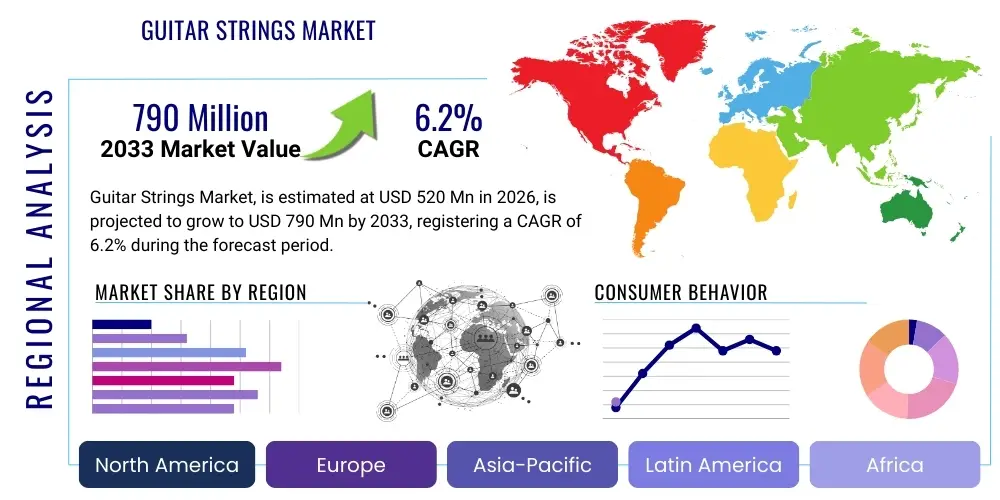

Guitar Strings Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437734 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Guitar Strings Market Size

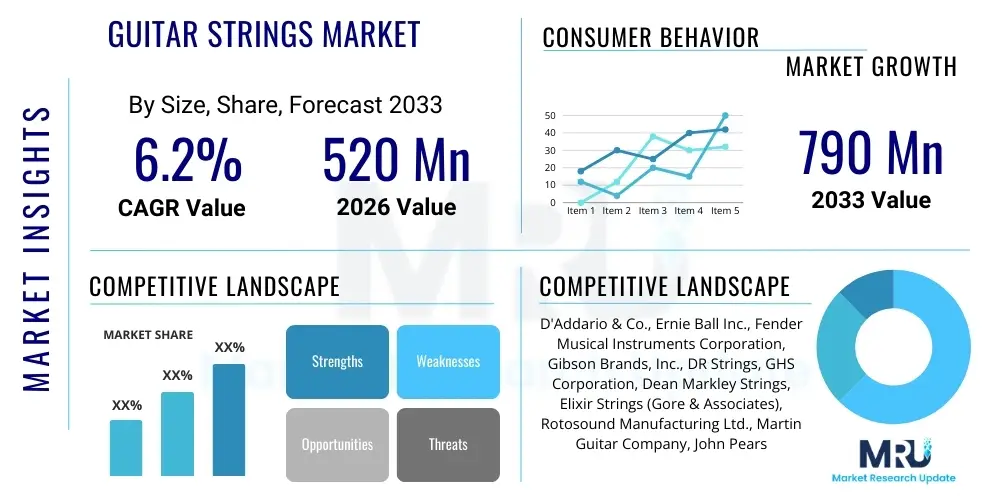

The Guitar Strings Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.2% between 2026 and 2033. The market is estimated at USD 520 Million in 2026 and is projected to reach USD 790 Million by the end of the forecast period in 2033.

Guitar Strings Market introduction

The Guitar Strings Market encompasses the manufacturing, distribution, and sale of strings designed for various types of guitars, including acoustic, electric, classical, and bass guitars. These strings are critical consumable components, directly influencing the instrument's tone, playability, and lifespan. The market is driven primarily by the global population of guitar players, ranging from amateur hobbyists and students to professional touring musicians and recording artists. Technological advancements in winding techniques, core materials (such as steel, nickel, and synthetic compounds), and specialized coatings (like polymer treatments) continue to enhance string durability and tonal quality, prompting frequent replacement cycles.

Major applications of guitar strings span across music performance, recording studios, music education, and instrument manufacturing (OEMs). The demand is intrinsically linked to the health of the broader music industry, including live events, album sales, and the proliferation of digital music platforms that increase exposure to guitar-centric music. Furthermore, the rising interest in DIY music production and home recording, particularly among younger demographics, fuels consistent demand for high-quality strings and related accessories.

Key benefits associated with modern guitar strings include improved tuning stability, extended lifespan due to anti-corrosion coatings, enhanced acoustic projection, and specific tonal characteristics optimized for various musical genres (e.g., bright, punchy tone for rock or warm, mellow tone for jazz). Driving factors include the increasing disposable income in emerging economies allowing greater access to musical instruments, the cultural significance of the guitar worldwide, and aggressive marketing strategies by manufacturers highlighting performance benefits and artist endorsements.

Guitar Strings Market Executive Summary

The global Guitar Strings Market demonstrates robust resilience driven by the non-discretionary nature of string replacement for active players. Business trends indicate a strong focus on premiumization, where consumers increasingly opt for specialized, coated strings offering longer life and superior tone, justifying higher price points. Strategic mergers and acquisitions among core manufacturers, alongside significant investment in R&D for material science, are shaping the competitive landscape. E-commerce platforms have become the dominant distribution channel, offering convenience, wider product selection, and competitive pricing, fundamentally altering traditional retail models.

Regional trends highlight North America and Europe as mature markets characterized by high per capita expenditure on music equipment and a dense population of professional musicians. However, the Asia Pacific (APAC) region is emerging as the fastest-growing market, primarily fueled by rapid urbanization, increasing middle-class income, and the adoption of Western music culture in countries like China and India. This growth is supported by a burgeoning local manufacturing base that caters to both domestic and international low-to-mid-range segment demands. Latin America also shows promising growth due to vibrant local music scenes and increasing governmental support for music education programs.

Segment trends reveal that the electric guitar segment commands the largest market share, closely followed by the acoustic segment, reflecting the enduring popularity of these instrument types. In terms of material, the nickel-plated steel segment dominates electric strings, while bronze and phosphor bronze remain standard for acoustic applications. The coating technology segment (polymer-coated strings) is expected to exhibit the highest CAGR, driven by their superior durability and consumer willingness to pay a premium to minimize frequent string changes. Manufacturers are also diversifying product lines to target niche segments, such as strings optimized for baritone guitars, seven-string instruments, and specific genres like heavy metal or bluegrass.

AI Impact Analysis on Guitar Strings Market

User inquiries regarding the impact of AI on the Guitar Strings Market often revolve around manufacturing efficiency, personalized product recommendations, and the evolution of music creation that might affect string demand. Key themes include whether AI-driven manufacturing processes can lead to cost reduction and quality consistency, and how predictive maintenance models (leveraging AI) might inform guitarists about optimal string replacement timing. Furthermore, consumers are interested in AI algorithms that can analyze playing style, genre preferences, and instrument type to recommend the single best string type or gauge set, moving beyond simple genre classifications offered by current retail sites. There is also a latent concern regarding how the rise of AI-generated music, which sometimes bypasses traditional instrumentalists, might influence the overall demand volume for physical strings in the long term.

While AI is not directly involved in the material science of string production, its applications are profoundly influencing the operational and commercial aspects of the market. Manufacturers are utilizing machine learning to optimize supply chain logistics, forecasting demand with greater accuracy based on historical sales data, artist touring schedules, and localized music trends. This optimization reduces inventory costs and shortens lead times. Moreover, AI is critical in quality control during the winding process, using computer vision and sensor data to detect microscopic inconsistencies that could compromise string lifespan or tone, thereby ensuring higher product uniformity across batches.

On the consumer front, Generative AI tools are changing how music is composed, potentially leading to more experimental techniques and tunings, which may drive demand for highly specialized or custom-gauge string sets. Retailers are deploying sophisticated recommendation engines powered by AI to enhance the customer journey, cross-selling complementary products like picks, tuners, and cleaning kits based on string purchase history. This shift towards hyper-personalization, driven by data analytics, enhances customer loyalty and maximizes average order value, thus positively influencing market revenue streams.

- AI-driven optimization of manufacturing processes leads to higher quality consistency and reduced production waste.

- Machine learning algorithms improve supply chain forecasting, stabilizing inventory levels and mitigating stockouts.

- AI-powered recommendation engines personalize string choices for consumers based on playing style and tonal goals, boosting sales conversion.

- Predictive maintenance analytics, often supported by AI, could eventually offer data-driven advice on string change cycles, enhancing player satisfaction.

- The rise of AI in music composition may spur demand for non-standard string gauges and configurations tailored for experimental or synthesized sounds.

DRO & Impact Forces Of Guitar Strings Market

The Guitar Strings Market is shaped by significant forces including robust market drivers, critical restraints, and substantial growth opportunities. The primary driver is the large and perpetually renewing base of guitar players globally, demanding consumable replacement products at regular intervals. This factor is reinforced by aggressive product innovation, particularly in durable coatings, which, ironically, creates a new cycle of consumer upgrade interest despite increasing product lifespan. The opportunity lies in geographical expansion into underserved markets, coupled with the development of eco-friendly and sustainably sourced string materials, appealing to environmentally conscious consumers.

However, the market faces restraints, primarily the high level of price sensitivity among non-professional players, especially in emerging economies, leading to the prevalence of counterfeit products and reliance on cheaper, lower-quality strings. Additionally, the increasing digitization of music, including the popularity of virtual instruments and synthesizers that do not require physical strings, poses a long-term, albeit slow-moving, threat to volume growth. Manufacturers must continuously invest heavily in R&D to differentiate premium products from generic alternatives and maintain competitive pricing strategies to counteract these challenges.

The impact forces influencing market dynamics are centered on substitution threat, supplier power, and buyer power. The threat of substitution is low, as no viable alternative exists for a physical guitar string (the core product), but high within the product category (switching brands or materials). Supplier power is moderate; key material suppliers (e.g., specific metal alloys and coating polymers) have some leverage, but manufacturers maintain multiple sourcing options. Buyer power is substantial due to the transparency provided by e-commerce, allowing easy price comparison and abundant product information, pushing manufacturers to focus relentlessly on branding, quality assurance, and direct-to-consumer relationships.

Segmentation Analysis

The Guitar Strings Market is highly segmented based on crucial parameters such as instrument type, material, coating type, and distribution channel, allowing manufacturers to precisely target distinct player needs. The analysis of these segments is vital for understanding current revenue streams and identifying future growth pockets. Instrument type segmentation reveals the relative dominance of electric and acoustic guitars, requiring fundamentally different string compositions. Material and coating segmentations reflect technological advancements and consumer preferences for tone and longevity, driving significant premiumization in the market. Distribution channels underscore the profound shift toward online retail platforms.

- By Instrument Type:

- Electric Guitar Strings

- Acoustic Guitar Strings (Steel String)

- Classical Guitar Strings (Nylon/Synthetic)

- Bass Guitar Strings

- Other Strings (e.g., Ukulele, Specialty Guitars)

- By Material:

- Nickel-Plated Steel

- Pure Nickel

- Stainless Steel

- Bronze (80/20)

- Phosphor Bronze

- Nylon/Synthetic

- Others (e.g., Copper, Titanium)

- By Coating Type:

- Coated Strings (Polymer/Nanotechnology Treatments)

- Uncoated Strings

- By Distribution Channel:

- Offline Retail (Music Stores, Department Stores)

- Online Retail (E-commerce Websites, Company Websites)

Value Chain Analysis For Guitar Strings Market

The value chain for the Guitar Strings Market begins with raw material sourcing, involving specialized metal alloys (steel, nickel, copper, zinc) and synthetic polymers (for coatings and classical strings). Upstream analysis focuses on suppliers of high-quality wire stock, requiring stringent quality control regarding metallurgy and gauge consistency, as these factors fundamentally determine the final product's tonal quality and reliability. Key processes involve precision drawing of core wire and intricate winding techniques, often using high-speed machinery to wrap the cover wire around the core wire, followed by ball-end attachment and specialized coating application.

The midstream involves manufacturing and branding, where large players differentiate themselves through proprietary winding technologies, unique material combinations, and intensive marketing campaigns featuring artist endorsements. Quality assurance and packaging are critical steps here, ensuring strings are hermetically sealed to prevent premature corrosion. The downstream segment focuses heavily on distribution. Traditional distribution channels involve wholesalers and authorized distributors moving products to brick-and-mortar music shops. However, modern distribution is increasingly dominated by direct sales and large e-commerce platforms like Amazon, Sweetwater, and others.

Distribution channels are categorized into direct and indirect sales. Direct distribution involves manufacturers selling directly to consumers (D2C) via their own websites, allowing for higher margins and direct customer feedback. Indirect distribution, which still accounts for a significant volume, involves sales through third-party retailers. The optimization of this downstream segment—particularly inventory management and rapid fulfillment in the digital space—is crucial for maintaining market share, as consumers expect immediate availability of these essential replacement items.

Guitar Strings Market Potential Customers

Potential customers for the Guitar Strings Market are highly diversified, ranging from individuals engaging in music as a hobby to large institutional purchasers. The largest segment of end-users consists of individual guitar players, who purchase replacement strings based on their playing frequency, genre preference, and budget. These players fall into sub-categories such as beginners (seeking affordable, durable sets), intermediate players (balancing cost and quality), and professional musicians (demanding premium tone and consistency). Frequent replacement is necessitated by factors such as corrosion, metal fatigue, and grime buildup.

Another major customer segment includes Original Equipment Manufacturers (OEMs), which are guitar companies like Fender, Gibson, and Ibanez. These companies purchase strings in massive bulk quantities to equip new instruments before they leave the factory. These contracts are highly lucrative but subject to rigorous quality specifications. Music education institutions, schools, and professional recording studios represent institutional buyers that require large volumes of strings for student instruments, rental fleets, and session work, prioritizing bulk discounts and reliable supply.

Furthermore, guitar technicians, luthiers, and repair shops constitute a critical professional customer base, purchasing various gauges and types of strings for repair and custom setup work. Targeting these professional groups with specialized bulk packaging and technical support is a key strategy for market penetration. The diversity of the customer base requires manufacturers to maintain a wide product portfolio covering all instrument types and price points, from entry-level economy sets to high-end, specialized coated strings.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 520 Million |

| Market Forecast in 2033 | USD 790 Million |

| Growth Rate | CAGR 6.2% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | D'Addario & Co., Ernie Ball Inc., Fender Musical Instruments Corporation, Gibson Brands, Inc., DR Strings, GHS Corporation, Dean Markley Strings, Elixir Strings (Gore & Associates), Rotosound Manufacturing Ltd., Martin Guitar Company, John Pearse Strings, Thomastik-Infeld GmbH, Augustine Strings, La Bella Strings, Dunlop Manufacturing, Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Guitar Strings Market Key Technology Landscape

The technological landscape of the Guitar Strings Market is characterized by continuous refinement in material science and manufacturing precision, rather than radical disruption. The core technology centers around sophisticated wire drawing processes that ensure perfect gauge tolerance, critical for intonation and playability. A significant technological advancement driving market value is the development of ultra-thin, proprietary polymer coatings. These coatings, exemplified by companies like Elixir and D'Addario's XT line, utilize micro-thin film technology to protect the metal windings from oxidation and corrosive contaminants (sweat, dirt), dramatically extending string lifespan without significantly dampening the tone. This technology has successfully created a premium segment where consumers are willing to pay substantially more for longevity.

Another crucial area involves the refinement of winding methods. Advanced computer-controlled winding machines ensure consistent tension and precise spacing of the wrap wire around the core wire, eliminating potential inconsistencies that lead to uneven tone or premature breakage. Techniques such as 'hex core' and 'round core' construction remain foundational, but manufacturers continually iterate on the alloys used for the outer wrap wire. For instance, the use of unique phosphor bronze mixes (for acoustic strings) or specialized nickel alloys (for electric strings) allows manufacturers to fine-tune the frequency response, offering brighter, warmer, or more mid-focused tones to target specific genre demands.

Furthermore, technology is applied beyond the string itself into packaging. Advanced vacuum sealing and moisture control packets are now standard practice to ensure the strings remain factory fresh and non-oxidized before purchase. Research is also focused on developing new core materials, such as cryogenically treated metals, to enhance elasticity and tensile strength. The cumulative effect of these technological developments is the elevation of the overall performance standard of replacement strings, maintaining the market's high barrier to entry for new competitors who lack the necessary manufacturing precision and material science expertise.

Regional Highlights

- North America: This region holds the largest market share, driven by a deeply ingrained music culture, high disposable incomes, and the presence of major key market players and iconic instrument brands. The U.S. remains the epicenter of demand, characterized by a large professional musician base, high engagement in music education, and rapid adoption of premium coated strings. E-commerce penetration is maximal here, defining current sales strategies.

- Europe: Europe represents a mature and stable market with significant demand emanating from countries like the UK, Germany, and France. Germany, in particular, boasts a strong market for classical and acoustic string instruments. Consumer preferences lean toward high-quality, long-lasting strings, and there is a strong brand loyalty established over decades. Regulatory standards related to material sourcing and environmental impact are also beginning to influence purchasing decisions.

- Asia Pacific (APAC): APAC is the fastest-growing region, projected to surpass other regions in growth rate due to burgeoning middle-class populations in China, India, and Southeast Asia. The rise in music schools, increasing adoption of Western musical instruments, and local manufacturing capabilities that cater to the budget and mid-range segments are key growth drivers. While price sensitivity is higher, the sheer volume of new players entering the market provides massive revenue opportunities.

- Latin America (LATAM): The LATAM market, led by Brazil and Mexico, exhibits steady growth fueled by vibrant local music scenes (e.g., Samba, Bossa Nova, Rock). The focus here is often on affordable yet reliable strings. Distribution challenges related to logistics and retail fragmentation provide opportunities for manufacturers that can establish robust local partnerships.

- Middle East and Africa (MEA): This region is characterized by relatively smaller market size but shows promising potential, particularly in urban centers of the UAE and Saudi Arabia, where investment in entertainment and cultural infrastructure is increasing. Demand is heavily reliant on international touring acts and imported instruments, making distribution channels critical and often complex.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Guitar Strings Market.- D'Addario & Co.

- Ernie Ball Inc.

- Fender Musical Instruments Corporation

- Gibson Brands, Inc.

- DR Strings

- GHS Corporation

- Dean Markley Strings

- Elixir Strings (W. L. Gore & Associates)

- Rotosound Manufacturing Ltd.

- C. F. Martin & Co. (Martin Guitar Company)

- John Pearse Strings

- Thomastik-Infeld GmbH

- Augustine Strings

- La Bella Strings

- Dunlop Manufacturing, Inc.

- Pyramid Strings

- Hannabach

- S.I.T. Strings

- Cleartone Strings

- Savarez SA

Frequently Asked Questions

Analyze common user questions about the Guitar Strings market and generate a concise list of summarized FAQs reflecting key topics and concerns.What factors primarily drive the growth of the Guitar Strings Market?

Market growth is principally driven by the large, global installed base of guitar players who require frequent string replacement due to wear and corrosion. Product innovation, specifically in long-lasting coated strings and specialized alloys, also significantly contributes by promoting premium upgrades and maintaining player engagement.

How do coated strings impact market dynamics and revenue generation?

Coated strings significantly boost market revenue by creating a high-margin premium segment. Although they extend string lifespan, consumers are willing to pay more for enhanced durability and consistent tone, minimizing the frequency of maintenance and replacement work for active players, thus increasing the average transaction value.

Which geographical region is expected to show the highest growth rate during the forecast period?

The Asia Pacific (APAC) region is projected to register the highest Compound Annual Growth Rate (CAGR) due to rapid economic development, increasing disposable income, rising participation in music education, and the widespread adoption of Western musical culture across countries like China and India.

What is the most significant technological trend impacting guitar string manufacturing?

The most significant technological trend is the advancement in polymer and nanotechnology-based coatings. These ultra-thin treatments are essential for protecting strings against environmental corrosion and grime, which enhances longevity and tonal stability, differentiating high-end products from standard, uncoated strings.

What major challenge does the market face regarding price and competition?

The primary challenge is the high price sensitivity among non-professional and beginner players, particularly in emerging markets, leading to intense competition in the low-end segment and a persistent issue with counterfeit and generic strings undermining brand value and intellectual property protection.

How is the distribution channel shifting for guitar strings?

Distribution is rapidly shifting from traditional brick-and-mortar music stores toward online retail platforms. E-commerce offers greater convenience, broader product selection, direct-to-consumer options, and competitive pricing, making it the dominant channel for high-volume sales and niche product distribution.

What material dominates the electric guitar string segment?

Nickel-plated steel is the dominant material for electric guitar strings. It offers a balance of magnetic properties essential for pickups, durability, and a bright, versatile tonal character suitable for most contemporary genres.

Are sustainable materials becoming relevant in string production?

Yes, sustainability is an emerging opportunity. Manufacturers are exploring eco-friendly materials and packaging alternatives to appeal to environmentally conscious consumers, although the widespread adoption of completely non-metallic or recycled core materials remains nascent.

What role do OEMs play in the Guitar Strings Market?

Original Equipment Manufacturers (OEMs), such as major guitar builders, are crucial customers. They purchase strings in massive volumes for equipping new instruments, ensuring consistent demand for high-quality, standardized sets, often leading to lucrative supply contracts for major string manufacturers.

How does AI contribute to optimizing the guitar string value chain?

AI primarily optimizes the value chain through enhanced quality control during manufacturing (detecting flaws), improving supply chain logistics (accurate demand forecasting), and personalizing consumer recommendations in online retail, thereby increasing operational efficiency and maximizing sales conversions.

What defines the classical guitar strings segment?

The classical guitar strings segment is defined by the use of nylon or synthetic core materials, often combined with silver-plated or copper wrap wires. These materials are essential for producing the warmer, less sustained tone required for classical music and flamenco, distinct from steel-string acoustics.

Why is tuning stability a critical factor for professional musicians?

Tuning stability is critical because temperature changes, aggressive playing, and bending can cause string tension variation. Manufacturers invest heavily in precise wire drawing and winding to ensure the string holds pitch reliably under performance conditions, a non-negotiable requirement for professional use.

What are the implications of the hex core vs. round core construction debate?

Hex core construction (common today) provides better grip for the outer winding, resulting in longer string life and brighter tone. Round core construction offers a more flexible feel and vintage tone. This debate drives segmentation, allowing manufacturers to cater to players seeking modern durability or traditional tonality, respectively.

How significant is the impact of artist endorsements on string sales?

Artist endorsements are highly significant. Professional musicians influence purchasing decisions among their fanbase, driving demand for specific signature sets, gauges, or string types. This strategy is a cornerstone of brand visibility and validation in the professional segment.

How does the threat of substitution impact the string market?

The threat of substitution for the guitar string itself is low, as the instrument physically requires them. However, substitution between string brands and materials (e.g., switching from uncoated to coated or steel to nylon) is high, making brand loyalty and product differentiation crucial for market share retention.

What challenges exist for market penetration in the Latin American region?

Challenges in LATAM include retail fragmentation, complex import duties, and infrastructure limitations, which necessitate establishing robust local partnerships and adapting pricing strategies to accommodate market economic variances and consumer purchasing power.

What determines the gauge choice for a typical player?

Gauge choice is determined by playing style, instrument type, and desired tension. Heavy gauges are typically preferred by rock and jazz players for volume and tone, while lighter gauges are favored by beginner players or those focusing on faster, easier bending and legato techniques.

What role does Phosphor Bronze play in acoustic string material?

Phosphor bronze, typically an 80/20 copper-zinc alloy with added phosphorus, is valued for its rich, warm, and long-lasting tone on acoustic guitars, offering a more mellow sound profile compared to standard 80/20 bronze, which is often brighter and harsher initially.

Why are coatings typically applied to the outer wrap wire and not the core?

Coatings are applied to the outer wrap wire because this part is most exposed to oxygen, dirt, and corrosive elements like sweat, which initiate rust and deadening of the tone. The core wire is largely protected by the winding structure, and coating it would negatively impact the metal-to-metal contact necessary for tone transfer.

How do manufacturers maintain quality consistency across batches?

Manufacturers maintain quality consistency through stringent metallurgical checks of raw wire stock, computer-controlled precision winding machinery, continuous in-line gauge monitoring, and rigorous post-production testing, often utilizing AI-assisted visual inspection systems to ensure uniformity.

What is the primary difference between roundwound and flatwound bass strings?

Roundwound strings are standard, offering a bright, aggressive tone and sustain. Flatwound strings have a smooth, flattened outer wrap, producing a muted, deep, 'thumpy' tone favored by jazz, Motown, and vintage players, and are less abrasive on frets.

How does the rise of digital music platforms influence string demand?

Digital music platforms generally increase string demand indirectly by broadening exposure to guitar-centric music globally, inspiring new players and sustaining the careers of professional musicians, ensuring the instrument remains culturally relevant and frequently played.

What is the significance of the ball-end attachment technology?

The ball-end attachment technology, which secures the string to the instrument bridge, is vital for reliability. Manufacturers use advanced locking mechanisms and precise crimping to prevent slippage and ensure the string breaks at the neck or under the winding tension, rather than at the connection point.

In the Value Chain, where is the highest value addition located?

The highest value addition is typically located in the midstream—manufacturing, R&D for proprietary coatings and alloys, and branding/marketing. These elements differentiate premium products and allow manufacturers to capture higher margins than raw material suppliers or basic distributors.

Why is the replacement cycle for strings a crucial metric for the market?

The replacement cycle is crucial because guitar strings are consumables; the market's size is fundamentally tied to how frequently players replace their strings. Manufacturers prioritize technologies (like coatings) that influence this cycle, either by extending it (premiumization) or speeding it up (new product release cycles).

What impact does social media have on guitar string purchasing decisions?

Social media and platforms like YouTube provide demonstrations, reviews, and tutorials, heavily influencing purchasing decisions. Influencers and product reviewers act as crucial intermediaries, often driving traffic toward specific brands or newly launched specialized string sets.

How does cryogenic treatment affect string performance?

Cryogenic treatment (freezing strings to extremely low temperatures) is hypothesized to alter the molecular structure of the metal, leading to increased density, enhanced tensile strength, improved durability, and potentially better tonal characteristics, positioning these strings in the ultra-premium segment.

Which instrument type holds the largest market share in terms of revenue?

Electric guitar strings typically hold the largest market share in terms of revenue, driven by the sheer volume of electric guitar players globally, the prevalence of nickel and specialized alloys, and the frequent replacement demands of gigging professionals.

What are the key concerns for manufacturers regarding raw material supply?

Key concerns include volatility in global metal alloy prices (nickel, copper, steel), securing reliable supply chains for specialized wire stock with low impurity levels, and maintaining consistency in the metallurgical composition vital for tonal quality and breaking point specification.

How does the demand for seven-string and eight-string guitar strings affect the market?

The increasing popularity of heavy metal and progressive genres drives demand for multi-scale and extended-range instruments (seven and eight strings). This niche segment requires unique, heavy-gauge string sets and specific core/wrap ratios, offering a high-growth opportunity for specialization and premium pricing.

What distinguishes bronze (80/20) from phosphor bronze strings for acoustic guitars?

80/20 Bronze strings offer a very bright, articulate tone, often preferred for bluegrass or cutting through a mix. Phosphor Bronze is a warmer, more balanced material that maintains its warm tone longer than 80/20, making it preferred for solo acoustic performance and singer-songwriters.

Why is precise gauge tolerance critical in guitar string manufacturing?

Precise gauge tolerance is critical because even minor variations in string diameter directly affect intonation, tension balance across the set, and overall playability. Inconsistencies lead to tuning instability and poor tone, compromising the quality perception of the brand.

What is the outlook for the uncoated strings segment?

The uncoated strings segment remains significant, particularly in the entry-level and traditional professional segments. While coated strings are growing rapidly, many purists still prefer the feel and immediate tone of uncoated strings, maintaining its stable demand profile, often necessitating frequent replacement.

How are environmental regulations affecting string material choices?

Environmental regulations are increasingly pressuring manufacturers to minimize hazardous materials in production and favor recyclable packaging. This pushes R&D towards identifying sustainable, yet high-performing, alternatives for core metals and coating polymers, particularly in Europe.

What is 'hex core' and why is it prevalent in modern strings?

A hex core is a hexagonal shaped steel wire used as the string foundation. It is prevalent because its sharp edges effectively grip the outer wrap wire, preventing slippage, which results in better tuning stability, longer lasting tone, and enhanced consistency during manufacturing compared to traditional round core wire.

How do regional music genres influence string demand segmentation?

Regional genres heavily influence demand; for example, classical music strongholds drive demand for high-tension nylon strings, while regions dominated by rock and metal increase demand for heavy gauge electric strings and specialized alloys like stainless steel for brightness and durability.

What is the primary function of nickel plating on steel electric strings?

Nickel plating serves two primary functions: it slightly mellows the harsh brightness of pure steel, contributing to a balanced tone, and more importantly, it offers crucial protection against corrosion, extending the playable life of the string compared to bare steel.

How do manufacturers combat the threat of counterfeit products?

Manufacturers combat counterfeiting by implementing proprietary packaging designs, using holographic security seals, selling directly through authorized channels (especially online), and utilizing sophisticated tracking technology to monitor product movement from factory to consumer.

Why is the market defined as robust despite the consumable nature of the product?

The market is robust because string replacement is non-negotiable for active players, ensuring continuous, stable demand regardless of minor economic fluctuations. Furthermore, manufacturers successfully drive incremental revenue through premiumization and product differentiation.

What are the implications of direct-to-consumer (D2C) sales for the market?

D2C sales increase manufacturer margins, provide direct access to customer data for personalized marketing, and strengthen brand loyalty. They also bypass traditional retail markups, allowing for competitive pricing or premium service offerings directly to the end-user.

What distinguishes bass guitar strings from standard guitar strings technologically?

Bass guitar strings are characterized by much thicker gauges, longer scale lengths, and often specialized construction (e.g., tapered core or compound windings) to produce the deep, low-frequency tones necessary, requiring heavier machinery and different metallurgical properties.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager