Guanidine Hydrochloride Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435314 | Date : Dec, 2025 | Pages : 241 | Region : Global | Publisher : MRU

Guanidine Hydrochloride Market Size

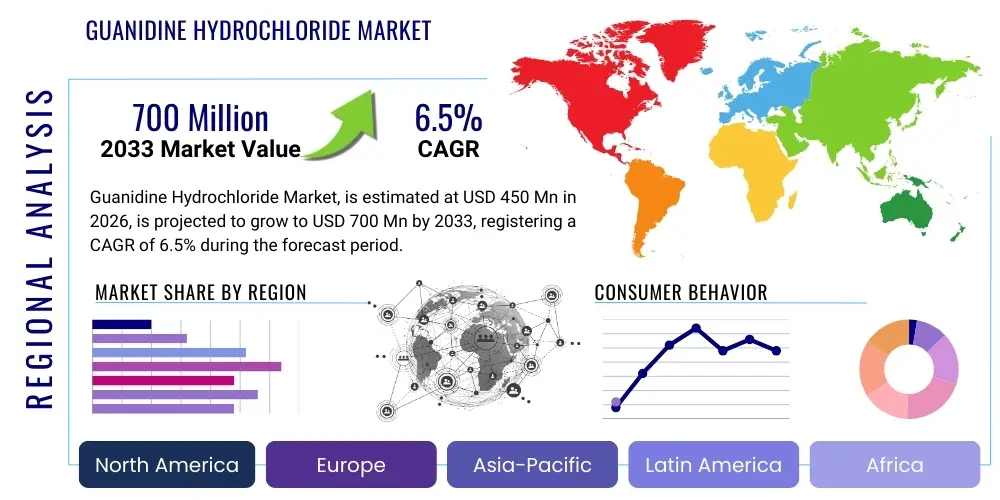

The Guanidine Hydrochloride Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at $450 Million USD in 2026 and is projected to reach $700 Million USD by the end of the forecast period in 2033.

Guanidine Hydrochloride Market introduction

Guanidine Hydrochloride (GHCL) is a crucial chemical compound, generally recognized as the salt of guanidine and hydrochloric acid. It is a highly versatile intermediate widely utilized across various industrial sectors, most notably in the pharmaceutical industry due to its role as a fundamental precursor in the synthesis of several active pharmaceutical ingredients (APIs). GHCL is characterized by its high stability, crystalline structure, and solubility, making it ideal for large-scale chemical processes. Its purity level is often critical, especially when destined for pharmaceutical applications where stringent regulatory standards must be met.

The primary application driving market demand is the synthesis of Metformin Hydrochloride, the world’s most commonly prescribed drug for Type 2 diabetes. As global prevalence of diabetes continues to rise, the sustained demand for affordable and effective antidiabetic medication directly translates into robust market growth for GHCL. Beyond pharmaceuticals, GHCL finds extensive use in the manufacturing of agrochemicals, specifically certain herbicides and insecticides, owing to its reactive functional groups that allow for complex organic syntheses. Additionally, it serves as an important component in specific laboratory reagents and biochemical research applications, particularly in protein denaturation processes.

Market growth is substantially fueled by rapid industrialization in emerging economies, particularly across the Asia Pacific region, coupled with increasing investments in healthcare infrastructure globally. The benefits offered by GHCL, such as its cost-effectiveness as a synthesis intermediate and its critical role in high-volume drug production like Metformin, ensure its sustained importance. However, managing supply chain volatility associated with key raw materials like dicyandiamide remains a focal point for manufacturers aiming to capitalize on the increasing application diversity.

Guanidine Hydrochloride Market Executive Summary

The Guanidine Hydrochloride market trajectory is overwhelmingly dictated by global pharmaceutical manufacturing trends, specifically the soaring demand for Metformin resulting from the rising incidence of Type 2 diabetes worldwide. Business trends indicate a strong move towards capacity expansion among major producers, predominantly located in China and India, to maintain cost competitiveness and fulfill large volume orders from contract manufacturing organizations (CMOs) and large pharmaceutical enterprises. Strategic partnerships and long-term supply agreements are becoming crucial elements of market strategy to mitigate supply risk and ensure consistent quality, particularly for the high-purity grades required by regulated markets in North America and Europe. Innovation focuses primarily on optimizing synthesis processes to improve yield and reduce environmental impact.

Regionally, the Asia Pacific (APAC) stands as the undisputed leader, not only in terms of production volume but also consumption. This dominance is attributed to the presence of large, low-cost manufacturing bases and rapidly expanding domestic pharmaceutical and agrochemical industries in countries such as China and India. North America and Europe, while consuming high-purity GHCL, rely heavily on imports but offer premium pricing due to stringent quality control requirements. Future regional trends suggest Latin America and the Middle East & Africa (MEA) will exhibit accelerated growth rates, driven by improving healthcare access and increased domestic production efforts of essential medicines.

Segmentation trends highlight the critical importance of the Application segment, with the Pharmaceutical sector holding the largest market share by value, while the Agrochemical segment is projected to show the fastest growth rate due to the increasing adoption of modern farming techniques and crop protection chemicals. Furthermore, the market for High Purity Grade GHCL (99.5% and above) is outpacing the Standard Grade market, reflecting the stringent quality mandates across the end-use industries, particularly in regulated drug manufacturing. This shift necessitates significant investment in advanced purification and quality control technologies across the production landscape.

AI Impact Analysis on Guanidine Hydrochloride Market

Common user questions regarding AI's impact on the Guanidine Hydrochloride market center on optimizing chemical reaction pathways, predicting supply chain disruptions related to raw materials (like dicyandiamide), and enhancing quality control measures during the crystallization and purification stages. Users are keen to understand how AI-driven predictive maintenance could reduce downtime in large-scale reactors and how machine learning algorithms might accelerate the discovery of novel guanidine derivatives for new applications in materials science or advanced agrochemicals. A prevailing concern is the ability of AI models to ensure the ultra-high purity required for pharmaceutical-grade GHCL consistently, minimizing batch failures and reducing operational expenditure.

AI’s influence is primarily felt in three core areas: R&D optimization, manufacturing efficiency, and supply chain resilience. In R&D, AI algorithms can simulate millions of reaction parameters, identifying optimal conditions for GHCL synthesis or derivative creation faster than traditional experimentation, potentially leading to new, more sustainable manufacturing routes. In manufacturing, machine learning models analyze sensor data in real-time to predict equipment failure, control exothermic reactions precisely, and fine-tune crystallization parameters to achieve superior purity levels with reduced energy consumption. This data-driven approach allows manufacturers to move towards continuous process improvement, reducing waste and increasing batch throughput significantly.

Moreover, the application of AI in supply chain management offers a crucial advantage in mitigating the volatility inherent in chemical feedstock markets. Predictive analytics leverage global economic indicators, weather patterns, and geopolitical risks to forecast potential shortages or price spikes in dicyandiamide or hydrochloric acid, allowing procurement teams to adjust inventory levels proactively. This enhanced predictability stabilizes production costs and ensures a reliable supply to downstream pharmaceutical partners, which is a major value proposition for leading GHCL manufacturers aiming for global competitiveness.

- AI-driven optimization of GHCL synthesis parameters, leading to improved yield and reduced energy usage.

- Machine learning for real-time quality control and prediction of impurities in high-purity pharmaceutical grades.

- Predictive maintenance schedules for large-scale reactors and crystallization equipment, minimizing unplanned downtime.

- Advanced supply chain analytics predicting fluctuations in raw material pricing and availability (Dicyandiamide).

- Accelerated discovery of novel guanidine derivatives for flame retardant and specialized chemical applications.

DRO & Impact Forces Of Guanidine Hydrochloride Market

The Guanidine Hydrochloride market's growth dynamics are fundamentally shaped by the escalating global healthcare needs, juxtaposed against operational complexities inherent in chemical production. The primary driver is the indispensable role of GHCL in the production of Metformin, which is facing ever-increasing demand due to the global epidemic of diabetes. Furthermore, rising demand for advanced crop protection chemicals across Asia and Latin America provides a strong secondary driver. However, the market faces significant restraints, chiefly concerning the high volatility and increasing cost of key raw materials, particularly dicyandiamide, whose supply is concentrated in specific geographical areas, leading to potential geopolitical and logistical vulnerabilities. Additionally, environmental regulations pertaining to chemical waste disposal and energy consumption present operational challenges, forcing manufacturers to invest heavily in sustainable practices.

Opportunities for market expansion are abundant in the field of specialty chemicals, where GHCL derivatives are utilized in the formulation of high-performance flame retardants and specific surfactants, benefiting from stricter global fire safety standards in construction and textiles. Furthermore, the push towards green chemistry offers avenues for developing cleaner synthesis routes that are less energy-intensive and minimize toxic byproducts, enhancing the product's compliance profile in highly regulated Western markets. Innovation in purification technologies also represents a key opportunity to serve the premium, high-purity segment of the pharmaceutical industry more effectively.

Impact forces acting on the market are high. The primary positive force is the pervasive technological influence on healthcare, where established treatments like Metformin remain the gold standard, ensuring continuous, baseline demand for GHCL. Conversely, the market is severely impacted by intense price competition, particularly among Asian manufacturers, which pressures profit margins across the value chain. Regulatory shifts, such as stricter impurity testing standards implemented by the US FDA or EMA, act as powerful modifying forces, weeding out non-compliant manufacturers and raising the barriers to entry for high-grade supply. Overall, the market remains highly sensitive to both global health trends and the stability of the Chinese chemical raw material supply chain.

Segmentation Analysis

The Guanidine Hydrochloride market is comprehensively segmented primarily based on Application, Grade, and Region. The segmentation based on Application is crucial, defining the end-use and, subsequently, the required purity level and volume demand. The pharmaceutical application segment dominates the market, leveraging GHCL as the foundational intermediate for large volume generic drug synthesis, particularly Metformin. The growth within this segment is exceptionally stable and resistant to short-term economic downturns, given the non-discretionary nature of healthcare consumption. Meanwhile, the Agrochemical segment, utilizing GHCL for herbicide and pesticide synthesis, is showing the fastest compounded annual growth, propelled by the need for increased crop yields in densely populated regions.

Grade segmentation, classifying GHCL into Standard Grade and High Purity/Pharmaceutical Grade, reflects the stringent requirements of specific end-users. The High Purity Grade, defined by ultra-low impurity profiles (typically <0.5% total impurities), commands a significant price premium and is essential for regulated pharmaceutical production. Manufacturers specializing in this grade must adhere to Good Manufacturing Practices (GMP) and invest heavily in advanced analytical chemistry and purification techniques, leading to higher operational costs but better margins. The Standard Grade is generally adequate for bulk industrial uses, such as certain flame retardant formulations, textile treatments, and less sensitive agrochemical formulations, and is characterized by high volume, low margin transactions.

Geographically, market segmentation reveals a clear disparity between production hubs and high-value consumption centers. Asia Pacific leads in both production and consumption volume due to localized pharmaceutical manufacturing capabilities and lower production costs. North America and Europe, however, represent the most valuable markets in terms of average selling price (ASP) per kilogram, driven by demand for guaranteed high-purity material and stringent procurement standards. Understanding these segment dynamics is critical for market players, allowing them to tailor production capabilities—either high-volume, cost-optimized production for Standard Grade or low-volume, high-value specialized production for Pharmaceutical Grade.

- By Application

- Pharmaceuticals (Metformin Synthesis)

- Agrochemicals (Herbicides and Pesticides)

- Industrial Chemicals (Flame Retardants, Specialty Chemicals)

- Laboratory Reagents

- By Grade

- Standard Grade (<99%)

- High Purity Grade (99% and above)

- By Region

- North America

- Europe

- Asia Pacific (APAC)

- Latin America

- Middle East & Africa (MEA)

Value Chain Analysis For Guanidine Hydrochloride Market

The value chain for the Guanidine Hydrochloride market begins intensely upstream with the procurement of critical raw materials, primarily Dicyandiamide (DCD) and hydrochloric acid (HCl). DCD itself is derived from calcium cyanamide, placing the initial stages of the supply chain highly dependent on petrochemical processes and mining operations. Production of DCD is geographically concentrated, mainly in China, which introduces significant supply chain risk and price volatility for GHCL manufacturers globally. Effective supply management, including establishing dual sourcing strategies and long-term contracts, is crucial for mitigating these upstream risks and ensuring stable input costs for the GHCL production phase.

The middle segment of the value chain involves the synthesis, purification, and manufacturing of GHCL. This stage is capital-intensive, requiring specialized chemical reactors, advanced crystallization equipment, and robust quality control systems, particularly for producing pharmaceutical-grade material. Manufacturing typically involves the reaction of DCD with hydrochloric acid under controlled conditions, followed by complex purification steps, including filtration and recrystallization, to meet stringent purity specifications. Efficiency and scale are paramount in this segment, as fierce competition often dictates narrow profit margins, especially in the Standard Grade market. Continuous process improvement and waste reduction are key competitive advantages for maximizing profitability.

The downstream analysis focuses on distribution and the final consumption channels. Distribution channels are typically a mix of direct sales to large, established pharmaceutical companies (which prefer guaranteed quality and traceability) and indirect sales through specialized chemical distributors and traders who serve smaller manufacturers, research laboratories, and agrochemical producers. The key customers are large pharmaceutical API manufacturers and Contract Manufacturing Organizations (CMOs) synthesizing Metformin. Traceability, certification (such as ISO, GMP), and timely delivery are crucial factors differentiating successful players in the downstream market. Due to the critical nature of pharmaceutical applications, the relationship between the GHCL supplier and the end-user is often highly collaborative and long-term, centered around quality assurance.

Guanidine Hydrochloride Market Potential Customers

The primary customer base for Guanidine Hydrochloride is overwhelmingly concentrated within the pharmaceutical industry, specifically companies involved in the large-scale synthesis of antidiabetic drugs. These customers are typically major pharmaceutical companies, generic drug manufacturers, and specialized Contract Manufacturing Organizations (CMOs) that require consistent, high-volume supply of ultra-high purity GHCL to comply with regulatory mandates (FDA, EMA, etc.). Their purchasing criteria prioritize Certificate of Analysis (CoA) documentation, reliable logistics, and the supplier's capacity to manage global quality audits, often leading to preference for established, vertically integrated suppliers capable of guaranteeing batch-to-batch consistency and traceability.

A secondary, yet rapidly expanding, customer segment is the agrochemical industry. These buyers include manufacturers of specialty pesticides, herbicides, and fertilizer additives. While they may tolerate slightly lower purity levels compared to the pharmaceutical sector, their demand volumes are often substantial, particularly in agricultural powerhouses in APAC and Latin America. These customers seek competitive pricing and materials that facilitate efficient synthesis of complex molecules designed for crop protection, valuing suppliers who can provide technical support regarding material handling and reaction optimization.

Other potential customers span the specialty chemical and industrial sectors. This includes companies producing specific fire retardants (using guanidine derivatives), manufacturers of textile auxiliaries, and various research institutions and diagnostic laboratories utilizing GHCL as a protein denaturant or buffer component. These buyers often require smaller, highly specialized batches and value niche capabilities and certifications, offering opportunities for smaller, specialized GHCL manufacturers to penetrate targeted markets with customized product offerings and flexible logistics solutions.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $450 Million USD |

| Market Forecast in 2033 | $700 Million USD |

| Growth Rate | 6.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Merck KGaA, BASF SE, AlzChem Group AG, Ningxia Jinzheng Group Co., Ltd., Jining Zhonghe Chemical Co., Ltd., Hubei Xingfa Chemicals Group Co., Ltd., Shanghai Chem-Gen Industrial Co., Ltd., Nippon Carbide Industries Co., Inc., Hengsheng Chemical Co., Ltd., K. G. International, Inc., Jiangsu Lianrun Chemical Co., Ltd., Hebei Chengxin Co., Ltd., Avantor Inc., TCI Chemicals (India) Pvt. Ltd., Tokyo Chemical Industry Co., Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Guanidine Hydrochloride Market Key Technology Landscape

The technological landscape of the Guanidine Hydrochloride market is primarily centered on enhancing the efficiency and purity of the synthesis process, which fundamentally relies on the reaction between dicyandiamide (DCD) and hydrochloric acid. Traditional synthesis methods are generally mature, but modern technological efforts are focused on optimizing parameters such as temperature, pressure, and reaction time to maximize yield and minimize side product formation. Advancements in continuous flow chemistry, as opposed to conventional batch processing, are gaining traction. Continuous flow systems offer superior control over reaction kinetics, leading to more uniform product quality, higher throughput, and enhanced safety, particularly important when handling exothermic chemical reactions on a large industrial scale.

Crucially, technology related to purification and separation is driving competitive differentiation, especially for suppliers targeting the lucrative pharmaceutical grade market. Key technological breakthroughs involve advanced chromatography techniques, improved fractional crystallization methods, and membrane separation technologies. These processes are vital for effectively removing residual impurities, unreacted starting materials, and potential heavy metal contaminants to achieve purity levels exceeding 99.5%, necessary for API production like Metformin. Investment in sophisticated analytical tools, such as High-Performance Liquid Chromatography (HPLC) and Mass Spectrometry, integrated with manufacturing processes, is mandatory for real-time quality assurance and process validation, adhering to stringent GMP guidelines globally.

Furthermore, sustainability and environmental compliance are major technological focuses. Manufacturers are actively exploring and implementing technologies to reduce solvent usage, recycle process water, and manage wastewater containing nitrogen compounds generated during production. The adoption of green chemistry principles involves searching for alternative, less corrosive catalysts and developing solvent-free or supercritical fluid processes, although these alternatives are still in early commercial stages. Technology also extends to digitalization, with sensors, IoT devices, and AI integration increasingly used to monitor reaction conditions, predict maintenance needs, and optimize energy consumption, thereby lowering the overall carbon footprint of GHCL production facilities.

Regional Highlights

- Asia Pacific (APAC): Dominates the global market both in terms of production capacity and consumption volume. China and India are the world's leading manufacturing hubs, leveraging lower operational costs and the presence of vast domestic pharmaceutical and agrochemical industries. The high prevalence of diabetes in these countries further ensures robust local demand for Metformin synthesis intermediates.

- North America: Represents a high-value market characterized by demand for stringent, high-purity GHCL, primarily for the highly regulated pharmaceutical sector. Although manufacturing is limited due to high labor and environmental costs, the region is a major importer, offering significant potential for suppliers who can guarantee compliance with FDA standards and consistent quality assurance.

- Europe: Similar to North America, Europe is a net importer of GHCL, demanding premium grades for pharmaceutical and advanced specialty chemical applications. Strict REACH regulations and strong environmental standards necessitate high compliance costs for local manufacturers, making high-quality, reliable imported supply chains essential for the regional market continuity.

- Latin America: Expected to show above-average growth, driven by expanding healthcare spending and increasing agricultural output. Countries like Brazil and Mexico are increasing domestic pharmaceutical production, creating localized demand for GHCL, particularly in the agrochemical segment where advanced crop protection is increasingly vital.

- Middle East & Africa (MEA): Currently holds the smallest market share but is poised for steady growth. Expansion is linked to governmental initiatives aimed at localizing pharmaceutical manufacturing and improving healthcare access. The MEA region represents an emerging opportunity for cost-competitive GHCL suppliers to establish early market presence.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Guanidine Hydrochloride Market.- Merck KGaA

- BASF SE

- AlzChem Group AG

- Ningxia Jinzheng Group Co., Ltd.

- Jining Zhonghe Chemical Co., Ltd.

- Hubei Xingfa Chemicals Group Co., Ltd.

- Shanghai Chem-Gen Industrial Co., Ltd.

- Nippon Carbide Industries Co., Inc.

- Hengsheng Chemical Co., Ltd.

- K. G. International, Inc.

- Jiangsu Lianrun Chemical Co., Ltd.

- Hebei Chengxin Co., Ltd.

- Avantor Inc.

- TCI Chemicals (India) Pvt. Ltd.

- Tokyo Chemical Industry Co., Ltd.

- Shaoxing Shangyu Anhua Chemical Co., Ltd.

- Parchem fine & specialty chemicals

- Solvay S.A.

- Mitsubishi Chemical Corporation

- Wuhan Fengshou Chemical Co., Ltd.

Frequently Asked Questions

Analyze common user questions about the Guanidine Hydrochloride market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary driver for the Guanidine Hydrochloride market growth?

The main market driver is the sustained, increasing global demand for Metformin, the first-line medication for Type 2 diabetes. Guanidine Hydrochloride is an essential, high-volume intermediate chemical required for the cost-effective synthesis of Metformin Hydrochloride, directly linking market growth to global diabetes prevalence.

Which application segment holds the largest share in the GHCL market?

The Pharmaceutical application segment holds the largest market share by value, demanding high-purity grades of GHCL for the synthesis of APIs. This segment is characterized by strict quality requirements and consistent, large-scale consumption volumes.

How does the volatility of raw material prices affect GHCL producers?

The volatility of raw material prices, particularly for Dicyandiamide (DCD), poses a significant restraint. Since DCD production is geographically concentrated (mainly in China), price fluctuations and supply chain disruptions can heavily impact the operating margins and cost stability for GHCL manufacturers globally.

Why is the Asia Pacific region dominant in the Guanidine Hydrochloride market?

APAC is dominant due to its vast, cost-efficient manufacturing base, particularly in China and India, which are major global suppliers of bulk chemicals. The region also exhibits robust domestic consumption driven by burgeoning pharmaceutical and agrochemical industries.

What is the difference between Standard Grade and High Purity Grade GHCL?

Standard Grade is used for industrial applications like flame retardants, while High Purity Grade (typically 99.5%+) is mandated for pharmaceutical manufacturing. High Purity Grade requires rigorous purification processes and compliance with GMP standards, commanding a significant price premium.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager