance, longevity, and adherence to specific standards (e.g., extremely low impedance grounding) over initial cost, making them lucrative targets for manufacturers offering advanced materials and complex grounding matrices. The maintenance and retrofit market also provides continuous demand, as older systems are upgraded or replaced due to corrosion or increased load capacity requirements, ensuring a recurring revenue stream independent of new construction cycles.

Finally, the vast residential and light commercial segments constitute a significant volume market, serviced primarily through established distribution channels like electrical supply houses and hardware retailers. Electricians, building contractors, and specialized lightning protection installers purchase rods regularly for standard home wiring, solar panel installations, and small office buildings. While these individual purchases are smaller, the aggregated volume is substantial. Manufacturers must balance the provision of high-specification, custom products for utility and industrial clients with the efficient, cost-effective mass production required to serve the expansive retail and residential customer base, utilizing distinct marketing and sales strategies for each target group.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $780 Million |

| Market Forecast in 2033 | $1165 Million |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | ABB Ltd., Emerson Electric Co., Harger Lightning & Grounding, Hubbell Incorporated, Pentair plc, Schneider Electric SE, Southwire Company, LLC, TE Connectivity Ltd., Total Grounding, Eaton Corporation plc, Kingsmill Industries (UK) Ltd., Galvan Industries, Inc., Allied Tube & Conduit (Atkore), DEHN SE, East Coast Lightning Equipment, Inc., Lyncole XIT Grounding, LPI Group, Kumwell. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Grounding Rods Market Key Technology Landscape

The technology landscape in the Grounding Rods Market is evolving primarily through material science innovation and advancements in installation methodology aimed at improving conductivity, longevity, and ease of use. A crucial technological focus is the perfection of Copper-Clad Steel (CCS) manufacturing processes, specifically ensuring a high-quality, metallurgical bond between the copper sheath and the steel core to prevent delamination and ensure consistent conductivity over the rod's lifespan. Advances in continuous casting and electroplating techniques are enhancing the uniformity of the copper layer, allowing manufacturers to optimize the copper thickness based on the intended corrosion environment and expected fault current levels, thus maximizing cost-efficiency without compromising performance. Furthermore, the development of specialty alloys and treatments for galvanized rods is aimed at extending the service life in highly corrosive or aggressive soil chemistries, providing a competitive alternative where copper rods are deemed cost-prohibitive. This material optimization is central to meeting the market demand for durable, low-maintenance grounding solutions globally.

Another significant technological development lies in the emergence of chemically enhanced and modular grounding systems. Chemical grounding rods, often filled with highly conductive mineral salts, are utilized in areas characterized by high soil resistivity, where conventional driven rods fail to achieve the required low resistance. These systems offer superior performance in difficult ground conditions by effectively increasing the electrical contact surface area with the soil, creating a highly stable and reliable ground connection. Modular grounding systems, consisting of interconnecting rods and pre-engineered components, simplify complex installations, reducing reliance on specialized labor and project time frames, which is particularly appealing for high-volume deployments like solar farms and telecommunication network rollouts. These modular solutions also often integrate features for future expansion or easy maintenance, reflecting a shift towards systemized rather than standalone grounding components.

The intersection of grounding technology with digital monitoring systems represents a frontier of innovation. The incorporation of IoT sensors directly into or adjacent to the grounding grid allows for continuous, remote monitoring of earth resistance, current flow, and even early detection of rod corrosion or degradation. This smart grounding technology is crucial for critical infrastructure like data centers and major substations, enabling proactive maintenance and ensuring immediate compliance verification. Furthermore, sophisticated software tools are being deployed for site assessment, utilizing geological surveys and machine learning to recommend the optimal type, depth, and placement configuration of grounding rods before physical installation begins. These predictive technologies minimize installation failures and ensure that newly installed systems meet stringent operational requirements from day one, marking a decisive move towards precision engineering in grounding solutions.

Regional Highlights

-

Asia Pacific (APAC): Dominance and High Growth Trajectory

The Asia Pacific region commands the largest market share and is projected to exhibit the fastest Compound Annual Growth Rate (CAGR) during the forecast period. This dominance is intrinsically linked to massive, ongoing investments in critical infrastructure, rapid urbanization, and extensive rural electrification programs, particularly across economic giants such as China, India, and the ASEAN countries. Government initiatives focused on modernizing outdated power grids, constructing smart cities, and supporting large-scale renewable energy projects (solar parks and wind farms) are creating an unprecedented demand for reliable grounding solutions. Furthermore, the burgeoning telecommunications sector, driven by 5G network deployment across the continent, necessitates extensive installation of grounding rods for cell towers and edge data centers. The market here is highly competitive, characterized by a mix of international providers offering premium copper and CCS solutions, and strong regional manufacturers supplying cost-effective galvanized rods for the high-volume construction segment.

A key characteristic of the APAC market is the wide variation in geological and environmental conditions, ranging from highly corrosive coastal areas to dry, rocky inland terrains, which drives demand for diverse product types, including chemical and modular grounding systems tailored for challenging installations. Regulatory enforcement is tightening across key economies, mandating adherence to international safety standards in new construction, thereby ensuring a baseline demand for certified products. The high rate of industrial expansion, especially in manufacturing and heavy industry, further solidifies APAC's position as the primary driver of global grounding rod consumption. The substantial need to protect newly installed high-voltage transmission lines and substation upgrades ensures sustained, large-scale utility purchasing throughout the forecast horizon.

-

North America: Grid Modernization and Data Center Demand

North America represents a mature yet highly valuable market, where growth is primarily fueled by the replacement of aging utility infrastructure and the unparalleled expansion of the data center industry. Utility companies in the United States and Canada are undertaking significant grid modernization efforts, transitioning from conventional power systems to smart grids that require meticulous grounding to protect sensitive digital controls and communication equipment. The region exhibits a high preference for premium materials, notably high-quality copper and specialized copper-clad steel, driven by stringent regulatory requirements (NEC, IEEE standards) and the focus on long-term reliability and minimal maintenance costs. The market is less price-sensitive compared to emerging regions, prioritizing performance and certification.

The colossal investment in Hyperscale and Colocation data centers across key hubs like Virginia, Texas, and Quebec is a principal factor driving demand. These critical facilities require extensive, low-impedance grounding grids to ensure zero downtime and protection against transient surges, pushing manufacturers to innovate in modular and integrated grounding systems. Furthermore, the growth of rooftop solar and large utility-scale solar installations across the Sun Belt states contributes steadily to the grounding rod requirement. Manufacturers focus heavily on optimizing logistics and maintaining strong distribution partnerships with specialized electrical contractors who manage the complex installation requirements typical of large-scale infrastructure projects in this region, ensuring consistent market performance.

-

Europe: Regulatory Compliance and Renewable Energy Integration

The European market is defined by exceptionally strict environmental and electrical safety regulations, driving the adoption of high-performance grounding rods and innovative installation techniques. Growth is moderately steady, supported strongly by the continuous push toward renewable energy sources, particularly offshore and onshore wind farms, which require bespoke and highly durable grounding solutions resistant to harsh weather and corrosive environments. Grid interconnections and cross-border power transmission projects also necessitate substantial grounding infrastructure, ensuring reliability across the continental network. Western European countries often lead in adopting specialized chemical grounding systems and advanced monitoring technologies to manage high soil resistivity challenges prevalent in certain geological areas.

Eastern Europe is showing accelerated growth rates, catching up with Western counterparts through EU-backed infrastructure funding aimed at improving power grid stability and reliability. A unique regional demand driver is the retrofitting of older industrial facilities and public infrastructure to comply with updated EU safety directives. European manufacturers emphasize sustainability and material sourcing transparency, aligning their products with circular economy principles. Competition often centers on product innovation, durability certifications, and the ability to provide integrated safety solutions that go beyond the grounding rod itself, encompassing full lightning protection systems and surge protective devices, maintaining the region's focus on high-quality engineered solutions.

-

Latin America: Infrastructure Development and Electrification

The Latin American market is characterized by significant potential, driven by ongoing infrastructure development, particularly in Brazil, Mexico, and Chile. Investments in mining, oil and gas, and expansion of power distribution networks to remote and underdeveloped areas fuel the demand for grounding rods. The market faces unique challenges related to diverse climate zones and high levels of informal construction in some areas, necessitating a dual approach: high-specification rods for formal utility projects and cost-effective, durable rods for general construction. Volatility in local currencies and political instability can occasionally impact project timelines, making demand somewhat cyclical. However, the foundational need for reliable electrical safety drives long-term market interest.

-

Middle East and Africa (MEA): Large-Scale Project Driven Demand

Growth in the MEA region is strongly tied to mega-projects, including new city developments (like NEOM in Saudi Arabia), expansion of oil and gas processing facilities, and rapid urbanization across major African nations. The extreme arid conditions and often highly saline coastal environments necessitate the use of premium, corrosion-resistant grounding materials, with specialized copper and thick-clad CCS rods being preferred. Demand is largely project-based and concentrated in the utility, energy, and commercial construction sectors. Investment in telecommunications infrastructure, particularly in Africa, is also a significant market catalyst, requiring robust protection against electrical surges in remote locations.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Grounding Rods Market.- ABB Ltd.

- Emerson Electric Co.

- Harger Lightning & Grounding

- Hubbell Incorporated

- Pentair plc

- Schneider Electric SE

- Southwire Company, LLC

- TE Connectivity Ltd.

- Total Grounding

- Eaton Corporation plc

- Kingsmill Industries (UK) Ltd.

- Galvan Industries, Inc.

- Allied Tube & Conduit (Atkore)

- DEHN SE

- East Coast Lightning Equipment, Inc.

- Lyncole XIT Grounding

- LPI Group

- Kumwell

- ERITECH

- A.D. Engineering International

Frequently Asked Questions

Analyze common user questions about the Grounding Rods market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary factors driving the growth of the Grounding Rods Market?

Market growth is primarily driven by global infrastructure development, extensive power grid modernization projects (smart grids), strict enforcement of electrical safety regulations worldwide, and the rapid expansion of sensitive electrical loads in industrial, data center, and telecommunications sectors requiring robust surge protection.

How does the choice of material affect the performance and cost of grounding rods?

Material choice directly impacts cost, conductivity, and corrosion resistance. Pure copper offers the highest conductivity but is expensive. Galvanized steel is the most cost-effective but has lower conductivity and corrosion resistance. Copper-Clad Steel (CCS) provides an optimal balance, offering good conductivity and durability at a moderate price point, making it increasingly popular for utility applications.

Which region currently holds the largest share in the Grounding Rods Market?

The Asia Pacific (APAC) region currently holds the largest market share and is projected to experience the highest growth rate, fueled by massive infrastructure investments, urbanization, and ambitious renewable energy targets across countries like China and India.

What role does technology play in modern grounding systems?

Technology enhances grounding systems through material science (e.g., advanced CCS manufacturing), the development of specialized chemical and modular installation systems for difficult terrains, and the integration of IoT and AI for real-time remote monitoring and predictive maintenance of the grounding grid integrity.

What is the significance of the Utilities and Energy segment for grounding rod demand?

The Utilities and Energy segment is the largest end-user, demanding high-specification grounding rods and systems for substations, power generation facilities, and transmission lines to manage massive fault currents and ensure the functional stability and safety of the entire electrical grid infrastructure.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager