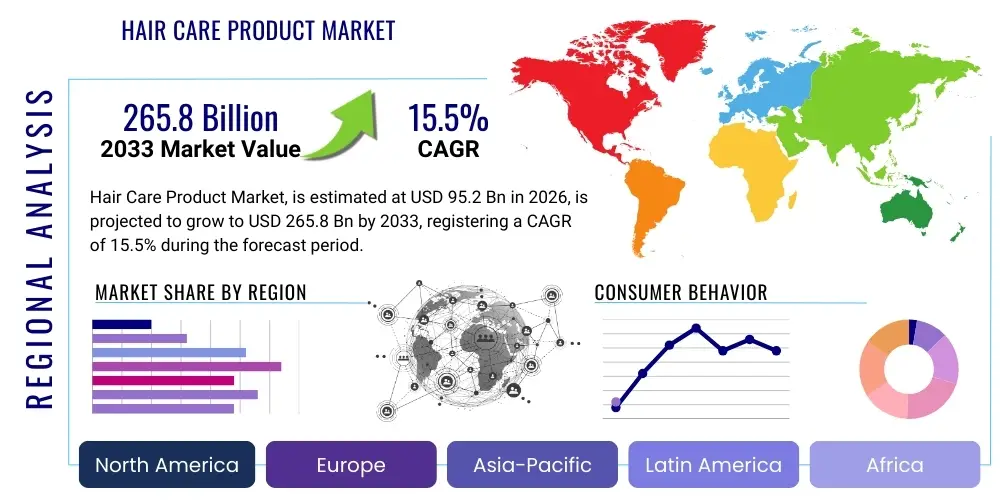

Hair Care Product Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434804 | Date : Dec, 2025 | Pages : 245 | Region : Global | Publisher : MRU

Hair Care Product Market Size

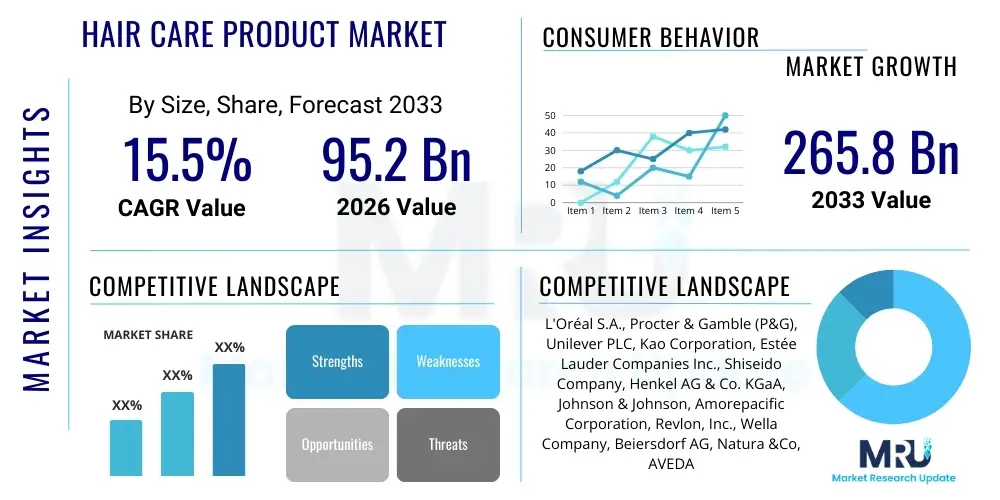

The Hair Care Product Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 15.5% between 2026 and 2033. The market is estimated at USD 95.2 Billion in 2026 and is projected to reach USD 265.8 Billion by the end of the forecast period in 2033.

Hair Care Product Market introduction

The Hair Care Product Market encompasses a vast array of consumer goods designed for the cleansing, conditioning, styling, and treatment of hair and scalp. This market includes essential products such as shampoos, conditioners, hair oils, styling gels, sprays, and specialized items targeting specific concerns like dandruff, hair loss, and color protection. Driven by rising consumer awareness regarding hair health, increasing disposable incomes, and the strong influence of fashion and beauty trends propagated through social media platforms, the demand for sophisticated and specialized hair care solutions continues to surge globally. The primary objective of these products is to maintain aesthetic appeal and physiological health of the hair, enhancing texture, strength, and overall manageability. These products are broadly applicable across all demographics, though specific formulations are tailored for different hair types, environmental conditions, and ethnic requirements.

Major applications of hair care products span daily hygiene, cosmetic enhancement, and therapeutic intervention. Daily use products focus on maintaining scalp health and hair cleanliness, preventing buildup and environmental damage. Cosmetic applications, particularly in styling and coloring segments, are witnessing robust growth due to the cultural emphasis on personal grooming and the rapid adoption of diverse hairstyles. Furthermore, the rising prevalence of specific hair issues, such as premature greying, excessive shedding, and chemically induced damage, fuels the demand for advanced therapeutic treatments, often incorporating high-efficacy active ingredients derived from biotechnology or natural sources. The professional salon segment remains a critical application area, driving innovation and setting benchmarks for product performance and ingredient efficacy, which eventually trickle down to the retail consumer segment.

Key benefits derived from utilizing market products include improved hair texture, enhanced volume and shine, protection against thermal and UV damage, and addressing underlying scalp conditions. The primary driving factors steering market expansion are multifaceted, centering on demographic shifts, technological advancements, and shifting consumer preferences towards clean beauty and personalization. Specifically, the growth of the young adult population, heightened concerns about environmental pollutants affecting hair quality, and the continuous introduction of scientifically backed, premium-priced products, particularly in the deep conditioning and scalp treatment categories, serve as major catalysts for sustained market growth over the forecast period. Moreover, digital marketing strategies and the role of beauty influencers significantly amplify product visibility and consumer adoption rates across all major geographic regions.

Hair Care Product Market Executive Summary

The global Hair Care Product Market is characterized by vigorous competition, rapid product innovation, and a noticeable shift toward premiumization, driven largely by consumer demand for natural, sustainable, and high-performance ingredients. Current business trends indicate a strong move toward direct-to-consumer (D2C) channels, leveraging e-commerce and personalized subscription models, which allows brands greater control over customer data and product feedback, bypassing traditional retail intermediaries. Furthermore, established market leaders are increasingly acquiring smaller, niche brands that possess expertise in specific areas like organic formulation or ethnic hair care, thereby diversifying their portfolio and capturing specialized consumer segments. Supply chain resilience, focusing on ethical sourcing and traceable ingredients, has become a core competitive differentiator, impacting both brand loyalty and operational costs across the sector.

Regionally, the Asia Pacific (APAC) market exhibits the highest growth potential, fueled by large populations, increasing urbanization, and escalating disposable incomes in countries like China and India, where traditional hair care rituals are merging with modern, convenient product formats. North America and Europe, while mature, remain crucial centers for innovation, particularly in the introduction of sustainable packaging solutions and clinical-grade scalp treatments, adhering to stringent regulatory standards regarding ingredient safety and environmental claims. Latin America is demonstrating significant demand for colorants and styling products, reflecting a dynamic beauty culture, while the Middle East and Africa (MEA) are emerging markets focused on specialized products addressing climate-related hair challenges and religious grooming requirements. Investment in local manufacturing and tailored regional distribution networks is essential for maximizing market penetration in these diverse geographies.

Segment trends confirm the ascendance of the treatment and styling categories, outpacing basic cleansing products. Within segments, the professional channel is capitalizing on advanced treatments like keratin and complex restorative services, setting a higher revenue per user. Ingredient-wise, consumers are prioritizing products free from sulfates, parabens, and silicones, leading to significant reformulation efforts across the industry. Furthermore, the rise of customized hair care regimens, utilizing digital diagnostics and AI-driven recommendations, represents a profound segment trend, moving away from mass-market offerings towards highly individualized solutions. This shift necessitates investment in robust R&D capabilities and flexible manufacturing processes capable of handling smaller batch sizes and personalized formulations efficiently, ensuring that brands can meet the evolving expectations for efficacious and bespoke hair health products.

AI Impact Analysis on Hair Care Product Market

Common user questions regarding AI's impact on the Hair Care Product Market frequently revolve around personalization capabilities, supply chain transparency, and predictive trend analysis. Users often ask: "How accurately can AI diagnose my specific hair needs?" and "Will AI lead to fully customized shampoo formulations delivered monthly?" Other critical concerns center on whether AI algorithms compromise data privacy when analyzing hair selfies or purchase history, and how smaller brands can afford to implement such sophisticated technologies. There is also significant curiosity about AI's role in accelerating new product development, particularly in identifying novel effective ingredients from large genomic or chemical databases, and optimizing manufacturing parameters for sustainable production processes. The key themes summarized from user queries highlight high expectations for hyper-personalization, efficiency improvements, and sustainable sourcing enabled by intelligent systems, coupled with concerns about accessibility and consumer data security.

The integration of Artificial Intelligence (AI) and Machine Learning (ML) is fundamentally transforming the hair care ecosystem from research and development (R&D) to consumer engagement and retail distribution. In R&D, AI accelerates the discovery of novel compounds, predicting the efficacy and safety profiles of potential cosmetic ingredients, drastically cutting down the time and cost associated with traditional laboratory testing. On the consumer front, AI powers virtual try-ons, diagnostic apps that analyze scalp health and hair damage via smartphone cameras, and recommendation engines that create truly bespoke product formulas based on genetic data, lifestyle factors, and environmental exposure. This intelligent personalization model drives higher customer loyalty and maximizes average order value. For supply chain management, AI optimizes inventory, forecasts demand variations across different regions with greater accuracy, and identifies potential bottlenecks, particularly crucial for brands relying on highly sensitive or seasonal natural ingredients. The overall impact is a shift towards a data-driven, hyper-responsive, and more sustainable market landscape.

- AI-driven personalized product formulation and dosage recommendations.

- Enhanced consumer diagnostics via mobile apps analyzing hair and scalp images.

- Optimized supply chain and demand forecasting, reducing waste and inventory costs.

- Accelerated R&D through predictive modeling of ingredient efficacy and stability.

- Intelligent inventory management for customizable subscription services.

- Creation of targeted marketing campaigns based on deep consumer behavior analysis.

- Automation of quality control processes in manufacturing, ensuring formulation consistency.

- Virtual reality and augmented reality tools for product trials and styling simulations.

DRO & Impact Forces Of Hair Care Product Market

The market dynamics of hair care products are subject to a complex interplay of Drivers, Restraints, and Opportunities (DRO), collectively forming significant impact forces that shape investment decisions and market entry strategies. Key drivers include rising consumer expenditure on appearance and grooming, particularly among millennials and Generation Z, who prioritize self-care routines. The proliferation of digital media and celebrity endorsements amplifies these trends, creating rapid demand for innovative and specialized products targeting specific concerns like anti-frizz, curl definition, or extreme hydration. Furthermore, the growing awareness of scalp health as the foundation for hair quality has spurred growth in the treatment category, moving beyond basic cleaning to include serums, exfoliators, and specialized nutritional supplements. These drivers collectively exert a strong positive force, propelling continuous innovation and market expansion across both developed and emerging economies.

Conversely, the market faces several significant restraints that moderate growth rates and increase operational complexity. High regulatory hurdles, particularly in Europe and North America concerning ingredient safety (e.g., restrictions on certain preservatives or colorants), impose substantial costs on reformulation and testing for global brands. Additionally, the fragmented nature of the market, characterized by intense competition from both large multinationals and agile niche players, makes achieving and maintaining market share difficult and often necessitates aggressive marketing expenditure. Another critical restraint is consumer confusion resulting from 'clean beauty' labeling and greenwashing, leading to skepticism and requiring brands to invest heavily in transparent certification and validated claims to build trust. Economic downturns and inflationary pressures also act as temporary restraints, as consumers may trade down from premium or professional brands to mass-market alternatives.

Opportunities for growth are abundant, primarily revolving around technological integration, sustainability, and market specialization. The untapped potential in ethnic hair care, catering specifically to African, Asian, and Latin American hair structures, offers a lucrative pathway for targeted product development and distribution. The sustainability mandate presents opportunities for packaging innovation (e.g., waterless formulas, refillable systems) and ingredient sourcing (e.g., upcycled raw materials, certified organic extracts), appealing directly to environmentally conscious consumers. Impact forces are currently leaning towards positive drivers, powered by continuous advancements in ingredient science—such as personalized biotech components and micro-encapsulation technology—and the scalable distribution afforded by e-commerce platforms, ensuring that the momentum towards premium, performance-driven hair care is sustained throughout the forecast period. The strategic leveraging of opportunities, particularly in digital engagement and niche market capture, will determine competitive success.

Segmentation Analysis

The Hair Care Product Market is extensively segmented based on product type, distribution channel, application (end-user), and pricing category, reflecting the diverse landscape of consumer needs and purchasing behaviors. Product types range from daily essentials like shampoos and conditioners to highly specialized items such as hair masks, colorants, and professional treatment kits. The market structure reveals a growing consumer inclination towards premiumization, where efficacy and ingredient quality supersede cost, particularly in the segments focusing on anti-hair loss and scalp therapeutic solutions. Distribution segmentation is crucial, differentiating between retail sales (supermarkets, drug stores, online) and the professional salon channel, which often drives initial adoption of cutting-edge technologies and formulations. This detailed segmentation allows manufacturers to precisely tailor their marketing strategies and product portfolios to maximize penetration within high-growth sub-segments, ensuring specific demographic and functional requirements are effectively met.

- By Product Type:

- Shampoos and Conditioners

- Hair Styling Products (Gels, Mousses, Sprays, Waxes)

- Hair Colorants

- Hair Oils and Serums

- Hair Treatment Products (Masks, Scalp Treatments, Hair Loss Solutions)

- Hair Perm and Relaxants

- By Application (End-User):

- Residential/Individual Use

- Commercial Use (Salons and Spas)

- By Distribution Channel:

- Offline Channels (Supermarkets, Drug Stores, Specialty Retail Stores)

- Online Channels (E-commerce Platforms, Direct-to-Consumer Websites)

- Professional Channel (Salons and Barber Shops)

- By Pricing Category:

- Mass Market Products

- Premium Products

Value Chain Analysis For Hair Care Product Market

The value chain for the Hair Care Product Market commences with Upstream Activities, primarily focusing on the sourcing and processing of raw materials. This stage is complex, involving agricultural sourcing for natural extracts (botanicals, essential oils), chemical synthesis for surfactants, emulsifiers, and preservatives, and specialized sourcing for active ingredients such as vitamins, peptides, and advanced bio-engineered molecules. Key upstream players include chemical manufacturers (e.g., specialty chemical companies providing performance ingredients) and agricultural suppliers. Increasing consumer demand for natural, ethical, and traceable ingredients places intense pressure on this segment for certified sourcing and sustainable extraction methods, often involving rigorous auditing and documentation to ensure compliance and substantiate 'clean label' claims. Efficiency in this stage significantly impacts the final product cost and market positioning.

The Midstream phase involves Research and Development (R&D), formulation, manufacturing, and primary packaging. R&D is a high-investment activity, focusing on creating stable, efficacious, and aesthetically pleasing formulations that meet diverse consumer needs and regulatory requirements. Manufacturing involves large-scale blending, filling, and packaging operations, often requiring specialized equipment to handle different viscosity levels and ingredient sensitivities (e.g., organic or natural compounds). Quality control and adherence to Good Manufacturing Practices (GMP) are paramount to ensure product safety and consistency. This stage is highly competitive, often leveraging contract manufacturers to optimize capacity utilization and access regional expertise, particularly in rapidly growing markets like APAC, thereby reducing logistical burdens and tariff exposure.

The Downstream Analysis covers distribution, marketing, and final retail sales channels. Distribution is bifurcated into direct channels (D2C e-commerce) and indirect channels (wholesalers, distributors serving retail or professional outlets). The Professional Channel, servicing salons and barbers, acts as a critical distribution mechanism for premium and high-performance products, often providing educational support. Retail distribution relies heavily on strategic placement in supermarkets and drug stores for mass-market appeal. Marketing and branding expenditure is substantial, utilizing digital platforms, influencer collaborations, and targeted advertising to influence consumer purchasing decisions. The success of the downstream phase is critically dependent on strong logistical networks and dynamic inventory management systems capable of responding swiftly to rapidly changing consumer trends and promotional activities across diverse retail formats, maximizing product shelf visibility and final consumer uptake.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 95.2 Billion |

| Market Forecast in 2033 | USD 265.8 Billion |

| Growth Rate | 15.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | L'Oréal S.A., Procter & Gamble (P&G), Unilever PLC, Kao Corporation, Estée Lauder Companies Inc., Shiseido Company, Henkel AG & Co. KGaA, Johnson & Johnson, Amorepacific Corporation, Revlon, Inc., Wella Company, Beiersdorf AG, Natura &Co, AVEDA (Estée Lauder), OLAPLEX, Kérastase (L'Oréal), MoroccanOil, P&G Prestige, Sephora Collection, Coty Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Hair Care Product Market Potential Customers

The primary segment of potential customers for the Hair Care Product Market includes the vast global B2C consumer base, segmented by age, gender, hair type, and specific concern. Women aged 20-55 constitute a major demographic, driving demand for premium, complex products such as hair colorants, specialized treatments, and advanced styling products. This group is highly responsive to marketing based on aesthetic outcomes and ingredient quality, often utilizing digital channels for product discovery and peer reviews. Men's hair care, traditionally focused on basic cleansing, is rapidly evolving, driven by demand for specialized thinning hair solutions, beard care, and sophisticated styling waxes and pomades. Addressing specific concerns, such as oily scalp, damaged hair, or curl maintenance, creates highly targeted potential customer groups who demonstrate low price sensitivity for efficacious solutions, forming a crucial revenue stream for high-end brands.

A significant and growing segment comprises End-User/Buyers requiring specialized or therapeutic solutions. This includes individuals suffering from scalp disorders (e.g., dermatitis, psoriasis), hair loss (alopecia), or those with chemically or thermally damaged hair requiring intense repair. These customers often seek dermatologist-recommended or clinically backed products, viewing them as a necessity rather than a luxury. This segment frequently engages with the professional channel (salons and medical spas) for initial diagnosis and product recommendation, valuing expert advice and professional-grade formulations that are often unavailable in mass retail. Brands that invest in clinical validation and transparent ingredient labeling are best positioned to capture this discerning customer base, leveraging trust and proven results over promotional appeal.

The Business-to-Business (B2B) customer segment, which includes professional salons, barbershops, luxury spas, and institutional buyers (hotels, gyms), represents a high-volume, continuous purchasing stream. These businesses require bulk quantities of high-performance products used in service delivery, alongside retail lines sold directly to their clientele. Salons, in particular, act as powerful brand ambassadors and early adopters of new technologies, influencing mass consumer behavior. Capturing the B2B segment requires robust supply chain capabilities, competitive pricing for bulk orders, and extensive training and educational support for professional stylists. Furthermore, the rising demand for private label manufacturing presents an opportunity to service retail chains and specialized beauty brands seeking custom formulations under their own names, adding another layer of complexity and potential revenue generation within the professional supply chain ecosystem.

Hair Care Product Market Key Technology Landscape

The technological landscape of the Hair Care Product Market is evolving rapidly, centered around material science, diagnostic tools, and sustainable manufacturing processes. A primary area of focus is Advanced Formulation Science, utilizing micro-encapsulation technologies to deliver active ingredients (like vitamins, proteins, and essential oils) deep into the hair shaft or scalp over an extended period, maximizing efficacy and reducing the volatility of sensitive components. Furthermore, the development of intelligent polymers and smart silicones allows for tailor-made sensory profiles and enhanced thermal protection without residue buildup, addressing a key consumer frustration. Biotechnology plays a vital role, enabling the creation of sustainable, high-purity ingredients such as synthetic peptides, recombinant proteins, and cultured stem cells, offering performance benefits superior to traditionally sourced natural extracts and mitigating supply chain risks associated with environmental variability. These innovations are critical for driving the premiumization trend and justifying higher price points in the treatment categories.

Digital technologies, particularly diagnostic and personalization platforms, are reshaping the consumer experience. Handheld devices and mobile applications integrated with AI algorithms are becoming commonplace, allowing users to analyze their hair porosity, density, scalp moisture levels, and damage severity using non-invasive methods. This data fuels personalized product recommendation engines, which dynamically adjust formulas or suggest personalized regimens based on real-time environmental factors (humidity, pollution levels). This hyper-personalization extends into manufacturing through bespoke mixing and filling technologies, enabling 'batch-of-one' production models, which significantly reduce the inventory risk associated with conventional mass production. The seamless integration of digital diagnostics with physical product delivery is a defining technological trend, enhancing customer loyalty and driving D2C channel growth through superior service offerings and targeted efficacy.

Sustainability and Clean Manufacturing techniques represent another critical technological pillar. Innovations in green chemistry focus on developing biodegradable surfactants and solvents, reducing the environmental footprint of rinse-off products. Waterless and concentrated formulations, facilitated by novel preservation systems and highly stable dry ingredients, are technological responses to water scarcity concerns and logistics efficiency. Packaging technology is shifting towards bio-based plastics, post-consumer recycled (PCR) materials, and innovative refill systems that maintain product integrity while drastically minimizing plastic waste. Additionally, advanced tracking technologies, such as blockchain, are being piloted to ensure the transparency and ethical sourcing of key natural ingredients, providing consumers with verified provenance information. These technologies not only address environmental responsibilities but also align with the ethical preferences of modern consumers, offering a competitive edge in a highly conscious marketplace.

Regional Highlights

- Asia Pacific (APAC): The APAC region is poised for exponential growth due to rapid economic development, increasing penetration of professional hair care services, and a huge consumer base transitioning from traditional remedies to sophisticated westernized products. China, Japan, and South Korea are innovation hubs, driving demand for technologically advanced products focused on anti-aging, hair density improvement, and scalp detox treatments. India and Southeast Asian nations show robust growth in mass-market shampoos and conditioners, heavily influenced by climate-specific needs like anti-dandruff solutions and sun protection.

- North America: North America is characterized by high adoption rates of premium and specialized products. The market is dominated by trends toward clean beauty, vegan and cruelty-free certifications, and highly personalized hair care solutions, often driven by wellness and health concerns. Significant focus is placed on ethnic hair care products tailored specifically for diverse hair textures (Type 3 and 4 hair), reflecting the region's diverse population and driving niche market innovation and competition among smaller specialized brands.

- Europe: Europe maintains a strong focus on regulatory compliance, sustainability, and high-quality natural/organic ingredients. Consumers here are highly educated about product composition, favoring brands with transparent sourcing and eco-friendly packaging. Western Europe, particularly the UK, France, and Germany, leads in the adoption of professional coloring and restorative treatments, upholding stringent standards for cosmetic ingredient safety, which often influences global formulation guidelines and market entry strategies.

- Latin America (LATAM): LATAM displays dynamic growth, particularly in Brazil and Mexico, driven by a strong cultural emphasis on personal appearance and voluminous, well-maintained hair. Demand for professional coloring, intensive conditioning treatments, and thermal straightening products remains exceptionally high. The market is sensitive to price but shows loyalty to brands that deliver visible results and offer accessible, large-format packaging solutions, catering both to salon use and high-frequency residential consumption.

- Middle East and Africa (MEA): The MEA market is evolving, influenced by high-end luxury preferences in the GCC countries and necessity-driven demand in emerging African nations. Key demands include products offering protection against heat, humidity, and arid environments, as well as specialized lines adhering to Halal certification requirements. The region serves as a growing opportunity for premium imported brands, alongside increasing investment in local manufacturing to address unique regional hair care needs effectively.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Hair Care Product Market.- L'Oréal S.A.

- Procter & Gamble (P&G)

- Unilever PLC

- Kao Corporation

- Estée Lauder Companies Inc.

- Shiseido Company, Limited

- Henkel AG & Co. KGaA

- Johnson & Johnson Services, Inc.

- Amorepacific Corporation

- Revlon, Inc.

- Wella Company

- Beiersdorf AG

- Natura &Co Holding S.A.

- AVEDA (Subsidiary of Estée Lauder)

- OLAPLEX

- Kérastase (Subsidiary of L'Oréal)

- MoroccanOil

- P&G Prestige

- Sephora Collection

- Coty Inc.

Frequently Asked Questions

Analyze common user questions about the Hair Care Product market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is driving the growth of the premium hair care market segment?

The premium segment growth is primarily driven by rising consumer awareness regarding ingredient safety and efficacy, leading to increased investment in specialized, high-performance products often containing biotechnological components or rare natural extracts. Personalized diagnostics and D2C marketing also contribute significantly to the premiumization trend.

How significant is the shift towards sustainable and clean beauty in hair care?

The shift is critically significant. Sustainability dictates innovation in packaging (refillable and PCR materials), formulation (waterless and biodegradable ingredients), and ethical sourcing. Consumers actively seek products certified as free from sulfates, parabens, and silicones, making ‘clean label’ transparency a key purchasing factor.

Which distribution channel is experiencing the fastest growth for hair care products?

The Online Distribution Channel, encompassing both large e-commerce marketplaces and direct-to-consumer (D2C) brand websites, is currently experiencing the fastest growth. This acceleration is fueled by personalized subscription models, AI-driven recommendations, and the ability to access specialized or niche global brands easily.

What role does technology play in personalizing hair care products?

Technology plays a central role through AI-powered diagnostic apps that analyze individual scalp health, hair type, and environmental factors. This data is used to custom-blend formulations or recommend highly specific regimens, moving the industry away from mass-market solutions toward individualized, results-oriented care.

What are the key challenges facing hair care manufacturers in the current market?

Key challenges include navigating stringent global regulatory requirements for ingredient safety, managing supply chain complexity to ensure ethical and sustainable sourcing of natural ingredients, and maintaining competitive differentiation in a highly fragmented market increasingly dominated by niche, digital-native brands.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Cosmetovigilance Market Statistics 2025 Analysis By Application (Clinical Research Organizations, Business Process Outsourcing), By Type (Skin Care Safety, Hair Colorant Safety, Perfume Safety, Hair Care Product Safety, Other), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

- Hair Care Product Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Hair Oils, Colorants, Shampoos, Conditioners, Hair Styling Products, Others), By Application (Hypermarket/Supermarket, Specialty Store, Online Stores, Convenience Stores, Others), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager