Guided Missile and Space Vehicle Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433959 | Date : Dec, 2025 | Pages : 241 | Region : Global | Publisher : MRU

Guided Missile and Space Vehicle Market Size

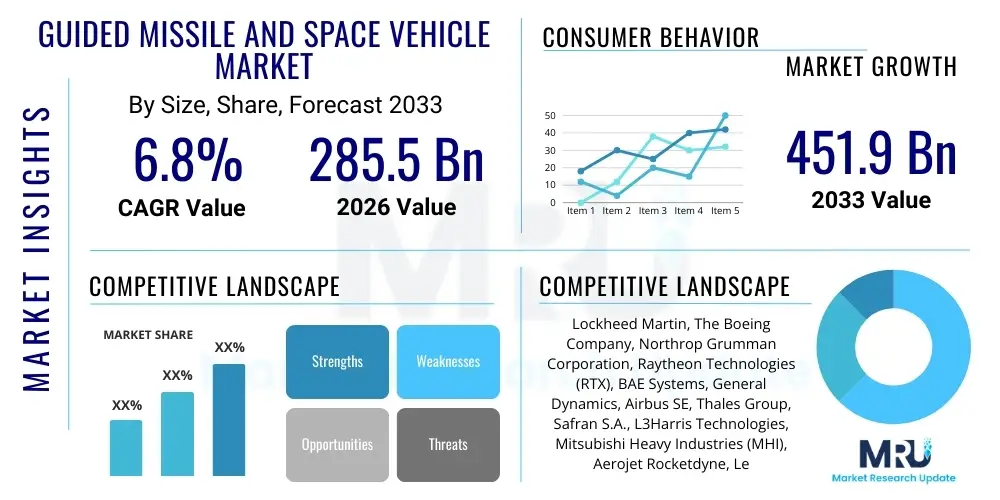

The Guided Missile and Space Vehicle Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 285.5 Billion in 2026 and is projected to reach USD 451.9 Billion by the end of the forecast period in 2033. This substantial growth trajectory is primarily underpinned by escalating global defense spending, particularly focused on modernizing existing arsenals and developing advanced, highly maneuverable strike capabilities. The shift towards multi-domain warfare strategies necessitates continuous investment in sophisticated guidance systems, enhanced propulsion technologies, and resilient space assets, which are critical components of this market. Furthermore, the proliferation of geopolitical tensions across key regions, alongside renewed commitments to deep space exploration and commercial utilization of Low Earth Orbit (LEO), ensures a robust demand environment for both military and civilian applications.

The market expansion is not solely driven by traditional defense contracts; the burgeoning commercial space sector represents a significant accelerator. Increased satellite launches, driven by the demand for global connectivity, remote sensing, and navigation services, require reliable launch vehicles and associated guidance technologies. Companies are increasingly investing in reusable rocket technology, reducing operational costs and thereby stimulating higher launch frequencies. This technological maturation, coupled with government policies supporting indigenous space programs in emerging economies, contributes significantly to the anticipated CAGR. The defense segment, however, remains dominant, with a clear focus on countermeasures against emerging threats such as hypersonic weapons, necessitating rapid innovation and procurement cycles for interceptor missiles and advanced sensor technologies, thereby sustaining high revenue generation across the forecast period and solidifying the market’s positive outlook.

Guided Missile and Space Vehicle Market introduction

The Guided Missile and Space Vehicle Market encompasses the design, manufacture, integration, and service of complex systems utilized for military strike, defense, and orbital transportation purposes. This includes a vast array of products such as ballistic missiles, cruise missiles, anti-aircraft systems, advanced tactical munitions, launch vehicles, orbital spacecraft, and specialized propulsion systems. Major applications span critical defense capabilities, including strategic deterrence, area denial, and precision targeting, alongside critical commercial and governmental space activities such as satellite deployment, crewed missions, and planetary exploration. The immediate benefits derived from this market include enhanced national security through superior defense and strike capabilities, improved global communication via satellite networks, and the advancement of scientific knowledge through space-based research, driving significant governmental and private expenditure in this high-technology domain.

The market is characterized by high barriers to entry, driven by stringent regulatory requirements, the need for deep technical expertise, and substantial capital investment in research and development facilities. Key driving factors stimulating growth include persistent global security concerns, the strategic importance of maintaining space superiority (especially in military operations), and the accelerating pace of technological innovation, particularly in areas like artificial intelligence for guidance and navigation, and composite materials for lighter, faster structures. Furthermore, the global race to develop viable hypersonic flight platforms—for both offensive and defensive purposes—is a primary expenditure driver, forcing nations to allocate massive budgets towards advanced missile and interceptor systems. The integration of networked battle management systems relies fundamentally on the capabilities delivered by modern space vehicles and guided weapons, solidifying their central role in contemporary military strategy.

Guided Missile and Space Vehicle Market Executive Summary

The Guided Missile and Space Vehicle Market is poised for substantial growth, driven by synergistic developments across geopolitical, commercial, and technological landscapes. Key business trends include aggressive mergers and acquisitions among established defense primes seeking vertical integration and specialized technology acquisition, coupled with the rising prominence of new space companies disrupting traditional launch services via cost-effective and reusable architectures. Regionally, North America maintains its market dominance due to massive defense procurement budgets and a robust private space industry ecosystem, while the Asia Pacific region exhibits the fastest growth due to intensified military modernization programs, particularly in China and India, and increasing governmental support for domestic space exploration. Segment-wise, the launch vehicle category is experiencing rapid diversification with the advent of small-lift launch solutions catering to the booming small satellite market, while the missile segment sees dominant activity in the development of advanced hypersonics and increasingly sophisticated anti-missile defense systems, reflecting a global pivot towards rapid, long-range capabilities.

Technological imperatives dictate market evolution, with significant investments directed toward enhancing autonomy, precision, and survivability of platforms. The adoption of AI and machine learning algorithms is revolutionizing guidance systems, enabling missiles to execute complex maneuvers and terminal guidance corrections independently, thereby significantly increasing probability of kill (Pk). Simultaneously, the commercial space sector is witnessing profound transformation, moving from government-led infrastructure projects to privately funded mega-constellations requiring reliable, high-cadence launch services. This competitive pressure is forcing established providers to accelerate innovation in propulsion and manufacturing. Overall, the market remains highly strategic, intensely competitive, and deeply tied to national security priorities, ensuring continuous, heavily funded research and development pipelines that will sustain the projected CAGR throughout the forecast period and beyond.

AI Impact Analysis on Guided Missile and Space Vehicle Market

User queries regarding the integration of Artificial Intelligence (AI) in the Guided Missile and Space Vehicle Market frequently revolve around themes of autonomous decision-making, enhanced targeting precision, resilience against electronic warfare, and the ethical implications of ‘human-out-of-the-loop’ systems. Users are keenly interested in how AI algorithms facilitate complex, high-speed calculations necessary for maneuvering hypersonic vehicles and enabling swarm missile attacks. A primary concern is the reliability and trustworthiness of AI-driven guidance systems, especially given the catastrophic consequences of failure in strategic defense assets. Expectations are high for AI to reduce dependence on vulnerable GPS/GNSS systems through advanced celestial navigation and terrain matching (TERCOM/DSMAC) capabilities, significantly increasing the survivability and effectiveness of guided platforms in contested environments. The common user query seeks to understand the balance between increased operational superiority afforded by autonomy and the necessary ethical and regulatory oversight required for weapons systems.

The deployment of AI is moving beyond simple data processing to encompass mission planning, sensor fusion, and real-time threat assessment. In the space vehicle segment, AI optimizes trajectory corrections, manages on-board power systems, and enables autonomous docking and rendezvous operations, crucial for satellite servicing and debris removal. For guided missiles, AI is the core enabler for differentiating real targets from decoys (fusing data from imaging, radar, and infrared sensors), ensuring terminal phase accuracy even in heavily cluttered electromagnetic environments. This integration drastically reduces response times and enhances the capacity of missiles to defeat advanced defensive measures, fundamentally altering the calculus of conflict. The continued investment in AI-driven simulators and digital twin technology is also prevalent, designed to rigorously test and validate complex autonomous functions before live deployment, addressing reliability concerns raised by end-users and policymakers globally.

- AI enhances autonomous navigation and target recognition in GPS-denied environments.

- Machine learning algorithms optimize missile flight paths for minimal energy consumption and maximum maneuverability.

- AI-powered sensor fusion improves target discrimination and reduces susceptibility to jamming.

- Predictive maintenance for space vehicle components is enabled by AI analysis of telemetry data.

- AI facilitates real-time, complex cooperative behaviors in missile swarms and satellite constellations.

DRO & Impact Forces Of Guided Missile and Space Vehicle Market

The Guided Missile and Space Vehicle Market is shaped by a confluence of powerful drivers and stringent restraints, balanced by transformative opportunities and intense competitive impact forces. Key drivers include persistent geopolitical instability, necessitating continuous defense modernization across developed and emerging economies, and the rapid pace of space commercialization, which generates high demand for launch services and orbital assets. However, significant restraints impede unfettered growth, notably the exceptionally high cost associated with R&D, material procurement, and manufacturing of strategic systems, alongside complex, multi-layered international regulatory frameworks governing technology transfer and export controls. Opportunities are abundant, specifically in the development of counter-hypersonic defenses, reusable launch vehicles drastically lowering access-to-space costs, and the exploration of novel propulsion technologies like nuclear thermal propulsion.

Impact forces in this sector are formidable; the strategic nature of the products ensures high government scrutiny and reliance on bilateral political relationships. Competition is fierce, not only among legacy defense contractors but also from innovative, venture-backed space startups challenging established business models, compelling incumbents to accelerate internal innovation and cost-reduction initiatives. The cyclical nature of government defense budgeting and procurement cycles introduces financial volatility, requiring companies to manage long lead times and uncertain contract renewal timelines. Furthermore, the persistent threat of cyber warfare targeting critical infrastructure, including guidance systems and launch control networks, acts as a perpetual impact force requiring continuous, expensive investment in cybersecurity measures across the entire value chain. Successfully navigating this environment demands deep technological expertise, robust supply chain resilience, and keen geopolitical awareness, differentiating successful market players from those struggling with compliance and innovation gaps.

Segmentation Analysis

The Guided Missile and Space Vehicle Market is highly segmented based on system type, application, component, and operational technology, allowing for granular analysis of demand patterns and strategic investment areas. The segmentation by system type clearly delineates between various missile classes—such as ballistic, cruise, and anti-tank—and distinct space vehicles including launch systems, satellites, and spacecraft, each possessing unique technological complexities and end-user requirements. Application segmentation separates military defense (the largest segment) from commercial space (the fastest-growing segment) and civil government programs. The complexity and diverse technological requirements inherent in modern platforms necessitate this detailed categorization to accurately assess market size, competitive intensity, and future growth potential, providing stakeholders with clear insights into where value generation is concentrated across the ecosystem and how technological shifts influence traditional market boundaries.

- By Product Type:

- Missile Systems (Ballistic Missiles, Cruise Missiles, Anti-Tank Guided Missiles (ATGM), Surface-to-Air Missiles (SAM), Air-to-Air Missiles (AAM))

- Space Vehicles (Launch Vehicles/Rockets, Satellites, Deep Space Probes, Crewed Spacecraft, Hypersonic Glide Vehicles)

- By Technology:

- Guidance Systems (Inertial Navigation Systems (INS), GPS/GNSS, Seeker Technology (Infrared, Radar, Laser))

- Propulsion Systems (Solid Fuel, Liquid Fuel, Hybrid, Scramjet/Ramjet)

- By Component:

- Airframe and Control Systems

- Warhead/Payload

- Avionics and Telemetry

- Radars and Sensors

- By Application:

- Defense (Strategic Deterrence, Tactical Operations, Missile Defense)

- Commercial (Telecommunication, Earth Observation, Launch Services)

- Civil Government (Scientific Research, Weather Monitoring)

- By End-User:

- Military and Defense Forces

- Commercial Space Operators

- Government Space Agencies

Value Chain Analysis For Guided Missile and Space Vehicle Market

The Guided Missile and Space Vehicle value chain is characterized by its high degree of technological specialization, vertical integration, and extensive governmental involvement, segmented into five core stages: upstream material supply, component manufacturing, system integration, distribution, and downstream deployment/maintenance. The upstream phase involves the supply of highly specialized materials such as advanced composite structures, specialized alloys, energetic materials for propulsion (propellants and explosives), and sophisticated microelectronics necessary for guidance and control. Suppliers in this stage require rigorous certification and often operate under strict regulatory oversight, demanding impeccable quality control and supply chain traceability due to the mission-critical nature of the final product. The component manufacturing stage transforms these raw materials into specific subsystems like rocket engines, inertial measurement units (IMUs), seeker heads, and flight control surfaces, where intellectual property ownership and technological patents hold immense value and restrict market entry.

Midstream activities center on system integration and testing, a phase dominated by prime contractors (e.g., Lockheed Martin, Boeing, Northrop Grumman, SpaceX). These integrators manage thousands of sub-components, assembling them into the final missile or launch vehicle platform, requiring extensive, complex testing facilities and highly skilled engineering teams. Distribution and sales channels are overwhelmingly direct, particularly in the defense segment where government agencies or national defense departments are the exclusive buyers, necessitating long-term contract relationships and continuous technical support. For the commercial space segment, distribution involves direct contractual relationships with satellite operators or other commercial entities seeking launch capacity. Downstream value is realized through mission execution, operational maintenance, system upgrades, and decommissioning, all of which generate recurring service revenues and require substantial logistical support and post-sales technical engagement throughout the operational lifespan of these high-value assets.

The prevalence of direct sales channels, especially within the defense ecosystem, means indirect distribution via third-party resellers is minimal, emphasizing the strategic importance of direct relationship management between primes and government acquisition bodies. Furthermore, intellectual property rights and secure data handling are paramount throughout the value chain, driving substantial investment in secure digital engineering environments and cybersecurity measures. The increasing trend of vertical integration, particularly seen in leading commercial launch providers like SpaceX, aims to internalize component manufacturing, reducing reliance on third-party suppliers and gaining greater control over cost and production timelines, thereby creating significant competitive pressure on traditional segment-specific vendors.

Guided Missile and Space Vehicle Market Potential Customers

The primary customers for the Guided Missile and Space Vehicle Market are robustly categorized into three distinct, high-value groups: sovereign military and defense organizations, national civil government space agencies, and a rapidly expanding segment of commercial space operators and service providers. Military organizations represent the largest revenue stream, requiring continuous procurement of strategic and tactical missiles, interceptors, and associated command and control infrastructure to maintain national security and deterrence capabilities against evolving global threats. These customers prioritize performance specifications, reliability, lethality, and interoperability with existing defense architectures, leading to multi-billion dollar, multi-year procurement contracts that necessitate stringent contractual adherence and long-term technical partnership between the defense primes and the buyer nations.

Civil government space agencies, such as NASA, ESA, and ISRO, constitute another crucial customer base, driving demand for launch vehicles for scientific missions, deep space exploration probes, and infrastructure projects like navigation satellite systems (e.g., GPS, Galileo). These customers emphasize technological innovation, safety standards, and scientific capability, often funding long-duration research and development programs with specific technical deliverables. Finally, the commercial segment, comprising telecommunication companies (for satellite constellations), remote sensing providers, and private entities seeking microgravity research access, represents the fastest growing customer pool. This group is highly sensitive to launch costs and turnaround times, driving intense demand for affordable, highly reliable small- and medium-lift launch services and high-volume, standardized satellite platforms, which encourages competitive pricing and rapid innovation cycles from suppliers.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 285.5 Billion |

| Market Forecast in 2033 | USD 451.9 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Lockheed Martin, The Boeing Company, Northrop Grumman Corporation, Raytheon Technologies (RTX), BAE Systems, General Dynamics, Airbus SE, Thales Group, Safran S.A., L3Harris Technologies, Mitsubishi Heavy Industries (MHI), Aerojet Rocketdyne, Leonardo S.p.A., Israel Aerospace Industries (IAI), Roketsan, Sierra Nevada Corporation, Virgin Galactic, SpaceX, Blue Origin, United Launch Alliance (ULA) |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Guided Missile and Space Vehicle Market Key Technology Landscape

The technological landscape of the Guided Missile and Space Vehicle Market is defined by intense innovation across three primary domains: advanced propulsion, sophisticated guidance and navigation, and specialized material science. In propulsion, the focus is shifting towards high-performance systems capable of extreme speeds and long endurance, driving investment in ramjet and scramjet engines for air-breathing hypersonic missiles, offering speeds exceeding Mach 5. Concurrently, the space sector is developing reusable liquid-fuel rocket engines, such as those utilized by SpaceX and Blue Origin, drastically reducing the marginal cost of payload delivery to orbit and enabling higher launch frequencies crucial for deploying large satellite constellations. Furthermore, interest in green propellants and electric propulsion systems (e.g., Hall effect thrusters) for orbital maneuvering and deep space missions is increasing, promising enhanced efficiency and sustainability for future space operations.

Guidance and navigation technology advancements are fundamentally reliant on integrating Artificial Intelligence (AI) and improved sensor fusion capabilities. Modern guided systems utilize highly sophisticated Inertial Navigation Systems (INS) augmented by resilient, anti-jam Global Navigation Satellite System (GNSS) receivers, supplemented by advanced seekers—including high-resolution imaging infrared (IIR), synthetic aperture radar (SAR), and active phased array radar systems. These technologies enable all-weather, precision-strike capabilities and enhanced target discrimination, vital for operating in highly contested electromagnetic environments. The next generation of guidance systems is focused on autonomy, allowing missiles and space vehicles to navigate, avoid countermeasures, and select targets without real-time human intervention, a critical feature for long-range and strategic applications where communication latency is a challenge.

Material science innovation is equally vital, concentrating on developing extremely lightweight yet heat-resistant materials. The emergence of carbon-carbon composites and specialized ceramic matrix composites (CMCs) is essential for the construction of high-speed aerospace vehicles, particularly hypersonic platforms, where aerodynamic heating is a major design constraint. These advanced materials reduce structural mass, increase payload capacity, and improve vehicle survivability under extreme thermal and mechanical loads. Furthermore, advanced manufacturing techniques, including additive manufacturing (3D printing), are becoming commonplace, allowing for rapid prototyping and the production of complex, performance-optimized engine components and airframe parts, thus shortening development cycles and reducing long-term manufacturing costs across both the missile and space vehicle production lines.

Regional Highlights

- North America: North America, led overwhelmingly by the United States, holds the largest market share globally due to the colossal defense budget allocations directed towards advanced guided missile procurement and next-generation space exploration programs. The region is the epicenter for technological innovation in hypersonics, missile defense systems (e.g., GMD, THAAD), and commercial space infrastructure. The presence of major defense primes (Lockheed Martin, Raytheon, Northrop Grumman) and pioneering private space companies (SpaceX, Blue Origin) creates a dynamic ecosystem, strongly supported by massive governmental contracts from the Department of Defense (DoD) and NASA. The market in this region is mature but is currently experiencing a modernization wave focused on network integration and counter-peer competition capabilities, driving continuous investment in complex, high-cost systems.

- Asia Pacific (APAC): The APAC region is projected to register the highest Compound Annual Growth Rate (CAGR) during the forecast period. This rapid expansion is primarily fueled by intensified geopolitical tensions, particularly concerning territorial disputes, driving widespread military modernization efforts across countries like China, India, and South Korea. China is aggressively investing in its indigenous space program, aiming for deep space capabilities and developing advanced missile systems, including intermediate-range ballistic missiles and anti-access/area denial (A2/AD) assets. India's growing defense spending and self-reliance initiatives (Atmanirbhar Bharat) mandate increased domestic production of guided weapons and launch vehicles (ISRO programs). This region’s growth is characterized by technology transfer, localized production joint ventures, and a strategic shift towards strengthening regional aerospace and defense industrial bases.

- Europe: The European market demonstrates steady growth, driven by collective defense initiatives under NATO and the European Union’s increased focus on strategic autonomy. Key defense spenders like the UK, France, and Germany are replacing aging arsenals and investing heavily in next-generation tactical missiles and anti-air defense systems (e.g., MBDA programs). The European Space Agency (ESA) also drives substantial demand for launch services (Ariane series) and satellite technology. While European budgets are generally smaller than those in the US, the collective effort to develop sovereign capabilities in response to renewed security concerns ensures consistent investment in guidance technology, advanced propulsion, and strategic missile defense capabilities, often through pan-European collaborative projects.

- Middle East and Africa (MEA): The MEA market is characterized by substantial imports of advanced missile systems, particularly from the US and Europe, driven by regional conflicts and high energy revenues supporting major defense expenditures, especially in Saudi Arabia and the UAE. There is also a nascent but growing trend toward developing indigenous space programs and localized assembly and maintenance capabilities. The demand profile is heavily skewed towards tactical missile systems, precision-guided munitions, and sophisticated air defense infrastructure (e.g., THAAD deployments), with purchasing decisions strongly influenced by geopolitical alliances and immediate security requirements.

- Latin America: The Latin American market remains a niche player, focused predominantly on smaller tactical missiles, surveillance, and basic space infrastructure. Market growth is stable but moderate, driven primarily by localized security needs and occasional satellite launch requirements for communication and resource monitoring. Key spending is concentrated in countries like Brazil and Argentina, often utilizing international partnerships for access to high-end aerospace technology and launch services, rather than leading major independent strategic system development.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Guided Missile and Space Vehicle Market.- Lockheed Martin Corporation

- The Boeing Company

- Northrop Grumman Corporation

- Raytheon Technologies Corporation (RTX)

- BAE Systems plc

- Airbus SE

- Thales Group

- Safran S.A.

- L3Harris Technologies, Inc.

- General Dynamics Corporation

- Mitsubishi Heavy Industries, Ltd. (MHI)

- Aerojet Rocketdyne Holdings, Inc.

- Leonardo S.p.A.

- Israel Aerospace Industries (IAI)

- Roketsan A.Ş.

- Space Exploration Technologies Corp. (SpaceX)

- Blue Origin, LLC

- United Launch Alliance (ULA)

- Virgin Galactic Holdings, Inc.

- Sierra Nevada Corporation (SNC)

Frequently Asked Questions

Analyze common user questions about the Guided Missile and Space Vehicle market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary technological drivers shaping the future of guided missiles?

The future of guided missiles is primarily driven by three core technologies: Hypersonic flight capabilities (scramjet propulsion), enhanced autonomy and precision via Artificial Intelligence (AI)-driven guidance systems, and the integration of highly durable, lightweight advanced composite materials to increase speed and range. These innovations are critical for defeating sophisticated defensive systems.

How does the commercial space sector influence the overall market growth?

The commercial space sector significantly influences market growth by increasing the demand for reliable, cost-effective launch vehicles necessary for deploying mega-constellations of small satellites (LEO). This drives innovation in reusable rocket technology, reduces the cost barrier to space access, and encourages market entry for disruptive private companies, ultimately diversifying the customer base beyond traditional government agencies.

Which region dominates the Guided Missile and Space Vehicle Market, and why?

North America dominates the market, largely due to the United States’ immense and consistently high defense budget allocated for advanced weapon system procurement and the robust federal funding directed towards civil and military space programs (DoD and NASA). The region hosts the world's leading aerospace and defense prime contractors, fostering unparalleled research and manufacturing capacity.

What are the main restraints impacting market expansion?

The principal restraints include the extremely high capital expenditure required for research and development (R&D) of new systems, complex and time-consuming government procurement processes, and stringent international regulatory restrictions such as export control laws (e.g., ITAR), which inhibit global technology transfer and market access for many advanced components and finished systems.

How is AI being used to enhance missile defense systems?

AI is crucial for enhancing missile defense by improving the speed and accuracy of threat assessment, enabling rapid data fusion from multiple sensor types (ground, air, and space-based radar), and optimizing interceptor launch trajectories in real-time. This reduces the decision cycle time, which is essential for successfully engaging high-velocity threats like hypersonic missiles.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager