Group Purchasing Organization Service Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 431732 | Date : Dec, 2025 | Pages : 255 | Region : Global | Publisher : MRU

Group Purchasing Organization Service Market Size

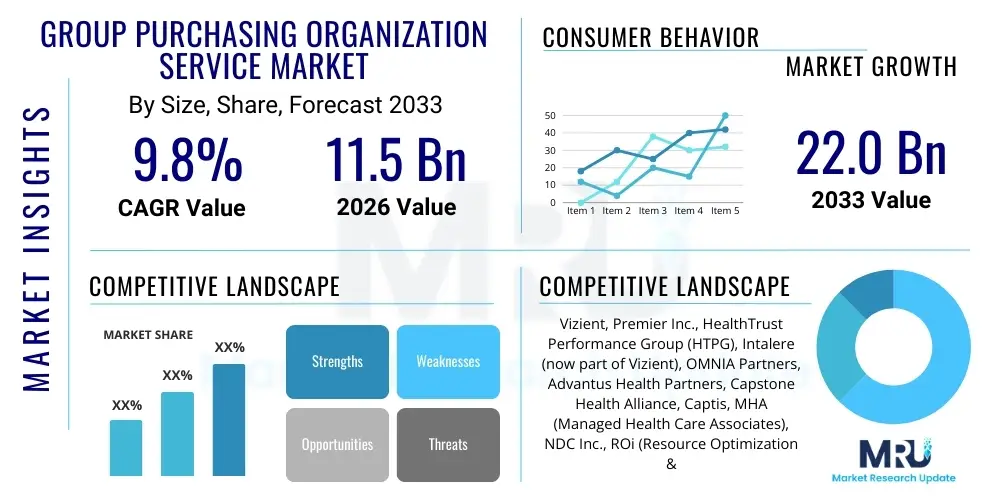

The Group Purchasing Organization Service Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 9.8% between 2026 and 2033. The market is estimated at USD 11.5 Billion in 2026 and is projected to reach USD 22.0 Billion by the end of the forecast period in 2033. This robust growth trajectory is primarily fueled by the escalating pressure on healthcare providers and organizations across diverse industries to optimize operational efficiency, standardize procurement processes, and significantly reduce supply chain expenditures. Group Purchasing Organizations (GPOs) provide crucial economies of scale by aggregating demand, enabling members to access high-quality products, equipment, and services at preferential, negotiated pricing that would be unattainable individually. The quantifiable return on investment offered by GPO services, particularly in managing indirect spend and complex capital equipment acquisition, cements its necessity in highly competitive and cost-sensitive operational environments.

Furthermore, market expansion is intrinsically linked to the increasing complexity of global supply chains and the stringent regulatory environment in critical sectors such as healthcare and pharmaceuticals. GPOs are transitioning beyond mere cost reduction to offering comprehensive value-added services, including clinical utilization data analysis, supply chain resilience strategies, and technology implementation support. The shift towards integrated performance management, where GPOs act as strategic partners rather than transactional intermediaries, significantly broadens their market appeal. Geographically, North America currently dominates the market due to established healthcare infrastructure and high adoption rates of formal procurement management services, though the Asia Pacific region is expected to demonstrate the fastest growth rate, driven by expanding healthcare infrastructure and the formalization of purchasing practices in emerging economies.

Group Purchasing Organization Service Market introduction

The Group Purchasing Organization Service Market encompasses the range of strategic and operational services provided by GPOs to their member organizations, facilitating the purchase of goods, equipment, and services at reduced costs. A GPO acts as an intermediary, leveraging the collective buying power of its members (which can include hospitals, schools, hotel chains, and manufacturing firms) to negotiate favorable contract terms and pricing with vendors and suppliers. These services are crucial for organizations striving to maintain high operational quality while managing increasingly tight budgetary constraints. Key offerings extend beyond basic contracting to include compliance monitoring, supply chain data analytics, clinical integration support, and logistics optimization, providing holistic spend management solutions.

Major applications of GPO services span critical operational areas, most prominently within the healthcare sector where they manage everything from medical surgical supplies and pharmaceuticals to IT systems and facility maintenance services. Outside of healthcare, GPOs are increasingly vital in education, hospitality, and corporate environments for managing office supplies, energy procurement, and outsourced services. The principal benefits derived from utilizing GPO services include immediate cost savings, streamlined administrative overhead associated with vendor management, enhanced transparency in procurement, and access to a standardized portfolio of vetted, high-quality products. GPO membership effectively shifts the burden of extensive vendor qualification and contract negotiation from the individual entity to the specialized GPO.

The primary driving factors propelling market growth include the escalating global cost of goods and services, forcing organizations to aggressively seek external cost containment strategies. Regulatory shifts, such as those emphasizing transparency and quality metrics in healthcare, necessitate sophisticated supply chain management tools that GPOs are equipped to provide. Furthermore, the push towards digitalization in procurement, integrating systems like Enterprise Resource Planning (ERP) and electronic health records (EHR) with GPO purchasing data, enhances efficiency and visibility, making GPO services an indispensable component of modern institutional management. The desire for supply chain resilience following global disruptions also drives organizations to leverage GPOs' broad vendor networks for reliable supply assurance.

Group Purchasing Organization Service Market Executive Summary

The Group Purchasing Organization Service Market is positioned for substantial expansion, characterized by a fundamental shift from transactional purchasing to strategic partnership models. Current business trends indicate a strong move toward vertical integration and specialization, particularly in the highly complex healthcare segment, where GPOs are acquiring or partnering with data analytics firms and supply chain technology providers to offer sophisticated clinical and operational insights. Non-healthcare sectors, such as manufacturing and hospitality, are also seeing increased GPO penetration focused heavily on managing indirect spend categories and sustainability compliance. Innovation is centered around enhancing contract management lifecycle tools and improving data interoperability between GPOs and their members' procurement platforms, thus delivering superior overall value beyond simple discount aggregation.

Regional trends reveal the continued maturity and dominance of the North American market, largely due to the sheer volume and complexity of its healthcare ecosystem, which mandates efficient cost management mechanisms. However, Asia Pacific (APAC) is emerging as the fastest-growing region, driven by rapid urbanization, the privatization of healthcare, and increasing awareness of the benefits of centralized purchasing among nascent hospital chains and corporate entities. European markets are characterized by diverse national GPO models, with growing efforts toward cross-border collaboration and standardization, particularly in managing high-cost medical devices and pharmaceutical procurement under varying regulatory frameworks. The common thread globally is the prioritization of resilient and ethical sourcing, pushing GPOs to audit and verify their suppliers rigorously.

Segmentation trends highlight the increasing importance of technology and specialized service types. The segment of 'Strategic Sourcing and Consulting Services' is gaining significant traction over traditional administrative fee models, as members seek tailored advice on utilization standardization and clinical preference management. End-User analysis confirms that the Healthcare segment remains the primary revenue contributor, but the emergence of robust GPOs catering exclusively to specialized sectors like education and municipalities is diversifying the market landscape. Technology integration, specifically in areas of predictive analytics for demand forecasting and automated invoice processing, is revolutionizing how GPOs operate, driving efficiency and minimizing human error across all service models.

AI Impact Analysis on Group Purchasing Organization Service Market

User inquiries concerning the impact of Artificial Intelligence (AI) on the GPO Service Market largely revolve around three core themes: cost optimization potential, enhancement of contract negotiation efficacy, and the future of manual procurement tasks. Common questions include whether AI can replace human negotiators, how machine learning can predict supply shortages, and if AI tools will make smaller, non-tech-savvy GPOs obsolete. Users are particularly keen on understanding AI's role in processing massive datasets (EHR data, supply chain metrics) to identify non-obvious cost-saving opportunities or hidden risk factors within vendor contracts. The general expectation is that AI will transform GPOs from reactive intermediaries to proactive, predictive strategic partners, necessitating significant technological investment but promising unprecedented operational precision.

The integration of AI and Machine Learning (ML) is fundamentally changing the service delivery model of GPOs. AI algorithms are now deployed to perform advanced predictive spend analysis, forecasting member demand with significantly higher accuracy than traditional statistical models. This predictability allows GPOs to negotiate better volume commitments and hedge against price volatility for critical supplies. Furthermore, natural language processing (NLP) capabilities are being utilized to rapidly audit complex vendor contracts, ensuring compliance, identifying favorable or unfavorable clauses, and comparing contract terms against market benchmarks in real time. This dramatically reduces the cycle time for new contract implementation and ongoing oversight.

AI also plays a vital role in demand aggregation and inventory management for GPO members. By analyzing historical purchasing data, clinical utilization rates, and external market signals, AI systems can optimize inventory levels, minimizing waste and preventing stock-outs for high-volume items. This advanced analytical capability enhances the value proposition of the GPO by providing actionable intelligence that directly impacts member profitability and patient care quality. The future trajectory involves leveraging generative AI for personalized vendor communications and hyper-efficient robotic process automation (RPA) to handle routine administrative tasks like invoice matching and purchase order generation, allowing GPO personnel to focus solely on high-value, strategic interactions.

- AI-driven predictive analytics optimize demand forecasting, leading to superior contract negotiation leverage and lower unit costs.

- Machine Learning enhances contract compliance monitoring by automatically scanning terms and identifying deviations or risks.

- Natural Language Processing (NLP) accelerates the review and comparison of complex, multi-layered vendor agreements, significantly speeding up onboarding.

- Robotic Process Automation (RPA) reduces administrative costs by automating repetitive procurement tasks like invoice processing and supplier vetting documentation.

- AI supports clinical integration by correlating supply consumption data with patient outcomes, driving standardization toward evidence-based best practices.

- Smart contracts utilizing blockchain and AI enhance transparency and automated fulfillment across the supply chain, minimizing disputes.

- Generative AI tools are used for drafting optimized Requests for Proposal (RFPs) and customizing member communications based on specific purchasing profiles.

DRO & Impact Forces Of Group Purchasing Organization Service Market

The Group Purchasing Organization (GPO) Service Market is currently shaped by a powerful confluence of Driving forces (D), Restraints (R), and Opportunities (O), which collectively define the Impact Forces governing its growth trajectory. The primary driver is the pervasive, unrelenting need for cost containment across highly regulated industries, particularly healthcare, where supply chain expenditure represents a significant portion of operating budgets. GPOs offer a proven, immediate mechanism to achieve these savings. However, the market faces restraints, chiefly stemming from ongoing regulatory scrutiny regarding transparency and anti-competitive practices, forcing GPOs to invest heavily in robust compliance frameworks. This complexity creates a significant barrier to entry for smaller players. The major opportunities lie in expanding value-added services beyond basic contracting—focusing on integrating technology, offering clinical consulting, and establishing resilient, ethically sourced global supply networks.

The internal and external Impact Forces operate dynamically. Internally, the push for digital transformation drives investments in advanced analytics and data integration tools, maximizing efficiency. Externally, the shift in healthcare payment models towards value-based care strengthens the GPO value proposition, as efficient supply utilization directly correlates with quality metrics and reimbursement success. Furthermore, the volatility witnessed during recent global events (like the pandemic) has amplified the need for GPOs that can guarantee supply continuity and diversify sourcing options, elevating supply chain resilience from a desired feature to a mandatory requirement. Conversely, internal resistance from individual member organizations—particularly large systems preferring self-contracting—and skepticism about contract depth pose continuous headwinds that GPOs must strategically overcome.

These forces mandate that GPOs continually evolve their business models. Drivers necessitate aggregation and scale, while restraints demand impeccable ethical standards and reporting capabilities. Opportunities encourage specialization in niche service areas, such as pharmaceutical aggregation or capital equipment refurbishment programs. The overall impact force structure favors established GPOs with broad networks, sophisticated data infrastructure, and strong member loyalty built upon transparent operations and measurable cost reduction delivered consistently year-over-year. Smaller GPOs must find specific, high-value niches, often leveraging technology partnerships to compete effectively with industry giants that benefit from monumental economies of scale.

Segmentation Analysis

The Group Purchasing Organization Service Market is analyzed through critical segmentation parameters including Service Type, End-User, and Operational Model. Analyzing these segments provides a detailed understanding of market dynamics, growth pockets, and competitive intensity across different verticals. The differentiation among service types—spanning from purely administrative contract management to complex, integrated supply chain consulting—reflects the maturation of the market and the varying needs of member organizations. While administrative services remain foundational, the demand is significantly shifting toward consultative and strategic support, where GPOs help members optimize utilization, manage clinical preferences, and achieve long-term operational standardization. The healthcare segment dominates the end-user landscape due to the sheer volume of managed spend, but the non-healthcare sectors, driven by standardized procurement needs in areas like facility management and IT, are accelerating their adoption rates and shaping niche market structures.

- By Service Type:

- Strategic Sourcing and Contract Management

- Procurement Management and Automation

- Supply Chain Consulting and Optimization

- Clinical Utilization Management

- Data Analytics and Benchmarking Services

- By End-User:

- Healthcare (Hospitals, IDNs, Ambulatory Surgical Centers, Long-Term Care)

- Non-Healthcare (Education, Hospitality, Government/Public Sector, Manufacturing)

- By Operational Model:

- Administrative Fee Model (Vendor paid)

- Membership Fee Model (Member paid)

- Hybrid/Performance-Based Model

- By Product Category:

- Medical/Surgical Supplies

- Pharmaceuticals

- Capital Equipment

- Non-Medical Supplies (IT, Facilities, HR)

Value Chain Analysis For Group Purchasing Organization Service Market

The Group Purchasing Organization (GPO) service value chain is distinctively complex, centered around aggregation and negotiation rather than physical manufacturing. The upstream segment involves the foundational activities of supplier identification, vetting, and relationship management. GPOs must continuously identify innovative, reliable, and compliant vendors globally. This phase requires significant investment in market intelligence and supplier audits to ensure quality and adherence to ethical sourcing standards. Successful upstream activities result in a broad, high-quality portfolio of potential contracts, ready for negotiation. Inefficiencies here directly translate to limited contract depth and higher costs for members downstream, making robust due diligence a critical competitive differentiator.

The core of the value chain is the contract negotiation and management phase, where the GPO leverages aggregated member volume to secure highly preferential pricing and terms. This central phase is supported by sophisticated legal teams, specialized commodity experts, and data analysts who model potential savings and market benchmarks. Distribution channels for GPO services are primarily indirect; the GPO negotiates the contract, and the products are typically fulfilled directly from the vendor or via third-party distributors (e.g., medical distributors like Owens & Minor or McKesson). The GPO's role is transactional oversight and strategic optimization, ensuring members access the negotiated terms seamlessly. Direct channels are rare but can occur when a GPO owns a distribution arm or a specific private-label product line.

The downstream value chain focuses heavily on service delivery to the end-users (members). This involves providing essential support services such as implementation assistance, compliance training, invoice auditing, and utilization consulting. Effective downstream operations rely on strong technological integration—ensuring the GPO's contract pricing accurately loads into the member's procurement systems (ERP/EHR). Value is created here through continuous monitoring and reporting, demonstrating verifiable savings and offering specialized clinical consulting to drive standardization. GPOs that successfully manage the entire lifecycle—from identifying niche suppliers upstream to maximizing member adoption downstream—capture the highest market share and demonstrate the strongest member retention rates.

Group Purchasing Organization Service Market Potential Customers

The potential customers and end-users of Group Purchasing Organization services represent any organization with substantial recurring operational expenditures that benefits significantly from economies of scale, standardization, and professional contract management. Traditionally, the predominant buyers are complex institutional entities within the healthcare sector, including Integrated Delivery Networks (IDNs), large standalone hospitals, regional health systems, community hospitals, and specialized ambulatory care facilities. These organizations face immense pressure to balance high quality of care with increasing costs for medical devices, pharmaceuticals, and sophisticated technology. GPOs provide the essential infrastructure to manage this complexity, acting as strategic allies in clinical and non-clinical procurement efforts.

Beyond healthcare, the fastest-growing segment of potential customers resides in the non-healthcare sectors that increasingly seek GPO discipline to manage indirect and non-core spend. This includes major educational institutions (K-12 school districts and large universities), large multinational hospitality chains (hotels and restaurant groups), and organizations within the manufacturing and government sectors. These entities utilize GPOs primarily for managing common categories such as IT hardware/software, utility services, office supplies, fleet management, and facility maintenance contracts. The appeal lies in consolidating fragmented spending and gaining access to specialized contracts without needing dedicated in-house procurement expertise across numerous commodity groups.

A burgeoning segment involves specialized niche entities, such as non-profit organizations, regional alliances, and specialized provider groups like dental chains or veterinary clinics. For these smaller customers, GPO services unlock access to pricing that is otherwise reserved for the largest market players, providing them with a critical competitive edge. The decision criteria for all potential customers focus heavily on the GPO’s contract portfolio depth, demonstrated savings track record, technology platform compatibility, and the quality of supplementary consulting and data analysis services offered, making the GPO a strategic rather than purely transactional investment.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 11.5 Billion |

| Market Forecast in 2033 | USD 22.0 Billion |

| Growth Rate | 9.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Vizient, Premier Inc., HealthTrust Performance Group (HTPG), Intalere (now part of Vizient), OMNIA Partners, Advantus Health Partners, Capstone Health Alliance, Captis, MHA (Managed Health Care Associates), NDC Inc., ROi (Resource Optimization & Innovation), Conductiv, Equify, SourceTrust, US Foods CHEF’STORE, Acurity, Texas Purchasing Group (TPG), Prodigo Solutions, Supply Chain Services LLC, Group Purchasing Alliance (GPA). |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Group Purchasing Organization Service Market Key Technology Landscape

The Group Purchasing Organization Service Market is undergoing a rapid technological transformation, moving away from legacy, siloed procurement systems toward integrated, data-driven platforms. The core technology stack relies heavily on robust cloud-based Enterprise Resource Planning (ERP) systems customized for multi-organizational procurement, providing scalability and seamless data exchange between the GPO, its members, and third-party vendors. Crucially, the deployment of advanced data warehousing and visualization tools is essential for handling the massive volume of transactional data generated by thousands of members. This technological infrastructure supports real-time spend analytics, benchmarking against national data sets, and generating customized reports detailing savings realization and contract utilization performance for each member entity, enhancing transparency and accountability.

Beyond foundational ERP and data infrastructure, specialized technologies are driving innovation and differentiation. Artificial Intelligence (AI) and Machine Learning (ML) are increasingly used for predictive modeling, particularly for demand forecasting of critical supplies, anticipating price fluctuations, and identifying compliance gaps in complex contracts. Integration capabilities, specifically Application Programming Interfaces (APIs), are vital for ensuring the GPO’s contract catalog and pricing data can integrate directly and efficiently with member organization systems (e.g., Electronic Health Records or inventory management software). This seamless integration capability is a major competitive factor, minimizing the administrative burden and accelerating the realization of negotiated savings for members.

Emerging technologies like Blockchain are also being piloted to enhance supply chain provenance and verification, especially concerning high-risk or high-value items like pharmaceuticals and surgical implants. Blockchain offers an immutable record of product origin and transaction history, dramatically improving supply chain security and reducing counterfeit risks, thereby increasing trust in GPO-sourced products. Furthermore, advanced digital contracting platforms are being adopted to manage the complexity of multi-year, multi-option contracts, offering dynamic updates and automated alerts for contract renewals and performance milestones. GPOs are effectively becoming B2B Software-as-a-Service (SaaS) providers, wrapping sophisticated technology around their core negotiation expertise.

Regional Highlights

Regional dynamics play a crucial role in shaping the Group Purchasing Organization Service Market, primarily influenced by local regulatory environments, the maturity of the healthcare sector, and cultural attitudes toward centralized procurement. North America (NA), driven overwhelmingly by the United States, represents the largest and most mature market. The extensive penetration of GPOs in US healthcare, largely due to a fragmented payer system and high costs, has established a sophisticated service ecosystem. Key activities in NA focus on clinical integration, high-level data consultancy, and adapting to value-based care models, pushing GPOs to offer complex performance management services rather than simple contract aggregation. The high degree of competition means GPOs must continuously innovate and demonstrate quantifiable savings through advanced technology and broad supplier diversity initiatives.

Europe exhibits a fragmented market, where national health systems (like the NHS in the UK or centralized systems in France and Germany) utilize varying degrees of centralization. Growth in Europe is steady, focused on standardization across countries, particularly concerning high-value medical devices and pharmaceuticals procured under EU directives. GPOs in this region often work closely with public sector buying entities, facing stringent transparency and sustainability requirements. The structure is characterized by both public-sector GPOs and strong, private, multinational groups aiming to harmonize procurement standards across different national markets. The emphasis here is often on maintaining supplier competition while ensuring compliance with diverse national procurement laws.

The Asia Pacific (APAC) region is forecasted to be the fastest-growing market globally. This surge is driven by rapid investment in healthcare infrastructure, the rise of large private hospital chains in countries like India, China, and Southeast Asia, and the nascent adoption of formalized procurement strategies. Many APAC organizations are bypassing early-stage manual processes and directly implementing modern, integrated GPO platforms and supply chain solutions. The lack of deeply established legacy systems allows for quicker adoption of advanced cloud-based technologies. Challenges include supply chain fragmentation, varying quality control standards across manufacturing hubs, and the need for GPOs to build robust, localized vendor networks to manage regional logistical complexities. Latin America (LATAM) and the Middle East & Africa (MEA) present emerging opportunities, primarily focused on basic cost reduction and ensuring reliable access to essential supplies, with growth dependent on economic stability and infrastructure investment.

- North America (US & Canada): Dominant market share; characterized by high GPO penetration in healthcare; focus on clinical integration, advanced analytics, and strategic capital planning services. Regulatory compliance demands are extremely high.

- Europe: Stable growth driven by centralization efforts and harmonization of purchasing across EU member states; strong emphasis on public sector procurement efficiencies and sustainable sourcing practices.

- Asia Pacific (APAC): Highest CAGR forecast; fueled by expanding private healthcare sector and rapid infrastructure development; market driven by the immediate need for formalized, transparent cost control mechanisms.

- Latin America (LATAM): Emerging market; growth tied to economic stability and modernization of healthcare systems; demand concentrated on securing stable supply chains and managing pharmaceutical costs.

- Middle East and Africa (MEA): Growth driven by government investment in health services and diversification away from oil economies; GPOs aid in securing international vendor relationships and ensuring quality standards.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Group Purchasing Organization Service Market.- Vizient

- Premier Inc.

- HealthTrust Performance Group (HTPG)

- OMNIA Partners

- Intalere (now part of Vizient)

- Advantus Health Partners

- Capstone Health Alliance

- Captis

- MHA (Managed Health Care Associates)

- NDC Inc.

- ROi (Resource Optimization & Innovation)

- Conductiv

- Equify

- SourceTrust

- US Foods CHEF’STORE

- Acurity

- Texas Purchasing Group (TPG)

- Prodigo Solutions

- Supply Chain Services LLC

- Group Purchasing Alliance (GPA)

Frequently Asked Questions

Analyze common user questions about the Group Purchasing Organization Service market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary cost benefits of joining a Group Purchasing Organization (GPO)?

The primary benefit is immediate access to preferential contract pricing achieved through the collective purchasing power of the GPO’s large membership base. This typically results in substantial cost reductions on medical supplies, equipment, pharmaceuticals, and non-clinical operational goods, alongside reduced administrative overhead from simplified vendor management and streamlined procurement processes.

How does AI technology specifically enhance the value proposition of GPO services?

AI enhances GPO value by enabling predictive analytics for demand forecasting, optimizing inventory recommendations for members, and rapidly analyzing complex vendor contracts using Natural Language Processing (NLP). This leads to smarter negotiation strategies, minimized supply chain risk, and ensures accurate compliance monitoring, moving the GPO beyond transactional support to strategic, data-driven partnership.

What is the difference between a GPO's Administrative Fee Model and a Membership Fee Model?

In the Administrative Fee Model, the GPO is compensated directly by the vendors or suppliers based on sales volume generated through the GPO contract. In the Membership Fee Model, the GPO is compensated directly by its member organizations through subscription or annual fees. The Administrative Fee Model is more common, particularly in healthcare, but the Membership Fee Model often promotes higher perceived transparency.

Are GPO services primarily limited to the healthcare industry?

While the healthcare sector represents the largest revenue segment, GPO services are increasingly utilized across diverse non-healthcare sectors, including education, hospitality, manufacturing, and government/public sector entities. These non-healthcare GPOs focus on aggregating spend for indirect goods and services such as IT, utilities, maintenance, and facility supplies.

What are the major compliance challenges facing the Group Purchasing Organization Service Market?

Major compliance challenges revolve around navigating complex anti-kickback statutes, ensuring complete price transparency concerning administrative fees, and adhering to strict governmental regulations (especially in US healthcare and European public procurement). GPOs must maintain robust auditing and disclosure practices to ensure ethical operations and build trust among members and regulators.

How do GPOs contribute to supply chain resilience and risk mitigation for their members?

GPOs enhance supply chain resilience by diversifying vendor portfolios globally, reducing single-source dependency, and proactively monitoring supplier financial health and geographic stability. Their aggregated market intelligence allows them to anticipate major disruptions, secure prioritized access to essential goods during crises, and implement contingency planning for critical supply categories, providing a significant buffer for individual members.

What role does clinical utilization play in modern GPO service offerings?

Modern GPOs integrate clinical utilization management by analyzing data that correlates purchased supplies with patient outcomes. This capability allows the GPO to work with clinicians to standardize the use of cost-effective, clinically superior products, moving beyond simply reducing acquisition cost to optimizing the total cost of care and ensuring product standardization aligns with evidence-based best practices.

What is strategic sourcing, and how is it different from traditional procurement management services?

Traditional procurement focuses on transactional activities like issuing purchase orders and managing inventory. Strategic sourcing, a key GPO service, is a systematic, data-intensive approach that analyzes organizational spend, evaluates market opportunities, vets suppliers rigorously, and negotiates long-term, relationship-based contracts aimed at maximizing value, quality, and standardization, rather than just securing the lowest immediate price.

Why is the Asia Pacific (APAC) region expected to show the fastest growth rate in this market?

APAC growth is driven by massive investment in private hospital infrastructure, rapidly expanding demand for standardized, high-quality medical supplies, and the formalization of procurement practices in emerging economies. Organizations in APAC are increasingly recognizing that centralized GPO models are essential to manage rapid expansion while maintaining cost control and supply quality standards, leapfrogging older, fragmented purchasing systems.

How are smaller GPOs competing effectively against dominant industry leaders like Vizient and Premier?

Smaller GPOs compete by focusing on niche specialization (e.g., catering exclusively to dental clinics, specific capital equipment, or non-acute care), offering personalized, localized consulting services, and leveraging flexible, cutting-edge technology platforms that often integrate faster and more seamlessly than legacy systems used by larger competitors. They aim for depth of service within a narrow segment rather than breadth.

What impact did the COVID-19 pandemic have on the demand for Group Purchasing Organization services?

The pandemic significantly heightened the demand for GPO services, particularly their ability to secure critical Personal Protective Equipment (PPE) and other essential medical supplies during periods of extreme scarcity. It underscored the critical value of GPOs' established vendor networks, market intelligence, and collective strength in managing global supply chain volatility and mitigating future risk.

What are Integrated Delivery Networks (IDNs), and why are they significant customers for GPOs?

IDNs are healthcare systems comprising multiple facilities, including hospitals, clinics, and physician groups, operating under shared governance. They are significant customers because GPOs help them achieve seamless clinical and operational standardization across all their disparate sites, maximizing the systemic savings potential and providing necessary data visibility across the entire network to measure performance accurately.

How do GPOs handle pharmaceutical purchasing, given the specialized nature of drug contracts?

GPOs handle pharmaceutical purchasing through dedicated pharmacy programs that aggregate drug volumes, negotiate rebates, manage distribution logistics, and support formulary standardization. They use sophisticated models to navigate complex pricing tiers, biosimilar introduction, and generic drug strategies, often establishing specialized sub-GPOs or partnerships focusing solely on pharmaceutical supply chain management.

What is the role of blockchain technology in the future of GPO services?

Blockchain is being explored to create secure, immutable records of transactions and product provenance throughout the supply chain. This improves transparency, reduces the risk of counterfeit medical products, automates verification processes, and simplifies audits, particularly for highly regulated and sensitive product categories, enhancing overall supply chain integrity for GPO members.

How do GPOs ensure the quality and safety of products sourced through their contracts?

GPOs employ rigorous supplier vetting processes, including financial reviews, site visits, quality assurance audits, and regulatory compliance checks (e.g., FDA, ISO standards). They utilize clinical advisory boards, composed of member clinicians, to review products and ensure that contract offerings meet or exceed necessary safety and performance standards before being added to the contract portfolio for member access.

What kind of data analytics services do GPOs provide to their members?

GPOs provide sophisticated data analytics covering spend benchmarking, contract utilization rates, variance analysis, and clinical correlation reports. These services help members identify areas of non-compliance, pinpoint opportunities for product standardization, compare their costs against regional and national averages, and measure the tangible financial impact derived from GPO contract adoption, enabling informed strategic decision-making.

How does the shift to value-based care payment models affect the GPO market?

The shift to value-based care strengthens the GPO market position, as these models necessitate higher quality outcomes at lower costs. GPOs support this by driving standardization toward proven, high-value products and providing utilization data that helps members manage clinical variation, directly supporting the financial success required under value-based reimbursement frameworks.

In the hospitality sector, what products or services are most frequently sourced through GPOs?

In the hospitality sector, GPOs primarily source high-volume operational goods and indirect services, including food and beverage supplies, linens, operating technology (POS systems), energy contracts, facility maintenance services, and insurance policies. This consolidation allows chains to achieve brand consistency and significant cost reduction across geographically dispersed properties.

What is meant by the term "clinical preference items" in GPO contracting?

Clinical preference items are products, often high-cost medical devices or specialty implants (like orthopedic joints or cardiac stents), where purchasing decisions are heavily influenced by the specific training, historical practice, and individual choice of the physician. GPOs address this by involving clinicians early in the contracting process to balance cost savings with clinical efficacy and drive consensus toward standardization.

How are GPOs addressing the growing market demand for sustainable and ethically sourced products?

GPOs are increasingly incorporating Environmental, Social, and Governance (ESG) criteria into their supplier vetting process. They require vendors to provide documentation regarding labor practices, carbon footprint, and waste reduction efforts. Many GPOs have established supplier diversity programs and sustainability initiatives, favoring suppliers who meet specific ethical and environmental performance benchmarks to satisfy rising member and societal demands.

What is a key challenge for GPO expansion into the European market?

A key challenge in the European market is the fragmentation of national healthcare systems and diverse national procurement laws, requiring GPOs to customize their service models significantly for each country. Furthermore, navigating cultural resistance to centralized procurement, especially in countries with deeply entrenched local supplier relationships, presents a barrier to large-scale, pan-European contract standardization.

How important is membership size to the success and competitiveness of a GPO?

Membership size is critically important as it directly correlates with purchasing volume, which is the primary leverage tool in negotiations with vendors. Larger membership translates to greater volume commitments, enabling GPOs to secure deeper discounts, more favorable contract terms, and access to unique supplier performance incentives, thus reinforcing their competitive advantage and value proposition to members.

What kind of services do GPOs offer concerning capital equipment acquisition?

For capital equipment, GPOs offer services that go beyond mere discounts. This includes technology assessment and consulting (helping members choose the right equipment), lifecycle cost analysis, managing complex multi-year financing arrangements, equipment refurbishment programs, and securing favorable maintenance and warranty contracts. They help members manage these large, long-term investments strategically.

Why is data interoperability a critical factor for GPO service effectiveness?

Data interoperability ensures seamless and accurate transfer of contract pricing and utilization data between the GPO's systems and the member's ERP/EHR platforms. Poor interoperability leads to manual errors, off-contract purchasing, and inability to track savings accurately. High interoperability is essential for maximizing savings realization and providing timely, accurate performance reporting to members.

What distinguishes a hybrid operational model in the GPO market?

A hybrid operational model combines elements of both administrative fees (vendor paid) and membership fees (member paid). This model allows the GPO to secure basic funding through vendor fees while offering specialized, high-value consulting or analytics services on a fee-for-service basis to members, providing greater flexibility, transparency, and diversified revenue streams for the GPO.

How are GPOs leveraging technology to improve transparency in pricing?

GPOs are utilizing secure, individualized online portals and advanced reporting dashboards to provide members with real-time access to their contract pricing, utilization metrics, and the administrative fee structure related to their purchases. This digital transparency empowers members to audit their own spending and confirm that they are receiving the contracted savings effectively, addressing historical concerns about pricing clarity.

What is meant by the term "supply chain consulting" as a GPO service?

Supply chain consulting involves GPOs using their expertise to advise members on optimizing internal logistics, inventory management protocols, warehousing strategies, and distribution network design. Unlike contracting, this service focuses on improving the member's operational efficiency downstream, often resulting in additional savings beyond the contract price through waste reduction and process optimization.

How are GPOs supporting the growth of small and diverse suppliers?

GPOs actively develop supplier diversity programs that mandate targets for contracting with certified small, minority-owned, and women-owned businesses. They provide technical assistance and streamlined onboarding processes for these suppliers, helping them navigate the complexities of large-scale contracting and increasing the resilience and ethical profile of the GPO's overall supplier base.

What factors constrain the growth of GPOs in developing regions like Africa?

Growth constraints in regions like Africa include infrastructural deficiencies, volatile currency exchange rates, high import duties, limited technological adoption by potential members, and a highly fragmented supply base. GPOs entering these markets must overcome logistical hurdles and often need to tailor contracts to smaller volumes and more localized vendor requirements, requiring significant initial investment.

Why is standardization of products across an organization a key goal supported by GPOs?

Standardization is crucial because it reduces product variety, simplifies inventory management, minimizes staff training requirements, and, most importantly, maximizes purchasing volume for fewer products. By reducing clinical variation through standardization, GPOs help members secure the highest volume discounts and reduce non-labor operating costs significantly across the entire system.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager