Haematococcus Pluvialis Astaxanthin Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437832 | Date : Dec, 2025 | Pages : 253 | Region : Global | Publisher : MRU

Haematococcus Pluvialis Astaxanthin Market Size

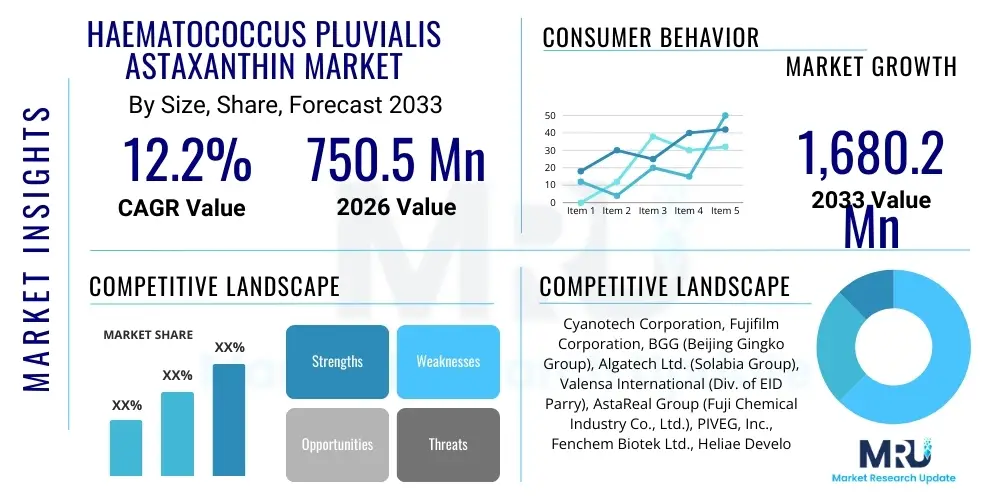

The Haematococcus Pluvialis Astaxanthin Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 12.2% between 2026 and 2033. The market is estimated at USD 750.5 Million in 2026 and is projected to reach USD 1,680.2 Million by the end of the forecast period in 2033.

Haematococcus Pluvialis Astaxanthin Market introduction

The Haematococcus Pluvialis Astaxanthin Market centers around the production and commercialization of astaxanthin derived exclusively from the microalga Haematococcus pluvialis. Astaxanthin, a potent keto-carotenoid, is renowned for its exceptional antioxidant capabilities, estimated to be several hundred times stronger than Vitamin E. This natural source is highly valued across various industries due to its purity and efficacy, distinguishing it from synthetic alternatives. The primary applications span across functional foods, dietary supplements (nutraceuticals), high-end cosmetics, and the aquaculture sector, where it is used as a pigmentation agent for salmon and shrimp.

Product demand is largely driven by escalating consumer awareness regarding preventive healthcare and the rising prevalence of chronic diseases linked to oxidative stress and inflammation. Furthermore, the robust clinical evidence supporting astaxanthin’s benefits for skin health, eye health (reducing oxidative damage), and cardiovascular function has significantly boosted its adoption in premium wellness products. The technological advancements in cultivation, particularly the shift towards closed photobioreactors (PBRs), are enabling higher yields and improved cost-efficiency, mitigating historical challenges related to scaling production.

Major market participants are heavily invested in R&D to optimize extraction techniques, enhance the stability and bioavailability of the final product, and explore novel delivery systems such as nanoemulsions and liposomal formulations. The natural origin and non-GMO status of Haematococcus pluvialis astaxanthin provide a substantial competitive advantage in developed markets like North America and Europe, where consumers increasingly prefer clean-label and sustainably sourced ingredients. Regulatory approvals and standardization efforts globally are further paving the way for wider commercial acceptance and integration into mainstream consumer goods, securing the market's trajectory toward strong expansion.

Haematococcus Pluvialis Astaxanthin Market Executive Summary

The Haematococcus Pluvialis Astaxanthin Market is experiencing robust growth fueled by favorable business trends centered on the global nutraceutical boom and growing scientific validation of its health benefits. Key business dynamics include strategic investments in vertical integration by major players, from microalgae cultivation to final product encapsulation, ensuring quality control and supply stability. Technological innovations in high-density cultivation and novel stabilization methods (e.g., microencapsulation) are critical to maintaining market competitiveness, particularly as companies seek to reduce the current high cost of production compared to synthetic counterparts. The market is also witnessing a surge in partnerships between ingredient suppliers and consumer goods manufacturers to co-develop functional foods and beverages, expanding astaxanthin’s market reach beyond traditional capsules and softgels.

Regionally, North America holds the largest market share, driven by high per capita expenditure on dietary supplements and a well-established regulatory framework that facilitates product innovation and marketing. However, the Asia Pacific region, particularly China and Japan, is projected to register the fastest growth rate. This rapid expansion is attributed to the long-standing use of algae-derived products in traditional Asian medicine, increasing disposable incomes, and the swift modernization of the aquaculture sector demanding high-quality natural feed ingredients. Europe remains a significant market, although subject to stricter Novel Food regulations which necessitate rigorous testing and approval processes for new astaxanthin formulations.

Segmentation analysis highlights the Nutraceuticals segment as the dominant application, leveraging astaxanthin’s powerful antioxidant properties for anti-aging, immunity support, and eye health formulas. Within product forms, the oil and oleoresin segment maintains relevance due to its higher concentration, while the powder form is gaining traction for incorporation into functional foods and beverages. The trend toward closed photobioreactors (PBRs) is accelerating within the cultivation technology segment, offering superior contamination control, higher biomass productivity, and greater sustainability credentials compared to traditional open pond systems, ensuring a consistent and high-quality supply necessary for demanding cosmetic and pharmaceutical applications.

AI Impact Analysis on Haematococcus Pluvialis Astaxanthin Market

User inquiries concerning AI's role in the Haematococcus Pluvialis Astaxanthin Market predominantly focus on optimizing cultivation efficiency, ensuring product quality consistency, and accelerating new strain development. Common questions revolve around how Machine Learning (ML) can predict optimal harvest times based on biomass density and astaxanthin accumulation, or how AI-driven image recognition systems can detect contamination or stress factors in large-scale photobioreactors (PBRs). There is significant interest in using predictive analytics to manage complex variables like light exposure, pH levels, and nutrient profiles dynamically, minimizing waste and maximizing yield. Users also expect AI to play a crucial role in regulatory compliance and supply chain transparency, ensuring the traceability of natural ingredients from farm to final product, thereby addressing concerns about sustainability and quality assurance in this high-value ingredient sector.

The direct application of Artificial Intelligence and Machine Learning algorithms is fundamentally transforming the upstream segment of the astaxanthin value chain. By integrating sensor data from automated PBRs, AI systems can process massive datasets related to environmental parameters in real-time. This allows for the creation of sophisticated predictive models that guide decision-making regarding nutrient dosing, CO2 injection, and temperature regulation, achieving conditions that stress the algae optimally for high astaxanthin production while preventing system collapse due to contamination. This level of precision farming significantly reduces operational variability, which is a key barrier to scaling microalgae production, thus promising substantial cost reductions over the forecast period.

Furthermore, AI facilitates advanced product development. In R&D, ML is being utilized to analyze genomic and metabolomic data of various H. pluvialis strains, identifying genetic markers associated with higher astaxanthin productivity or resistance to environmental fluctuation. This capability dramatically shortens the time required for strain selection and optimization. Downstream, AI algorithms are applied in quality control, utilizing spectroscopic analysis to verify the purity and concentration of extracted astaxanthin rapidly and non-invasively, ensuring every batch meets stringent industry standards for nutraceutical and cosmetic grades. The integration of AI therefore promises not just efficiency gains, but a new era of quality standardization in the natural carotenoid industry.

- AI-driven optimization of light intensity and nutrient delivery in photobioreactors (PBRs) to maximize biomass and astaxanthin yield.

- Machine Learning predictive models for stress induction timing, ensuring peak carotenoid accumulation before harvesting.

- Automated quality control systems using computer vision for real-time detection of microbial contamination in cultivation tanks.

- Predictive analytics for demand forecasting and inventory management, optimizing complex global supply chains.

- Genomic analysis acceleration using AI to identify superior H. pluvialis strains with enhanced resilience and productivity.

- Enhanced process control in extraction and purification (e.g., Supercritical Fluid Extraction) to ensure high stability and purity of the final oleoresin.

DRO & Impact Forces Of Haematococcus Pluvialis Astaxanthin Market

The market is primarily driven by escalating consumer interest in natural, plant-based health supplements, coupled with increasing scientific evidence validating astaxanthin's powerful antioxidant, anti-inflammatory, and neuroprotective qualities. However, the high capital expenditure required for setting up advanced photobioreactor systems, along with the relatively high end-product cost compared to synthetic astaxanthin (used mostly in aquaculture), acts as a significant restraint, limiting broader market penetration in price-sensitive segments. The most critical opportunities lie in expanding applications into clinical nutrition, pharmaceuticals, and personalized health, particularly leveraging its benefits for cognitive function and metabolic health. These dynamics are shaped by strong impact forces, notably rising consumer preference for clean-label ingredients and intensifying competition from alternative antioxidant compounds, demanding continuous technological innovation to improve cost structures and demonstrate superior efficacy.

Drivers: The global demographic shift towards an aging population contributes significantly to the market growth, as astaxanthin is increasingly sought after for managing age-related conditions, including macular degeneration and joint stiffness. Furthermore, regulatory bodies in key regions are increasingly favoring natural food coloring and functional ingredients, boosting the demand for naturally sourced astaxanthin in the Food & Beverage and cosmetic sectors. The expanding application scope beyond simple dietary supplements, moving into performance sports nutrition and specialized veterinary products, provides diversified revenue streams, reinforcing the market’s stability and long-term expansion potential. This sustained demand profile compels manufacturers to scale up cultivation efforts.

Restraints: One major challenge is the inherent instability of astaxanthin when exposed to light, heat, and oxygen, necessitating expensive microencapsulation or stabilization technologies, which adds to the final product cost. Moreover, securing reliable, large-scale, and contaminant-free cultivation facilities demands significant investment and operational expertise. Regulatory ambiguity or stringent requirements in emerging economies regarding novel food ingredients can delay market entry and necessitate complex, localized approval processes. These operational and regulatory hurdles restrain small-to-medium enterprises (SMEs) from entering the specialized production of high-grade natural astaxanthin, concentrating market power among a few large, well-funded companies.

Opportunities: The largest untapped opportunity lies in the development of genetically enhanced or optimized H. pluvialis strains capable of producing higher concentrations of astaxanthin under less energy-intensive conditions. Expanding research into pharmaceutical applications, particularly regarding neurological protection and cardiovascular drug delivery, promises exceptionally high-value market segments. Furthermore, developing sustainable, low-energy cultivation models, potentially utilizing wastewater or integrating into carbon capture technologies, provides a pathway to address environmental concerns and appeal to the growing segment of environmentally conscious consumers, differentiating natural astaxanthin beyond mere efficacy.

Segmentation Analysis

The Haematococcus Pluvialis Astaxanthin market is comprehensively segmented based on product form, application, and cultivation technology, providing a detailed view of current market dynamics and future growth vectors. The segmentation reveals a clear hierarchy of value, with highly concentrated forms such as astaxanthin oleoresin commanding premium prices due to their ease of incorporation into oil-based supplements like softgels. Application-wise, the nutraceutical industry remains the foundational segment, absorbing the majority of high-purity production, reflecting its strong positioning as a core ingredient in preventative healthcare formulations focused on immune, eye, and skin health. Analyzing these segments helps stakeholders tailor their production strategies and marketing efforts toward the highest-growth and highest-margin opportunities.

The cultivation technology segment is particularly dynamic, reflecting the industry’s drive for efficiency and sustainability. While traditional open ponds offer low initial investment, their susceptibility to contamination and reliance on climatic conditions push high-quality producers toward sophisticated closed systems. Closed photobioreactors (PBRs) are characterized by precise environmental control, ensuring superior product consistency and purity, which is mandatory for pharmaceutical and advanced cosmetic applications. The choice of technology directly impacts operational expenditure, yield, and the final price point of the astaxanthin derivative, creating distinct competitive arenas within the market structure.

Furthermore, understanding the downstream application differences is crucial. The aquaculture segment, which primarily uses astaxanthin for fish pigmentation, requires vast quantities but can tolerate lower-purity grades, often accepting synthetic alternatives. Conversely, the high-end cosmetic segment demands the highest quality, non-GMO, and traceable natural astaxanthin due to consumer sensitivities and regulatory requirements for topical applications focusing on UV protection and anti-aging benefits. These segmented needs necessitate different product specifications, packaging, and distribution pathways, highlighting the fragmented nature of demand despite a singular source ingredient.

- By Product Form:

- Oil/Oleoresin

- Powder

- Beads/Microencapsulated

- Softgels and Capsules (Final Dosage Form)

- By Application:

- Nutraceuticals (Dietary Supplements)

- Cosmetics & Personal Care

- Food & Beverages (Functional Foods)

- Aquaculture (Feed Additives)

- Animal Nutrition (Excluding Aquaculture)

- By Cultivation Technology:

- Open Pond Systems

- Closed Photobioreactors (PBRs)

- Hybrid Systems

- By Region:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America

- Middle East & Africa (MEA)

Value Chain Analysis For Haematococcus Pluvialis Astaxanthin Market

The value chain for Haematococcus Pluvialis Astaxanthin is intricate, starting with highly technical upstream research and cultivation, moving through complex midstream extraction and stabilization processes, and culminating in highly specialized downstream distribution across disparate industry sectors like health supplements, cosmetics, and animal feed. The upstream analysis focuses heavily on R&D for strain optimization and the capital-intensive setup and operation of sophisticated cultivation facilities, which includes managing sensitive biological environments within photobioreactors. Efficiency in this stage—optimizing biomass yield and astaxanthin accumulation—determines the foundational cost structure of the final product, creating high barriers to entry for new competitors lacking technological expertise or substantial capital.

The midstream processing stage is critical, involving harvesting the biomass, cell disruption, and extracting the astaxanthin oleoresin, often utilizing advanced techniques like Supercritical Fluid Extraction (SFE) to ensure high purity and minimize solvent residue, thereby meeting stringent clean-label requirements. This is followed by stabilization and formulation—converting the oleoresin into stable powder, beadlets, or oil solutions suitable for manufacturing. Direct distribution typically occurs when large B2B ingredient suppliers sell high volumes of astaxanthin raw material (powder or oil) directly to nutraceutical and cosmetic manufacturers who then formulate and package the final consumer product. Indirect channels involve ingredient brokers and specialized distributors who manage logistics and provide localized technical support to smaller formulators globally.

Downstream analysis highlights the distinct distribution needs of the major application segments. For nutraceuticals, distribution leverages pharmacy chains, health food stores, and, increasingly, e-commerce platforms, requiring extensive marketing and consumer education regarding the health benefits. Conversely, the aquaculture segment utilizes specialized animal feed distributors. The high-value cosmetic sector often involves distribution through exclusive specialty chemical and cosmetic ingredient distributors, catering to R&D labs and luxury brand formulation centers. Successful market penetration depends heavily on rigorous quality certification (e.g., ISO, GMP, GRAS) and robust supply chain integrity to guarantee the natural source and potency of the astaxanthin, establishing trust with high-value end-users.

Haematococcus Pluvialis Astaxanthin Market Potential Customers

The primary potential customers for high-grade Haematococcus pluvialis astaxanthin are manufacturers operating within highly regulated and specialized market verticals. The most dominant buyer group is the Dietary Supplement and Nutraceutical Manufacturing industry, utilizing astaxanthin as a flagship active ingredient in anti-aging, immunity-boosting, and vision health formulations, often packaged as softgels or capsules. These companies prioritize ingredient purity, clinical efficacy data, and sustainable sourcing credentials to differentiate their premium products in competitive retail markets. Their buying decisions are heavily influenced by supplier capacity, regulatory status (e.g., FDA-GRAS status), and the availability of stable, highly concentrated forms like microencapsulated powder or stabilized oleoresin suitable for long shelf life.

The Cosmetics and Personal Care industry represents another significant, high-value customer base, focusing on astaxanthin’s UV-protective, anti-inflammatory, and collagen-preserving properties for skin care lines, particularly serums, creams, and internal beauty supplements. These buyers require impeccable quality, solvent-free extraction methods, and often small, highly traceable batches, targeting the luxury and natural cosmetic consumer segment. Additionally, the Animal Nutrition and Aquaculture sectors, while sometimes leveraging synthetic alternatives, are increasingly shifting towards natural astaxanthin, driven by consumer demand for naturally pigmented farmed fish (like salmon and trout) and high-quality feed for companion animals where oxidative stress reduction is critical.

Finally, emerging customer segments include Functional Food and Beverage manufacturers developing fortified products such as health drinks, energy bars, and specialized dairy items. These buyers demand astaxanthin derivatives (typically stabilized powders or water-soluble formulations) that can withstand food processing conditions without losing efficacy or altering the taste profile. The focus here is on ease of incorporation, stability in complex matrices, and compelling sensory attributes, positioning astaxanthin not just as a supplement, but as an essential health-boosting component of daily food intake.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 750.5 Million |

| Market Forecast in 2033 | USD 1,680.2 Million |

| Growth Rate | CAGR 12.2% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Cyanotech Corporation, Fujifilm Corporation, BGG (Beijing Gingko Group), Algatech Ltd. (Solabia Group), Valensa International (Div. of EID Parry), AstaReal Group (Fuji Chemical Industry Co., Ltd.), PIVEG, Inc., Fenchem Biotek Ltd., Heliae Development, LLC, Parry Nutraceuticals, Beijing Brilliance Bio, Yunnan Algae Biotech, E.I.D. Parry (India) Ltd., Nextar Chempharma Solutions Ltd., Igene Biotechnology Inc., Algae Health Sciences (A division of BGG), JNC Corporation, Shaivaa Algaetech LLP, BlueBio Tech GmbH, Biogenic Pharma. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Haematococcus Pluvialis Astaxanthin Market Key Technology Landscape

The technological landscape of the Haematococcus Pluvialis Astaxanthin market is defined by continuous innovation aimed at overcoming the primary challenges of scaling production and maintaining product stability and purity. The core of this advancement lies in the optimization and deployment of Closed Photobioreactors (PBRs). PBRs, which include vertical column systems and tubular loop reactors, represent a significant evolution from traditional open pond cultivation. These systems offer hermetically sealed, controlled environments that drastically minimize the risk of contamination by competing microorganisms, ensuring a purer product and predictable biomass yield. Furthermore, PBRs allow for precise control over light, temperature, pH, and CO2 injection, enabling manufacturers to meticulously optimize the stress phase required to maximize astaxanthin accumulation in the H. pluvialis cells, thus achieving higher productivity per unit area.

Beyond cultivation, extraction technology plays a pivotal role in determining the quality of the final product. Supercritical Fluid Extraction (SFE), particularly using supercritical CO2, is gaining prominence as the preferred method for high-grade astaxanthin intended for nutraceuticals and cosmetics. SFE is a solvent-free technique that operates at relatively low temperatures, effectively preserving the integrity and stability of the delicate astaxanthin molecule while yielding an exceptionally pure oleoresin concentrate. This technology directly addresses the clean-label trend, providing a residue-free extract that meets the stringent quality requirements of premium markets, offering a distinct advantage over traditional solvent-based extraction methods.

Further innovation is being driven by genetic and metabolic engineering techniques. While currently highly regulated, advancements in gene editing tools are being explored to develop new strains of H. pluvialis that inherently exhibit accelerated growth rates, increased resistance to common diseases, or significantly higher natural astaxanthin content under standard cultivation conditions. Additionally, microencapsulation technology is essential downstream, employing spray drying or fluid bed coating to envelop the astaxanthin oil within a protective matrix (often carbohydrates or proteins). This stabilization technique significantly enhances the ingredient's shelf life, protects it from oxidation during storage, and facilitates its seamless incorporation into complex matrices like water-based functional beverages and food powders, thereby expanding its application scope considerably.

Regional Highlights

Regional dynamics play a crucial role in shaping the Haematococcus Pluvialis Astaxanthin Market, with North America, Europe, and Asia Pacific dominating both consumption and production capabilities.

- North America: This region is the largest consumer market for astaxanthin, driven by high consumer awareness of dietary supplements, substantial spending on health and wellness products, and a favorable regulatory environment (particularly in the US with GRAS status). The presence of major nutraceutical companies and the growing popularity of premium, science-backed anti-aging and sports nutrition supplements solidify its leading position. The emphasis here is on transparency, clinical validation, and highly concentrated dosage forms.

- Europe: Characterized by stringent food and supplement regulations, Europe represents a high-value but challenging market. The enforcement of the Novel Food Regulation requires suppliers to undergo rigorous authorization processes, ensuring high quality and safety standards. Demand is robust in the cosmetics sector and among consumers prioritizing natural ingredients, but market growth is slower than in North America due to regulatory hurdles. Germany, France, and the UK are the primary consumer hubs.

- Asia Pacific (APAC): APAC is projected to exhibit the fastest growth, serving as both a key production base (particularly China and India due to lower operational costs and favorable climates) and a rapidly expanding consumer market (Japan, South Korea, and China). Japan is a mature market where astaxanthin has long been accepted in food and beverage applications. The surging middle class, coupled with traditional reliance on natural health remedies and rapid growth in the aquaculture industry, makes APAC a critical growth engine for the next decade.

- Latin America (LATAM) and Middle East & Africa (MEA): These regions currently hold smaller shares but are emerging due to increasing interest in functional ingredients and growing foreign investment in local aquaculture projects. Market penetration here is dependent on economic stability and developing local regulatory frameworks concerning dietary supplements and novel ingredients.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Haematococcus Pluvialis Astaxanthin Market.- Cyanotech Corporation

- Fujifilm Corporation

- BGG (Beijing Gingko Group)

- Algatech Ltd. (Solabia Group)

- Valensa International (Div. of EID Parry)

- AstaReal Group (Fuji Chemical Industry Co., Ltd.)

- PIVEG, Inc.

- Fenchem Biotek Ltd.

- Heliae Development, LLC

- Parry Nutraceuticals

- Beijing Brilliance Bio

- Yunnan Algae Biotech

- E.I.D. Parry (India) Ltd.

- Nextar Chempharma Solutions Ltd.

- Igene Biotechnology Inc.

- Algae Health Sciences (A division of BGG)

- JNC Corporation

- Shaivaa Algaetech LLP

- BlueBio Tech GmbH

- Biogenic Pharma

Frequently Asked Questions

Analyze common user questions about the Haematococcus Pluvialis Astaxanthin market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between natural and synthetic astaxanthin?

Natural astaxanthin, derived from Haematococcus pluvialis, exists predominantly as the 3S, 3'S stereoisomer and is approved for human consumption, primarily due to its superior antioxidant profile and high bioavailability. Synthetic astaxanthin, derived petrochemicals, is typically a mixture of stereoisomers (3R, 3'S, and 3R, 3'R) and is primarily used as a coloring agent in the aquaculture feed industry, often lacking the full spectrum of health benefits associated with the natural form.

Which application segment drives the highest demand for natural astaxanthin?

The Nutraceuticals segment drives the highest demand for natural astaxanthin. Its potent anti-inflammatory and antioxidant properties make it a premium ingredient in dietary supplements focused on eye health, cardiovascular support, skin hydration, and anti-aging formulas. This segment demands the highest purity and concentration levels, commanding premium market prices.

How do closed photobioreactors (PBRs) impact the astaxanthin production cost?

While PBRs require significantly higher initial capital investment compared to open pond systems, they mitigate long-term costs by maximizing yield stability, preventing contamination losses, and enabling precise environmental control. Although operational expenses (especially energy) can be high, the resulting high-purity, consistent product commands a premium price, justifying the investment for high-grade natural astaxanthin production.

What is the main challenge related to astaxanthin stability and shelf life?

The primary challenge is astaxanthin's high susceptibility to degradation via oxidation, light exposure, and heat, which necessitates complex stabilization techniques. Manufacturers overcome this by using protective measures like microencapsulation (creating powder beadlets) or incorporating the oleoresin into oxygen-free softgel capsules, significantly extending shelf life and ensuring potency until consumption.

Which region is leading in technological advancements for astaxanthin cultivation?

North America and Europe currently lead in technological advancements, particularly in the adoption of highly efficient, automated closed photobioreactor systems (PBRs) and advanced extraction techniques like Supercritical Fluid Extraction (SFE). These regions focus on high-tech solutions to achieve scalability and maintain the ultra-high purity levels required by their regulated nutraceutical and cosmetic industries.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager