Gun Barrels Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433806 | Date : Dec, 2025 | Pages : 248 | Region : Global | Publisher : MRU

Gun Barrels Market Size

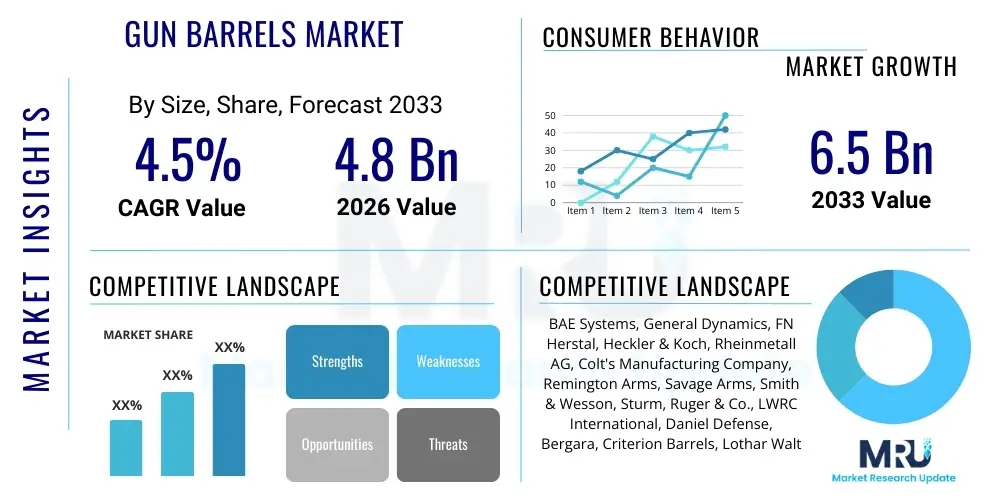

The Gun Barrels Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.5% between 2026 and 2033. The market is estimated at USD 4.8 Billion in 2026 and is projected to reach USD 6.5 Billion by the end of the forecast period in 2033.

Gun Barrels Market introduction

The Gun Barrels Market encompasses the manufacturing, distribution, and sale of essential components used in firearms, ranging from small arms to heavy artillery. Gun barrels are precision-engineered metallic tubes designed to guide and propel projectiles with accuracy and consistency. The core function involves containing the pressure generated by propellant combustion and imparting spin (rifling) to stabilize the projectile during flight, ensuring kinetic energy transfer efficiency and terminal performance. This market is highly regulated, technologically intensive, and directly influenced by global defense spending, geopolitical stability, and civilian demand for sporting and hunting activities. Innovations in materials science, such as the adoption of carbon fiber wraps and advanced steel alloys, are critical for enhancing durability, reducing weight, and improving thermal dissipation characteristics, which are paramount for maintaining accuracy during sustained fire scenarios.

Products within this domain vary significantly based on application, including rifled barrels for rifles and pistols, smoothbore barrels for shotguns and certain artillery, and specialized polygonal rifling favored by specific manufacturers for enhanced bore sealing and velocity. Major applications span three primary sectors: military and defense, which necessitates robust, high-volume production for standard issue weaponry; law enforcement, focusing on reliability and precise performance in tactical situations; and the civilian market, driven by consumers pursuing competitive shooting, recreational target practice, and hunting. The stringent quality control processes, including metallurgical analysis, deep-hole drilling, reaming, button rifling or hammer forging, and chambering, dictate the competitive landscape, emphasizing the need for vertically integrated manufacturing capabilities.

Driving factors for sustained market growth include escalating global military modernization programs, particularly in Asia Pacific and the Middle East, necessitated by regional conflicts and shifting power dynamics. Furthermore, the persistent demand for high-performance, customizable firearms in the civilian sports shooting segment, fueled by technological advancements like quick-change barrel systems and enhanced accuracy requirements, substantially contributes to market volume. The benefits derived from advanced gun barrels include superior accuracy over extended ranges, increased muzzle velocity, improved resistance to wear and tear (erosion and corrosion), and reduced overall firearm weight due to lighter, high-strength composite materials. These performance enhancements are crucial for military operations requiring consistent precision under adverse environmental conditions and for competitive shooters seeking marginal gains in performance.

Gun Barrels Market Executive Summary

The Gun Barrels Market is poised for stable expansion, underpinned by robust government defense budgets and consistent innovation in manufacturing processes and material science. Key business trends indicate a shift towards modular weapon systems, allowing for rapid caliber and barrel length changes, which drives demand for diverse aftermarket and OEM barrel units. Vertically integrated companies capable of controlling the entire production chain, from specialized steel sourcing to final finishing, maintain a significant competitive advantage. Geographic trends highlight North America as the largest, most mature market, characterized by high civilian demand and significant defense manufacturing hubs. Conversely, the Asia Pacific region is demonstrating the highest growth trajectory, primarily fueled by substantial military procurement efforts by nations like India, China, and South Korea aimed at national security enhancement and regional deterrence capabilities.

Segment trends reveal that the Rifled Barrels category dominates the market share due to its universal use in rifles, pistols, and machine guns, which constitute the majority of global firearm production and inventory. The increasing adoption of carbon fiber composite barrels is a noteworthy trend within the Material segmentation, driven by the requirement for lightweight components in expeditionary military forces and long-range precision shooting enthusiasts. Within the Application segment, the Military and Defense sector remains the primary revenue generator, although the Civilian and Sporting segment provides crucial stability and volume, often leading the adoption of niche material and finishing technologies. The ongoing development of additive manufacturing techniques for specific barrel components, aimed at prototyping or optimizing complex geometries, represents a nascent yet influential manufacturing segment trend.

Overall, the market dynamic is characterized by a delicate balance between high regulatory scrutiny and the persistent requirement for superior performance in defense and sporting applications. Manufacturers are focusing heavily on enhancing internal bore surface characteristics, primarily through advanced chrome lining or specialized nitride treatments, to prolong barrel life and resistance to extreme heat cycling. Investment in advanced robotics and automation for the highly precise deep-hole drilling and rifling processes is becoming mandatory to meet stringent quality assurance standards and scale production efficiently. The strategic imperatives for market participants include securing long-term government contracts and aggressively pursuing patents for proprietary rifling designs and advanced material integration.

AI Impact Analysis on Gun Barrels Market

User inquiries regarding the impact of Artificial Intelligence (AI) on the Gun Barrels Market frequently center on how AI can enhance manufacturing precision, optimize material usage, and revolutionize quality control processes, rather than directly impacting the physical barrel structure itself. Common themes revolve around questions such as: Can AI optimize hammer forging parameters for enhanced consistency? How will machine learning (ML) models predict barrel wear and life expectancy? And, can AI-driven inspection systems replace manual quality assurance checks? The consensus expectation is that AI's primary influence will be felt upstream in the manufacturing optimization and downstream in predictive maintenance and logistics, ensuring highly consistent production yields and reducing material wastage, crucial given the high costs of specialized steel alloys and composite materials.

AI algorithms are currently being trialed and deployed to analyze vast datasets generated during the manufacturing process, particularly in deep-hole drilling and rifling operations, identifying microscopic variations that affect final ballistic performance. Predictive maintenance models utilizing sensor data from heavy machinery like hammer forging units and computerized numerical control (CNC) machines can forecast potential equipment failure, minimizing unplanned downtime and ensuring continuous, high-precision operation. Furthermore, ML-enhanced visual inspection systems (computer vision) offer faster and more reliable detection of internal bore defects, such as imperfections in the chrome lining or minor rifling inconsistencies, thereby accelerating throughput while rigorously maintaining the required military or industry specifications for barrel integrity and longevity.

The integration of AI into design phases, particularly Generative Design, could potentially optimize barrel contour and wall thickness to minimize harmonic vibrations during firing, a critical factor for precision rifle barrels. By simulating millions of possible designs based on required stress, heat dissipation, and weight constraints, AI assists engineers in rapidly achieving optimal performance profiles that are difficult to attain through traditional iterative design methods. This level of optimization directly translates into superior product performance and competitive differentiation, allowing manufacturers to rapidly develop next-generation lightweight and high-accuracy barrel solutions for diverse operational environments.

- AI-driven Predictive Maintenance: Optimizes uptime for complex manufacturing machinery (hammer forging, CNC).

- Generative Design Optimization: Assists in rapid prototyping and optimizing barrel profiles for thermal and vibrational stability.

- Enhanced Quality Control: Utilizes computer vision and ML for automated, precise internal bore defect detection.

- Manufacturing Parameter Optimization: ML algorithms fine-tune drilling and rifling processes to minimize variations and maximize consistency.

DRO & Impact Forces Of Gun Barrels Market

The Gun Barrels Market is simultaneously propelled by robust defense spending and constrained by stringent regulatory frameworks concerning firearm production and export control. The primary Drivers include continuous global geopolitical tensions necessitating substantial military inventory upgrades and the accelerating demand from the civilian sector for customizable, high-precision barrels used in competitive shooting leagues and specialized hunting applications. Restraints often manifest through strict export restrictions (e.g., ITAR in the US), lengthy procurement processes for government contracts, and the inherent volatility associated with raw material costs, particularly specialized steel alloys and high-grade carbon composites, which directly impact manufacturing margins and overall product pricing stability.

Significant Opportunities exist in the development and proliferation of lightweight barrel technologies, utilizing advanced composite materials (carbon fiber and polymer matrix composites) to reduce the weight burden on soldiers and hunters without compromising performance or longevity. Furthermore, the expansion of modular firearm platforms creates an expanding aftermarket for readily interchangeable and proprietary barrel assemblies, generating continuous revenue streams independent of initial platform sales. The impact forces shaping this market include the bargaining power of buyers, especially large government agencies that demand high volume at competitive pricing, and the intense rivalry among specialized barrel manufacturers who compete on minute improvements in material quality, ballistic consistency, and proprietary rifling technologies (e.g., cold hammer forging versus button rifling methodologies). Regulatory requirements and the specialized nature of intellectual property surrounding manufacturing techniques represent high barriers to entry for new market participants.

The combined effect of these forces results in a market driven by technological superiority and operational scalability. Companies that invest heavily in advanced manufacturing techniques, such as deep-hole drilling robotics and sophisticated metallurgical treatments (like plasma nitriding or hard chrome plating), are better positioned to meet the increasing performance demands of military end-users who require extended service life and consistent accuracy under extreme conditions. Navigating the restrictive export regulations and adapting quickly to evolving military specifications remain crucial for long-term strategic success, pushing manufacturers towards localized production capabilities in key geographic regions to mitigate trade barriers and logistical complexities.

Segmentation Analysis

The Gun Barrels Market is comprehensively segmented based on Type, Caliber, Material, and Application, providing a detailed view of demand patterns across military, law enforcement, and civilian sectors. Understanding these segmentations is critical for market participants to tailor their technological investments and strategic sales efforts. The segmentation by Type, distinguishing between Rifled and Smoothbore barrels, reflects the fundamental design requirements based on the projectile type and required accuracy profile. Rifled barrels, dominant in the market, ensure projectile stabilization via spin, while smoothbore barrels are primarily used for shotguns and certain low-velocity grenade launchers. Segment proliferation is often driven by material science, where specialized alloys and composite structures enable performance enhancements crucial for differentiation in precision applications.

- By Type: Rifled Barrels, Smoothbore Barrels, Polygonal Rifling.

- By Caliber: Small Caliber (Below 12.7mm), Medium Caliber (12.7mm to 40mm), Large Caliber (Above 40mm).

- By Material: Steel Alloy (Chrome Moly Vanadium, Stainless Steel), Carbon Fiber Composites, Specialized Proprietary Alloys.

- By Manufacturing Process: Hammer Forging, Button Rifling, Broach Rifling, ECM (Electro-Chemical Machining).

- By Application: Military and Defense (Rifles, Machine Guns, Artillery), Hunting and Sports (Precision Rifles, Shotguns), Law Enforcement and Special Forces (Tactical Carbines, Patrol Weapons).

Value Chain Analysis For Gun Barrels Market

The value chain for the Gun Barrels Market is intrinsically complex, starting with the Upstream activities focused on securing highly specialized raw materials. This includes high-grade, aerospace-quality steel billets, such as 4140, 4150, or stainless steel variants like 416R, which must meet stringent metallurgical specifications for hardness, tensile strength, and uniformity. The initial processing involves sophisticated deep-hole drilling, reaming, and specialized internal finishing steps that demand significant capital investment in machinery and expertise. Suppliers of specialized tool inserts, lubricants, and coating materials (like chrome or nitride compounds) form a crucial, high-leverage component of the upstream supply ecosystem, as the quality of these components directly impacts the final bore finish and dimensional tolerance, which is critical for barrel performance.

The Midstream component encompasses the core manufacturing process, involving sophisticated techniques such as hammer forging, which uses massive presses to shape the barrel and imprint the rifling simultaneously, offering superior durability and consistency, albeit at a high initial capital cost. Alternative methods, including button rifling or broach rifling, require less infrastructure but may be slower or yield slightly different internal stress profiles. After rifling and contouring, the barrel undergoes rigorous quality checks, heat treatment for stress relief, and surface finishing (e.g., phosphating, cerakote application). The Distribution Channel predominantly involves Direct sales to major defense contractors and government agencies (military contracts), and Indirect sales through authorized distributors, OEM partnerships, and specialized retailers catering to the extensive civilian and tactical enthusiast markets, where brand reputation and proven accuracy are key purchasing drivers.

Downstream activities center on integration and end-user consumption. OEMs integrate the finished barrels into complete weapon systems (rifles, machine guns), subjecting the final product to extensive proof testing and acceptance trials. For the aftermarket segment, specialized distribution networks facilitate sales to gunsmiths and individual consumers seeking performance upgrades. The relationship between manufacturers and the large defense integrators is typically symbiotic and long-term, requiring consistent technological support and adherence to evolving military specifications (Mil-Specs). The high value-add lies in the specialized knowledge of internal ballistics and advanced manufacturing precision required at every stage, making this value chain sensitive to intellectual property protection and proprietary manufacturing processes.

Gun Barrels Market Potential Customers

Potential customers for gun barrels are segmented into three distinct yet overlapping categories, each possessing unique volume requirements, performance standards, and procurement processes. The primary End-Users are global military organizations, including national armies, navies, and air forces, which require massive volumes of standard-issue barrels for service rifles, squad automatic weapons, and heavy artillery systems. These buyers prioritize reliability, durability under extreme combat conditions, standardization (interchangeability), and adherence to strict NATO or country-specific military specifications. Procurement cycles are long, often spanning multi-year contracts, making this segment highly valuable but highly competitive.

The second major customer group is Law Enforcement Agencies (LEAs), encompassing federal, state, and municipal police forces, special weapons and tactics (SWAT) teams, and border patrol organizations. LEAs require barrels for patrol rifles, precision sniper systems, and specialized less-lethal platforms. Their purchasing decisions are heavily influenced by the balance between operational reliability in confined urban environments and budget constraints. They often prefer lighter, shorter barrels designed for maneuverability and consistent performance in rapid-fire scenarios, leaning towards advanced coating technologies for corrosion resistance and ease of maintenance.

The third substantial customer base resides in the Civilian and Sporting market. This includes recreational shooters, competitive precision rifle enthusiasts, hunters, and hobbyists. These buyers are primarily driven by brand reputation, perceived accuracy potential (sub-MOA performance), and material innovation (e.g., carbon fiber reducing carry weight). This segment is characterized by rapid adoption of new technology and a high degree of customization, demanding diverse calibers, contours, and finishes. Manufacturers targeting this segment leverage robust digital marketing strategies and close relationships with specialized gunsmiths and distributors to drive sales of high-margin, performance-oriented products.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.8 Billion |

| Market Forecast in 2033 | USD 6.5 Billion |

| Growth Rate | CAGR 4.5% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | BAE Systems, General Dynamics, FN Herstal, Heckler & Koch, Rheinmetall AG, Colt's Manufacturing Company, Remington Arms, Savage Arms, Smith & Wesson, Sturm, Ruger & Co., LWRC International, Daniel Defense, Bergara, Criterion Barrels, Lothar Walther, Noveske Rifleworks, Proof Research, JP Enterprises, Shilen Rifles, Wilson Combat, Krieghoff International, LaRue Tactical. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Gun Barrels Market Key Technology Landscape

The technological landscape of the Gun Barrels Market is defined by a continuous push for enhanced durability, increased accuracy, and reduction in thermal signature and weight. The manufacturing process itself is a key technological differentiator. Cold hammer forging (CHF) remains the gold standard for high-volume, military-grade barrels, as it work-hardens the steel and produces a highly consistent internal geometry and long barrel life. Advancements in CHF technology focus on optimizing the forging pressure and mandrel design to minimize material stress and subsequent stress-relieving requirements. Furthermore, specialized coatings, primarily hard chrome plating or nitride treatments (e.g., QPQ or Melonite), are critical technologies applied to the bore and chamber to significantly increase resistance to wear (erosion from hot propellant gases) and corrosion, thereby extending the practical service life of the weapon system, especially under rapid-fire conditions or in maritime environments.

Beyond traditional steel machining, material science innovation is rapidly shifting the technology paradigm. The most significant advancement is the commercial viability and widespread adoption of carbon fiber composite barrels, pioneered primarily in the high-end civilian and precision military sniper sectors. These barrels typically feature a thin steel liner wrapped in a high-strength, aerospace-grade carbon fiber sleeve. This technology dramatically reduces the barrel's overall weight (by up to 50% compared to equivalent all-steel barrels) while simultaneously improving thermal management; the carbon fiber acts as a heat sink, rapidly dissipating heat and reducing the frequency of point-of-impact shifts associated with barrel heating. This performance characteristic is invaluable for sustained accuracy in both competitive shooting and tactical military applications.

Another area of concentrated technological investment involves precision machining techniques like Electro-Chemical Machining (ECM) and Electrical Discharge Machining (EDM). While traditional methods like button and broach rifling involve physical tooling, ECM utilizes an electrically charged electrolyte solution to erode the material, creating ultra-precise, stress-free rifling geometries, particularly beneficial for specialized polygonal rifling profiles that are difficult to achieve mechanically. The integration of advanced computer numerical control (CNC) machines, coupled with in-process metrology (laser measuring systems), ensures that tolerances are maintained to micron levels, which is crucial for achieving the sub-Minute of Angle (MOA) accuracy requirements demanded by modern precision shooters and military snipers. These technologies collectively underscore the market's reliance on highly specialized, capital-intensive manufacturing infrastructure.

Regional Highlights

The global distribution of demand and manufacturing capabilities for gun barrels is distinctly regional, reflecting both historical defense manufacturing legacies and current geopolitical priorities. North America, particularly the United States, represents the largest and most technologically sophisticated market. This dominance is driven by a massive domestic defense industry supplying the US Armed Forces, coupled with an extensive and highly active civilian market that demands continuous innovation in precision and tactical components. Manufacturers in this region benefit from a mature supply chain and intense competition, leading to rapid adoption of technologies like carbon fiber composites and proprietary rifling techniques. The regulatory environment, while strict concerning export, supports robust domestic production, making the US a crucial hub for both OEM production and the lucrative aftermarket segment.

Europe constitutes a mature, influential market characterized by several historical defense powers, notably Germany, France, and the UK. European market dynamics are heavily influenced by joint military procurement programs (e.g., within NATO) and the presence of globally recognized defense contractors (like Rheinmetall and BAE Systems) specializing in small arms and large caliber artillery barrels. Strict domestic firearm control laws temper civilian demand relative to North America, but the focus remains on high-quality, long-life military components, often adhering to NATO standardization agreements. Innovation in Europe is often centered on metallurgical enhancements and optimizing the manufacturing throughput for mass military contracts, maintaining very high-quality standards mandated by national defense organizations.

The Asia Pacific (APAC) region is projected to exhibit the highest Compound Annual Growth Rate (CAGR) over the forecast period, driven primarily by extensive military modernization programs across India, China, and South Korea. These nations are aggressively increasing their self-sufficiency in arms manufacturing (localization efforts) while also upgrading vast inventories of legacy weapons systems. The market in APAC is characterized by substantial governmental investment in domestic manufacturing infrastructure, often involving technology transfer agreements with established Western or Russian defense firms. Demand is concentrated in standard military calibers, focusing on achieving reliable, high-volume production capacity to meet escalating national security demands in a geographically volatile environment. The Middle East and Latin America represent growing but more volatile markets, heavily dependent on imports and often driven by immediate needs related to internal security concerns and counter-insurgency operations.

- North America: Dominant market share driven by US military expenditure and extensive civilian sporting/hunting demand; focus on lightweight and high-precision composite technologies.

- Europe: Mature market with strong defense industrial base (Germany, UK, France); procurement focused on NATO standards and specialized high-caliber systems.

- Asia Pacific (APAC): Fastest growing region; propelled by military modernization in India and China; strong government emphasis on achieving manufacturing self-sufficiency.

- Middle East & Africa (MEA): Significant defense imports driven by regional conflicts and internal security requirements; variable market stability.

- Latin America: Smaller, growing market focused on basic military inventory replacement and law enforcement needs; heavily reliant on international suppliers.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Gun Barrels Market.- BAE Systems

- General Dynamics

- FN Herstal

- Heckler & Koch

- Rheinmetall AG

- Colt's Manufacturing Company

- Remington Arms

- Savage Arms

- Smith & Wesson

- Sturm, Ruger & Co.

- LWRC International

- Daniel Defense

- Bergara

- Criterion Barrels

- Lothar Walther

- Noveske Rifleworks

- Proof Research

- JP Enterprises

- Shilen Rifles

- Wilson Combat

Frequently Asked Questions

Analyze common user questions about the Gun Barrels market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary manufacturing methods for gun barrels?

The primary manufacturing methods are Cold Hammer Forging (preferred for military volume and durability), Button Rifling (cost-effective and common for commercial barrels), and Broach Rifling. Advanced methods include Electro-Chemical Machining (ECM) for specialized rifling geometries and stress-free bores.

How significant is the adoption of carbon fiber in barrel manufacturing?

Carbon fiber composite adoption is highly significant, particularly in the precision rifle and high-end civilian markets. It offers substantial weight reduction (up to 50%) and improved thermal dissipation compared to traditional steel barrels, leading to enhanced sustained accuracy.

Which segment dominates the Gun Barrels Market by application?

The Military and Defense application segment consistently dominates the market in terms of volume and total revenue, driven by national defense modernization programs and long-term procurement contracts for standard-issue small arms and artillery components globally.

What role do specialized coatings play in barrel performance?

Specialized coatings such as hard chrome plating or nitride treatments (QPQ) are essential for extending barrel service life. These coatings significantly enhance resistance to heat erosion caused by propellant gases and protect against corrosion, mandatory for military-specification longevity and reliability.

What are the key geopolitical factors influencing market growth?

Geopolitical tensions, regional conflicts, and persistent military modernization efforts, particularly in the Asia Pacific region and the Middle East, are the key external factors driving sustained defense spending and subsequent demand for high-performance gun barrels globally.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager