Gypsum Centrifuges Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436466 | Date : Dec, 2025 | Pages : 253 | Region : Global | Publisher : MRU

Gypsum Centrifuges Market Size

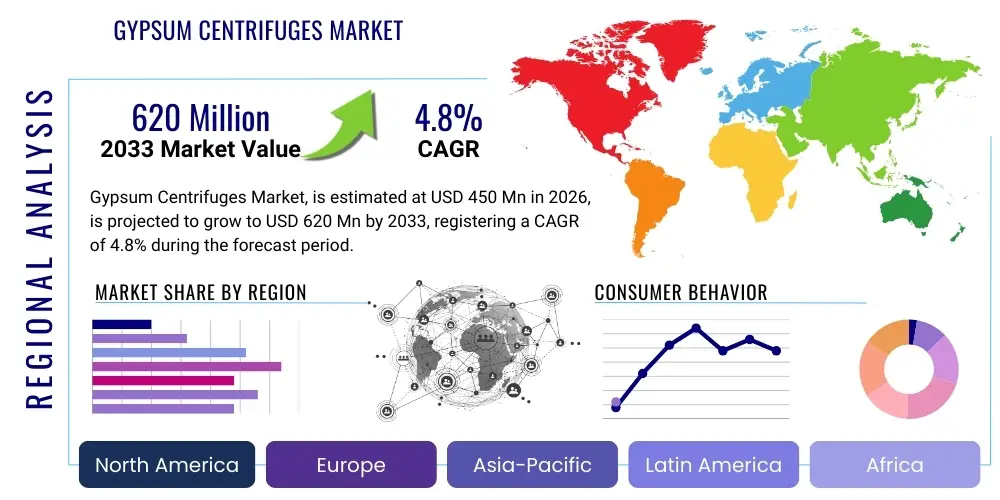

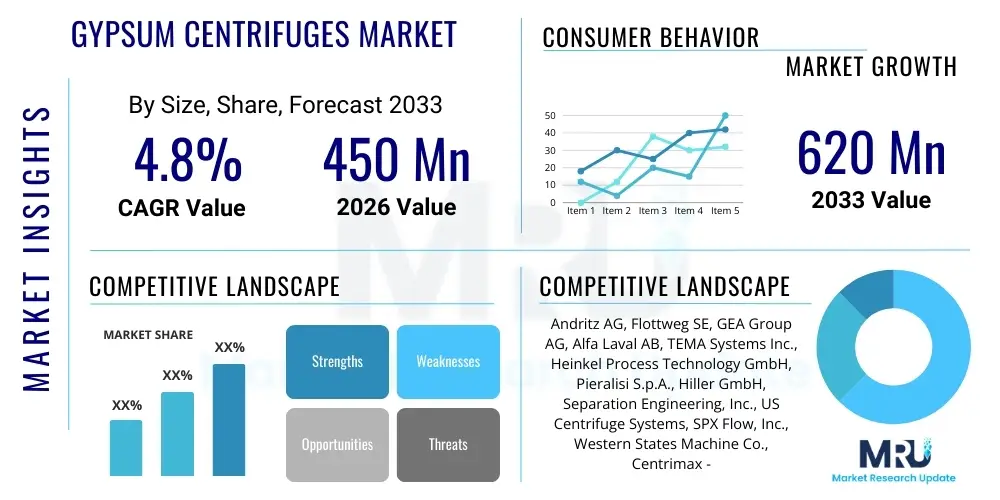

The Gypsum Centrifuges Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.8% between 2026 and 2033. The market is estimated at USD 450 Million in 2026 and is projected to reach USD 620 Million by the end of the forecast period in 2033.

Gypsum Centrifuges Market introduction

The Gypsum Centrifuges Market encompasses specialized industrial machinery designed for the efficient solid-liquid separation of gypsum slurry, primarily utilized within Flue Gas Desulfurization (FGD) plants, phosphoric acid production, and various chemical processing industries. These centrifuges are critical components in purifying and dewatering synthetic gypsum produced as a byproduct of environmental scrubbing processes, ensuring the resultant material meets stringent quality standards for further industrial use in cement or drywall manufacturing. The technology focuses on achieving low residual moisture content, which is vital for reducing energy consumption in subsequent drying phases and improving the economic viability of gypsum recycling efforts across heavy industries.

Gypsum centrifuges, often employing pusher or decanter designs, offer high throughput capacity and continuous operation, making them indispensable for large-scale industrial operations where efficiency and consistency are paramount. Major applications include environmental protection systems in coal-fired power plants, where FGD systems generate vast quantities of calcium sulfate (gypsum), and fertilizer complexes, specifically those producing phosphoric acid where phosphogypsum separation is required. The primary benefits derived from the adoption of advanced gypsum centrifuges include enhanced product purity, significant operational cost reductions through energy savings, and compliance with increasingly stringent environmental regulations concerning wastewater and byproduct management.

The market driving factors include global initiatives toward cleaner energy generation, which necessitates higher adoption rates of FGD technologies, particularly in emerging economies with substantial reliance on coal. Furthermore, the rising demand for high-quality synthetic gypsum in the construction sector, driven by rapid urbanization and infrastructure development, provides a robust downstream market. Continuous technological innovation focused on improving material corrosion resistance, optimizing bowl geometry for better separation efficiency, and integrating intelligent monitoring systems further propels market expansion by offering superior performance characteristics to end-users.

Gypsum Centrifuges Market Executive Summary

The global Gypsum Centrifuges Market exhibits stable growth, fueled predominantly by robust regulatory pressures aimed at controlling sulfur dioxide emissions from industrial sources and the concurrent economic incentive to commercialize synthetic gypsum. Current business trends indicate a strong focus on high-capacity decanter centrifuges and specialized pusher centrifuges that can handle abrasive and corrosive slurries typical of FGD and phosphogypsum processes. Key manufacturers are investing heavily in R&D to develop advanced materials, such as Duplex and Super Duplex Stainless Steels, to extend equipment lifespan and minimize maintenance downtime, addressing a critical pain point for heavy industry operators globally.

Regionally, Asia Pacific maintains the dominant market share, primarily due to the vast number of coal-fired power plants in China and India and ongoing infrastructural boom driving high demand for construction materials. North America and Europe, characterized by established environmental regulations and modernization of existing FGD facilities, are focusing on replacement cycles and the adoption of energy-efficient, automated centrifuge systems. Segment trends highlight the dominance of the power generation sector based on application, while technology segmentation shows an increasing shift towards continuous decanter centrifuges owing to their versatility in handling varying particle sizes and slurry concentrations encountered in large-scale processing.

The competitive landscape is moderately consolidated, featuring established global suppliers who provide comprehensive solutions encompassing process design, equipment supply, installation, and long-term maintenance services. Strategic initiatives, including mergers, acquisitions, and long-term service agreements (LTSAs), are prevalent strategies adopted by market leaders to expand their geographical footprint and secure major contracts within the utility and chemical sectors. Overall, the market trajectory is positive, underpinned by mandated environmental investments and the commercial value of the recovered gypsum byproduct, positioning the centrifuge as a pivotal technology in the circular economy of construction materials.

AI Impact Analysis on Gypsum Centrifuges Market

User inquiries regarding the impact of Artificial Intelligence (AI) on the Gypsum Centrifuges Market frequently center on predictive maintenance, operational efficiency improvements, and quality control automation. Key themes reveal user expectations for AI to minimize unexpected downtime, a significant operational risk in continuous chemical and power production, by precisely forecasting component failure based on vibration analysis, temperature fluctuations, and historical performance data. Users also express interest in how Machine Learning (ML) algorithms can dynamically adjust centrifuge operational parameters, such as bowl speed and differential speed, in real-time to optimize solid recovery and moisture content despite variations in the incoming gypsum slurry composition. A recurring concern is the feasibility and cost-effectiveness of retrofitting existing centrifuge fleets with advanced AI-driven sensors and control systems, highlighting a clear industry expectation for integrated, smart dewatering solutions that ensure peak efficiency and high-purity product output.

- AI-Powered Predictive Maintenance: Utilizing ML models trained on sensor data (vibration, temperature, pressure) to anticipate mechanical failures in bearings or drives, thus maximizing uptime and reducing costly emergency repairs in continuous production environments.

- Real-Time Process Optimization: Deployment of deep learning algorithms to analyze feed characteristics (density, viscosity, particle size distribution) and automatically fine-tune centrifuge settings (e.g., flocculant dosage, scroll speed) for optimal moisture reduction and separation quality.

- Enhanced Anomaly Detection: Implementing AI vision systems and data correlation tools to identify subtle deviations in byproduct quality or equipment performance far earlier than conventional SCADA systems, preventing off-spec production batches.

- Automated Diagnostics and Troubleshooting: Integrating expert systems that can rapidly diagnose operational faults and suggest precise corrective actions to maintenance personnel, thereby significantly reducing mean time to repair (MTTR).

- Optimized Energy Consumption: Using reinforcement learning to determine the most energy-efficient operating profile for the centrifuge based on current load and desired output specifications, contributing to lower operational expenditure (OPEX) in energy-intensive FGD plants.

- Digital Twin Modeling: Creation of precise virtual replicas of the centrifuge system, allowing operators to simulate the effects of different slurry compositions or operational changes before deployment, minimizing risk and accelerating process commissioning.

DRO & Impact Forces Of Gypsum Centrifuges Market

The dynamics of the Gypsum Centrifuges Market are profoundly shaped by regulatory drivers mandating sulfur emission controls, restrained by high capital expenditure requirements for specialized equipment, and presented with significant opportunities arising from the global pivot towards sustainable construction materials. Drivers primarily revolve around the widespread adoption of Flue Gas Desulfurization (FGD) systems, particularly in Asian economies, making centrifugation essential for byproduct recovery. Restraints include the intense corrosiveness and abrasiveness of gypsum slurries, which demand expensive, high-grade materials (like specialized alloys), escalating the initial purchase cost and increasing long-term maintenance needs. Opportunities are centered on the expansion of the synthetic gypsum recycling infrastructure and the increasing market acceptance of processed FGD gypsum as a sustainable substitute for natural gypsum in drywall and cement production, creating a robust, circular material flow system. These internal and external forces generate significant impact, pushing manufacturers toward innovation in material science and process automation to maintain competitiveness and meet the twin goals of environmental compliance and operational efficiency.

Segmentation Analysis

The Gypsum Centrifuges Market is comprehensively segmented across several key dimensions, providing detailed insights into market dynamics based on technology type, material of construction, end-use application, and geographical regions. Technology segmentation differentiates between high-speed decanter centrifuges, which are highly versatile and suitable for varying feed conditions, and pusher centrifuges, favored for large-capacity, consistent feed processing, alongside specialized vertical basket centrifuges used in batch purification processes. Material segmentation is crucial, reflecting the aggressive chemical environment, with stainless steel alloys (316L, Duplex, Super Duplex) dominating due to their superior corrosion and abrasion resistance, directly influencing equipment longevity and pricing structure. The application segment delineates demand predominantly driven by the coal-fired power sector (FGD) and the chemical industry (phosphoric acid production), each requiring specific centrifuge characteristics tailored to their unique slurry properties.

- By Technology Type:

- Decanter Centrifuges (Horizontal/Vertical)

- Pusher Centrifuges (Single/Multi-stage)

- Basket Centrifuges (Vertical/Horizontal)

- Hydrocyclones (Pre-thickening applications)

- By Material of Construction:

- Stainless Steel (SS 304, SS 316L)

- Duplex Stainless Steel (DSA)

- Super Duplex Stainless Steel (SDSA)

- Specialized Alloys and Coatings (e.g., Tungsten Carbide wear protection)

- By Capacity (Throughput):

- Low Capacity (Under 5 tons/hour)

- Medium Capacity (5 to 15 tons/hour)

- High Capacity (Above 15 tons/hour)

- By Application:

- Flue Gas Desulfurization (FGD) Systems (Power Plants)

- Chemical Processing (Phosphoric Acid Production – Phosphogypsum)

- Water Treatment and Sludge Dewatering

- Mining and Minerals Processing

- By End-Use Industry:

- Power Generation and Utilities

- Fertilizer and Chemical Manufacturing

- Construction Material Manufacturing

- Environmental Engineering

Value Chain Analysis For Gypsum Centrifuges Market

The value chain for the Gypsum Centrifuges Market begins with the upstream procurement of specialized raw materials, primarily high-grade stainless steel and specialized wear-resistant alloys, which form the core of the centrifuge bowl, scroll, and casing. Manufacturers then undertake precision engineering and assembly, relying heavily on advanced machining and welding techniques to meet the strict tolerance and durability requirements necessary for handling abrasive gypsum slurries. The crucial mid-stream activities involve intense research and development focused on optimizing centrifugal separation efficiency, developing sophisticated control systems, and integrating intelligent monitoring features to reduce operator intervention and maximize throughput stability across diverse operating conditions. This phase is characterized by high technical expertise and stringent quality control, defining the competitive advantage of key market players.

Downstream activities involve distribution, installation, and, most importantly, long-term service and maintenance. Centrifuges are typically distributed through a mix of direct sales channels, especially for large utility and chemical projects requiring bespoke engineering consultations, and specialized regional distributors who possess local market knowledge and immediate service capabilities. The installation phase often requires close collaboration between the manufacturer's engineers and the end-user's plant operational teams to ensure seamless integration into existing FGD or chemical processing lines. Post-sale service, including preventative maintenance contracts, spare parts supply, and rapid repair services for wear components (e.g., scroll coatings, bearings), represents a significant and stable revenue stream for centrifuge suppliers, given the continuous, harsh operating environment of the equipment.

Direct sales channels are preferred for major capital projects due to the complexity of the equipment and the necessity for detailed contractual negotiations, often involving long lead times and specific performance guarantees regarding moisture content and purity targets. Indirect channels, utilizing specialized process equipment integrators and regional agents, facilitate market penetration in smaller industrial applications or in geographically disparate regions where a local presence is essential for swift response times. The effectiveness of the value chain relies heavily on maintaining a seamless flow of high-quality components and delivering expert after-sales support to ensure equipment reliability, which is paramount for end-users operating high-cost, continuous processes.

Gypsum Centrifuges Market Potential Customers

Potential customers for Gypsum Centrifuges are concentrated within industrial sectors that generate large volumes of calcium sulfate or phosphogypsum as a byproduct, requiring sophisticated dewatering and purification processes before disposal or commercial reuse. The largest segment of end-users comprises utility companies and independent power producers operating coal-fired power plants equipped with wet FGD systems, where the efficient recovery of high-purity synthetic gypsum is essential for both environmental compliance and maximizing the value of the recoverable byproduct. These entities require high-capacity, robust centrifuges capable of continuous operation with minimal supervision and maximum resistance to corrosion and abrasion inherent in the slurry.

Another major customer group resides within the chemical and fertilizer industry, specifically companies involved in the production of phosphoric acid through the wet process. These facilities generate phosphogypsum, which necessitates advanced separation technology to reduce toxicity and prepare it for stacking or, ideally, conversion into useful products. Furthermore, the burgeoning construction material industry, including drywall manufacturers and cement producers who utilize synthetic gypsum as a raw material, increasingly influences centrifuge procurement decisions by demanding higher purity and lower moisture content in the recovered material, directly impacting the final quality of their products.

Peripheral markets, such as specialized environmental engineering firms and municipal solid waste treatment facilities that handle certain industrial sludges containing sulfates, also represent smaller but growing customer bases. These buyers prioritize systems that offer flexibility and rapid adjustability to handle heterogeneous feed materials. The common requirement across all these potential customers is the need for reliable, high-performance solid-liquid separation equipment that offers the lowest total cost of ownership (TCO) over a lifespan often exceeding 15 years, emphasizing durability and efficiency.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 450 Million |

| Market Forecast in 2033 | USD 620 Million |

| Growth Rate | 4.8% ( Include CAGR Word with 4.8% Value ) |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Andritz AG, Flottweg SE, GEA Group AG, Alfa Laval AB, TEMA Systems Inc., Heinkel Process Technology GmbH, Pieralisi S.p.A., Hiller GmbH, Separation Engineering, Inc., US Centrifuge Systems, SPX Flow, Inc., Western States Machine Co., Centrimax - Winkelhorst Trenntechnik GmbH, Mitsubishi Kakoki Kaisha, Ltd., Bird Machine, Broadbent Ltd., Zoppas Industries Heating Element Technologies, Sanborn Technologies, Rousselet Robatel. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Gypsum Centrifuges Market Key Technology Landscape

The core technology landscape of the Gypsum Centrifuges Market is dominated by two primary types: decanter centrifuges and pusher centrifuges, both undergoing continuous incremental innovation to enhance efficiency and durability. Decanter centrifuges are favored for their adaptability to fluctuating feed conditions and particle size distributions characteristic of various FGD processes. Recent technological advancements focus heavily on optimizing the screw conveyor design and improving the differential speed control systems through Variable Frequency Drives (VFDs) and sophisticated algorithms, allowing for highly precise control over the cake discharge and liquor clarity, thereby ensuring consistent low residual moisture content critical for downstream processes.

Pusher centrifuges, while less flexible regarding feed variations, excel in continuous, high-volume processing of coarse, crystalline gypsum. Key technological improvements in pusher systems involve advanced hydraulic pusher mechanisms and specialized multi-stage designs that increase the effective filtration area and residence time, leading to superior wash efficiency and remarkably dry cake output. Manufacturers are also heavily focused on material science advancements, specifically the application of ceramics, tungsten carbide tiles, and specialized corrosion-resistant coatings to scroll surfaces and discharge ports, significantly mitigating the severe wear caused by the abrasive nature of gypsum crystals and extending the operational lifespan between scheduled overhauls.

Furthermore, the integration of Industry 4.0 principles, including high-definition sensors, remote monitoring capabilities, and sophisticated process control software, is transforming the operational profile of modern gypsum centrifuges. These smart systems enable operators to monitor parameters like vibration levels, temperature, and residual moisture in real-time, facilitating predictive maintenance strategies and automated process adjustments. This technological evolution aims not only to maximize throughput but also to minimize the consumption of resources such as wash water and energy, aligning the technology with global sustainability and operational excellence benchmarks across the power and chemical sectors.

Regional Highlights

The Gypsum Centrifuges Market exhibits distinct growth trajectories across major global regions, dictated by regulatory frameworks, industrial capacity, and infrastructure investment patterns. Asia Pacific (APAC) currently represents the largest market share, primarily driven by China and India, where rapid industrialization and high energy demand necessitate the construction of new coal-fired power plants and the mandated installation of FGD systems to comply with increasingly strict air quality standards. The sheer volume of synthetic gypsum generated in these economies demands high-capacity centrifugation solutions, making APAC a critical hub for both equipment manufacturing and deployment.

Europe and North America, categorized as mature markets, display steady demand driven less by new installations and more by the replacement and modernization of existing centrifuge fleets. European environmental directives (e.g., the Industrial Emissions Directive) push operators to adopt Best Available Techniques (BAT), favoring highly energy-efficient and automated centrifugation systems that minimize environmental impact and maximize resource recovery. North America focuses on technological sophistication, with utility companies investing in AI-integrated predictive maintenance solutions to ensure maximum reliability and lower overall operational expenditures.

Latin America and the Middle East & Africa (MEA) are emerging markets demonstrating promising potential. In Latin America, growth is linked to expansion in the fertilizer industry, particularly the production of phosphoric acid, requiring phosphogypsum dewatering. The MEA region's market growth is tied to large-scale infrastructure projects and developing industrial bases, with initial adoption concentrated in large state-owned utility projects. However, the market in these regions is sensitive to fluctuations in commodity prices and political stability, impacting capital expenditure cycles for industrial equipment.

- Asia Pacific (APAC): Dominates the market due to substantial investments in coal-fired power generation and mandatory FGD installations in China, India, and Southeast Asian nations. High demand for synthetic gypsum in construction sectors further fuels the need for efficient dewatering equipment.

- North America: Characterized by replacement demand, modernization of legacy power infrastructure, and high adoption rates of advanced automation and predictive maintenance technologies to optimize existing centrifuge performance and reliability.

- Europe: Driven by strict environmental regulations (BAT principles) and a strong focus on maximizing resource efficiency and purity for recycled gypsum destined for the premium construction and building materials markets.

- Latin America (LATAM): Growth primarily associated with the expansion of the fertilizer industry (phosphoric acid) and the requirement for efficient phosphogypsum separation and handling in countries like Brazil and Chile.

- Middle East and Africa (MEA): Emerging market growth tied to new infrastructure development, particularly in GCC countries, and environmental projects related to water and industrial waste management, though market penetration is still relatively low compared to APAC.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Gypsum Centrifuges Market.- Andritz AG

- Flottweg SE

- GEA Group AG

- Alfa Laval AB

- TEMA Systems Inc.

- Heinkel Process Technology GmbH

- Pieralisi S.p.A.

- Hiller GmbH

- Separation Engineering, Inc.

- US Centrifuge Systems

- SPX Flow, Inc.

- Western States Machine Co.

- Centrimax - Winkelhorst Trenntechnik GmbH

- Mitsubishi Kakoki Kaisha, Ltd.

- Bird Machine

- Broadbent Ltd.

- Zoppas Industries Heating Element Technologies

- Sanborn Technologies

- Rousselet Robatel

- Eriez Manufacturing Co. (Focusing on filtration adjuncts)

Frequently Asked Questions

Analyze common user questions about the Gypsum Centrifuges market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary function of a Gypsum Centrifuge in industrial applications?

The primary function of a Gypsum Centrifuge is the efficient solid-liquid separation and dewatering of gypsum slurry, most critically used in Flue Gas Desulfurization (FGD) processes at power plants or during phosphoric acid production, aiming to achieve a low residual moisture content in the recovered solid gypsum cake for subsequent commercial use or disposal. This process is essential for environmental compliance and optimizing byproduct value.

Which type of centrifuge technology is most commonly used for high-capacity FGD gypsum dewatering?

High-capacity continuous decanter centrifuges and large-scale pusher centrifuges are the most common technologies for FGD gypsum dewatering. Decanter centrifuges offer flexibility for varying feed conditions, while multi-stage pusher centrifuges are often favored when consistent, high purity, and very low moisture content crystalline gypsum is required for large utility operations, providing robust continuous throughput.

What materials are essential for centrifuge construction to handle abrasive gypsum slurries?

Due to the corrosive and abrasive nature of gypsum (calcium sulfate), essential construction materials include high-grade stainless steels such as SS 316L, Duplex, and Super Duplex stainless steel alloys. Critical high-wear surfaces like the screw conveyor tips and discharge ports are typically protected with extremely hard materials such as tungsten carbide tiles or specialized ceramic coatings to ensure longevity and reduce maintenance frequency.

How do stringent environmental regulations influence the Gypsum Centrifuges Market?

Strict environmental regulations, particularly those targeting sulfur dioxide (SOx) emissions, directly boost the market by mandating the installation and continuous operation of FGD systems in coal-fired power plants. Centrifuges are integral to these systems, converting the liquid effluent into a manageable solid byproduct, thereby driving consistent demand for efficient separation equipment that adheres to purity and moisture standards.

What are the key operational challenges associated with Gypsum Centrifuges?

Key operational challenges include managing the high abrasiveness of gypsum crystals, which causes rapid wear on internal components; mitigating corrosion from acidic slurries; ensuring stable operational performance despite fluctuations in feed concentration; and managing the high energy consumption inherent in continuous, high-speed centrifugal separation processes. Addressing these requires advanced metallurgy and sophisticated control systems.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager