Gum Base Candy Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434410 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Gum Base Candy Market Size

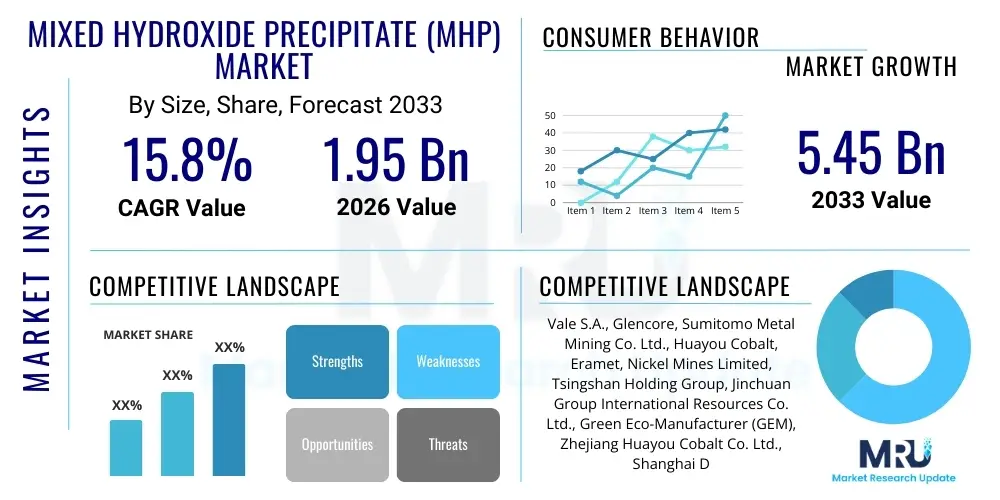

The Gum Base Candy Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 8.5 Billion in 2026 and is projected to reach USD 12.6 Billion by the end of the forecast period in 2033.

Gum Base Candy Market introduction

The Gum Base Candy Market encompasses the highly specialized segment responsible for the core non-nutritive component of chewing gum, bubble gum, and various medicated gums. Gum base is an inert, non-digestible substance that provides the characteristic masticatory properties—elasticity, texture, chew quality, and flavor release capability—essential for the final candy product. This base is typically a complex mixture of elastomers (such as synthetic rubbers like Polyisobutylene, or natural latices like chicle), resins (like polyvinyl acetate or pine resins), plasticizers, waxes, and fillers (e.g., calcium carbonate). The primary function of the gum base is to hold the sweeteners, flavors, and active ingredients in suspension during chewing, ensuring a stable and long-lasting consumer experience. Demand is heavily driven by consumer desire for stress relief, oral health benefits (sugar-free gums), and the increasing adoption of functional chewing gum formats designed to deliver vitamins, caffeine, or other wellness compounds.

Gum base manufacturing involves intricate compounding processes where raw materials are melted, mixed under high shear, and then extruded to form a stable, homogeneous mixture ready for integration with sweeteners and flavors. The market is constantly evolving, shifting away from older, fully synthetic bases toward hybrid or natural formulations driven by consumer preference for clean-label products and sustainable sourcing. Major applications include traditional stick and pellet chewing gum aimed at refreshing breath or providing dental benefits, as well as bubble gum, which requires a specific high-molecular-weight composition to achieve desirable bubble properties. The market's robust growth is underpinned by rising disposable incomes in emerging economies, innovative flavor profiles developed through sophisticated research, and effective marketing linking gum consumption to positive health and lifestyle outcomes, particularly in reducing sugar intake through sugar-alcohol-based formulations.

The composition of the gum base is critical to the final product's performance and regulatory compliance. Manufacturers must balance the need for excellent masticatory quality (softness, resistance to hardening) with cost efficiency and regulatory approval, especially concerning food contact materials. The ongoing trend of developing biodegradable gum bases utilizing materials derived from natural sources or specialized biopolymers represents a significant area of research and investment, addressing environmental concerns related to disposal. Benefits of the final product range from improved concentration and stress mitigation to enhanced oral hygiene through xylitol and fluoride delivery. These diverse benefits and applications ensure a broad consumer base across all demographics, sustaining the long-term viability and growth trajectory of the specialized gum base ingredient market.

Gum Base Candy Market Executive Summary

The Gum Base Candy Market is experiencing dynamic shifts, largely characterized by the bifurcation of demand between high-performance synthetic bases necessary for complex flavor retention and the rapidly growing consumer preference for natural, sustainable, and clean-label alternatives. Business trends indicate significant consolidation among major ingredient suppliers seeking economies of scale and enhanced R&D capabilities, particularly in developing non-stick and environmentally friendly formulations. Manufacturers are heavily investing in microencapsulation technologies to protect volatile flavors and functional ingredients during the compounding process, thereby extending shelf life and enhancing the intensity of flavor release during consumption. Geographically, the Asia Pacific (APAC) region stands out as the primary growth engine, fueled by massive population growth, increasing urbanization, and the adoption of Western confectionery habits, particularly in China and India. Conversely, North America and Europe, while mature, focus on premiumization, functional attributes, and adherence to stringent health and environmental regulations, driving innovation in areas like CBD-infused gums and dental health products.

Segmentation trends highlight the dominance of synthetic bases due to their versatility and cost-effectiveness, primarily driven by the massive scale of mainstream chewing gum production. However, the fastest growth is observed within the natural/hybrid segment, spurred by retail efforts to meet clean-label consumer mandates. The application segment sees robust performance from chewing gum due to its widespread adoption for oral hygiene, though bubble gum maintains steady demand, particularly among younger demographics. Furthermore, the specialized medicated and functional gum segment is rapidly gaining traction as pharmaceutical and nutraceutical companies leverage gum bases as efficient, patient-friendly delivery vehicles for active pharmaceutical ingredients (APIs) and dietary supplements. This functional shift necessitates highly specialized, chemically stable gum bases capable of interacting safely and effectively with pharmaceutical compounds without compromising bioavailability.

The market faces inherent challenges related to the volatility of petrochemical feedstock prices, which directly impact the cost of synthetic elastomers and resins. Regulatory scrutiny regarding synthetic polymers and their environmental impact also presents a structural restraint. To counteract these factors, key industry players are strategically forming partnerships with sustainable raw material suppliers and engaging in vertical integration to secure the supply chain. The overall market outlook remains highly positive, underpinned by continuous product diversification, a strong global focus on preventative health (driving sugar-free consumption), and technological advancements in manufacturing that enhance product quality and sustainability credentials. The successful navigation of environmental regulations and the effective commercialization of novel, plant-based gum base materials will determine the competitive landscape in the medium to long term, positioning sustainability as a major differentiator.

AI Impact Analysis on Gum Base Candy Market

Common user questions regarding AI's impact on the Gum Base Candy Market frequently center on how machine learning can accelerate new product development, optimize complex supply chains given the number of specialized chemical components, and ensure highly consistent quality in flavor dispersion and texture. Users are keenly interested in the role of generative AI in designing novel flavor profiles that appeal to local tastes, predicting consumer sensory responses to different gum base formulations, and optimizing production scheduling to reduce waste and energy consumption. Furthermore, there is significant inquiry into AI's capability to monitor extrusion parameters in real-time, minimizing variability in batch consistency, a critical factor for confectionery quality. The key themes revolve around enhanced efficiency, hyper-personalization of products, and leveraging data analytics to secure competitive advantages in an ingredient-driven, highly technical manufacturing sector.

Artificial intelligence and machine learning (ML) are fundamentally transforming the research and development pipeline for gum base manufacturers, primarily by enabling rapid iterative testing of novel polymer mixtures and plasticizer combinations. AI algorithms analyze vast datasets of material properties, rheological characteristics, and consumer sensory panels to predict the optimal formulation needed to achieve specific elasticity, tackiness, and flavor-release profiles without costly and time-consuming physical experimentation. This capability significantly shortens the time-to-market for innovative products, such as next-generation biodegradable or functional gum bases. Furthermore, in manufacturing, AI-powered predictive maintenance minimizes downtime associated with complex extrusion and compounding machinery, ensuring maximum operational efficiency and high throughput, which is essential for meeting large-scale confectionery demand.

In terms of consumer interface and market strategy, AI is crucial for understanding nuanced demand patterns across diverse geographical regions and demographic segments. ML models track social media trends, sales data, and health claims to identify unmet consumer needs (e.g., specific functional ingredients or sustainable packaging preferences), guiding flavor innovation and ingredient sourcing. For large-scale operations, AI-driven supply chain management optimizes the procurement of specialized raw materials—elastomers, natural resins, and food-grade waxes—by forecasting price volatility and managing inventory levels precisely. This sophisticated analytical approach allows gum base manufacturers to maintain competitive pricing while ensuring the uninterrupted supply of high-quality, complex chemical inputs.

- AI-driven Predictive Flavor Formulation: Utilizing generative algorithms to design flavor combinations optimal for specific gum base compositions and targeted demographic preferences.

- Optimized Production Scheduling: Machine learning minimizes raw material waste and energy consumption by predicting optimal batch sizes and sequencing complex manufacturing runs.

- Real-time Quality Control: AI vision systems and sensor data analysis monitor mixing and extrusion parameters, ensuring stringent consistency in texture and elasticity across all batches.

- Sustainable Material Sourcing: Algorithms identify and vet sustainable, bio-based feedstock suppliers and predict the performance characteristics of novel, environmentally friendly polymers.

- Supply Chain Resilience: Predictive analytics forecast potential disruptions in the global chemical supply chain, mitigating risks associated with petrochemical and specialized resin procurement.

DRO & Impact Forces Of Gum Base Candy Market

The Gum Base Candy Market is shaped by a confluence of strong underlying drivers related to consumer health and wellness, moderated by significant restraints associated with raw material volatility and environmental backlash against synthetic polymers. The primary driver is the accelerating global shift towards sugar-free confectionery, where gum serves as a popular, low-calorie alternative utilizing gum bases formulated specifically for sugar alcohols like xylitol and sorbitol. This health-conscious movement, combined with the successful integration of functional ingredients (vitamins, probiotics, CBD), provides substantial momentum. Conversely, high dependency on petroleum-derived polymers, such as butyl rubber and polyisobutylene, makes the industry vulnerable to global oil price fluctuations. Furthermore, increasing regulatory pressure and consumer awareness concerning the environmental impact of non-biodegradable gum waste act as a strong structural restraint, forcing expensive transitions towards sustainable material science.

Opportunities in the market center on capitalizing on the demand for clean-label and natural products. The development and commercialization of genuinely biodegradable, plant-derived gum bases (often based on chicle, jelutong, or advanced biopolymers) offer a high-growth avenue, allowing brands to differentiate themselves through superior environmental credentials. Geographical expansion into high-growth, underdeveloped markets in Africa and Southeast Asia represents another critical opportunity for volume growth. Technological advances, particularly in microencapsulation, allow for the creation of innovative products with controlled, long-lasting flavor release, capturing premium market segments. Impact forces fundamentally influencing the market include shifting consumer perception—where gum is increasingly viewed as a functional delivery mechanism rather than just a treat—and regulatory changes, particularly those governing the use of artificial sweeteners and novel food ingredients, which necessitate costly compliance and re-formulation efforts.

The interplay between these forces dictates strategic investment decisions across the value chain. Drivers encourage investment in R&D focusing on functional ingredients and sugar alternatives, whereas restraints mandate aggressive exploration of alternative, sustainable raw material suppliers. The market’s future is intrinsically linked to its ability to manage the environmental footprint of its core product. Successful companies are those that can strategically mitigate material cost volatility through hedging and long-term contracts, while simultaneously addressing the societal impact of plastic waste through the pioneering of truly compostable gum base formulations. This necessity for sustainable innovation has transformed from a niche opportunity into a fundamental requirement for market longevity and consumer trust.

Segmentation Analysis

The Gum Base Candy Market is comprehensively segmented based on the type of base material used, the specific application of the final product, and the geographic region. Segmentation is crucial for understanding market dynamics as the performance characteristics and cost structures vary significantly between synthetic and natural bases. The market is primarily dominated by synthetic gum bases due to their cost-effectiveness, consistency, and superior ability to deliver specific properties required for large-scale, mass-market chewing gum. However, the fastest growth is observed within the natural and hybrid segments, reflecting a strong consumer and industry push towards sustainable and naturally derived ingredients. Manufacturers must navigate these segments carefully, tailoring their polymer science and ingredient sourcing to meet the specific demands of each application area, from high-performance bubble gum to highly regulated medicated delivery systems.

Application segmentation reveals that general chewing gum (including functional and dental gums) accounts for the largest market share, driven by widespread use for oral hygiene, breath freshening, and stress relief. Bubble gum remains a stable, culturally significant segment, though it requires gum bases with specific high-molecular-weight elastomers to ensure maximum bubble inflation and resilience. The emerging medicated/functional gum segment, while smaller in volume, offers the highest growth potential and profit margins. These applications require pharmaceutical-grade gum bases that must be non-reactive, stable, and capable of ensuring the consistent bioavailability of active pharmaceutical ingredients (APIs), demanding higher regulatory standards and specialized manufacturing processes. Analyzing these segments provides strategic insights into investment priorities, favoring innovation in functional delivery systems and sustainable sourcing over sheer volume expansion in traditional synthetic segments.

- By Type:

- Synthetic Gum Base (Polyisobutylene, Polyvinyl Acetate, Synthetic Rubbers, Esters of Glycerol)

- Natural Gum Base (Chicle, Jelutong, Natural Resins, Gutta Percha substitutes)

- Hybrid Gum Base

- Biodegradable Gum Base (Emerging)

- By Application:

- Chewing Gum (Stick, Pellet, Center-filled)

- Bubble Gum

- Medicated Gum (Nicotine Gum, Vitamin Delivery)

- Functional Gum (Energy, CBD, Weight Management)

- By End-User:

- Confectionery Companies

- Pharmaceutical/Nutraceutical Companies

- By Region:

- North America (US, Canada, Mexico)

- Europe (Germany, UK, France, Italy, Spain)

- Asia Pacific (China, India, Japan, South Korea)

- Latin America (Brazil, Argentina)

- Middle East and Africa (MEA)

Value Chain Analysis For Gum Base Candy Market

The value chain for the Gum Base Candy Market begins upstream with the procurement of highly specialized raw materials, primarily synthetic polymers (petrochemical derivatives), natural elastomers, resins, waxes, and calcium carbonate fillers. Upstream analysis focuses on securing stable, cost-effective supplies of these complex chemical inputs. Since synthetic bases rely on the petrochemical industry, manufacturers face commodity price volatility and must manage complex global logistics for specialized chemicals. Natural base procurement involves sustainable sourcing from tropical regions for materials like chicle, necessitating ethical and environmental compliance monitoring. Successful upstream management requires strategic, long-term contracts with key chemical producers and specialized natural material collectors to ensure supply security and quality consistency, forming the initial foundation of product quality and cost structure.

The intermediate stage involves the specialized manufacturing and compounding of the gum base itself. This is a highly technical process where raw materials are melted, mixed under vacuum and heat, and homogenized through high-shear extrusion to create the final base material tailored to specific customer needs (e.g., sugar-free requirements, specific chew softness). Key manufacturers operate sophisticated, often proprietary, compounding facilities. Distribution channels are primarily business-to-business (B2B), as the gum base is an industrial ingredient sold directly or indirectly via specialized distributors to large confectionery and pharmaceutical manufacturers. Direct sales channels are favored for large-volume customers and customized formulations, allowing for close technical collaboration and quality control, ensuring the base integrates perfectly with the buyer's flavor and sweetener systems.

The downstream segment consists of confectionery companies that take the manufactured gum base, incorporate sweeteners (sugar or sugar substitutes), flavors, colors, and active ingredients, and then shape, condition, and package the final consumer product. This phase includes the robust marketing and sales efforts targeting final consumers through mass retail channels (supermarkets, convenience stores, pharmacies). The reliance on indirect distribution (via wholesalers, large retail chains, and e-commerce) is paramount for reaching consumers globally. The effectiveness of the gum base—in terms of flavor delivery and texture—directly impacts brand perception downstream. The value chain's efficiency is measured by the ability of gum base manufacturers to provide consistent, compliant, and cost-optimized bases that enable confectionery clients to achieve superior final product performance and market differentiation, especially in the competitive sugar-free and functional gum segments.

Gum Base Candy Market Potential Customers

The primary consumers of gum base are large, multinational confectionery manufacturers who utilize the base ingredient to produce chewing gum and bubble gum products for global distribution. These companies require vast volumes of highly consistent gum base, often tailored to specific regional regulatory standards and consumer texture preferences. Their demands often focus on cost-effectiveness, long shelf life, and guaranteed performance parameters, such as minimizing tackiness and maximizing flavor retention. Establishing long-term relationships and providing technical support for integrating the base into high-speed production lines is crucial for serving this dominant segment of end-users. Their purchasing decisions are heavily influenced by the supplier's ability to innovate in areas like non-stick formulations and cost optimization.

A rapidly growing segment of potential customers includes pharmaceutical and nutraceutical companies. These buyers leverage gum base as an innovative, non-invasive, and often aesthetically pleasing oral delivery system for active pharmaceutical ingredients (APIs), vitamins, supplements, and functional botanicals like CBD or specialized probiotics. For this segment, the primary requirements shift from texture and cost to chemical stability, regulatory compliance (often requiring GMP standards), and demonstrated capability to ensure the effective bioavailability of the active ingredient. Suppliers catering to this market must provide pharmaceutical-grade gum bases with detailed documentation regarding inertness and consistency, requiring rigorous quality control protocols and specialized R&D collaboration.

Beyond the major industrial users, smaller, specialized confectionery firms focusing on niche, premium, or organic markets also constitute potential customers. These buyers often demand natural or biodegradable gum bases exclusively, aligning with clean-label mandates and environmental ethics. While their volume demand is smaller, they are willing to pay a premium for certified natural ingredients, traceable sourcing, and specialized artisanal formulations. Gum base manufacturers targeting these customers must emphasize sustainability certifications, ethical sourcing, and flexibility in providing customized, often smaller batch sizes, contrasting sharply with the volume requirements of major global players.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 8.5 Billion |

| Market Forecast in 2033 | USD 12.6 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Perfetti Van Melle Group, Mondelēz International, Gum Base Co. S.p.A., Ingredion Incorporated, The Goodyear Tire & Rubber Company (Elastomers Division), Eurobase S.A., Dandy Gum Base, Cafosa Gum, K&S Gum Base Co., Lotte Confectionery, Wuxi Yuantong Gum Base Co., Inc., The Gum Base Company Pvt. Ltd., Shandong Xinchu Chemical Co., Ltd., Arcor Group, BAZOOKA CANDY BRANDS (Topps). |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Gum Base Candy Market Key Technology Landscape

The technology landscape in the Gum Base Candy Market is focused heavily on achieving superior sensory attributes, enhancing the functional delivery capabilities, and mitigating environmental impact. A critical technological advancement is the application of advanced extrusion and compounding techniques, particularly co-rotating twin-screw extruders. These systems allow for precise temperature control and high shear mixing, essential for creating homogenous gum bases from polymers with vastly different melting points and viscosities. High-tech compounding ensures that the gum base has the optimal elasticity, firmness, and flavor-holding capacity, preventing flavor burnout or textural degradation during storage. Manufacturers are leveraging precise automation in these processes to ensure batch-to-batch consistency, which is paramount when supplying high-volume confectionery clients worldwide.

Another pivotal technology is microencapsulation, utilized not directly in the gum base manufacturing but in the immediate downstream process where the base is mixed with flavors and active ingredients. Microencapsulation involves coating volatile flavors or sensitive functional components (like probiotics or vitamins) within a protective matrix. This technology ensures controlled release during chewing, preventing premature flavor dissipation and protecting the efficacy of sensitive ingredients, particularly in functional and medicated gums. This enables the creation of complex flavor profiles that remain potent over extended periods and facilitates the integration of otherwise unstable health components, directly addressing consumer demand for long-lasting performance and advanced nutritional delivery.

Perhaps the most transformative technological shift lies in the adoption of sustainable polymer science and green chemistry. Leading manufacturers are investing heavily in R&D aimed at replacing traditional, petroleum-derived elastomers with bio-based, compostable polymers derived from natural sources, such as specialized starches, cellulose derivatives, or polyhydroxyalkanoates (PHAs). Developing viable, scalable biodegradable gum bases requires complex polymer engineering to mimic the rheological properties of synthetic bases—specifically elasticity and non-tackiness—while ensuring complete decomposition post-disposal. The successful implementation of these sustainable technologies is vital for future compliance with environmental regulations and for capturing the increasing market share driven by eco-conscious consumers, necessitating profound changes in core manufacturing chemistries and processes.

Regional Highlights

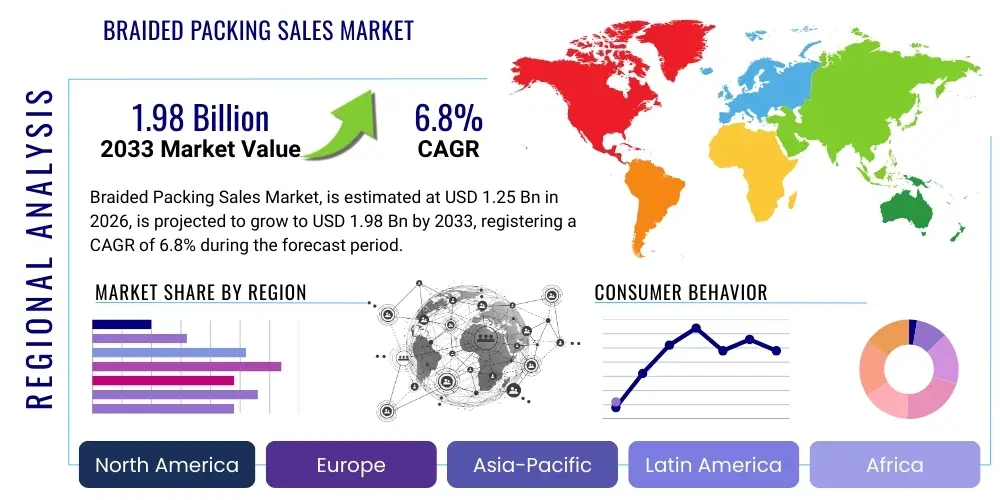

Regional analysis of the Gum Base Candy Market reveals differential growth rates and distinct consumption patterns influenced by local economic development, cultural preferences, and regulatory environments.

- Asia Pacific (APAC): APAC is the fastest-growing region, driven primarily by massive population bases in China and India, rapidly increasing disposable incomes, and the growing influence of Western dietary habits. The market is characterized by high demand for traditional bubble gum and increasing adoption of sugar-free chewing gum as awareness of dental health improves. Key growth drivers include extensive distribution networks and competitive pricing strategies catering to price-sensitive consumers.

- North America: This region represents a mature, high-value market focused heavily on innovation and functional attributes. North American consumers drive demand for premium gum bases used in specialized products such as nicotine replacement therapy gums, energy gums, and CBD-infused varieties. The market thrives on technological advancements, stringent quality control, and a consumer willingness to pay a premium for novel health benefits and differentiated sensory experiences.

- Europe: Europe is characterized by strict regulatory oversight, particularly regarding food additives and environmental waste. This regulation drives innovation in biodegradable and natural gum bases. The market shows strong demand for sugar-free and functional gums, aligned with European consumers’ general preference for clean labels and preventative health measures. Germany, the UK, and France are critical markets dictating trends in ethical sourcing and sustainable packaging solutions.

- Latin America (LATAM): LATAM exhibits consistent growth, largely due to strong demand for mass-market chewing gum and bubble gum, particularly among younger populations. Brazil and Mexico are leading markets, experiencing urbanization and a corresponding rise in organized retail. The focus here is balanced between cost efficiency and local flavor preferences, with a slower but steady adoption of sugar-free alternatives compared to North America and Europe.

- Middle East and Africa (MEA): MEA is an emerging region showing increasing market penetration, particularly in urbanized centers of the GCC countries and South Africa. Growth is stimulated by rising incomes and a young demographic. Challenges include fragmented distribution channels and varying regulatory frameworks, but opportunities exist in specialized religious-compliant (Halal) confectionery products.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Gum Base Candy Market.- Perfetti Van Melle Group

- Mondelēz International

- Gum Base Co. S.p.A.

- Ingredion Incorporated

- The Goodyear Tire & Rubber Company (Elastomers Division)

- Eurobase S.A.

- Dandy Gum Base

- Cafosa Gum

- K&S Gum Base Co.

- Lotte Confectionery

- Wuxi Yuantong Gum Base Co., Inc.

- The Gum Base Company Pvt. Ltd.

- Shandong Xinchu Chemical Co., Ltd.

- Arcor Group

- BAZOOKA CANDY BRANDS (Topps)

- GNT Group

- Ferrara Candy Company

- Simply Gum

- RevTech Gum Base

- Cosmo Base, Inc.

Frequently Asked Questions

Analyze common user questions about the Gum Base Candy market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between synthetic and natural gum bases?

Synthetic gum bases are predominantly composed of petroleum-derived polymers, such as polyisobutylene and polyvinyl acetate (PVAC), offering superior cost consistency and specific performance traits like non-tackiness. Natural gum bases utilize plant-derived substances like chicle or jelutong and are favored for clean-label, sustainable products, often commanding a higher price point due to sourcing and processing complexities.

How significant is the shift towards biodegradable gum base materials?

The shift towards biodegradable gum bases is strategically significant and represents a critical long-term growth opportunity, driven by increasing consumer concern over plastic waste and escalating municipal regulations regarding gum disposal. While currently a niche segment, investment in specialized biopolymer research is intense, aiming to achieve the elasticity and texture of traditional bases using environmentally benign materials.

Which application segment drives the highest volume in the gum base market?

The standard Chewing Gum application segment, encompassing regular, breath-freshening, and general dental health gums, drives the highest overall volume in the gum base market. This segment benefits from widespread global consumption for oral hygiene, stress relief, and as the most common format for sugar-free products utilizing synthetic and hybrid bases.

What role does microencapsulation technology play in modern gum bases?

Microencapsulation is a crucial downstream technology applied to flavors and active ingredients that are integrated into the gum base. Its role is to protect sensitive components (like probiotics or volatile mint oils) from degradation during processing and ensure a delayed, controlled, and longer-lasting release of flavor or functionality during the actual chewing process, enhancing product premiumization.

Which geographic region is forecasted to exhibit the highest growth rate?

The Asia Pacific (APAC) region is consistently forecasted to exhibit the highest compound annual growth rate (CAGR), fueled by demographic factors such as rapid urbanization, a substantial young population, and increasing per capita expenditure on convenience and confectionery products, particularly in emerging economies like China and India.

The Gum Base Candy Market is a highly specialized sector within the global confectionery industry, responsible for supplying the non-nutritive, essential component that provides chewing gum with its fundamental physical characteristics. This component, the gum base, is a complex matrix synthesized from a variety of raw materials, including elastomers, resins, waxes, plasticizers, and fillers. Elastomers, such as synthetic polyisobutylene (PIB) or natural chicle, provide the characteristic elastic and rubbery texture. Resins, often polyvinyl acetate (PVAC), contribute to the chewability and softening properties, ensuring the gum remains pliable throughout consumption. Waxes and plasticizers are added to modify the consistency and aid in the incorporation of flavors and sweeteners, while fillers like calcium carbonate provide bulk and texture. The market's complexity stems from the need to balance performance requirements—like excellent flavor release, minimized stickiness, and longevity of chew—with stringent food safety regulations and cost efficiency. Innovation is central to competition, focusing heavily on developing sugar-free formulations and functional gums that deliver active ingredients like vitamins, caffeine, or nicotine replacements. The global industry is characterized by a limited number of specialized manufacturers who supply vast quantities of customized gum base mixtures to major confectionery producers.

Market drivers are numerous, encompassing the rising global health consciousness that promotes sugar-free consumption, the utilization of chewing gum as a tool for stress management and concentration improvement, and the expansion of the gum category into pharmaceutical and nutraceutical delivery systems. The economic growth in emerging markets, especially across Asia, is creating massive consumer bases eager for both traditional and innovative gum products. However, the market faces significant structural challenges. The reliance on petrochemical inputs for synthetic elastomers subjects manufacturers to volatile raw material costs. Crucially, the non-biodegradability of most synthetic gum bases poses a major environmental problem, attracting public scrutiny and regulatory pressure, necessitating substantial investment in sustainable R&D. This regulatory environment and public demand for sustainable alternatives represent a major determinant of future investment and technological trajectories.

In terms of regional dynamics, North America and Europe are mature markets defined by high consumer expectations for functional benefits and premium, clean-label ingredients. These regions drive innovation in specialized segments, such such as CBD and energy gums. Conversely, the Asia Pacific region dominates in terms of volume growth, reflecting lower cost manufacturing and expanding consumer access to Western-style confectionery. The industry is currently in a transition phase, moving from purely functional performance to integrated sustainability and health delivery systems, requiring sophisticated supply chain management, advanced material science, and adherence to evolving global food and environmental standards. Strategic partnerships and vertical integration are commonly employed to mitigate supply chain risks and ensure proprietary access to innovative base formulations. The long-term success of stakeholders relies on their ability to commercialize effective, scalable biodegradable gum bases that meet both consumer performance and environmental compliance requirements.

The technical specifications of gum base are highly varied depending on the intended application. For instance, bubble gum bases require higher molecular weight elastomers and specific resin ratios to create the required film-forming capabilities and elasticity for bubble blowing. Chewing gum bases are engineered for smoothness and rapid flavor delivery. Medicated bases must be inert and chemically compatible with APIs, preventing premature degradation or unwanted interaction. Technological advancements are focused on enhancing flavor encapsulation techniques, ensuring that the flavor oils are protected within the base until chewing commences, resulting in a burst of fresh flavor. Extrusion technology continues to be refined, using advanced cooling and mixing systems to minimize thermal degradation of sensitive components during processing. The development of non-tack bases is also critical for consumer satisfaction and mitigating disposal issues.

The competitive landscape is dominated by large players who benefit from established supply chains and proprietary formulation knowledge. However, specialized, smaller firms often lead the way in niche areas like natural and organic gum bases, responding directly to clean-label market mandates. Financial performance in this sector is intrinsically linked to material sourcing efficiencies and the ability to pass on innovation costs to premium-segment consumers. The investment cycle is long, requiring significant outlay in R&D for novel polymers and compliance testing. Overall market stability is high due to the habitual nature of gum consumption, ensuring steady demand despite economic fluctuations. Future market differentiation will be strongly influenced by transparent ingredient sourcing, certifications related to sustainability, and the successful navigation of global regulatory hurdles concerning food contact materials.

The integration of artificial intelligence into the gum base market is a nascent but high-potential area. AI is being utilized in two primary areas: enhancing R&D efficiency and optimizing large-scale manufacturing processes. In R&D, machine learning algorithms can analyze data from hundreds of experimental polymer mixes, predicting the optimal combination of elastomers and resins needed to achieve desired rheological properties, substantially reducing the physical testing required. This accelerates the development of specialized bases, particularly for complex functional gum formulations or difficult-to-engineer biodegradable bases. On the manufacturing floor, AI-powered systems monitor extrusion temperatures, shear rates, and ingredient flow in real-time. This predictive maintenance and quality assurance capability ensures unparalleled batch consistency, minimizes energy consumption, and preemptively flags potential mechanical failures, leading to significant operational cost savings and reduced waste in a high-volume production environment.

The value chain is intricate, starting from chemical synthesis plants and forestry operations, moving through highly specialized gum base compounding facilities, and finally reaching the large confectionery manufacturers who formulate the finished product. Logistics management for temperature-sensitive resins and specialized chemical components is complex and critical. The shift towards natural bases introduces new challenges in agricultural sourcing and ethical supply chain traceability, requiring sophisticated environmental and social governance (ESG) reporting. Effective management of the distribution channel, which includes both direct B2B sales and specialized ingredient distributors, is vital for ensuring that confectionery clients globally receive customized, high-quality, and timely supplies of the base materials essential for their final product lines.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager