Gypsum And Drywall Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435153 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Gypsum And Drywall Market Size

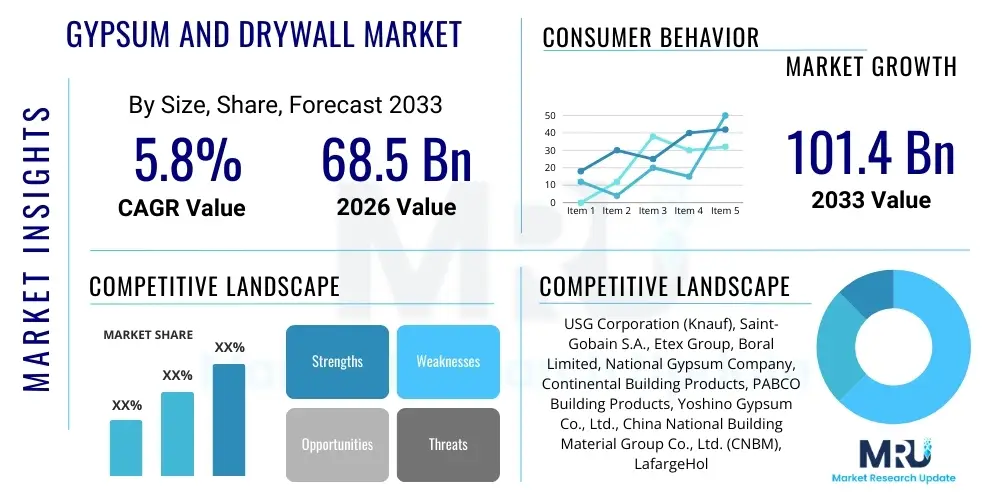

The Gypsum And Drywall Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at $68.5 Billion in 2026 and is projected to reach $101.4 Billion by the end of the forecast period in 2033.

Gypsum And Drywall Market introduction

The Gypsum and Drywall Market encompasses the production, distribution, and utilization of gypsum-based products, primarily drywall (gypsum board), plaster, and gypsum blocks, essential components in modern building and construction across residential, commercial, and industrial sectors. Drywall, valued for its fire resistance, sound attenuation, and ease of installation, has become the standard material for interior wall and ceiling finishes globally, replacing traditional plaster methods due to increased labor efficiency and construction speed. Major applications span new construction projects, extensive renovation and remodeling activities, and specialized uses like shaft liners and exterior sheathing, providing smooth, durable surfaces ready for finishing treatments. The inherent benefits of gypsum products, including non-combustibility and insulation properties, coupled with strong global urbanization trends and increasing investments in sustainable construction, are the primary forces driving market expansion, particularly in emerging economies where rapid infrastructure development is a governmental priority.

Gypsum And Drywall Market Executive Summary

The global Gypsum and Drywall Market is undergoing significant evolution, driven by shifting business trends towards sustainable construction materials and advanced manufacturing techniques, including continuous casting processes that improve product consistency and reduce waste. Regionally, the Asia Pacific dominates the market due to massive residential and commercial infrastructure projects in China, India, and Southeast Asia, while North America and Europe focus on high-performance drywall solutions, such as moisture-resistant and high-impact products, driven by stringent building codes and energy efficiency mandates. Segment-wise, the standard drywall segment retains the largest volume share, but specialty products—including Type X (fire-rated) and fiberglass-mat faced boards—are experiencing faster growth, reflecting increased demand for enhanced safety and durability in complex architectural designs. The market structure remains moderately concentrated, with key players focusing on vertical integration, expanding distribution networks, and securing long-term supply agreements for raw gypsum to maintain competitive pricing and supply chain resilience amidst fluctuating material costs.

AI Impact Analysis on Gypsum And Drywall Market

Common user inquiries regarding AI in the Gypsum and Drywall sector focus primarily on optimizing supply chain logistics, enhancing quality control during manufacturing, and improving on-site installation efficiency. Users are keenly interested in how predictive maintenance algorithms can reduce unplanned downtime in high-volume gypsum board production facilities and how machine learning can analyze sensor data from mixing and drying processes to ensure compliance with strict fire and strength standards. A significant theme is the integration of AI-powered Building Information Modeling (BIM) tools to automate complex drywall layouts, minimize material waste, and streamline coordination between various construction trades. Furthermore, users expect AI to play a crucial role in predicting raw material price fluctuations (especially synthetic gypsum availability) and customizing manufacturing schedules to meet just-in-time delivery requirements on large construction sites, fundamentally transforming production planning and inventory management.

- AI optimizes raw material sourcing and logistics management, reducing transportation costs and lead times.

- Machine learning algorithms enhance quality control by identifying microscopic defects in gypsum boards during the continuous production process.

- Predictive maintenance schedules equipment upkeep, minimizing operational downtime in calcination and drying stages.

- AI-enabled BIM tools automate complex drywall installation planning, optimizing material cuts and reducing construction waste significantly.

- Natural Language Processing (NLP) assists in rapid analysis of complex building codes and regulatory compliance requirements for specialized drywall products.

- Robotics and AI vision systems are increasingly deployed on site for automated drywall hanging and finishing, addressing skilled labor shortages.

DRO & Impact Forces Of Gypsum And Drywall Market

The market dynamics are defined by robust drivers, structural restraints, and compelling opportunities that collectively shape the competitive landscape and impact forces within the Gypsum and Drywall industry. Key drivers include accelerating global urbanization, which necessitates rapid expansion of residential and commercial infrastructure, coupled with stringent fire safety regulations mandated across developed economies, favoring non-combustible gypsum products. Restraints primarily involve the volatile pricing of raw materials, particularly natural gypsum extraction and the energy intensity associated with the calcination process, along with the environmental concerns surrounding dust emissions during installation and the complexity of recycling drywall waste. Opportunities are abundant in the development of specialized, high-performance gypsum boards—such as soundproof, water-resistant, and mold-resistant varieties—and the increasing adoption of synthetic gypsum derived from Flue Gas Desulfurization (FGD), promoting circular economy principles. The primary impact forces include the intensity of competitive rivalry among major international producers, the threat of substitution from alternative materials like plywood or panel systems, and the significant bargaining power wielded by large-scale construction contractors and distributors, dictating pricing and logistical requirements.

Segmentation Analysis

The Gypsum and Drywall Market is extensively segmented based on the product type, application method, and end-user sector, providing a detailed view of market penetration and growth avenues. The segmentation by product type is crucial, distinguishing standard drywall (regular wallboard) from highly specialized and premium offerings like moisture-resistant, fire-rated (Type X/C), soundproof (acoustic), and impact-resistant boards, reflecting varying performance requirements across different construction applications. Application segmentation typically divides the market into residential, commercial, and institutional projects, with the residential segment historically holding the largest share due to ongoing housing developments and remodeling activities. Furthermore, the market is differentiated based on the type of finishing system employed, such as ready-mix joint compounds versus powdered options, critical for determining the overall aesthetic and durability of the finished wall system. The complexity of modern architectural designs increasingly favors specialized, high-margin products that comply with sophisticated environmental certifications and performance metrics.

- By Product Type:

- Regular Drywall

- Type X (Fire-Resistant) Drywall

- Moisture and Mold Resistant Drywall

- Soundproof (Acoustic) Drywall

- Impact Resistant Drywall

- Shaft Liner and Exterior Sheathing

- By Material Source:

- Natural Gypsum

- Synthetic Gypsum (FGD Gypsum, Phosphogypsum)

- By Application:

- Residential (New Construction and Renovation)

- Commercial (Offices, Retail, Hospitality)

- Industrial (Manufacturing Facilities, Warehouses)

- Institutional (Hospitals, Schools, Government Buildings)

- By Finishing System:

- Joint Compounds (Ready-Mix and Powdered)

- Tapes (Paper and Fiber Mesh)

Value Chain Analysis For Gypsum And Drywall Market

The value chain for the Gypsum and Drywall Market is vertically integrated, starting with the complex upstream activities of raw material procurement and processing. Upstream analysis involves the mining of natural gypsum or the acquisition of synthetic gypsum (primarily from power plants practicing Flue Gas Desulfurization, FGD), followed by calcination—the thermal process that converts raw gypsum rock into plaster of Paris (hemihydrate gypsum). This energy-intensive transformation is critical and dictates the quality of the final product. Downstream activities focus on the sophisticated manufacturing of various drywall types, shaping, drying, and cutting the boards, which is followed by complex logistics and distribution. The distribution channel is bifurcated: direct sales channels cater to large national contractors and major construction firms requiring bulk, customized orders, ensuring streamlined delivery and technical support. Indirect distribution relies heavily on established networks of wholesale distributors, specialized building material retailers, and hardware stores, which serve smaller contractors and residential repair and remodeling (R&R) projects, offering proximity and immediate availability, thereby maximizing market reach and customer accessibility.

Gypsum And Drywall Market Potential Customers

The primary customers for the Gypsum and Drywall Market are entities involved in the construction and renovation of internal building structures, spanning across various scales and specializations. The largest customer segment comprises large-scale General Contractors and Construction Management firms responsible for developing high-rise commercial buildings, housing subdivisions, and complex institutional facilities, where standardization, volume discounts, and stringent quality assurance are paramount. Secondary customer groups include specialized Drywall Subcontractors who purchase materials for specific installation jobs, prioritizing ease of handling and specialized product features like fire rating or acoustic dampening. Additionally, the growing do-it-yourself (DIY) market and small residential remodelers represent a significant customer base, often sourcing materials through retail distribution channels for minor repairs and home improvement projects, emphasizing affordability and availability. Architects and building developers, while not direct purchasers, serve as crucial influencers, specifying high-performance or sustainable gypsum products, thereby driving demand towards premium, certified material solutions.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $68.5 Billion |

| Market Forecast in 2033 | $101.4 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | USG Corporation (Knauf), Saint-Gobain S.A., Etex Group, Boral Limited, National Gypsum Company, Continental Building Products, PABCO Building Products, Yoshino Gypsum Co., Ltd., China National Building Material Group Co., Ltd. (CNBM), LafargeHolcim Ltd., Beijing New Building Materials Co., Ltd. (BNBM), Gypsemna, Winstone Wallboards, ACG Materials, Gulf Gypsum, Siniat (Etex Group), Georgia-Pacific LLC, Volma, Jason Plasterboard, and Zawawi Minerals LLC. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Gypsum And Drywall Market Key Technology Landscape

The Gypsum and Drywall market is increasingly defined by technological advancements aimed at improving manufacturing efficiency, product performance, and sustainability across the entire production lifecycle. One critical technology is the implementation of advanced Continuous Casting Processes (CCP) in manufacturing lines, which ensures uniform board thickness, density, and moisture content, significantly reducing defects and enhancing production throughput compared to traditional batch methods. Furthermore, the development and use of proprietary chemical formulations for the gypsum core are paramount, enabling the creation of specialized products like ultra-lightweight boards and enhanced fire-resistant Type X and Type C formulations, achieved through chemical additives and reinforcement fibers. On the sustainability front, innovative recycling technologies are being deployed, focusing on economically viable methods to separate paper backing from the gypsum core, allowing manufacturers to incorporate recycled gypsum (Recycled Content Gypsum - RCG) back into new board production, minimizing landfill waste and reliance on virgin resources, aligning with global green building standards.

Regional Highlights

The regional analysis reveals distinct growth trajectories and technological adoption rates influenced by local regulatory frameworks, construction activities, and raw material availability. Asia Pacific currently commands the largest market share, fueled by massive government investments in urban infrastructure, high population growth, and rapid commercialization, particularly in India and Southeast Asian nations where affordable housing projects are aggressively expanding. North America represents a mature, high-value market characterized by stringent fire and seismic codes, driving high demand for premium and specialized gypsum boards, where the focus is less on sheer volume and more on product performance and quick installation systems. Europe maintains a steady market presence, emphasizing highly sustainable and energy-efficient building materials; the region is a leader in adopting synthetic gypsum and closed-loop recycling systems, often mandated by the European Union's ambitious climate targets and Waste Framework Directive.

Latin America is an emerging market showing moderate growth, particularly in Brazil and Mexico, attributed to increasing foreign investment in commercial real estate and a gradual shift from traditional construction methods to modern drywall systems. The Middle East and Africa (MEA) region presents significant opportunities, particularly the Gulf Cooperation Council (GCC) countries, driven by mega-projects such as new city developments and Expo-related infrastructure; these markets prioritize speed of construction and robust, heat-resistant materials. Overall, regional market dynamics highlight a global trend where manufacturers must tailor their product portfolios—from high-volume standard boards in APAC to highly specialized, regulatory-compliant solutions in the West—to effectively capture market share.

- Asia Pacific (APAC): Dominates the market due to accelerated urbanization, infrastructure spending, and high-volume residential construction in China, India, and Indonesia.

- North America: Characterized by high penetration of specialized products (Type X, Type C, soundproof) driven by strict building codes, energy efficiency regulations, and a robust renovation market.

- Europe: Focuses heavily on sustainability, promoting the use of synthetic gypsum and advanced recycling methods, with steady growth driven by green building standards and residential refurbishment.

- Latin America: Emerging growth market, transitioning towards modern construction techniques, with potential driven by commercial and hospitality sector investments in key economies like Brazil and Mexico.

- Middle East & Africa (MEA): Growth stimulated by large-scale government-backed infrastructure and commercial development projects, requiring materials with high durability and fast installation capabilities.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Gypsum And Drywall Market.- USG Corporation (A subsidiary of Knauf)

- Saint-Gobain S.A.

- Etex Group

- Boral Limited

- National Gypsum Company

- Continental Building Products (Acquired by Saint-Gobain)

- PABCO Building Products

- Yoshino Gypsum Co., Ltd.

- China National Building Material Group Co., Ltd. (CNBM)

- LafargeHolcim Ltd.

- Beijing New Building Materials Co., Ltd. (BNBM)

- Gypsemna

- Winstone Wallboards

- ACG Materials

- Gulf Gypsum

- Siniat (Part of Etex Group)

- Georgia-Pacific LLC

- Volma

- Jason Plasterboard

- Zawawi Minerals LLC

Frequently Asked Questions

Analyze common user questions about the Gypsum And Drywall market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the current growth of the Gypsum and Drywall Market?

The primary driver is the accelerating pace of global urbanization, particularly in Asia Pacific and developing regions, necessitating rapid residential and commercial construction coupled with increasingly stringent international fire and safety regulations that mandate the use of non-combustible gypsum wallboard.

How does the use of synthetic gypsum impact market sustainability?

Synthetic gypsum, mainly Flue Gas Desulfurization (FGD) gypsum, promotes sustainability by reducing the reliance on natural gypsum mining, minimizing industrial waste from power generation, and lowering the environmental footprint of drywall manufacturing, aligning with circular economy models.

Which specialized drywall segment is projected to show the highest growth rate?

The specialized drywall segment, particularly moisture- and mold-resistant boards and high-performance acoustic drywall, is projected to show the highest growth rate due to increased regulatory requirements for building health and comfort in commercial and institutional applications.

What are the main restraints affecting the profitability of drywall manufacturers?

The main restraints include the volatility and high cost of energy required for the calcination process, fluctuations in raw material pricing (both natural and synthetic gypsum), and the complex logistical challenges and costs associated with managing construction and demolition (C&D) drywall waste.

Where is the largest demand for standard drywall currently concentrated globally?

The largest demand for standard drywall is concentrated in the Asia Pacific region, specifically driven by massive new residential housing projects and large-scale commercial developments in countries like China and India, prioritizing volume and cost-effectiveness.

The detailed analysis within this report underscores the robust future of the Gypsum and Drywall Market, positioning it as an indispensable component of the global construction industry. The transition toward high-performance specialized products, combined with operational efficiencies driven by technological integration and vertical integration strategies among key market players, ensures sustained growth through the forecast period. Manufacturers must strategically navigate raw material scarcity and environmental pressures by focusing on sustainable sourcing, product innovation, and optimizing distribution channels to capitalize on the sustained demand from high-growth urban centers worldwide. Furthermore, the increasing integration of digital tools and construction technology, including AI-driven optimization, will be paramount in maintaining competitive edge and meeting evolving regulatory and performance expectations within the global construction ecosystem.

Market growth is also critically influenced by the cyclic nature of the construction industry and macroeconomic stability. While long-term trends favor gypsum products due to their fire-resistant properties, short-term economic downturns can temporarily suppress new construction starts, impacting sales volumes. However, the renovation and repair (R&R) segment often acts as a counter-cyclical stabilizer, maintaining moderate demand for finishing materials even when large-scale capital projects slow down. Manufacturers are therefore diversifying their focus, ensuring their product lines are equally appealing to professional contractors and the growing DIY market, facilitated by accessible retail chains and online platforms. This dual-market approach cushions against volatility, enhancing overall market resilience. The push toward green building certification standards, such as LEED and BREEAM, continues to force manufacturers to transparently document the environmental impacts of their materials, favoring products with high recycled content or low embodied carbon, which is becoming a non-negotiable factor in procurement decisions for major developers and public projects.

In terms of competitive dynamics, strategic mergers and acquisitions (M&A) remain a common approach for market leaders to consolidate regional presence, acquire new technologies, and secure key distribution channels. Recent consolidation activities, such as the acquisition of large North American producers by European conglomerates, highlight the globalization of the market and the desire for diversified geographic portfolios. Pricing strategies are highly localized, often reflecting the cost of energy and transportation in specific regions, particularly for bulk products like standard drywall. Innovation is not limited to the board itself; manufacturers are also heavily investing in system solutions, including specialized framing, jointing compounds, and comprehensive installation training programs, positioning themselves not just as material suppliers but as full-service solution providers. This holistic approach builds strong brand loyalty among contractors who prioritize system reliability and ease of use, which ultimately determines project timelines and profitability on site. Therefore, success in this market increasingly depends on a combination of cost leadership for standard products and technological differentiation for premium, specialized applications.

The ongoing global effort to reduce carbon emissions is particularly relevant to the Gypsum and Drywall industry, given the energy-intensive nature of the calcination process. Manufacturers are exploring alternative, lower-temperature calcination methods and utilizing renewable energy sources, such as solar or wind power, to fuel their production facilities. These investments are driven by both regulatory pressures and demand from corporate customers committed to achieving net-zero carbon operations. Furthermore, the development of specialized cement-gypsum composites is gaining traction, offering enhanced water resistance and structural integrity for specific applications, thus expanding the traditional scope of drywall usage into semi-exposed or high-humidity environments. This product evolution demonstrates a commitment to innovation beyond standard fire and sound resistance. The geopolitical landscape also plays a role, with trade tariffs and localized supply chain disruptions affecting the movement of both raw gypsum and finished products, compelling global players to maintain robust regional manufacturing hubs to mitigate risk and ensure uninterrupted supply, especially to large, time-sensitive construction sites.

Technology deployment on the job site is another critical area of transformation. Digital tools are revolutionizing how drywall is measured, cut, and installed. For instance, laser-guided layout systems and augmented reality (AR) tools are enhancing precision and reducing installation errors, thereby improving labor efficiency—a vital consideration given the persistent skilled labor shortage in many developed construction markets. The push for prefabrication and modular construction is also influencing demand, with manufacturers developing panelized drywall systems and specialized structural insulated panels (SIPs) that incorporate gypsum products, allowing for faster assembly off-site and quicker enclosure times on-site. This modular approach minimizes waste and allows for better quality control in a factory setting. These technological shifts, from sustainable manufacturing practices to digital installation aids, are essential for the industry to meet the ambitious productivity and sustainability goals set by the global construction sector, reinforcing the long-term viability and growth prospects of advanced gypsum-based building materials in the global market.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager