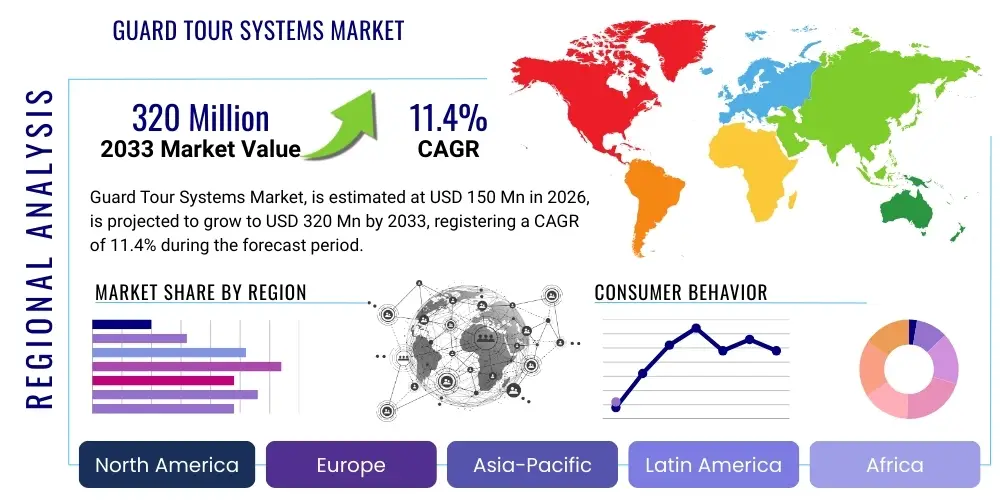

Guard Tour Systems Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436154 | Date : Dec, 2025 | Pages : 253 | Region : Global | Publisher : MRU

Guard Tour Systems Market Size

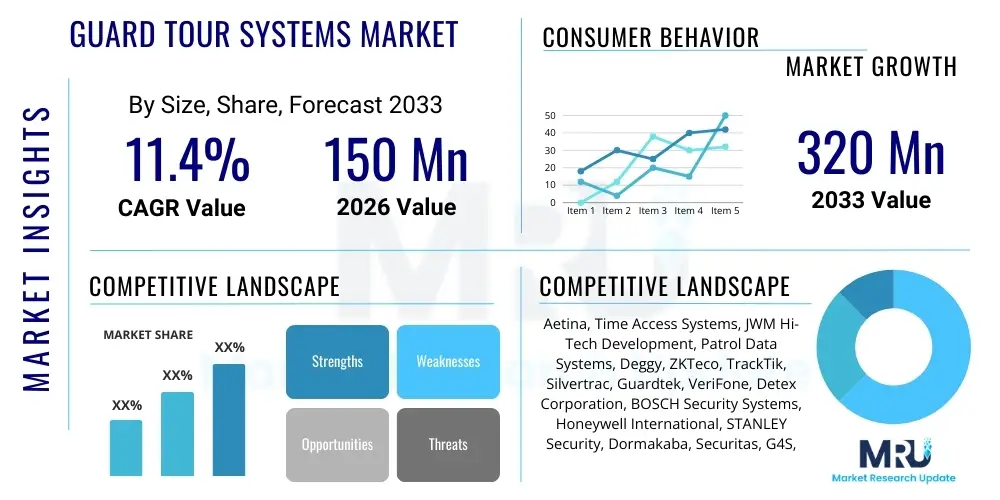

The Guard Tour Systems Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 11.4% between 2026 and 2033. The market is estimated at $150 Million USD in 2026 and is projected to reach $320 Million USD by the end of the forecast period in 2033.

Guard Tour Systems Market introduction

The Guard Tour Systems Market encompasses specialized technologies designed to record and monitor the movements, patrol routes, and activities of security personnel during their scheduled tours. These systems replace traditional, often unreliable, paper-based logs with automated, verifiable digital records, ensuring accountability and improving the overall effectiveness of security operations. The core function is to confirm that guards are present at designated checkpoints at specific times, thereby mitigating risks associated with missed patrols or complacency. Modern systems integrate various components, including handheld readers (or mobile apps), checkpoint tags (such as RFID, NFC, or QR codes), and sophisticated cloud-based software platforms for real-time monitoring, reporting, and data analysis.

Guard Tour Systems find extensive application across diverse sectors requiring robust physical security and compliance documentation. Major applications include commercial buildings (office spaces, retail complexes), industrial facilities (manufacturing plants, warehouses), institutional settings (hospitals, universities), critical infrastructure (power plants, data centers), and residential communities (gated estates, apartment complexes). The fundamental requirement for these systems stems from increasing regulatory compliance standards, stringent insurance requirements, and the necessity for indisputable evidence regarding security service delivery. The versatility of these systems allows them to be deployed in both indoor and expansive outdoor environments, offering flexible solutions tailored to various operational scales and complexities.

The primary driving factors propelling the growth of this market include the escalating global threat landscape, necessitating heightened security protocols; the continuous migration from manual processes to digitized, verifiable security management; and the increasing emphasis on security officer accountability and performance optimization. Furthermore, the integration of advanced technologies like GPS tracking, IoT sensors, and mobile connectivity has enhanced the capabilities of these systems, offering real-time situational awareness and rapid incident response. These benefits, including reduced liability, improved operational efficiency, and verifiable proof of presence, solidify the Guard Tour System’s role as an indispensable tool in modern security management.

Guard Tour Systems Market Executive Summary

The global Guard Tour Systems Market is undergoing a rapid evolution, primarily driven by the transition toward software-as-a-service (SaaS) and cloud-based deployment models. Business trends show a significant move away from legacy hardware-centric systems toward integrated platforms that offer comprehensive workforce management, including scheduling, incident reporting, and compliance documentation alongside basic patrol monitoring. Key industry players are focusing on modular solutions that allow enterprises to scale their security infrastructure efficiently. Furthermore, there is a distinct trend towards convergence, where Guard Tour Systems are being bundled or integrated with broader physical security information management (PSIM) and enterprise resource planning (ERP) systems, enhancing seamless data flow and holistic operational oversight across large organizations. This focus on integrated, scalable, and data-driven security solutions defines the current competitive landscape.

Regionally, North America and Europe currently dominate the market share, attributed to stringent regulatory environments, high adoption rates of advanced security technologies, and the presence of major industry vendors. However, the Asia Pacific (APAC) region is projected to exhibit the highest growth rate during the forecast period. This rapid expansion in APAC is fueled by massive infrastructure development, increasing urbanization, and growing awareness among commercial and industrial sectors regarding the benefits of automated security verification systems. Governments and large corporations in developing economies within APAC are increasingly mandating digital security protocols to ensure accountability, creating vast opportunities for cloud-based and mobile-first guard tour solutions. Latin America and the Middle East & Africa (MEA) are also seeing steady adoption, particularly in sectors related to oil and gas, mining, and critical national infrastructure protection.

Segmentation trends indicate that the Software segment, particularly cloud-based offerings, is accelerating faster than the traditional Hardware segment. Within the technology segment, GPS/Cellular-based solutions are gaining traction due to the widespread use of smartphones by security personnel, enabling real-time location tracking and immediate incident reporting capabilities far beyond fixed checkpoint verification. Application-wise, the commercial and industrial sectors remain the primary consumers, but the institutional segment (schools and healthcare) is demonstrating a notable increase in demand, driven by heightened concerns over site safety and the need for verifiable visitor management and internal patrol logs. This shift toward mobile and cloud-based software emphasizes the market's preference for flexibility, ease of deployment, and rich analytical capabilities.

AI Impact Analysis on Guard Tour Systems Market

User inquiries regarding AI's influence on Guard Tour Systems primarily center on concerns about job displacement for security guards versus the expectation of enhanced operational intelligence and predictive capabilities. Key themes include how AI can automate patrol route optimization, whether machine learning can accurately predict security incidents based on patrol data and environmental factors, and the role of computer vision in verifying checkpoint adherence without relying solely on manual tag scanning. Users are keen to understand if AI integration will reduce false reporting, provide deeper anomaly detection in guard behavior (e.g., unauthorized loitering or deviations), and ultimately transform routine supervision into proactive risk management. The consensus is that AI is viewed less as a replacement for human guards and more as a sophisticated analytical layer ensuring higher standards of compliance and efficiency in security operations.

- AI-Powered Route Optimization: Machine learning algorithms analyze historical data (traffic, time constraints, incident hotspots) to generate the most efficient and risk-mitigated patrol routes in real-time.

- Predictive Analytics for Risk: AI models analyze patrol logs, environmental sensor data, and external threat intelligence to forecast potential security vulnerabilities before they escalate.

- Automated Anomaly Detection: AI monitors guard check-in timings and deviations from established procedures, flagging unusual patterns that suggest complacency or malpractice.

- Integration with Computer Vision: AI processes video feeds at checkpoints, correlating visual presence verification with GPS/NFC check-in data, eliminating manual intervention errors.

- Enhanced Incident Prioritization: AI rapidly filters and categorizes incident reports generated during tours, ensuring high-priority threats receive immediate supervisory attention.

- Optimization of Supervisory Workflows: AI generates summarized compliance reports and highlights performance metrics, drastically reducing the time supervisors spend reviewing raw patrol data.

DRO & Impact Forces Of Guard Tour Systems Market

The Guard Tour Systems Market is influenced by a dynamic interplay of factors that both accelerate and constrain its expansion, forming critical impact forces shaping the competitive landscape. Key drivers include the global mandate for verifiable security accountability, particularly in heavily regulated sectors like finance and infrastructure, where proof of patrol and documented adherence to security protocols are non-negotiable. Furthermore, the continuous reduction in the cost and increase in the capability of GPS, IoT, and mobile computing technologies have made advanced guard tour solutions accessible and appealing to a broader range of small and medium-sized enterprises (SMEs). This technological affordability, combined with the rising operational costs associated with manual security management, strongly favors digital adoption. Simultaneously, restraining factors such as the initial capital investment required for comprehensive system deployment, particularly for on-premise solutions, and persistent concerns regarding data privacy and the security of cloud-based patrol data act as bottlenecks to market saturation. Opportunities, however, abound in emerging markets and through the strategic integration of biometric verification and AI tools into existing platforms, promising enhanced reliability and intelligence-led patrols.

The primary driver impacting the market is the shift toward compliance and liability mitigation. Organizations worldwide are recognizing that robust, tamper-proof digital records generated by Guard Tour Systems are essential for defending against negligence claims and meeting regulatory requirements (such as OSHA or industry-specific standards). This necessity pushes large corporations and government bodies to invest significantly in these systems, establishing a firm demand floor. However, a significant restraint is the resistance to change within established security firms that rely on legacy processes, coupled with the complexity of integrating new digital systems into disparate, older facility management infrastructure. Training security personnel, often characterized by high turnover rates, on complex new software platforms also presents an ongoing operational challenge that vendors must address through highly intuitive user interfaces.

The core impact forces driving long-term growth stem from technological convergence and the move towards proactive security. The opportunity lies in providing complete workforce management suites—not just tour verification—that incorporate scheduling, training modules, and real-time communication tools, transforming the Guard Tour System into an indispensable operational hub. The market's overall trajectory is positive, supported by the increasing global emphasis on security standardization and the competitive advantage derived from data-driven performance management. Vendors who successfully navigate the challenges of data security and integration complexity, while offering robust, user-friendly mobile solutions, are poised to capture the majority of the projected market growth over the forecast period.

Segmentation Analysis

The Guard Tour Systems market is segmented to reflect the diversity of deployment methods, underlying technologies, system components, and target applications. The fundamental segmentation provides a granular view of market dynamics, highlighting areas of rapid adoption and maturity. The segmentation by Component (Hardware, Software, Services) is critical, showing the rapid shift in revenue generation from physical devices (readers, tags) to recurring subscription revenue from software and support services. Technology segmentation reveals the competitive battle between mature RFID systems and rapidly expanding GPS/Cellular and QR code solutions. Geographic analysis remains essential, differentiating between high-penetration markets in North America and high-growth potential regions in Asia Pacific, reflecting varied security maturity levels and budget allocations across the globe.

- By Component

- Hardware (Handheld Readers, Checkpoint Tags, Docks)

- Software (Cloud-based, On-premise management platforms)

- Services (Consulting, Implementation, Maintenance, Training)

- By Technology

- RFID/NFC-based Systems

- GPS/Cellular-based Systems

- Biometric Systems

- QR/Barcode Systems

- By Application

- Commercial (Office Buildings, Retail)

- Industrial (Manufacturing, Logistics, Energy)

- Residential (Gated Communities, Apartments)

- Institutional (Hospitals, Schools, Universities)

- Government and Critical Infrastructure

- By Deployment

- On-premise

- Cloud-based

Value Chain Analysis For Guard Tour Systems Market

The Guard Tour Systems value chain begins with the upstream activities centered on raw material procurement, electronic component manufacturing, and software development. Upstream complexity involves securing high-quality sensors (RFID chips, GPS modules) and developing robust, encrypted operating systems and cloud infrastructure necessary for reliable data capture and transmission. Manufacturers of handheld devices must ensure durability and ingress protection (IP ratings) suitable for harsh patrol environments, while software developers focus heavily on user experience, real-time data security, and scalability. Key suppliers at this stage are technology component providers and specialized software development firms that license core algorithms for tracking and verification.

The midstream phase involves the integration, manufacturing, and assembly of the final product—the guard tour system itself. This includes integrating hardware components with proprietary firmware and packaging the solution with the central software platform. Distribution channels play a critical role here, often involving a mix of direct sales channels for large, customized enterprise deployments and indirect channels utilizing security systems integrators, certified value-added resellers (VARs), and regional distributors. Integrators are vital, as they provide the crucial service of tailoring the system to the client's specific site layout, security protocols, and existing infrastructure (such as access control or CCTV).

The downstream segment focuses on the end-users and post-sales support, which is predominantly service-driven. Direct interaction with end-users (security companies or facility managers) facilitates crucial feedback loops for software updates and feature improvements. Indirect distribution often relies on national or global security service providers (like G4S or Allied Universal) who purchase the systems wholesale and deploy them as part of their comprehensive service offering to clients. Maintenance, training, and ongoing technical support, especially for cloud-based subscriptions, constitute a major source of recurring revenue downstream, emphasizing the long-term relationship between vendors and customers and underscoring the shift toward a service-centric business model within the market.

Guard Tour Systems Market Potential Customers

The primary customer base for Guard Tour Systems is highly diverse, encompassing any entity with significant assets, liability concerns, and requirements for verifiable security patrol evidence. The largest end-users include commercial property management firms that oversee large office portfolios and retail chains needing to ensure timely lock-up procedures and internal safety checks. Industrial customers, particularly in the manufacturing, oil and gas, and logistics sectors, rely on these systems to monitor perimeter checks, machinery inspections, and safety compliance tours in vast and often hazardous environments. The core requirement for all these buyers is minimizing organizational liability by providing indisputable audit trails proving that security protocols were followed meticulously.

A rapidly growing segment of potential customers includes institutional buyers such as healthcare providers and educational campuses. Hospitals utilize guard tour systems for regular checks of sensitive areas, patient safety patrols, and monitoring staff adherence to specific safety protocols, particularly during night shifts. Universities and school districts implement them to ensure external doors are secured, parking lots are checked, and remote campus areas are regularly monitored, often integrating the tour data with broader campus security emergency response protocols. For these institutional users, the ability to generate detailed reports for regulatory bodies and internal risk management committees is paramount, driving demand for advanced reporting features within the software platforms.

Government agencies and operators of critical national infrastructure represent another high-value customer segment. This includes facilities like power grids, water treatment plants, airports, and military bases where security breaches carry catastrophic consequences. These customers demand the highest levels of system robustness, encryption, and reliability, often opting for on-premise or highly secure private cloud deployment models. The systems are used not only for standard perimeter patrols but also for mandatory procedural compliance checks and key management accountability, making the integration capabilities with other high-security systems a deciding factor in purchasing decisions. The demand from the security service industry itself—the third-party providers who manage security staff—is also foundational, as they need these systems to prove service delivery quality to their own clients.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $150 Million USD |

| Market Forecast in 2033 | $320 Million USD |

| Growth Rate | 11.4% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Aetina, Time Access Systems, JWM Hi-Tech Development, Patrol Data Systems, Deggy, ZKTeco, TrackTik, Silvertrac, Guardtek, VeriFone, Detex Corporation, BOSCH Security Systems, Honeywell International, STANLEY Security, Dormakaba, Securitas, G4S, Allied Universal, AMR Systems, GuardForce |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Guard Tour Systems Market Key Technology Landscape

The technology landscape of the Guard Tour Systems Market is characterized by a shift towards convergence and real-time connectivity, moving far beyond the simple dataloggers used two decades ago. The core technologies currently dominating the market include Radio-Frequency Identification (RFID) and Near Field Communication (NFC) for proximity-based checkpoint identification, offering rugged and reliable tag reading in harsh environments. However, the rapidly expanding adoption of smartphones and tablets in professional security environments has positioned GPS/Cellular technology as a primary growth driver. These mobile-first solutions leverage the device's internal GPS for precise location verification and cellular connectivity for instantaneous data transmission to the central management platform, enabling real-time monitoring and geo-fencing capabilities. This real-time data is crucial for rapid response planning and supervisory oversight, marking a significant advancement over systems requiring manual docking for data download.

Furthermore, the utilization of QR codes and standard barcodes, while a low-cost alternative, remains popular in smaller or less sensitive applications, offering straightforward checkpoint verification using basic mobile devices. The major technological frontier involves the integration of biometrics (fingerprint or facial recognition) at critical checkpoints to verify the identity of the patrolling officer in addition to their presence, thereby adding an extra layer of accountability and reducing the risk of badge sharing. These biometric solutions, increasingly affordable and robust, are being adopted primarily in high-security facilities and government installations where identity assurance is paramount. The hardware aspect is concurrently focusing on increased durability, longer battery life, and compatibility with multiple sensing technologies within a single handheld device, catering to varied operational needs.

The most significant technological development, however, lies in the Software-as-a-Service (SaaS) management platforms. These platforms are incorporating advanced features such as incident management workflows, automated report generation, and integration APIs to connect with other security infrastructure elements like CCTV and access control systems. The development emphasis is on cloud scalability, robust data encryption, and mobile accessibility for both the patrolling guard and the supervisory team. Future innovations are heavily focused on leveraging Artificial Intelligence (AI) and Machine Learning (ML) to process the massive amounts of data generated by these systems, moving the market from simple documentation to sophisticated, predictive security management.

Regional Highlights

- North America: This region maintains market leadership due to high technological maturity, stringent regulatory frameworks demanding verifiable security protocols (especially in financial and healthcare sectors), and the widespread adoption of SaaS-based security solutions. The presence of major global security service providers and strong investment in critical infrastructure modernization further solidify its dominant position. Innovation in mobile-first and AI-integrated systems is highly concentrated here.

- Europe: Europe is a highly mature market characterized by a strong focus on data privacy (GDPR compliance), driving demand for highly secure, localized data hosting solutions. Western European countries exhibit high penetration rates, emphasizing operational efficiency and integration with existing physical security systems. The market is moderately regulated, driving stable, consistent demand across commercial and institutional applications.

- Asia Pacific (APAC): APAC is the fastest-growing market globally, driven by rapid urbanization, massive infrastructure expansion in countries like India and China, and increasing foreign direct investment requiring internationally benchmarked security standards. The region is highly price-sensitive, leading to strong adoption of cost-effective QR code and basic GPS solutions initially, but quickly transitioning to sophisticated cloud platforms as security budgets increase.

- Latin America (LATAM): This region shows significant growth potential, particularly in industrial sectors (mining, energy) and large residential complexes, where security accountability is paramount due to higher crime rates. The market demand is centered around reliable, rugged hardware and cellular connectivity features to compensate for sometimes inconsistent local network infrastructure.

- Middle East and Africa (MEA): Growth is primarily fueled by extensive investments in government projects, critical energy infrastructure (oil and gas), and smart city initiatives, especially in the GCC countries. MEA demands robust, high-security systems capable of operating reliably under extreme climatic conditions, driving specialization in durable hardware components and secure, managed services offerings.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Guard Tour Systems Market.- Aetina

- Time Access Systems

- JWM Hi-Tech Development

- Patrol Data Systems

- Deggy

- ZKTeco

- TrackTik

- Silvertrac

- Guardtek

- VeriFone

- Detex Corporation

- BOSCH Security Systems

- Honeywell International

- STANLEY Security

- Dormakaba

- Securitas

- G4S

- Allied Universal

- AMR Systems

- GuardForce

Frequently Asked Questions

Analyze common user questions about the Guard Tour Systems market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is a Guard Tour System and why is it essential for security accountability?

A Guard Tour System is a technology solution used to verify that security personnel are fulfilling their patrol duties by checking designated checkpoints at specific times. It replaces manual logs with tamper-proof digital records, ensuring accountability, minimizing operational liability, and providing verifiable proof of service delivery for clients and regulators.

Which technology is currently dominating the Guard Tour Systems Market?

While traditional RFID/NFC remains widely used for stationary checkpoints, GPS/Cellular-based systems are dominating new deployments. This dominance stems from their ability to provide real-time location tracking, immediate incident reporting via mobile apps, and flexibility that exceeds fixed-point verification.

What are the key differences between cloud-based and on-premise Guard Tour Systems?

Cloud-based systems offer lower upfront costs, remote access, automatic updates, and scalability via subscription models (SaaS). On-premise systems require significant initial investment in hardware and servers but offer maximum data control and customization, preferred by high-security and government organizations with strict data sovereignty requirements.

How is Artificial Intelligence (AI) impacting security patrols and management?

AI is transforming guard tour management by offering predictive analytics, optimizing patrol routes based on real-time risks, and automating anomaly detection in guard behavior. AI enhances supervision efficiency and shifts the focus from simple compliance checking to proactive risk mitigation.

Which end-user segment demonstrates the fastest growth rate in Guard Tour System adoption?

The Industrial and Institutional segments (including manufacturing, logistics, healthcare, and education) are exhibiting the fastest growth rates. This acceleration is driven by the critical need to secure complex sites, ensure environmental health and safety (EHS) compliance, and manage increasing regulatory pressure on site safety verification.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager