Gummy Candies Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433661 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Gummy Candies Market Size

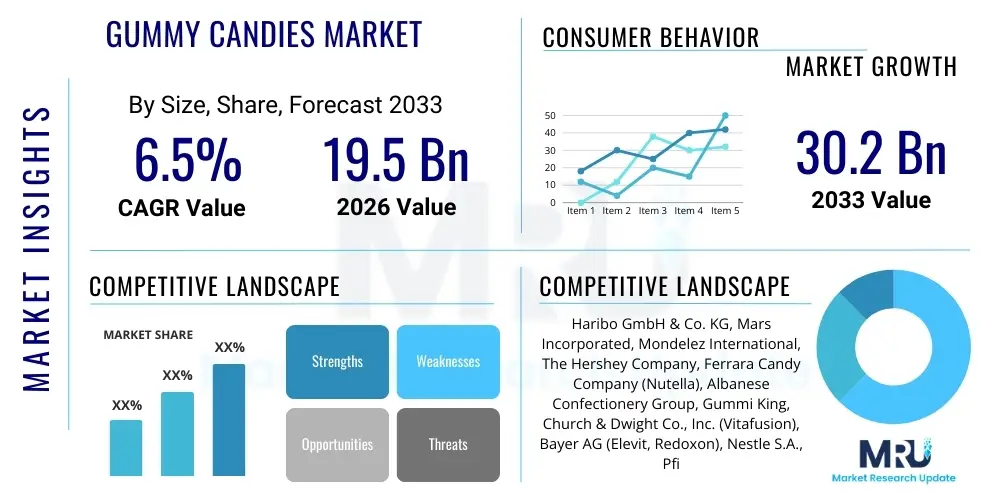

The Gummy Candies Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at USD 19.5 Billion in 2026 and is projected to reach USD 30.2 Billion by the end of the forecast period in 2033.

Gummy Candies Market introduction

The Gummy Candies Market encompasses the global production, distribution, and consumption of gelatin-based or pectin-based confectionery products characterized by their chewy texture and variety of flavors, shapes, and colors. These products are primarily categorized under the wider confectionery industry but hold a distinct position due to their appeal across various age groups, particularly children and young adults. The basic product description involves the use of hydrocolloids (like gelatin or plant-based alternatives) mixed with sweeteners, coloring agents, and flavor enhancers, processed through molding and starch-free deposition techniques to achieve the signature gummy consistency.

Major applications of gummy candies extend beyond traditional indulgence snacks, now significantly penetrating the nutraceutical and functional food sectors. Gummy vitamins, supplements (such as CBD or melatonin gummies), and functional treats appealing to health-conscious consumers represent a burgeoning segment, driving innovation in ingredient formulation and delivery formats. The inherent appeal of gummies—convenience, palatability, and ease of dosage—makes them an ideal delivery system for active ingredients. Furthermore, the traditional confectionery application remains robust, fueled by seasonal demands and continuous product novelty, including sour, filled, and hybrid textures.

The market’s benefits are rooted in product flexibility and strong consumer loyalty. Gummy candies offer manufacturers versatility in flavor profiles and aesthetic design, allowing for rapid adaptation to changing consumer tastes and themed promotions. Driving factors include rising disposable income in emerging economies, aggressive marketing strategies by key industry players focused on social media and targeted demographics, and the sustained global trend toward permissible indulgence. The continuous development of healthier alternatives, such as sugar-free, low-calorie, and vegan-friendly options, further stabilizes market growth by mitigating health-related consumption barriers.

Gummy Candies Market Executive Summary

The Gummy Candies Market is undergoing substantial transformation, primarily driven by converging demands for both indulgence and functional health benefits. Business trends indicate a shift towards sustainable sourcing, clean-label ingredients, and advanced manufacturing processes, particularly starchless molding, to reduce cross-contamination risks and increase production efficiency. Strategic expansions through mergers and acquisitions are frequent, with large confectionery conglomerates acquiring niche functional gummy manufacturers to diversify their product portfolio rapidly. Furthermore, packaging innovation, focusing on single-serving packs and environmentally friendly materials, is critical for maintaining competitiveness and appealing to modern consumer preferences for convenience and ecological responsibility.

Regional trends highlight the dominance of North America and Europe, attributed to high consumption rates, robust distribution networks, and early adoption of functional gummies, especially in the vitamin and dietary supplement space. However, the Asia Pacific (APAC) region is poised for the fastest growth, propelled by rapid urbanization, increasing per capita spending on consumer packaged goods (CPG), and the burgeoning popularity of Western-style confectionery among the youth population. Manufacturers are increasingly tailoring flavors (e.g., exotic fruit profiles) and textures to cater specifically to regional palatability preferences in high-growth markets like China and India, leading to localized product launches and marketing campaigns.

Segmentation trends reveal that the functional gummies segment (vitamins, supplements, and CBD) is accelerating significantly faster than traditional confectionery gummies, though the latter retains the largest volume share. Ingredient analysis shows a strong consumer preference shift away from traditional gelatin toward plant-based alternatives such as pectin, tapioca, and carrageenan, catering to the growing vegan and vegetarian consumer base. Furthermore, the retail distribution segment, particularly supermarkets and hypermarkets, remains the dominant sales channel, while e-commerce platforms are experiencing exponential growth, driven by subscription models and direct-to-consumer (D2C) sales of niche health-focused gummy products.

AI Impact Analysis on Gummy Candies Market

User queries regarding the intersection of Artificial Intelligence (AI) and the Gummy Candies Market frequently revolve around personalization, supply chain optimization, and novel flavor development. Consumers and industry stakeholders are keen to understand how AI algorithms can predict granular taste preferences based on demographic and historical consumption data, leading to highly personalized product recommendations and flavor combinations. There is significant interest in using AI for predictive quality control and optimizing complex manufacturing processes, such as ingredient blending and drying cycles, to reduce batch variance and ensure consistent texture and flavor profile. Key concerns often focus on the ethical use of consumer data for personalized marketing and the potential displacement of human labor in highly automated production facilities, though the overarching expectation is that AI will accelerate innovation and enhance operational efficiency.

- AI-driven Predictive Analytics for Flavor Trends: Utilizing machine learning models to analyze social media chatter, sensory reports, and sales data to forecast future ingredient and flavor demands, significantly shortening the product development lifecycle.

- Optimized Supply Chain Management: Implementing AI to manage volatile raw material costs (like sugar, gelatin, or specialty ingredients), predict demand fluctuations, and optimize inventory levels across global distribution centers, minimizing waste and logistical bottlenecks.

- Personalized Nutraceutical Formulation: AI algorithms are employed to suggest optimal dosages and combinations of vitamins, minerals, or active botanicals for personalized gummy supplements based on individual health profiles and dietary needs.

- Enhanced Quality Control and Consistency: Computer vision and AI systems monitoring production lines for consistency in shape, color saturation, and detecting defects with greater accuracy and speed than traditional manual inspection methods.

- Marketing and Consumer Engagement: AI powers hyper-targeted advertising campaigns and analyzes user interaction data to optimize packaging designs and point-of-sale displays for maximum consumer appeal.

DRO & Impact Forces Of Gummy Candies Market

The dynamics of the Gummy Candies Market are shaped by a complex interplay of internal and external forces. The primary driving force (Driver) is the burgeoning consumer demand for functional and fortified confectionery, leveraging the appealing format of gummies to deliver health benefits without the stigma or difficulty associated with pills. This trend is strongly supported by the rapid expansion of the dietary supplements industry globally. Conversely, significant restraints (Restraints) include stringent regulatory scrutiny regarding sugar content, labeling accuracy, and health claims, particularly in regions like Western Europe and North America, forcing manufacturers to invest heavily in reformulation efforts and compliance measures. The volatility in the price of key raw materials, such as sugar, high-fructose corn syrup, and hydrocolloids, also acts as a constraint, impacting profit margins and forcing frequent price adjustments.

The most compelling opportunity (Opportunity) lies in the innovation within plant-based and clean-label ingredient sourcing. Developing stable, high-quality alternatives to traditional gelatin and refining natural coloring and flavoring agents presents a significant pathway for market leaders to capture the growing segment of vegan, allergen-sensitive, and natural-food consumers. Furthermore, market penetration in underserved geographic areas, especially Tier 2 and Tier 3 cities across APAC and MEA, represents substantial untapped potential for both traditional and functional gummy products, provided manufacturers can adapt distribution strategies to local retail infrastructure and consumer purchasing power.

Impact forces illustrate how these internal and external factors interact to steer market direction. The increasing emphasis on health and wellness acts as a high-impact driver, compelling rapid product diversification (e.g., low-sugar, high-fiber, immunity-boosting variants). However, the persistent threat of alternative confectionery formats and heightened competition from private-label brands maintains downward pressure on pricing, characterized by high competitive intensity. Technological advancements in deposition and molding equipment, coupled with AI integration, serve as key leveraging forces, enabling manufacturers to efficiently scale production of complex, multi-layered, or fortified gummy formulations, thereby stabilizing supply and supporting the aggressive expansion into functional product categories globally.

Segmentation Analysis

The Gummy Candies Market is comprehensively segmented based on product type, ingredient type, distribution channel, and end-user application to accurately reflect the diverse market dynamics and specialized consumer demands within the global confectionery and nutraceutical landscape. This granular segmentation allows industry participants to target specific consumer groups, ranging from children consuming traditional treats to adults seeking specific health benefits delivered through functional gummies. The increasing diversification of ingredients, particularly the shift toward vegetarian and specialized alternatives, is significantly influencing the segmentation structure, often resulting in cross-segment opportunities like vegan, low-sugar functional gummies.

The segmentation by Product Type, distinguishing between Traditional Confectionery Gummies and Functional Gummies, is crucial for understanding the revenue shift toward health-focused products. Ingredient type segmentation addresses the clean label trend, differentiating products based on the use of gelatin, pectin, or other hydrocolloids. Furthermore, the segmentation by Distribution Channel highlights the varying importance of brick-and-mortar retail versus the rapidly expanding e-commerce segment, which is particularly vital for specialized, direct-to-consumer functional products. Analyzing these segments provides a clear roadmap for investment priorities and strategic market entry.

- By Product Type:

- Traditional Confectionery Gummies

- Functional Gummies (Vitamins, Supplements, CBD/THC, Probiotics)

- By Ingredient Type:

- Gelatin-based

- Plant-based (Pectin, Agar-agar, Carrageenan, Tapioca)

- By Flavor Type:

- Fruit Flavors (Berry, Citrus, Tropical)

- Non-Fruit Flavors (Cola, Mint, Specialty)

- By Sugar Content:

- Sugar-based

- Sugar-Free/Reduced Sugar (using Polyols, Stevia, Monk Fruit)

- By Distribution Channel:

- Supermarkets/Hypermarkets

- Convenience Stores

- Online Retail/E-commerce

- Pharmacies/Drug Stores

- By End-User:

- Children

- Adults

Value Chain Analysis For Gummy Candies Market

The Gummy Candies market value chain commences with upstream analysis, focusing on the sourcing and processing of core raw materials. This stage involves the acquisition of high-quality sweeteners (sugar, corn syrup, alternative sweeteners), hydrocolloids (gelatin, pectin, starches), and specialized ingredients (natural colors, flavorings, active nutraceutical compounds). Efficient upstream operations require robust supplier relationships and contracts to mitigate price volatility and ensure ingredient quality consistency, especially for clean-label and functional ingredients which often require specialized handling and certification (e.g., non-GMO, organic). Manufacturing operations involve cooking, mixing, molding (traditionally starch molding or modern starchless systems), drying, oiling/coating, and final packaging. Continuous investment in starchless molding technology is a critical factor for maintaining hygiene and maximizing production scalability.

The midstream logistics and distribution segment is highly complex due to the product's sensitivity to temperature and humidity, which can compromise texture and shelf life. The primary distribution channels are direct and indirect. Direct distribution involves manufacturers supplying large retailers or specialized pharmacies directly, often utilized for high-margin functional gummies requiring strict control over storage conditions. Indirect distribution relies heavily on wholesalers and third-party logistics providers (3PLs) who manage bulk shipments to convenience stores, small retailers, and regional distributors, particularly common for traditional confectionery items.

Downstream analysis focuses on retail execution and consumption patterns. The effectiveness of the distribution channel is paramount; traditional retail settings (supermarkets/hypermarkets) leverage high foot traffic and impulse buying, while the rapidly growing e-commerce channel offers customization, subscription services, and greater reach for specialized dietary supplements. Key activities at this stage include effective shelving, promotional activities, and point-of-sale marketing. The modern value chain increasingly integrates reverse logistics and waste management practices, emphasizing sustainable packaging solutions to appeal to the environmentally conscious end-user, thereby closing the loop and enhancing brand value.

Gummy Candies Market Potential Customers

The Gummy Candies Market targets a highly diversified customer base, spanning across all age demographics, primarily segmented into two major categories: traditional confectionery consumers and health-focused functional consumers. Traditional customers, predominantly children and young adults, seek indulgence, novelty, and variety. Their purchasing decisions are highly influenced by flavor innovation, attractive packaging, brand recognition, and price point. Manufacturers target this group through mass-market retail presence, seasonal promotions, and licensed character collaborations, emphasizing the experience of pleasure and permissible treats.

The rapidly expanding segment of functional gummy customers (Adults and Senior citizens) represents higher-value potential. These buyers are primarily motivated by health and wellness outcomes, seeking convenient and palatable alternatives to traditional pills or capsules for delivering vitamins, supplements (like Vitamin C, D, Collagen), and specific active compounds (e.g., CBD, melatonin). Potential customers in this segment include busy professionals, individuals with dysphagia (difficulty swallowing pills), and consumers adopting specific dietary regimes (vegan, keto). Marketing for this group is concentrated through pharmacies, health food stores, and D2C online channels, focusing on efficacy, clean ingredients, and clinical backing rather than pure indulgence.

Furthermore, niche markets such as athletes, individuals with specific nutritional deficiencies, and pet owners (gummy supplements for animals are a growing adjacent market) also constitute potential customers. The core strategy for capturing these segments involves tailoring the active ingredient profile and flavor to specific needs, providing clear evidence of benefits, and ensuring the product complies with strict regulatory standards for efficacy and safety. The convergence of these diverse customer needs—indulgence for one segment and clinical efficacy for the other—requires manufacturers to maintain dual innovation pipelines.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 19.5 Billion |

| Market Forecast in 2033 | USD 30.2 Billion |

| Growth Rate | 6.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Haribo GmbH & Co. KG, Mars Incorporated, Mondelez International, The Hershey Company, Ferrara Candy Company (Nutella), Albanese Confectionery Group, Gummi King, Church & Dwight Co., Inc. (Vitafusion), Bayer AG (Elevit, Redoxon), Nestle S.A., Pfizer Inc. (Centrum), Goli Nutrition Inc., SmartSweets, Better Nutritionals, and Zydus Wellness. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Gummy Candies Market Key Technology Landscape

The manufacturing technology landscape for the Gummy Candies Market is rapidly evolving, driven primarily by the need for increased efficiency, better hygiene standards, and the capability to produce complex, multi-functional products. The transition from traditional starch molding to starchless molding systems represents the most significant technological shift. Starchless deposition uses silicone or specialized plastic molds, offering unparalleled hygiene by eliminating the risk of starch cross-contamination, which is crucial for nutraceutical and allergen-free product lines. These systems also facilitate faster product changeovers and reduce operational costs associated with starch conditioning and drying, providing manufacturers with greater flexibility in short-run, specialized gummy production.

Furthermore, advanced cooking and blending technology is vital for integrating temperature-sensitive active ingredients, such as vitamins, probiotics, and CBD, without compromising their efficacy. Vacuum cooking processes minimize thermal degradation, ensuring maximum bioavailability of functional compounds in the final gummy product. High-shear mixing and continuous processing systems are also increasingly utilized to ensure homogenous distribution of active ingredients and flavorings across large batches, which is essential for maintaining dose accuracy in pharmaceutical and supplement gummies. Precision temperature control and in-line viscosity monitoring are standard features in modern manufacturing plants.

Innovation also extends to packaging and customization. Three-dimensional (3D) printing technology, while still nascent, holds potential for creating highly intricate and personalized gummy shapes and textures, offering unique differentiation in the highly saturated market. Automated sorting and high-speed packaging equipment, often integrated with vision systems for quality checks, improve output volume and reduce labor costs. Moreover, the implementation of sophisticated Enterprise Resource Planning (ERP) systems, linked with the manufacturing execution system (MES), allows for real-time tracking of batch traceability, ingredient provenance, and energy consumption, supporting compliance and sustainability goals.

Regional Highlights

- North America (NA): North America maintains market dominance, primarily due to the established high consumption culture of both traditional confectionery and an aggressive market penetration of functional gummies. The US, in particular, leads the global market in functional gummy supplements, driven by consumer willingness to adopt convenient delivery formats for health and wellness. High regulatory standards ensure quality, though they also necessitate high investment in R&D for compliant sugar reduction and clean-label initiatives. Robust retail infrastructure and high internet penetration further facilitate market accessibility for D2C brands specializing in niche functional products like CBD and specialized vitamin gummies. The competitive landscape is mature, focusing heavily on innovation in flavor and texture alongside aggressive marketing campaigns.

- Europe: The European market is characterized by a strong dichotomy: high consumption of traditional, well-established European brands (like Haribo) alongside rigorous consumer demand for clean labels, organic certification, and reduced sugar content. Germany, the UK, and France are the major revenue contributors. The EU's strict food safety and labeling regulations heavily influence product formulation, driving rapid adoption of plant-based alternatives (pectin) to cater to the widespread vegetarian and vegan populations. Functional gummies are growing quickly, particularly those targeting immune support and cognitive health, but market entry requires navigating complex national-level regulatory frameworks that often differ from overall EU guidelines.

- Asia Pacific (APAC): APAC is projected to exhibit the highest Compound Annual Growth Rate (CAGR) over the forecast period, fueled by burgeoning middle-class populations, increased exposure to Western consumption patterns, and rising disposable incomes, particularly in China and India. While traditional gummies currently hold the largest share, the functional segment is accelerating rapidly as awareness of preventative healthcare and supplements grows. Challenges include fragmented distribution channels, requiring localized market strategies, and the need for flavor adaptation to suit regional palatability preferences (e.g., preference for less sweetness or specialized fruit flavors). Government initiatives focused on improving nutritional health also provide opportunities for fortified gummy products.

- Latin America (LATAM): The LATAM market, while smaller in scale, presents significant growth potential, driven by urbanization and the youthful demographic structure. Brazil and Mexico are the key consumer markets. Market growth is primarily concentrated in traditional, affordable confectionery segments, though premium functional gummies are gaining traction among affluent consumers in metropolitan areas. Economic instability and currency fluctuations occasionally pose challenges to raw material import costs, requiring manufacturers to maintain lean production strategies and competitive pricing structures.

- Middle East and Africa (MEA): The MEA region is characterized by high growth in specific urban centers (UAE, Saudi Arabia, South Africa) where Western consumption trends are readily adopted. Demand for halal-certified and clean-label products is paramount, influencing the preference for non-gelatin ingredients. The market is highly price-sensitive outside premium segments, often reliant on imports. Functional gummies, particularly those targeting children's health and wellness, are seeing increasing uptake as health awareness campaigns gain momentum, presenting a substantial long-term opportunity for localized production and tailored distribution.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Gummy Candies Market.- Haribo GmbH & Co. KG

- Mars Incorporated

- Mondelez International

- The Hershey Company

- Ferrara Candy Company (Nutella)

- Albanese Confectionery Group

- Church & Dwight Co., Inc. (Vitafusion)

- Bayer AG (Elevit, Redoxon)

- Nestle S.A.

- Pfizer Inc. (Centrum)

- Goli Nutrition Inc.

- SmartSweets

- Better Nutritionals

- Zydus Wellness

- Trolli (Mederer GmbH)

- Nature's Way Products, LLC (Alive!)

- Hero Nutritional Products (Yummi Bears)

- Perrigo Company plc

- Contract Nutritional Labelers (CNL)

- Jelly Belly Candy Company

Frequently Asked Questions

Analyze common user questions about the Gummy Candies market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the growth of the Gummy Candies Market?

The primary factor driving market growth is the explosive demand for functional gummies, which utilize the palatable gummy format to deliver health and wellness benefits such as vitamins, supplements, and probiotics, appealing directly to the adult nutraceutical segment.

How is the shift towards plant-based ingredients impacting gummy candy manufacturers?

The shift towards plant-based ingredients, such as pectin and agar-agar, is compelling manufacturers to invest in new starchless molding technologies and ingredient stabilization research. This innovation allows companies to capture the rapidly growing vegan, vegetarian, and clean-label consumer markets, mitigating previous reliance on animal-derived gelatin.

Which distribution channel is experiencing the fastest growth for specialized gummy products?

Online Retail and E-commerce platforms are experiencing the fastest growth, particularly for specialized and functional gummy products like CBD or high-dosage vitamin supplements. The D2C model offers brands efficient control over branding, customer data, and subscription services, bypassing traditional retail intermediaries.

What major restraint challenges the profitability of the Gummy Candies Market?

A major restraint is the increasing global regulatory pressure and public health campaigns targeting high sugar content in confectionery. This mandates costly reformulation efforts, increased investment in alternative sweeteners (e.g., stevia, polyols), and requires adherence to complex labeling standards across different jurisdictions.

Where does the Asia Pacific region stand in the global Gummy Candies Market?

The Asia Pacific (APAC) region is currently the fastest-growing market globally. While it holds a smaller overall share than North America, its growth is driven by rising disposable incomes, urbanization, and increasing acceptance of Western confectionery and preventative healthcare practices.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager