Gyrocompasses Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432673 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Gyrocompasses Market Size

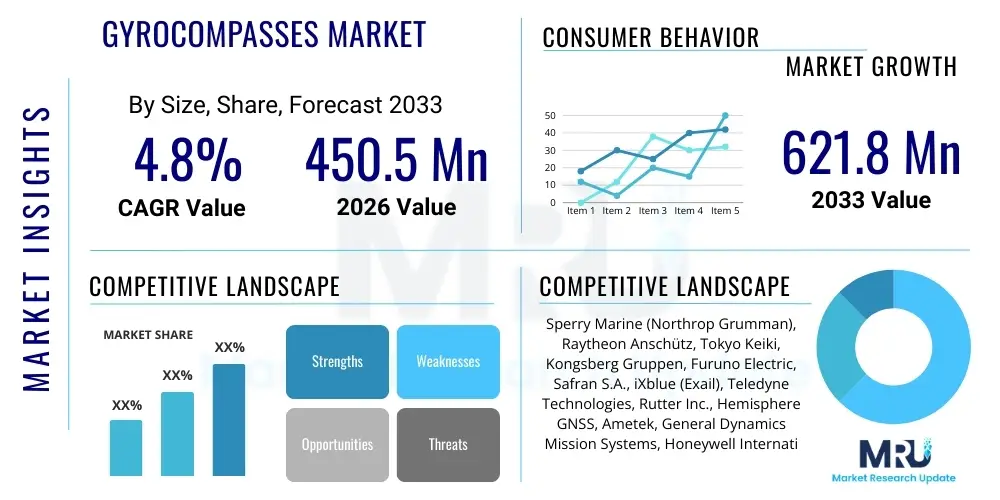

The Gyrocompasses Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.8% between 2026 and 2033. The market is estimated at USD 450.5 Million in 2026 and is projected to reach USD 621.8 Million by the end of the forecast period in 2033.

Gyrocompasses Market introduction

The Gyrocompasses Market encompasses the design, manufacturing, distribution, and utilization of sophisticated navigational instruments that determine true north without relying on magnetic fields. These devices are critical components in maritime, aerospace, and defense applications where precise heading and attitude stabilization are mandatory for safe operation and mission success. The foundational technology exploits the principle of angular momentum, where a spinning mass resists changes in the direction of its axis, combined with the Earth's rotation, to provide an accurate, stable reference point for navigation systems.

Modern gyrocompasses have evolved significantly from traditional mechanical models to highly advanced solid-state technologies, such as Fiber Optic Gyroscopes (FOGs) and Ring Laser Gyroscopes (RLGs). This technological shift has minimized maintenance requirements, enhanced accuracy, reduced size, and increased reliability, making them indispensable in complex navigation environments. Major applications span commercial shipping, governmental naval vessels, offshore drilling platforms, surveying systems, and autonomous underwater vehicles (AUVs), ensuring continuous and reliable heading data regardless of weather or external electromagnetic interference.

Key driving factors propelling market growth include the increasing global trade requiring expanded commercial shipping fleets, heightened defense spending focused on sophisticated naval warfare capabilities, and stringent international regulations mandating the installation of advanced navigational equipment on large vessels (e.g., IMO requirements). Furthermore, the proliferation of autonomous vehicles and remotely operated systems, which demand high-precision inertial navigation solutions, provides significant momentum for high-performance gyrocompass adoption, particularly in high-latitude operational zones where magnetic compasses become unreliable.

Gyrocompasses Market Executive Summary

The Gyrocompasses Market is experiencing moderate yet stable growth, driven predominantly by modernization initiatives within global navies and the regulatory push for enhanced safety standards in commercial shipping. Business trends indicate a strong preference for solid-state technologies (FOG and RLG) over conventional mechanical gyros due to superior accuracy, faster settling times, and low total cost of ownership over the product lifecycle. Key manufacturers are focusing on integrating gyrocompass technology with advanced Inertial Navigation Systems (INS) and satellite positioning data (GNSS) to offer comprehensive, resilient navigation solutions, capitalizing on the demand for navigation systems that can operate reliably in GNSS-denied environments.

Regionally, the Asia Pacific (APAC) stands out as the primary growth engine, fueled by massive shipbuilding activity, particularly in South Korea, China, and Japan, coupled with significant naval fleet expansion programs underway in India and China. North America and Europe remain crucial markets, characterized by high-value contracts for defense and high-end offshore energy exploration, necessitating highly ruggedized and accurate systems. Conversely, regions like Latin America and MEA are focused primarily on retrofitting existing fleets and smaller commercial vessel installations, driving demand for cost-effective, durable mechanical or FOG-based systems.

Segment trends highlight the dominance of the Commercial Marine application segment in terms of volume, while the Naval and Defense segment commands the highest average selling price (ASP) due to stringent military specifications and the need for advanced sensor fusion capabilities. Technology-wise, Fiber Optic Gyrocompasses are projected to witness the highest CAGR, primarily because they strike an optimal balance between high precision, affordability, and durability, making them highly suitable for a broad spectrum of commercial and mid-tier defense applications, effectively bridging the gap between legacy mechanical systems and high-cost Ring Laser Gyroscopes.

AI Impact Analysis on Gyrocompasses Market

Common user questions regarding AI's impact on the Gyrocompasses Market typically center around how artificial intelligence and machine learning (ML) enhance navigation accuracy, whether AI integration can detect and correct subtle sensor drifts faster than traditional Kalman filters, and if AI will enable entirely new forms of autonomous heading determination. Users are keenly interested in the potential for predictive maintenance enabled by AI, allowing operators to anticipate mechanical failure or performance degradation in real-time, especially in older mechanical gyrocompass units. Furthermore, there is significant inquiry into how AI facilitates the fusion of data from multiple disparate sensors (e.g., radar, sonar, GNSS, and gyrocompass) to create robust, highly resilient navigational awareness, essential for Level 4 and Level 5 autonomous marine vessels navigating congested or hostile waters.

The core theme summarizing user expectations is the desire for AI to transition the gyrocompass from a static heading sensor to an intelligent, self-calibrating component within a broader, resilient navigation ecosystem. AI algorithms, particularly those based on ML and deep learning, are proving instrumental in refining the sensor data fusion process, mitigating errors caused by environmental factors (such as hull vibration, temperature fluctuation, or high sea states), and achieving continuous, unparalleled accuracy even under conditions where traditional filtering methods struggle. This integration is vital for the deployment of highly sophisticated systems such as uncrewed surface vessels (USVs) and advanced anti-access/area denial (A2/AD) defense systems, where momentary loss of accurate heading data is unacceptable.

Ultimately, AI does not replace the fundamental physics of the gyrocompass but significantly enhances its performance, reliability, and utility. By providing sophisticated diagnostics and predictive performance modeling, AI minimizes human intervention and maximizes operational uptime. This shift drives the market towards smarter, interconnected inertial units, moving away from standalone devices. Manufacturers who successfully embed advanced AI/ML capabilities into their FOG and RLG products to offer superior resilience against jamming or spoofing threats will secure a decisive competitive advantage in the defense and high-end commercial sectors.

- AI-driven sensor fusion enhances navigational resilience in GNSS-denied environments.

- Machine Learning algorithms facilitate predictive maintenance, reducing mechanical failures in legacy systems.

- AI enables real-time drift detection and correction, improving long-term accuracy and stability.

- Intelligent diagnostics speed up troubleshooting and minimize operational downtime for critical vessels.

- Deep Learning models optimize performance based on real-world sea state and environmental conditions.

- Automation of calibration procedures through AI significantly lowers required crew expertise.

DRO & Impact Forces Of Gyrocompasses Market

The Gyrocompasses Market dynamics are shaped by a complex interplay of rigorous regulatory demands, accelerated technological evolution, and inherent operational constraints associated with high-precision inertial sensing. Key drivers include mandatory regulatory compliance, particularly stringent mandates from the IMO (International Maritime Organization) and various national maritime agencies requiring redundant and highly accurate heading systems for large commercial vessels. This baseline requirement, coupled with global increases in maritime security concerns and the associated boost in naval spending, establishes a stable demand floor. Opportunities primarily reside in the niche markets of autonomous vehicles (both underwater and surface) and the expanding offshore energy sector, both of which necessitate the highest caliber of inertial measurement units (IMUs) where gyrocompass technology is foundational.

Restraints largely center on the high initial acquisition cost of advanced RLG and high-end FOG systems, posing a barrier to entry for smaller maritime operators who may opt for lower-cost alternative solutions or legacy magnetic compasses supplemented by basic GNSS. Furthermore, the market faces competition from alternative inertial measurement technologies, such as micro-electro-mechanical systems (MEMS) based gyroscopes, which, while offering lower accuracy, are rapidly improving and are significantly cheaper and smaller, challenging the dominance of traditional gyros in lower-tier applications. The necessity for highly specialized technical expertise for installation, calibration, and ongoing maintenance of these complex electromechanical and optical systems also acts as a limiting factor in developing regions.

The impact forces are substantial, manifesting primarily through intensified R&D efforts aimed at miniaturization and increased ruggedization to meet military specifications (MIL-SPEC) and extreme environmental operating conditions (e.g., Arctic navigation). The primary enduring force is the persistent demand for redundancy and reliability; any system failure in a commercial or naval vessel can lead to catastrophic outcomes, cementing the indispensable role of highly accurate, non-magnetic heading reference systems. This focus drives continuous innovation toward higher Mean Time Between Failure (MTBF) rates and enhanced system integrity checking, ensuring market stability despite disruptive technological competition.

Segmentation Analysis

The Gyrocompasses Market is systematically segmented based on technology type, application, and end-user, reflecting the diverse requirements across the commercial, naval, and energy sectors. Technology segmentation differentiates between older mechanical systems, the rapidly expanding Fiber Optic Gyroscopes (FOG), and the high-precision, high-cost Ring Laser Gyroscopes (RLG), with FOG leading in terms of market penetration due to its excellent performance-to-cost ratio. Application segmentation clearly delineates the high-volume commercial marine segment from the high-value naval defense segment and the specialized offshore oil and gas sector.

Analyzing these segments provides a clear pathway for strategic investment and product development. For instance, while RLG technology dominates high-end military and aerospace inertial navigation where zero drift is paramount, FOG technology is critical for the mass commercial shipping market where stability, durability, and compliance with navigational standards are the main criteria. The segmentation by End-User (e.g., OEMs vs. Aftermarket/Retrofit) also offers insights; the OEM segment is crucial for capturing new shipbuilding trends, whereas the Aftermarket segment is driven by technology refreshment cycles and mandatory regulatory upgrades for existing fleets, often favoring cost-effective retrofit solutions.

- Technology Type

- Mechanical Gyrocompasses (Traditional)

- Fiber Optic Gyrocompasses (FOG)

- Ring Laser Gyrocompasses (RLG)

- Other Solid-State Gyros (e.g., Hemispherical Resonator Gyros)

- Application

- Commercial Marine (Tankers, Cargo Vessels, Ferries)

- Naval and Defense (Submarines, Surface Combatants, Patrol Vessels)

- Offshore Oil & Gas (Drilling Rigs, Support Vessels, Surveying)

- Aerospace and Land Navigation Systems

- End-User

- Original Equipment Manufacturers (OEMs)

- Aftermarket/Retrofit

- Sales Channel

- Direct Sales

- Distributor/Dealer Network

Value Chain Analysis For Gyrocompasses Market

The value chain for the Gyrocompasses Market begins with the highly specialized upstream component providers who supply critical raw materials and intricate sub-components, such as high-purity optical fibers (for FOGs), sophisticated lasers and mirrors (for RLGs), and precision machining services for mechanical components. This upstream segment is characterized by high intellectual property requirements and limited supplier concentration, meaning pricing power often rests with the component specialists. Manufacturers then engage in complex assembly, calibration, and integration processes, which require exceptionally clean environments and highly trained technical staff to ensure the navigational accuracy meets required specifications.

The midstream involves the core manufacturing process, where integration with navigation processors, control units, and robust housing is completed. The distribution channel is bifurcated: direct sales are typically employed for high-value governmental and defense contracts, ensuring confidentiality and specialized support. Indirect channels, involving global distributors, authorized dealers, and system integrators, are critical for accessing the widely dispersed commercial marine and retrofit markets. These distributors often provide value-added services such as installation, integration with existing bridge electronics, and local maintenance support, serving as the primary interface with end-users.

The downstream sector is dominated by end-users, primarily shipbuilding yards (OEMs) and vessel owners (aftermarket). Post-sales service and long-term maintenance contracts represent a significant portion of the value chain's revenue, particularly given the long operational lifespan of vessels. Because gyrocompasses are critical safety components, reliable maintenance and calibration services are mandatory, ensuring continuous engagement between manufacturers/distributors and the end-user base, thereby extending the product lifecycle and locking in repeat revenue streams from servicing contracts.

Gyrocompasses Market Potential Customers

Potential customers for the Gyrocompasses Market are highly concentrated in sectors that require absolute certainty in heading, attitude, and position tracking for safety, operational efficiency, or mission critical objectives. The primary customer base comprises global shipbuilding conglomerates and major shipping companies (e.g., container lines, bulk carriers, passenger cruise lines) mandated by international law to utilize certified navigational equipment. These entities prioritize reliability, compliance, and systems integration compatibility with existing bridge infrastructure.

The second major group includes governmental defense organizations and navies worldwide. These customers demand the highest precision (RLG and high-grade FOG), ruggedization (MIL-SPEC), and resilience against electronic warfare threats (anti-jamming capabilities). Their purchasing decisions are driven by strategic defense planning, fleet modernization cycles, and stringent performance metrics that exceed commercial standards, often involving multi-year procurement contracts with established defense contractors.

Furthermore, specialized industrial operators, such as companies involved in seismic surveying, offshore drilling, deep-sea mining, and the operation of advanced uncrewed vehicles (USVs, AUVs), form a rapidly growing niche customer base. These operations require extremely stable and accurate positional referencing systems over extended periods. Their demand is shifting towards compact, highly efficient, and low-power solid-state gyrocompasses capable of deep integration into autonomous control platforms and dynamic positioning systems.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 450.5 Million |

| Market Forecast in 2033 | USD 621.8 Million |

| Growth Rate | 4.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Sperry Marine (Northrop Grumman), Raytheon Anschütz, Tokyo Keiki, Kongsberg Gruppen, Furuno Electric, Safran S.A., iXblue (Exail), Teledyne Technologies, Rutter Inc., Hemisphere GNSS, Ametek, General Dynamics Mission Systems, Honeywell International, KVH Industries, Garmin, L3Harris Technologies, Yokogawa Electric, Rockwell Collins (Collins Aerospace), Kearfott Corporation, China North Industries Group Corporation (NORINCO) |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Gyrocompasses Market Key Technology Landscape

The Gyrocompasses Market technology landscape is characterized by a definitive shift from traditional electromechanical spinning mass devices towards advanced solid-state inertial sensors. Fiber Optic Gyroscopes (FOGs) represent the most pervasive contemporary technology, leveraging the Sagnac effect to measure rotation using light waves traveling through coiled optical fiber. FOGs offer zero moving parts, instantaneous operation, exceptional reliability, and high dynamic range, making them highly resistant to shock and vibration, which is critical in marine environments. Their architecture allows for scalability in performance, catering to diverse needs from standard commercial navigation to mid-tier military targeting systems.

At the apex of precision lies the Ring Laser Gyroscope (RLG). RLGs provide the highest degree of accuracy, thermal stability, and long-term repeatability, primarily utilized in strategic applications such as ballistic missile guidance, high-altitude aerospace navigation, and ultra-precise naval inertial navigation systems (INS). Although significantly more expensive and complex than FOGs, the RLG’s unparalleled performance is non-negotiable for defense applications where mission success relies on micro-radian accuracy. The continued focus in RLG technology development is on miniaturization and cost reduction, although its inherent complexity maintains its premium price point.

A crucial technological trend across all gyrocompass types is the integration of advanced filtering techniques, predominantly Kalman filtering and specialized non-linear estimators, combined with external positioning data (GNSS). This sensor fusion is vital for creating robust Inertial Navigation Systems (INS) that compensate for the natural drift inherent in inertial sensors. Modern gyrocompass manufacturers are focused on developing proprietary algorithms that allow the gyrocompass to function effectively in challenging conditions, such as prolonged GNSS signal denial, by improving short-term drift stability and recalibration routines using terrain matching or map-aided navigation techniques. Furthermore, there is ongoing research into Micro-Electro-Mechanical Systems (MEMS) gyroscopes, attempting to push their accuracy limits enough to compete with lower-end FOGs in smaller, cost-sensitive, and disposable autonomous vehicles.

Regional Highlights

- Asia Pacific (APAC): APAC is the dominant market region, primarily driven by China, South Korea, and Japan, which together control the majority of global commercial shipbuilding capacity. Robust naval fleet modernization and expansion programs in nations like India, Australia, and China are significant consumers of high-precision FOG and RLG systems. The region's increasing engagement in offshore activities and territorial defense heightens the demand for reliable, resilient navigation solutions, making it the fastest-growing market globally.

- North America: This region is characterized by high defense spending and advanced technological adoption. The US Navy and Coast Guard are major end-users, focusing almost exclusively on high-specification, military-grade RLG and FOG systems for submarines and surface combatants. The market here is driven by advanced research, development, and stringent military procurement cycles, prioritizing resilience against electronic warfare threats and system integration complexity.

- Europe: Europe represents a mature market with significant naval presence, driven by nations such as the UK, France, Germany, and Russia. The region sees strong demand from both the commercial shipping sector (due to strict EU maritime safety regulations) and the defense sector. European manufacturers often lead innovation in FOG technology and specialized solutions for harsh environments, particularly in the North Sea oil and gas operations and polar navigation.

- Latin America (LATAM): The LATAM market is smaller, characterized mainly by retrofit and maintenance demands for existing commercial and smaller naval fleets. Price sensitivity is high, favoring durable mechanical gyros or mid-range FOG systems. Growth is moderate, tied to regional economic stability and infrastructure investment in ports and trade.

- Middle East and Africa (MEA): Growth is concentrated in the Middle East, fueled by strategic naval investments by Gulf Cooperation Council (GCC) countries and the expansion of oil and gas transport infrastructure. These nations are selectively investing in high-end systems for defense modernization, while the commercial sector focuses on essential compliance, leading to a bifurcated demand structure.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Gyrocompasses Market.- Sperry Marine (Northrop Grumman)

- Raytheon Anschütz

- Tokyo Keiki

- Kongsberg Gruppen

- Furuno Electric

- Safran S.A.

- iXblue (Exail)

- Teledyne Technologies

- Rutter Inc.

- Hemisphere GNSS

- Ametek

- General Dynamics Mission Systems

- Honeywell International

- KVH Industries

- Garmin

- L3Harris Technologies

- Yokogawa Electric

- Rockwell Collins (Collins Aerospace)

- Kearfott Corporation

- China North Industries Group Corporation (NORINCO)

Frequently Asked Questions

Analyze common user questions about the Gyrocompasses market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between a Gyrocompass and a Magnetic Compass?

A gyrocompass determines True North based on the Earth's rotation and angular momentum, providing a precise and stable heading regardless of local magnetic variations or metallic interference, unlike a magnetic compass which aligns with Magnetic North and requires correction for deviation and variation.

How do Fiber Optic Gyroscopes (FOGs) compare to Ring Laser Gyroscopes (RLGs) in performance?

RLGs offer superior accuracy, long-term stability, and lowest drift rates, typically used for high-end defense and aerospace inertial navigation. FOGs provide excellent accuracy at a lower cost and higher reliability with no moving parts, making them the preferred choice for most commercial marine and mid-tier naval applications.

What impact do autonomous marine vessels have on Gyrocompass demand?

Autonomous marine vessels significantly increase the demand for high-reliability, solid-state gyrocompasses, especially FOGs and RLGs, as they form the core of the Inertial Navigation System (INS). These systems require highly accurate, continuous heading data resilient to GNSS signal loss, demanding premium gyro technology.

Are mechanical gyrocompasses still relevant in the modern maritime industry?

While mechanical gyrocompasses are increasingly being replaced by solid-state alternatives (FOG/RLG) in new builds, they remain relevant in the aftermarket and retrofit segment due to their robust nature and lower replacement cost compared to high-end solid-state systems. However, their market share is steadily declining due to higher maintenance requirements.

Which geographical region dominates the Gyrocompasses Market in terms of growth?

The Asia Pacific (APAC) region dominates the growth of the Gyrocompasses Market, primarily driven by massive commercial shipbuilding activities in China, South Korea, and Japan, coupled with substantial, ongoing naval modernization and fleet expansion programs across the region.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager