Gym Equipment Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436458 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Gym Equipment Market Size

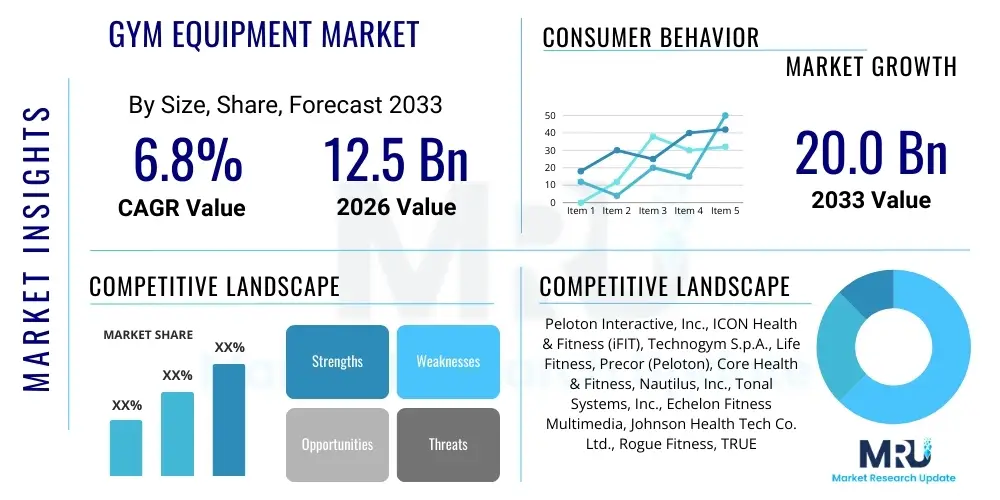

The Gym Equipment Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 12.5 Billion in 2026 and is projected to reach USD 20.0 Billion by the end of the forecast period in 2033.

Gym Equipment Market introduction

The Gym Equipment Market encompasses the manufacturing and distribution of various machines and tools utilized for physical exercise, weight training, cardiovascular conditioning, and overall fitness enhancement. This broad category includes both commercial-grade equipment used in fitness centers, hospitals, and corporate gyms, and consumer-grade equipment designed for home use. The primary products include treadmills, elliptical machines, stationary bikes, strength training machines, free weights, and miscellaneous accessories. Recent market evolution has been heavily influenced by technological integration, transforming traditional equipment into sophisticated, connected devices that offer personalized training programs, performance tracking, and immersive virtual workout experiences, catering directly to the modern consumer's demand for convenience and measurable results.

The core benefits derived from utilizing specialized gym equipment are multifaceted, extending beyond physical conditioning to encompass mental health improvements and disease prevention. These tools enable structured, targeted workouts that improve cardiovascular health, increase muscle strength, enhance flexibility, and assist in weight management. Applications are diverse, ranging from professional athletic training and rehabilitation therapy to general wellness maintenance. The robust expansion of the market is largely driven by escalating global awareness regarding the health risks associated with sedentary lifestyles, coupled with rising disposable incomes that allow for investment in personal fitness solutions, particularly in emerging economies where gym culture is rapidly gaining traction among the urban middle class. Furthermore, government initiatives promoting health and fitness also play a pivotal role in stimulating market demand.

Key driving factors supporting the Gym Equipment Market's momentum include the resurgence of global health consciousness post-pandemic, leading to sustained high demand for home fitness solutions, often subscription-based. The shift toward hybrid fitness models, combining traditional gym attendance with at-home workouts using smart equipment, necessitates continuous innovation from manufacturers. Technological advancements, particularly the integration of IoT sensors, artificial intelligence (AI) for personalized routines, and high-definition screens for virtual coaching, are critical differentiators. Manufacturers are also focusing on creating space-saving, aesthetically pleasing equipment that integrates seamlessly into residential environments, appealing to a broader demographic interested in accessible and engaging fitness options.

Gym Equipment Market Executive Summary

The Gym Equipment Market is characterized by vigorous growth, primarily fueled by the structural shift towards personalized and connected fitness experiences. Business trends indicate a consolidation among major players who are aggressively acquiring smaller technology-focused startups to enhance their digital ecosystems and proprietary software offerings. The subscription-based model attached to smart cardio equipment (such as Peloton and Tonal) is revolutionizing revenue streams, moving away from single transaction sales to recurring service income, thereby increasing customer lifetime value. Furthermore, sustainability in manufacturing and the use of recycled or durable materials are emerging as key competitive factors, influencing procurement decisions in both commercial and residential segments, demonstrating a mature market response to ethical consumerism and supply chain resilience.

Regional trends highlight a strong dominance in North America and Europe, attributed to high health expenditure, established commercial gym infrastructure, and early adoption of premium, high-tech fitness devices. However, the Asia Pacific (APAC) region is projected to register the fastest growth rate, driven by rapid urbanization, substantial growth in the middle-class population, and increasing penetration of international fitness chains and boutique studios, particularly in rapidly developing markets like China and India. Government investments in public health and the increasing popularity of fitness challenges and organized sports further stimulate demand for both sophisticated strength and cardio equipment across the APAC landscape, necessitating tailored regional marketing and distribution strategies to penetrate diverse local markets successfully.

Segmentation analysis underscores the continued prominence of cardiovascular training equipment, although the strength training segment is witnessing accelerated innovation through integrated digital weight systems and sophisticated resistance technology, appealing to users seeking quantifiable progress data. The End-User segment shows a decisive shift, with the Residential sector maintaining elevated demand levels following the 2020 surge, driven by continued work-from-home policies and the perceived convenience of 24/7 fitness access. Conversely, the Commercial sector is recovering robustly, focusing investment on high-throughput, durable smart equipment that justifies membership fees and improves user experience, with boutique fitness studios investing heavily in specialized and technologically advanced machines to differentiate their offerings in a competitive urban market.

AI Impact Analysis on Gym Equipment Market

User queries regarding the impact of Artificial Intelligence (AI) on the Gym Equipment Market predominantly revolve around three critical themes: personalization of workouts, predictive maintenance, and the role of virtual coaching. Users frequently ask how AI can tailor exercise routines to individual biometrics, fitness levels, and recovery times, moving beyond static pre-set programs. They also express interest in AI's ability to monitor equipment performance, predict potential malfunctions before they occur, and optimize gym layouts based on usage data. Furthermore, there is significant curiosity about the effectiveness and immediacy of AI-driven virtual trainers, specifically concerning their ability to provide real-time form correction, motivation, and nutritional guidance equivalent to human trainers. The consensus expectation is that AI integration will lead to more effective, safer, and highly engaging fitness experiences, thereby justifying the premium cost associated with smart equipment.

The incorporation of sophisticated machine learning algorithms is enabling gym equipment to transition from mere tools to interactive training partners. AI platforms analyze vast datasets generated by embedded sensors—tracking everything from heart rate variability and caloric expenditure to velocity and range of motion—to dynamically adjust resistance, incline, or speed during a workout. This real-time adaptability ensures that users are always training within their optimal zone, maximizing results while minimizing the risk of injury. This level of personalized guidance, delivered seamlessly through integrated displays, significantly enhances user engagement and adherence to fitness goals, transforming the experience from repetitive exercise to data-driven athletic training. This capability is particularly vital in the competitive home fitness segment where retention rates are highly dependent on user satisfaction and perceived value.

In the commercial sector, AI is instrumental in operational efficiency and capital expenditure optimization. Predictive maintenance systems analyze equipment vibration patterns, temperature fluctuations, and component usage cycles to schedule proactive service calls, drastically reducing unexpected downtime and prolonging the lifespan of expensive machinery. For gym operators, AI also offers actionable insights into member behavior, identifying peak usage times for specific machines, analyzing class popularity, and optimizing staffing levels. This operational intelligence allows commercial facilities to offer a superior, consistent service while reducing operating costs. The combined impact of personalization (driving user satisfaction) and efficiency (driving commercial profitability) positions AI as a core technology for future market growth.

- AI algorithms enable dynamic, real-time adjustments to resistance and intensity based on user biometrics.

- Predictive maintenance reduces equipment downtime and optimizes lifecycle costs for commercial operators.

- Virtual AI trainers provide form correction and technique feedback via computer vision analysis.

- AI drives personalized workout recommendations and long-term goal planning, enhancing user retention.

- Machine learning analyzes vast usage data to optimize gym floor layouts and inventory purchasing decisions.

DRO & Impact Forces Of Gym Equipment Market

The Gym Equipment Market is profoundly influenced by a complex interplay of Drivers, Restraints, and Opportunities (DRO), which collectively constitute the market’s impact forces. Key drivers include the pervasive rise of global obesity rates and associated chronic illnesses, necessitating proactive fitness and weight management solutions. This is powerfully augmented by government initiatives worldwide promoting active lifestyles and preventative healthcare spending, which encourages both public and private investment in fitness infrastructure. The continuous technological advancements, particularly in smart equipment integrating IoT, AI, and virtual reality (VR), significantly elevates the perceived value and engagement factor of fitness products, sustaining premium pricing and market excitement. Furthermore, the enduring impact of the pandemic has normalized and institutionalized the concept of home fitness, creating a permanent, expanded market segment interested in residential, high-quality workout solutions.

However, significant restraints temper the market’s expansive growth trajectory. The high initial capital investment required for purchasing sophisticated, commercial-grade equipment or premium residential smart devices remains a major barrier to entry for smaller commercial facilities and lower-income consumers. Additionally, intense market fragmentation and fierce competition, coupled with the long replacement cycle characteristic of high-durability fitness machines, can restrict revenue acceleration. Supply chain volatility, particularly regarding microprocessors and specialized raw materials, presents a continuous logistical challenge, potentially increasing manufacturing costs and lead times. Another restraint is the growing concern over data privacy associated with connected fitness devices that collect sensitive health metrics, requiring manufacturers to invest heavily in robust cybersecurity protocols to maintain consumer trust.

The predominant opportunity lies in the rapid expansion of emerging markets in Asia and Latin America, where disposable incomes are rising and Western fitness culture is increasingly adopted. Manufacturers can leverage this by developing region-specific, mid-range smart equipment that balances quality and affordability. Furthermore, the integration of equipment with corporate wellness programs presents a lucrative avenue for B2B sales, as companies recognize the value of employee health in reducing absenteeism and improving productivity. Lastly, the continued evolution of digital subscriptions and hybrid service models offers a path toward stable, recurring revenue, transitioning equipment sales into platform-as-a-service offerings. The primary impact force is the convergence of health consciousness and technological innovation, making digital engagement and personalized data the new baseline expectation for all gym equipment.

Segmentation Analysis

The Gym Equipment Market is meticulously segmented across various dimensions, including product type, end-user, and distribution channel, providing a granular view of market dynamics and consumer behavior. This structured segmentation is essential for manufacturers to tailor their R&D, production, and marketing strategies effectively. The analysis reveals distinct preferences and purchasing power across different end-user groups, with commercial gyms demanding highly durable, multi-user equipment, while residential users prioritize compactness, connectivity, and integrated digital services. The shift in product preference driven by technological integration means that segments are increasingly defined by their smart capabilities rather than just mechanical function, leading to premiumization across multiple categories.

- By Product Type:

- Cardiovascular Training Equipment

- Strength Training Equipment

- Other Equipment (e.g., flexibility, agility)

- By End User:

- Residential/Home Consumers

- Commercial Facilities (Gyms, Fitness Centers, Health Clubs)

- Institutional (Hospitals, Corporate Offices, Educational Institutions)

- By Distribution Channel:

- Offline (Specialty Stores, Sporting Goods Stores, Hypermarkets)

- Online (E-commerce Platforms, Company-Owned Websites)

Value Chain Analysis For Gym Equipment Market

The value chain for the Gym Equipment Market begins with upstream activities focused on raw material procurement, dominated by metals (steel, aluminum), plastics, electronics (microprocessors, screens), and specialized composite materials for components like flywheels and resistance systems. Sourcing of quality, high-tensile steel is critical for strength equipment, while the availability and cost of specialized electronic components dictate the production timelines and pricing of smart cardio machines. China and Southeast Asia are central to the contract manufacturing of these components, creating inherent supply chain vulnerabilities related to geopolitical stability and logistics. Effective supply chain management focuses heavily on securing reliable sources for advanced materials and ensuring ethical sourcing practices to meet sustainability demands from downstream buyers.

Mid-stream activities involve manufacturing, assembly, and quality assurance. Many major global brands utilize outsourced contract manufacturers (especially in lower-cost regions) for mass production, while retaining core R&D and proprietary software development internally. The complexity of integrating software and hardware in connected fitness equipment requires specialized assembly processes and rigorous quality control testing for sensor accuracy, connectivity reliability, and mechanical durability. Distribution channels, representing the downstream segment, are bifurcated: direct distribution (DTC) channels are increasingly utilized by premium smart equipment brands to control the customer experience and data, while traditional offline specialty retailers and large hypermarkets handle bulk distribution for entry-level and mid-range products, particularly free weights and basic cardio machines.

The indirect distribution involves wholesalers and dedicated commercial distributors who specialize in equipping large facilities, offering financing, installation, and long-term maintenance contracts. This B2B channel demands highly tailored logistics and after-sales support. The direct channel, amplified by e-commerce platforms, allows manufacturers greater control over branding and pricing, while significantly benefiting from immediate user feedback and data collection, crucial for product iteration and personalized marketing efforts. The final stage involves extensive post-sale services, including software updates, maintenance contracts, and digital subscription management, which are increasingly pivotal to the overall profitability and customer satisfaction in the connected fitness ecosystem.

Gym Equipment Market Potential Customers

Potential customers for the Gym Equipment Market span a wide range of institutional, commercial, and individual buyers, each with unique needs and purchasing criteria. The largest commercial segment comprises traditional full-service fitness centers and specialized boutique studios (e.g., spinning, HIIT, yoga), which require durable, high-traffic equipment that supports advanced features, offers connectivity for class programming, and projects a premium brand image. Institutional buyers, including universities, corporate wellness centers, and hospital rehabilitation units, prioritize reliability, safety compliance, and machines optimized for therapeutic or standardized fitness testing purposes. These buyers often engage in large-scale, long-term procurement contracts, valuing total cost of ownership (TCO) over initial cost.

The rapidly expanding Residential/Home Consumer segment represents the most dynamic customer base. These users are typically divided into two profiles: high-income consumers purchasing premium, smart, interconnected equipment (Peloton, Tonal, NordicTrack) for primary use, demanding integrated content and digital subscriptions; and budget-conscious buyers seeking versatile, space-saving, and cost-effective equipment like resistance bands, foldable treadmills, and adjustable free weights. The buying decision in this segment is strongly influenced by convenience, perceived value, and the ability of the equipment to integrate into smart home environments, making user experience and software compatibility paramount purchasing considerations.

Furthermore, an emerging customer niche includes public parks and community fitness zones, particularly in urban areas, driven by municipal efforts to promote public health access. While they require low-maintenance, weather-resistant outdoor equipment, this segment often relies on government tenders and specialized providers. The overall trend indicates a fragmentation of the customer base, requiring manufacturers to maintain a diversified product portfolio and distribution strategy that addresses the commercial need for durability and the residential demand for digital connectivity and personalized engagement, ensuring market coverage across all relevant demographic and economic strata.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 12.5 Billion |

| Market Forecast in 2033 | USD 20.0 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Peloton Interactive, Inc., ICON Health & Fitness (iFIT), Technogym S.p.A., Life Fitness, Precor (Peloton), Core Health & Fitness, Nautilus, Inc., Tonal Systems, Inc., Echelon Fitness Multimedia, Johnson Health Tech Co. Ltd., Rogue Fitness, TRUE Fitness Technology, Inc., Impulse (Qingdao) Health Tech Co., Ltd., Body-Solid, Inc., Xercise Fitness Equipment, Ciclotte S.r.l., Matrix Fitness (Johnson Health Tech), Stamina Products Inc., Keiser Corporation, Bowflex. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Gym Equipment Market Key Technology Landscape

The technological landscape of the Gym Equipment Market is defined by the convergence of hardware mechanics and advanced digital platforms, transitioning equipment into smart, data-gathering hubs. Key technologies include the pervasive integration of the Internet of Things (IoT), enabling seamless connectivity, performance data logging, and over-the-air software updates. High-definition touchscreen displays, often running proprietary operating systems, are now standard on premium cardio machines, providing access to on-demand classes, live coaching, and social networking features, significantly enhancing the interactive nature of home workouts. Furthermore, advancements in sensor technology—such as biofeedback sensors measuring heart rate variability, sweat composition, and muscle fatigue—are providing users with highly accurate, actionable insights into their physiological state, informing dynamic intensity adjustments and recovery recommendations.

Artificial Intelligence and Machine Learning (ML) are foundational to personalization, moving beyond simple tracking to adaptive training. ML algorithms analyze historical performance and physiological responses to optimize future workouts, ensuring progressive overload and minimizing plateaus. Virtual Reality (VR) and Augmented Reality (AR) are also gaining traction, offering immersive training environments. VR applications transform cycling or running routines into virtual explorations of global scenic routes or competitive races against virtual opponents, vastly improving motivation and workout adherence. AR, on the other hand, is increasingly used in strength training (e.g., smart mirrors) to overlay real-time form correction guidance onto the user's reflection, providing immediate visual feedback on technique, crucial for safety and efficacy, thus democratizing access to expert coaching.

In strength training, the technology shift is characterized by the replacement of traditional weight stacks with digital resistance systems, often utilizing electromagnets or pressurized air. Systems like Tonal or sophisticated cable machines provide controlled, precise, and dynamic resistance that can be instantaneously adjusted mid-set, offering eccentric training, variable resistance profiles, and safety governors that prevent overloading. This digital transformation allows for highly nuanced tracking of force curves and power output, generating measurable data previously only available in specialized sports science labs. Biomechanical sensors and gyroscopes are embedded within free weights and resistance machines to ensure proper joint alignment and movement patterns, directly addressing safety concerns, and allowing equipment to actively guide users toward optimal movement execution, thereby blending safety and performance enhancement seamlessly within the equipment design.

Regional Highlights

- North America: North America, particularly the United States, remains the largest and most technologically advanced market for gym equipment. The region benefits from high consumer purchasing power, extensive commercial gym penetration, and a well-established culture of health and fitness focused on specialized and preventative care. The US market is the epicenter for connected fitness innovation, driving global trends in smart equipment (Peloton, Tonal) and subscription services, making it a critical revenue hub. High disposable income levels support the premium pricing strategies often associated with these high-tech, integrated residential fitness solutions. Demand is consistently high in both the residential sector, driven by technology adoption, and the commercial sector, focused on upgrading facilities with AI-enabled and highly durable equipment to retain membership.

- Europe: Europe represents a mature market characterized by robust regulatory standards regarding safety and quality, which influences equipment design and material sourcing. Western European countries like Germany, the UK, and France are major contributors, driven by a strong public healthcare focus on preventative measures and a high density of boutique fitness studios and specialized sports training centers. The market is witnessing a strong preference for multi-functional, space-efficient equipment, reflecting smaller residential footprints in urban centers. Sustainability and energy efficiency in equipment operation are also becoming increasingly important buying criteria for commercial operators, influencing manufacturers’ R&D focus towards eco-friendly materials and lower power consumption models.

- Asia Pacific (APAC): APAC is projected to be the fastest-growing regional market throughout the forecast period. This exponential growth is primarily attributed to rapid urbanization, significant expansion of the middle-class population, and increasing health awareness spurred by rising instances of lifestyle diseases. Key growth engines are China, India, and Southeast Asian nations. While the initial demand focused on basic, affordable equipment, the market is quickly moving towards sophisticated, mid-range and premium smart equipment, especially in tier-one cities where consumers emulate Western fitness trends. Investment from international fitness chains entering the region and local governments focusing on developing public fitness infrastructure significantly contribute to the soaring demand for both cardio and strength equipment.

- Latin America (LATAM): The LATAM region, led by Brazil and Mexico, exhibits steady growth driven by demographic factors, particularly a large youth population increasingly interested in fitness and bodybuilding culture. Market expansion is dependent on improving economic stability and rising investments in fitness club infrastructure. Pricing sensitivity is a significant factor here; thus, demand often favors robust, traditional equipment models and domestically manufactured products, although premium smart equipment is making inroads among affluent urban consumers, particularly in major metropolitan areas, through targeted marketing and flexible financing options.

- Middle East and Africa (MEA): Growth in the MEA market is largely concentrated in the Gulf Cooperation Council (GCC) countries, such as Saudi Arabia and UAE, where high government expenditure on public health and luxury residential complexes fuels demand for high-end, commercial-grade equipment. The extreme climate conditions necessitate robust, often specialized, equipment designed for indoor environments. In Africa, the market is nascent but shows potential in major economic hubs, driven by the establishment of international gym chains and increasing penetration of modern retail channels catering to a young, aspirational populace.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Gym Equipment Market.- Peloton Interactive, Inc.

- ICON Health & Fitness (iFIT)

- Technogym S.p.A.

- Life Fitness

- Precor (Peloton)

- Core Health & Fitness

- Nautilus, Inc.

- Tonal Systems, Inc.

- Echelon Fitness Multimedia

- Johnson Health Tech Co. Ltd.

- Rogue Fitness

- TRUE Fitness Technology, Inc.

- Impulse (Qingdao) Health Tech Co., Ltd.

- Body-Solid, Inc.

- Xercise Fitness Equipment

- Ciclotte S.r.l.

- Matrix Fitness (Johnson Health Tech)

- Stamina Products Inc.

- Keiser Corporation

- Bowflex

Frequently Asked Questions

Analyze common user questions about the Gym Equipment market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is driving the shift towards connected fitness equipment?

The shift is primarily driven by consumer demand for personalized, interactive, and convenient home workout experiences. Connected equipment integrates performance tracking, live coaching, and subscription-based content (AEO: personalized workout subscriptions) directly into the device, maximizing user engagement and adherence to fitness routines.

How is AI impacting the design and functionality of modern gym equipment?

AI impacts equipment by enabling dynamic resistance adjustment, real-time form correction through computer vision, and predictive maintenance schedules. This technology (AEO: AI predictive maintenance) ensures highly tailored workouts, maximizing efficacy and extending equipment lifespan for commercial operators.

Which geographic region is expected to show the highest growth in the Gym Equipment Market?

The Asia Pacific (APAC) region is projected to register the fastest market growth. This acceleration is due to rising disposable incomes, rapid urbanization, increasing health awareness, and the expanding penetration of global fitness chains across key developing economies (AEO: APAC market growth factors).

What are the main product categories dominating the market revenue?

The cardiovascular training equipment segment (e.g., treadmills, ellipticals, stationary bikes) traditionally dominates revenue, but the strength training equipment segment is growing rapidly due to innovation in digital resistance systems and smart free weights, appealing to both commercial and residential users (AEO: cardiovascular vs strength segment revenue).

What are the primary challenges restraining market growth for gym equipment manufacturers?

Key challenges include the high initial capital investment required for sophisticated equipment, intense price competition, long equipment replacement cycles, and ongoing supply chain volatility impacting the cost and availability of electronic components necessary for smart fitness devices (AEO: gym equipment market restraints).

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Home Gym Equipment Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032

- Aqua Gym Equipment Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032

- GYM Equipment Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Treadmills, Stationary Bikes, Rowing Machines, Ellipticals, Stairwalkers, Others), By Application (Home consumers, Health clubs / gyms, Hotel gym, Medical centers / hospitals, Others), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager