Grouting Material Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433363 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Grouting Material Market Size

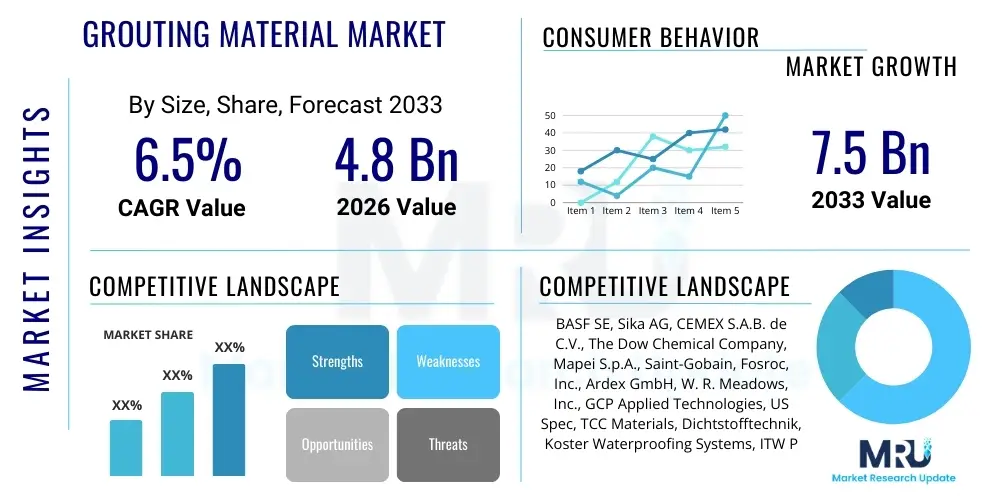

The Grouting Material Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at USD 4.8 Billion in 2026 and is projected to reach USD 7.5 Billion by the end of the forecast period in 2033.

Grouting Material Market introduction

The Grouting Material Market encompasses a diverse range of chemical formulations and mixtures primarily used in construction and civil engineering for filling voids, cracks, or gaps, stabilizing soil and structures, and providing waterproofing or load-bearing capabilities. These materials, which include cementitious grouts, chemical/resin grouts (epoxy, polyurethane, acrylic), and bituminous grouts, are essential components in maintaining the structural integrity and longevity of both new infrastructure projects and existing assets requiring repair or rehabilitation. The market is fundamentally driven by global infrastructure development, urbanization trends, and the necessity for continuous maintenance and retrofitting of aging public works.

Grouting materials find major applications across sectors such as building and construction (tiling, anchoring, pre-stressing), large-scale infrastructure projects (dams, tunnels, bridges, railways), and specialized industrial uses (mining, oil & gas well sealing). Their primary benefits include enhanced structural stability, effective water blockage, corrosion protection, and improved durability of constructed facilities. High-performance grouts, particularly those based on advanced polymers and resins, are increasingly favored for critical applications demanding high compressive strength, rapid setting times, and superior chemical resistance.

The primary driving factors sustaining market growth include unprecedented levels of government spending on resilient infrastructure projects globally, particularly in emerging economies of Asia Pacific. Furthermore, the growing awareness regarding preventative maintenance and the shift towards sophisticated sealing and repair methodologies in geotechnical and structural engineering contribute significantly. Technological advancements focusing on developing eco-friendly, low-shrinkage, and self-consolidating grouting materials are also expanding the scope of application and accessibility of these critical construction chemicals.

Grouting Material Market Executive Summary

The Grouting Material Market is poised for stable expansion, underpinned by robust business trends emphasizing sustainable construction practices and high-performance material usage. Key industry participants are focusing heavily on product innovation, specifically in formulating cementitious grouts with reduced carbon footprints and chemical grouts offering greater flexibility and durability for demanding applications like seismic retrofitting and high-speed rail construction. Mergers and acquisitions remain a central strategy for market leaders seeking to consolidate regional market shares and expand their technological portfolios, particularly in specialized domains such as precision machinery grouting and deep foundation injection techniques.

Regional trends indicate that Asia Pacific (APAC) will maintain its dominance in terms of market size and growth rate, propelled by massive infrastructure investments in China, India, and Southeast Asian nations. North America and Europe, while more mature, exhibit significant demand for specialized, high-specification grouts driven by extensive maintenance projects aimed at extending the lifespan of critical infrastructure, tunnels, and aging wastewater systems. The Middle East and Africa (MEA) are emerging as high-growth regions, fueled by large-scale urban development projects and increasing demands for efficient sealing materials in the energy and mining sectors.

Segmentation analysis highlights the cementitious segment retaining the largest market share due to its cost-effectiveness and widespread use in general construction and mass-filling applications. However, the chemical/resin grouts segment, encompassing polyurethane and epoxy formulations, is projected to register the fastest CAGR, driven by their superior performance characteristics in extreme environments requiring waterproofing, rapid repair, and exceptional strength. Application-wise, the Infrastructure segment is the principal driver of demand, reflecting the global backlog of necessary bridge, road, and utility rehabilitation projects.

AI Impact Analysis on Grouting Material Market

Common user questions regarding AI's impact on the Grouting Material Market frequently center on its role in predictive maintenance, optimization of mix designs, and automated quality control during large-scale injection projects. Users are keen to understand if AI can minimize material waste, predict long-term performance under various environmental stresses, and enhance the safety and precision of deep injection processes. The overarching expectation is that AI and machine learning will transition the industry from traditional, experience-based formulation and application methods to data-driven, highly efficient, and adaptive processes, particularly for complex geotechnical stabilization tasks where precise material delivery is crucial.

- AI-driven Predictive Analytics: Used for monitoring structural health and predicting the precise timing and required volume of repair grouting, moving away from scheduled maintenance cycles.

- Optimized Mix Design: Machine learning algorithms analyze raw material variability and performance requirements to automatically generate optimal, high-performance, and sustainable grout formulations.

- Automated Quality Control (AQC): AI vision systems monitor grout consistency and injection parameters (pressure, flow rate) in real-time on-site, ensuring adherence to strict specifications and minimizing human error.

- Supply Chain and Inventory Management: AI models predict regional demand fluctuations for specific grout types, optimizing warehousing and distribution logistics, particularly for temperature-sensitive chemical grouts.

- Robotics and Automated Injection: Integration of AI with robotic systems to perform precise, deep-level grout injection in hazardous or inaccessible locations, enhancing project safety and accuracy.

- Environmental Impact Minimization: AI simulation tools assess the life cycle analysis of different grout compositions, guiding manufacturers toward materials with lower embodied carbon and improved longevity.

DRO & Impact Forces Of Grouting Material Market

The market dynamics are defined by a complex interplay of strong infrastructure drivers, material cost volatility, and increasing pressure for sustainable solutions. The primary driver is the pervasive need for civil engineering rehabilitation and new mega-project construction globally. Restraints primarily revolve around the high capital investment required for specialized polymer-based grouts and the regulatory hurdles associated with chemical components, particularly those impacting water resources. Opportunities lie significantly in developing high-specification, rapidly deployable grouting materials for emergency repairs and disaster mitigation, coupled with geographical expansion into underserviced construction markets.

Impact forces currently skew positively toward growth, primarily driven by government initiatives globally to upgrade and expand essential public utilities such as water retention structures, transportation networks, and mining infrastructure. These sectors demand grouting solutions capable of extreme durability and reliability. However, the volatility in the price of key petrochemical derivatives used in resin-based grouts (e.g., epoxy, polyurethane monomers) consistently poses a challenge to manufacturer profitability and pricing stability, forcing constant innovation in filler materials and composite blending techniques.

Furthermore, the increasing global emphasis on sustainable construction practices presents a dual challenge and opportunity. While environmental regulations can act as a restraint by restricting the use of certain chemical additives, they simultaneously open vast avenues for companies investing in green cementitious alternatives, bio-based polymers, and recycled content in their grouting products. The market's resilience is tied to its indispensable role in structural preservation, ensuring consistent, although sometimes fluctuating, demand irrespective of short-term economic cycles.

Segmentation Analysis

The Grouting Material Market is segmented based on material type, application, and end-user, providing a granular view of demand patterns and technological adoption across the construction industry. The segmentation reveals a mature but evolving market where traditional materials like cement grouts coexist with high-growth, high-value specialty chemical grouts designed for demanding engineering specifications. Understanding these segments is crucial for manufacturers aiming to optimize their product portfolio to meet specific structural, geotechnical, or waterproofing requirements in various construction phases, from foundation stabilization to post-tensioning element protection.

- By Product Type:

- Cementitious Grout (Microfine Cement, Standard Cement)

- Chemical/Resin Grout (Epoxy, Polyurethane, Acrylic, Polyester)

- Bentonite Grout

- Others (Bituminous, Lime)

- By Application:

- Building & Construction (Tiling, Anchoring, Pre-stressing)

- Infrastructure (Bridges, Dams, Tunnels, Roads, Railways)

- Mining

- Oil & Gas (Well Sealing, Annulus Filling)

- By End-Use Sector:

- Residential

- Commercial

- Industrial

- Public Utilities

Value Chain Analysis For Grouting Material Market

The value chain for the Grouting Material Market is complex, stretching from the extraction and processing of raw materials (upstream) to the specialized application on construction sites (downstream). Upstream activities involve sourcing bulk commodities like cement clinker, various polymers, mineral fillers (silica sand, fly ash), and specialized chemical additives. Due to the reliance on petrochemicals for resin-based grouts, input costs are highly sensitive to the global oil and gas market. Key manufacturers often engage in backward integration or establish long-term supply contracts to mitigate volatility and ensure quality control over specialized additives that determine the final material performance.

Midstream processing involves manufacturing, blending, and packaging the final grouting products. This phase requires significant investment in mixing equipment, quality assurance laboratories, and packaging infrastructure, ensuring the finished product maintains its chemical stability and application properties, such as precise viscosity and setting time. Manufacturers must adhere to stringent regional and international construction standards, necessitating rigorous testing protocols before distribution. Innovation at this stage focuses on developing ready-to-use, pre-packaged systems to simplify on-site application and reduce mixing errors.

The downstream component includes distribution channels, which are bifurcated into direct sales to large engineering, procurement, and construction (EPC) firms for massive infrastructure projects, and indirect channels through specialized distributors, retailers, and dedicated construction material suppliers for smaller contractors and residential repair work. Direct channels allow for specialized technical support and customized product solutions, which is critical for complex geotechnical projects. Indirect channels ensure broad market reach and accessibility. The technical nature of advanced grouting often requires manufacturers to provide extensive on-site training and technical support to ensure correct application and optimal performance.

Grouting Material Market Potential Customers

The primary customers for grouting materials span across multiple sectors, united by the common need for structural integrity, void filling, and water management. Potential customers include major EPC contractors specializing in large-scale infrastructure, geotechnical engineering firms focused on foundation and soil stabilization, and specialized construction chemical applicators. These customers require materials certified for high performance, often demanding customized formulations for projects involving high hydrostatic pressure, seismic activity, or extreme temperature variations. Product specification is heavily influenced by consulting engineers and architects who mandate specific performance criteria.

Another significant segment comprises municipal and government bodies, particularly public works departments responsible for maintaining and rehabilitating critical infrastructure like water reservoirs, sewer systems, and public transportation networks. These entities are frequent buyers of cementitious and polyurethane grouts for sealing leaks, repairing concrete structures, and stabilizing railway ballast. For these large institutional buyers, the longevity, cost-effectiveness, and compliance with public safety standards are paramount purchasing criteria.

Lastly, the residential and commercial building sectors constitute a consistent market base, driven by smaller contractors and DIY enthusiasts. These end-users utilize standard cementitious grouts and basic epoxy kits for tiling, crack repair, and residential foundation sealing. While the volume per transaction is lower, the frequency is high. The transition towards pre-mixed and easy-to-apply products caters specifically to this segment, emphasizing ease of use and availability through standard construction supply retailers.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.8 Billion |

| Market Forecast in 2033 | USD 7.5 Billion |

| Growth Rate | 6.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | BASF SE, Sika AG, CEMEX S.A.B. de C.V., The Dow Chemical Company, Mapei S.p.A., Saint-Gobain, Fosroc, Inc., Ardex GmbH, W. R. Meadows, Inc., GCP Applied Technologies, US Spec, TCC Materials, Dichtstofftechnik, Koster Waterproofing Systems, ITW Performance Polymers, Master Builders Solutions (MBCC Group), The Euclid Chemical Company, Hexion Inc., Five Star Products, Cimbria. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Grouting Material Market Key Technology Landscape

The Grouting Material market is increasingly leveraging advanced chemical engineering and material science to enhance product performance, durability, and application efficiency. A pivotal technological trend is the development of ultra-fine particle size cementitious grouts (microfine cement), which offer superior penetration capabilities into fine cracks and porous soil structures compared to traditional Portland cement. This technology is critical for pre-injection curtain grouting in tunneling and deep foundation stabilization where precision and minimal disturbance are essential. Furthermore, significant research focuses on incorporating nano-materials, such as carbon nanotubes and modified silica fume, to improve the compressive strength and reduce the permeability and shrinkage of cement-based systems, extending the service life of repaired structures.

In the chemical grouting segment, polyurethanes and advanced epoxies dominate the innovation landscape. Polyurethane grouts are engineered for high-speed water stopping and sealing applications, leveraging formulations that react instantly with water to form impermeable, flexible foams or solid gels. The focus here is on developing controllable reaction times and enhanced chemical resistance for aggressive environments, such as sewage systems. Epoxy grouts, conversely, are being improved for machine base plate grouting, requiring extremely high early and ultimate compressive strengths, low heat generation, and zero shrinkage characteristics, achieved through modified amine curing agents and specialized fillers.

The application technology sector is also evolving rapidly, emphasizing automation and precision. Key innovations include specialized injection equipment for multi-component resin systems that ensures accurate mixing ratios immediately before injection, thus minimizing waste and maximizing performance predictability. Furthermore, the integration of sensors (IoT) and computational fluid dynamics (CFD) modeling allows engineers to simulate grout flow and predict penetration depths in complex geological formations, moving geotechnical grouting from an art to a precise, data-driven science. This confluence of material science and digital technology is defining the next generation of grouting solutions, prioritizing speed, sustainability, and structural integrity.

The adoption of sustainable and low-emission grouting solutions represents a major technological pivot. Manufacturers are heavily investing in alkali-activated materials (AAMs) and geopolymers as replacements for traditional cement, significantly reducing CO2 emissions associated with clinker production. Simultaneously, the focus on developing solvent-free and low-volatile organic compound (VOC) chemical grouts addresses stringent health and environmental regulations, particularly in confined space applications. These technological shifts are not merely incremental improvements but represent foundational changes aimed at meeting future infrastructure demands while adhering to global climate goals.

Additionally, self-consolidating grouts (SCG) are gaining traction, especially in precast and complex structural connections where conventional vibration techniques are impractical. These materials utilize sophisticated superplasticizers and viscosity-modifying admixtures (VMAs) to achieve high fluidity without segregation, ensuring uniform filling of intricate voids and complex geometries, thereby simplifying placement and accelerating construction schedules. The technological challenge lies in maintaining the balance between high flowability and structural performance, a hurdle that continuous polymer and admixture research is actively addressing across the industry's leading research facilities.

Another crucial area of innovation involves hybrid grouts that combine the best properties of both cementitious and resin systems, such as cement-epoxy composites. These hybrid formulations offer enhanced flexibility and bonding strength compared to pure cement systems, while being more cost-effective than pure resin systems. Such materials are particularly useful in repair applications requiring good chemical resistance coupled with high structural stability and are poised to capture a significant share of the structural rehabilitation market segment in the coming decade. The ability to tailor the material properties via smart blending technologies is a core competency driving competition among market leaders.

Regional Highlights

- Asia Pacific (APAC): APAC is the largest and fastest-growing market, driven by massive infrastructure expansion, particularly in China, India, and ASEAN countries. The demand is high across all segments, but especially for cost-effective cementitious grouts in large civil engineering projects (dams, high-speed rail, ports). Rapid urbanization and the resultant need for residential and commercial repair also fuel significant consumption of general-purpose grouts.

- North America: Characterized by high demand for specialized, high-performance grouts, primarily for the repair, maintenance, and rehabilitation of aging transportation and utility infrastructure. Strict environmental regulations promote the adoption of low-VOC chemical grouts and microfine cement for precise geotechnical applications, especially in urban environments and seismic zones.

- Europe: The market is mature, emphasizing technological quality, sustainability, and advanced engineering solutions. Demand is driven by structural preservation, tunnel construction, and offshore energy infrastructure maintenance. European regulations heavily favor low-carbon and eco-friendly grouting solutions, making it a hub for polymer and geopolymer grout innovation.

- Latin America: This region shows strong potential due to increasing government investments in mining infrastructure, energy projects, and urbanization. Brazil and Mexico are key markets, focusing on both standard cementitious grouts for residential builds and specialized systems for large industrial facility development and maintenance.

- Middle East and Africa (MEA): Growth is tied to large-scale construction projects (Expo sites, mega-cities, oil & gas facilities). The challenging climatic conditions (high heat, salinity) necessitate highly durable, high-specification grouts for concrete protection and deep foundation work, driving demand for specialized epoxy and modified cement systems.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Grouting Material Market.- BASF SE

- Sika AG

- CEMEX S.A.B. de C.V.

- The Dow Chemical Company

- Mapei S.p.A.

- Saint-Gobain

- Fosroc, Inc.

- Ardex GmbH

- W. R. Meadows, Inc.

- GCP Applied Technologies

- US Spec

- TCC Materials

- Dichtstofftechnik

- Koster Waterproofing Systems

- ITW Performance Polymers

- Master Builders Solutions (MBCC Group)

- The Euclid Chemical Company

- Hexion Inc.

- Five Star Products

- Cimbria

Frequently Asked Questions

Analyze common user questions about the Grouting Material market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary differences between chemical and cementitious grouting materials?

Cementitious grouts are typically based on Portland cement, cost-effective, and used for mass filling and standard structural applications. Chemical or resin grouts (epoxy, polyurethane) are high-performance materials offering superior strength, rapid setting, excellent waterproofing, and resistance to chemicals, used primarily for intricate repairs and specialized geotechnical stabilization.

Which application segment drives the highest demand for grouting materials globally?

The Infrastructure application segment, encompassing bridges, tunnels, dams, and public utility rehabilitation projects, is the largest demand driver. These large-scale projects require significant volumes of grouting material for structural stabilization, pre-stressing cable protection, and water ingress control, driving consistent market volume.

How does the volatility of raw material prices affect the profitability of the grouting material market?

Volatility significantly impacts the cost structure, particularly for chemical/resin grouts which rely on petrochemical derivatives (monomers and polymers). Manufacturers must frequently adjust pricing or absorb costs, leading to pressure on profit margins, especially if long-term supply contracts are not secured to stabilize input costs.

What is the future outlook for sustainable grouting material adoption?

The outlook is highly positive. Driven by stringent environmental regulations and corporate sustainability mandates, there is a strong shift toward developing and adopting green solutions like microfine cement with supplementary cementitious materials (SCMs), geopolymers, and low-VOC chemical grouts. Sustainability is expected to be a major competitive differentiator.

What is the function of polyurethane grout and where is it most effectively used?

Polyurethane grout is primarily used for rapid water stopping and sealing applications. When injected, it reacts quickly with water to form an impermeable, flexible barrier (foam or gel). It is highly effective in geotechnical applications, such as tunnel sealing, controlling ground water flow, and leak repair in concrete structures.

What is the role of additives in modern grouting formulations?

Additives are crucial for tailoring the performance characteristics of grouting materials. These include superplasticizers to enhance fluidity, expansive agents to compensate for shrinkage, accelerators or retarders to control setting time, and viscosity modifying agents (VMAs) to prevent segregation, ensuring the grout meets precise project specifications and application requirements.

How are grouting materials classified based on compressive strength?

Grouting materials are typically classified into non-shrink grouts (used for load-bearing applications like machine bases, requiring high compressive strength, often >8,000 psi), standard structural grouts, and flexible grouts (used primarily for sealing and crack repair, prioritizing flexibility over high strength). The specific performance standard depends heavily on the intended structural application.

What technical advancements are making microfine cement grouts increasingly relevant?

Microfine cement grouts utilize particles measuring typically less than 10 micrometers, allowing deep penetration into tight fissures and fine-grained soils where traditional cement particles cannot pass. Advancements focus on enhanced grinding technology and specialized dispersants to maintain suspension stability and maximize penetration effectiveness for critical foundation stabilization.

In which regional market is demand for specialized epoxy grouts highest?

Demand for specialized, high-performance epoxy grouts is particularly high in North America and Europe. This is driven by advanced industrial applications, such as precision grouting for heavy machinery, structural anchoring in seismic zones, and corrosive environment protection in chemical plants and processing facilities, where zero shrinkage and high chemical resistance are mandatory.

What is AEO and GEO optimization in the context of this market report?

AEO (Answer Engine Optimization) and GEO (Generative Engine Optimization) involve structuring the content, using explicit headings, providing direct answers (like in FAQs and summaries), and using semantic tagging (like and specific IDs) to make the report easily digestible, indexable, and directly usable by AI models and modern search engine generative features.

What is the difference between injection grouting and void filling?

Injection grouting typically involves forcing low-viscosity material under pressure into cracks, joints, or soil to seal leaks or stabilize ground conditions. Void filling involves filling larger, accessible cavities (e.g., behind tunnel linings, abandoned pipes) often using flowable, lower-strength materials, primarily for load transfer and preventing subsidence rather than sealing.

How does the mining sector utilize specialized grouting solutions?

The mining sector heavily uses grouting for ground consolidation, stabilizing rock formations, sealing water inflows into mine shafts and tunnels, and backfilling excavated voids to maintain structural integrity and safety. Specialized grouts, including certain resin and cementitious foaming grouts, are engineered for rapid deployment and high resistance to groundwater chemistry.

What are the main constraints facing the adoption of acrylic grouts?

Acrylic grouts, while offering excellent flexibility and very low viscosity, face constraints due to their relatively lower structural strength compared to cement or epoxy. Furthermore, concerns regarding the environmental profile of certain acrylic monomers and regulatory pressures in some regions can limit their use outside of niche waterproofing applications.

What factors influence the selection of a non-shrink grout for machinery baseplates?

Selection is critical and influenced by the equipment's vibration level, the load applied, required curing speed, and temperature exposure. Essential material characteristics include exceptional compressive strength, minimal to zero shrinkage (often achieved through controlled expansion), excellent flowability to fill complex spaces completely, and resistance to oil and chemicals.

What is the definition of thixotropy in relation to grouting materials?

Thixotropy is the property of some gels or fluids to become less viscous when subjected to stress (like mixing or pumping) and subsequently revert to a higher viscosity (thicker, less flowable state) when at rest. This property is crucial for vertical and overhead grouting applications where the material must flow during placement but stiffen immediately afterward to prevent sagging or runoff.

How does the Grouting Material Market contribute to sustainable infrastructure?

The market contributes by supplying durable repair and stabilization materials that extend the service life of existing infrastructure, delaying demolition and reducing resource consumption. Furthermore, the development of low-carbon cements and recycled material content in grouts directly reduces the embodied carbon footprint of construction and rehabilitation projects globally.

What role does the oil and gas sector play in the specialized grouting market?

The oil and gas sector requires specialized high-performance grouts, primarily for well cementing (sealing the annular space between the casing and the borehole), often under extreme pressure and temperature conditions. Demand is focused on materials that offer high durability, low permeability, and resistance to aggressive downhole fluids to ensure long-term well integrity and safety.

Why is quality control crucial for pre-stressing tendon grouting?

Quality control is vital because the grout protects the critical steel tendons within pre-stressed concrete structures (like bridges) from corrosion and provides structural connection. Improper grout quality, insufficient filling, or excessive bleed can lead to tendon failure, compromising the structural integrity and safety of the entire structure, necessitating high-specification, non-bleeding, flowable grouts.

What are the key technical challenges in applying polyurethane grouts?

The main challenges involve controlling the speed and extent of the reaction with water, especially in variable flow conditions. Proper application requires specialized equipment for accurate two-component mixing and injection pressure management, as improper mixing can lead to weak, inconsistent foam structures or incomplete sealing.

How are government regulations impacting the market, particularly in Europe?

European regulations, such as REACH, heavily influence the market by restricting the use of certain chemicals in resin formulations, pushing manufacturers toward safer, low-toxicity, and low-emission products. Furthermore, public procurement policies increasingly mandate the use of products with lower embodied carbon, favoring sustainable cement alternatives.

What is the significance of the Base Year 2025 in the market report forecast?

The Base Year 2025 serves as the reference point for calculating the projected market growth (CAGR) from 2026 to 2033. It represents the most current, fully analyzed market size and structure used as the foundation for future projections, incorporating the most recent economic and developmental data trends.

Which factors contribute to the Asia Pacific region being the fastest-growing market?

The rapid growth is attributable to massive government-led infrastructure investment programs, fast-paced urbanization, and a high volume of new construction activities. Countries like India and China drive enormous demand for basic and specialty construction materials necessary to support expanding cities and transportation networks.

Explain the concept of 'Bleed' in grouting materials and its importance.

Bleed refers to the separation of water from the solid constituents of the grout mix after placement. Excessive bleed is detrimental as it creates voids and reduces the compressive strength of the hardened material, leading to poor adhesion and structural weakness, particularly critical in pre-stressed concrete applications.

What are geopolymers and how are they changing the cementitious segment?

Geopolymers are innovative, inorganic polymers formed by activating natural minerals (like fly ash or slag) with alkaline solutions. They are fundamentally changing the cementitious segment by offering highly durable, high-strength alternatives to traditional Portland cement, significantly reducing CO2 emissions associated with clinker production, aligning with green building standards.

In the Value Chain, why is the technical support component so crucial for high-end grouts?

For high-end, specialized grouts (e.g., geotechnical resins, precision epoxies), correct application procedures are highly technical and site-specific. Technical support ensures the material is mixed, injected, and cured precisely according to specifications, maximizing the product's performance and preventing costly structural failures that could arise from misuse.

How do Grouting materials prevent seismic damage in structures?

Grouting is used in seismic retrofitting by strengthening foundations, stabilizing liquefiable soils, and injecting specialized flexible grouts into structural joints to enhance ductility and absorb energy during seismic events, preventing collapse and minimizing structural damage.

What are the implications of digital transformation on grout distribution channels?

Digital transformation is streamlining distribution by enabling e-commerce platforms for smaller contractors, optimizing inventory through predictive demand forecasting (GEO influence), and utilizing digital tools for tracking specialized, time-sensitive material deliveries, enhancing efficiency and reducing logistics costs.

What is the typical difference in cost between a standard cementitious grout and an advanced epoxy grout?

Standard cementitious grouts are generally the most cost-effective option on a volume basis. Advanced epoxy grouts are significantly more expensive, often costing several times more due to the higher cost of petrochemical raw materials, specialized additives, and the superior performance (strength, non-shrink, chemical resistance) they deliver in critical applications.

Why are tunnels and subway systems major consumers of grouting materials?

Tunnels and subway systems constantly battle water ingress, soil settlement, and structural movement. Grouting is essential for stabilizing the surrounding rock and soil, sealing pre-cast segments, and performing corrective injection grouting to mitigate leaks and ensure the long-term operational safety and integrity of the subterranean structures.

How is AI specifically being utilized to improve grout manufacturing processes?

In manufacturing, AI optimizes the grinding and blending processes, analyzes sensor data from mixers to ensure homogeneity, and models the impact of subtle raw material variations on the final product consistency and performance, leading to tighter quality control and reduced batch-to-batch variability.

What defines a good 'flowability' characteristic for a grouting material?

Good flowability refers to the grout's ability to flow and fill voids or cracks completely under low pressure without segregating or bleeding. It is often measured using standardized tests like the flow cone method. High flowability is vital for filling dense networks of cracks or highly intricate machine baseplates.

Which segments of the Grouting Material Market are most susceptible to high raw material price fluctuations?

The Chemical/Resin Grout segment, particularly epoxy and polyurethane formulations, is the most susceptible, as they are derived from petrochemical sources (monomers and polymers) whose prices are directly correlated with crude oil market volatility.

What is the significance of the Forecast Year range (2026 - 2033) in the market report?

The 2026–2033 period represents the duration for which future market trends, growth rates, and size projections are calculated. This timeframe is chosen to provide a medium-to-long term view, offering strategic planning insight for stakeholders regarding investment and market entry decisions.

How do manufacturers ensure the durability and longevity of grouting materials?

Manufacturers ensure durability through rigorous R&D focused on minimizing shrinkage, maximizing compressive strength, and enhancing resistance to chemical attack, freeze-thaw cycles, and water permeability. Accelerated aging tests and field performance data validation are crucial steps in this process.

What is the primary function of bentonite grouts in the construction industry?

Bentonite grouts are primarily used for low-strength sealing and anti-seepage applications, such as constructing impermeable barriers (slurry walls), sealing boreholes, and low-pressure ground stabilization. Their natural swelling capacity when exposed to water makes them effective barriers against migration.

How does the market distinguish between residential and commercial end-use sectors?

The residential sector typically utilizes standard, off-the-shelf cementitious grouts for tiling and basic home repair. The commercial sector demands higher-specification materials, often epoxies or specialized polymers, for larger, high-traffic areas, structural repairs, and specialized industrial flooring or anchoring.

What is the technical challenge of grouting post-tensioning tendons?

The key technical challenge is ensuring complete void filling along the entire length of the duct, preventing air pockets and bleed water accumulation, which could lead to corrosion of the steel strands. This requires highly flowable, non-bleeding, and non-segregating grouts placed under monitored pressure to fully encapsulate the tendons.

Why is the control of heat of hydration important in mass grouting applications?

In mass applications (like large dams or foundation fills), the heat generated by cement hydration must be carefully controlled. Excessive heat can lead to thermal cracking upon cooling, compromising the structural integrity of the grout. Manufacturers use specific cement types and admixtures to manage this exothermic reaction effectively.

Which companies are recognized leaders in advanced chemical grouting technology?

Companies such as Sika AG, BASF SE (through Master Builders Solutions), and Fosroc are recognized leaders, leveraging extensive R&D capabilities to produce proprietary polyurethane, epoxy, and acrylic formulations optimized for high-demand waterproofing and structural repair applications globally.

How are advancements in 3D printing impacting the application methods of grouting materials?

While 3D printing focuses mainly on concrete, the technology influences grouting by requiring specialized, high-flow, rapid-setting cementitious and polymer-modified grouts to fill the complex structural voids and joints created by 3D-printed building components, ensuring structural connections meet performance requirements.

What safety concerns are paramount when working with chemical grouts?

Safety concerns include exposure to volatile organic compounds (VOCs), isocyanates (in polyurethane), and irritants (in epoxy curing agents). Proper ventilation, use of personal protective equipment (PPE), and adherence to material safety data sheets (MSDS) are critical during mixing and application to mitigate health risks.

What strategic advantage does backward integration offer to market participants?

Backward integration (controlling raw material supply, such as specialized resins or mineral fillers) offers strategic advantages by ensuring stable supply chain resilience, mitigating raw material price volatility, maintaining stringent quality control over input materials, and ultimately improving cost competitiveness.

What defines the difference between a filler and an additive in a grout mixture?

A filler (e.g., sand, fly ash) is an inert bulk material added primarily to reduce cost and adjust density or mechanical properties. An additive (e.g., superplasticizer, accelerator, pigment) is a chemical compound added in small quantities to actively modify the fresh or hardened state properties of the grout, such as flowability or setting time.

How does demand in the restoration and repair market compare to new construction?

The restoration and repair market often exhibits more stable demand, as infrastructure maintenance is mandatory irrespective of economic cycles. While new construction drives higher volume, repair work typically requires higher-value, specialized grouts (resins, microfine cement) suitable for complex retrofitting, leading to high revenue concentration in the repair segment.

What are the key drivers for the adoption of low-VOC grouting materials?

Key drivers include increasingly stringent environmental regulations, particularly in North America and Europe, growing concern over indoor air quality (IAQ) in commercial and residential buildings, and client demand for safer, healthier construction materials, especially for indoor or confined space applications.

How does the Grouting Material Market address challenges posed by saline environments?

In saline environments (coastal infrastructure, marine structures), the market offers specialized grouts, often utilizing sulfate-resistant cements or highly dense epoxy formulations, which are engineered to resist chemical deterioration from chlorides and sulfates, thereby ensuring the longevity of structural repairs and stabilization.

What is the primary objective of pre-injection grouting in tunneling projects?

The primary objective is to consolidate loose ground ahead of the tunneling machine (TBM) and reduce the permeability of the soil or rock mass. This prevents excessive water inflow during excavation, minimizes ground settlement, and enhances stability, safeguarding both the equipment and the constructed tunnel lining.

How does digital twin technology benefit the structural repair process using grouts?

Digital twin technology allows engineers to create virtual models of the damaged structure. By simulating various grouting scenarios (material properties, injection pressures), engineers can accurately predict the final struct

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager