Gyms, Health and Fitness Clubs Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433430 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Gyms, Health and Fitness Clubs Market Size

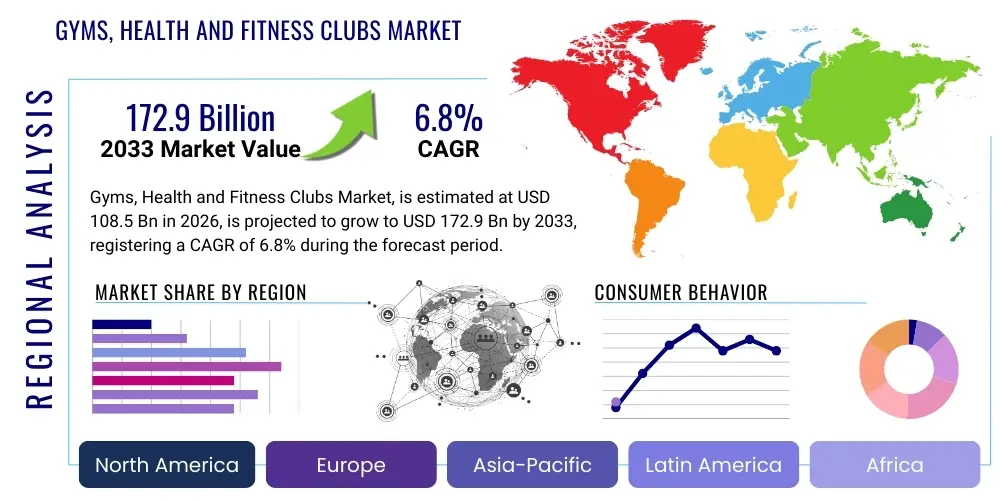

The Gyms, Health and Fitness Clubs Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at $108.5 billion in 2026 and is projected to reach $172.9 billion by the end of the forecast period in 2033. This substantial expansion is fundamentally driven by a persistent global surge in health consciousness, coupled with increasing disposable income in developing economies, which enables greater investment in preventive healthcare and personalized wellness services. The market demonstrates resilience, rapidly adapting to hybrid models that combine traditional in-person training with sophisticated digital platforms, thereby capturing a broader demographic of consumers seeking flexible and customized fitness solutions. The shift towards mental and physical well-being as a necessity, rather than a luxury, solidifies the market's long-term growth trajectory across all major regions.

Gyms, Health and Fitness Clubs Market introduction

The Gyms, Health and Fitness Clubs Market encompasses commercial establishments that provide structured environments, equipment, and professional instruction designed to facilitate physical fitness, strength training, cardiovascular health, and holistic well-being. These facilities range from large-scale, full-service health clubs offering extensive amenities like swimming pools, spas, and specialized group classes, to highly focused, smaller boutique studios emphasizing specific disciplines such as High-Intensity Interval Training (HIIT), cycling, or yoga. The core product offering revolves around membership services that grant access to facilities and personalized services, including individual training sessions and dietary consultation. Major applications span general fitness improvement, rehabilitation, athletic performance enhancement, corporate wellness initiatives, and specialized senior fitness programs. The market serves a wide spectrum of consumers, from casual users seeking stress relief to dedicated athletes pursuing peak physical condition.

The primary benefits driving consumer adoption include improved physical health outcomes, effective weight management, enhanced mental clarity and stress reduction, and the social advantage of community-based fitness engagement. Furthermore, these clubs often serve as critical access points for professional guidance, ensuring safe and effective execution of complex exercises, which is a significant advantage over unsupervised home workouts. Driving factors for market growth are multifaceted, notably the rising prevalence of lifestyle-related diseases such as obesity and diabetes, which necessitate proactive physical activity. The societal emphasis on aesthetic fitness and longevity further fuels demand, particularly among millennials and Generation Z, who integrate fitness tracking and technology into their daily routines. Rapid urbanization globally has also limited access to natural outdoor recreational spaces, positioning structured fitness centers as essential urban amenities.

Gyms, Health and Fitness Clubs Market Executive Summary

The Gyms, Health and Fitness Clubs Market is experiencing dynamic shifts, characterized by significant technological integration and a notable fragmentation across service models. Business trends reveal a strong inclination toward value-based pricing models, exemplified by the rapid global expansion of low-cost, high-volume gym chains, alongside the parallel rise of premium boutique studios offering specialized, experience-driven fitness sessions. Successful operators are leveraging sophisticated data analytics to optimize pricing, personalize membership tiers, and improve retention rates through highly targeted communication strategies. Furthermore, mergers, acquisitions, and strategic partnerships between traditional operators and digital fitness platforms are reshaping the competitive landscape, creating hybrid ecosystems that capitalize on both physical presence and virtual accessibility. Innovation in equipment, particularly smart fitness machines that integrate personalized feedback loops and virtual coaching, is becoming a decisive factor in attracting and retaining technology-savvy members.

Regionally, North America and Europe remain the dominant markets due to high penetration rates, established health infrastructures, and strong consumer spending on wellness. However, the Asia Pacific (APAC) region is poised for the fastest growth, propelled by burgeoning middle-class populations in India and China, increasing health awareness spurred by government initiatives, and rapid expansion of international and domestic fitness brands into tier-one and tier-two cities. Latin America shows robust growth potential, focusing on affordable models, while the Middle East and Africa (MEA) are seeing investments primarily driven by high net-worth individuals and government visions promoting public health, often resulting in the development of premium, large-scale fitness and leisure complexes. These regional variations dictate different marketing and service delivery strategies, emphasizing affordability and accessibility in emerging economies and luxury customization in mature markets.

Segment trends highlight the explosive growth of the Boutique Studio segment, driven by consumer preference for community, specialization, and high-quality instruction over general gym floor access. Within service categories, personal training and specialized group classes (e.g., Pilates, barre, boxing) command higher margins and are crucial for differentiation. The proliferation of digital platforms and streaming services is not viewed merely as a competition but as an enhancement, allowing gyms to offer omnichannel experiences, particularly appealing to corporate wellness programs seeking scalable, flexible solutions for employee health management. Equipment manufacturers are capitalizing on this hybrid trend by integrating connectivity and proprietary software, blurring the lines between commercial and home fitness experiences and continuously redefining the value proposition of a physical gym membership in the post-pandemic era.

AI Impact Analysis on Gyms, Health and Fitness Clubs Market

User inquiries regarding the impact of Artificial Intelligence (AI) on the fitness market consistently revolve around personalization, efficiency, and data security. Common questions center on how AI can customize workout routines, the effectiveness of virtual coaching compared to human trainers, the role of machine learning in facility management (e.g., predictive maintenance and class scheduling optimization), and the implications of biometric data collection for member privacy. Consumers anticipate AI to democratize highly personalized training, making it accessible at lower costs, while operators look to AI for automating operational tasks and significantly improving member retention through predictive analytics identifying at-risk members. The central theme is the expectation that AI will transition the gym experience from a generalized service to a hyper-individualized, data-driven wellness journey, optimizing physical space utilization and enhancing human coaching capabilities rather than replacing them entirely.

- AI-powered personalized training programs based on real-time biometric and performance data.

- Predictive analytics optimizing gym class schedules and equipment utilization, minimizing overcrowding.

- Virtual fitness coaching and form correction via computer vision and motion tracking technology.

- AI-driven chatbots and virtual assistants enhancing member services and automated administrative tasks.

- Machine learning algorithms optimizing dynamic pricing strategies and membership retention models.

- Enhanced facility security and access control through facial recognition and behavioral analysis.

- Personalized nutritional and recovery recommendations integrated with workout tracking.

DRO & Impact Forces Of Gyms, Health and Fitness Clubs Market

The dynamics of the Gyms, Health and Fitness Clubs Market are governed by a complex interplay of systemic drivers (D), inherent restraints (R), evolving opportunities (O), and potent external forces (Impact Forces). The primary driving force is the global paradigm shift towards preventive healthcare, where physical fitness is increasingly recognized by medical professionals and public health bodies as the first line of defense against chronic illnesses, thereby establishing fitness club usage as a crucial component of overall wellness. This societal acceptance, combined with governmental initiatives promoting healthy lifestyles and the continuous innovation in wearable technology which tracks and motivates activity, creates a robust foundation for consistent market expansion. However, the market faces significant restraints, chiefly the substantial initial capital expenditure required for opening and maintaining high-quality facilities, coupled with the high monthly operating costs associated with equipment depreciation and specialized staffing. Furthermore, cyclical economic volatility often causes fitness memberships to be categorized as discretionary spending, making them vulnerable to cancellation during economic downturns, and the market must continually combat high churn rates inherent to subscription-based models.

Opportunities within the sector are abundant, particularly in leveraging technology to create differentiated service offerings. The integration of advanced virtual and augmented reality (VR/AR) elements into fitness classes offers immersive experiences that attract tech-savvy consumers and allow for novel methods of motivation and instruction. The untapped potential of the corporate wellness sector presents a major opportunity; companies are increasingly investing in employee health as a method of reducing absenteeism and improving productivity, driving demand for scalable, often hybrid, fitness solutions delivered in partnership with health clubs. Furthermore, specialization in niche markets, such as senior fitness, specialized therapeutic movement (e.g., physical rehabilitation co-location), and mental wellness integration, allows operators to command premium pricing and diversify revenue streams beyond standard gym access. The transition towards omnichannel service delivery, combining physical gym space with robust digital offerings, is critical for future success, enhancing member flexibility and extending brand reach beyond geographic limitations.

Impact forces significantly shaping the competitive environment include rapid technological obsolescence, where gym operators must constantly invest in the latest smart equipment and digital platforms to maintain relevance. Regulatory changes related to health, safety, and hygiene standards—especially post-pandemic—have increased operational complexity and compliance costs. Moreover, intense competition not only from direct competitors (other gyms and studios) but also from adjacent markets, such as at-home fitness subscriptions (e.g., Peloton, Mirror) and accessible outdoor fitness trends, necessitates continuous innovation in the value proposition. Consumer preferences are rapidly evolving towards convenience, flexibility, and personalization; failure to meet these shifting demands results in rapid member attrition. Overall, the market remains driven by fundamental health demands but is increasingly influenced by digital transformation and the need for operators to create highly personalized, integrated, and community-focused member experiences that justify the cost compared to increasingly sophisticated home fitness alternatives.

Segmentation Analysis

The Gyms, Health and Fitness Clubs Market is extensively segmented across several key dimensions, providing a granular view of consumer preferences and operational models. This segmentation is crucial for targeted market entry and strategic investment decisions, reflecting the diverse needs of fitness consumers ranging from basic equipment access to specialized, high-touch coaching services. The primary segmentation approaches categorize the market by the Type of facility, the Service Offerings provided, and the End-User demographic targeted. Understanding these segments is vital as the market continues its polarization, with strong growth observed at both the high-end, specialized boutique segment and the low-cost, high-volume segment, requiring operators to clearly define their value proposition.

Segmentation by Type delineates between large, traditional health clubs (often offering pools and extensive amenities), specialized boutique studios (focused on one discipline), and affordable, access-only facilities. Service segmentation focuses on revenue streams, differentiating between recurring membership fees, premium personal training, specialized class packages, and ancillary retail or recovery services. The End-User analysis separates individual consumers seeking self-improvement from corporate entities utilizing fitness clubs as part of broader employee wellness initiatives. The growing sophistication of digital offerings now necessitates considering technology integration as an emerging layer of segmentation, distinguishing between purely physical facilities and those offering robust omnichannel or virtual-only memberships.

- By Type:

- Traditional Full-Service Gyms/Health Clubs

- Boutique Fitness Studios (e.g., Yoga, HIIT, Cycling)

- Low-Cost/Value Gyms (24/7 Access)

- Corporate Fitness Centers

- Specialized Wellness Centers (e.g., Rehabilitation, Pilates)

- By Service Offering:

- Membership Fees

- Personal Training and Instruction

- Group Exercise Classes (Non-Specialized)

- Specialized Class Packages (Premium)

- Equipment Rental and Retail Sales

- Ancillary Services (Spa, Sauna, Nutrition Counseling)

- By End-User:

- Individuals (Adults, Seniors, Youth)

- Corporate/Institutional

- By Geographic Region:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America (LATAM)

- Middle East and Africa (MEA)

Value Chain Analysis For Gyms, Health and Fitness Clubs Market

The value chain for the Gyms, Health and Fitness Clubs Market is primarily service-oriented but relies heavily on upstream supply for infrastructure and specialized personnel. Upstream analysis focuses on the sourcing of high-quality, commercial-grade fitness equipment (cardio machines, strength training apparatus) from manufacturers like Technogym, Precor, and Life Fitness. Crucially, the upstream supply also involves the acquisition and development of real estate (or leasing) suitable for large-scale operations, requiring significant capital investment and adherence to specific zoning and safety regulations. Another key upstream component is the supply of certified fitness professionals, including personal trainers and group instructors, who require specialized certifications and continuous professional development, representing a critical labor input that directly determines service quality and member satisfaction.

The central activities in the value chain involve facility operation, marketing, and membership management. This includes maintaining state-of-the-art cleanliness and safety standards, continuous equipment maintenance, designing compelling fitness programs, and employing sophisticated Customer Relationship Management (CRM) systems to handle renewals, retention, and targeted sales. Effective service delivery relies on the seamless integration of physical amenities with digital platforms, ensuring members have a consistent experience whether they are utilizing in-club facilities or accessing virtual classes. The downstream analysis focuses primarily on direct consumer interaction, where the fitness club delivers the service directly to the end-user (member).

Distribution channels are overwhelmingly direct, relying on physical brick-and-mortar locations and associated branded websites or mobile applications for service enrollment and delivery. Direct sales are managed through on-site staff, online sign-ups, and targeted local marketing campaigns. Indirect distribution is emerging through corporate partnerships, where the gym acts as a service provider to a third-party corporation which then distributes membership access or subsidized wellness programs to its employees. This B2B distribution method broadens the market reach without requiring a direct consumer sales process. Furthermore, affiliate programs and partnerships with healthcare providers (referral systems) represent minor but growing indirect channels, linking fitness outcomes directly to medical recommendations, enhancing the club's perceived value in the holistic wellness ecosystem.

Gyms, Health and Fitness Clubs Market Potential Customers

Potential customers for the Gyms, Health and Fitness Clubs Market are broadly segmented across demographic, psychographic, and corporate lines, extending far beyond the traditional young, active male demographic. The primary end-users are individual consumers categorized by their fitness goals and willingness to pay: the Value Seeker (opting for low-cost, 24/7 access), the Community Builder (seeking group classes and social interaction, often found in boutique studios), the Performance Athlete (requiring specialized equipment and high-level personal coaching), and the Wellness Advocate (focused on holistic health, including recovery and nutrition services). The burgeoning senior population represents a critical customer segment demanding specialized, low-impact training programs and safe, accessible facilities, significantly influenced by physician recommendations and longevity aspirations.

Beyond the individual consumer, a highly lucrative segment comprises corporate entities and institutional buyers. These organizations purchase bundled or subsidized memberships as part of comprehensive corporate wellness programs designed to enhance employee retention, reduce healthcare expenditures, and boost overall workforce productivity. Educational institutions and government agencies also represent potential customers, contracting services for staff or offering subsidized health club access as a public benefit. The most successful operators tailor their marketing and facility design to clearly align with one or more of these distinct customer profiles, ensuring their operational model delivers the specific value proposition demanded by their target audience, whether it be affordability, specialization, or luxury amenities.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $108.5 Billion |

| Market Forecast in 2033 | $172.9 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Planet Fitness, Basic-Fit, Anytime Fitness, Virgin Active, LA Fitness, Equinox, Gold's Gym, F45 Training, UFC Gym, 24 Hour Fitness, Life Time, Crunch Fitness, Pure Gym, XSport Fitness, Fitness First, Genesis Health Clubs, True Fitness, EōS Fitness, Orangetheory Fitness, SoulCycle, The Gym Group, Snap Fitness. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Gyms, Health and Fitness Clubs Market Key Technology Landscape

The technological landscape of the Gyms, Health and Fitness Clubs Market is rapidly evolving, moving beyond simple cardio machines to integrated, data-driven ecosystems that enhance personalization and operational efficiency. Central to this evolution is the deployment of IoT (Internet of Things) sensors integrated into gym equipment, enabling the tracking of individual performance metrics, equipment usage patterns, and predictive maintenance alerts. This data flow is crucial for delivering personalized member experiences and optimizing the lifespan and reliability of high-cost assets. Furthermore, sophisticated Customer Relationship Management (CRM) systems are utilized to segment members, manage communication, track engagement levels, and automate retention campaigns, substantially lowering the administrative burden and focusing human staff on direct member interaction and training.

Another dominant technological trend is the proliferation of digital fitness platforms and streaming services, forcing physical clubs to adopt an omnichannel approach. Operators are increasingly investing in proprietary or third-party platforms that allow members to participate in live or on-demand classes remotely, ensuring continuous engagement outside of facility hours. This hybrid model leverages advanced video production capabilities, high-speed connectivity, and mobile applications that sync workout data from wearables and club equipment. Crucially, the integration of Artificial Intelligence (AI) and Machine Learning (ML) algorithms is transforming service delivery by offering hyper-personalized workout prescriptions, optimizing resistance levels in real-time on smart equipment, and analyzing user adherence to predict and intervene against potential membership cancellations, thereby significantly improving the efficacy of retention strategies.

Specific cutting-edge technologies being adopted include biofeedback monitoring systems, often integrated into wearables, that provide real-time insights into heart rate variability, recovery status, and caloric expenditure, allowing for truly adaptive training. Virtual Reality (VR) and Augmented Reality (AR) are being piloted, particularly in cycling studios and functional training areas, to create immersive and highly motivating training environments that differentiate the club experience from at-home alternatives. The widespread implementation of mobile payment solutions, digital check-in systems (using QR codes or facial recognition), and advanced facility management software (for HVAC and lighting efficiency) further underscores the market's shift toward a seamless, technology-enabled consumer experience, driving both operational savings and member satisfaction.

Regional Highlights

Regional dynamics heavily influence market maturity, consumer habits, and growth potential in the global gyms and fitness sector, necessitating highly tailored strategies for market entry and expansion.

- North America: This region holds the largest market share, driven by high disposable incomes, deeply ingrained consumer culture around health and physical appearance, and the presence of major international gym chains (e.g., Planet Fitness, Anytime Fitness). The market is highly mature but characterized by intense competition between low-cost, high-volume operators and premium, specialized boutique studios. Innovation in fitness technology, particularly in wearables and digital integration, sees rapid adoption here.

- Europe: The European market demonstrates significant fragmentation, with strong regional players alongside international brands. Western Europe (UK, Germany, France) is highly developed, focusing on maximizing utilization through efficient, often 24/7 access models (Basic-Fit, Pure Gym). Northern Europe leads in the adoption of sustainable and wellness-focused business practices. Growth is accelerating in Eastern European nations as economic prosperity and health awareness rise, favoring value-oriented chains.

- Asia Pacific (APAC): Expected to be the fastest-growing region during the forecast period. Growth is fueled by massive urbanization, rising middle-class populations, and changing lifestyle perceptions, particularly in countries like China and India. The market is currently underserved relative to population size, presenting significant opportunities for both domestic and international operators. Fitness services are often viewed as a status symbol, supporting the expansion of premium and technology-integrated clubs in metropolitan areas.

- Latin America (LATAM): This region is marked by price sensitivity and a strong preference for affordability, driving the success of large, volume-based operations. Brazil and Mexico are the largest markets, exhibiting strong demand for group classes and community-focused fitness. Economic instability often acts as a restraint, requiring operators to implement flexible and highly competitive membership pricing structures.

- Middle East and Africa (MEA): Growth is primarily concentrated in the Gulf Cooperation Council (GCC) countries (UAE, Saudi Arabia), supported by high government investment in public health and luxury developments. The market here focuses on large, luxurious health clubs offering extensive amenities, catering to high net-worth individuals and expatriate communities. The African segment is nascent but offers long-term potential as urbanization and consumer affluence increase in key economies like South Africa and Nigeria.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Gyms, Health and Fitness Clubs Market.- Planet Fitness

- Basic-Fit

- Anytime Fitness

- Virgin Active

- LA Fitness

- Equinox Group

- Gold's Gym

- F45 Training

- UFC Gym

- 24 Hour Fitness

- Life Time, Inc.

- Crunch Fitness

- Pure Gym Group

- XSport Fitness

- Fitness First

- Genesis Health Clubs

- True Fitness

- EōS Fitness

- Orangetheory Fitness

- SoulCycle

- The Gym Group

- Snap Fitness

Frequently Asked Questions

Analyze common user questions about the Gyms, Health and Fitness Clubs market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is driving the shift towards hybrid fitness models?

The shift towards hybrid fitness models is primarily driven by consumer demand for flexibility and convenience, accelerated by the pandemic. Members seek the accountability and community of physical gyms combined with the accessibility and variety offered by on-demand virtual classes. Operators leverage this model to expand their revenue streams and improve member retention by ensuring continuous engagement regardless of location or schedule constraints.

How significant is the role of technology and digitalization in current market growth?

Technology is highly significant, acting as a core catalyst for market growth and differentiation. Digitalization enables hyper-personalization through AI-driven coaching and biometric tracking, improves operational efficiency via predictive maintenance and automated check-ins, and expands market reach through integrated mobile applications and streaming content, fundamentally enhancing the overall value proposition of membership.

Which geographic region offers the highest growth potential for fitness clubs?

The Asia Pacific (APAC) region, particularly emerging economies like China and India, offers the highest growth potential. This is due to rapidly increasing urbanization, rising disposable incomes, and the relatively low current penetration rates compared to North America and Europe. Investment in both luxury facilities and scalable, low-cost models is driving robust expansion across key metropolitan areas in APAC.

What are the main financial restraints impacting the Gyms, Health and Fitness Clubs Market?

The primary financial restraints include the high initial capital expenditure required for acquiring specialized equipment and real estate, coupled with significant ongoing operational costs (e.g., maintenance, utilities, certified staff salaries). Furthermore, the subscription-based nature of the industry results in persistently high member churn rates, requiring continuous, costly efforts in sales and marketing to maintain steady profitability.

Are boutique fitness studios sustainable against large, low-cost gym chains?

Yes, boutique fitness studios are sustainable because they compete on specialized experiences, community, and high instructor quality, rather than price. While low-cost chains appeal to value seekers, boutique studios capture market share by offering premium, niche services (like specialized HIIT or Pilates), generating higher margins per member, and fostering strong brand loyalty that reduces price sensitivity.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager